Nitheesh NH

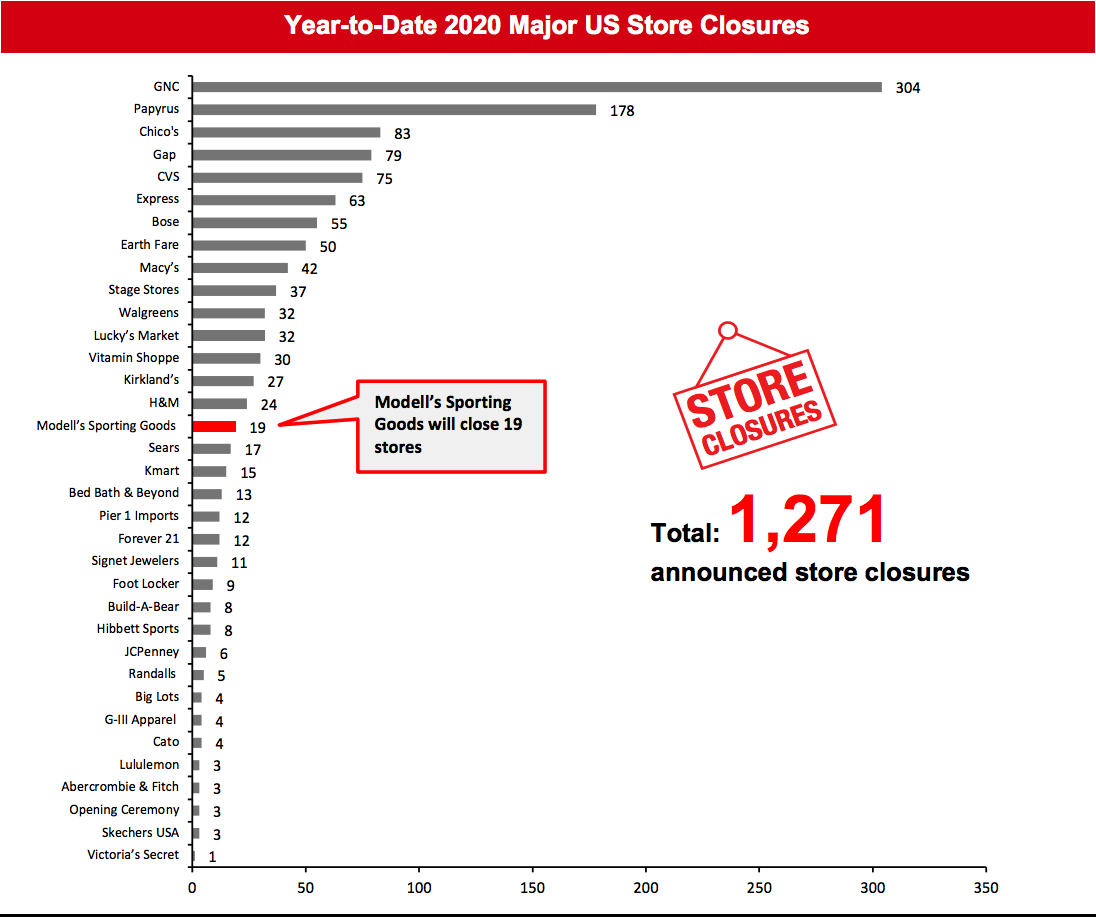

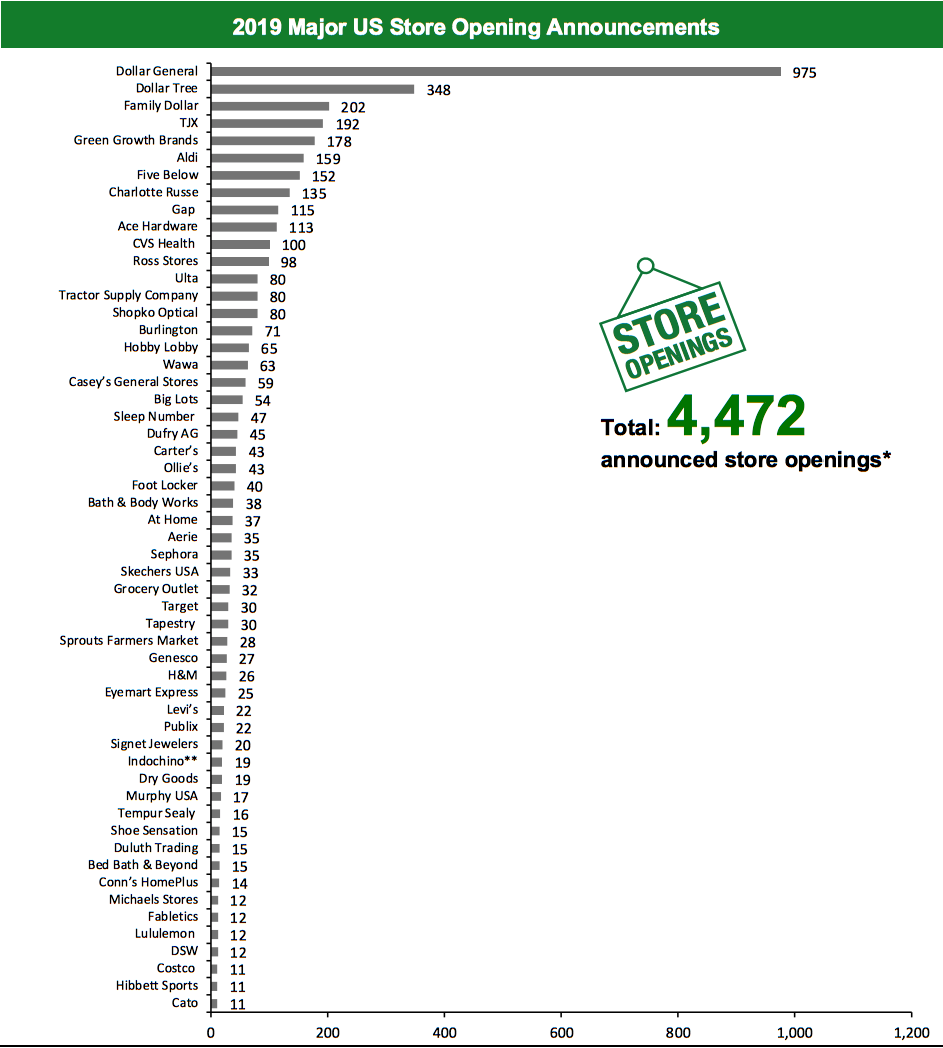

The US

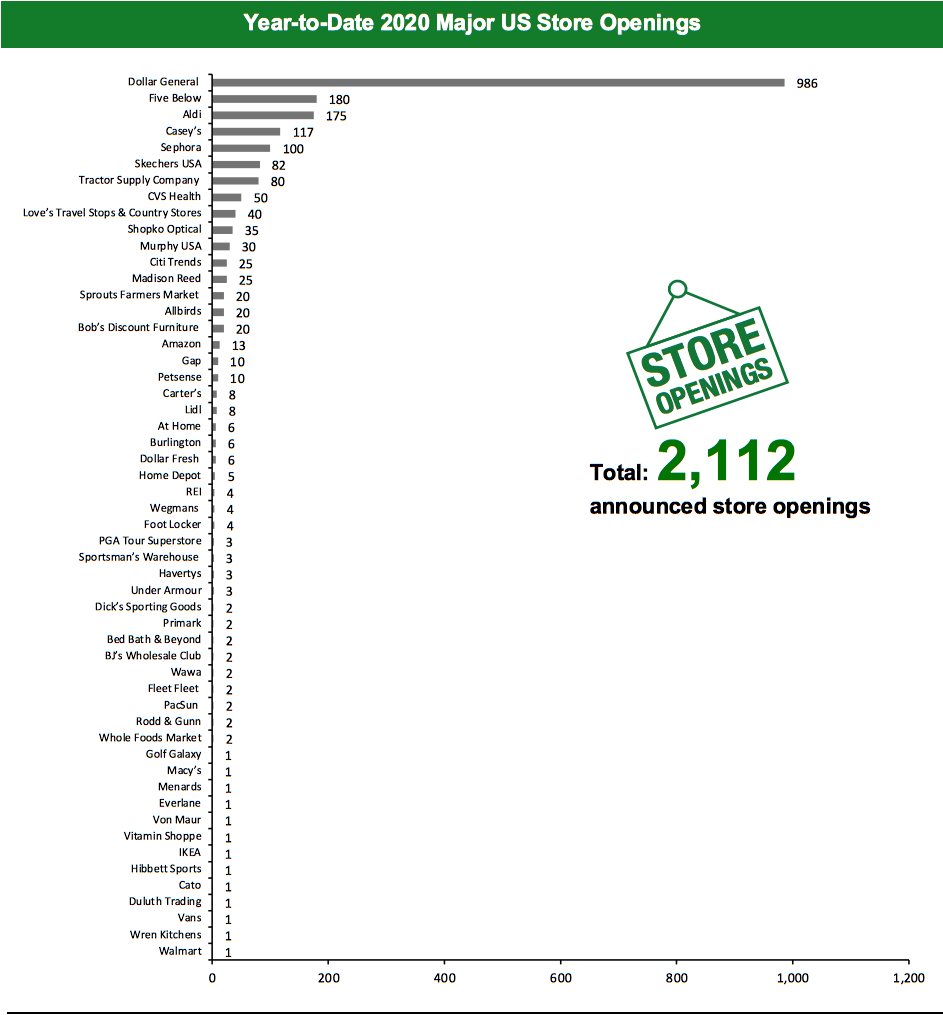

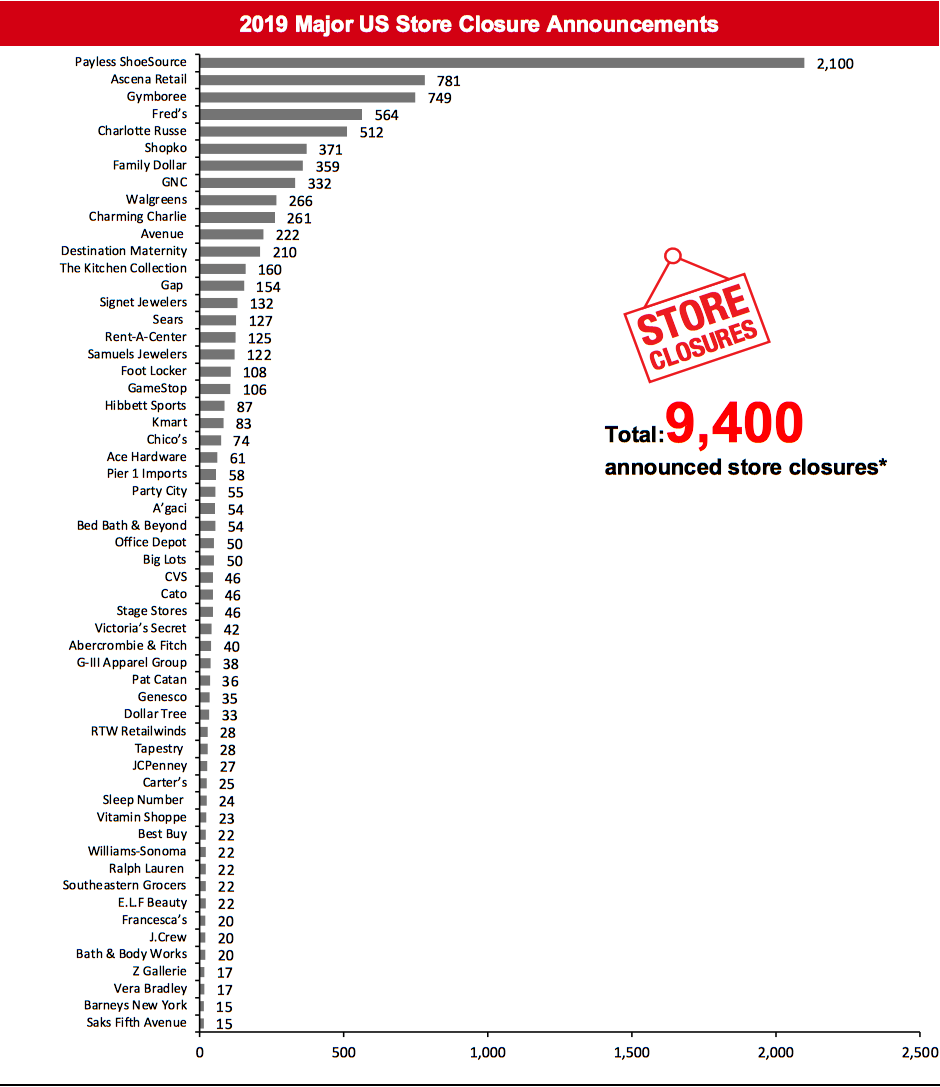

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,271 planned store closures and 2,112 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Sprouts Farmers Market, and this has changed our 2019 US closure count to 9,400. We revised our 2019 openings count for Carter’s, Murphy USA and Sprouts Farmers Market, and this has changed our 2019 US openings count to 4,472.What Is Happening This Week in the US

Amazon Opens Its First Amazon Go Grocery Store Amazon opened its first-ever Amazon Go Grocery store in the Capitol Hill neighborhood of Seattle on February 25, 2020. The store incorporates the same cashierless technology as Amazon Go stores, which first opened in January 2018. The new store offers around 5,000 items, including dairy, packaged seafood, meat, liquor and household goods. Coresight Research insight: Amazon has recognized that it cannot win major share in grocery with a pure-play online model, so has taken a major step into brick-and-mortar grocery that will alarm incumbent rivals. One inhibitor on the medium-term impact of Amazon Go Grocery is likely to be the cost of any rollout: The hardware for each small Amazon Go store costs a reported $1 million. While we do not know the hardware cost for the larger-format grocery version, the likely substantial setup costs would suggest that opportunities for Amazon Go Grocery lie mostly in areas that will generate high sales densities. Bob’s Discount Furniture Opens Four Stores Home-furnishings chain Bob’s Discount Furniture : two in Ohio and one each in Illinois and Kentucky. In addition, the retailer has relocated one of its stores to Norwalk, Connecticut. Bob’s Discount Furniture currently operates 126 stores across 20 states in the US, and it plans to open 20 stores this year, according to a company spokesperson. Coresight Research insight: Bob’s Discount Furniture is the 11th largest furniture chain in the US, and it continues to add outlets in both new and existing markets despite the challenging environment for brick-and-mortal retail. The company recently announced Cincinnati, Cleveland and Phoenix to be its latest metro markets, and revealed that it plans to grow its existing footprint in Southern California, the Midwest and New England. Modell’s Sporting Goods To Close 19 Stores Modell’s Sporting Goods has confirmed plans to close 19 stores instead of the 24 that were originally planned, after it was successful in negotiating with the landlords of five stores that were slated for closure. The retailer also intends to seek outside investment by selling a minority stake in its business, according to CEO Mitchell Modell. The initial plan to close 24 stores was announced last week and included outlets in New Jersey, New York and Pennsylvania, among others. PacSun Opens Store in Los Angeles Specialty apparel retailer PacSun has opened a 5,000-square-foot “landmark” store in Los Angeles. The landmark store features video screens which will search and display PacSun’s collections. It also features a dedicated “White Space” for brands and influencers to curate exhibits, workshops, performances, panels and pop-up shops. The retailer also plans to open a similar landmark store in SoHo, New York, in March 2020.Quarterly Store Openings/Closures Settlement

Carter’s Plans To Open Eight Cobranded Format Stores Children’s clothing retailer Carter’s has announced plans to open eight cobranded format stores in 2020. The retailer also reported that it opened 43 new stores—including 41 co-branded format stores—and closed 25 stores in fiscal year 2019, ended December 28. The retailer operates 862 stores in the US, as of the end of 2019. Home Depot Plans To Open Six Stores Home-improvement retailer Home Depot has announced plans to open six stores in fiscal year 2020, ending February 2021. As of February 2, , the company operates 2,291 stores in the US, Canada and Mexico. We have estimated our openings count based on the existing proportion of stores in the US. Murphy USA To Open Up To 30 Stores Convenience-store chain Murphy USA plans to open up to 30 new stores this year. The retailer has reported that it opened 10 new stores during its fourth quarter of fiscal year 2019, ended December 31. During the full year, Murphy USA opened 17 new stores, bringing its store count to 1,489 stores across 26 US states. Sprouts Farmers Market Plans To Open 20 Stores Supermarket chain Sprouts Farmers Market has announced plans to open 20 new stores in fiscal year 2020, ending December 29, 2020. Through February 20, 2020, it has so far opened one new store this fiscal year, bringing its total store count to 341. The chain opened 28 new stores and closed one underperforming store in fiscal year 2019, ended December 29, 2019.Non-Store-Closure News

Forever 21 Appoints New CEO Authentic Brands Group, Simon Property Group and Brookfield Property Partners, new owners of fast-fashion retailer Forever 21, have appointed Daniel Kulle as CEO, effective immediately. In his new role, Kulle will spearhead the brand’s content and social media strategies as well as sustainability initiatives. He most recently served as Strategic Advisor to former H&M Group CEO Karl-Johan Persson. Kulle, who has more than 20 years of experience in the fashion industry, also served as the President of H&M North America. Gap Partners with ThredUP Clothing and accessories retailer Gap Inc. has partnered with resale platform ThredUP to provide customers with the opportunity to exchange their used clothes for shopping credits. Customers can redeem the credits at Athleta, Banana Republic, Gap or Janie and Jack brands and receive an additional 15% payout bonus. Starting in April this year, ThredUP “Clean Out” bags or labels will be available at select Athleta, Banana Republic, Gap or Janie and Jack stores in the US. [caption id="attachment_104343" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_104344" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond, Foot Locker and Home Depot are based on the existing proportion of stores in the US. Gap, Sephora and Under Armour openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

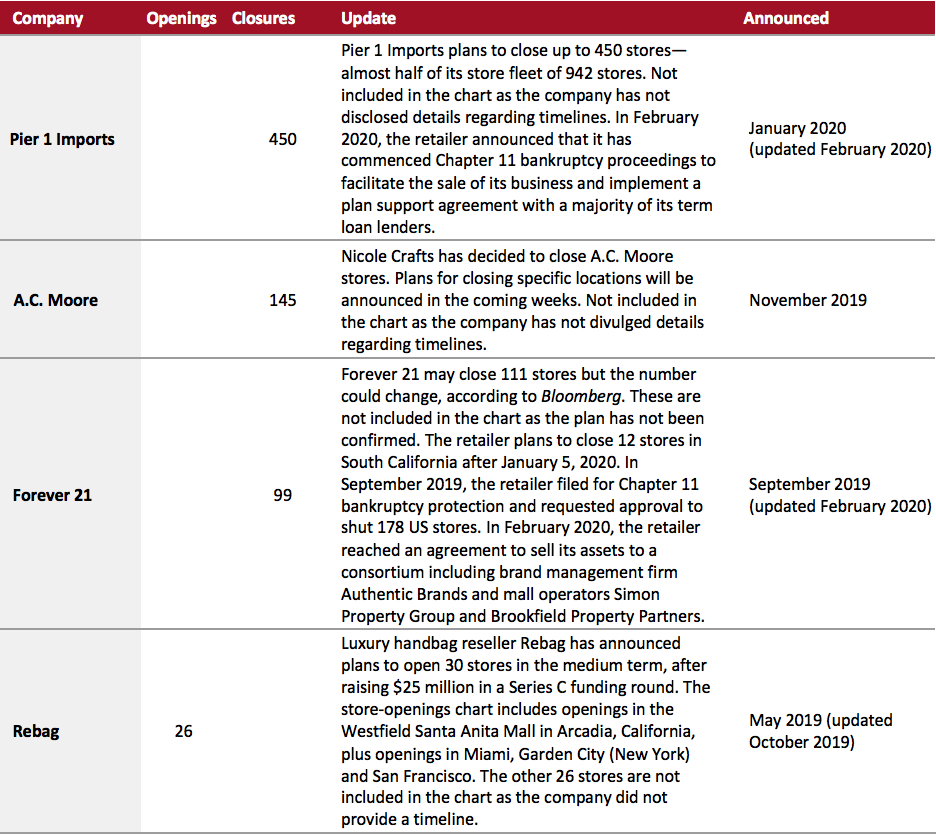

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond, Foot Locker and Home Depot are based on the existing proportion of stores in the US. Gap, Sephora and Under Armour openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_104345" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104346" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104346" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_104347" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

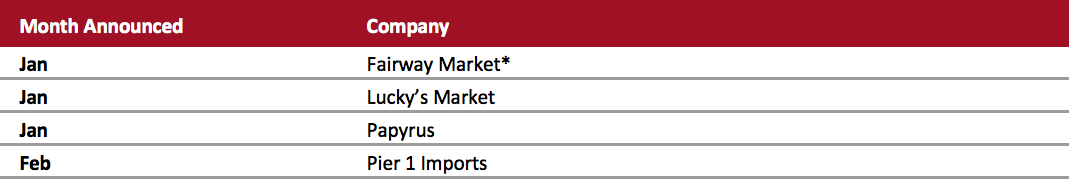

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_104348" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

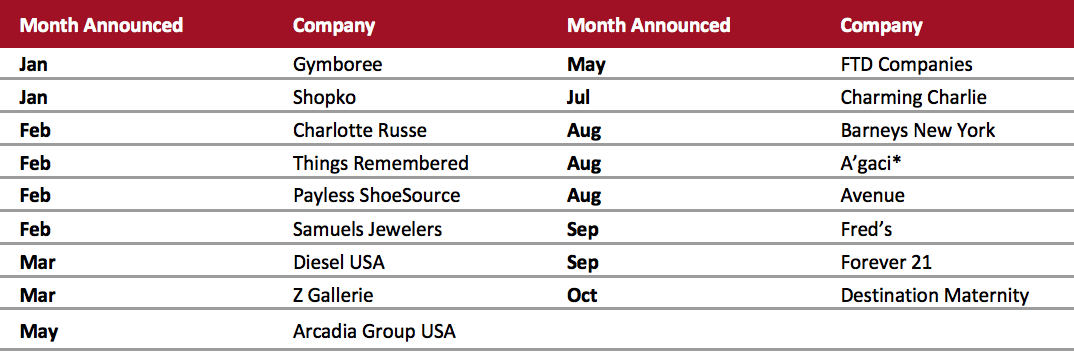

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_104349" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. Source: Company reports/Coresight Research[/caption]

The UK

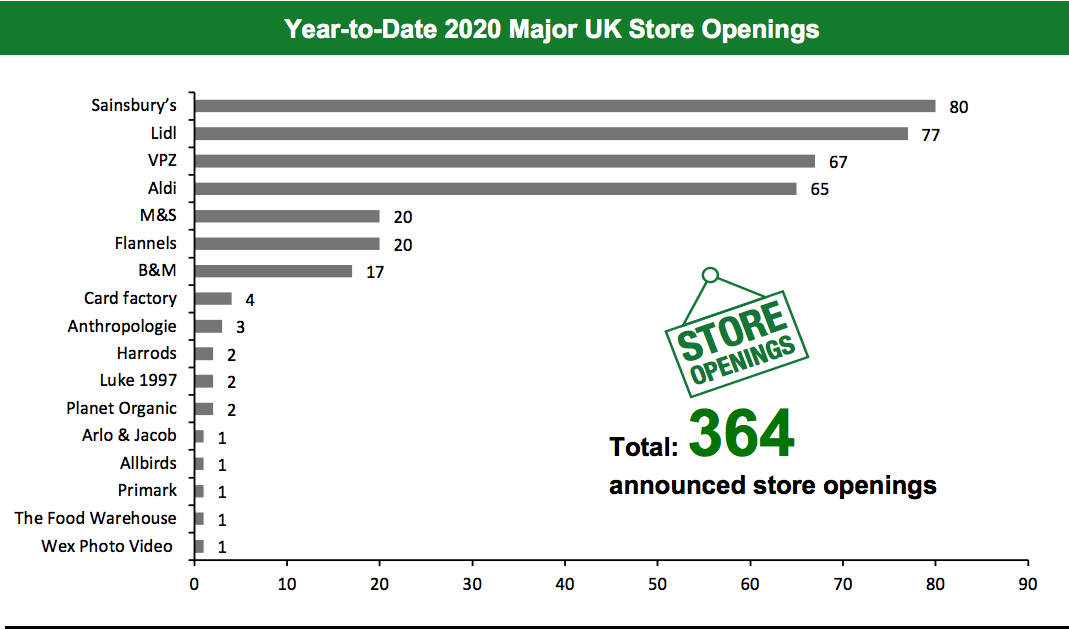

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 444 store closures and 364 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Boux Avenue Appoints Deloitte; Considers Store Closures Lingerie retailer Boux Avenue has appointed restructuring advisory specialists from Deloitte to conduct a review of its business. The decision from the review will be taken in the coming weeks. The retailer could close stores through an insolvency process, as it is struggling with increased rent bills. Boux Avenue operates 31 stores in the UK, according to its website. Lewis’s Home Retail To Appoint Administrators TJ Hughes owner Lewis’s Home Retail has filed a notice of intention to appoint administrators for its business. The potential administration process affects only a “small number” of its TJ Hughes and Paul Simon outlet stores, while TJ Hughes-branded department stores are expected to remain unaffected, according to Drapers. Two of the affected stores have been saved from administration following successful negotiation with landlords on February 24, 2020. The retailer is continuing to negotiate with its other landlords for rent reductions.Non-Store-Closure News

Peacocks Acquires Bonmarché Value clothing retailer Peacocks has reportedly acquired most of Bonmarché’s assets, including stock and around 200 stores. A decision regarding the remaining stores is yet to be taken and is subject to further negotiation with landlords. Bonmarché fell into administration in October last year, with almost 2,900 jobs facing uncertainty. [caption id="attachment_104350" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.Source: Company reports/Coresight Research[/caption] [caption id="attachment_104351" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

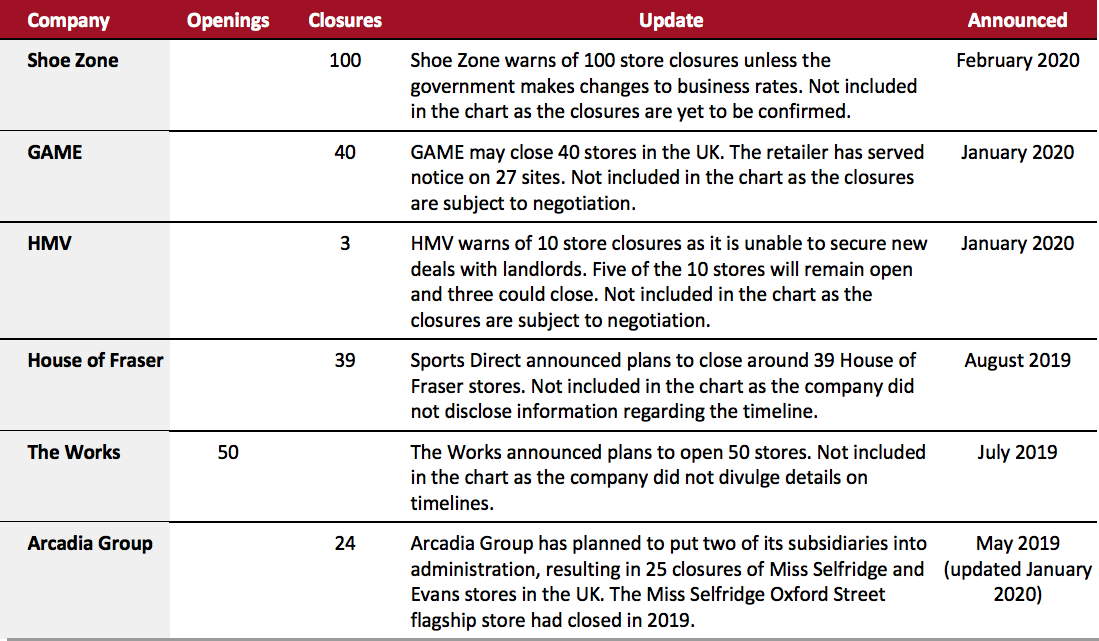

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_104354" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104355" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

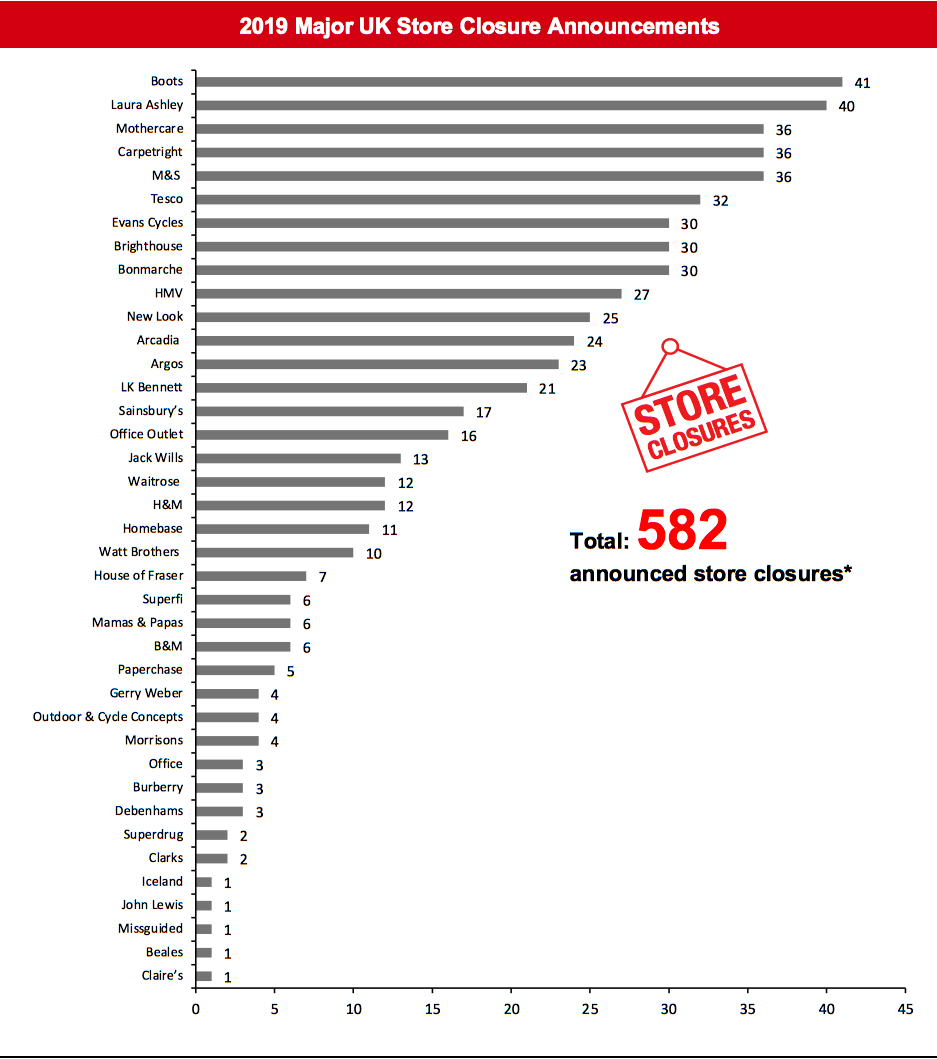

[caption id="attachment_104355" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_104356" align="aligncenter" width="700"]

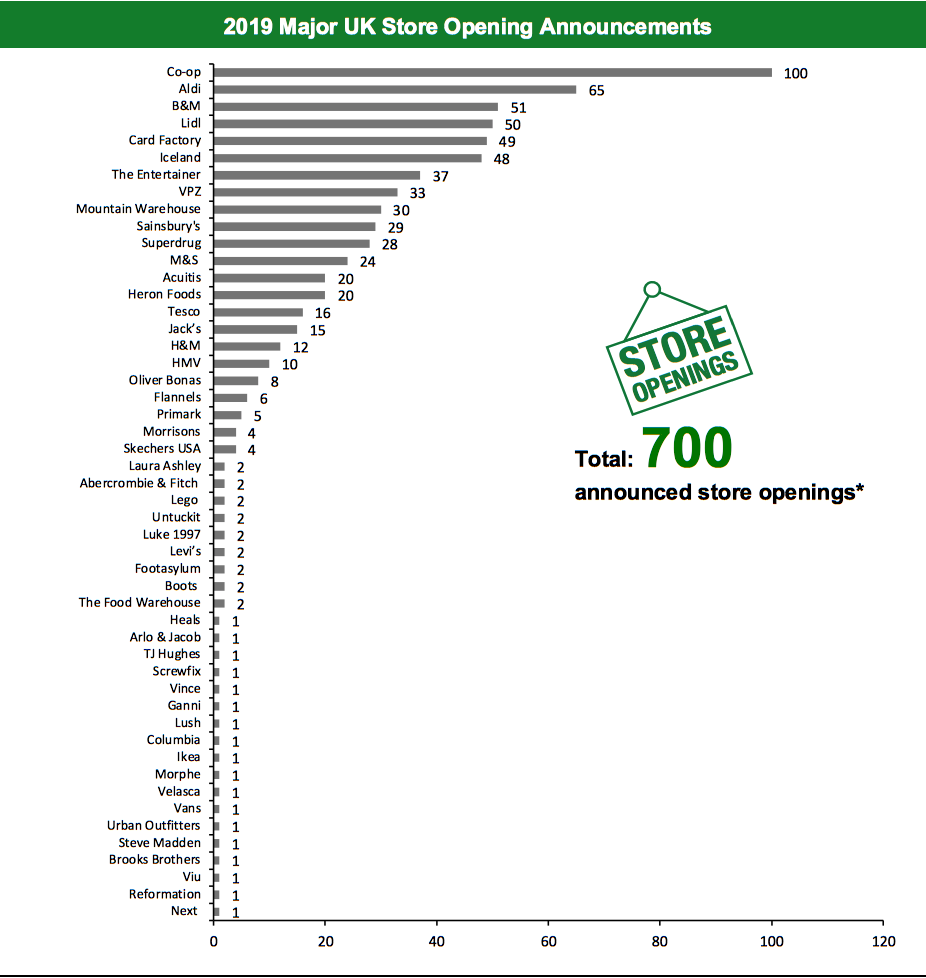

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.