Nitheesh NH

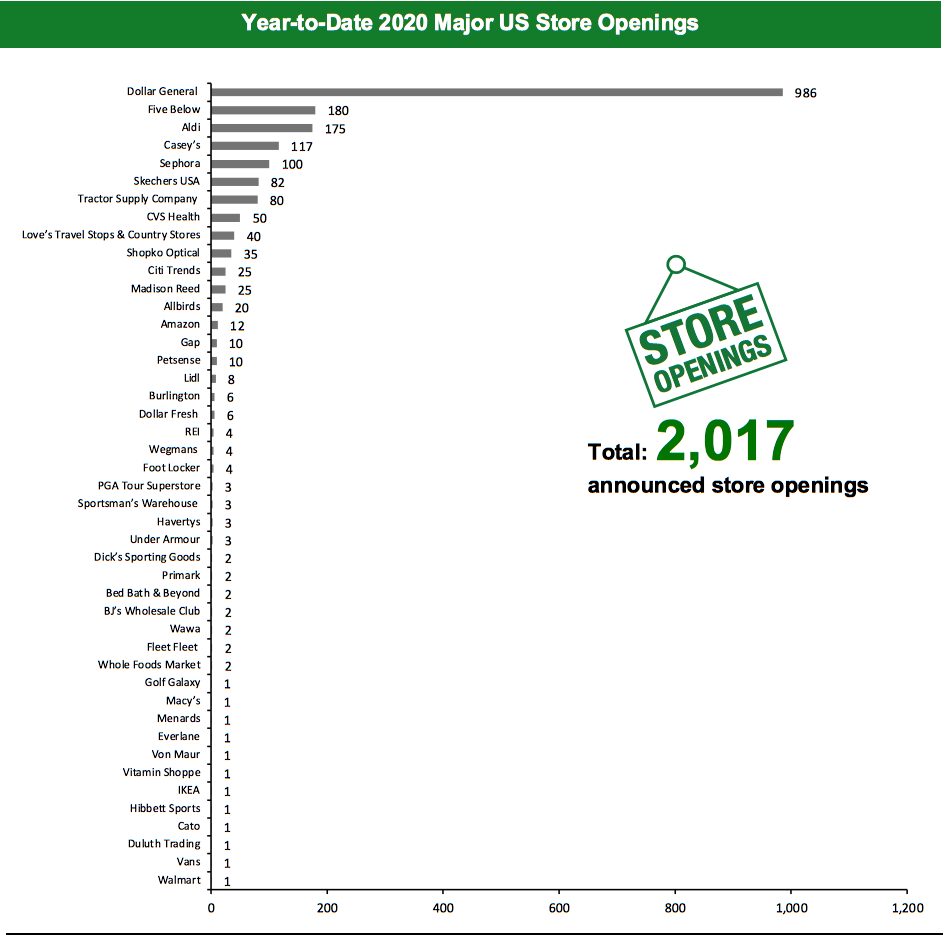

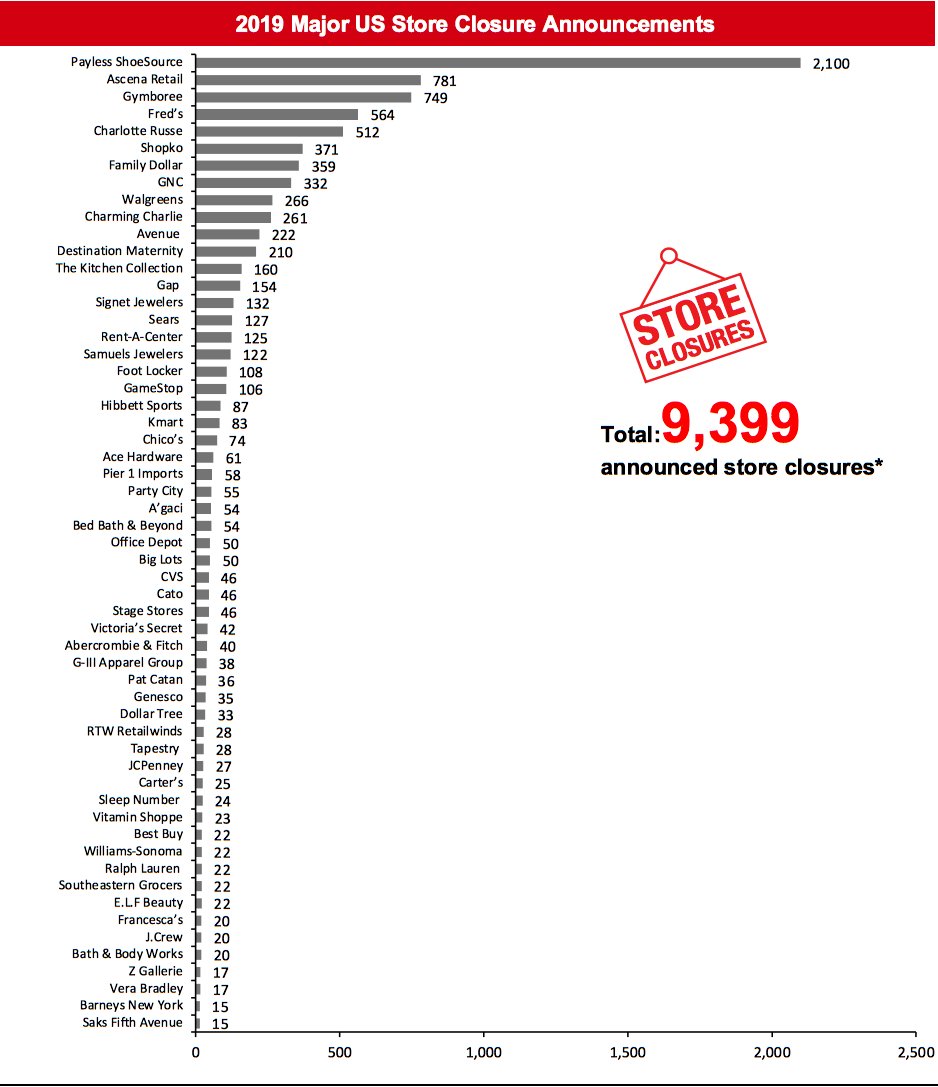

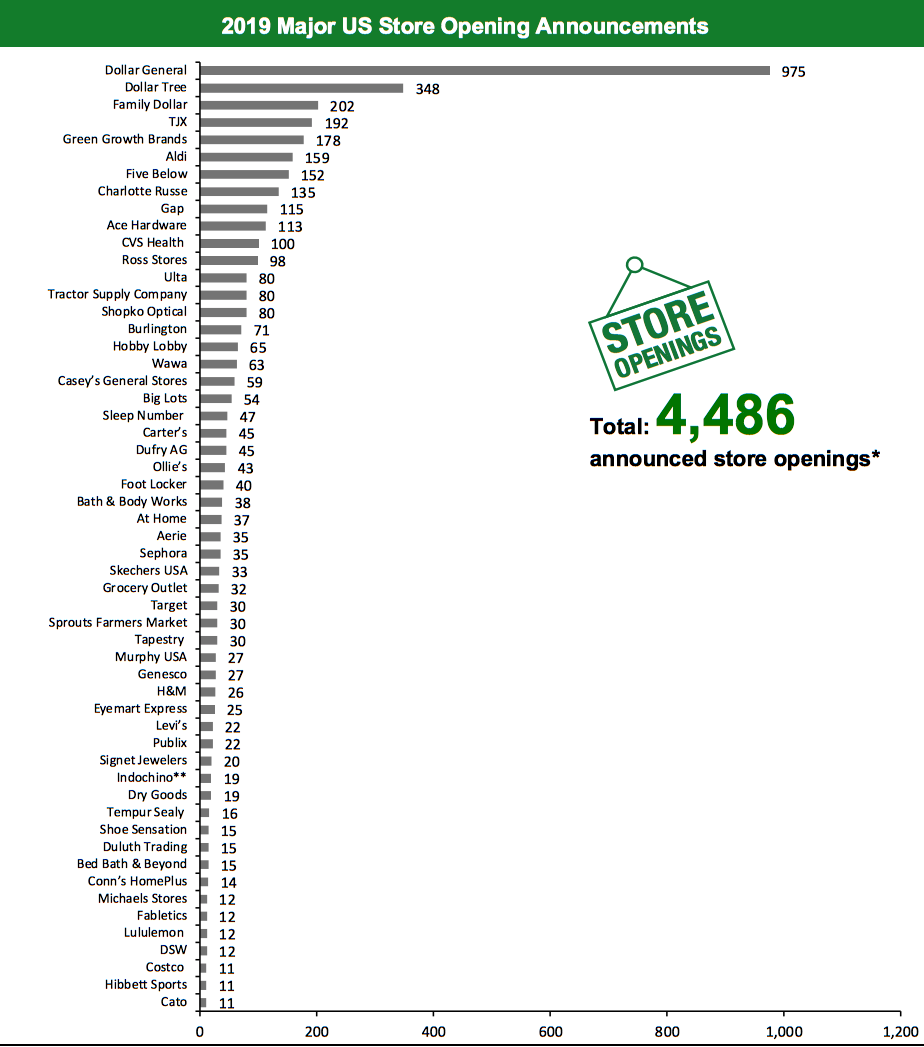

The US

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,252 planned store closures and 2,017 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our closure count for Skechers USA and Tapestry in the 2019 closure chart. We also revised our H&M, Petsense and Tractor Supply Company closure counts for 2019, following the latest updates from the companies. This changed our 2019 US store closure count to 9,399. We also revised our opening counts for H&M, Petsense, Skechers USA and Tapestry in the 2019 openings chart this week, and this changed our 2019 US openings count to 4,486.What Is Happening This Week in the US

Vans Opens New Concept Store Footwear and apparel retailer Vans has opened its first-ever community-driven retail outlet in Downtown Los Angeles. The 11,500-square-foot event and retail space features an in-store skate shop that offers Los Angeles-based skateboard brands such as Alva, Baker Girl and WKND, as well as the entire collection of Vans Pro Skate footwear and apparel. The store also houses a community-driven workshop space called Studio808 which offers free, hands-on art and design workshops. Coresight Research insight: A localized and socially relevant concept, the Vans DTLA store benefits from the brand’s Southern California roots and introduces Studio808—a gallery, lounge and workshop space which aims to give back to the local community and build an educational platform to uplift community members.Quarterly Store Openings/Closures Settlement

Skechers USA Plans To Open 75 to 85 Stores Performance and lifestyle footwear retailer Skechers USA has announced plans to open 75 to 85 new stores, mainly in its warehouse format, by the end of this year. To date in the first quarter of fiscal year 2020 ending March 31, the retailer opened seven company-owned stores and closed three in the US. Under Armour To Open Three Stores Sportswear retailer Under Armour has announced plans to open three full-price stores in North America this year, as it continues to focus on its smaller and more profitable Brand House commercial concept stores. The retailer has also announced that it may not open its flagship store in New York, as it intends to undertake a 2020 restructuring plan to improve profitability. Under Armour operates 169 Factory House and 19 Brand House stores in North America, as of December 31, 2019.Non-Store-Closure News

Brandless Shuts Down Operations Direct-to-consumer retailer Brandless, which sold no-name household products, has stopped taking orders and is shutting down its business operations. The company stated on its website that the competitive direct-to-customer market has proven to be an unsustainable business model. In July 2018, Japanese conglomerate SoftBank Vision Fund invested $240 million in Brandless. The online retailer, which was launched in July 2017, offered a wide range of merchandise, including organic food, personal care, home products and pet supplies. Coresight Research insight: Brandless suffered a series of high-profile executive exits, and the highly competitive market saw a number of new entrants with similar products. We see investors increasingly unwilling to invest in digitally native consumer brands that have little visibility into the road to profitability. Casey’s CFO To Retire Convenience store retailer Casey’s has announced that its Senior Vice President (SVP) and CFO Bill Walljasper will retire from service later this year. He will continue as CFO through the end of fiscal year 2020, ending April 30. Walljasper joined Casey’s in 1990 as a Risk Manager and was appointed as SVP and CFO in 2004. [caption id="attachment_103640" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_103641" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap, Sephora and Under Armour openings refer to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

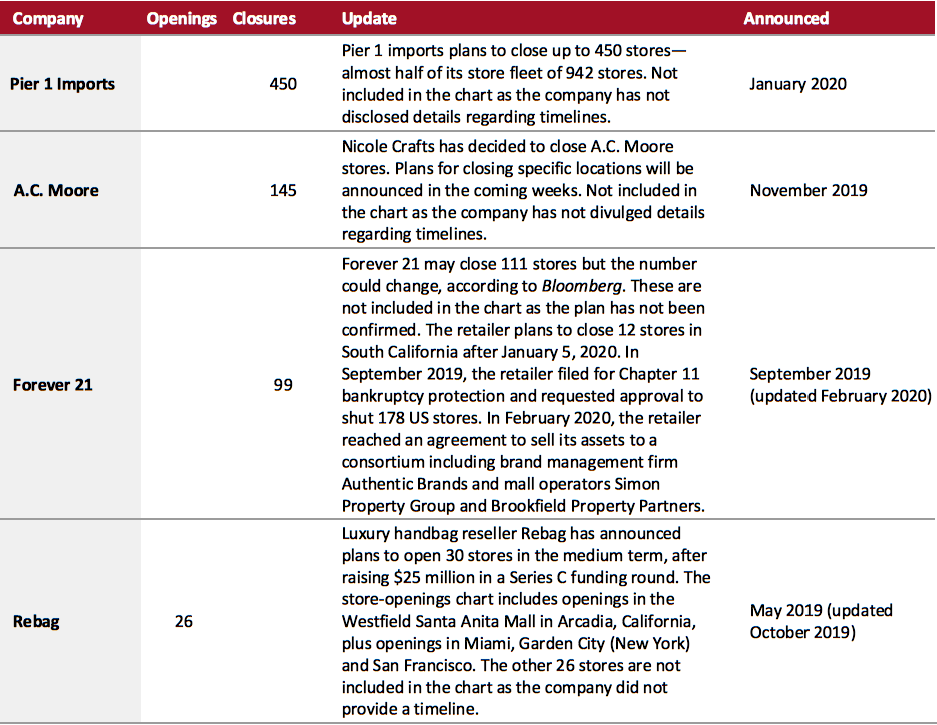

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap, Sephora and Under Armour openings refer to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_103642" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103643" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103643" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_103644" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

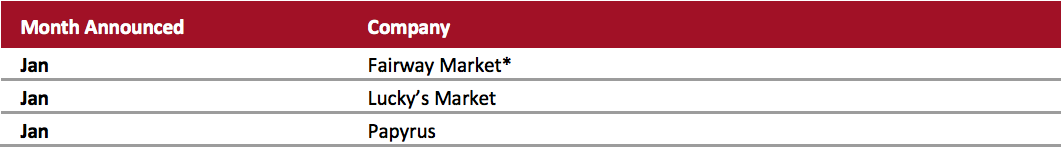

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_103645" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

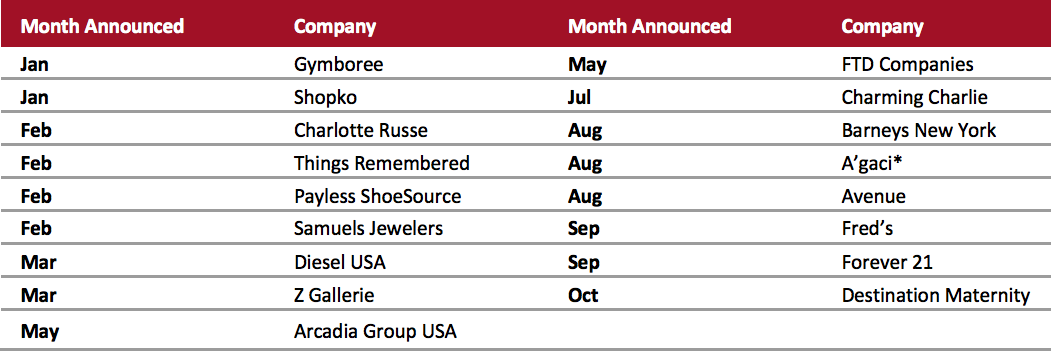

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_103646" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

The UK

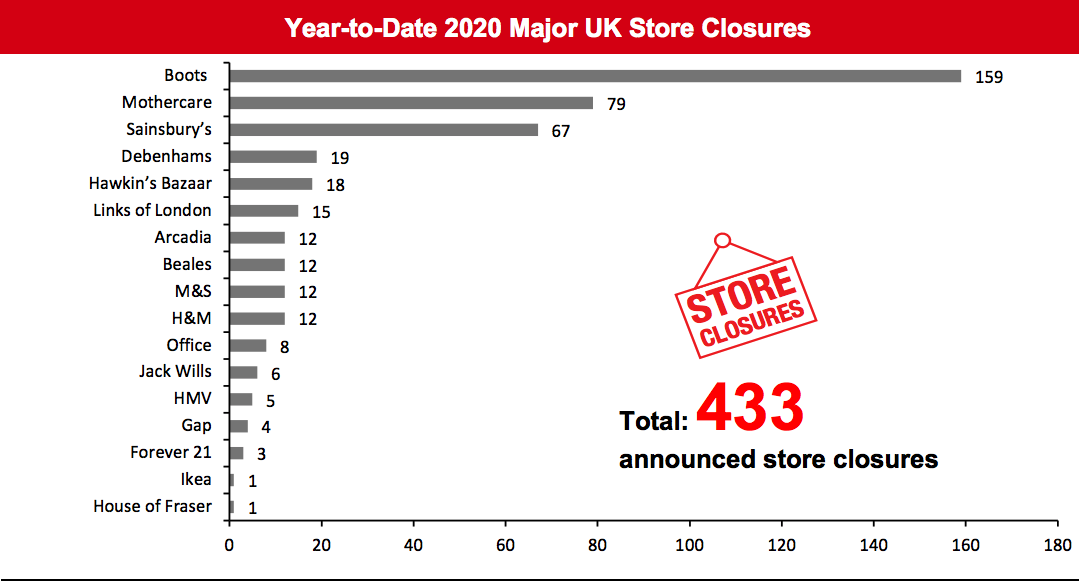

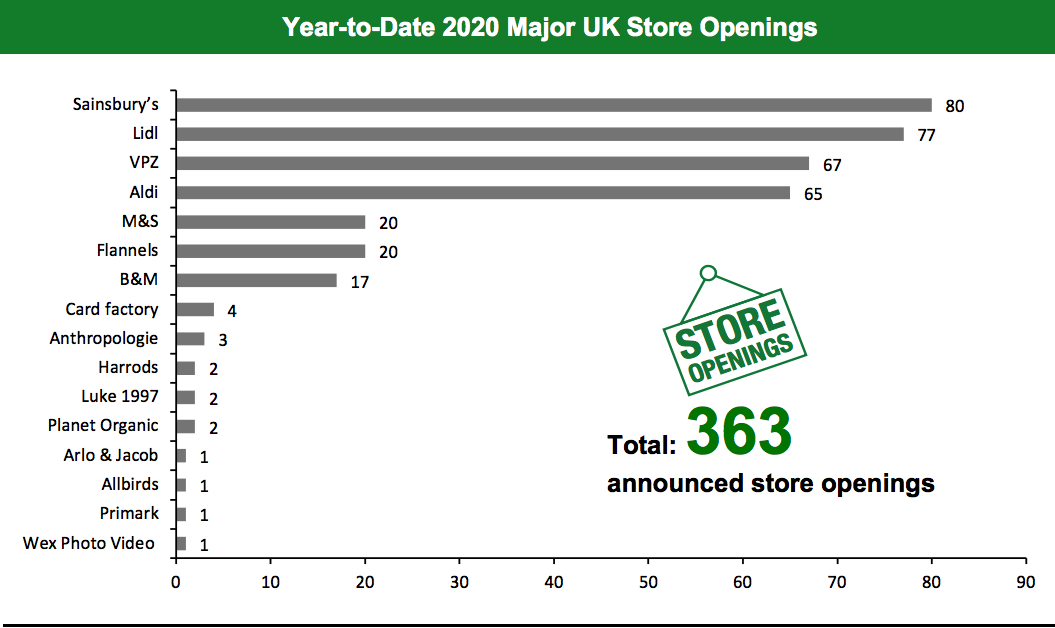

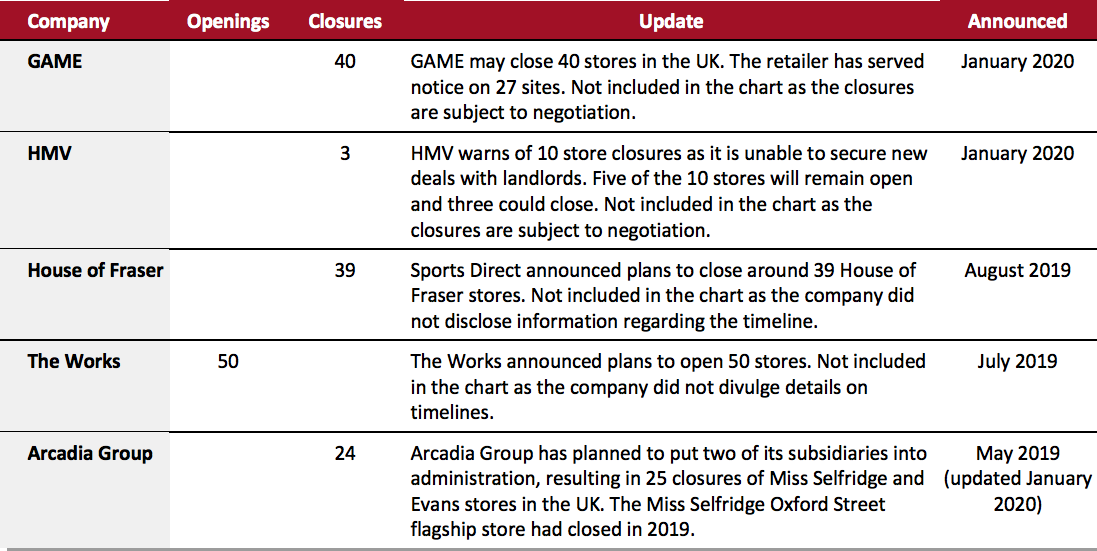

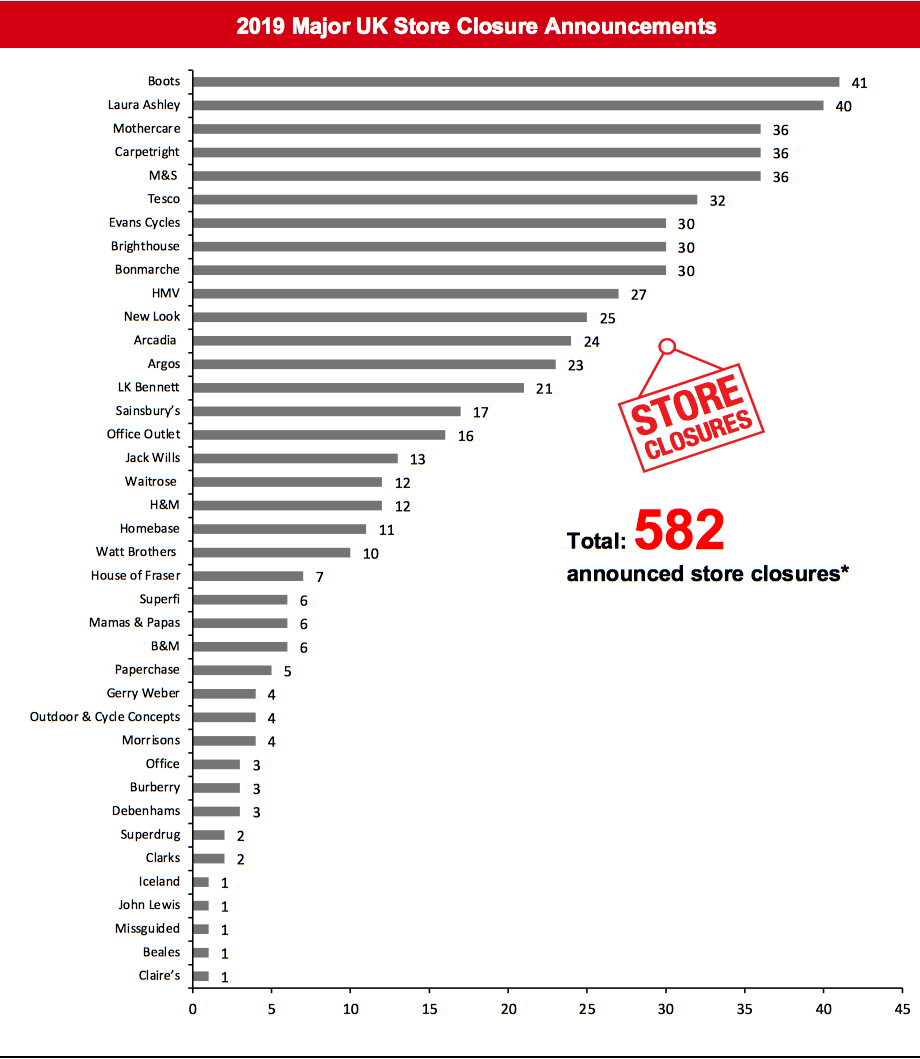

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 433 store closures and 363 store openings. Our data represents closures and openings by calendar year. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. We have revised our closure count for H&M in the 2019 closure chart this week, and this changed our 2019 UK store closure count to 582. We also revised our opening count for H&M and Skechers USA in the 2019 opening chart this week, and this changed our 2019 UK opening count to 700.What Is Happening This Week in the UK

Beales To Close 12 Stores Department store retailer Beales has announced plans to close 12 of its 23 stores in the UK. The stores will remain open for about eight weeks to clear remaining inventory. The stores slated for closure are located in Bedford, Bournemouth, Hexham, Keighley, Mansfield, Perth, Peterborough, Spalding, Tonbridge, Wisbech, Worthing and Yeovil. The remaining 11 stores will continue to operate until further notice regarding the sale of its business, according to administrators KPMG. Beales collapsed into administration last month, after it was unable to find a buyer for its business. John Lewis Partnership Warns of Store Closures John Lewis Partnership’s new chair Sharon White has sounded a warning regarding potential store closures and job losses but did not reveal the number of stores that are likely to close. White also stated that the partnership is encountering one of the most challenging periods since it was founded, and that its latest trading results were unsatisfactory and not generating enough profits. Last year, the retailer closed 12 Waitrose stores in the UK.Non-Store-Closure News

Marks & Spencer Appoints Eoin Tonge as CFO Marks & Spencer has appointed Eoin Tonge as its new CFO, effective June 2020. Tonge will succeed interim CFO David Surdeau, who will support Tonge during the transition to his new role. Tonge is currently the CFO of Irish food company Greencore Group PLC, a position he has held since 2016. [caption id="attachment_103647" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.Source: Company reports/Coresight Research[/caption] [caption id="attachment_103648" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

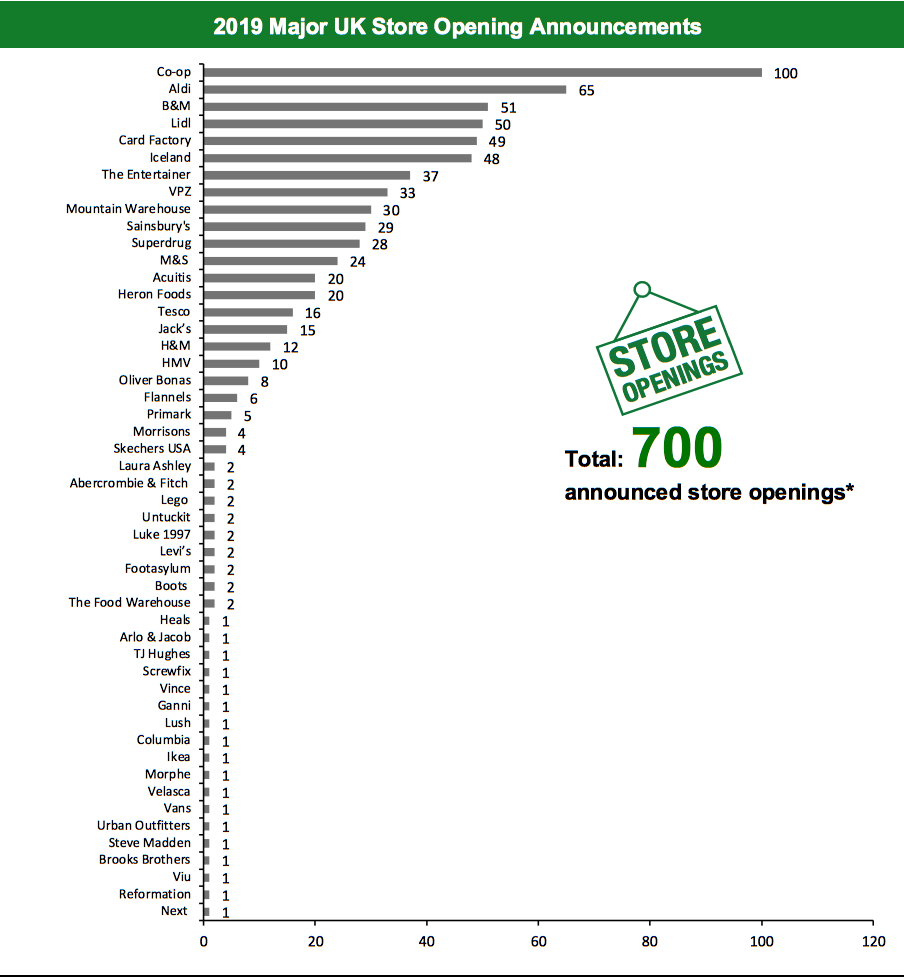

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_103649" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103650" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103650" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_103651" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.