Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

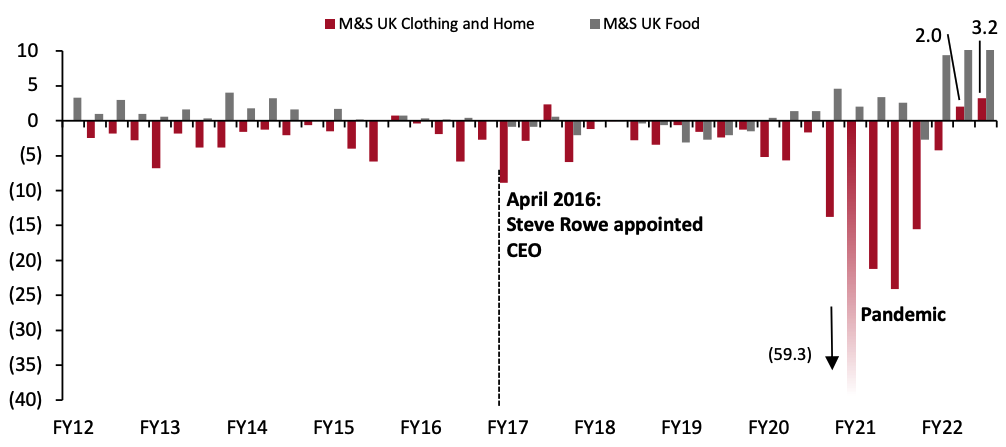

A Changing of the Guard at Marks & Spencer: Reviewing the UK Stalwart’s Turnaround UK retail heavyweight M&S last week announced that its CEO Steve Rowe will stand down in May. Rowe will be replaced as CEO by Stuart Machin, currently COO and MD of Food at M&S, with Katie Bickerstaffe, currently joint COO, in a new Co-CEO role. CFO Eoin Tonge will become Chief Strategy and Finance Officer. This week, we review the changes made at M&S under Rowe’s tenure—which were the latest in a series of overhauls for the retailer as it tried to turn performance around in its clothing and home division. In November 2017, Rowe outlined a five-year plan to “make M&S special again”—this included lower prices in clothing, closing and relocating some stores, and reducing the company’s cost base. Once the pandemic hit, that was updated to its “never the same again” strategy, which included growing online grocery capacity and accelerating the rotation of store real estate.- Clothing and home: Under Rowe and Chairman Archie Norman, M&S has opted for fewer clothing stores, a reduced number of product options and sharper entry-level pricing, and introduced third-party brands. A reduction in apparel product offerings and sharper prices were welcome and long overdue, and the introduction of major brands has allowed M&S to capitalize on the demise of rivals such as Debenhams. It has been a hard slog to revive the top line in M&S’s UK clothing and home segment, where long-term struggles to grow sales in its core womenswear category have depressed comparable sales over the past decade. The most recent two quarters have seen sales for clothing and home finally turn positive—as measured by total growth on a two-year basis (i.e., versus prepandemic); comp growth was not reported for these recent quarters (see Figure 1).

- Food: Rowe inherited weakened topline performance in Food after several prior years of outperformance in the UK grocery market. Since then, M&S has placed emphasis on capturing more “regular” (full-size) family shopping baskets, inching away from its longstanding position as a premium-positioned retailer of ready meals and other convenience foods. We are somewhat less convinced of M&S’s changes in food than in fashion, given its established, highly differentiated food positioning and prior outperformance based on that USP. The pandemic-driven jump in grocery demand makes it hard to discern how much of the post-2020 upturn in M&S food sales is due to the company’s strategy. Certainly fortuitous, in terms of timing, was M&S’s 2019 joint venture with Ocado, giving M&S its belated entry into the online grocery sector shortly before Covid-19 prompted a surge in e-commerce demand.

- International: M&S exited direct operations in a number of international markets.

Figure 1. M&S UK Segments: Sales Growth by Quarter (% Change) [caption id="attachment_143675" align="aligncenter" width="700"]

Figures are for year-over-year comparable sales growth, except for FY22 figures, which are for two-year total sales growth (comp growth not reported for FY22). Fiscal years close at the end of March.

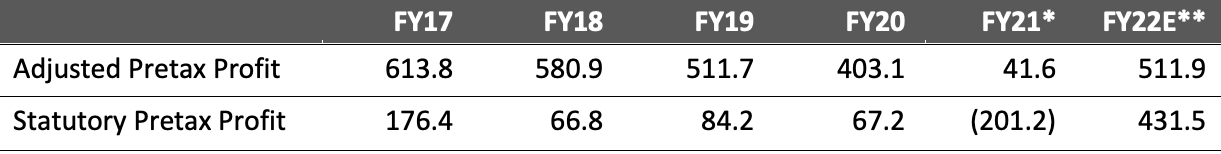

Figures are for year-over-year comparable sales growth, except for FY22 figures, which are for two-year total sales growth (comp growth not reported for FY22). Fiscal years close at the end of March.Source: Company reports[/caption] The bottom line tells a less positive story. For pre-exceptional costs, Rowe’s years have seen pretax profits dwindle, with fiscal 2021 impacted by the major disruption of the pandemic. (Exceptionals in the latest fiscal year included sizeable amounts for reorganization and store closures). And, regarding post-exceptionals, the picture is worse, with pretax profits only in the high double-digit millions in each of fiscal 2018, fiscal 2019 and fiscal 2020, before Covid-19 turned this metric deeply negative in fiscal 2021. Previous CEO Marc Bolland focused on growing margins in the fashion business, at the expense of topline expansion (primarily by switching to direct sourcing). However, managing margins on declining sales is an unsustainable strategy, and M&S under Bolland effectively banked cost savings in sourcing when it could have been sharpening prices to support topline growth. Rowe’s tenure has seen a reversal of focus, with topline expansion coupled with attrition of the bottom line. In almost any retail business, reviving flagging sales is the right strategy for anything beyond the shortest of timelines. For fiscal 2022, which M&S reports on May 25, analysts are penciling in strong recoveries in adjusted and statutory pretax profits, per S&P Capital IQ.

Figure 2. M&S: Pretax Profit (GBP Mil.) [caption id="attachment_143676" align="aligncenter" width="700"]

*52-week data; FY21 was 53 weeks

*52-week data; FY21 was 53 weeks**Consensus estimate

Source: Company reports/S&P Capital IQ[/caption] What’s Next? The move to bring in third-party brands positions M&S well to mop up share in fashion as multibrand rivals falter or close completely. M&S follows rival Next in switching from a private-label focus to a branded offering, and we perceive a structural shift in consumer demand from private label to branded apparel in the UK and wider European markets. M&S’s improved price positioning in clothing is welcome, although there look to be opportunities to drive up quality in details such as greater use of natural fibers and so cater to shoppers’ more sophisticated demands. M&S will likely remain challenged as a retailer at the very centerground of retail in an age of near-unlimited choice, but we see it as in a stronger position to rebuild sales and bolster market share than it has enjoyed for a number of years. [caption id="attachment_143677" align="aligncenter" width="700"]

“Deep-seated issues” identified in M&S’s fiscal 2021 full-year results

“Deep-seated issues” identified in M&S’s fiscal 2021 full-year resultsSource: Company reports[/caption]

US RETAIL AND TECH HEADLINES

Amazon Fresh Introduces Plant-Based Product Line (March 15) ProgressiveGrocer.com- Amazon’s supermarket chain, Amazon Fresh, has launched a plant-based product line online and in store. The line, named Fresh Plant-Based, offers customers affordable and healthier alternatives to meat products, according to the company.

- Amazon Fresh plans to expand the product line throughout 2022. A 20% discount for all products in the line is in place until the end of March this year.

- American department store chain Macy’s has announced the launch of Own Your Style, a customer insight platform that will offer personalized data-driven recommendations and expert advice to its customers, according to the company.

- Own Your Style will be implemented across all Macy’s channels beginning in March, including Macys.com, its app, social media accounts and in stores. The launch is a part of the company’s Polaris strategy, which aims to strengthen customer relationships, increase assortments, accelerate digital growth, optimize its store portfolio and reduce costs.

- US-based retail conglomerate Qurate Retail has appointed Terry Boyle as President and CEO of Zulily, its e-commerce company, effective March 14, 2022. Boyle succeeds Jeff Yurcisin, who resigned in February 2022.

- Previously, Boyle served in leadership roles across many retail firms, including HauteLook and Nordstrom. He also co-founded and led Behold, a venture-backed startup focused on innovating in online women’s fashion.

- Direct-to-consumer (DTC) lingerie brand ThirdLove has announced that it is focusing on re-launching its physical stores this year. The lingerie brand halted its physical expansion due to the pandemic and closed its pop-up store in New York in 2020.

- In February, the company opened its first store on the West Coast at Orange County’s Fashion Island Mall and another on Abbot Kinney Boulevard in downtown Venice, California. It plans to open at least six and up to 10 stores by the end of 2022.

- UpWest, a DTC brand run by US fashion retailer Express, has launched a new activewear line for men and women named Go. The new products are made from four-way stretch fabrics with no mesh and tags, according to the company. The products also feature in-built QR codes that provide access to yoga sessions, meditation and other interactive experiences.

- Express plans to open nine new UpWest stores in 2022—currently, UpWest operates seven stores in the US.

EUROPE RETAIL AND TECH HEADLINES

Gap Re-Enters UK Market via Joint Venture with Next (March 14) ChainStoreAge.com- Apparel specialty retailer Gap has returned to the British high street, one year after closing its UK stores. The company has opened a shop-in-shop space spanning 4,000 square feet within British fashion retailer Next’s flagship store on London’s Oxford Street.

- The new shop-in-shop location features a curated collection of elevated everyday essentials, according to the company, including denim, fleeces, khakis and shirts for children, men and women. In September 2021, Gap and Next announced a joint-venture deal for the latter to become Gap's franchise partner in the UK.

- Turkey-based rapid grocery delivery startup Getir is closing in on a deal to raise $800 million in funding, which will value the company at $11.8 billion. Around $250 million will come from lead investor Mubadala Investment Co.

- Other investors include Abu Dhabi’s state holding company ADQ and America-based venture capital firm Sequoia Capital, alongside American investment firms Tiger Global and Alpha Wave Global. Getir plans to use the funds to expand its presence into more US cities, and it is looking to go public by the end of 2022 or during 2023, according to the company.

- Spanish apparel retailer Inditex has reported net sales growth of 37.0% year over year on a constant-currency basis for fiscal 2021 (ended January 31, 2022). Its online sales increased by 14.0% year over year and accounted for 25.0% of its total sales. The company’s gross margin was up 123 basis points (bps) year over year to 57.1%.

- Inditex expects its spring/summer 2022 year-over-year sales growth to be in the mid-single digits. For the full year 2022, the company expects stable gross margin growth of 50 bps year over year and plans to spend €1.1 billion ($1.2 billion) in capital expenditures. It expects online sales to exceed 30.0% of total sales by 2024.

- UK-based fashion retailer Marks and Spencer (M&S) plans to introduce shop-in-shop concept stores for fashion brand Nobody’s Child and toy retailer Early Learning Centre (ELC). The move is part of the company’s strategy to sell external brands to increase its family appeal. M&S owns a 25% stake in Nobody’s Child.

- ELC’s toy shop-in-shop locations will open in 10 M&S stores, including its Bluewater, Longbridge and Liverpool locations, by the end of March 2022, and Nobody’s Child in nine of its stores. The company also plans to double the number shop-in-shop locations for women’s fashion brand Seasalt to 20.

- Online grocer Ocado has partnered with French hypermarket chain Auchan Retail to open a customer fulfillment center in Poland by 2024. The move aims to help Auchan develop its online business using the Ocado smart platform, which will enable its hypermarkets to pick more efficiently across both food and nonfood stores.

- In 2021, Ocado partnered with Auchan’s Spanish hypermarket banner, Alcampo. The two firms stated that they will explore further partnership opportunities in other markets.

ASIA RETAIL AND TECH HEADLINES

GoTo Plans To Raise Up to $1.1 Billion in IPO (March 15) BusinessWire.com- GoTo—an Indonesian tech company formed through a merger between ride-hailing giant Gojek and online marketplace Tokopedia—plans to raise at least Rp15.2 trillion ($1.1 billion) in an IPO, set for April 4, 2022.

- GoTo intends to offer up to 52 billion new series A shares at Rp316–Rp346 ($0.022–$0.024) each, raising $28.8 billion at the top end of the range. The company plans to use the revenue to fund its growth plan, which includes expanding its three businesses—e-commerce, financial services and ride-hailing.

- JD Logistics, a subsidiary of Chinese e-commerce giant JD.com, has agreed to acquire domestic courier company Deppon Logistics. Under the terms of the agreement, JD Logistics will acquire a 99.99% ownership stake in Deppon Holdco (Deppon Logistics’ parent company), for ¥9 billion ($1.4 billion). Deppon Holdco owns approximately 66.5% of Deppon Logistics.

- JD Logistics will subsequently make an offer for all Deppon Logistics-issued shares that are not held by Deppon Holdco, for ¥13.15 ($0.11) per share. Following the completion of the deal, Deppon Holdco and its subsidiaries will become a unit of JD Logistics.

- Licious, an Indian DTC fresh meat and seafood firm, has raised $150 million (₹11.5 billion) from investors in a Series F2 funding round, led by Singapore-based Amansa Capital. Kotak PE and Axis Growth Avenues AIF-I also invested. In July 2021, Licious raised $192 million in a Series F round.

- The company plans to use the funds to invest in technology that will aid category development and improve its overall consumer experiences. A portion of the funds will also be used for strategic acquisitions and brand expansion.

- Webuy, a Singapore-based social commerce company, has acquired Chilibeli, an Indonesian community group-buying platform, as part of its planned expansion into the largest market in Southeast Asia. The financial terms of the transactions were not disclosed.

- Webuy stated that it will capitalize on its global supply chain network to generate cooperation in the Indonesian grocery group-buying market. With the acquisition, Chilibeli’s 10,000 group leaders will be able to use Webuy’s in-app chat and short video features—as well as other technology solutions that will facilitate community sales and increase order size and volume.

- Zomato, an India-based food delivery service, and Blinkit, a 10-minute grocery delivery platform previously known as Grofers, have agreed to an all-stock merger worth $700 million. In August 2021, Zomato paid $68 million for a 9.9% share in Blinkit.

- As part of the merger agreement, Zomato has authorized a loan of up to $150 million for Blinkit to address the latter’s short-term capital needs. In February 2022, Zomato announced that it would invest up to $400 million in the Indian fast commerce industry over the next two years.