FROM THE DESK OF DEBORAH WEINSWIG

Amazon’s Private Labels and Third-Party Sellers: Powering Prime Day and Every Day on Amazon

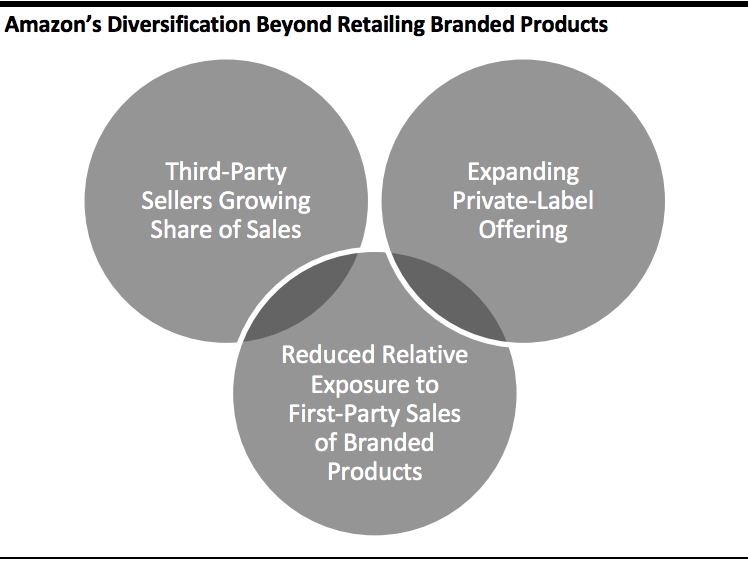

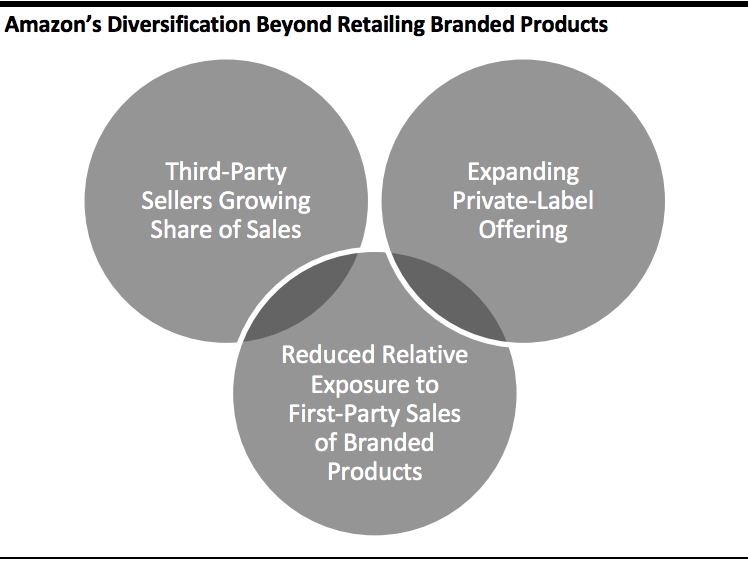

Powered by the contradictory forces of third-party sellers and private labels, Prime Day 2020 epitomized Amazon’s evolving retail strategy, which is most evident in more recently entered categories such as clothing and footwear. Third-party sellers grew sales by almost 60% compared to Prime Day 2019, yet the top-selling product was the Echo Dot, an Amazon-owned private-label product.

Amazon reported that shoppers bought “millions” of Alexa-compatible devices, which only Amazon sells.

Amazon may be coming to the same conclusion as the more established retailers whose sales it has helped decimate: Retail of third-party brands is among the weakest parts of the market. Instead, there are greater defensive positions to be found in being a retailer of exclusive brands—as long as those brands are sufficiently in demand. Nevertheless, expanding third-party listings allows Amazon to build out its total offering more profitably and with limited inventory risks compared to first-party retailing.

[caption id="attachment_118448" align="aligncenter" width="480"]

Source: Coresight Research

Source: Coresight Research[/caption]

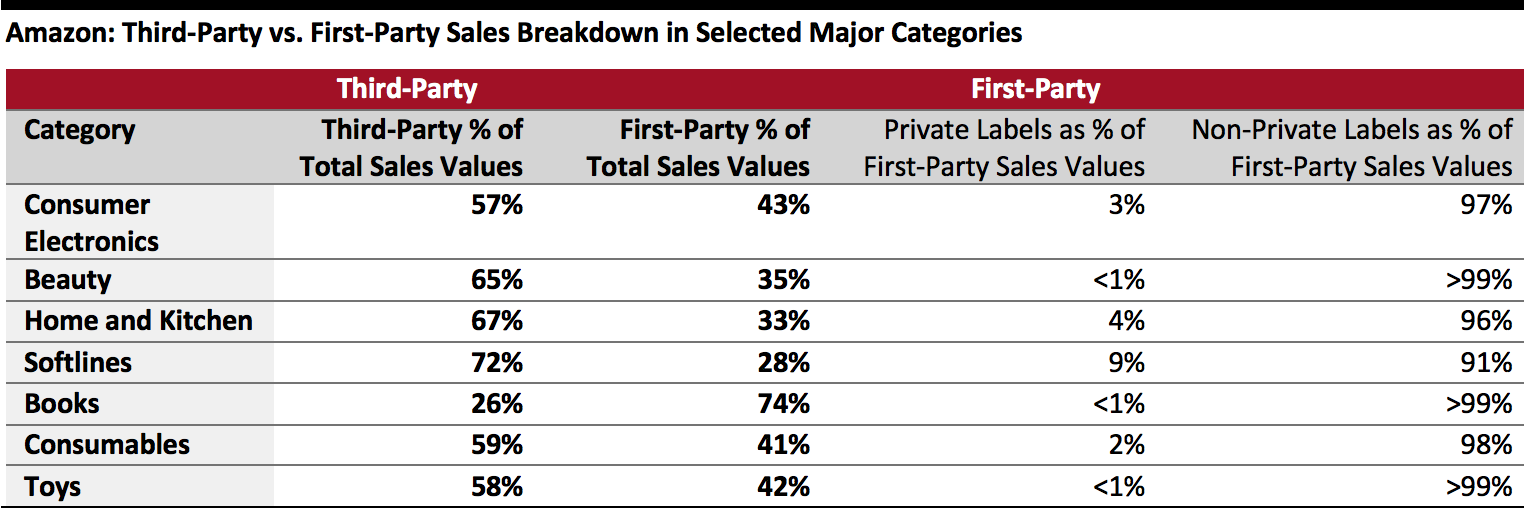

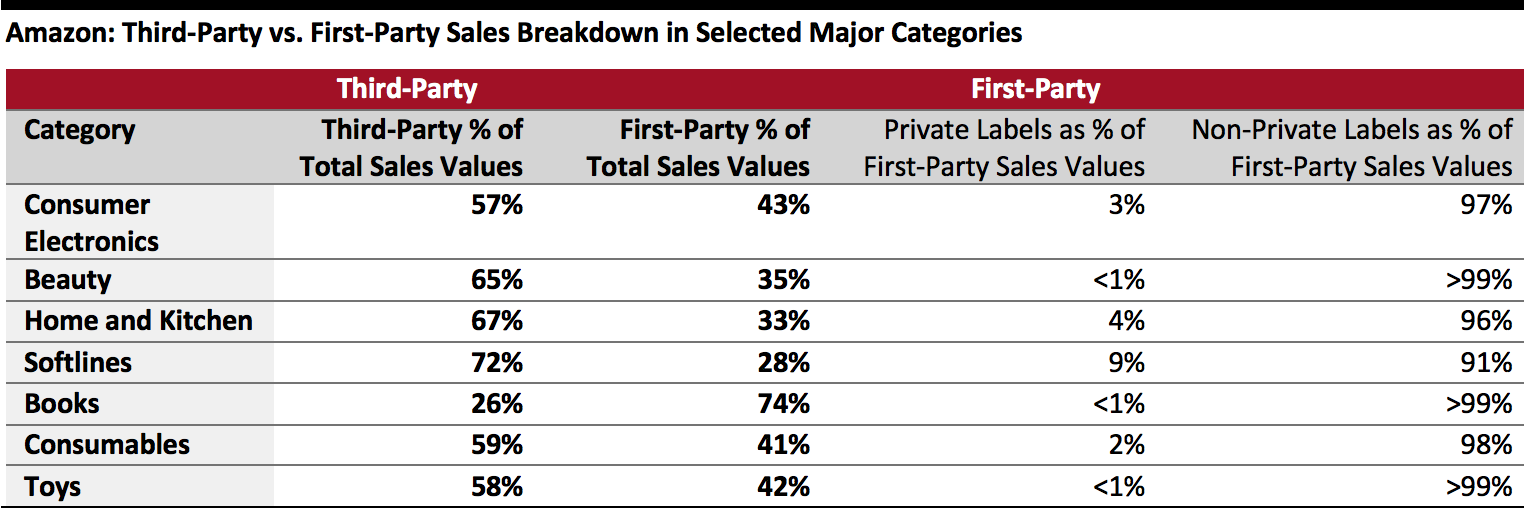

Data recently disclosed by Amazon and exclusive Coresight Research data helps to build a picture of how this strategy is playing out. In total, private labels make a still-small contribution to Amazon’s total sales, and these contributions are most prominent in the electronics, home and kitchen, and softlines categories, according to information filed by Amazon in September with the US House of Representatives (tabulated below).

[caption id="attachment_118449" align="aligncenter" width="700"]

Source: US House of Representatives Hearing of the Subcommittee on Antitrust, Commercial, and Administrative Law, Committee on the Judiciary

Source: US House of Representatives Hearing of the Subcommittee on Antitrust, Commercial, and Administrative Law, Committee on the Judiciary[/caption]

- Despite the popularity of Echo and other Amazon devices, in electronics, private labels account for 3% of Amazon’s first-party sales by dollar value, and, in turn, those first-party sales account for 43% of Amazon’s total electronics sales—implying that Amazon-brand devices account for around 1.3% of its total consumer electronics sales.

- Amazon’s private labels make a greater contribution to sales in apparel than in electronics. The company indicated that private labels account for 9% of its first-party sales in softlines by dollar value; in turn, first-party sales account for 28% of its softlines sales—implying that 2.5% of Amazon’s sales in apparel and other softlines are from its own brands.

- In beauty, books and toys, Amazon’s own data indicates that its private-label sales contribute a negligible share of total category sales.

Again representing the twin forces of private brands and third-party sales, independent sellers account for a higher proportion of dollar sales in softlines than in other major categories, at 72%, as shown above. This bears out

Coresight Research’s late-2019 data, which showed that a very substantial, and growing, majority of clothing listings on Amazon were from third-party sellers (as of September 2019). We identified that 87% of all men’s and women’s clothing products were listed by third-party sellers (although a product mix and sales mix are not identical). Across all categories, we estimate that third-party sales

accounted for around 58.5% of Amazon’s product sales in 2019.

Coresight Research’s extensive data on Amazon’s private-label offering provides further evidence of apparel’s longstanding overindexing in its own branded offering but suggests that Amazon’s push into private labels is extending to a range of categories.

Coresight Research analysis in April 2020 found that just over 12,000 of the private-label products sold on Amazon are clothing, footwear and accessories. That equates to around half of Amazon’s total private-label products, albeit down from almost 75% of private-label items when we undertook similar analysis in June 2018. This reflects that Amazon’s private labels now span a broader range of categories, with “home and kitchen,” “grocery and gourmet food” and “tools and home improvement” seeing the next highest numbers of private-label products, as of April 2020. Our research found that Amazon’s private-label offering spans 22,617 products across 111 identified private labels.

We have little doubt that Amazon will continue to push into private labels, likely with a particular focus on nontraditional categories such as food, furniture and home goods, personal care and—perhaps a tougher one to crack—beauty.

US RETAIL AND TECH HEADLINES

Ross Stores Completes Store Expansion Plan

(October 26) ChainStoreAge.com

- Off-price retailer Ross Stores has announced that it has concluded its store expansion plan for the year, adding 30 Ross Dress for Less and nine dd’s Discounts stores across 17 states.

- The retailer has added 66 new stores in total this fiscal year, well short of the approximately 100 stores that it had originally planned for the year.

Tapestry Appoints Joanne Crevoiserat as Permanent CEO

(October 27) Businesswire.com

- Tapestry’s Board of Directors confirmed Joanne Crevoiserat as the company’s new CEO. Crevoiserat has been operating as Interim CEO since July this year.

- Crevoiserat joined Tapestry in 2019 as CFO. Prior to that, she was COO at Abercrombie & Fitch Co., having joined in 2014 as CFO. She has also previously held senior positions at The May Department Stores Company, Kohl’s and Walmart.

Amazon To Hire 100,000 Seasonal Staff

(October 27) Company press release

- Amazon is looking to hire 100,000 seasonal workers to pick, pack and ship customer orders as it gears up for the holiday shopping season. The positions on offer include both part-time and full-time roles, and the jobs span all skill levels.

- According to Amazon, the jobs will offer “a path to a longer-term career or simply provide extra income and flexibility during the holiday season.”

Tuesday Morning To Seek Approval To Reorganize as a Standalone Entity

(October 27) RetailDive.com

- Off-price apparel retailer Tuesday Morning announced through a court filing on October 27, that it will seek approval for a plan to reorganize as a standalone entity and exit bankruptcy. The retailer has asked for a hearing on November 9 for approval of its disclosure statement, which will summarize its reorganization plans.

- Earlier this month, the retailer sought bids for a sale of its assets, but according to its most recent court filing, it will no longer pursue this.

TikTok Forays into US E-Commerce with Shopify Partnership

(October 27) Cityam.com

- TikTok has made its first major move into social commerce through a partnership with e-commerce tech provider Shopify. Merchants on Shopify can now run video ads on the TikTok platform. Users can click through the ads to merchants’ sites and make purchases.

- Currently, the feature has launched only in the US and will be available in Europe and Southeast Asia next year.

EUROPE RETAIL AND TECH HEADLINES

Next Reports Rise in Total and Full-Price Sales in Third Quarter

(October 28) Company press release

- British fashion retailer Next Plc has reported a 2.8% year-over-year increase in full-price sales and 1.4% growth in total sales (including markdown sales) in its third quarter, ended October 24. The company’s management remarked that performance was better than expected.

- Next reported that online sales were up by a strong 23.1% while offline sales were down 17.9%. Stores in retail parks in suburbs performed better than stores in shopping centers and cities. The company expects its full-year profit before tax to come in at £365 million ($475 million)—£65 million ($85 million) higher than its September forecast.

Flannels Opens New Store in Birmingham as Part of its Store Expansion Plan

(October 27) Retailgazette.co.uk

- British apparel retailer Flannel, a unit of Frasers Group, has opened a new 12,000-square-foot store in Birmingham and announced plans to open a total 17 new stores by 2021. The company plans to open two more stores this year, with the remainder in 2021.

- The new Birmingham store joins Flannels’ 40-plus store estate and offers products from luxury brands Alexander McQueen, Balenciaga, Balmain, Off White and others. It is the first store to feature a Flannels Café & Bar.

Russia Gets Its First Unstaffed, Contactless Store

(October 26) Retaildetail.eu

- Russian food retailer X5 Retail Group has announced the opening of the first fully automated convenience store, under its Pyaterochka banner, in Moscow. The store is open seven days a week from 7:00 a.m. to midnight.

- Consumers can use their smartphones and the retailer’s app to enter the store, scan products and make payments. The store also has an automated cash register for shoppers who wish to pay in cash. X5 Retail is looking to set up and trial similar stores in other neighborhoods of the city.

Tesco Launches Drone Delivery Service in Ireland

(October 27) Chargedretail.co.uk

- Grocery retailer Tesco has launched a trial of grocery home delivery via drones in Galway, Ireland, in partnership with drone delivery company Manna.

- During this trial, customers can order small-basket deliveries from a range of around 700 products through the FlipDish app. Once the order is placed, a Tesco employee packs the products and transfers them to a Manna drone supervisor for delivery. The products are delivered within one hour of ordering.

Tiffany & Co. Receives Regulatory Approval To Sell Its Business to LVMH

(October 27) Reuters.com

- US luxury jewelry retailer Tiffany & Co. has received regulatory approval from the European Commission for the sale of its $16 billion (£12 billion) business to French luxury conglomerate LVMH.

- The regulatory approval comes amid a legal battle between the two, as Tiffany & Co. sued LVMH for attempting to stall the deal unjustly and LVMH countersued Tiffany & Co. on the basis of alleged mismanagement during the coronavirus pandemic.

Vinted Acquires United Wardrobe

(October 27) Retaildetail.eu

- European online secondhand fashion platform Vinted has acquired United Wardrobe, a Dutch online marketplace for secondhand fashion goods.

- Through this acquisition, Vinted’s user base has increased by 4 million to 34 million buyers and sellers across 11 European countries. Vinted CEO Thomas Plantenga will continue to lead the firm while top executives from United Wardrobe will take leading roles at Vinted and oversee further expansion.

ASIA RETAIL AND TECH HEADLINES

FreshToHome Raises $121 Million To Ramp Up Its Presence in India and the Middle East

(October 27) news.yahoo.com

- FreshToHome, an Indian online retailer of fresh meat and fish, has raised $121 million in a Series C funding round led by Ascent Capital, Development Finance Corporation, Investment Corporation of Dubai and Investcorp, among others.

- FreshToHome will use the capital to rapidly expand within India and the Middle East. The e-commerce firm currently processes 1.5 million orders per month and generates $85 million in annualized sales.

Uniqlo Launches Online Shop in India

(October 27) thehindubusinessline.com

- Japanese apparel retailer Uniqlo has launched its Shop From Home service in India through its portal online.uniqlo.in to makes its products available to shoppers across the country.

- Through its online service, the company plans to offer its full line of over 20,000 items, including its AIRism masks, down jackets and EZY jeans. The retailer entered India in 2019 and operates four stores in Delhi.

Pinduodudo Teams Up with Hunan TV To Host Double 11 Super Night Gala

(October 27) Pandaily.com

- Chinese e-commerce marketplace Pinduoduo has partnered with local satellite TV station Hunan TV to host the upcoming Double 11 Super Night Gala on November 10.

- The theme of the Gala is “Boosting Consumer Confidence.” The e-commerce firm will distribute over ¥1 billion ($149 million) worth of coupons to consumers through online and offline interactions and other activities during the event.

Tokyu Plans To Withdraw from Thailand

(October 28) Insideretail.asia

- Japanese department store chain Tokyu plans to exit Thailand by closing its last location at Bangkok’s MBK shopping center in January 2021, putting an end to its 35 years of trading in the city.

- The company closed its other store at the Paradise Park Mall in Bangkok in January 2019 due to sluggish sales.

Tata Group Looks To Acquire Stake in BigBasket

(October 28) ETRetail.com

- Indian conglomerate Tata Group is planning to acquire a 50% stake in online grocery startup BigBasket for $1 billion, according to sources that spoke to The Economic Times.

- Alibaba, which holds a 26% stake in BigBasket, is reportedly planning to sell its entire shareholding in the e-grocery firm. Other major investors in BigBasket include the Abraaj Group, Ascent Capital and CDC Group.

Source: Coresight Research[/caption]

Data recently disclosed by Amazon and exclusive Coresight Research data helps to build a picture of how this strategy is playing out. In total, private labels make a still-small contribution to Amazon’s total sales, and these contributions are most prominent in the electronics, home and kitchen, and softlines categories, according to information filed by Amazon in September with the US House of Representatives (tabulated below).

[caption id="attachment_118449" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Data recently disclosed by Amazon and exclusive Coresight Research data helps to build a picture of how this strategy is playing out. In total, private labels make a still-small contribution to Amazon’s total sales, and these contributions are most prominent in the electronics, home and kitchen, and softlines categories, according to information filed by Amazon in September with the US House of Representatives (tabulated below).

[caption id="attachment_118449" align="aligncenter" width="700"] Source: US House of Representatives Hearing of the Subcommittee on Antitrust, Commercial, and Administrative Law, Committee on the Judiciary[/caption]

Source: US House of Representatives Hearing of the Subcommittee on Antitrust, Commercial, and Administrative Law, Committee on the Judiciary[/caption]