Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

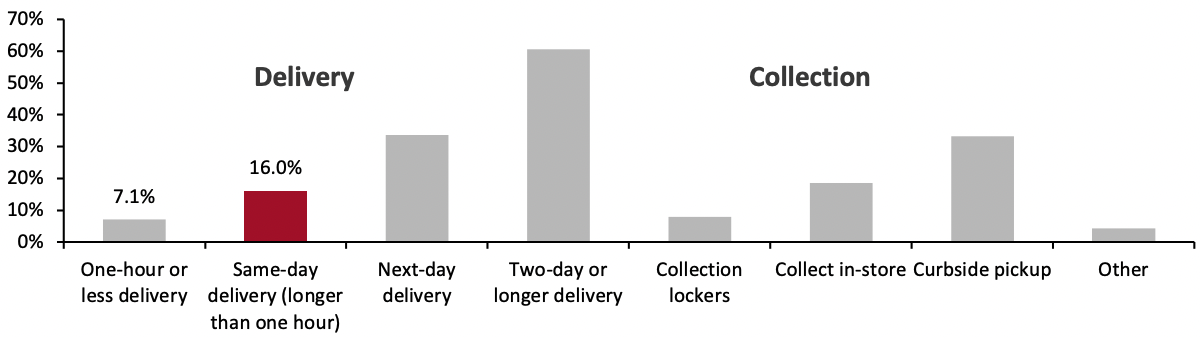

Amazon’s Same-Day Store Deliveries: Another Service Model in Retail Amazon’s latest retail initiative, announced earlier this week, offers same-day deliveries on behalf of select brands sold on its platform, fulfilled from those retailers’ stores, beginning with Diesel, GNC, PacSun and Superdry (more on this story in the US headlines section below). It’s not only Amazon’s latest leveraging of its logistics operation but also its most recent expansion in same-day commerce, representing an extension beyond the traditional “need-now” categories of groceries, toiletries and similar consumable products. This is not revolutionary—the companies selected for this venture are not the multibrand stores that Amazon traditionally competes with, and the sales must be made through Amazon’s website or app. However, the service will help the partner brands serve the growing niche of faster commerce. Amid the rush to quick commerce in the grocery and CPG sectors, opportunities have developed for discretionary retailers in sectors such as apparel to offer slightly slower, same-day delivery. As shown in Figure 1 below, in a May 2022 survey, 16.0% of US online shoppers told us that they had used same-day delivery in the past three months; a further 7.1% had used one-hour or faster delivery.Figure 1. US Online Shoppers: Delivery and Collection Services Used in the Past Three Months (% of Respondents) [caption id="attachment_153079" align="aligncenter" width="700"]

Base: 381 US respondents aged 18+ who had purchased products online in the past three months, surveyed in May 2022

Base: 381 US respondents aged 18+ who had purchased products online in the past three months, surveyed in May 2022Source: Coresight Research[/caption] An Evolution of Retail-as-a-Service More widely, Amazon’s new initiative represents a further move into retail services by the company. Its announcement came almost exactly a year after Walmart launched its white-label GoLocal service, which delivers on behalf of third-party retailers. The initiative builds on Amazon’s existing logistics operations on behalf of sellers (Fulfilled by Amazon) and the company’s licensing of its “Just Walk Out” technology to brick-and-mortar retailers. It comes amid a boom in retail media, as many of Amazon’s rivals attempt to catch up with its advertising stakes and it follows Amazon becoming a livestreaming platform for brands and sellers (Amazon Live is the third-most-used livestream platform in the US, according to Coresight Research survey data). Amazon’s same-day delivery arguably signals an evolution of retail-as-a-service, whereby retailers, marketplaces, real estate firms and vendors serve as platforms and service providers for brands and other sellers. This reflects that companies in the retail space are also data companies, fulfillment and logistics providers, and—as part of their inherent connections with shoppers—communications platforms. Echoing this, last week, we introduced our 3x3 Framework, which discussed three new things for retailers to sell and three new ways to sell them, noting the opportunities in monetizing data and retail media through new channels such as quick commerce and livestreaming. Beyond digital, we have noted previously that we see opportunities to take this model further into physical retail, with malls becoming platforms for retail tenants through omnichannel services, expertise in the retail ecosystem, responsive retail formats and localized experiences on behalf of their retail partners. An omnichannel world, marked by immediacy, cross-channel experiences and the complexities associated with managing multiple emerging platforms such as social media and livestreaming, is likely to lead to more unexpected and unlikely coalitions. We underscore that the expansion of channels, fulfillment methods, data and customer touchpoints bring new opportunities for retail companies to break out from traditional revenue models.

US RETAIL AND TECH HEADLINES

Amazon Now Offers Same-Day Delivery from Selected US Stores (Aug 2) RetailInsightNetwork.com- Amazon announced same-day delivery from selected brick-and-mortar retail stores in the US. The service is now available in over 10 US cities, including Atlanta, Chicago, Dallas, Las Vegas, Miami, Phoenix, Scottsdale, Seattle and Washington, DC.

- Prime members can use the free service to order items worth $25 or more from brands such as Diesel, GNC, PacSun and Superdry from the Amazon website or app and have them delivered the same day. However, if the order value is less than $25, customers must pay a $2.99 fee. Categories with items available for purchase include apparel, beauty, everyday essentials, electronics, pets and toys.

- Athletic sports retailer Lids introduced Explore by Lids, its first private label designed for children. In October 2022, Lids will expand the label to include adults’ headwear in matching designs. The brand is offered in the US and Canada.

- The label includes snapback and bucket hat collections aimed at children aged four to seven, and features designs with space, wildlife, rocket ship and shooting stars imagery.

- Jewelry retailer Tiffany launched a collection of 250 non-fungible tokens (NFTs) on August 5, 2022, which purchasers can exchange for a pendant called an NFTiff. These NFTs are from the CryptoPunk collection set of 10,000 NFTs launched in 2017. for 100 CryptoPunks holders whom Tiffany whitelisted.

- Each NFT costs 30 ethers (over $47,000), including the redeemable pendant designed to look like the NFT avatar. Customers are limited to purchasing a maximum of three NFTiffs (worth more than $140,000).

- Walmart has introduced a new refurbished goods program, “Walmart Restored,” which is intended to make it easier for customers to find refurbished goods. Walmart’s move comes as consumers continue to cut back on spending in the current inflationary environment.

- The refurbished items are now featured in a dedicated Walmart Restored section on Walmart’s website and include items from Apple, KitchenAid, and Samsung. These items will also be available in select Walmart locations beginning in the fall.

- Supermarket chain Weis Markets reported year-over-year sales growth of 8.4% in its second quarter of fiscal 2022, ended June 25, 2022. Its comparable store sales increased by 8.4% year over year; meanwhile, its diluted EPS increased by 8.9% year over year.

- For fiscal 2022, Weis Markets did not provide guidance. However, the company is concerned about the impact of inflation on its customers and, therefore, will continue promoting the value of its private brands, as well as the fuel and retail product savings available through its Weis rewards program. In May, the company lowered prices on hundreds of its best-selling brand-name products.

EUROPE RETAIL AND TECH HEADLINES

Dm-Drogerie Markt Launches In-Store Pick-Up Stations (Aug 2) Esmmagazine.com- German retailer dm-drogerie markt stated it will introduce pickup stations for online orders in approximately 700 of its stores, adding to its existing omnichannel services. The pickup stations can hold up to 26 orders at a time.

- These pickup stations are scheduled for operation during the store’s opening hours, allowing shoppers to pick up their orders seamlessly. Shoppers can purchase their products online or via the exclusive store app.

- British sports-fashion retailer JD Sports has sold Footasylum, a lifestyle fashion retailer, to German investment group Aurelius per the UK’s Competition and Market Authority’s (CMA) instructions, for £37.5 million ($45.9 million).

- JD Sports acquired Footasylum for £90 million ($110.3 million) in 2019. The CMA, however, found that both parties were guilty of exchanging financially sensitive information when key executives met in a car park in July 2021 and have therefore ordered JD Sports to sell Footasylum.

- UK food retailer Morrisons introduced “carbon-neutral eggs,” a new initiative that it has been working on for 18 months. It aligns with the company’s sustainability goal of being fully supplied by zero-emission British farms by 2030.

- Morrisons explained that these hens are fed a grain- and soya-free diet, which includes insects fed on food waste from its bakery, fruit and vegetable sites. This process occurs on a “mini farm container” created by Better Origin, an insect farming start-up. The company plans a national rollout in 2023.

- Auchan’s Spanish subsidiary Alcampo, a hypermarket chain, has agreed to acquire 235 supermarkets and a warehouse from DIA Group, a food sector franchiser. The company noted that the stores would offer healthy, local products and access to a wide range

- The deal includes a DIA warehouse in Villanubla and supermarkets in Aragón, Asturias, Madrid and The retailer added that this acquisition would add more than 180,000 square meters (1,937,504 square feet) of sales area to existing network.

- The founding family of Italian luxury group Tod’s has announced plans to buy out existing shareholders in a €338 million ($344 million) deal, taking the company private. This deal will value the company at €1.34 billion ($1.35 billion).

- The leading family members, the Della Valle brothers, hope the plan will develop the group’s individual brands, expand their reach and provide them with greater control over operations. The brothers will offer 25.5% of shareholders a deal through their joint holding company DeVa Finance S.r.l. The brothers already own 64.45% of Tod’s stake.

ASIA RETAIL AND TECH HEADLINES

Central Retail To Introduce Tops Club Wholesale Concept (Aug 2) insideretail.asia- Central Food Retail, a Thai supermarket chain, will launch a brand-new warehouse-style grocery concept akin to the Sam’s Club and Costco models. The new chain will be called Tops Club, and the first location will open late next month on the shopping street Rama II in Bangkok.

- Tops Club will use a membership business model and offer more than 3,500 items, 70% of which are imported and exclusive brands. The launch of the new chain is part of a $500 million investment plan to expand the company’s store network in Thailand and Vietnam to 1,700 locations over the next five years and establish itself as the “number one food retailer” in both regions.

- Global beauty giant Coty and digital services provider Ant Group have partnered to provide Alipay+ to the travel retail market worldwide, making Coty the first cosmetics brand to introduce Alipay+ globally in travel retail.

- Through the partnership with Ant Group and Alipay+, Coty will expand its digital operations by introducing comprehensive and varied marketing campaigns and payment platforms, making it easier for Coty to capture digital-first customers. Additionally, it will accelerate the growth of digital services in travel retail and foster deeper omnichannel collaboration across marketing, activations and digital payment options.

- Indonesia-based food technology startup GREENS has raised an undisclosed amount in pre-seed funding, led by East Ventures. Through “meta farming,” GREENS seeks to achieve food equity for everybody and build a hyperlocal food ecosystem where people can eat healthy and nutritious meals.

- The funding will be used to build the ecosystem for decentralized food production in two phases. Phase 1 will establish a hyperlocal food ecosystem by creating cloud networks of connected hyperlocal food outlets via the GREENS platform. Afterward, Phase 2 will focus on meta farming, enabling everyone to grow food in the metaverse for self-consumption or sale.

- Indian conglomerate ITC has announced its exit from the lifestyle retailing industry “after a strategic evaluation of its business portfolio.” The company entered the lifestyle retailing business over two decades ago under the Wills Lifestyle brand retailing a wide range of clothing, including formal, casual, evening and designer wear.

- The company previously had a selection of menswear accessories, denim and casuals under the John Players brand but restructured its lifestyle retailing division in 2019, reducing its activities in the sector and selling the brand to Reliance Retail for an undisclosed sum.

- Chinese online fast fashion retailer Shein hopes to boost its logistical capacity through a partnership with China Southern Airlines Logistics (CSAL). The recently finalized agreement will reportedly enable Shein to increase its flight capacity and warehouse capabilities, as well as facilitate additional exports to Europe and the US.

- The strategic alliance between CSAL and Shein comes at a crucial time when new opportunities and external obstacles coexist. According to the airline, through strategic collaboration, both sides will contribute long-term, win-win benefits to each other’s supply chain development.