Nitheesh NH

The US

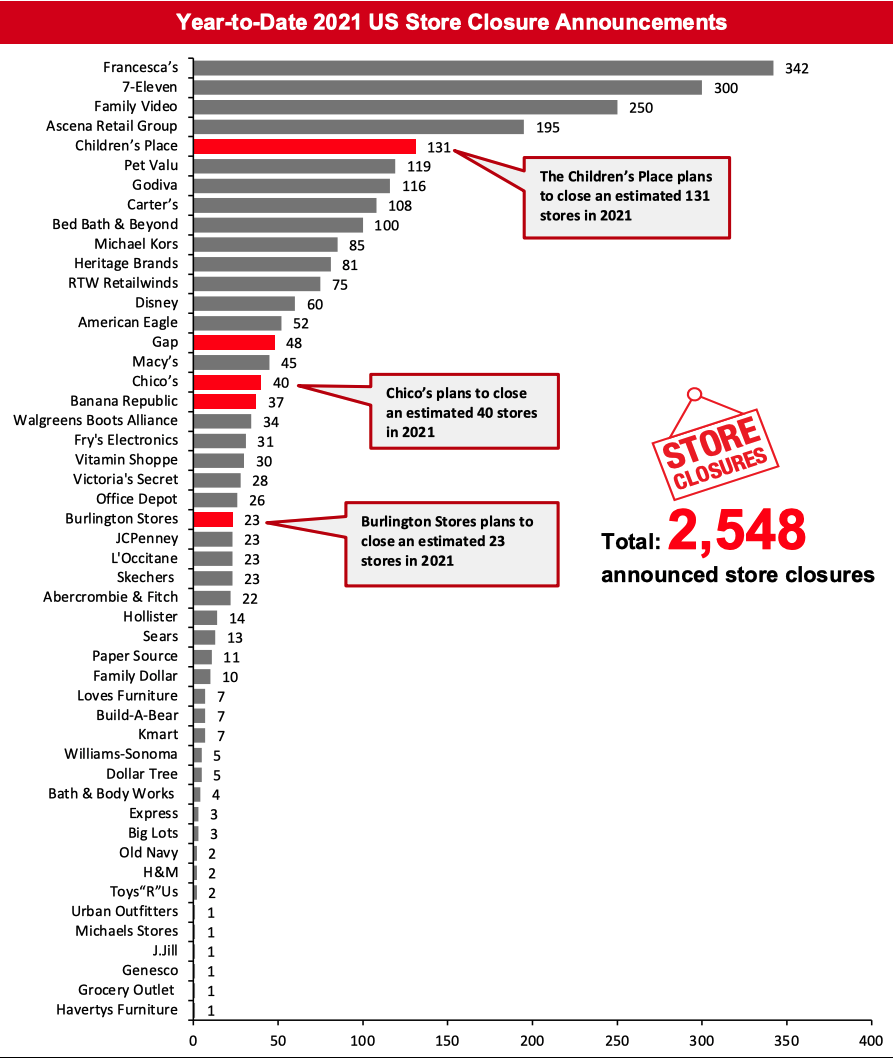

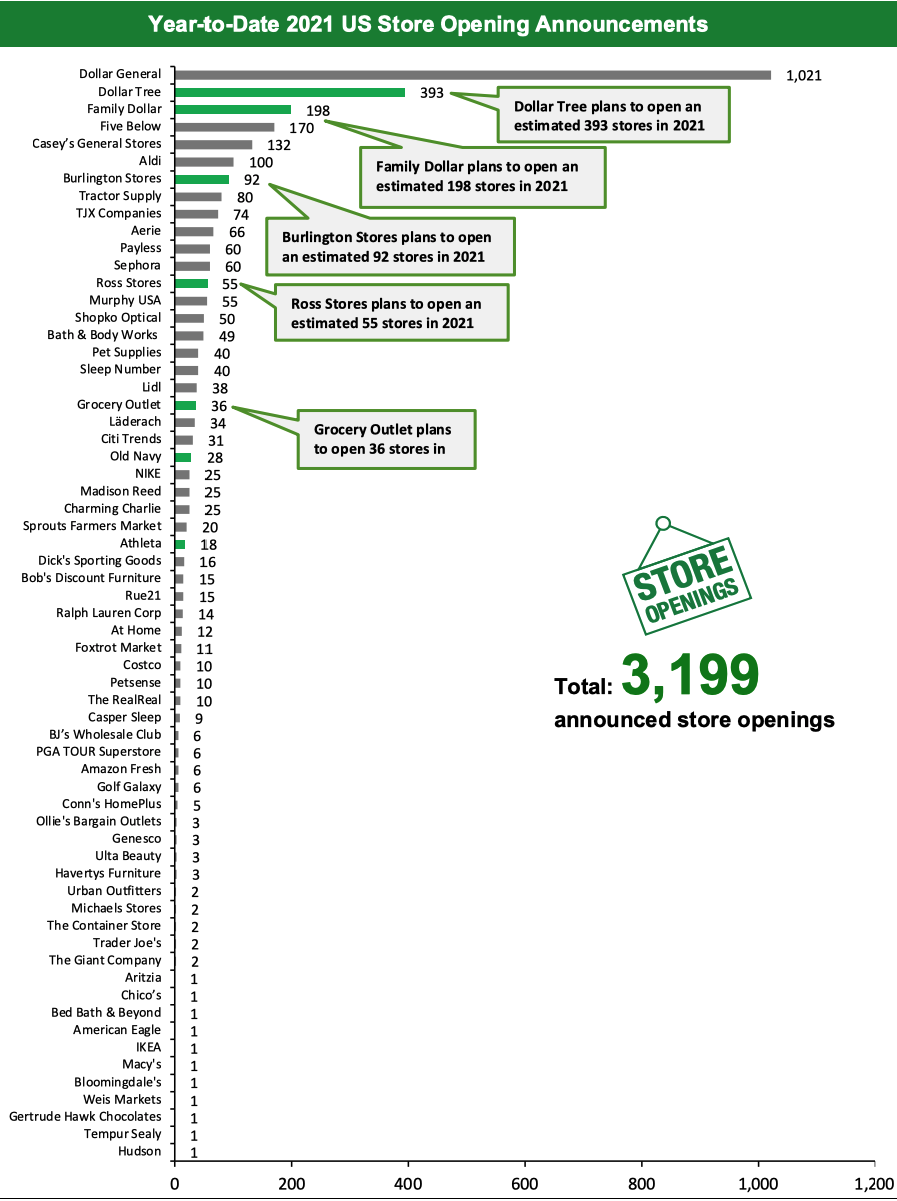

2021 Major US Store Closures and Openings Year to date in 2021, US retailers have announced 2,548 closures and 3,199 openings for the full year. Our data represent closures and openings by calendar year, so these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, updates for Burlington Stores, Dick’s Sporting Goods, Dollar Tree, Family Dollar, Gap, Grocery Outlet, and Ross Stores caused our 2021 US openings count to jump by 33% to 3,199. Following closure updates for Abercrombie & Fitch, Burlington Stores, Chico’s, Dollar Tree, Family Dollar, Gap and The Children’s Place, our 2021 US closures count changed to 2,548. The chart below depicts the week-by-week totals of announced US store closures and openings year to date in 2021. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=172]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks Source: Company reports/Coresight Research

What Is Happening This Week in the US

Burlington Stores To Open 100 Stores Off-price retailer Burlington Stores has announced plans to open 100 new stores and to close or relocate 25 stores in its current fiscal year. The retailer also expanded its long-term store count potential to 2,000 stores from 1,000 stores. The retailer operates 761 stores in the US as of January 30, 2021. We have charted an estimated 92 store openings and 23 store closures for calendar 2021. Coresight Research insight: This week, openings announcements from Burlington Stores, Dollar Tree, Grocery Outlet, Old Navy (under Gap) and Ross Stores drove the approximate one-third week-over-week jump in recorded store openings. 2021 is seeing little slowdown in demand for brick-and-mortar from discount and value formats such as off-pricers. This is in line with our estimate from the start of the year that the discount/value segment would account for around two-thirds of store openings in the US in 2021. As we recently discussed in detail, we think that value segments will need to look more to omnichannel propositions in the long term as value-focused e-commerce marketplaces continue to capture greater market share. Chico’s To Close up to 45 Stores in 2021 Apparel retailer Chico’s plans to close 40–45 stores in its fiscal year, ending February 2022. The retailer currently operates 1,302 stores and reported that the vast majority of the closures are expected to be mall-based stores. The retailer also said it plans to close 13–16% of its stores in the next three years. We have charted an estimated 40 store closures for calendar 2021. Dick’s Sporting Goods To Open 12 Stores Sport equipment and apparel retailer Dick’s Sporting Goods has announced plans to open six new Dick's Sporting Goods stores and six concept stores in its fiscal 2021, ending early February 2022. The company also expects to relocate 11 Dick's Sporting Goods stores and convert two former Field & Stream stores into Public Lands stores in its fiscal 2021. The retailer currently operates 726 Dick’s Sporting goods stores and 124 Golf Galaxy, Field & Stream and other concept stores as of January 30, 2021. The update takes our 2021 opening counts for Dick’s Sporting Goods to 16; the six concept stores have been charted under Golf Galaxy as it is the company’s primary concept store. Foxtrot Market To Open 11 Stores Online grocery delivery and convenience store company Foxtrot Market has opened a new convenience store in Washington, D.C. and plans to open another on March 22, 2021. The company operates eight stores in Chicago and two in Dallas as of March 12, 2021 and plans to open an additional nine stores in those markets by the end of 2021. The store expansion plans come after the company raised $42 million in a Series B fundraising round in late February 2021. Ross Stores Plans To Open 60 Stores in 2021 Off-price apparel and home accessories retailer Ross Stores plans to open around 60 new stores in its current fiscal year, ending early February 2022. The company will open 40 Ross Dress for Less stores and 20 dd’s Discounts stores. The company operates 1,585 Ross stores and 274 dd’s Discounts stores in the US as of January 30, 2021. We have charted an estimated 55 store openings for calendar year 2021.Quarterly Store Openings/Closures Settlement

Abercrombie & Fitch Closes 107 Stores in Its Fourth Quarter Apparel retailer Abercrombie & Fitch closed 66 Abercrombie stores and 41 Hollister Stores in the US in its fourth quarter, ended January 30 2021. The retailer operates 190 Abercrombie stores and 347 Hollister Stores in the US. The update takes our 2020 closure counts for Abercrombie & Fitch to 64 and to 35 for Hollister. We have updated our 2021 closure count for Abercrombie & Fitch to 22 and to 14 for Hollister. Dollar Tree To Open 600 stores in 2021 Discount retailer Dollar Tree has announced that it opened 79 Dollar Tree stores and 45 Family Dollar stores and closed 14 Dollar Tree stores and 31 Family Dollar stores in its fourth quarter ended January 30, 2021. The company plans to open 600 new stores in its current fiscal year, ending early February 2022. This will consist of 400 Dollar Tree stores and 200 Family Dollar stores. The retailer operates 7,805 Dollar Tree stores and 7,880 Family Dollar stores in the US as of January 30, 2021. The fourth-quarter update takes our 2020 opening counts for Dollar Tree to 330 and to 170 for Family Dollar. We have revised our 2021 opening counts for Dollar Tree to 393 to 198 for Family Dollar based on the update. We updated our closure counts for 2020 for Dollar Tree and Family Dollar to 38 and 94, respectively, and updated our 2021 closure counts for Dollar Tree and Family Dollar to five and 10, respectively. Gap Issues Updates on Store Openings for 2021 In its fourth-quarter earnings release, apparel retailer Gap announced plans to open 30–40 Old Navy stores, 20–30 Athleta stores and to close 75 Gap and Banana Republic stores in North America. The company also announced store closures and openings numbers in its fourth quarter, and we have updated our 2020 opening counts to 13 for Athleta, to three for Banana Republic, to two for Gap and to 32 for Old Navy. We have updated our 2020 closure counts in light of the update, taking Athleta to two, Banana Republic to 67, Gap to 129 and Old Navy to 16. The total store count in North America is 199 for Athleta, 471 for Banana Republic, 556 for Gap, and 1,220 for Old Navy, as of January 31, 2021. We have charted estimated store openings of 28 for Old Navy and 18 for Athleta for calendar year 2021. Based on existing store counts we have proportioned the 75 closures for Gap and Banana Republic and estimated store closures of 48 for Gap and 37 for Banana Republic for calendar 2021. Grocery Outlet To Open 36 Stores in 2021 Grocery retailer Grocery Outlet has opened eight stores in its fourth quarter, ended January 3, 2021. The company also announced plans to open 36–38 stores and close one store in 2021. The retailer currently operates 380 stores in the US. The Children’s Place To Close 122 Stores Children’s apparel and accessories retailer The Children’s Place has closed 60 stores in its fourth quarter ended January 30, 2021, taking its overall closure to 178 for the fiscal year. The retailer also announced plans to close around 122 stores in the current fiscal year to complete its previously announced target of closing 300 stores by end of fiscal 2021. The retailer will close 25 stores in the first quarter and 97 closures are planned for the remainder of the year. The retailer operates 749 stores in North America as of January 30, 2021. The announcement takes our 2020 closure count to 173 and 2021 closure count to 131.Non-Store-Closure News

NIKE Appoints New Head of North America Footwear and apparel retailer NIKE has appointed Sarah Mensah as Vice President and General Manager of North America, effective March 9, 2021. Mensah has taken over from Ann Hebert, who left the company on March 1, 2021. Mensah previously served as Vice President and General Manager of Asia Pacific and Latin America for the company and Amy Montagne has taken over this role. 2021 Major US Store Closures and Openings [caption id="attachment_124395" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for American Eagle, Bed Bath & Beyond, Children’s Place, Express, Gap, GNC, Godiva, Heritage Brands, JCPenney, H&M, L'Occitane, Michael Kors, Office Depot, RTW Retailwinds and Vitamin Shoppe, among others. Estimates for Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, and Michael Kors closures pertain to North America closures. Macy’s includes Macy’s and Bloomingdale’s banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Family Video, which operates primarily under a rental business model, is included in the chart since it also retails certain products and for comprehensiveness, given its outlets would commonly be perceived as retail stores.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124396" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings. TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and HomeSense stores.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aerie, Aldi, Casey’s, Dollar General, Dollar Tree, Lidl, Madison Reed and Payless, among others. Aerie, Bed Bath & Beyond, Chico’s, Michaels and Old Navy openings pertain to North America openings. TJX Companies includes Marmaxx (T.J. Maxx and Marshalls), HomeGoods, Sierra, and HomeSense stores.Source: Company reports/Coresight Research[/caption] 2021 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=793]

Source: Company reports/Coresight Research

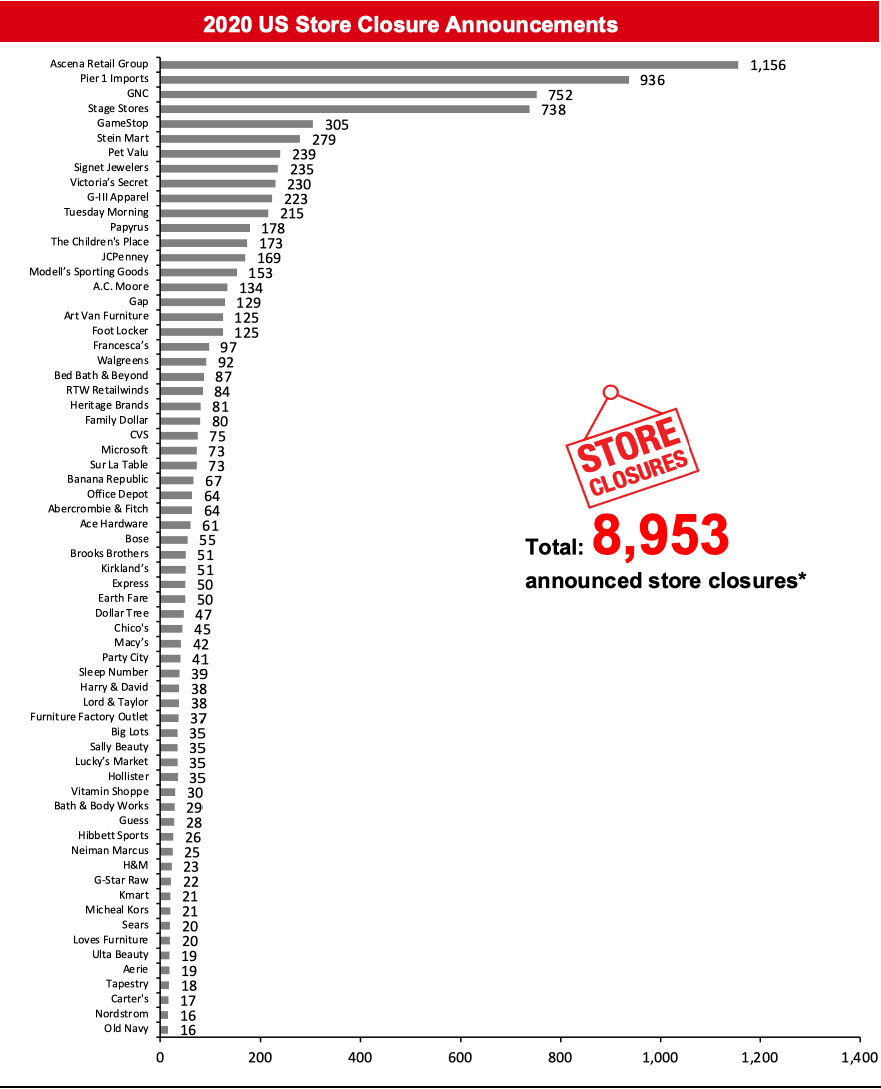

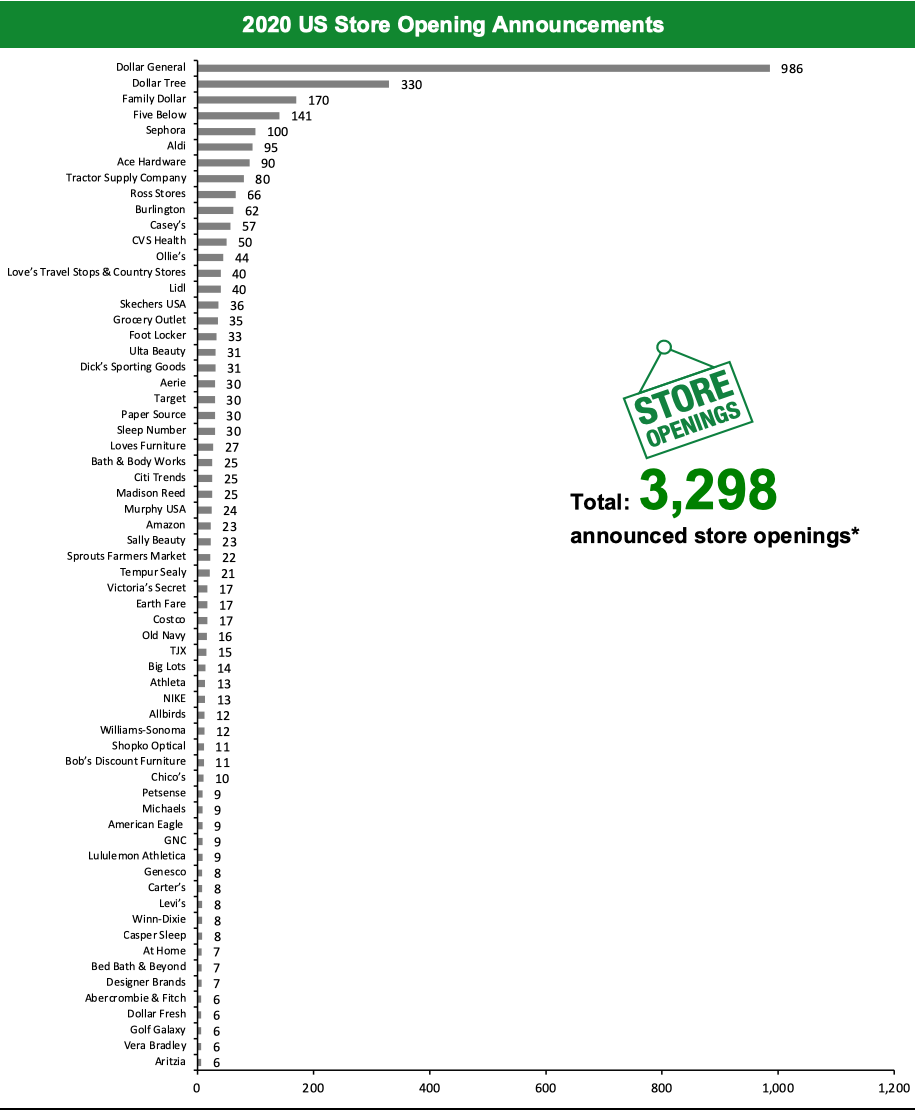

This week we have revised our 2020 US openings count to 3,298 following updates for Dollar Tree, Family Dollar, Gap and Grocery Outlet. With closure updates for Abercrombie & Fitch, Chico’s, Dollar Tree, Family Dollar and The Children’s Place, we have updated our 2020 US closures count to 8,953. [caption id="attachment_124397" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Heritage Brands, JCPenney, Kmart, Pet Valu, Sears and Signet Jewelers, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared, and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles, and Stage banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Victoria’s Secret includes PINK and Victoria’s Secret banners.*Total includes a small number of retailers that each announced fewer than 13 store closures and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124398" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister, and H&M, among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra, and T.J. Maxx banners. Beauty Systems Group, a subsidiary of Sally Beauty Holdings, is charted under the parent banner.*Total includes a small number of retailers that each announced fewer than six store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2021 Major US Retail Bankruptcies [wpdatatable id=794]

N/A – Not Available Source: Company reports/Coresight Research

2020 Major US Retail Bankruptcies [wpdatatable id=795]Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant, and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

The UK

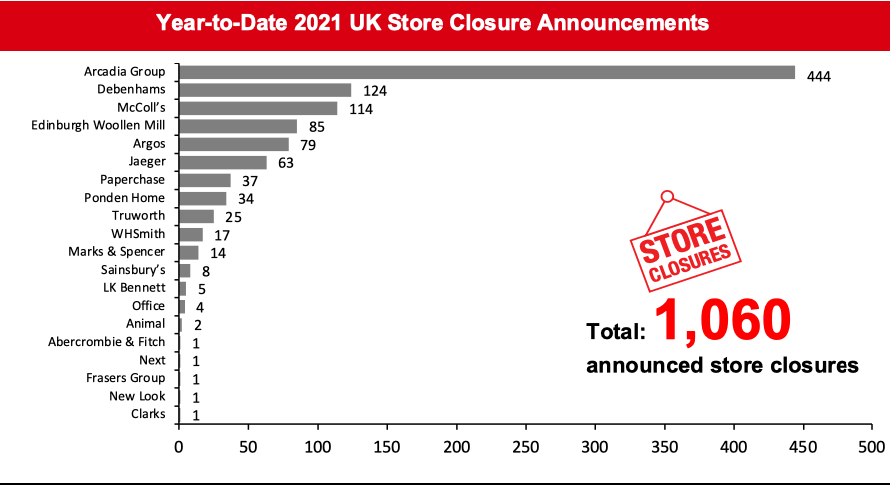

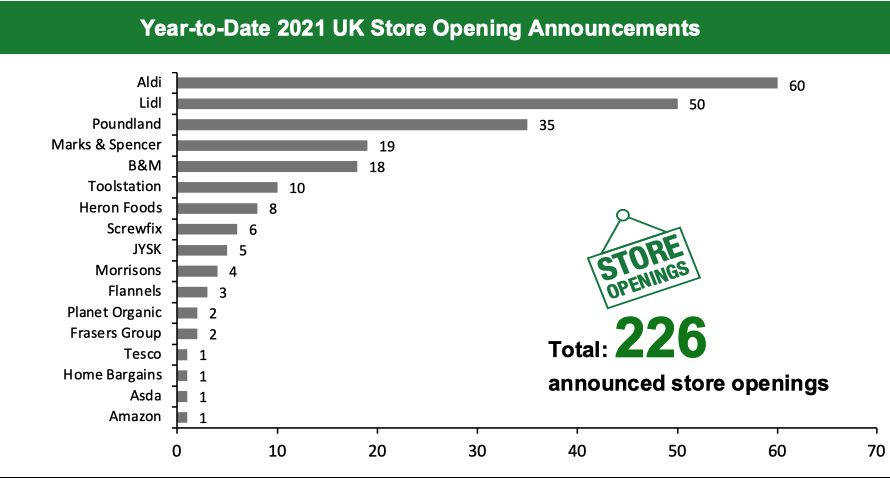

2021 Major UK Store Closures and Openings Year to date in 2021, UK retailers have announced 1,060 closures and 226 openings for the full year. Our data represent closures and openings by calendar year, so these totals include announcements made in 2020 of closures and openings expected to fall in 2021. This week, an update from Morrisons changed our 2021 UK openings count to 226. The closures count remains unchanged at 1060. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2021. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=173]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Clarks Appoints New CEO and Plans Store Closures Shoe retailer Clarks has hired Victor Herrero as CEO and Executive Chairman. Herrero replaced Giorgio Presca, who left the company in February 2021. Herrero previously served as CEO of Guess. Hong Kong-based private equity firm LionRock Capital acquired a majority stake in Clarks at the end of last year and is currently appointing a new management team to lead the retailer through the coronavirus pandemic, which will likely result in 320 store closures across the UK. The closures have not been included in the charts below as they have not been confirmed. Morrisons To Open Four Stores in 2021 Supermarket chain Morrisons opened six stores and closed one store in its fiscal year, ended January 31, 2021. The company plans to open four new stores in its current fiscal year. We expect all four openings to fall within calendar 2021 and have updated our charts accordingly.Non-Store-Closure News

Shoe Zone Appoints New Financial Director Shoe retailer Shoe Zone has hired Terry Boot as its new finance director with immediate effect. Boot replaces Peter Foot who stepped down from his role in February 2021 after joining the company in August 2020. Boot previously working as Chief Executive of UK-based jewelry firm The Company of Master Jewellers. Next Plc Acquires Minor Stake in Reiss Apparel retailer Next has signed a deal to acquire a 25% indirect interest in apparel retailer Reiss. Next will acquire shares from existing shareholders in the Reiss holding company. Next will make an equity investment of £33 million ($46 million) and a debt investment of £10 million ($14 million) if the deal receives regulatory clearance. The deal also gives Next an option to acquire an additional 26% interest at pre-agreed terms by July 2022, which would take Next’s total stake in the company to 51%. [caption id="attachment_124400" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Arcadia Group, Argos, Edinburgh Woollen Mill, Jaeger, Marks & Spencer, Office, Ponden Home, Sainsbury’s, Truworth and WHSmith. McColl’s includes convenience stores and newsagents. Arcadia Group includes 21 Outfit stores and other 10 stores that have not yet been disclosed.Source: Company reports/Coresight Research[/caption] [caption id="attachment_124401" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, B&M, Flannels, Heron Foods, JYSK, Lidl, Screwfix and Planet Organic.Source: Company reports/Coresight Research[/caption] 2021 Major UK Uncharted Openings and Closures [wpdatatable id=797]

Source: Company reports/Coresight Research

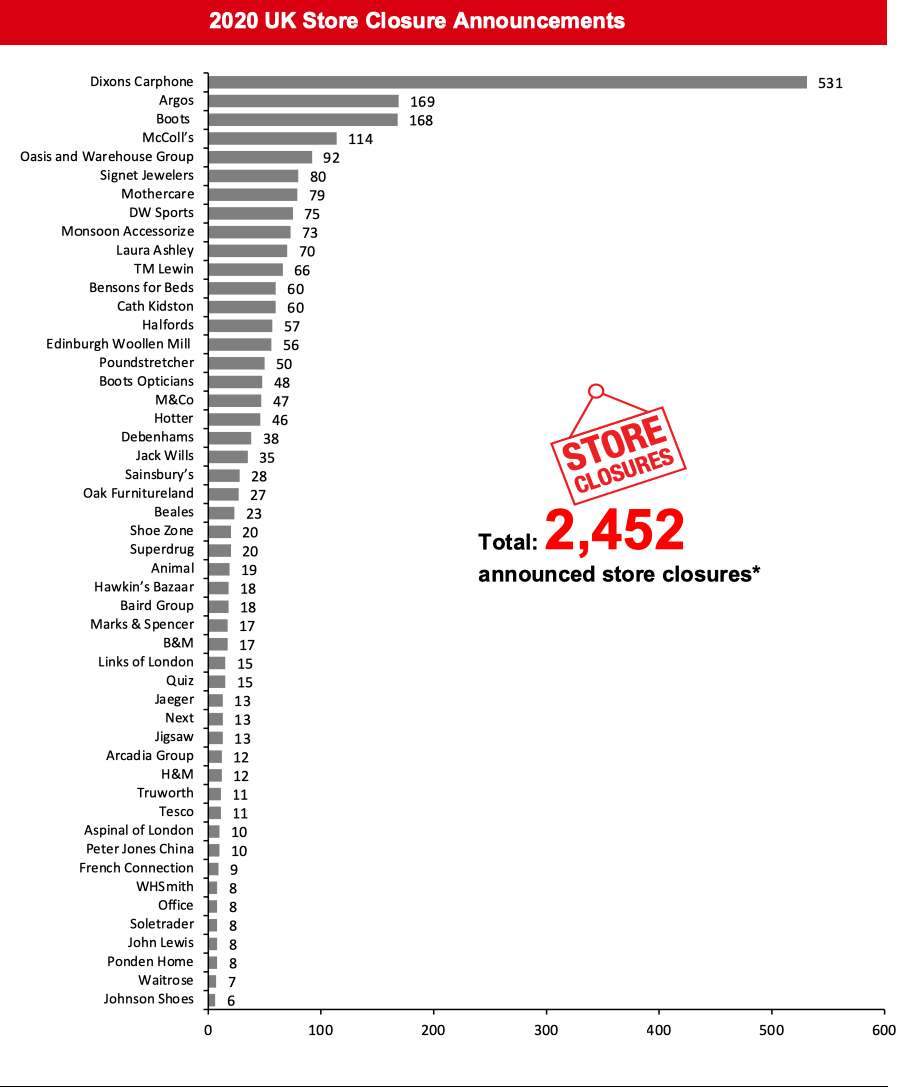

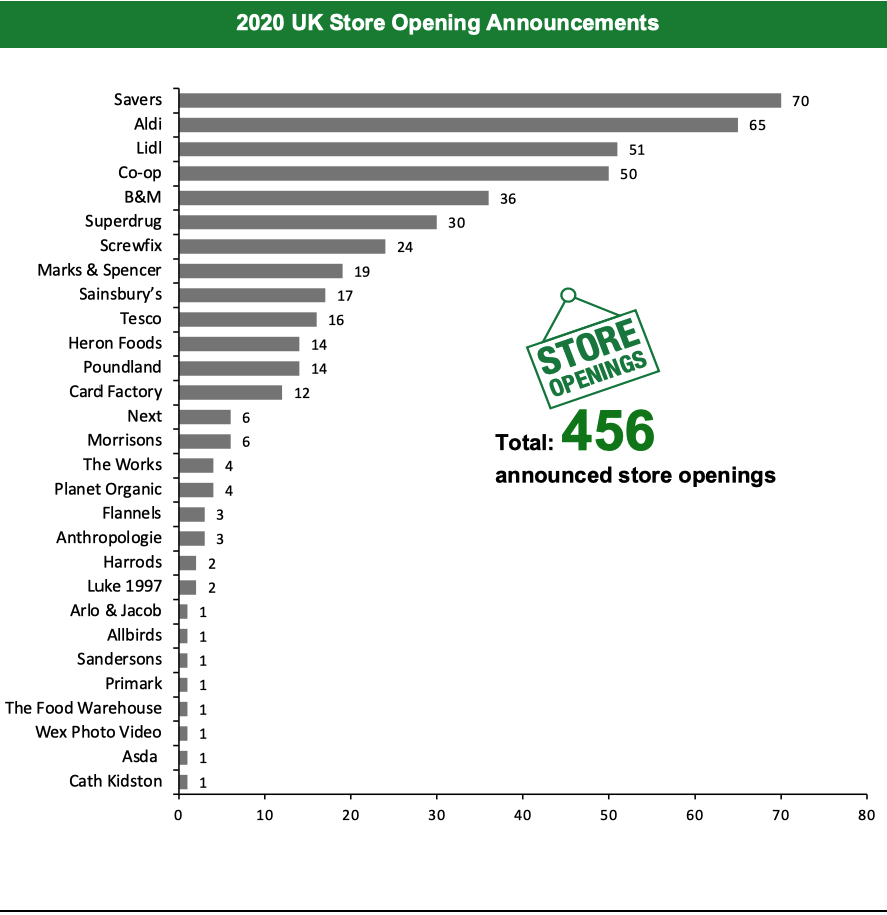

This week, an update from Morrisons changed our 2020 UK openings count and closure count to 456 and 2,452, respectively. [caption id="attachment_124402" align="aligncenter" width="720"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, Marks & Spencer, Sainsbury’s, Truworth and WHSmith. Arcadia Group refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores, among others.*Total includes a small number of retailers that each announced fewer than six store openings and so are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_124403" align="aligncenter" width="720"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, Marks & Spencer and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.