Nitheesh NH

The US

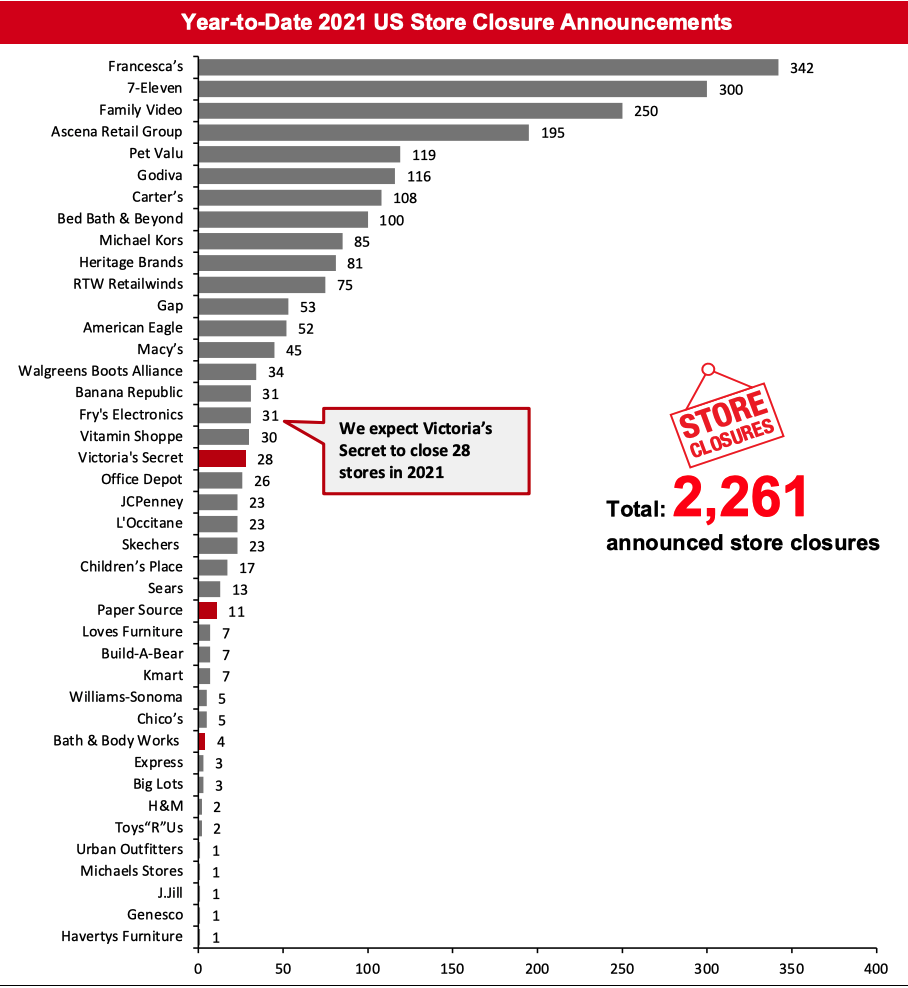

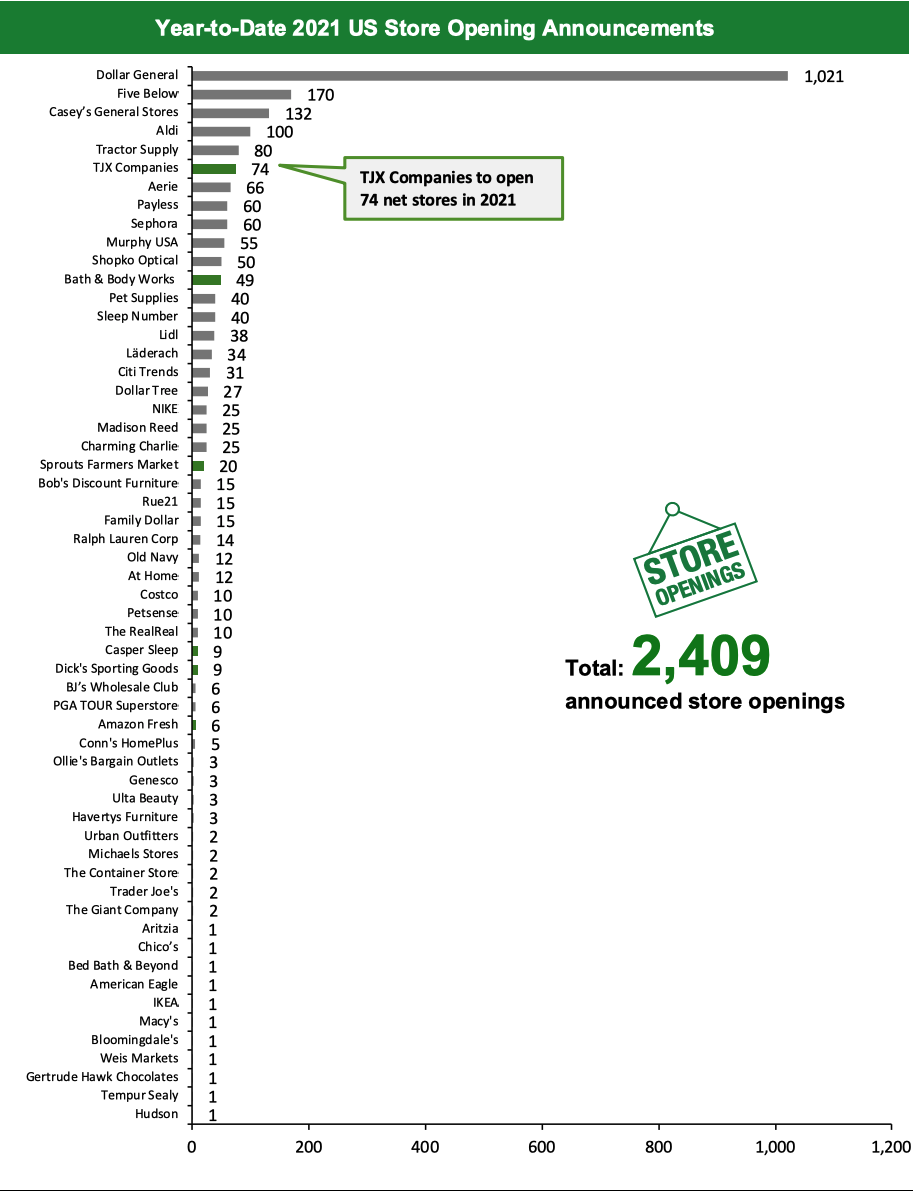

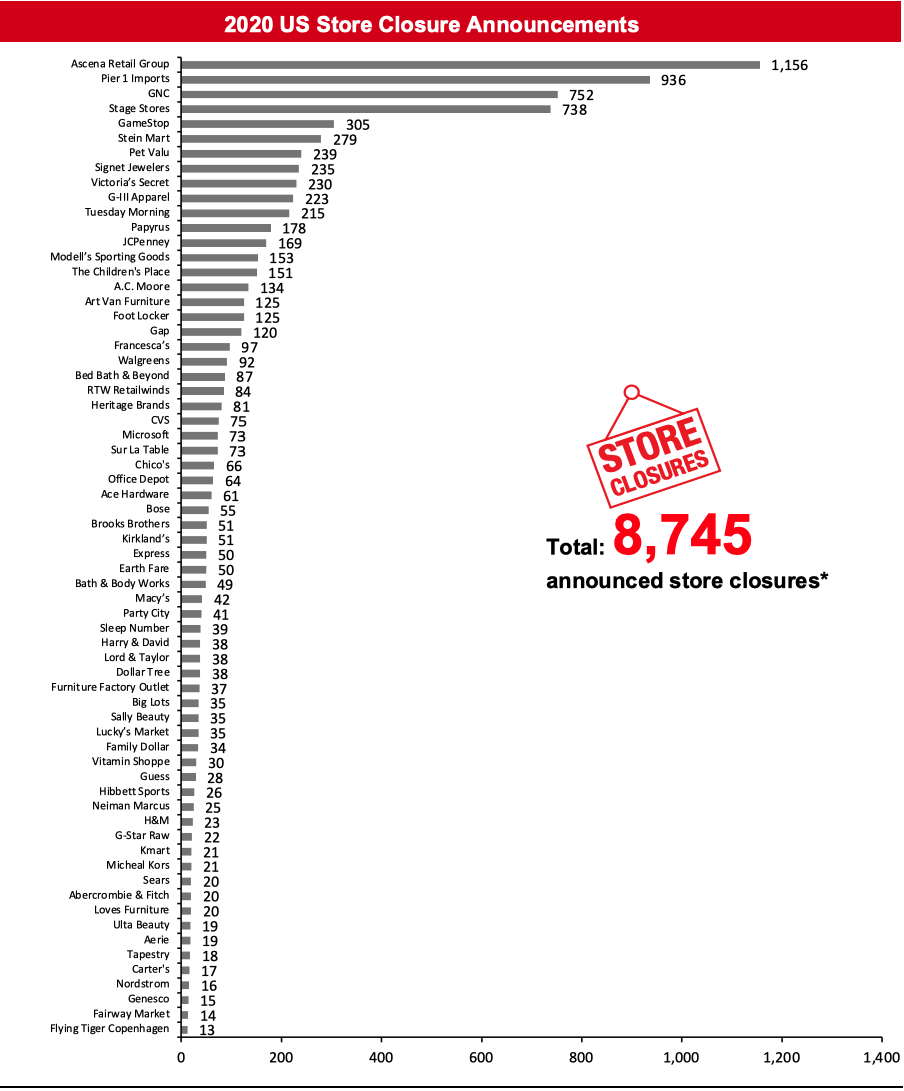

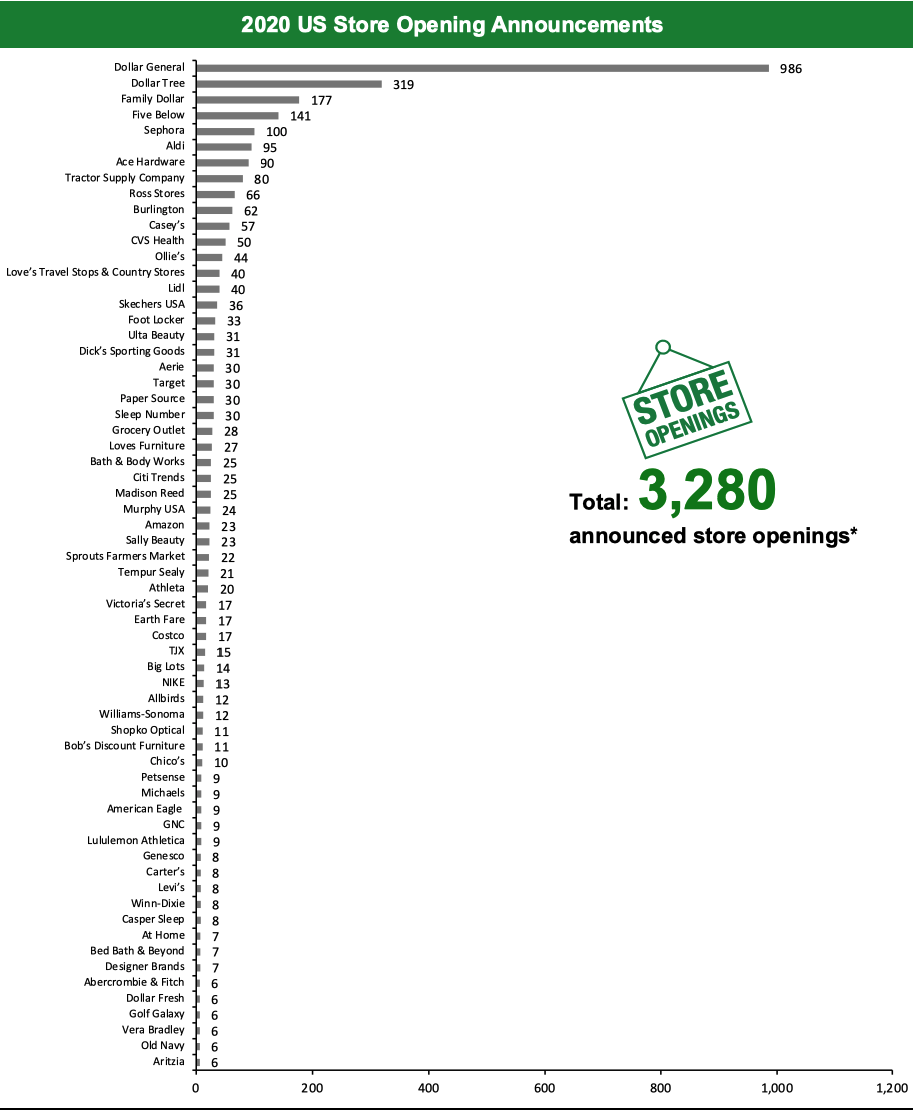

2021 Major US Store Closures and Openings Year to date in 2021, US retailers have announced 2,261 closures and 2,409 openings for the full year. Our data represent closures and openings by calendar year, so these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, updates for Amazon, Bath & Body Works, Casper Sleep, Dick’s Sporting Goods, Hudson, Sprouts Farmers Market and TJX Companies changed our 2021 US openings count to 2,409. Following the closure updates for Paper Source and Victoria’s Secret, the 2021 US closure count changed to 2,261. We have revised our 2020 US openings count to 3,280 with updates for Payless, TJX Companies and Sprouts Farmers Market. With closure updates for Bath & Body Works, Victoria’s Secret and PINK, we have updated our 2020 US closures count to 8,745. The chart below depicts the week-by-week totals of announced US store closures and openings year to date in 2021. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=170]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks Source: Company reports/Coresight Research

What Is Happening This Week in the US

Amazon Opens Its Tenth US Amazon Fresh Store On February 25, Amazon opened a new Amazon Fresh grocery store in Fullerton, California, spanning around 45,000 square feet. The store will mark the sixth Amazon Fresh grocery store opening in 2021. The retailer operates a total of 10 Amazon Fresh stores in the US as of February 25, 2021. Coresight Research insight: We cover two stories this week on Amazon’s multipronged encroachment into grocery retail through a selection of formats: Amazon opened its first UK brick-and-mortar grocery store in London on Thursday. We have long pointed to the need for stores if Amazon is to make a serious encroachment into the grocery market and that remains true despite the surge in grocery e-commerce in 2020 and into 2021. Grocery remains a predominantly offline sector and consumers that use grocery e-commerce tend to be cross-channel shoppers. Bath & Body Works To Open 49 Stores in Fiscal 2021 Bath & Body Works will open 49 stores in fiscal 2021, as disclosed on its parent company L Brands’ fourth-quarter earnings call on February 25. The company reported that it closed 29 Bath & Body Works stores in 2020 we have revised the closure count in our US 2020 charts for the brand. Bath & Body Works has closed four stores so far in 2021. The company has 1,633 stores in the US as of January 30, 2021. Bob’s Discount Furniture Opens New Store in New York Furniture chain Bob’s Discount Furniture opened a new store in Staten Island, New York, on March 4. The store spans 10,000 square feet and features a curated offering of its most popular items. We have already recorded 15 openings for the retailer in 2021. With these openings, the retailer will have a total of 140 store locations across the US. Casper Sleep To Open 10 Stores in 2021 Mattresses and bed furnishing retailer Casper Sleep announced plans to open “fewer than 10” stores in 2021 during its fourth-quarter earnings call on February 24. We have recorded nine store closures for the retailer in our US openings chart. The retailer operates a total of 67 stores across the US, as of December 31, 2020. Dick’s Sporting Goods To Open Four New Stores in March Dick’s Sporting Goods has announced plans to open four new stores by the end of March. The retailer will open three Dick’s Sporting Goods stores, one each in Lewisville, Texas; Las Vegas, Nevada; and Rockford, Illinois. The fourth opening will be a Warehouse Sale store in Pittsburgh, Pennsylvania. These are included in our charted total below. Following the store openings, Dick’s Sporting Goods will have a total of 730 stores across 47 US states. The Disney Store To Close At Least 60 North America Stores As we went to press, Disney announced that its Disney Store chain will close at least 60 North America stores before the end of the year as it focuses on e-commerce. There are around 300 Disney Stores worldwide. We will update our year-to-date totals and charts in next week’s report. Hudson Opens Its First Hudson Nonstop Store Travel retailer Hudson has opened its first contactless Hudson Nonstop store at Dallas Love Field Airport. Spanning 500 square feet, the new store concept has a single entry and exit point to leverage Amazon’s “Just Walk Out” checkout-free payment technology. Hudson has announced plans to open further Hudson Nonstop stores at leading airports across North America in 2021. The retailer currently operates more than 1,000 stores in airports, commuter hubs and tourist destinations. Paper Source To Close 11 Stores Card and gift retailer Paper Source has filed for Chapter 11 bankruptcy has announced that it will close 11 stores. The company has a stalking horse bid from its current lenders, led by MidCap Financial. Paper Source is set to hold an auction for its business on April 21 and a sale hearing on April 30. The company has a total of 154 stores. Payless Opens First Store in North Miami Discount footwear retailer Payless opened its first US store, spanning around 4,000 square feet, in North Miami, Florida, on March 1. The retailer has already announced plans to open 300 to 500 stores over the next five years, and we had already recorded 60 openings for 2021. In 2019, the retailer shut its 2,500 locations and online operations in North America after filing for bankruptcy protection. Sprouts Farmers Market To Open 20 New Stores Supermarket chain Sprouts Farmers Market has announced plans to open 20 stores in 2021. At an analyst conference in May 2020, CEO Jack Sinclair described the launch of a new store format, which will be smaller than its regular stores and feature an innovation center for product demonstrations and to showcase products from its incubator brands. Several of the 20 store openings will feature this new store format, and the majority will have a smaller footprint than its existing stores, of 25,000 square feet or less. The retailer confirmed that it opened 22 new stores 2020, which we have updated in our US 2020 openings chart. The retailer has 362 stores across 23 US states, as of January 2, 2021. TJX Companies To Add 81 Net Stores in Fiscal 2021 TJX Companies has announced plans to open 81 net US stores in fiscal year 2021, which includes 34 HomeGoods stores, 30 Marmaxx stores (T.J.Maxx and Marshalls), 12 Sierra stores, and five HomeSense stores. We have recorded an estimated 74 net store openings for calendar year 2021 in our charts. The company reported that it opened 15 net stores in 2020, which we have revised the counts in our US 2020 openings chart (which represents estimated openings in the calendar year). The company operates 3,305 stores in the US as of January 30, 2021. Victoria’s Secret To Close 30–50 Stores in Fiscal 2021 L Brands, the parent company of Victoria’s Secret, has announced that it will close 30 to 50 Victoria’s Secret stores in fiscal 2021 across the US. We have recorded an estimated 28 store closures for Victoria’s Secret in our closures chart for the calendar year. The company confirmed that it closed 230 Victoria’s Secret stores and three PINK stores in 2020, which we have updated in our US 2020 closures chart. The company has 703 Victoria’s Secret stores and 143 PINK stores across the US, as of January 30, 2021.Non-Store-Closure News

Macy’s Announces Leadership Changes Macy's has announced the departure of COO John Harper, effective August 1, and that it is removing the COO role at the company one he has left. The company has appointed Chuck DiGiovanna as Vice President of Real Estate to replace Douglas Sesler. The company also announced that Chief Technology Officer Naveen Krishna has been replaced by Laura Miller, who will assume the Chief Information Officer's role at Macy's. 2021 Major US Store Closures and Openings [caption id="attachment_124147" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124148" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings.TJX Companies includes Marmaxx, HomeGoods, Sierra, and HomeSense stores.

Source: Company reports/Coresight Research[/caption] 2021 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=783]

Source: Company reports/Coresight Research

[caption id="attachment_124150" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.*Total includes a small number of retailers that each announced fewer than 13 store closures and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124151" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.*Total includes a small number of retailers that each announced fewer than six store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Retail Bankruptcies [wpdatatable id=784]

N/A – Not Available Source: Company reports/Coresight Research

2020 Major US Retail Bankruptcies [wpdatatable id=785]Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

The UK

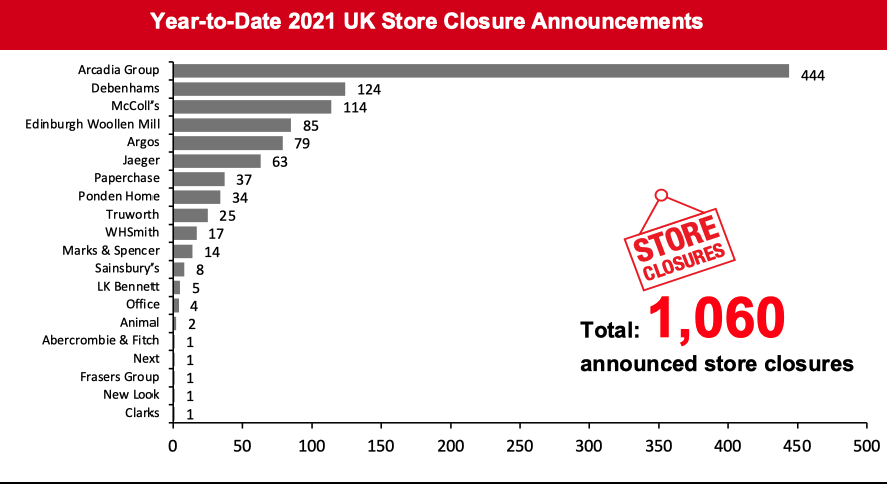

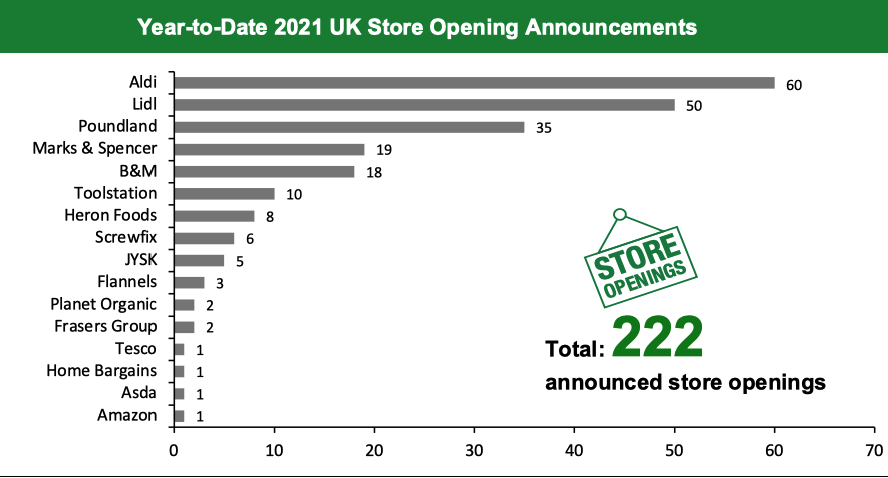

2021 Major UK Store Closures and Openings Year to date in 2021, UK retailers have announced 1,060 closures and 222 openings for the full year. Our data represent closures and openings by calendar year, so these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, updates for Amazon and Tesco changed our 2021 US openings count to 222. The 2021 UK closures count remains at 1,060, with no closure updates. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2021. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=171]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Amazon Opens First Physical Grocery Store in the UK Amazon opened its first UK physical grocery store in Ealing, London, this week. The Amazon Fresh supermarket is much smaller than a conventional supermarket and uses the company’s “Just Walk Out” technology seen in Amazon Go stores. Shoppers can buy prepared meals, some groceries and Amazon devices, as well as collect and return online orders, at the store. In 2018, Amazon announced plans to open 30 Amazon Go stores in the UK. Sainsbury’s To Close Welshpool Store Supermarket chain Sainsbury’s has confirmed plans to close its Welshpool store in July this year. In 2019, the retailer announced plans to close 15 stores over two years, and we had already recorded eight store closures for 2021. Tesco To Open A New Express Store Grocery retailer Tesco has announced plans to open a small-format Express store covering 4,500 square feet, in Belfast city center. The retailer will open the store on the former Poundworld site.Non-Store-Closure News

Thomas Pink To Resume Operations Shirtmaker Thomas Pink has announced plans to restart operations following its acquisition by former JD sports executive Nick Preston. Preston has brokered a deal to buy the intellectual property of Thomas Pink from luxury conglomerate LVMH, excluding its website and stores. Preston has previously worked at JD sports, Harvey Nichols, and House of Fraser. [caption id="attachment_124154" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124155" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.Source: Company reports/Coresight Research[/caption] 2021 Major UK Uncharted Openings and Closures [wpdatatable id=787]

Source: Company reports/Coresight Research

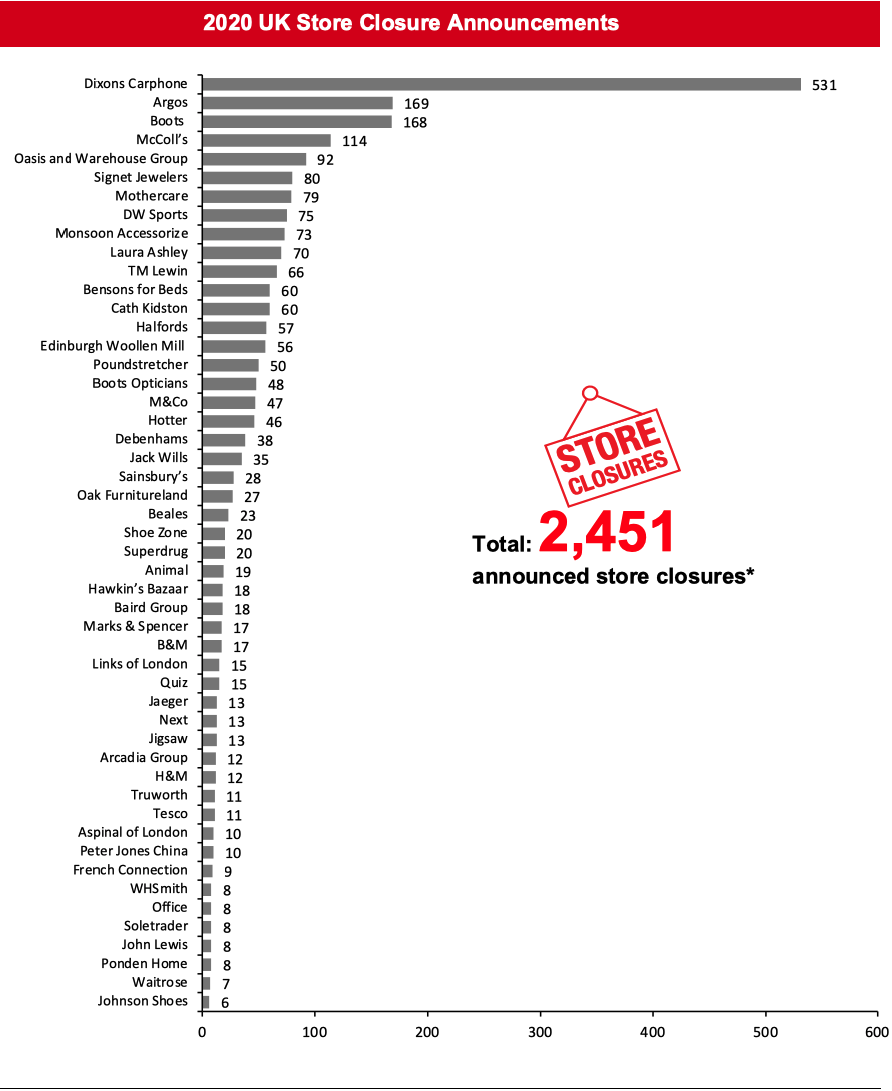

[caption id="attachment_124156" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.*Total includes a small number of retailers that each announced fewer than six store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124157" align="aligncenter" width="720"]

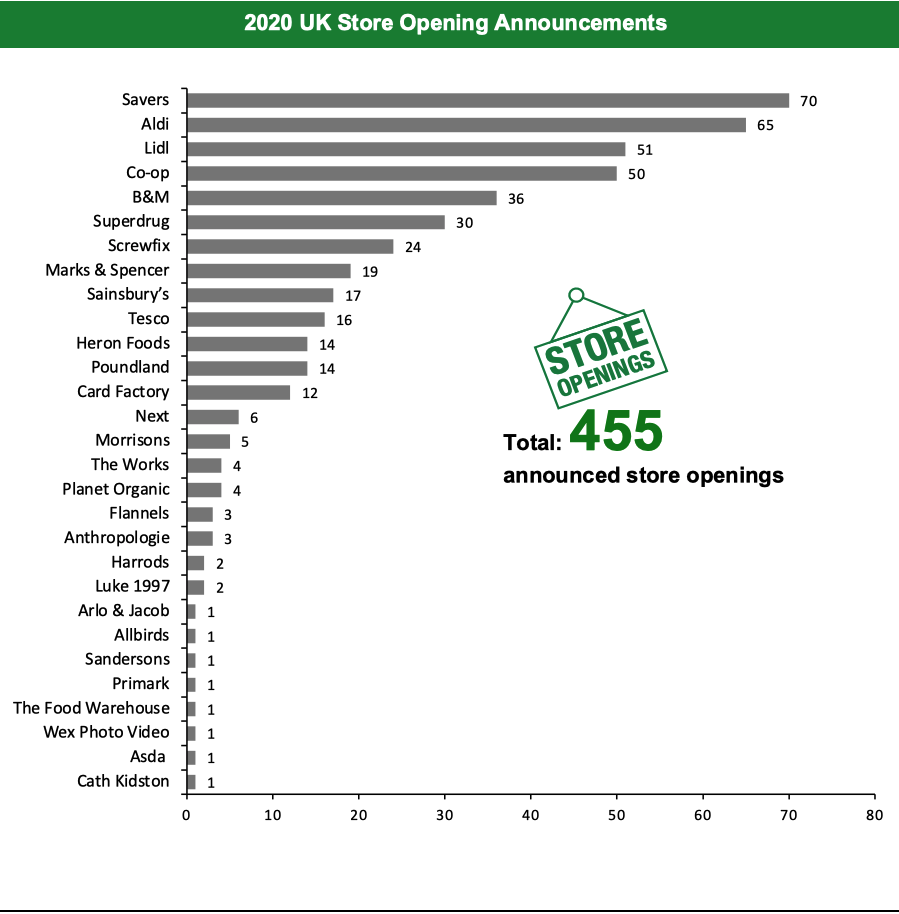

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.