Nitheesh NH

The US

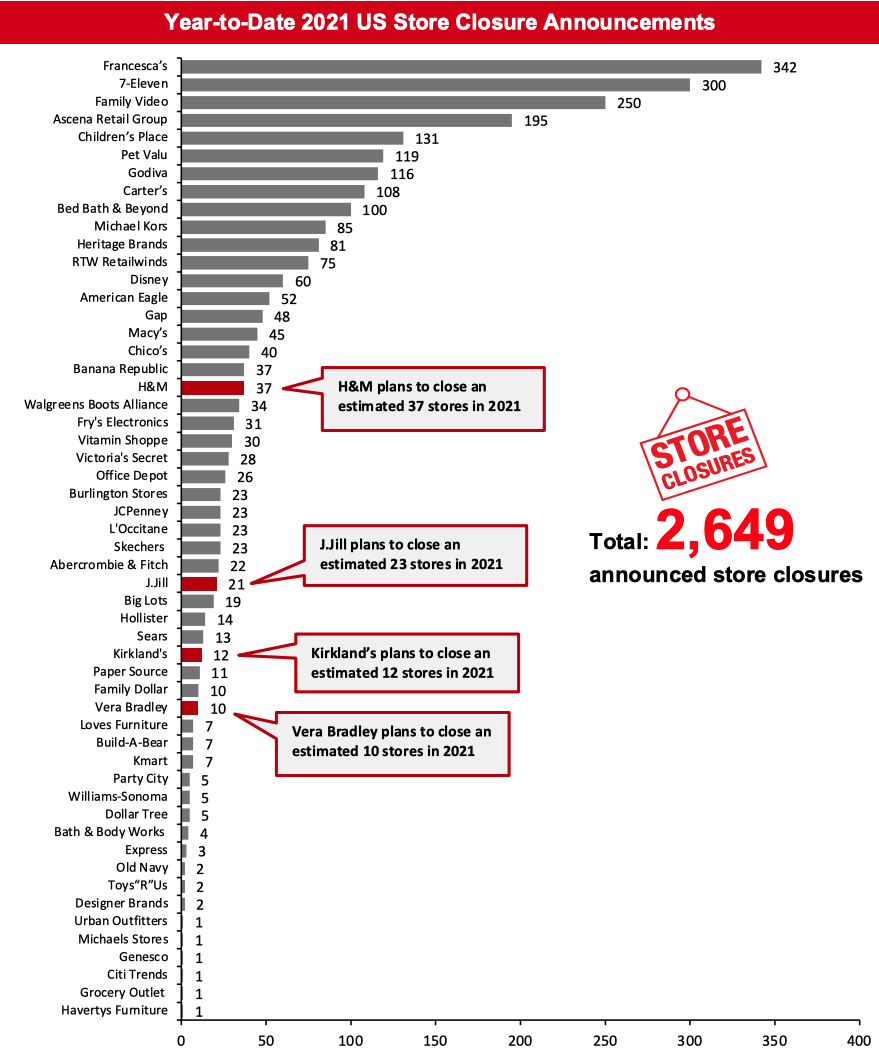

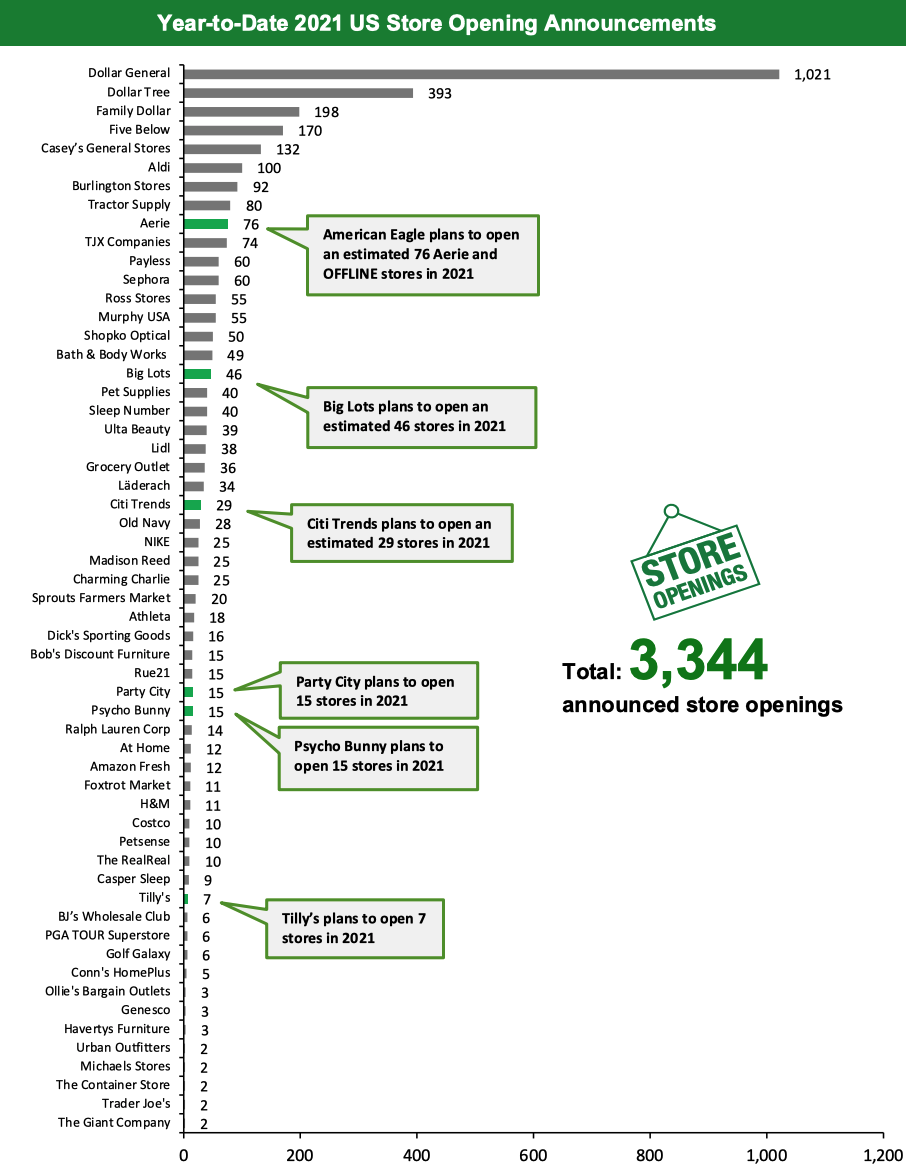

2021 Major US Store Closures and Openings So far in 2021, US retailers have announced 2,649 closures and 3,344 openings for the full year. As we represent closures and openings by calendar year, these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, we discuss updates for Amazon, American Eagle Outfitters, Big Lots, Citi Trends, Design Brands, H&M, J.Jill, Kirkland’s, Party City, Primark, Psycho Bunny, Tilly’s, Toys“R”Us and Vera Bradley. In light of these updates, we have changed our 2021 US openings count and closures count to 3,344 and 2,649, respectively. The charts below depict the week-by-week totals of announced US store closures and openings year to date in 2021 and 2020. For year-over-year comparisons, we compare closures and openings up to week 11 of 2021, ended March 19, 2021, with closures and openings tracked up to week 12 of 2020, ended March 20, 2020. Year-to-date in 2021 retailers have announced 39.5% more openings and 42.2% more closures compared to the same time last year. 2021 US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=174] 2020 US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=175]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

What Is Happening This Week in the US

Amazon To Open Five Amazon Fresh Stores Amazon has opened its eleventh Amazon fresh store in Bloomingdale, Illinois—marking its seventh Amazon fresh store opening in 2021. According to Bloomberg, Amazon is reportedly planning to open 28 more stores but the company has confirmed only five of these stores for 2021. The confirmed store openings take our 2021 openings count for Amazon to 12. Primark Opens One Store in Chicago British apparel retailer Primark has opened a store in Chicago, Illinois. The store spans 36,000 square-feet over three floors and is Primark’s eleventh store in the US. Psycho Bunny To Open 15 stores Menswear brand Psycho Bunny has announced plans to open 15 stores in 2021. The first of the new stores will open in Paramus, New Jersey on March 31, 2021. The retailer has nine stores as of March 17, 2021. Toys ‘R’ Us Acquired by WHP Global; Plans To Open Stores Private equity firm WHP Global has acquired a controlling interest in Tru Kids Inc., parent company of Toys“R”Us, Babies“R”Us, and other toy and baby brands. Tru Kids bought the brands and intellectual property of Toys“R”Us after the company filed for bankruptcy in 2017. Yehuda Shmidman, CEO of WHP Global said the company plans to open Toys“R”Us stores again in North America in time for the 2021 holiday shopping season.Quarterly Store Openings/Closures Settlement

American Eagle Outfitters To Open 50 Aerie Stores and 30 OFFLINE Stores Apparel retailer American Eagle Outfitters opened nine Aerie and two American Eagle stores and closed one Aerie store and 36 American Eagle stores in its fourth quarter, ended January 30, 2021. The company also plans to open 50 Aerie stores and 30 OFFLINE stores in its current fiscal year, ending early February 2022. The company operates 901 American Eagle stores and a total of 175 Aerie and OFFLINE stores as of January 31, 2021. The update takes our 2020 opening and closure counts for American Eagle to seven and 39, respectively, and our 2021 opening count to one. The 2021 closures have already been tracked. We have updated our Aerie 2020 openings and closure counts to 30 and five, respectively, and the 2021 opening count to 76. Big Lots Plans To Open 50–60 Stores in 2021 Discount retailer Big Lots closed four stores in its fourth quarter, ended January 30, 2021. The retailer plans to open 50–60 stores and close or relocate 20 stores in its current fiscal year, ending early February 2022. The retailer operates 1,410 stores as of January 30, 2021. We have updated our 2020 closure count to 19, and our 2021 openings and closures counts to 46 and 19, respectively. Citi Trends To Open 30 Stores Apparel retailer Citi Trends has closed two and opened four stores in its fourth quarter, ended January 30, 2021. The retailer plans to open at least 30 new stores in its current fiscal year, ending early February 2022. Citi Trends also plans to open 100 new stores by February 2024. We have updated our 2020 opening and closure counts to 17 and three, respectively, in light of the new information. We have updated our 2021 opening count for the retailer to 29 and our closure count to one. The retailer operates 585 stores as of January 31, 2021. Designer Brands Closed Five Stores Apparel retailer Designer Brands has closed five stores in the US in its fourth quarter, ended January 30, 2020. The retailer operates 516 stores in the US as of January 30, 2021. The update takes our 2020 and 2021 closure counts to six and two, respectively. H&M Provides Store Count Update H&M opened seven stores and closed 11 stores in the US in its fiscal year, ended November 30, 2020. The retailer has announced that it plans to open 100 stores and close 350 stores globally in its current fiscal year, ending late November 2021. The update takes our 2020 opening count to nine and our closure counts to 21. We have charted an estimated 11 store openings by the retailer and 37 store closures in the US in calendar 2021. The retailer operates 582 stores in the US as of November 30, 2020. J.Jill To Close 20 Stores Women’s apparel and accessories retailer J.Jill closed nine stores in its fourth quarter, ended January 30, 2021. The retailer plans to close 20 stores in its current fiscal year, ending early February 2022. J.Jill operates 267 stores as of January 30, 2021. Following the update, we have changed our 2020 closure count to 17. We have updated our 2021 closure count for the retailer to 21. Kirkland’s To Close 10 Stores Furniture retailer Kirkland’s closed eight stores in its fourth quarter, ended January 30, 2021. The retailer also plans to close around 10 stores in its fiscal year, ending early February 2022. The update takes our 2020 and 2021 closure counts to 56 and 12, respectively. The retailer operates 373 stores as of January 30, 2021. Party City Plans To Open 15 Stores Party supplies retailer Party City closed 42 stores and opened five stores in its fiscal year, ended December 31, 2020. The retailer plans to open 15 stores and close five stores in 2021. The retailer operates 746 stores as of December 31, 2020. Tilly’s To Open Seven Stores Apparel retailer Tilly’s closed four stores and opened two stores in its fiscal year, ended January 30, 2021. The retailer plans to open seven stores by early May 2021. The retailer operates 238 stores as of January 30, 2021. Vera Bradley To Close up to 10 Stores Women’s apparel and accessories retailer Vera Bradley opened six factory stores and closed 13 full-line stores in its fiscal year, ended January 30, 2021. The retailer plans to close up to 10 full-line stores in its current fiscal year, ending early February 2022. The retailer operates 75 full-line and 69 factory stores as of January 30, 2021.Non-Store-Closure News

Ulta Beauty Hires New CEO Beauty retailer Ulta Beauty has appointed Dave Kimbell as President of Ulta Beauty as CEO, effective June 2, 2021. Kimbell will take over from Mary Dillon, who has served as CEO for eight years. Dillon will transition to the role of Executive Chairman of the Board. 2021 Major US Store Closures and Openings [caption id="attachment_124728" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124730" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings.TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and HomeSense stores.

Aerie includes Aerie stores and OFFLINE stores.

*Total includes a small number of retailers that each announced fewer than 2 store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=806]

Source: Company reports/Coresight Research

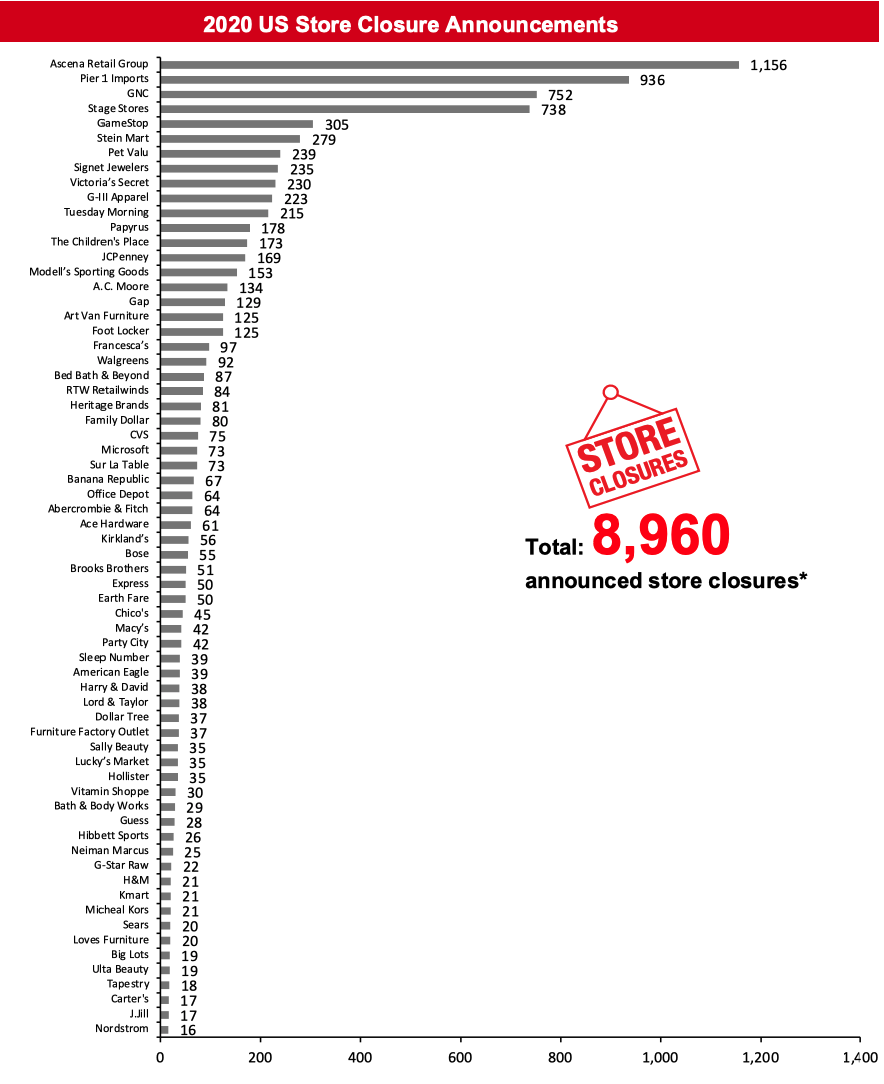

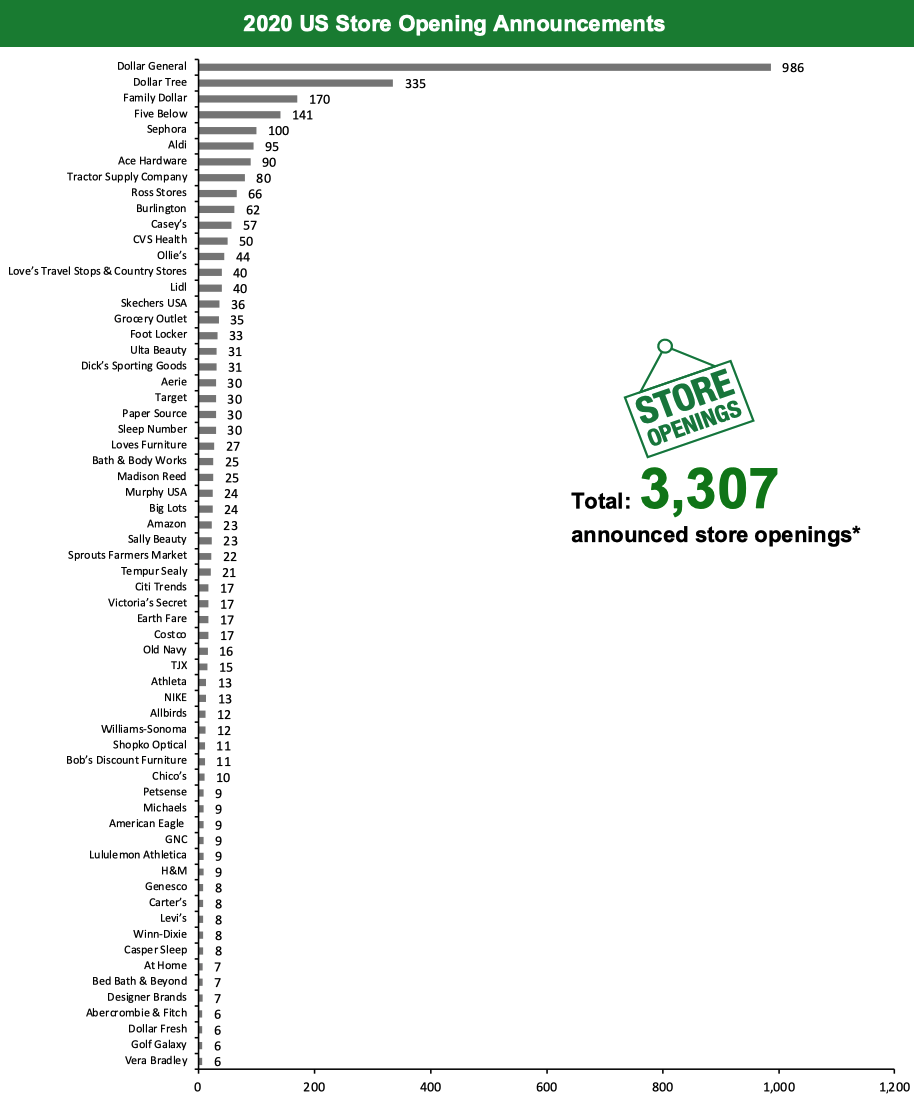

Following this week’s updates for Big Lots, Citi Trends, H&M, Tilly’s and Vera Bradley we have revised our 2020 US openings count to 3,307. In light of the closure updates for American Eagle, Big Lots, H&M, J.Jill, Kirkland’s and Party City, we have updated our 2020 US closures count to 8,960. [caption id="attachment_124732" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.*Total includes a small number of retailers that each announced fewer than 13 store closures and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124733" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.*Total includes a small number of retailers that each announced fewer than six store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Retail Bankruptcies [wpdatatable id=807]

N/A – Not Available *Belk emerged from bankruptcy in February 2021 Source: Company reports/Coresight Research

2020 Major US Retail Bankruptcies [wpdatatable id=808]Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant, and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

The UK

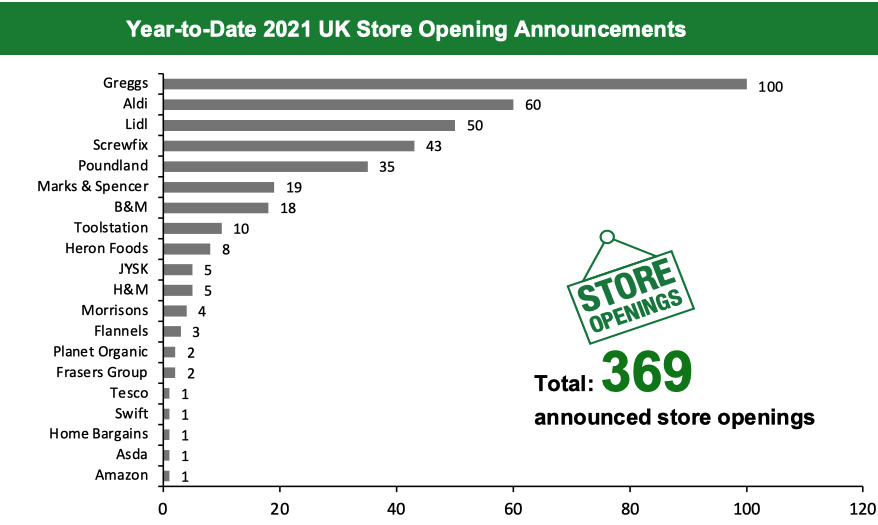

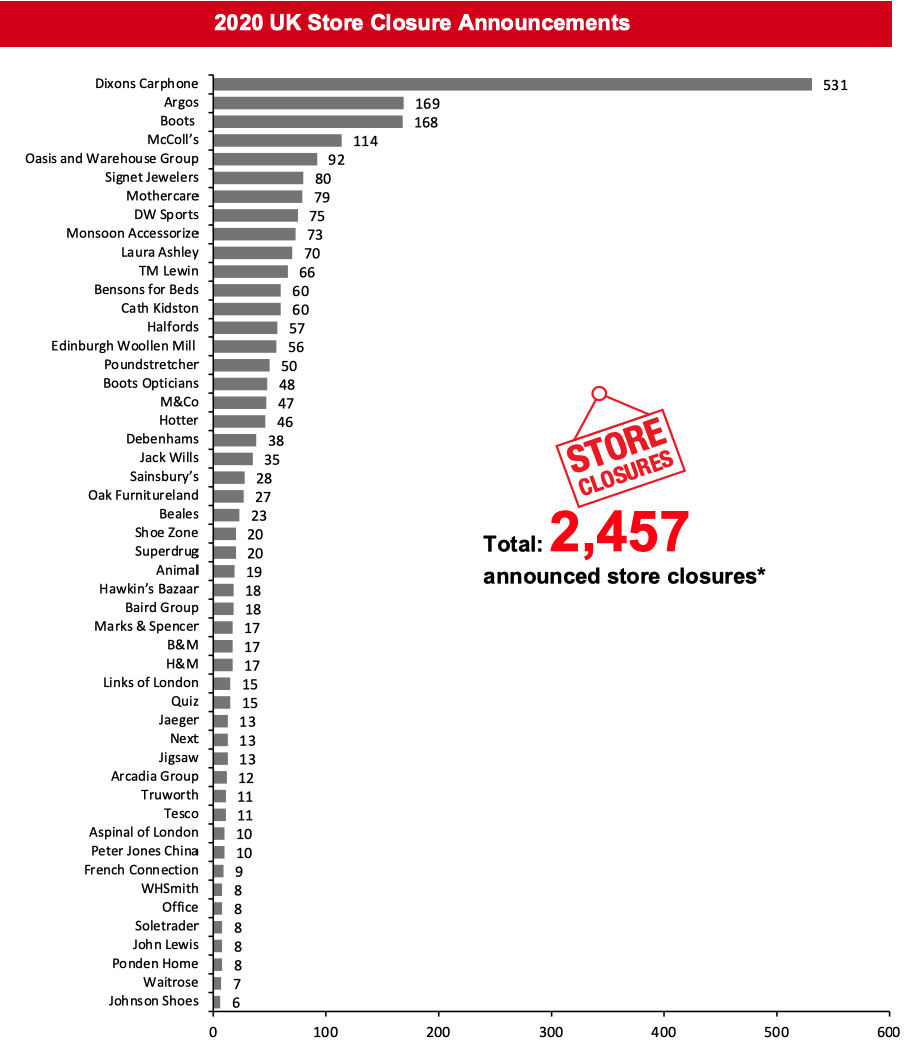

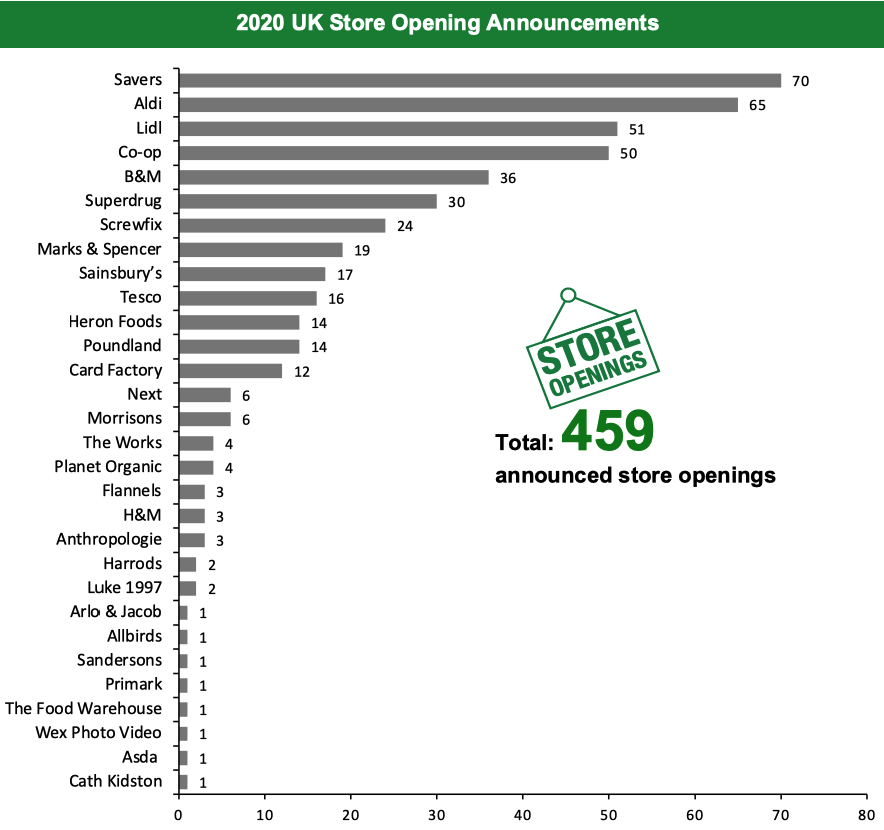

2021 Major UK Store Closures and Openings So far in 2021, UK retailers have announced 1,139 closures and 369 openings for the full year. As we represent closures and openings by calendar year, these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, we discuss updates for Greggs, H&M, Iceland, John Lewis, Screwfix and Thorntons. In light of these updates, we have changed our 2021 UK openings and closure counts to 369 and 1,139, respectively. The charts below depict the week-by-week totals of UK store closures and openings year to date in 2021 and 2020. For year-over-year comparisons, we are comparing closures and openings up to week 11 of 2021, ended March 19, 2021, to closures and openings tracked up to week 12 of 2020, ended March 20, 2020. Year-to-date in 2021 retailers have announced 3.6% fewer openings and 2.4% more closures compared to the same time last year. 2021 UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=176] 2020 UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=177]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Greggs To Open 100 Stores Bakery chain Greggs plans to open 100 new stores in 2021, despite reporting its first loss since its public listing in 1984. Greggs CEO Roger Whiteside said that the chain made a better-than-expected start to 2021 and is well placed to participate in the recovery from the pandemic. The company operates 2,078 stores as of January 2, 2021. H&M Provides Store Count Update H&M opened three stores and closed 19 stores in the UK in its fiscal year, ended November 30, 2020. The retailer plans to open 100 stores and closes 350 stores globally in its fiscal year, ending late November 2022. The retailer operates 289 stores in the UK as of November 30, 2020. The update takes our 2020 opening count to three and our and closure counts to 17 for the UK. We have updated our 2021 charts to reflect our estimate of five store openings and 18 store closures in the UK in calendar 2021. Iceland To Open New Concept Store Supermarket chain Iceland has launched a new convenience store concept format called Swift, opening the first of these new store formats on March 18, 2021 in Longbenton, Newcastle. A spokesperson for the company said that, “the new Swift stores will cover the full spectrum of grocery from frozen and fresh to food-to-go, alcohol and tobacco.” John Lewis To Close Stores Department store chain John Lewis announced that it does not expect to reopen some of its stores when the lockdown ends. The company announced the store closures in its annual earnings summary, where it also reported a £517 million ($722 million) loss for 2020. The company is currently in talks with landlords and is expected to release details of the store closures by the end of March 2021. Screwfix To Open 40 Stores Home improvement retailer Screwfix has announced plans to open 40 stores in the UK in its fiscal year ending January 2022. The retailer operates 711 stores in the UK as of January 30, 2021. We estimate 37 of the stores to open in calendar 2021 and this takes its 2021 opening count to 43. Thorntons To Close All Stores Chocolatier Thorntons plans to close all of its 61 UK stores, citing financial stress caused by the coronavirus pandemic and lockdown measures. The Thorntons brand will remain on offer in supermarkets and other retailers, while its factories will focus on making chocolates for international markets. The store closures are expected to result in around 600 job losses. Coresight Research insight: What is the value of stores to a brand? Stores often play a significant role in building brand identity and reputation, which is one reason as to why so many direct-to-consumer brands ultimately move into physical retail. This is also reflected in the need for online-only retailers to spend more aggressively on marketing than retailers with a store presence, and the shift among a number of global brands from third-party wholesaling to operating their own stores. We see a negative long-term impact of its store closures on Thorntons’ brand strength, as it becomes entirely focused on wholesaling to mass-market retailers, which our store checks suggest is sacrificing pricing integrity and brand building to support volumes. We see a parallel with the update from John Lewis that not all of its department stores will reopen after the UK lockdowns end. John Lewis already has a limited store base, with just 42 stores. It is the store experience—of service and expertise, events, product range and omnichannel options—that underpin consumer trust in the brand. Should the chain slim down further and focus on e-commerce, it loses the ability to sustain that brand image.Non-Store-Closure News

New Look Enters High Court Battle Over Restructuring Plans Apparel retailer New Look has reportedly entered a High Court battle with landlords British Land and Land Securities over its Company Voluntary Arrangements (CVA). The retailer has been challenged by landlords over its CVA, which helped switch its contracts to turnover-based rent last year. The CVA included terms that required property owners to forgo rent for three years on 68 of the retailer’s stores and receive as little as 2% of turnover on 402 others. [caption id="attachment_124736" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124737" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.Source: Company reports/Coresight Research[/caption] 2021 Major UK Uncharted Openings and Closures [wpdatatable id=811]

Source: Company reports/Coresight Research

An update from H&M has changed our 2020 UK openings count and closure count to 459 and 2,457, respectively. [caption id="attachment_124738" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.*Total includes a small number of retailers that each announced fewer than six store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124739" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.