FROM THE DESK OF DEBORAH WEINSWIG

Amid a Recovery in Demand, How Can Malls Become Platforms for Retailers?

US mall traffic is bouncing back. Bearing this out,

our most recent weekly US consumer survey found that the rates of avoidance of shopping centers have recently seen significant declines: Around 36% of consumers are avoiding malls, down 14.5 percentage points from just two weeks earlier.

Mall Demand is Recovering

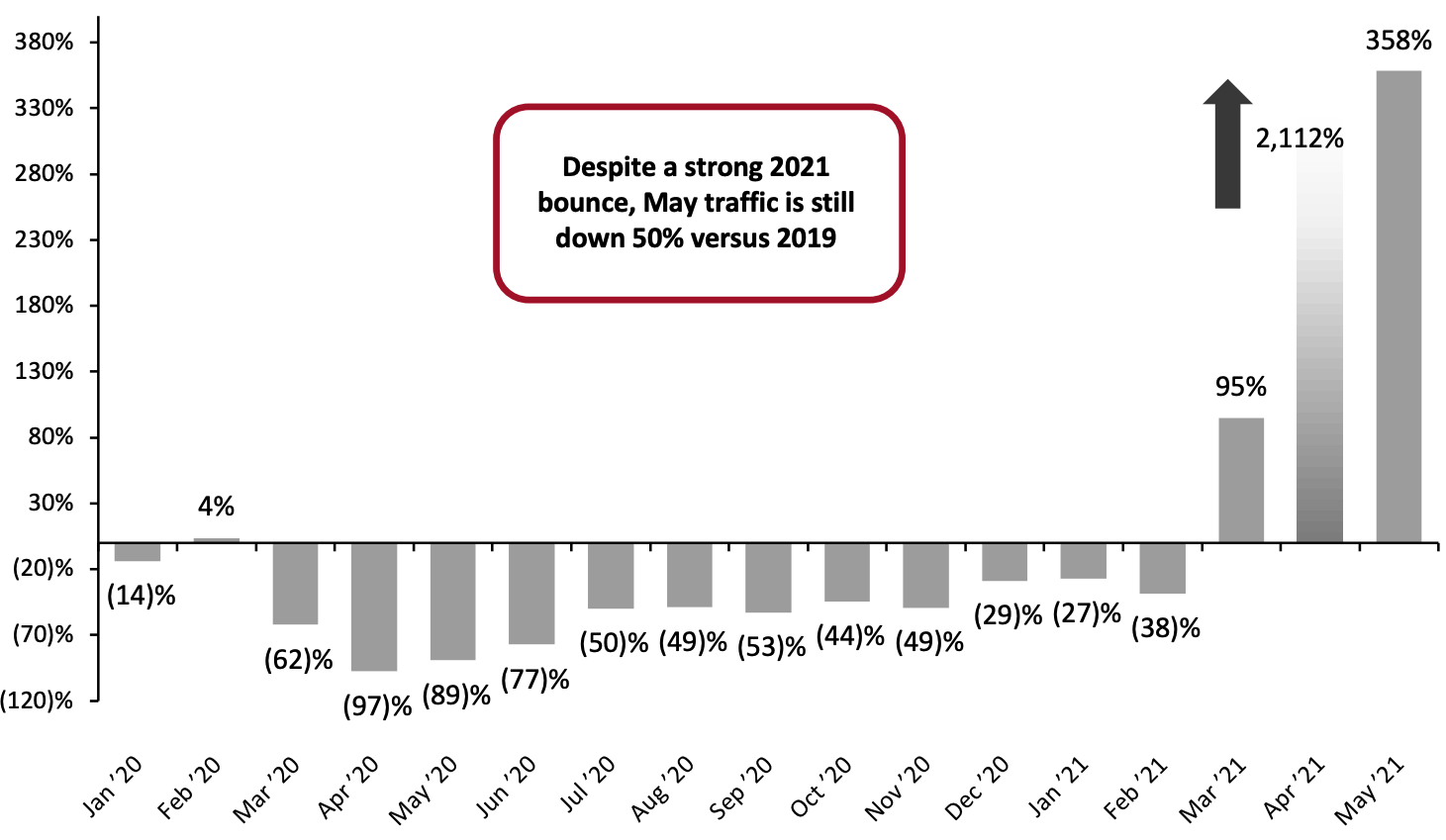

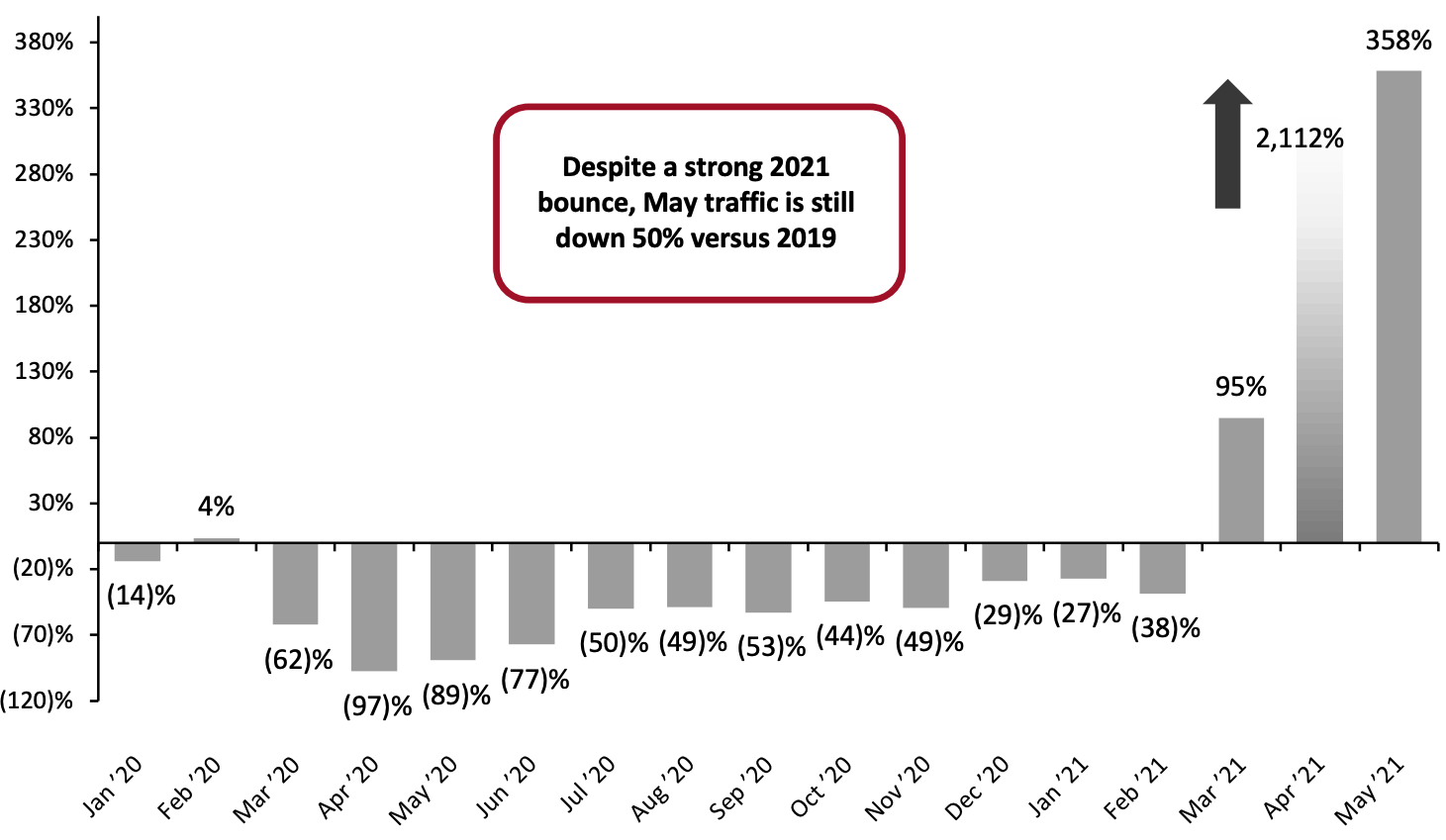

Foot-traffic data from location-based-data company Unacast provides further evidence of a shift in attitudes toward mall visits. We aggregated and analyzed data for two major US mall-based department store chains (as a rough proxy for malls) and found a 358% year-over-year increase in total visits in May, following a year-over-year jump of more than 2,000% in April, when the retail industry was annualizing lockdowns from one year earlier—as charted in Figure 1, mall visits were down 97.3% in April 2020.

However, even these impressive recoveries left total tracked visits in May 2021 down by one-half versus the comparable precrisis period of May 2019, underlining the need for mall owners and retailers to work together to attract shoppers back.

Figure 1. Tracked Visits to Two US Mall-Based Department Store Chains: YoY % Change

[caption id="attachment_128458" align="aligncenter" width="720"]

Source: Unacast/Coresight Research

Source: Unacast/Coresight Research[/caption]

Malls Can Become Platforms for Retailers

So, where next for the shopping mall? Just as we have seen e-commerce platforms expand as ecosystems for retailers, we see opportunities for malls to become platforms for their retail tenants, particularly in the following areas:

Omnichannel: The recent e-commerce boom has fueled demand for omnichannel services that integrate brick-and-mortar with digital channels. In 2020, malls enabled their tenants to serve demand with curbside collection spaces, and, as store capacity became an issue during the holiday peak, we saw mall-owning

real estate investment trusts (REITs) partner with technology vendors to launch virtual waitlists for their retail tenants. We see strong opportunities for malls to provide omnichannel services: At their best, centers can extend their position as platforms for retailers to the digital world, by offering more experiential online connections, such as through

livestreaming, as well as everyday convenience through tools such as customer-facing apps.

Expertise: REITs can serve as end-to-end experts, advising and supporting retailers on store-opening programs—from strategic advice on location types to industry networks that enable rapid store fit-outs. REITS can deploy their industry knowledge, networks and capabilities to help retailers more easily and confidently establish and equip the right stores in the right locations.

Flexibility: REITs can help retailers to adjust more swiftly and experiment more freely in response to the still-shifting and unpredictable nature of consumers’ behaviors, lifestyles and working lives. The pandemic has prompted many consumers to try new brands, switch shopping channels and change the mix of their spending. Supported by mall owners, retailers can respond with short-term retail formats and pop-up stores, enabling them to offer limited-time brand-building experiences, serve peak demand—such as for online order collection and return, and test new markets and concepts.

Local: We have seen some evidence that the disruption of the pandemic has accelerated consumer disinterest in homogeneous physical-retail experiences and driven a renewed appreciation for experiences that are local, distinctive and diverse. Retailers should consider localizing in-store experiences and product offerings, and mall owners can support them with localized center experiences. Already, many malls reflect their communities with tailored experiences and events, as well as a selection of retailers curated to serve the locality.

Consumer demand for physical retail, including traditional shopping malls, is recovering strongly but has not yet sprung back to anything like its pre-pandemic state. The shifts in consumer behavior underscore the opportunities for malls to serve as business platforms that provide expertise, services and flexibility for their retail partners.

US RETAIL AND TECH HEADLINES

Albertsons Partners with Fetch Rewards To Increase Customer Engagement

(June 8) SupermarketNews.com

- Albertsons has partnered with Fetch Rewards, a consumer loyalty and shopper rewards app, to expand its customer rewards program. The companies plan to launch a five-week pilot program in about 200 Albertsons stores.

- The program will enable Fetch Rewards users to access exclusive offers at Albertsons and its family of stores, including Haggen, Randalls, Safeway and Tom Thumb.

Five Below Plans To Add Associate-Assisted Self-Checkout in 250 Stores

(June 7) RisNews.com

- Five Below has announced plans to install associate-assisted self-checkout (ACO) in 60% of its stores by the end of 2021. The move is part of the company’s strategy of adding new technology across its value chain.

- The ACO installation aims to make the checkout process more efficient, enhancing the customer experience. CEO Joel Anderson stated, “ACO allows our crew to move from behind the register to the floor to assist our customers with their shopping and checkout process, which makes for a better and faster customer experience.”

Stitch Fix Reports 44% Year-over-Year Increase in Net Revenues During Its Third Quarter of Fiscal 2021

(June 7) Company press release

- Online styling service Stitch Fix reported $536 million in net revenue for its third quarter of fiscal 2021, ended May 1, 2021—up 44% year over year. Net loss narrowed to $18.8 million from the $33.9 million reported in its third quarter of fiscal 2020.

- The company witnessed strong demand for Fix, its personal styling offering, from both new and returning clients, which led to strong revenue growth. The company reported 4.1 million active clients, up 20% from one year ago and an increase of 234,000 clients from the previous quarter.

Torrid Holdings Plans for IPO

(June 8) ChainStoreAge.com

- Plus-size women’s apparel retailer Torrid Holdings has filed for an initial public offering (IPO). The company previously filed to go public in 2017 but withdrew in 2019.

- The company plans to apply for listing on the New York Stock Exchange (NYSE) under the ticker symbol “CURV.” The retailer, which operates a total of 608 stores globally, stated that its e-commerce sales accounted for 70% of total net sales during 2020.

Walmart Agrees To Distribute GNC Products in Stores and Online Platforms

(June 8) Post-Gazette.com

- Walmart has agreed to sell select products from health and wellness retailer GNC at 4,000 stores and on its websites, as part of a new partnership between the two companies.

- GNC aims to expand its customer base through the partnership. It offers vitamin and health supplements and plans to add new product offerings, including an expanded range of sports nutrition and weight management products.

EUROPE RETAIL AND TECH HEADLINES

Carrefour and Tesco Discontinue Purchasing Alliance

(June 8) Reuters.com

- Supermarket groups Carrefour and Tesco have decided to end their purchasing alliance. The companies entered the alliance in 2018 as a potential way to cut costs, demanding more favorable terms from suppliers.

- The companies have decided not to renew the alliance after its initial three-year period. It formally ends on December 31, after which both groups will focus on opportunities independently.

Gap Announces Plans To Close 19 Stores Across the UK and the Republic of Ireland

(June 9) RetailGazette.co.uk

- Gap has announced plans to permanently close 19 stores across the UK and the Republic of Ireland. The fashion retailer has not yet revealed the store locations.

- The company will terminate the leases upon their expiry on July 31. The decision follows a strategic review launched last year. In October 2020, the company announced it was considering shifting its European operations to a franchisee-only model—including potentially closing all its 129 company-owned European stores and its UK warehouse in Rugby.

Lush Revamps Its E-Commerce Website and App, Expands AR Feature “Lush Lens”

(June 8) ChargedRetail.co.uk

- British cosmetics retailer Lush has revamped its e-commerce website and app. It has launched new features including a 24-hour live-chat function, expanded payment options, improved search optimization and a new checkout process.

- The company has also expanded its augmented reality (AR) feature “Lush Lens.” The feature uses the customer’s smartphone to provide product information and demonstration videos, reducing the need for packaging.

Pinterest Introduces “Shopping List” Feature and Expands Its UK Verified Merchant Programme

(June 8) ChargedRetail.co.uk

- Social media giant Pinterest has added a new “Shopping List” feature, launched this week in the UK and the US. The feature automatically saves a user’s product pins to a list on their profile page. Product pins will be displayed in a grid format alongside price, reviews and shipping information, enabling customers to click through to the retailer’s website and complete their transaction.

- Pinterest is also expanding its Verified Merchant Programme in the UK. The program enables retailers to sign up for a review of their customer service—if they pass, Pinterest will award them a blue tick, signifying they are a trustworthy seller.

Zara Owner Inditex Reports Strong Growth in Quarterly Sales—Up by 50% to €4.9 Billion ($5.9 Billion)

(June 9) Company reports/RetailGazette.co.uk

- Zara owner Inditex has reported a jump in quarterly sales by 50%, to €4.9 billion ($5.9 billion) in its first quarter, ended April 30, 2021. Its EBITDA was €1.2 billion ($1.5 billion)—compared to €484 million ($590 million) in the same period last year.

- Inditex also reported that its revenues have subsequently been higher than pre-pandemic levels. Inditex Executive Chair Pablo Isla stated, “Our differentiation and strategic transformation toward a fully integrated, digital and sustainable model continues to bear fruit.”

ASIA RETAIL AND TECH HEADLINES

Dingdong Maicai Files for US IPO

(June 8) Company press release

- Chinese grocery app Dingdong Maicai—backed by investors such as Sequoia Capital and Tiger Global Management—has filed for a US IPO. The company plans to list on the NYSE under the symbol “DDL.”

- A valuation target has not been finalized. For the year ended December 31, 2020, Dingdong Maicai recorded total revenues of $1.73 billion and a net loss of $484.8 million.

Flipkart Brings Toys“R”Us to Its Platform

(June 8) Company press release

- The wholesale entity of Flipkart Group, a Walmart-owned Indian e-commerce company, has formed a joint venture (JV) with omnichannel capabilities provider Ace Turtle. The JV was formed to secure Indian licensing rights for Toys“R”Us and Babies“R”Us.

- The JV has secured the rights through a strategic agreement with WHP Global, the controlling shareholder of Toys“R”Us.

Lotte Shopping and Shinsegae Bid for eBay Korea

(June 8) Forbes.com

- South Korean retailers Lotte Shopping and Shinsegae Group have entered bids for eBay Korea. Telecommunications operator SK Telecom and private equity firm MBK are reportedly no longer bidding.

- eBay Korea currently has an asking price of $4.43 billion. It represents around 11% of eBay’s global sales and 12.8% of South Korea’s e-commerce market—behind Coupang’s 13% share and market leader Naver’s 18%. In 2020, South Korean e-commerce sales rose by 25%, according to Trade Ministry estimates.

Nykaa Fashion Launches Home Furnishings Vertical

(June 8) FashionNetwork.com

- Nykaa Fashion, Indian beauty retailer Nykaa’s fashion retail segment, has launched a new vertical, “Fashion Home.” The vertical’s product offerings include bath products, furnishings, home décor and kitchen essentials.

- Nykaa Fashion CEO Adwaita Nayar stated, “The curation, discovery, inspiration and convenience that have come to define the quintessential Nykaa Fashion experience will now transcend to our offering for home, complete with styling guides and customized content.”

Shoppicks Set To Launch in Hong Kong

(June 8) InsideRetail.asia

- Online flash-sale platform Shoppicks is scheduled to launch in Hong Kong on June 23, 2021. The online platform offers discounts as high as 90% on off-season fashion products from premium brands.

- The company’s product offerings will include accessories, handbags, makeup and women’s footwear. Shoppicks Hong Kong will also feature premium memberships, allowing members access to exclusive flash sales.

Source: Unacast/Coresight Research[/caption]

Malls Can Become Platforms for Retailers

So, where next for the shopping mall? Just as we have seen e-commerce platforms expand as ecosystems for retailers, we see opportunities for malls to become platforms for their retail tenants, particularly in the following areas:

Omnichannel: The recent e-commerce boom has fueled demand for omnichannel services that integrate brick-and-mortar with digital channels. In 2020, malls enabled their tenants to serve demand with curbside collection spaces, and, as store capacity became an issue during the holiday peak, we saw mall-owning real estate investment trusts (REITs) partner with technology vendors to launch virtual waitlists for their retail tenants. We see strong opportunities for malls to provide omnichannel services: At their best, centers can extend their position as platforms for retailers to the digital world, by offering more experiential online connections, such as through livestreaming, as well as everyday convenience through tools such as customer-facing apps.

Expertise: REITs can serve as end-to-end experts, advising and supporting retailers on store-opening programs—from strategic advice on location types to industry networks that enable rapid store fit-outs. REITS can deploy their industry knowledge, networks and capabilities to help retailers more easily and confidently establish and equip the right stores in the right locations.

Flexibility: REITs can help retailers to adjust more swiftly and experiment more freely in response to the still-shifting and unpredictable nature of consumers’ behaviors, lifestyles and working lives. The pandemic has prompted many consumers to try new brands, switch shopping channels and change the mix of their spending. Supported by mall owners, retailers can respond with short-term retail formats and pop-up stores, enabling them to offer limited-time brand-building experiences, serve peak demand—such as for online order collection and return, and test new markets and concepts.

Local: We have seen some evidence that the disruption of the pandemic has accelerated consumer disinterest in homogeneous physical-retail experiences and driven a renewed appreciation for experiences that are local, distinctive and diverse. Retailers should consider localizing in-store experiences and product offerings, and mall owners can support them with localized center experiences. Already, many malls reflect their communities with tailored experiences and events, as well as a selection of retailers curated to serve the locality.

Consumer demand for physical retail, including traditional shopping malls, is recovering strongly but has not yet sprung back to anything like its pre-pandemic state. The shifts in consumer behavior underscore the opportunities for malls to serve as business platforms that provide expertise, services and flexibility for their retail partners.

Source: Unacast/Coresight Research[/caption]

Malls Can Become Platforms for Retailers

So, where next for the shopping mall? Just as we have seen e-commerce platforms expand as ecosystems for retailers, we see opportunities for malls to become platforms for their retail tenants, particularly in the following areas:

Omnichannel: The recent e-commerce boom has fueled demand for omnichannel services that integrate brick-and-mortar with digital channels. In 2020, malls enabled their tenants to serve demand with curbside collection spaces, and, as store capacity became an issue during the holiday peak, we saw mall-owning real estate investment trusts (REITs) partner with technology vendors to launch virtual waitlists for their retail tenants. We see strong opportunities for malls to provide omnichannel services: At their best, centers can extend their position as platforms for retailers to the digital world, by offering more experiential online connections, such as through livestreaming, as well as everyday convenience through tools such as customer-facing apps.

Expertise: REITs can serve as end-to-end experts, advising and supporting retailers on store-opening programs—from strategic advice on location types to industry networks that enable rapid store fit-outs. REITS can deploy their industry knowledge, networks and capabilities to help retailers more easily and confidently establish and equip the right stores in the right locations.

Flexibility: REITs can help retailers to adjust more swiftly and experiment more freely in response to the still-shifting and unpredictable nature of consumers’ behaviors, lifestyles and working lives. The pandemic has prompted many consumers to try new brands, switch shopping channels and change the mix of their spending. Supported by mall owners, retailers can respond with short-term retail formats and pop-up stores, enabling them to offer limited-time brand-building experiences, serve peak demand—such as for online order collection and return, and test new markets and concepts.

Local: We have seen some evidence that the disruption of the pandemic has accelerated consumer disinterest in homogeneous physical-retail experiences and driven a renewed appreciation for experiences that are local, distinctive and diverse. Retailers should consider localizing in-store experiences and product offerings, and mall owners can support them with localized center experiences. Already, many malls reflect their communities with tailored experiences and events, as well as a selection of retailers curated to serve the locality.

Consumer demand for physical retail, including traditional shopping malls, is recovering strongly but has not yet sprung back to anything like its pre-pandemic state. The shifts in consumer behavior underscore the opportunities for malls to serve as business platforms that provide expertise, services and flexibility for their retail partners.