From the Desk of Deborah Weinswig

Brick-and-Mortar Looks Set to Lead the Battle for Millennial, Multichannel Grocery Shoppers

The battle for online grocery shoppers is intensifying. Last week, Jet.com appointed Simon Belsham, a veteran of the UK online grocery industry, as President, signaling a further commitment to grocery by Jet and, in turn, a heightening of competition in the fast-developing US online grocery market.

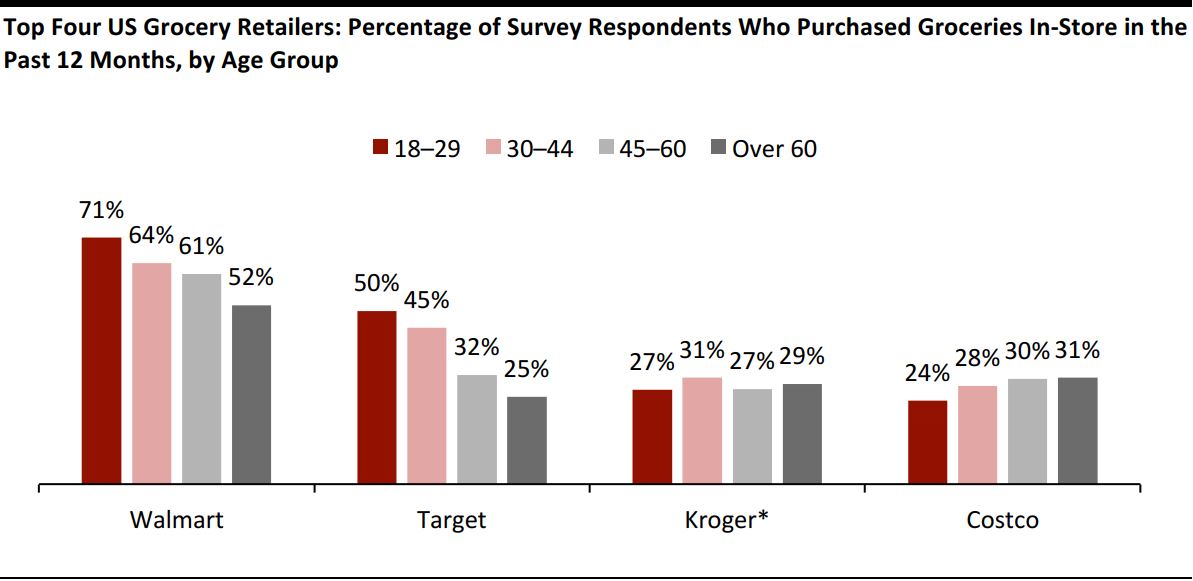

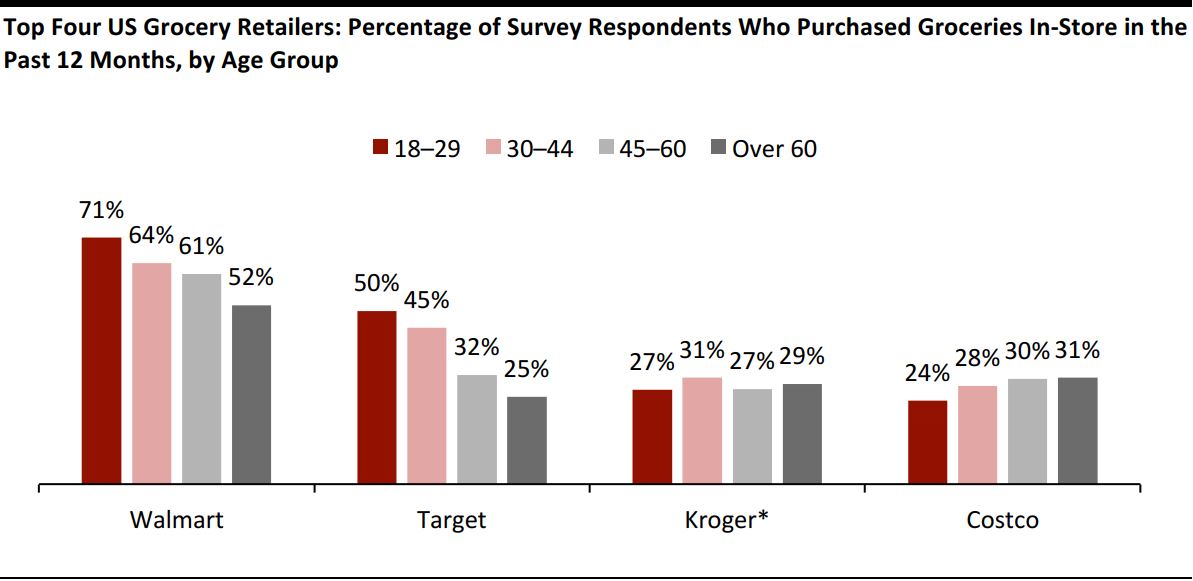

Walmart acquired Jet.com with the aim of tapping a younger consumer segment, as Jet attracts “higher-income, urban, millennial customers,” as Walmart CEO Doug McMillon said recently. However, the stereotype of digitally focused millennials seeking out on-trend pure-play retailers does not accurately reflect the grocery landscape. In fact, younger shoppers flock in disproportionate numbers to Walmart and Target for their groceries. For example, 18–29-year-olds are twice as likely as those over age 60 to buy groceries from Target stores, as shown below.

*Including Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months, surveyed in March 2018

Source: Coresight Research

*Including Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months, surveyed in March 2018

Source: Coresight Research

More broadly, we consider it much more difficult to make pure-play Internet retailing work in the grocery category than in nonfood categories, and Amazon’s recent retreat from Internet-only retailing in grocery reflects this: the company withdrew AmazonFresh from some US regions in late 2017, merged its Prime Now and AmazonFresh operations more recently, and ventured into brick-and-mortar grocery with its acquisition of Whole Foods and launch of the Amazon Go store format.

Together, these data points imply that Target and Walmart, rather than Internet-only retailers such as Jet.com, are likely to make the most impactful moves to cater to young, cross-channel grocery shoppers. And we have already seen a flurry of activity from Target and Walmart:

- Following its December acquisition of Shipt, Target is rolling out same-day delivery for a number of categories, including groceries, across its store portfolio. Last year, Target launched its Restock service, which allows customers to fill a box with essentials for next-day delivery.

- Target also made two significant hires in 2017 as part of its effort to strengthen its grocery offering: the company hired Mark Kenny as VP Divisional, Meat and Fresh Prepared Food, and Liz Nordlie as VP, Product Design and Development, Food and Beverage.

- In September last year, Walmart bought startup Parcel, a technology-based, last-mile delivery service that specializes in the delivery of perishable and nonperishable items to customers in New York City.

- In March, Walmart announced that it plans to expand grocery home delivery from six markets to 100 by the end of 2018, using partnerships with firms such as Uber. Walmart will also add grocery pickup services to 1,000 more stores this year.

Amazon is often lauded as the greatest innovator in retail, but in the grocery category, it is playing catch-up, and adapting as it recognizes it needs brick-and-mortar stores to fully compete in the category. Grocery is uniquely multichannel, and we expect multichannel retailers to continue to dominate, including among much-sought-after millennial consumers.

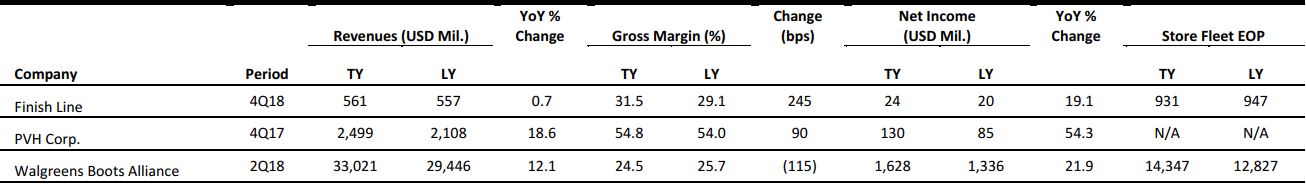

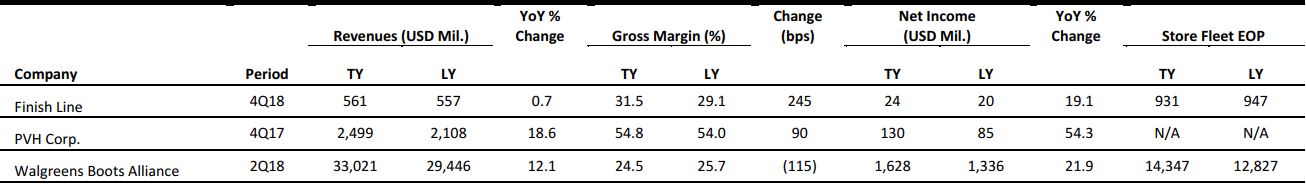

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Target Adding Three Small-Format Stores in NYC

(April 3) MarketWatch.com

Target Adding Three Small-Format Stores in NYC

(April 3) MarketWatch.com

- Target said that it will add three small-format stores in New York City. The stores will each be in a different borough, with one on the Upper East Side of Manhattan; one in Astoria, Queens; and one on Staten Island. Each of the stores will have between 50 and 100 workers.

- Target’s small-format stores are designed for urban and suburban neighborhoods, college campuses, and other densely populated areas. The retailer is on the path to having 130 small-format stores by the end of 2019, including three additional Manhattan locations.

Toys“R”Us Shuts Down E-Commerce Operations

(April 3) RetailDive.com

Toys“R”Us Shuts Down E-Commerce Operations

(April 3) RetailDive.com

- Toys“R”Us has stopped online retail operations. The bankrupt toy retailer now welcomes visitors to its website with a message that reads, “Thanks for visiting. We have shut down the website for any purchases, but our brick-and-mortar stores are open and holding going out of business sales.” The site redirects visitors to websites created around the store closings sales.

- The retailer, which announced plans in March to wind down its entire US business, is still trying to save 200 of its top-performing stores as part of a deal for its Canadian business. The company’s domestic business and assets go up for auction in April.

Data Breaches Revealed at Four US Retail Chains

(April 3) ComputerWeekly.com

Data Breaches Revealed at Four US Retail Chains

(April 3) ComputerWeekly.com

- Data breaches have come to light at US department store chains Saks Fifth Avenue, Saks OFF 5TH and Lord & Taylor and at bakery-style café chain Panera Bread. Hudson’s Bay Company, the parent company of the three department store chains, confirmed that a breach of its payment system had compromised the personal details of customers.

- The company did not say how many customers are affected, but did say that there was no indication that the breach affected its online shopping websites or other brands such as Hudson’s Bay stores in Canada.

Walmart in Talks to Strengthen Ties to Health Insurer Humana

(March 30) NYTimes.com

Walmart in Talks to Strengthen Ties to Health Insurer Humana

(March 30) NYTimes.com

- Walmart, the giant retailer, is constantly looking for ways to expand its business. Humana, the health insurer, is watching the consolidation taking place in its industry and looking for a partner. Now the two companies are exploring ways to strengthen their ties.

- A person briefed on the matter said that the two companies are discussing how to expand in ways that would help drive more traffic to Walmart’s 4,700 US stores while increasing Humana’s enrollment. Walmart could open urgent care clinics inside its stores or hold community events that cater to enrollees in Humana’s insurance plans.

Why Warehouse Clubs Aren’t Facing an “Apocalyptic” Decline

(March 29) ProgressiveGrocer.com

Why Warehouse Clubs Aren’t Facing an “Apocalyptic” Decline

(March 29) ProgressiveGrocer.com

- The story usually goes something like this: Virtually every warehouse club member has a Prime membership. So, it’s just a matter of time before Amazon starts eating clubs’ proverbial “lunch.” Others claim that the US club business is saturated and that only two club chains will ultimately survive.

- In fact, the club business has done quite well over the past five years. In spite of the headwinds from competitors, warehouse clubs’ sales have grown faster than overall US retail sales. Apparently, consumers are happy to hold both a warehouse membership and a Prime membership. In fact, research from HSA Consulting confirms that they will hold both, but rarely will they hold two warehouse memberships.

EUROPE RETAIL & TECH HEADLINES

Groupe Casino and Auchan Announce Strategic Purchasing Alliance

(April 3) Company press release

Groupe Casino and Auchan Announce Strategic Purchasing Alliance

(April 3) Company press release

- French retailer Groupe Casino announced a strategic purchasing partnership with Auchan. The new deal enables Casino and Auchan to jointly negotiate purchases from French and international food and nonfood suppliers.

- The companies said that the alliance will not extend to freshly fished or farmed products or to products developed by small and medium-sized French brands.

House of Fraser to Secure £30 Million from Parent Firm Sanpower

(April 1) TheTimes.co.uk

House of Fraser to Secure £30 Million from Parent Firm Sanpower

(April 1) TheTimes.co.uk

- Sanpower Group, House of Fraser’s Chinese owner, has promised to inject more than £30 million ($42 million) to help improve the department store chain’s strained financial health.

- Sanpower already pumped in £15 million ($21 million) last week to help House of Fraser meet payments to landlords, and it is expected to provide the same amount again. This injection follows the £15 million ($21 million) that Sanpower gave to House of Fraser last September.

Jigsaw Acquires Funding from a Rescue Deal Led by Carphone Warehouse Founder

(March 29) News.sky.com

Jigsaw Acquires Funding from a Rescue Deal Led by Carphone Warehouse Founder

(March 29) News.sky.com

- British womenswear retailer Jigsaw has obtained a £20 million ($28 million) rescue deal led by David Ross, founder of Carphone Warehouse. Sources told Sky News that Ross could likely become a major shareholder in Jigsaw, thanks to the deal.

- Jigsaw’s existing majority shareholder, John Robinson, is expected to invest a sum similar to Ross’s and Secure Trust Bank will commit £10 million ($14 million) to replace Barclays as principal lender.

SecretSales Founders Complete Management Buyout

(March 29) DrapersOnline.com

SecretSales Founders Complete Management Buyout

(March 29) DrapersOnline.com

- Nish and Sach Kukadia, the founders of flash-sales site SecretSales.com, have finalized a management buyout of the company, along with new investor Big Ideas Group. The Kukadias did not reveal the value of the deal.

- The Kukadias plan to focus more closely on the premium and luxury market. Big Ideas Group will contribute financial investment and marketing expertise as well as provide opportunities for offline, invite-only designer sales.

Albert Heijn to Trial App for In-Store Navigation

(March 30) RetailDetail.eu

Albert Heijn to Trial App for In-Store Navigation

(March 30) RetailDetail.eu

- Dutch retailer Albert Heijn is set to trial a smartphone app that will calculate the ideal shopping route within a store based on a user’s grocery list. The company will first test the app in a supermarket in Hoofddorp in May.

- The app is similar to Google Maps and shows shoppers the fastest route to pick up items on their list, eliminating the need for them to ask store staff for guidance. The app was codeveloped by Philips and Aisle411, which have previously partnered to create similar apps for two supermarkets in the US and one in the UAE.

ASIA RETAIL & TECH HEADLINES

Alibaba Takes Control of Ele.me, at $9.5 Billion Value

(April 2) Bloomberg.com

Alibaba Takes Control of Ele.me, at $9.5 Billion Value

(April 2) Bloomberg.com

- As it steps up efforts to expand in China’s fast-growing market for local delivery of food and other services, Alibaba Group is buying full control of startup Ele.me. The deal implies an enterprise valuation of $9.5 billion for Ele.me. Alibaba and its Ant Small and Micro Financial Services Group affiliate already owned about 43% of the startup’s voting shares. Alibaba paid all cash in the deal and has acquired all the shares formerly held by Baidu.

- me operates an army of delivery people on motorbikes across China and is vying for supremacy in the local services industry with Meituan Dianping, a startup backed by Tencent. The market is surging as people increasingly turn to their smartphones to order food, schedule beauty treatments and hire domestic helpers. The services market is also strategically important for Alibaba and Tencent as a means to promote their respective payment services.

SoftBank, Alibaba to Invest $445 Million in Indian E-Retailer Paytm E-Commerce

(April 3) CNBC.com

SoftBank, Alibaba to Invest $445 Million in Indian E-Retailer Paytm E-Commerce

(April 3) CNBC.com

-

- SoftBank Group is investing $400 million in India’s Paytm E-Commerce in a funding round that will value the online retailer at roughly $1.9 billion. Alibaba, an existing investor in Paytm E-Commerce, is adding $45 million in the round. SoftBank confirmed that it is investing in Paytm Mall, the brand name under which Paytm E-Commerce operates an online marketplace.

- “We believe Paytm Mall’s offline-to-online operating model, combined with the strength of the Paytm ecosystem, is uniquely positioned to enable India’s 15 million offline retail shops to participate in India’s e-commerce boom,” SoftBank said in a statement. Amit Sinha, COO of Paytm Mall, said the company would deploy the latest investment from SoftBank and Alibaba to beef up its technology and build superior logistics, among other things.

Stock Trading Startup 8 Securities Goes Bullish with $25 Million in Funding

(April 3) TechinAsia.com

Stock Trading Startup 8 Securities Goes Bullish with $25 Million in Funding

(April 3) TechinAsia.com

- Stock trading startup 8 Securities is pocketing its biggest-ever round of funding, of $25 million. The investment marks the fintech company’s first funding in four years. “Our last round was in the summer of 2014. We used that capital to develop Chloe and Tradeflix,” said 8 Securities Founder Mikaal Abdulla, referencing, respectively, the startup’s robo-advisor, which launched in 2016, and the commission-free stock trading service that was rolled out last October.

- “We decided to raise a larger round now in order to invest much more in marketing and to expand our software development team. We have to date not invested materially in marketing, but given the strong traction, we want to press the accelerator now,” Abdulla added. Unlike US-based trading app Robinhood, 8 Securities is focusing on Asia. Most of its users are in its home city of Hong Kong and in Mainland China and Singapore.

Singapore Says Uber-Grab Deal May Violate Competition Laws

(March 31) TechCrunch.com

Singapore Says Uber-Grab Deal May Violate Competition Laws

(March 31) TechCrunch.com

- Uber’s exit from Southeast Asia is under scrutiny from regulators in Singapore, who believe that Grab’s purchase of the US firm’s business in the region may violate competition laws. Singapore-based Grab, Uber’s chief rival in the region, announced the acquisition of Uber’s Southeast Asian business on March 26. In return, Uber is taking 27.5% of the Grab business, which is valued at more than $6 billion. The move appears to be a win for both parties

- Grab plans to shutter the Uber app in less than two weeks and migrate passengers and drivers to its services. It will also integrate Uber Eats into its nascent food delivery service. The coming together has already concerned consumers, who believe that prices may rise without two companies competing head to head, and now the Competition Commission of Singapore has announced that it is looking into the deal.

LATAM RETAIL & TECH HEADLINES

Tablet Market Reaches Maturity in Brazil

(April 2) ZDNet.com

Tablet Market Reaches Maturity in Brazil

(April 2) ZDNet.com

- The Brazilian tablet market continues to decline, but the decline has been less severe than in previous years. According to IDC’s Brazil Monthly Tablet Tracker, tablet sales dropped by 4.8% year over year in 2017, with a total of 3.79 million devices sold.

- Despite the decline, tablet sales seem to have stabilized in recent years. Tablet revenue decreased by 9% in 2017, to R$1.88 billion ($566 million). The average ticket fell from R$513 ($154) in 2016 to R$497 ($149) in 2017.

Motorola LatAm Head Becomes Global President

(March 28) ZDNet.com

Motorola LatAm Head Becomes Global President

(March 28) ZDNet.com

- Lenovo-owned smartphone maker Motorola has appointed Brazilian executive Sergio Buniac as Chairman and Global President. This follows a January announcement that Buniac, who had served as Latin America President since 2012, had been tasked with leading the company’s European operations as well.

- Buniac joined Motorola in 1996 and was appointed to head the company’s Brazil operations in 2007. He became head of the Southern Cone in 2011 before being promoted to Latin America President a year later. He succeeds previous Motorola Global President Aymar de Lencquesaing, who announced earlier this year that he planned to leave the company.

Alipay Enters Mexico with Openpay Partnership

(March 20) RetailTouchPoints.com

Alipay Enters Mexico with Openpay Partnership

(March 20) RetailTouchPoints.com

- Alipay will expand its service to Mexico through a partnership with Openpay, a payment platform with more than 17,500 associated point-of-sale systems across the country. The relationship is designed to help Mexican retailers meet demand for their products in China. An increasing number of Chinese shoppers are looking for Mexican goods they can’t find at home, according to Souheil Badran, President of Alipay Americas.

- “Chinese shoppers represent an important and growing audience for our Mexico-based merchants,” Openpay COO Eric Nuñez said in a statement. “By enabling our merchants to offer Alipay, we are ensuring that Chinese shoppers visiting their websites can use a frictionless, familiar payment method. We see Alipay as the superhighway connecting merchants in Mexico with this growing and increasingly affluent consumer group.”

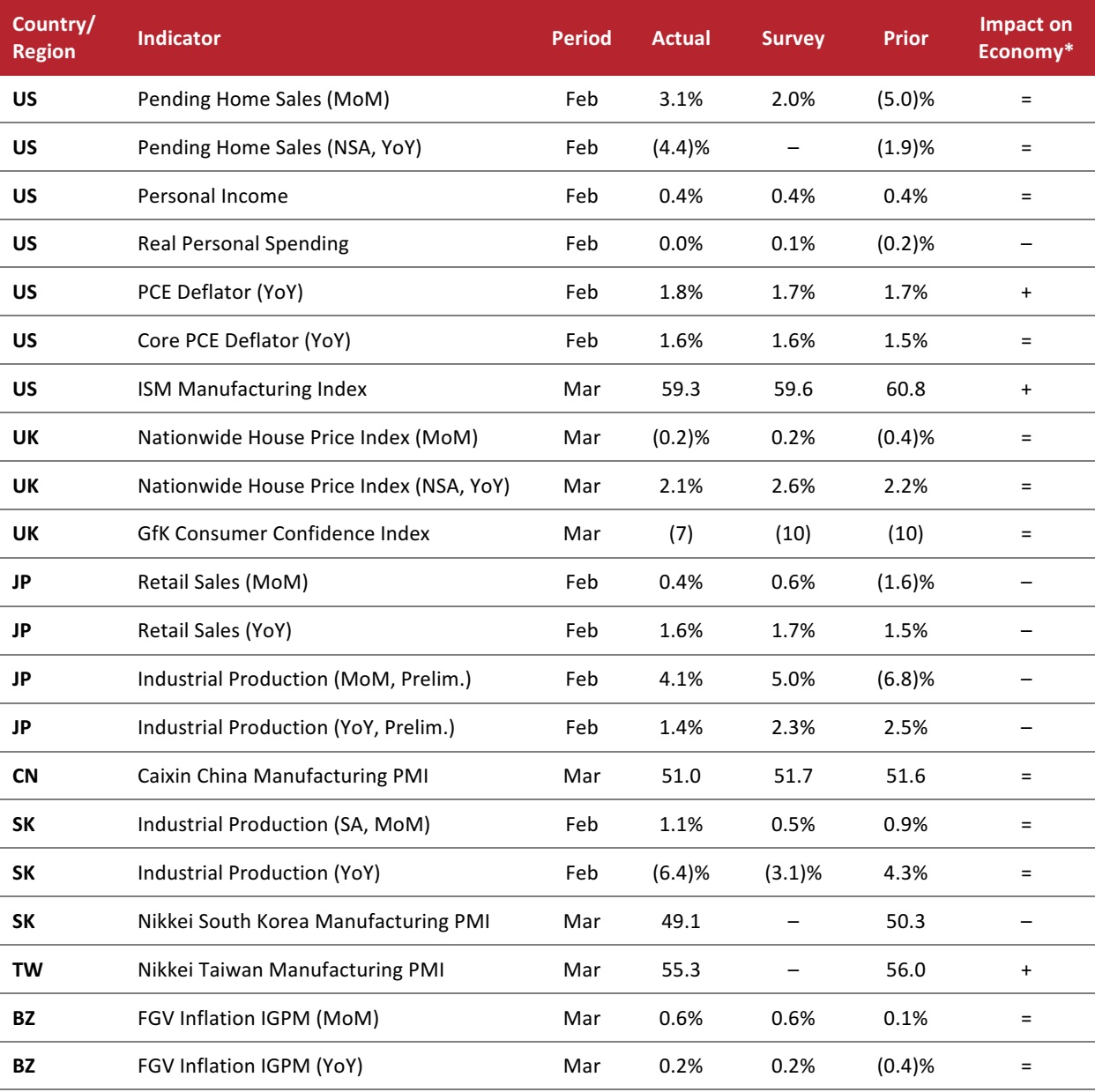

MACRO UPDATE

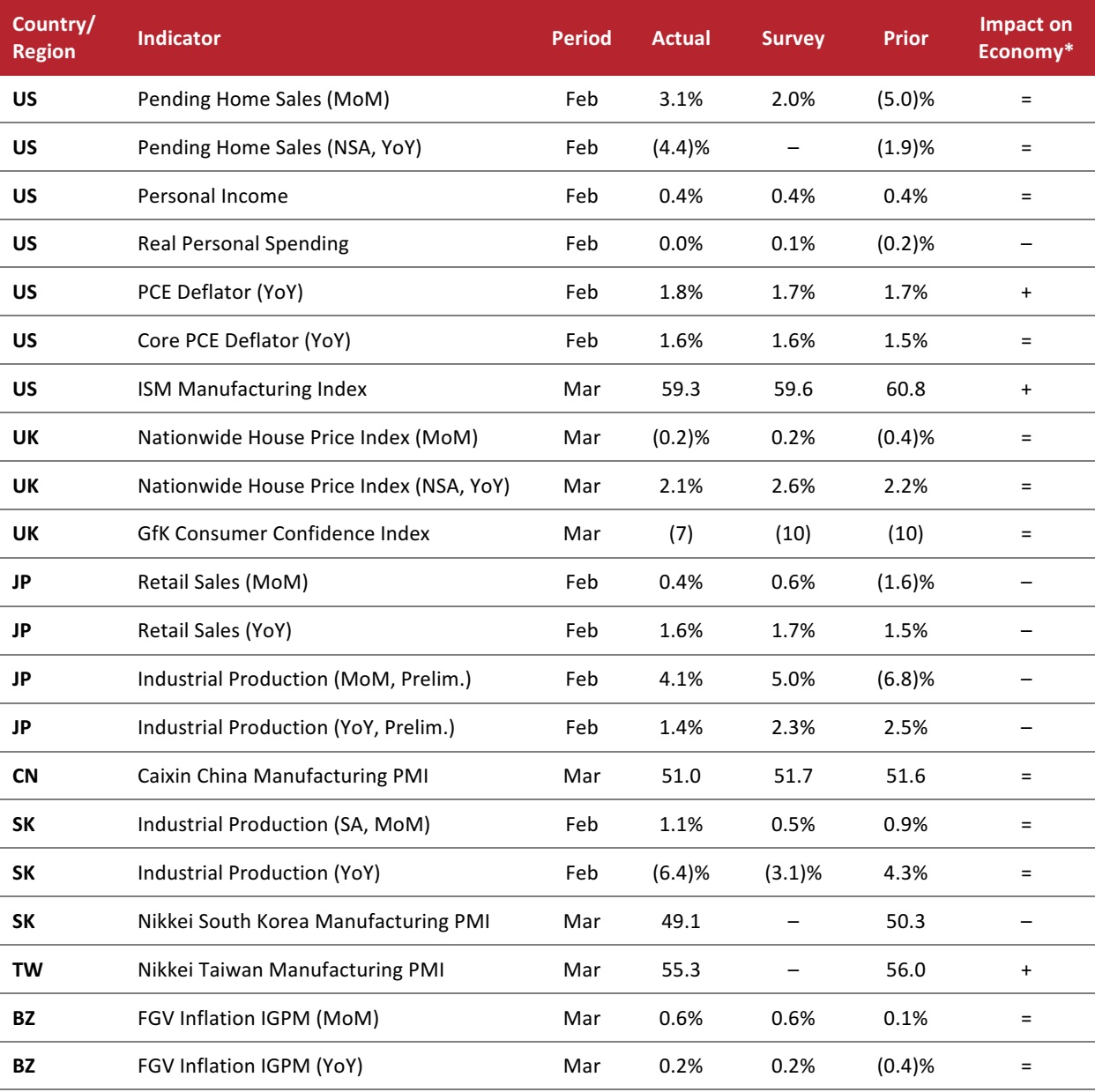

Key points from global macro indicators released March 28–April 4, 2018:

- US: Pending home sales increased by 3.1% month over month in February, but decreased by 4.4% year over year. Real personal spending stagnated in February. The Core Personal Consumption Expenditure (PCE) deflator increased by 1.6% year over year in February.

- Europe: In the UK, house prices edged down by 0.2% month over month in March, but increased by 2.1% year over year. The UK GfK Consumer Confidence Index increased to (7) in March, coming in ahead of the consensus estimate of (10).

- Asia-Pacific: In Japan, retail sales increased by 1.6% year over year in February. Industrial production in Japan increased by 1.4% year over year in February. In China, the Caixin Manufacturing Purchasing Managers’ Index (PMI) reading in March was lower than analysts had expected.

- Latin America: In Brazil, the FGV Inflation IGPM, an inflation index, increased by 0.6% month over month and by 0.2% year over year in March. The readings were in line with consensus estimates.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Bureau of Economic Analysis/Institute for Supply Management/Nationwide Building Society/GfK NOP (UK)/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Markit/Fundação Getulio Vargas/Coresight Research

*Including Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months, surveyed in March 2018

Source: Coresight Research

*Including Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 1,813 US Internet users ages 18+ who have bought groceries in-store in the past 12 months, surveyed in March 2018

Source: Coresight Research

Target Adding Three Small-Format Stores in NYC

(April 3) MarketWatch.com

Target Adding Three Small-Format Stores in NYC

(April 3) MarketWatch.com

Groupe Casino and Auchan Announce Strategic Purchasing Alliance

(April 3) Company press release

Groupe Casino and Auchan Announce Strategic Purchasing Alliance

(April 3) Company press release

House of Fraser to Secure £30 Million from Parent Firm Sanpower

(April 1) TheTimes.co.uk

House of Fraser to Secure £30 Million from Parent Firm Sanpower

(April 1) TheTimes.co.uk

Albert Heijn to Trial App for In-Store Navigation

(March 30) RetailDetail.eu

Albert Heijn to Trial App for In-Store Navigation

(March 30) RetailDetail.eu

Alibaba Takes Control of Ele.me, at $9.5 Billion Value

(April 2) Bloomberg.com

Alibaba Takes Control of Ele.me, at $9.5 Billion Value

(April 2) Bloomberg.com

SoftBank, Alibaba to Invest $445 Million in Indian E-Retailer Paytm E-Commerce

(April 3) CNBC.com

SoftBank, Alibaba to Invest $445 Million in Indian E-Retailer Paytm E-Commerce

(April 3) CNBC.com

Stock Trading Startup 8 Securities Goes Bullish with $25 Million in Funding

(April 3) TechinAsia.com

Stock Trading Startup 8 Securities Goes Bullish with $25 Million in Funding

(April 3) TechinAsia.com

Singapore Says Uber-Grab Deal May Violate Competition Laws

(March 31) TechCrunch.com

Singapore Says Uber-Grab Deal May Violate Competition Laws

(March 31) TechCrunch.com

Tablet Market Reaches Maturity in Brazil

(April 2) ZDNet.com

Tablet Market Reaches Maturity in Brazil

(April 2) ZDNet.com