albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

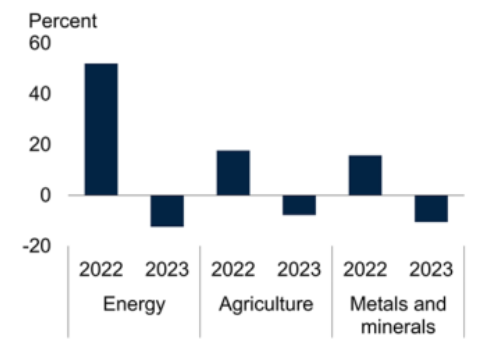

Alarm Bells Are Ringing Far and Wide The US Consumer Cuts Back As more metrics flow in—from companies, consumers and sectors—the picture of challenging conditions in mass-market US retail is crystalizing. Amid high inflation on essentials, America’s shoppers are, in total, cutting back on some discretionary categories. Management at Target last week noted that shoppers had passed up higher-margin, big-ticket items, such as home furnishings and apparel, in favor of essentials or low-margin items, such as groceries and beauty. At Walmart, CEO Doug McMillon said, “The rate of inflation in food pulled more dollars away from GM [general merchandise] than we expected as customers needed to pay for the inflation in food.” US food-at-home inflation reached 10.8% in April. Kohl’s reported sales declines and revised down its full-year sales guidance. While TJX had a strong first quarter, it, too, lowered its sales guidance for the full fiscal year. Best Buy reported an 8.5% decline in its US comp sales and revised down its full-year sales guidance. The pressures of inflation in essentials are heavily weighted toward consumers on low and modest incomes, which is reflected in the types of retailers reporting softer discretionary demand. Reflecting the bifurcation as luxury proves strong in the US, Nordstrom reported a solid first quarter and raised its full-year sales guidance. However, that high-end demand has not yet proved strong enough to offset real-terms declines elsewhere: In real terms, we estimate that total US retail sales were negative in March and April, at approximately (4.3)% and (1.2)% year over year, respectively. Crises Worldwide The picture elsewhere is worse. In China, retailers are battling a slump in sales amid widespread lockdowns. Total retail sales fell by almost 10% year over year in April—the steepest decline since March 2020. Sectors including fashion, beauty and communications were each down by almost one-quarter, year over year, in April. Meanwhile, the world is on the brink of a food crisis, the International Monetary Fund’s head, Kristalina Georgieva, warned last week, while a group of 50 economists surveyed by the World Economic Forum said the world is heading for its worst food crisis on record. On the back of this, we are seeing signs of renewed trade barriers in food supply, with India in mid-May banning the export of wheat. Food supply chains rely on the flow of trade and any widespread move toward trade restrictions will compound the challenges in food prices worldwide. Outlook and the Case for Transience Expected transience for current price inflation is the consolation. In its most recent Commodity Prices Outlook, the World Bank stated: “Most commodity prices are expected to be sharply higher in 2022 than in 2021 and to remain elevated in 2023 and 2024 compared to their levels over the past five years”—although it does expect some easing of the pressures in 2023, as shown in Figure 1.Figure 1. Commodity Price Forecasts: YoY % Change [caption id="attachment_148325" align="aligncenter" width="350"]

Source: World Bank[/caption]

Source: World Bank[/caption]

We expect current rates of inflation to be transitory, with oil prices and freight rates likely to be lower next year, and wheat production likely to be higher. In addition, any easing of lockdowns in China will boost the supply side in nonfood retail. US wage growth may ease should layoffs accelerate and a wider economic slowdown would help take some pressure off supply chains.

Given probable transience in the pace of inflation, retailers should be cautious about overreacting: Raised prices in commodities are likely to remain beyond 2022, but the trend in costs and prices, year over year, should turn negative. Moreover, in US retail, a slowdown in discretionary is arguably a correction after a very strong period, which was supported by stimulus payments: In 2021, total sales jumped by a near-unprecedented 14%.

Amid a rush to low prices on basics, limited and exclusive products remain levers that retailers can pull, albeit selectively and typically more among less price-conscious consumers. In the coming months, we expect many mass-market retailers to continue to take margin hits to maintain market share through price competitiveness.

US RETAIL AND TECH HEADLINES

Best Buy Reports First-Quarter Sales Decline, Revised Down Fiscal Guidance

(May 24) Company press release

- Electronics retailer Best Buy has reported a sales decline of 8.5% year over year in its first quarter of fiscal 2023 (ended April 30, 2022). Its comparable sales decreased by 8.0% year over year and its EPS declined by 29.6%. The company’s operating income rate decreased by 180 basis points (bps) year over year to 4.6%, due to supply chain investments and high freight costs.

- For fiscal 2023, the company revised down its sales and comps guidance and now expects sales of $48.3–49.9 billion, compared to the prior guidance of $49.3–50.8 billion, representing a decline of 3.7%–6.8% year over year and a comp decline of 3.0–6.0% year over year, compared to prior guidance of a decline of 1.0%–4.0%. The company also revised down its adjusted EPS guidance to $8.4–$9.0, compared to prior guidance of $8.9–$9.2.

Nordstrom Reports Strong First-Quarter Sales Growth, Raises Sales Guidance for Fiscal 2022

(May 24) Company press release

- Department store Nordstrom has reported sales growth of 18.7% year over year in its first quarter of fiscal 2022 (ended April 30, 2022). Its gross merchandise value (GMV) increased by 19.6% year over year and its diluted EPS increased by 112.4%. The company’s gross margin increased by 190 bps year over year to 32.8%, driven by improved merchandise margins from favorable pricing impacts and lower markdown rates.

- For fiscal 2022, the company raised its sales and EPS guidance and now expects sales growth of 6.0%–8.0% year over year, compared to prior guidance of 5.0%–7.0% growth. It expects diluted EPS of $3.20–3.50, compared to prior guidance of $3.15–$3.50.

Petco Reports Positive Sales Growth in Its First Quarter, Reaffirms Its Fiscal 2022 Financial Guidance

(May 24) Company press release

- Petcare retailer Petco has reported sales growth of 4.3% year over year in its fiscal 2022 first quarter (ended April 30, 2022). Its comparable sales increased by 5.1% year over year and its adjusted EPS was $0.2, in line with the prior year’s first quarter. The company’s gross margin declined by 102 bps year over year to 41.2%, due to high supply chain and commodity costs.

- For fiscal 2022, the company maintained its financial guidance, expecting sales growth of 6.0%–8.0% year over year and adjusted EPS growth of 6.6%–9.9% year over year. It expects adjusted EBITDA growth of 7.0%–9.0% year over year.

Urban Outfitters Reports Strong Results in Its First Quarter, Expects Gross Margin Decline Ahead

(May 24) Company press release

- Apparel specialty retailer Urban Outfitters has reported sales growth of 13.4% year over year in its first quarter of fiscal 2022 (ended April 30, 2022). Its comparable retail segment sales increased by 11.0% year over year and its EPS declined by 38.9%. The company’s gross margin decreased by 169 bps year over year to 30.7%, due to lower initial merchandise markups given high inbound transportation expenses and raw materials costs.

- While the company did not provide guidance for its fiscal 2022 full year it expects sales growth in the low-single-digit percentage for its second quarter. Urban Outfitters expects its gross margin to decline by 500 bps year over year in the next quarter, due to higher markdown rates and lower product margins.

(May 24) Company press release

- Walmart is planning to expand its drone delivery service in partnership with DroneUp, a drone delivery and drone technology solutions company, to 34 stores across six US states by the end of 2022. According to the company, the expansion will enable it to reach 4 million US households in Arizona, Arkansas, Florida, Texas, Utah and Virginia.

- The company expects to be able to deliver more than 1 million packages by drone annually. Customers will be able to order items between 8:00 am and 8:00 pm for drone delivery in 30 minutes for a delivery fee of $3.99.

EUROPE RETAIL AND TECH HEADLINES

Gorillas Realigns Strategic Priorities To Focus on Profitability

(May 24) Company press release

- Berlin-based ultrafast grocery delivery provider Gorillas has announced that it is shifting its focus from hyper-growth to profitability in order to strengthen its position in the long term.

- The company will lay off 300 employees globally and tighten its focus on the five core markets that account for 90% of its revenue—Germany, France, the Netherlands, the UK and the US. It is also considering all possible strategic options in Spain, Denmark, Italy and Belgium—the four other markets in which it currently operates.

H&M Foundation Unveils Clothing with Carbon Capture Properties

(May 23) Company press release

- Swedish fashion group H&M’s non-profit entity, H&M Foundation, and The Hong Kong Research Institute of Textiles and Apparel have unveiled cotton garments that can capture carbon dioxide from the air and release it as nutrition to plants. The clothing is now being tested by restaurant staff at Fotografiska Stockholm in Sweden.

- The company stated that the cotton garments are treated with an amine-containing solution that enables the fabric to lock in carbon dioxide from the surrounding air. The carbon dioxide can then be discharged from the fabric by being heated to 30–40°C (86–04°F), where plants can naturally take it up during photosynthesis.

Mountain Warehouse Launches Online Marketplace

(May 24) FashionUnited.uk

- UK-based outdoor equipment and clothing retailer Mountain Warehouse has launched its own online marketplace called Mountain Warehouse Marketplace. It features a broad range of outdoor living and garden products and an extended pet offering.

- The company stated that the sellers joining the platform will have access to its 1.7 million active online customers and 600,000 weekly visitors. The brands that are currently signed up include Canterbury, Donda Cycling, NIKE and Slazenger.

Ocado Acquires Robotic Handling Startup Myrmex

(May 23) Company press release

- UK-based online grocery retailer and technology provider Ocado has acquired Athens-based material handling robotic startup Myrmex for €10.2 million ($11.0 million). The Myrmex solution will help Ocado accelerate the development of intelligent asset handling systems.

- Ocado acquired a minority stake in Myrmex in October 2020 and tasked it to design and develop a solution that automates the loading of totes containing customer orders onto frames ready for dispatch from Ocado’s warehouses. The “Automated Frameload” solution Myrmex designed is set to go live in Ocado's warehouses later this year.

Weird Fish Partners with Next and Zalando To Boost Its Overseas Reach

(May 24) Just-Style.com

- UK-based clothing retailer Weird Fish has teamed up with UK-based apparel specialty retailer Next and German fashion e-commerce platform Zalando in a move enabling it to reach more than 53 million customers across 93 countries. Weird Fish will sell its full range of menswear and womenswear on its partners’ e-commerce sites.

- The collaboration follows a record year for Weird Fish—the company posting e-commerce revenue of £21 million ($26.3 million) for the year ended December 31, 2021, almost double the £12 million ($15.1 million) it recorded in 2020.

ASIA RETAIL AND TECH HEADLINES

Aditya Birla Fashion and Retail Limited Secures $283.2 Million from Singapore’s GIC

(May 24) Company press release

- Indian fashion retailer Aditya Birla Fashion and Retail Limited (ABFRL) has secured ₹22.0 billion ($283.2 million) in funding from GIC, Singapore’s sovereign wealth fund. The investment will be completed in three installments: GIC will invest ₹7.7 billion ($99.4 million) within the next few days and release the remaining investment within 18 months upon the exercise of warrants. GIC will own 7.5% of ABFRL post disbursement of total funds as part of the contract.

- ABFRL will use the funding to strengthen its organic and inorganic growth strategies and improve its e-commerce business.

Indian Government Scraps Base Import Duty and Imposes Inventory Limits To Curb Vegetable Oil Prices

(May 24) ETRetail.com

- The Indian government has removed its base import duty on various vegetable oils and has imposed inventory limits to prevent hoarding to curb swelling prices. India has witnessed a steep increase in vegetable oil prices primarily due to supply chain disruptions caused by the Russia-Ukraine war.

- The Indian government is also planning to either reduce or abolish the agriculture infrastructure and development tax, which is currently at 5.0%, to ease the price surge further.

Novelship Raises $10 Million Funding

(May 25) DealStreetAsis.com

- Singapore-based sneakers and streetwear retailer Novelship has raised $10 million in series A funding. Key investors included East Ventures and GSR Ventures, along with K3 Ventures and iGlobe partners. The company has secured $12.4 million in funding since it launched in 2018.

- Novelship plans to use the funds to build brand partnerships, expand its business operations to international locations and explore ways to incorporate the metaverse in its business model. The retailer has already launched cryptocurrency as one of its alternative payment options.

Sparty Receives Funding from L'Oréal

(May 24) InsideRetail.asia

- Sparty, a Tokyo-based direct-to-consumer (DTC) beauty startup, has received investment from French beauty multinational company L'Oréal, of an undisclosed amount. The deal marks L'Oréal’s first venture capital deal in Japan.

- This funding will allow Sparty to grow its business across Japan and internationally. Currently, the brand offers personalized products and consumer services from two brands—Medulla in haircare and Hotaru in skincare.