From the Desk of Deborah Weinswig

The Chinese Male Beauty Market Looks Set for Further Growth

China’s male grooming market has exhibited solid growth and is likely to continue to grow strongly for the foreseeable future. Urban Chinese men, particularly millennials, are increasingly focusing on their appearance and are spending more of their disposable income on grooming than are men in other demographics. Men’s grooming products—from basic personal hygiene items to skincare and cosmetics—have been flying off the shelves in the booming Chinese retail landscape. Historically, beauty brands have focused on women, but men’s grooming and beauty purchases are becoming a significant driver in China’s multibillion-dollar beauty industry.

The total market for male grooming consumables in China is estimated to reach $2.1 billion (¥14.2 billion) this year, according to Euromonitor International. The firm estimates that the market grew at a CAGR of 6.5% over the past five years, with growth of 6.9% last year exceeding that average. This year, Euromonitor expects the market to grow by 6.8%. The three largest male grooming categories in China are toiletries, skincare and haircare. The fastest-growing categories are men’s fragrances, with 14.3% growth expected this year, followed by bath and shower (8.7%) and deodorants (7.5%), according to Euromonitor. The market research suggests that Chinese men are trading up from basic, traditional men’s grooming categories such as shaving to less-traditional categories such as skincare and fragrances.

The urbanization trend in China is likely spurring demand, as urban Chinese men seek to project a sophisticated lifestyle and young urban Chinese consumers are increasingly equating personal success with more sophisticated grooming and dressing behaviors. Chinese men spent 2.2 hours a week on personal grooming in 2015 (versus 3.8 hours for women), according to a study conducted by research firm GfK, and that figure is likely higher today. A 2016 survey of Chinese men’s attitudes toward grooming found that 39% of male respondents ages 20–30 said that they used skincare products or makeup, compared with 29% of male respondents ages 31–45, according to the Hong Kong Trade Development Council. A 2017 study by CBNData found that attitudes of men born in 1995 (i.e., 22-year-olds) regarding the use of cosmetics, light makeup, or beauty and blemish (BB) cream were much more positive than those of men born just five years earlier.

Chinese millennials have increasing purchasing power in the men’s skincare and cosmetics market. Chinese men ages 18–34 spent an average of $28 per month during a 12-month survey period ended June 2018, according to Prosper Insights & Analytics, 9% more than the monthly average for all males surveyed. These millennials will continue to spend, and they will likely spend even more as their disposable incomes increase. New generations of 18-year-olds entering the workforce are likely to continue this trend.

Many brands are capitalizing on the growing popularity of men’s grooming and beauty products in China, launching advertising campaigns specifically targeted at Chinese men, whose product choices are often influenced by South Korean pop culture. For example, L’Occitane ran an advertising campaign featuring Luhan—formerly a pop music icon in South Korea who returned to his native China to continue his entertainment career—as brand ambassador. Nivea, owned by German company Beiersdorf, has long offered male grooming products in China, and its Nivea Men brand has become its largest brand in China, its success driven by the popularity of online shopping. L’Oréal launched its Paris Men Expert line as its flagship, mass-market male skincare brand in 2005. The brand subsequently engaged many top Chinese celebrities as brand ambassadors, such as Daniel Wu, who is currently in his late 40s and therefore represents sophistication and gentlemanly qualities, and Jing Boran, who is in his 30s and appeals to a younger audience. Chinese audiences are highly familiar with these celebrities’ TV spots promoting L’Oréal’s cleansing and toning products.

The popularity of male beauty products is growing at above-market rates in China, fueling growth of the entire male grooming category. Within men’s grooming, toiletries is the largest category, but fragrances is the fastest-growing category. Global brands have taken note of Chinese men’s increasing interest in grooming products, and many are particularly targeting urban Chinese millennial men, who have growing disposable incomes and more favorable attitudes toward male beauty categories.

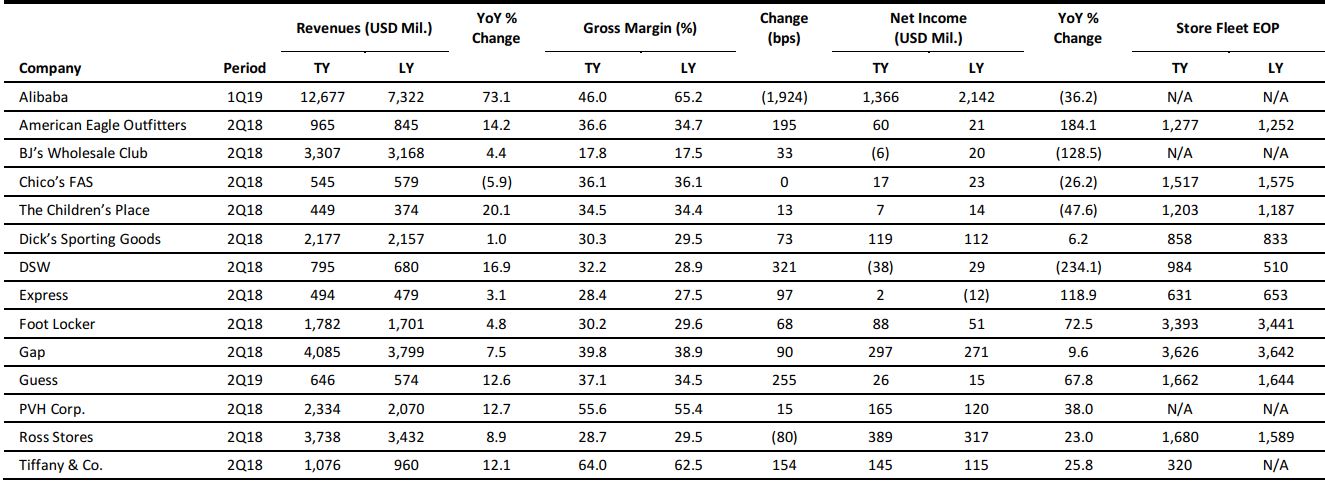

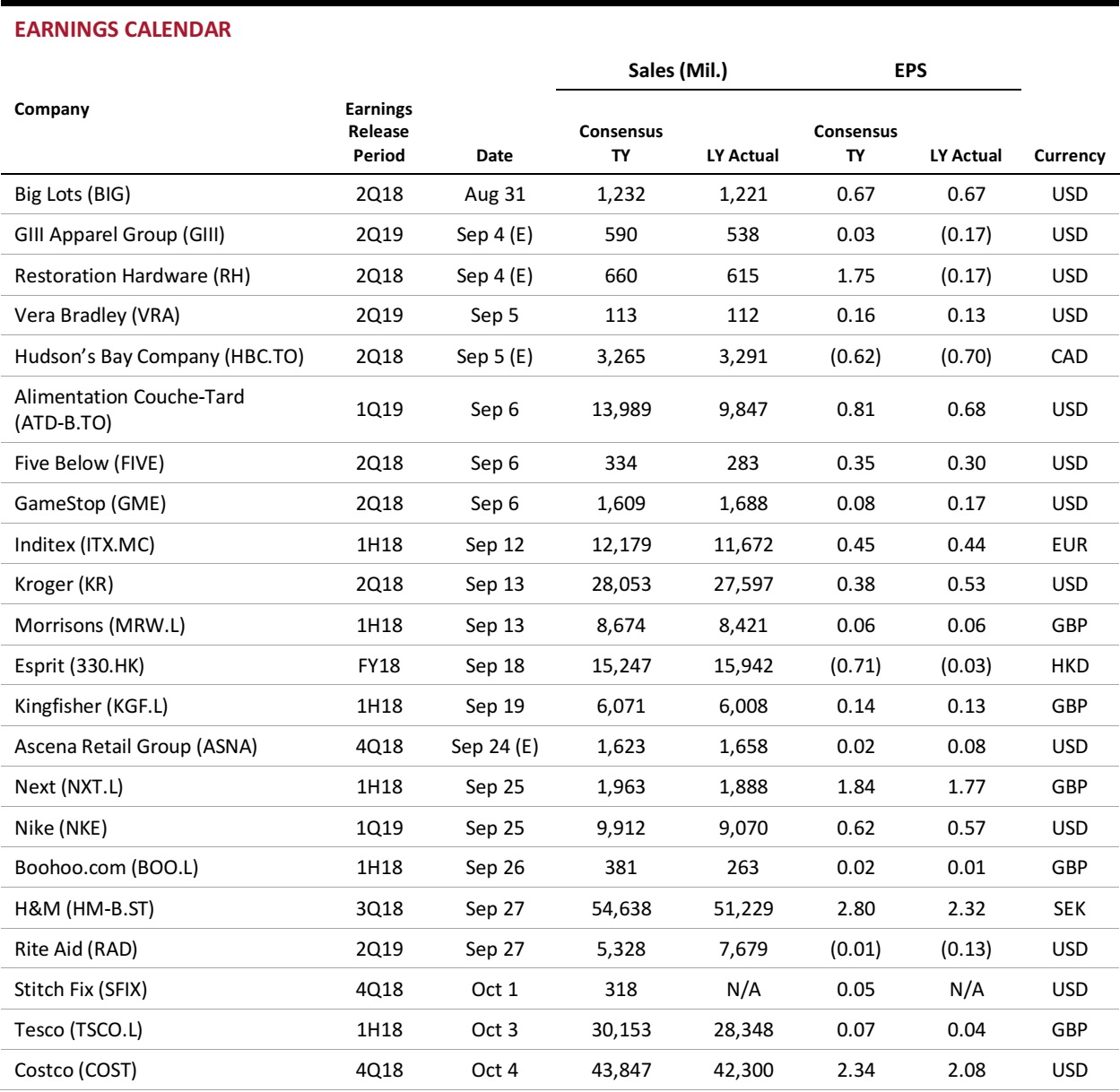

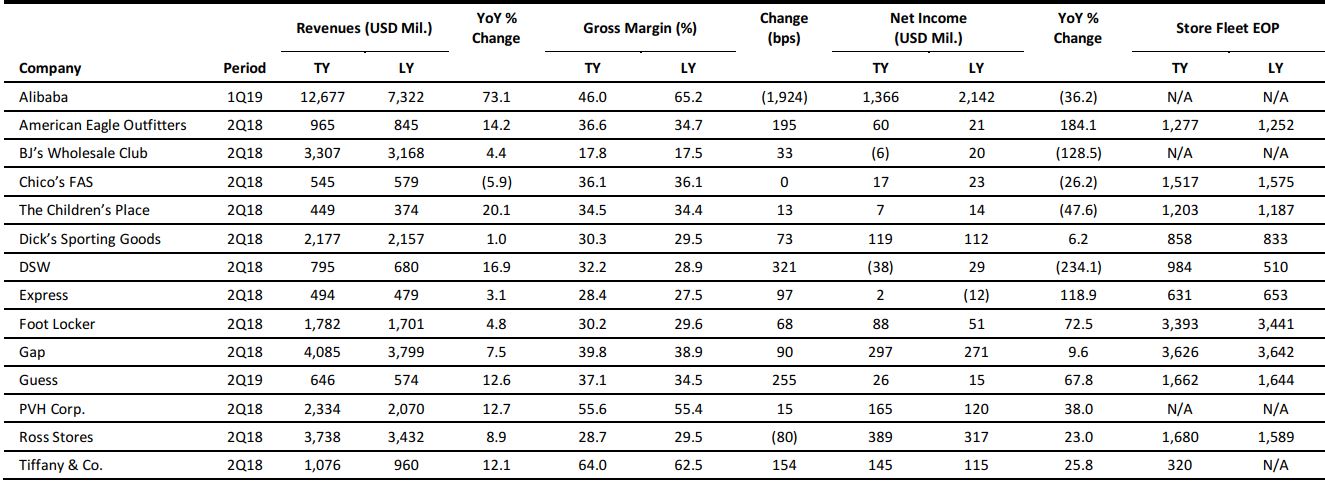

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

How Retailers Are Recouping Costs from Returned Merchandise

(August 29) Digiday.com

How Retailers Are Recouping Costs from Returned Merchandise

(August 29) Digiday.com

- Returned purchases are a major drain on retailers, particularly after consumer purchase activity spikes around holidays. Retailers are trying to make some money off returned goods, often through third-party logistics companies that route them back to off-price clearing centers, charities and e-commerce markets for used goods.

- Last week, retailer REI launched its used goods e-commerce store, aimed at reselling used goods more cost effectively while responding to customers demanding affordable, high-quality, used outdoor goods. REI has beta-tested the site since October of last year.

Go Figure! Amazon Proving to Be Solid Partner to Retailers

(August 29) ZDNet.com

Go Figure! Amazon Proving to Be Solid Partner to Retailers

(August 29) ZDNet.com

- The common (and increasingly simplistic) Amazon storyline goes like this: Amazon is killing physical retail as shopping goes digital. The reality is way more nuanced. Amazon is increasingly a partner to the brick-and-mortar crowd and is often involved in win-win deals.

- In recent earnings conference calls, retailers have reported strong same-store sales and results that were generally better than expected. Retail isn’t dead; it’s on fire. And Amazon, in some cases, is even boosting foot traffic.

Retail Association: Tariffs on Goods from China Will Cost American Consumers Billions

(August 28) USAToday.com

Retail Association: Tariffs on Goods from China Will Cost American Consumers Billions

(August 28) USAToday.com

- Tariffs on goods from China imported into the US will cost American consumers roughly $6 billion a year, according to a study commissioned by the National Retail Federation.

- The report showed that the proposed 25% tariff on furniture from China would cost Americans $4.6 billion per year in added cost “even if retailers switched their sourcing to other foreign countries or US furniture makers.”

2017 Shrink Cost US Retailers $42.49 Billion, 1.85% of Sales

(August 27) RetailTouchPoints.com

2017 Shrink Cost US Retailers $42.49 Billion, 1.85% of Sales

(August 27) RetailTouchPoints.com

- Global retail shrink led to losses of $99.56 billion in 2017, according to the Sensormatic Global Shrink Index. US shrink generated losses of $42.49 billion, accounting for 1.85% of retail sales, above the global average of 1.82%.

- The National Retail Federation and the University of Florida analyzed US shrink trends and found that shrink averaged33% of sales in 2017, down from 1.44% the year before.

Are Walmart and Amazon Playing the Same Game?

(August 27) RetailDive.com

Are Walmart and Amazon Playing the Same Game?

(August 27) RetailDive.com

- Comparisons between Amazon and Walmart are inevitable. That juxtaposition is made difficult not only by the two companies’ differences, beginning with their ages and sizes, but also by the changing definition of e-commerce.

- But as e-commerce continues to evolve, Walmart’s major advantage could be the very thing that seemed like a disadvantage just a few years ago: its formidable brick-and-mortar footprint.

EUROPE RETAIL & TECH HEADLINES

Bestseller Acquires 29% Stake in About You

(August 22) RetailDetail.eu

Bestseller Acquires 29% Stake in About You

(August 22) RetailDetail.eu

- Heartland, the investment group that operates Danish fashion group Bestseller, obtained a 29% stake in German e-commerce site About You in a capital round that raised approximately $300 million.

- About You is estimated to be worth around a billion euros and aims to be one of the three largest online fashion retailers in Europe by 2020.

Tesco to Shutter 13 Polish Stores

(August 27) ESMMagazine.com

Tesco to Shutter 13 Polish Stores

(August 27) ESMMagazine.com

- Tesco, Britain’s largest supermarket chain, announced that it will close 13 loss-making stores in Poland. In terms of store numbers, Poland is currently Tesco’s second-largest overseas market, after Thailand.

- A ban on Sunday trading was cited as one of the key reasons behind Tesco’s decision to streamline its Polish operations.

Sports Direct Seeks Rent Cuts on House of Fraser Stores

(August 28) BBC.com

Sports Direct Seeks Rent Cuts on House of Fraser Stores

(August 28) BBC.com

- Sports Direct, which recently acquired department store retailer House of Fraser, is seeking rent cuts on the chain’s 59 stores in an attempt to keep them from closing.

- Mike Ashley, Sports Direct’s owner, has pledged to save 47 House of Fraser stores and aims to make the chain “the Harrods of the high street.”

Yoox Net-a-Porter to Launch Own-Brand Footwear

(August 28) RetailGazette.co.uk

Yoox Net-a-Porter to Launch Own-Brand Footwear

(August 28) RetailGazette.co.uk

- Online luxury retailer Yoox Net-a-Porter announced that it will debut a footwear and accessories range under its Mr P. private-label brand next month. The Mr P. range is sold exclusively on the Mr Porter website.

- The new footwear and accessories range includes formal and casual shoes, socks and scarves.

Iceland Reaches Agreement to Take Over 19 Poundworld Stores

(August 24) RetailGazette.co.uk

Iceland Reaches Agreement to Take Over 19 Poundworld Stores

(August 24) RetailGazette.co.uk

- Iceland, a frozen food specialist, has reached an in-principle agreement to take control of 19 of Poundworld’s stores following the collapse of a deal between Poundworld and the Henderson family.

- Of the 19 stores, four are set to become Iceland’s Food Warehouses, while the other 15 are to become regular Iceland stores.

ASIA RETAIL & TECH HEADLINES

Toyota Plans to Invest $500 Million in Uber to Develop Self-Driving Cars

(August 28) BBC.com

Toyota Plans to Invest $500 Million in Uber to Develop Self-Driving Cars

(August 28) BBC.com

- Japanese automobile giant Toyota announced that it would invest $500 million toward a partnership with taxi aggregator Uber to develop autonomous cars.

- Self-driving technology from both companies will be integrated into purpose-built Toyota vehicles that will be used as part of Uber’s fleet in the US. The pilot trials are expected to begin in 2021.

WeChat Launches Platform for Digital Payments in Malaysia

(August 26) RetailinAsia.com

WeChat Launches Platform for Digital Payments in Malaysia

(August 26) RetailinAsia.com

- WeChat, China’s most popular chat app, has launched a digital wallet service in Malaysia, its first such launch outside the China and Hong Kong markets.

- The development comes amid a favorable environment in Malaysia, where the central bank has been implementing policies to promote digital payments in an effort to catch up with other Southeast Asian markets.

Uniqlo Is Set to Double Its Southeast Asia Network

(August 23) InsideRetail.hk

Uniqlo Is Set to Double Its Southeast Asia Network

(August 23) InsideRetail.hk

- Japanese casualwear retailer Uniqlo plans to double its store count in Southeast Asia and Oceania to around 400 by 2022, according Satoshi Hatase, Group SVP at Uniqlo parent company Fast Retailing.

- The focus will be on stand-alone suburban stores, which marks a departure from the chain’s traditional shopping mall locations.

Suning.com Breaks Record with 818 Shopping Festival

(August 22) InsideRetail.hk

Suning.com Breaks Record with 818 Shopping Festival

(August 22) InsideRetail.hk

- Sales at this year’s 818 Shopping Festival, run by Chinese retailer Suning.com, increased by 155% over last year.

- “Every year, we aim to surpass all previous years, and this year we have achieved a quantum leap,” said Suning Holdings Group Chairman Zhang Jindong.

LATAM RETAIL & TECH HEADLINES

Walmart Investing Significantly in Chile Expansion

(August 23) ElMagallaNews.cl

Walmart Investing Significantly in Chile Expansion

(August 23) ElMagallaNews.cl

- Walmart Chile President and CEO Horacio Barbeito announced that the company will open 46 new stores, remodel more than 110 stores and open some 100 new pickup points in Chile over the next two years.

- “We are living the greatest transformation in our history,” said Barbeito during the company’s annual supplier summit in Chile last week, which was attended by more than 800 suppliers.

Motta Captures a Duty-Free Concession at Tocumen T2

(August 24) TRBusiness.com

Motta Captures a Duty-Free Concession at Tocumen T2

(August 24) TRBusiness.com

- Panama-based retailer Motta Internacional has acquired control of a duty-free concession at Terminal 2 of Panama’s Tocumen International Airport.

- The terminal is expected to open in the first half of 2019 and Motta expects the concession to run until around June 2029.

Brazil’s IT Investment Sees Enhancement

(August 24) ZDNet.com

Brazil’s IT Investment Sees Enhancement

(August 24) ZDNet.com

- Brazilian investments in IT, including hardware, software and IT services, grew by 4.5%, to $38 billion, in 2017, according to a study by the Brazilian Association of Software Companies (ABES).

- The development places Brazil ninth among the top 10 countries worldwide in terms of technology investment.

Santafé Mall to Welcome 16 New Brands

(August 27) America-Retail.com

Santafé Mall to Welcome 16 New Brands

(August 27) America-Retail.com

- Santafé, a shopping center in North Bogotá, Colombia, is set to welcome 16 new brands. The mall houses 598 stores and 397 brands.

- In 2017, amid a difficult period for the Colombian economy, 51 stores in the mall were closed, while 46 new stores were opened.

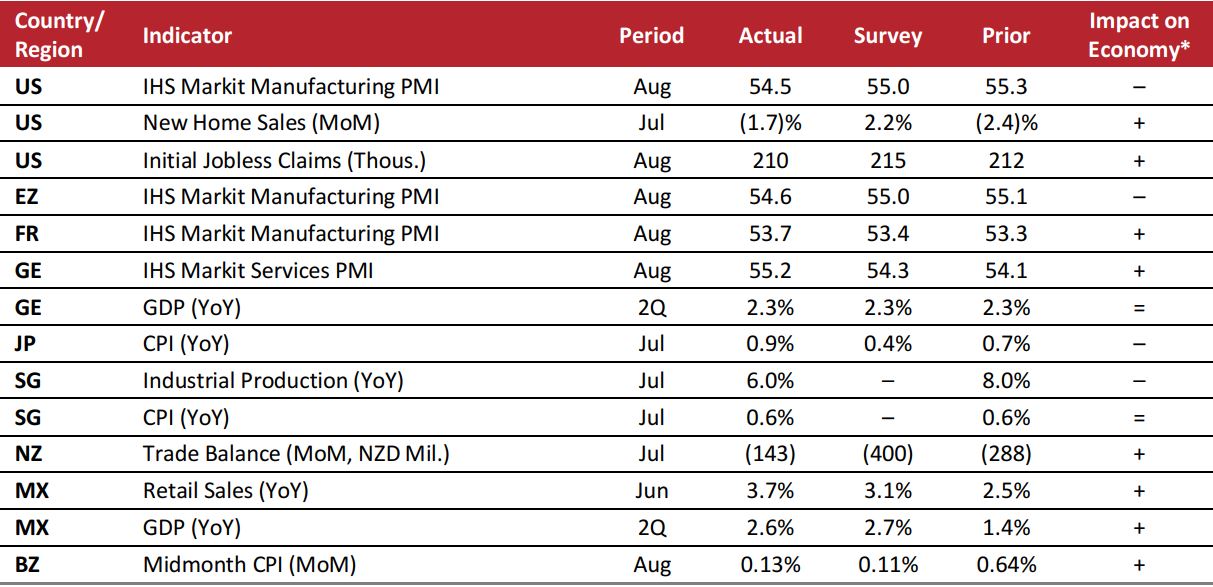

MACRO UPDATE

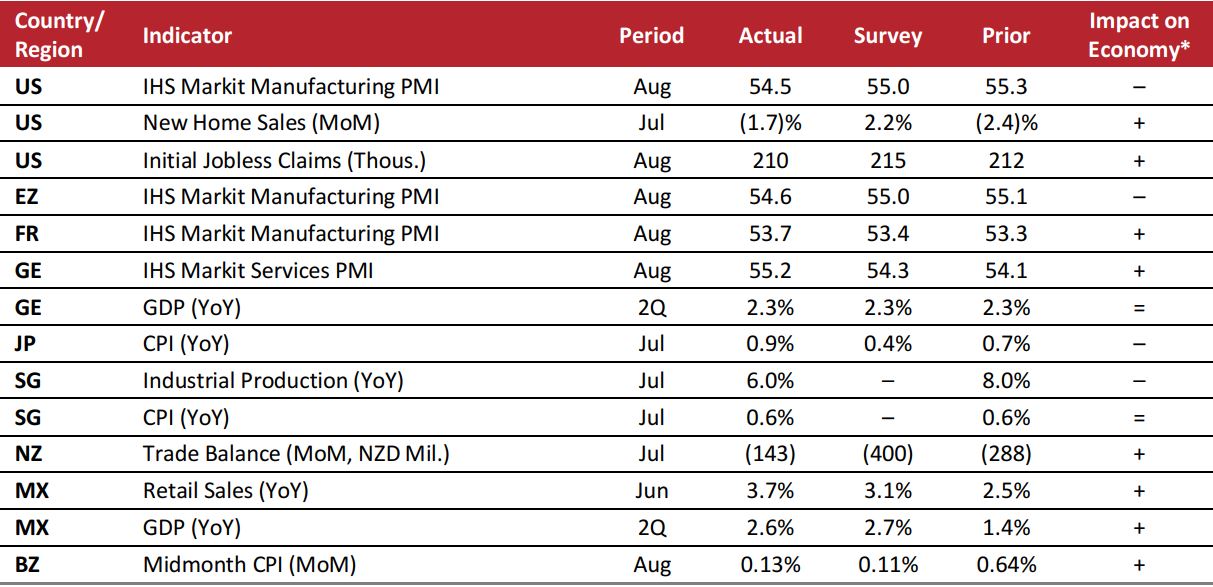

Key points from global macro indicators released August 22–28, 2018:

- US: The IHS Markit US Manufacturing Purchasing Managers’ Index (PMI) fell to 54.5 in August from 55.3 in July. Initial jobless claims decreased to 210,000 in the week ending August 18 from 212,000 the previous week.

- Europe: In the eurozone, the IHS Markit Manufacturing PMI fell to 54.6 in August from 55.1 in July. In France, the IHS Markit Manufacturing PMI increased to 53.7 in August from 53.3 in July.

- Asia-Pacific: Japan’s Consumer Price Index (CPI) increased by 0.9% year over year in July, compared with a 0.7% increase in June. Industrial production in Singapore grew by 6.0% year over year in July after rising by 8.0% the previous month.

- Latin America: The Latin American economy is showing signs of improvement. Retail sales in Mexico increased by 3.7% year over year in June, exceeding analysts’ estimate of 3.1% growth. In Brazil, the midmonth inflation gauge in August was up 0.13% month over month, compared with 0.64% in the previous month.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: IHS Markit/US Census Bureau/US Bureau of Labor Statistics/Statistisches Bundesamt/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Stats NZ Tatauranga Aotearoa/Instituto Nacional de Estadística y Geografía/Instituto Brasileiro de Geografia e Estatística/Coresight Research

How Retailers Are Recouping Costs from Returned Merchandise

(August 29) Digiday.com

How Retailers Are Recouping Costs from Returned Merchandise

(August 29) Digiday.com

2017 Shrink Cost US Retailers $42.49 Billion, 1.85% of Sales

(August 27) RetailTouchPoints.com

2017 Shrink Cost US Retailers $42.49 Billion, 1.85% of Sales

(August 27) RetailTouchPoints.com

Tesco to Shutter 13 Polish Stores

(August 27) ESMMagazine.com

Tesco to Shutter 13 Polish Stores

(August 27) ESMMagazine.com

WeChat Launches Platform for Digital Payments in Malaysia

(August 26) RetailinAsia.com

WeChat Launches Platform for Digital Payments in Malaysia

(August 26) RetailinAsia.com

Uniqlo Is Set to Double Its Southeast Asia Network

(August 23) InsideRetail.hk

Uniqlo Is Set to Double Its Southeast Asia Network

(August 23) InsideRetail.hk

Suning.com Breaks Record with 818 Shopping Festival

(August 22) InsideRetail.hk

Suning.com Breaks Record with 818 Shopping Festival

(August 22) InsideRetail.hk