Nitheesh NH

The US

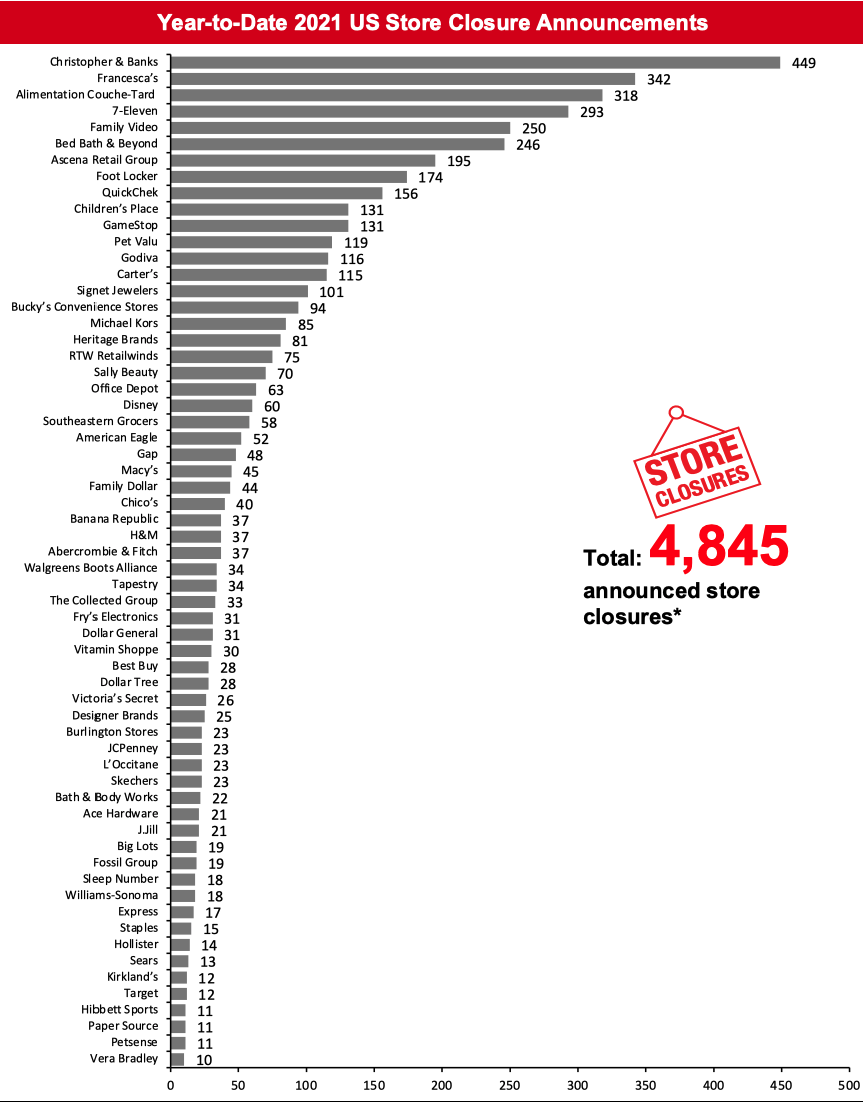

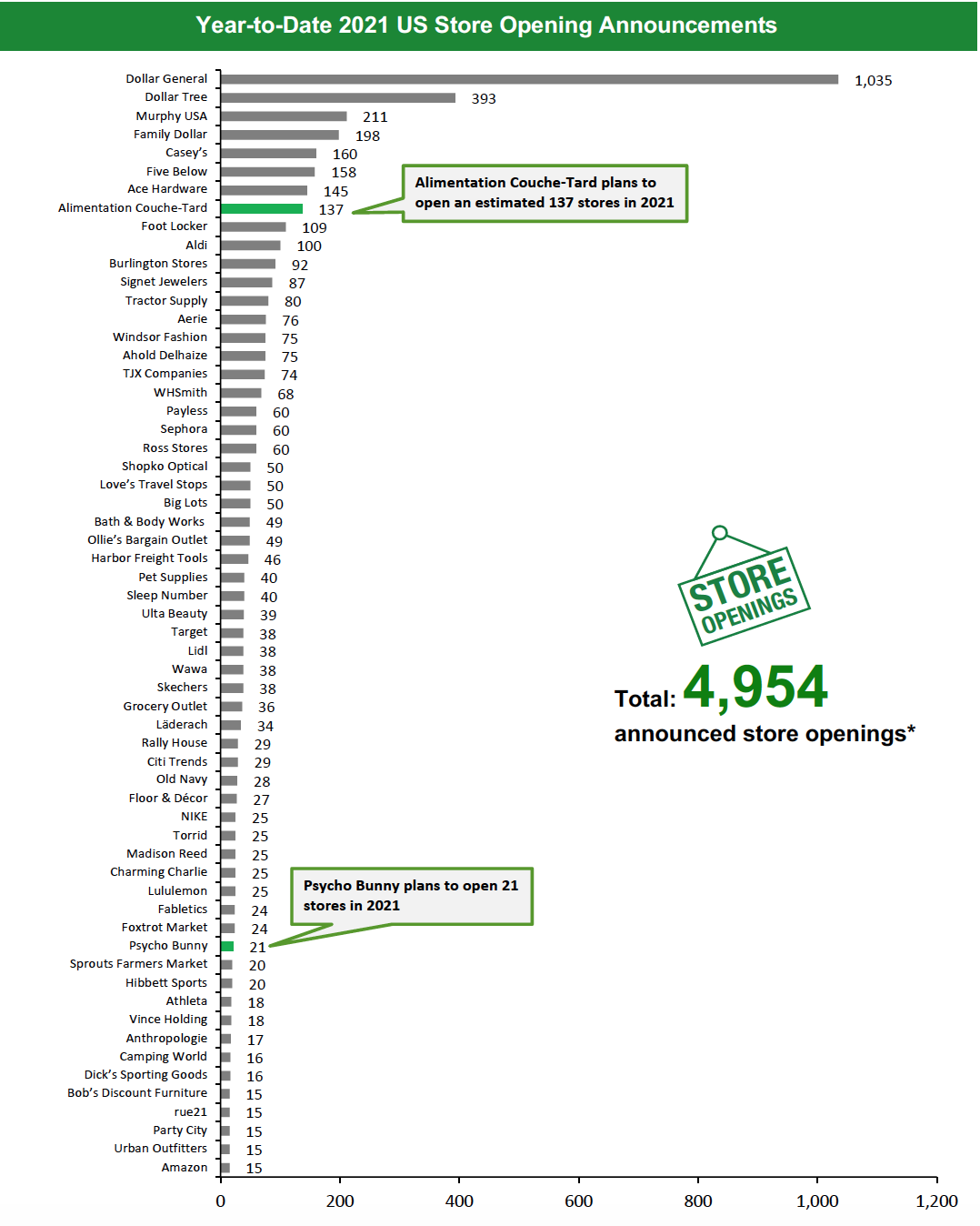

2021 Major US Store Closures and Openings This week, we discuss updates for Alimentation Couche-Tard, American Eagle Outfitters, Giant Eagle, Primark, Psycho Bunny Tory Burch and Vera Bradley. In light of these updates, our 2021 US closures and openings counts stand at 4,845 and 4,954, respectively. The charts below depict the week-by-week totals of announced US store closures and openings year to date in 2021 and 2020. For year-over-year comparisons, we are comparing closures and openings up to week 36 of 2021, ended September 10, 2021, to closures and openings tracked up to week 37 of 2020, ended September 11, 2020. Year to date in 2021, major retailers have announced 57.9% more openings and 37.1% fewer closures compared to the same period in 2020. This week year to date, openings pulled ahead of closures by 2%—compared to being 145.5% behind at the same time last year.2021 US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=286]

2020 US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=287]

Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

What Is Happening This Week in the US

Giant Eagle To Close One Store Supermarket chain Giant Eagle plans to close one store in Lewis Center in Ohio in the fall of 2021. The closure will take the company’s store count to 480. Primark To Open One Store Apparel retailer Primark plans to open a store in Philadelphia, Pennsylvania, on September 16, 2021. The store opening will take the company’s store count in the US to 13. Psycho Bunny To Open 21 Stores Apparel retailer Psycho Bunny plans to open 21 stores in 2021. The retailer had previously announced plans to open 15 stores in 2021 but has revised this number up. The new stores will primarily be located in malls and will take the company’s store count to 29. Tory Burch Opens One Store Luxury brand Tory Burch opened a flagship store in New York on September 9, 2021. The store spans 6,000 square feet over three floors and takes the company’s store count to 110.Quarterly Store Openings/Closures Settlement

Alimentation Couche-Tard Provides Store-Count Update Convenience-store chain Alimentation Couche-Tard opened 232 stores and closed 121 in the US in 2020 and opened 114 stores and closed 99 in year-to-date 2021 in the US. The company plans to open an additional 23 stores in the coming quarter. The closures for 2021 have been tracked previously, and the update takes the company’s 2021 opening count to 137. The company operates 7,161 stores in the US as of July 18, 2021. American Eagle Outfitters Provides Store-Count Update Apparel retailer American Eagle Outfitters opened seven American Eagle stores and closed four in the US in its second quarter, ended July 31, 2021. The closures were previously tracked; the update takes the company’s 2021 opening count to 12. The company operates 894 American Eagle stores as of July 31, 2021. Vera Bradley Provides Store-Count Update Apparel accessories retailer Vera Bradley opened three stores and closed one in its second quarter, ended August 1, 2021. The company also plans to open two more stores by the end of October 2021. The closure was previously tracked; the update takes the company’s openings count to six. The company operates 145 stores as of August 31, 2021.Non-Store-Closure News

Sally Beauty Appoints New CEO Beauty retailer Sally Beauty appointed Denise Paulonis as President and CEO effective October 1, 2021. Paulonis succeeds Chris Brickman, who will step down on September 30, 2021 and will serve in an advisory role until March 31, 2022. Paulonis most recently served as CFO of Sprouts Farmers Market. 2021 Major US Store Closures and Openings [caption id="attachment_132454" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L’Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Fossil Group, Gap, Michael Kors Tapestry, and Signet Jewelers closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Tapestry includes Coach, Kate Spade and Stuart Weitzman stores. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given that its outlets would commonly be perceived as retail stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L’Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Fossil Group, Gap, Michael Kors Tapestry, and Signet Jewelers closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Tapestry includes Coach, Kate Spade and Stuart Weitzman stores. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given that its outlets would commonly be perceived as retail stores.*Total includes a small number of retailers that each announced fewer than 10 store closures and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_132490" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Alimentation Couche-Tard, Bed Bath & Beyond, Chico’s, Michaels Old Navy and Signet Jewelers openings pertain to North America openings. TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and Homesense stores. Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Go stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Alimentation Couche-Tard, Bed Bath & Beyond, Chico’s, Michaels Old Navy and Signet Jewelers openings pertain to North America openings. TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and Homesense stores. Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Go stores.*Total includes a small number of retailers that each announced fewer than 15 store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide details on timing or location. [wpdatatable id=1245]

Source: Company reports/Coresight Research

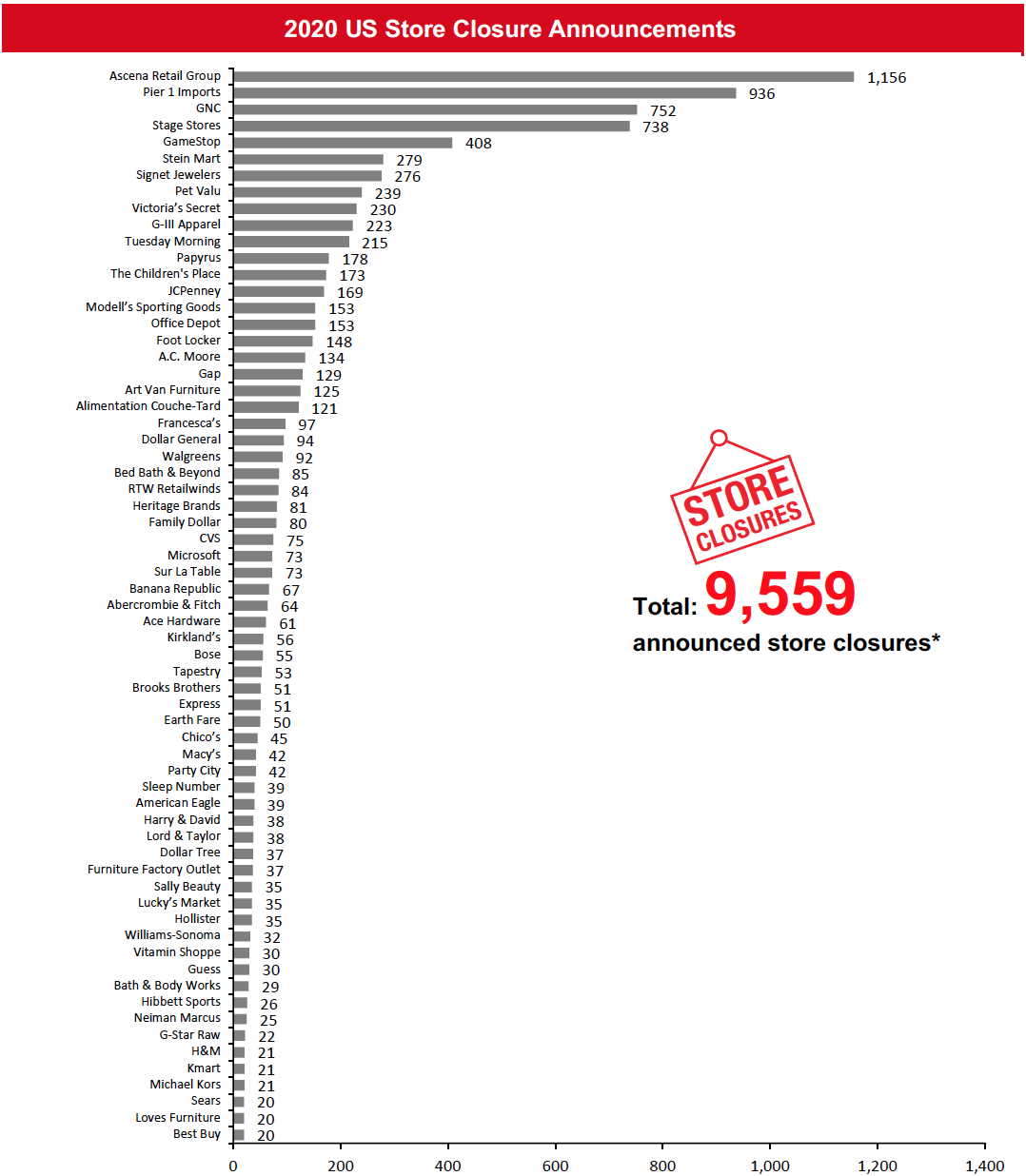

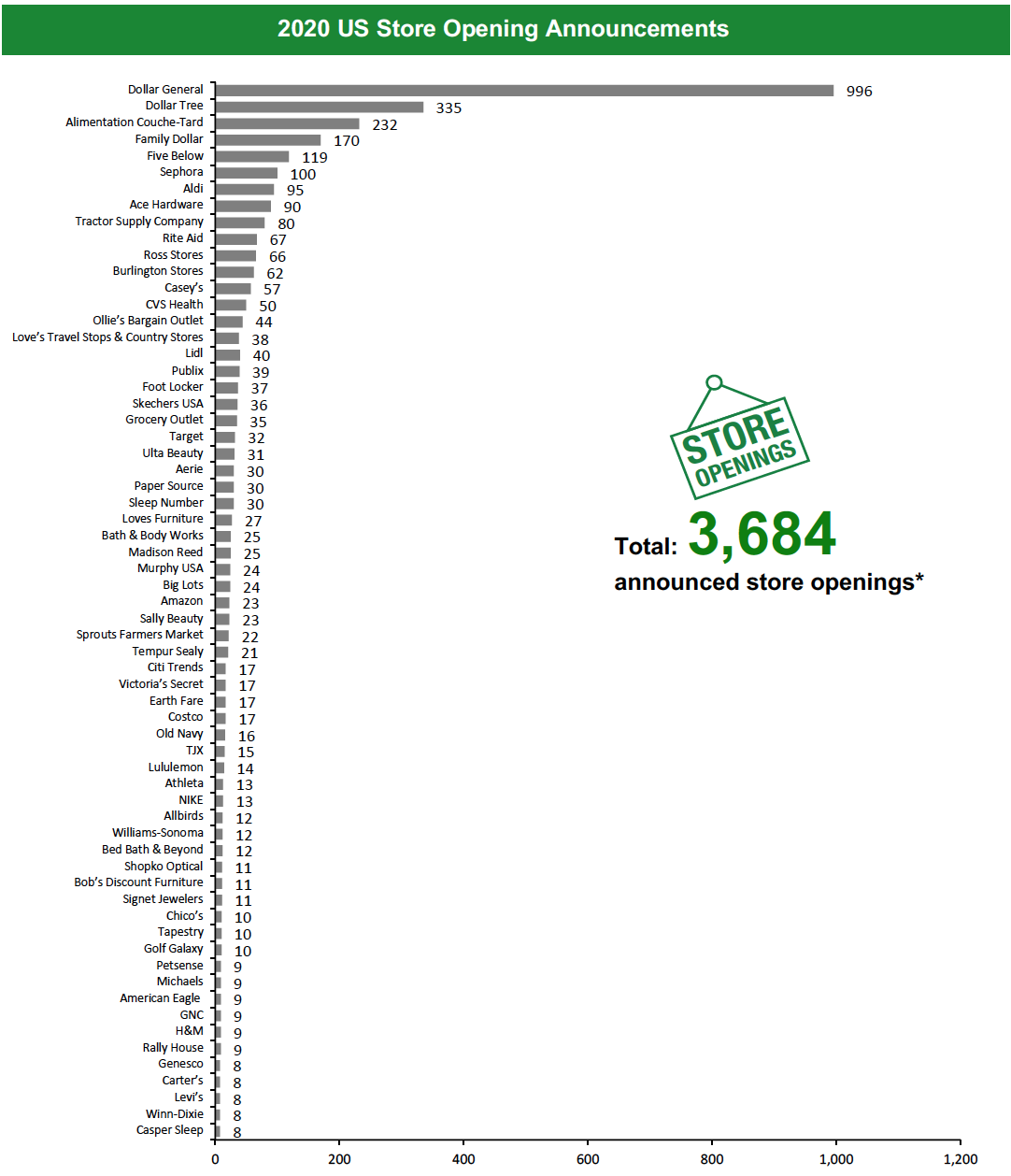

This week saw an update from Alimentation Couche-Tard and took the 2020 closure and openings counts to 9,559 and 3,684, respectively.

[caption id="attachment_132511" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_132512" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Fossil Group, Michaels, Old Navy, Sephora, Tapestry, and Under Armour openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Fossil Group, Michaels, Old Navy, Sephora, Tapestry, and Under Armour openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.*Total includes a small number of retailers that each announced fewer than eight store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Retail Bankruptcies [wpdatatable id=1246]

N/A – Not Available *Belk emerged from bankruptcy in February 2021 **The Collected Group emerged from bankruptcy in June 2021 Source: Company reports/Coresight Research

2020 Major US Retail Bankruptcies [wpdatatable id=1247]Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant, and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

The UK

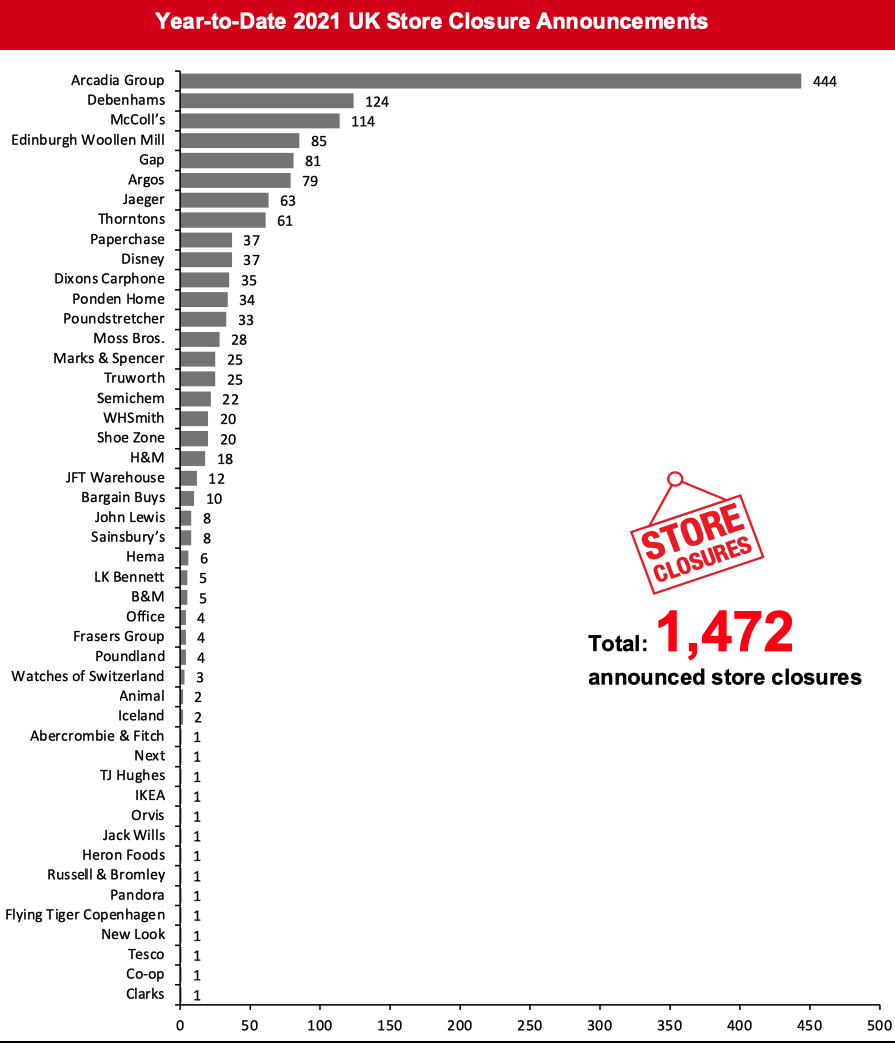

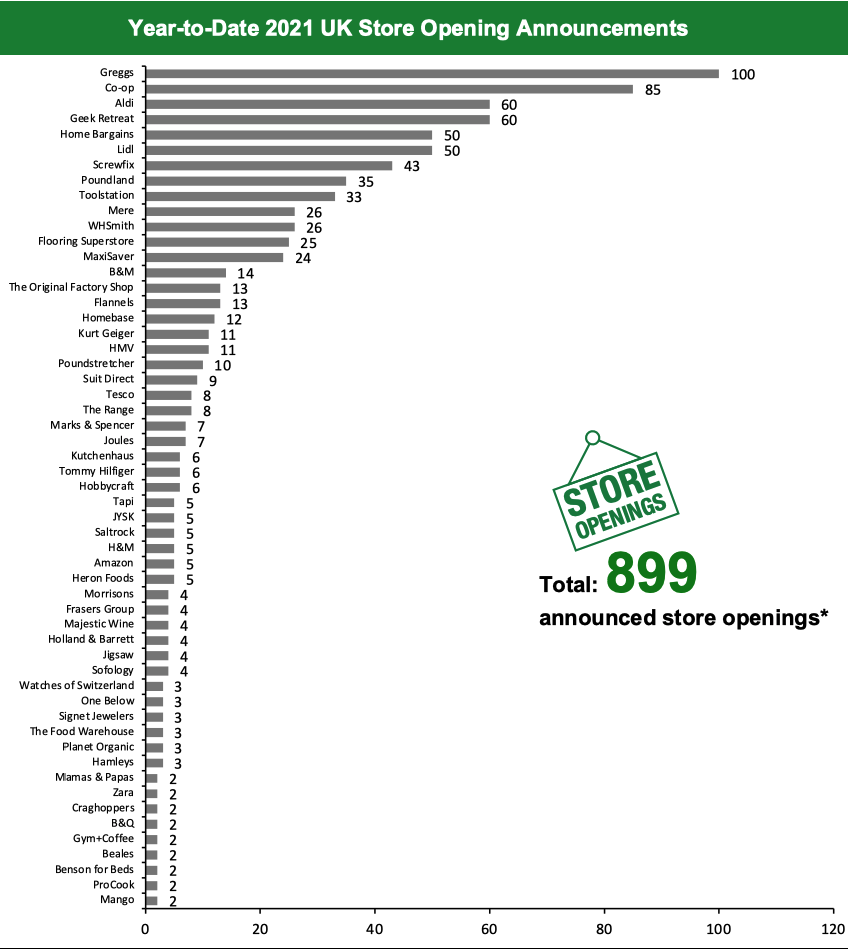

2021 Major UK Store Closures and Openings This week, we discuss updates for Hamleys, Hobbycraft and Tapi. In light of these updates, our 2021 UK openings counts increased to 899 and the closures count remains unchanged at 1,472. The charts below depict the week-by-week totals of UK store closures and openings year to date in 2021 and 2020. For year-over-year comparisons, we are comparing closures and openings up to week 36 of 2021, ended September 10, 2021, to closures and openings tracked up to week 37 of 2020, ended September 11, 2020. Year to date in 2021, major UK retailers have announced 77.3% more openings and 28.4% fewer closures compared to the same time last year.2021 UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=288]

2020 UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=289]

Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Hamleys to Open One Store Toy retailer Hamleys plans to open a store in the Chantry Place shopping center in Norwich in September 2021. The opening will take the company’s store count in the UK to 23. Hobbycraft To Open One Store Arts and crafts retailer Hobbycraft plans to open one store in Kent on October 6, 2021. The opening will take the company’s 2021 opening count to six and overall store count to 109. Tapi to Open 15 Stores Carpet and flooring retailer Tapi plans to open 15 stores in the next 12 months. We estimate that five of these openings will fall in calendar 2021. The company operates 180 stores as of September 10, 2021.Non-Store-Closure News

Asda COO and Chief Strategy Officer Step Down Supermarket chain Asda announced that its COO Anthony Hemmerdinger and Chief Strategy Officer Preyash Thakrar have stepped down from their roles. Hemmerdinger joined the company in 2016 and served as COO since 2019. Thakrarke joined the company as Chief Strategy Officer in 2017. The resignations come after gas company EG Group finalized its acquisition of Asda in August 2021. [caption id="attachment_132463" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and 10 other stores that have not yet been disclosed. Gap includes Republic of Ireland.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and 10 other stores that have not yet been disclosed. Gap includes Republic of Ireland.Source: Company reports/Coresight Research[/caption] [caption id="attachment_132464" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Planet Organic and Screwfix. Kurt Geiger includes Kurt Geiger and Carvela stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Planet Organic and Screwfix. Kurt Geiger includes Kurt Geiger and Carvela stores.*Total includes a small number of retailers that each announced fewer than two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major UK Uncharted Openings and Closures [wpdatatable id=1251]

Source: Company reports/Coresight Research

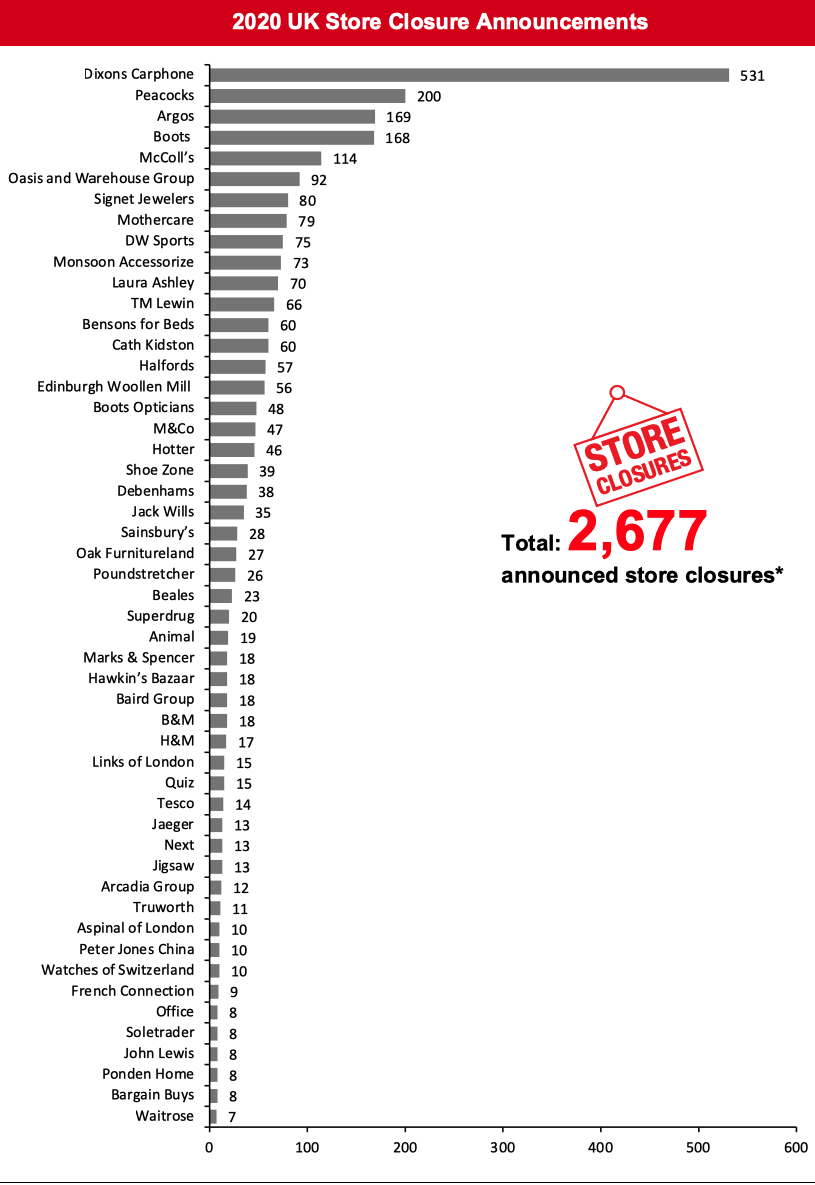

[caption id="attachment_132466" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to the Topshop and Topman banner stores. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to the Topshop and Topman banner stores. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.*Total includes a small number of retailers that each announced fewer than seven store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_132467" align="aligncenter" width="700"]

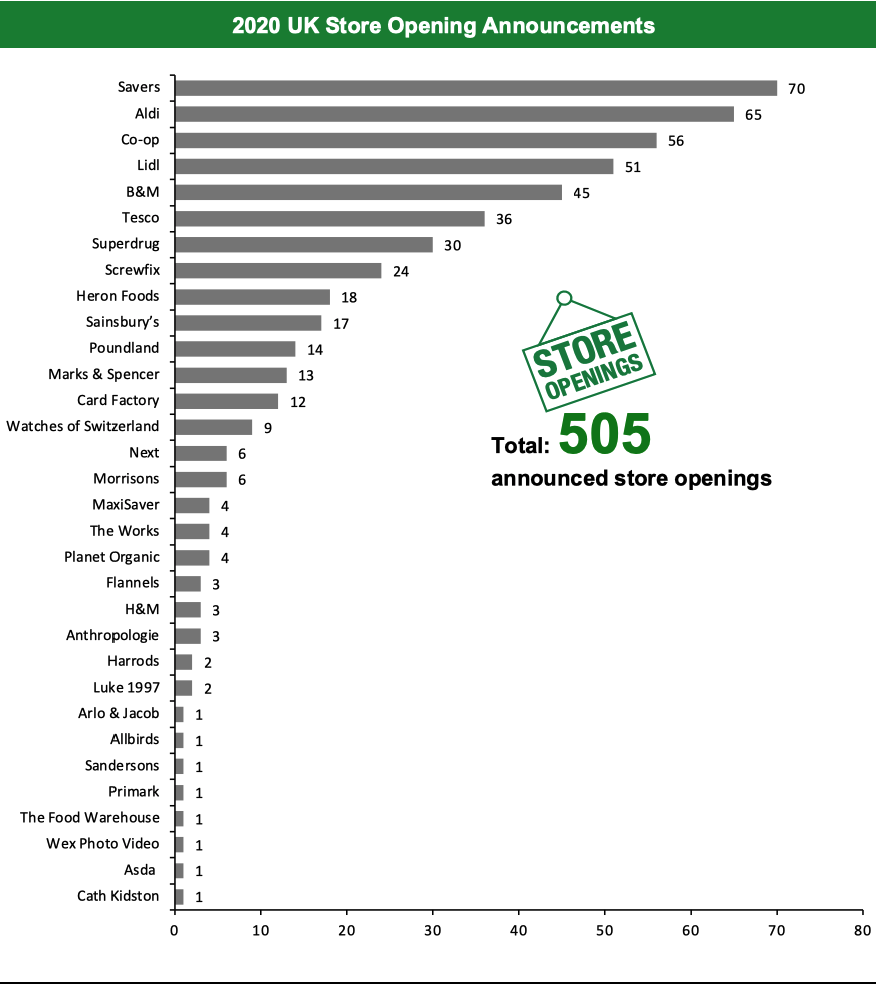

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross. Figures represent retail closures (i.e., B2C), so closures by solely B2B companies are excluded.