DIpil Das

The US

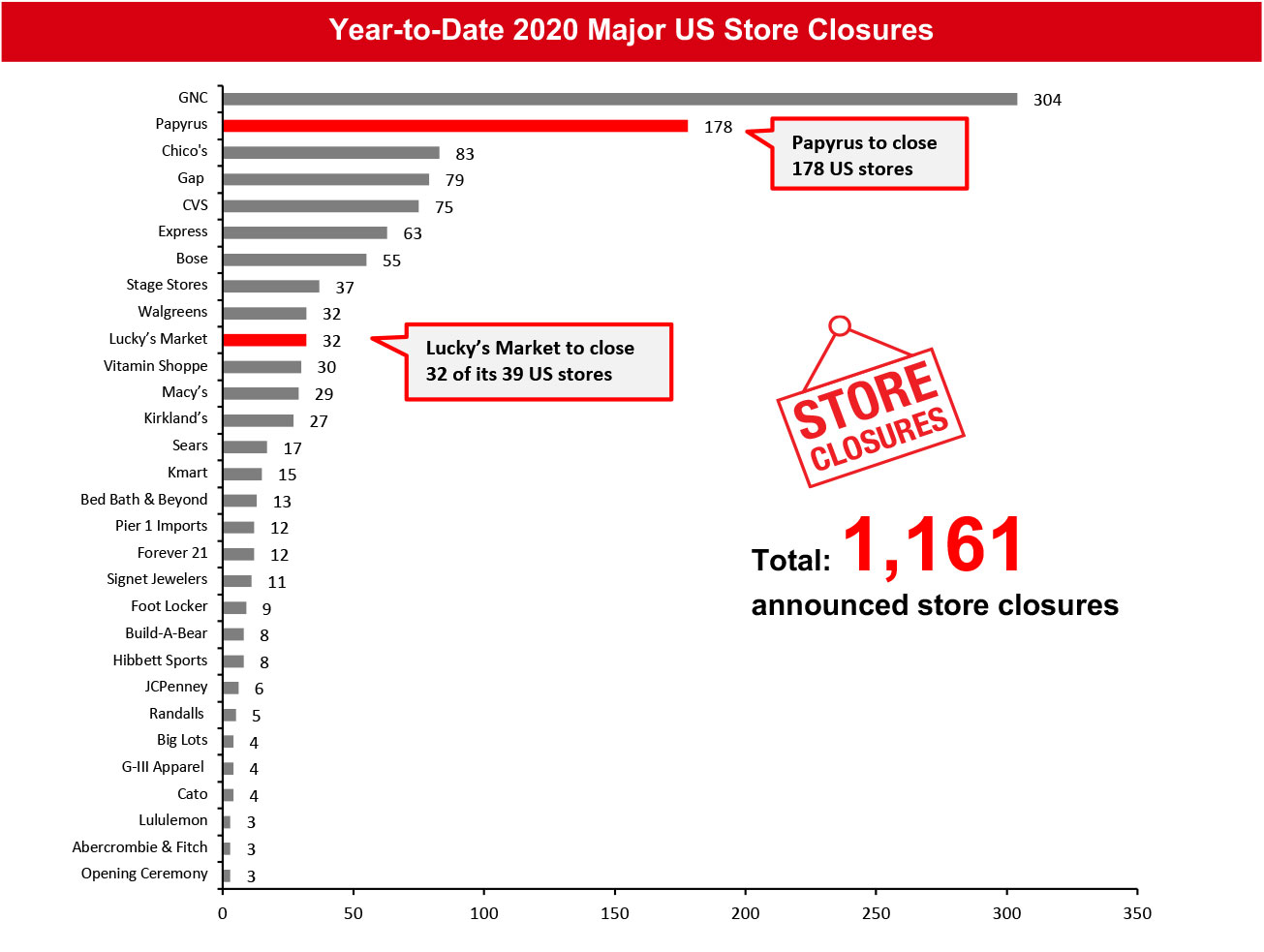

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,161 planned store closures and 1,720 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. We have revised our closure count for Papyrus in the 2020 closure chart this week, and this has changed our 2020 US closure count to 1,161.What Is Happening This Week in the US

Fairway Market Files for Bankruptcy, To Sell Five Supermarkets New York-based grocery chain Fairway Market filed for Chapter 11 bankruptcy protection on January 23, 2020. It has entered into an agreement to sell five Manhattan stores and a distribution center to Village Super Market for around $70 million. Fairway Market also plans to sell its remaining nine stores under a court-supervised process and stated that these stores would be operational during the sale process. The chain’s CEO Abel Porter said that the court-supervised sale process will help preserve jobs and position Fairway for long-term success under its new owners. Fairway Market had previously filed for Chapter 11 bankruptcy in 2016, three years after its IPO. Gap Inc. Closes 29 Stores Clothing and accessories retailer Gap Inc. has confirmed that it closed 40 stores globally on January 26, 2020: 29 in the US, seven in Canada and four in the UK. These closures are a part of the retailer’s previously announced plans to close 230 specialty stores over a period of two years. While the company rationalizes its Gap banner store footprint, it also plans to open Old Navy and Athleta banner stores. Lucky’s Market Files for Bankruptcy, To Close 32 Stores Lucky’s Market, a grocery chain that is majority-owned by Kroger, has filed for Chapter 11 bankruptcy protection with plans to close 32 of its 39 stores. The chain has begun shutting down stores and expects to complete the closure program within three weeks. The company intends to keep its remaining seven stores open and plans to sell them—these are located in Cleveland and Columbus in Ohio, Columbia in Missouri, Fort Collins and North Boulder in Colorado, Melbourne in Florida and Traverse City in Michigan. Lucky’s Market has signed agreements with Aldi and Publix Super Markets to sell 11 of its 32 closing stores, but the deals are subject to negotiation and court approval. Coresight Research insight: The US grocery market is in flux, with a nascent but rapid migration online fueled by the entry of Amazon and ventures by established grocery rivals. Another influence on the sector is the expansion of the discount segment, including dollar stores, Grocery Outlet and Aldi. Nondiscount, offline legacy players are therefore likely to find it a more challenging market. Papyrus’s Parent Company Files for Bankruptcy; Plans To Close 178 Stores Schurman Retail Group, parent company of stationery chain Papyrus, filed for Chapter 11 bankruptcy protection on January 23, 2020. It plans to close 254 retail stores including 178 stores across 27 states in the US and 76 stores in Canada, with around 1,100 employees likely to lose their jobs. According to a company spokesperson, most of the stores will close in the coming four to six weeks. Following confirmation from the court filings regarding closures specific to the US, we have revised the Papyrus store closure count in our US closures chart. Whole Foods Market Opens Two Stores Supermarket chain Whole Foods Market, a subsidiary of Amazon, has opened a new store in Richmond, Virginia. Aside from other merchandise, the 47,000-square-foot store, which opened on January 30, 2020, also offers a self-serve eatery and self-serve wine and beer. The chain also opened a 41,000-square-foot store in Delray Beach, Florida, on January 29, 2020.Non-Store-Closure News

Gap Inc. CMO Departs Gap Inc. has confirmed that its Chief Marketing Officer (CMO) Alegra O’Hare has resigned after less than one year with the retailer. According to a company spokesperson, Gap will redefine the role of CMO. O’Hare joined Gap from Adidas in February 2019, after a decade with the latter. She reported to CEO and President Neil Fiske, who recently departed from the company after the Old Navy spin-off plans were shelved. J.Crew Appoints New CEO Specialty apparel retailer J.Crew announced that it has appointed Jan Singer as its CEO, effective February 2, 2020. Singer will also join the retailer’s board and will be responsible for the J.Crew and J.Crew Factory brands. She will succeed Michael J. Nicholson, who served as Interim CEO after the departure of James Brett. Singer most recently held the role of CEO at lingerie brand Victoria’s Secret and had previously worked for lingerie brand Spanx and sportswear retailer Nike. Vitamin Shoppe Collaborates with LA Fitness Nutritional supplements retailer Vitamin Shoppe has partnered with gym chain LA Fitness to open Vitamin Shoppe shops inside LA Fitness health clubs. The shops, which each span around 300 square feet, offer a selective mix of sports nutrition products, vitamins, minerals, supplements and on-the-go healthy snacks and beverages. Vitamin Shoppe has opened shops in nine LA Fitness health clubs—three on the East Coast and six in Florida. [caption id="attachment_103031" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Source: Company reports/Coresight Research [/caption] [caption id="attachment_103032" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

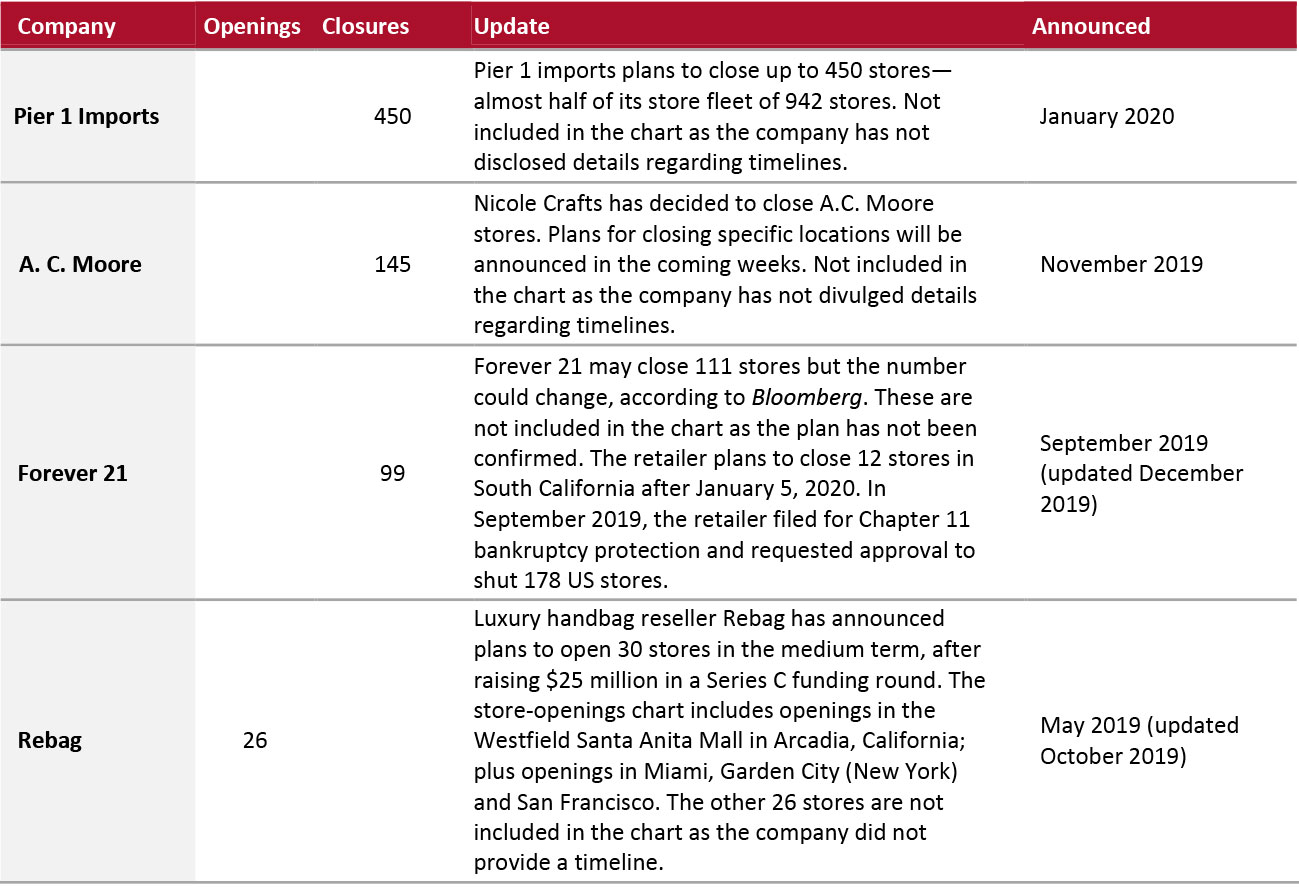

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. Source: Company reports/Coresight Research [/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_103033" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103034" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

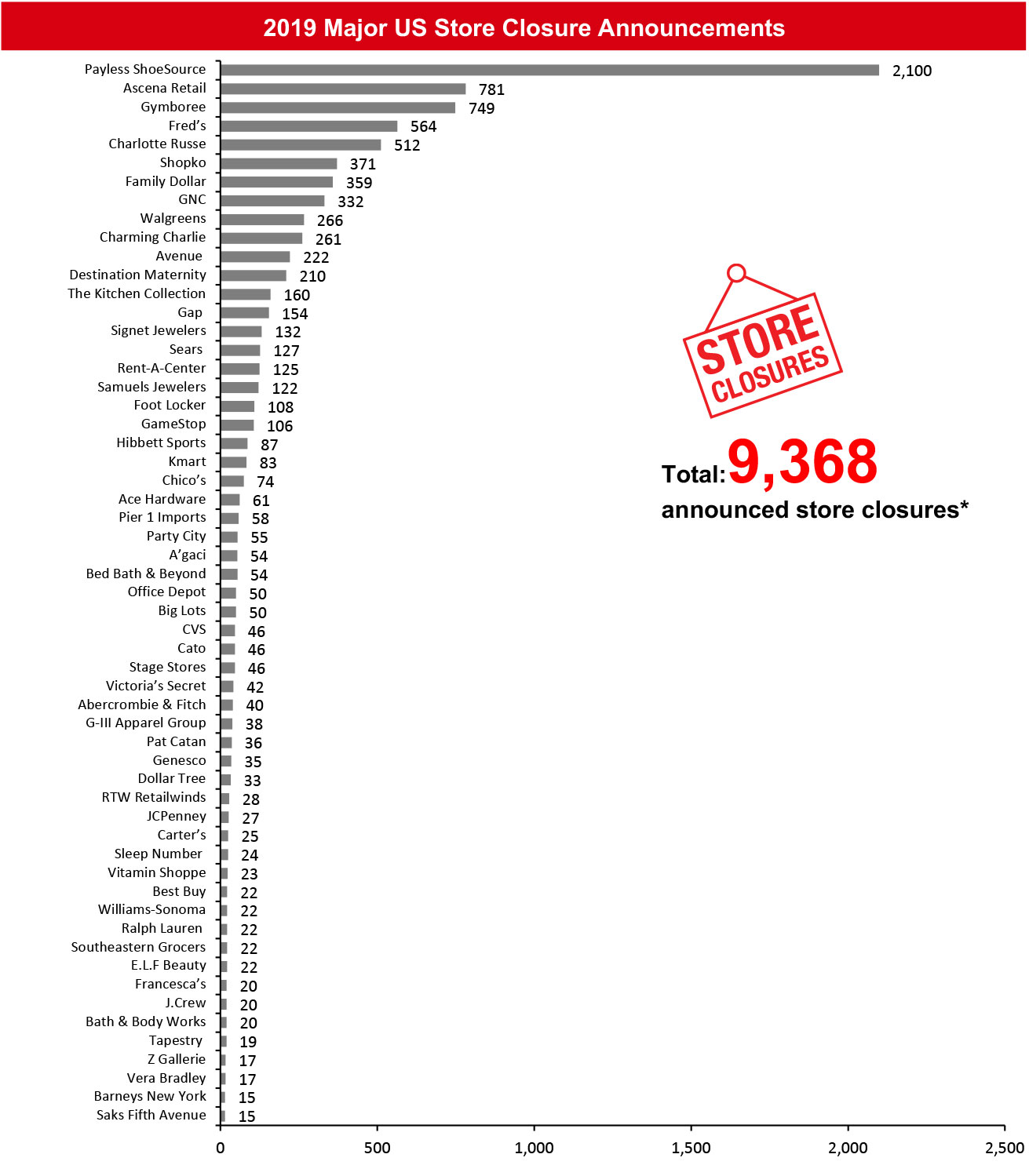

[caption id="attachment_103034" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.Source: Company reports/Coresight Research [/caption] [caption id="attachment_103035" align="aligncenter" width="700"]

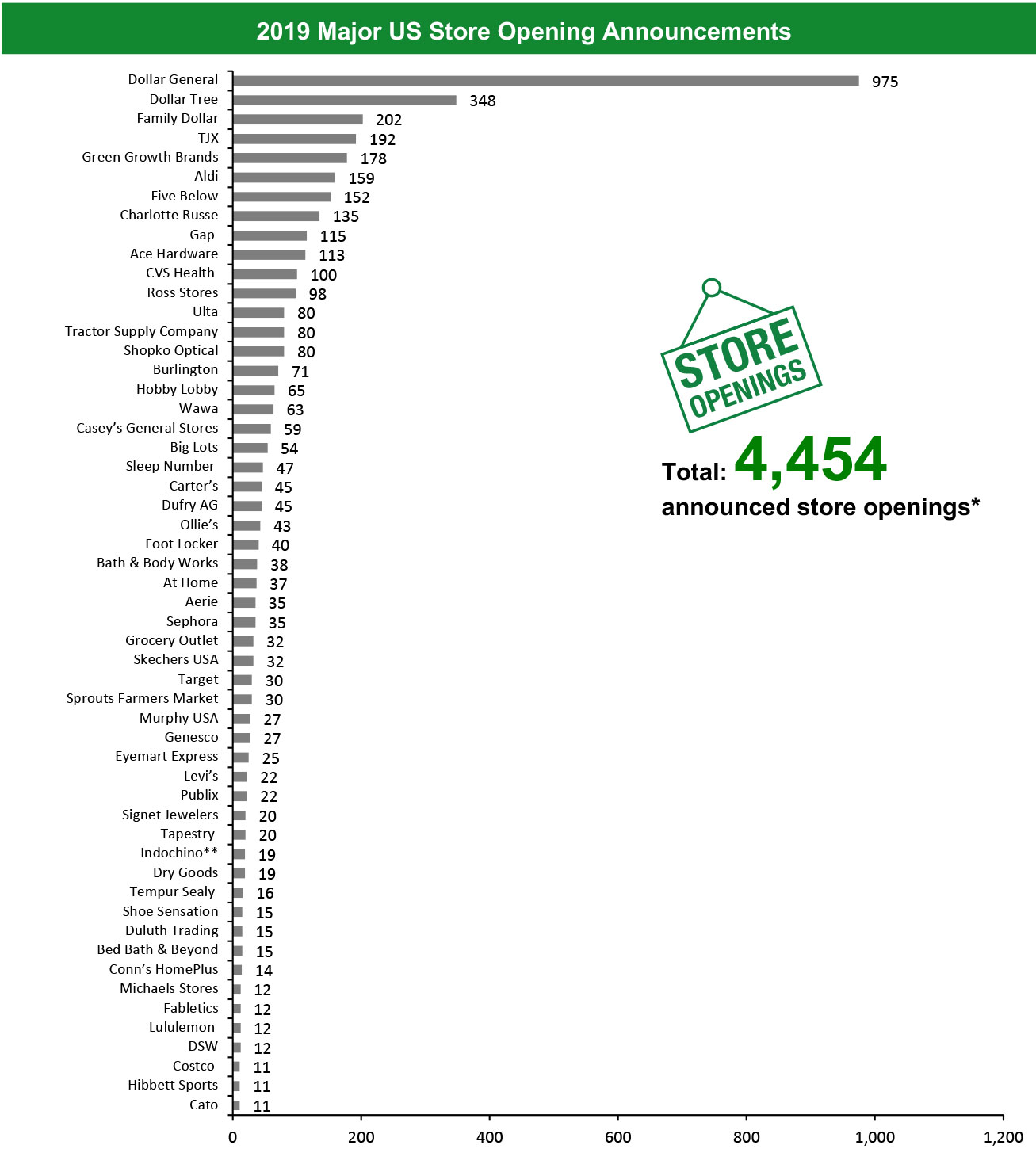

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart. **Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart. **Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area. Source: Company reports/Coresight Research [/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_103036" align="aligncenter" width="700"]

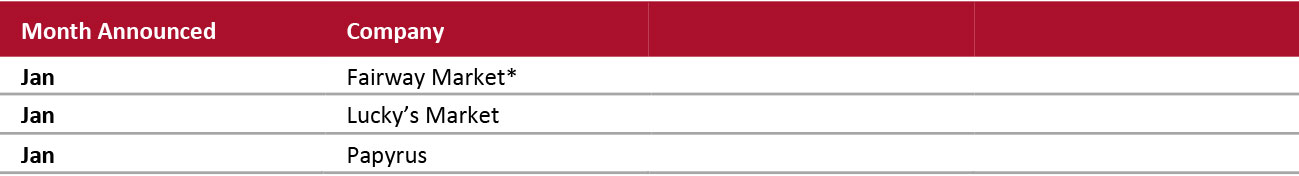

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_103037" align="aligncenter" width="700"]

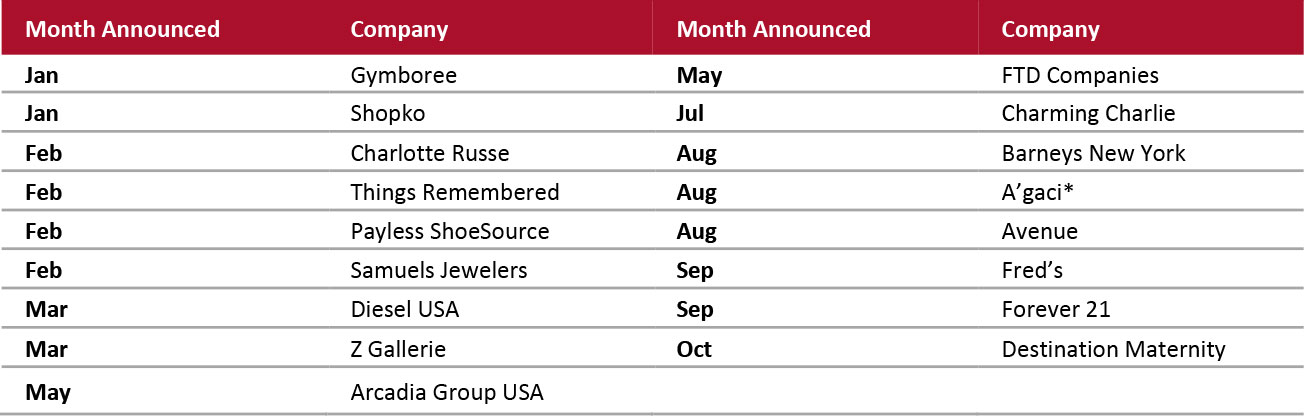

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. Source: Company reports/Coresight Research [/caption]

The UK

2020 Major UK Store Closures and Openings

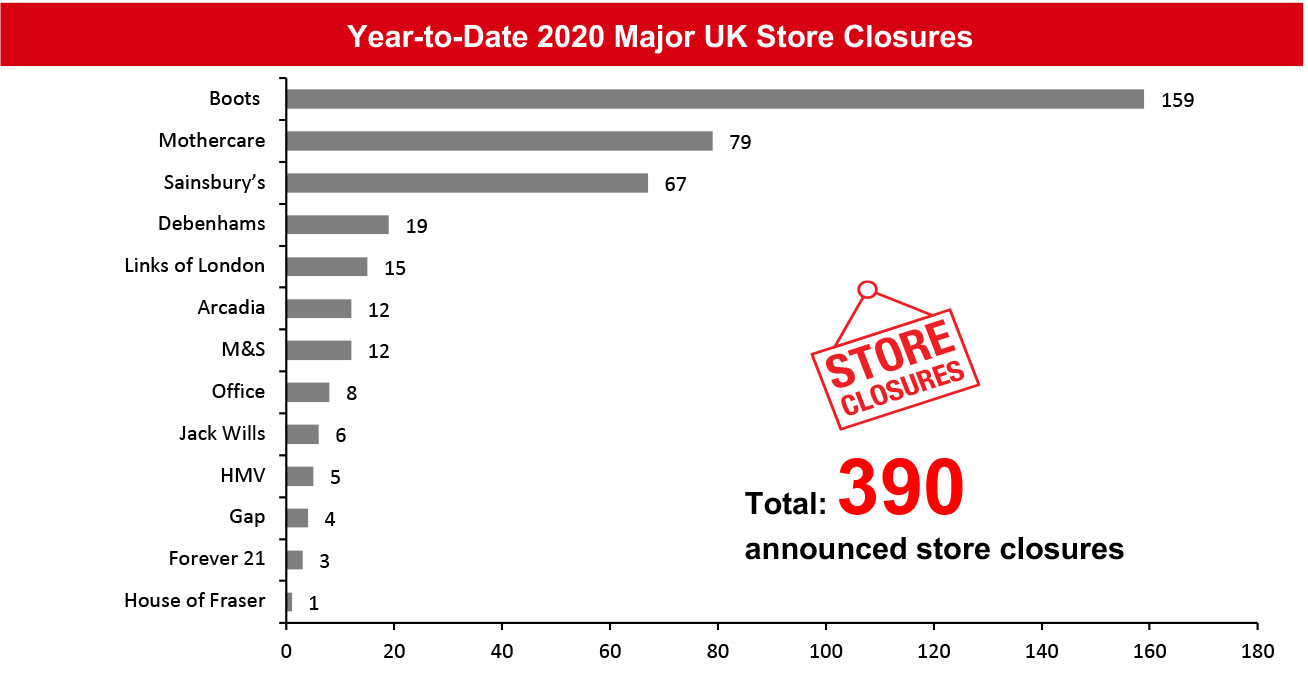

For 2020, major retailers in the UK have announced 390 store closures and 362 store openings. Our data represents closures and openings by calendar year.

What Is Happening This Week in the UK

Hawkin’s Bazaar Collapses into Administration

Gift and toy retail chain Hawkin’s Bazaar has entered into administration, with 20 stores and 177 employees facing uncertainty. The retailer appointed Moorfields Advisory partners Tom Straw and Simon Thomas as joint administrators on January 23, 2020. Although website sales have been suspended, the chain’s 20 stores will continue trading until further notice, according to the administrators.

Planet Organic Plans To Double Store Count

Supermarket chain Planet Organic has announced plans to double its store count over the next four years. The company intends to open at least 10 stores in the next five years, taking its store count to 18 stores in the UK. The retailer currently operates eight stores across the UK.

Wex Photo Video To Open in Milton Keynes

Photography and videography equipment and accessories specialist Wex Photo Video has announced plans to open a store at Silbury Boulevard in Milton Keynes during the first quarter of 2020. The 3,000-square-foot outlet will be the retailer’s ninth store. It also recently relocated its Hagley Road, Birmingham store to a bigger premise in the same locality.

Non-Store-Closure News

Mothercare CEO Departs

Mothercare has announced that its CEO Mark Newton-Jones has resigned, as part of the retailer’s transformation plan. Newton-Jones will remain as an Executive Director until July 2020. Mothercare’s CFO Glyn Hughes has been appointed as CEO on an interim basis, effective immediately.

Sainsbury’s CEO Resigns

Supermarket chain Sainsbury’s has announced that its CEO Mike Coupe will step down from his role in May 2020, after six years in the role and more than 15 years with the company. The retailer’s current Retail and Operations Director Simon Roberts will succeed Coupe, effective June 1, 2020.

[caption id="attachment_103038" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. Source: Company reports/Coresight Research [/caption] [caption id="attachment_103039" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

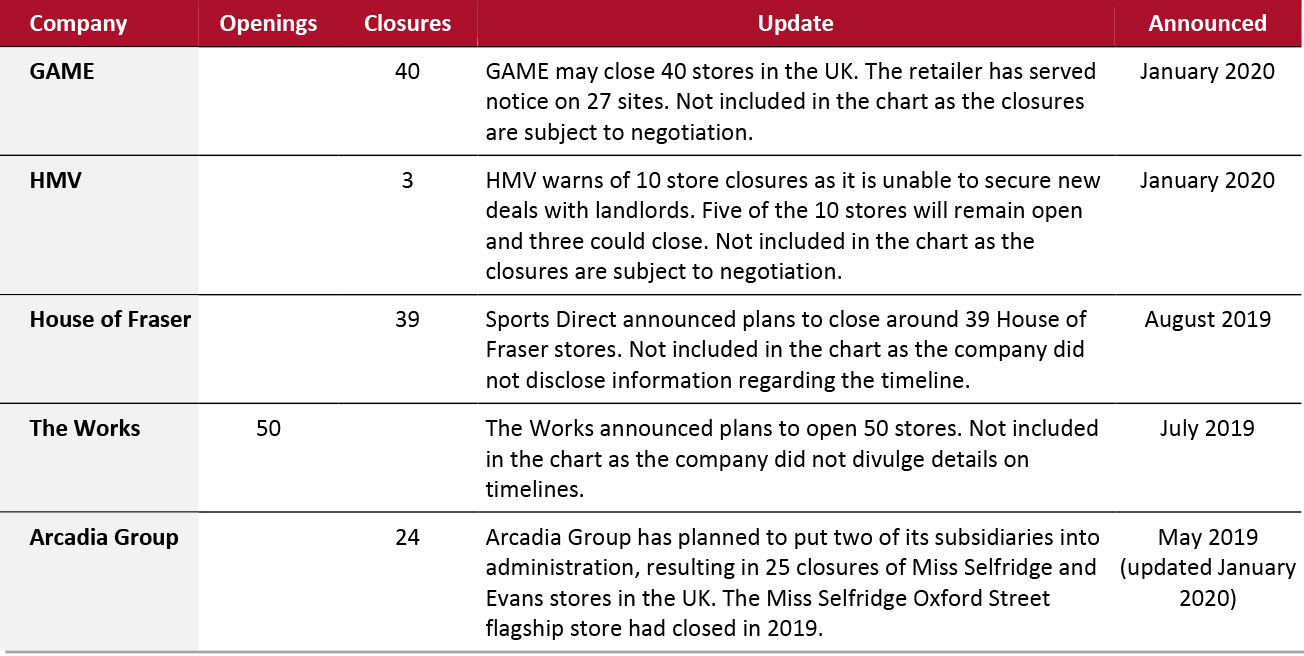

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK. Source: Company reports/Coresight Research [/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_103040" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_103041" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

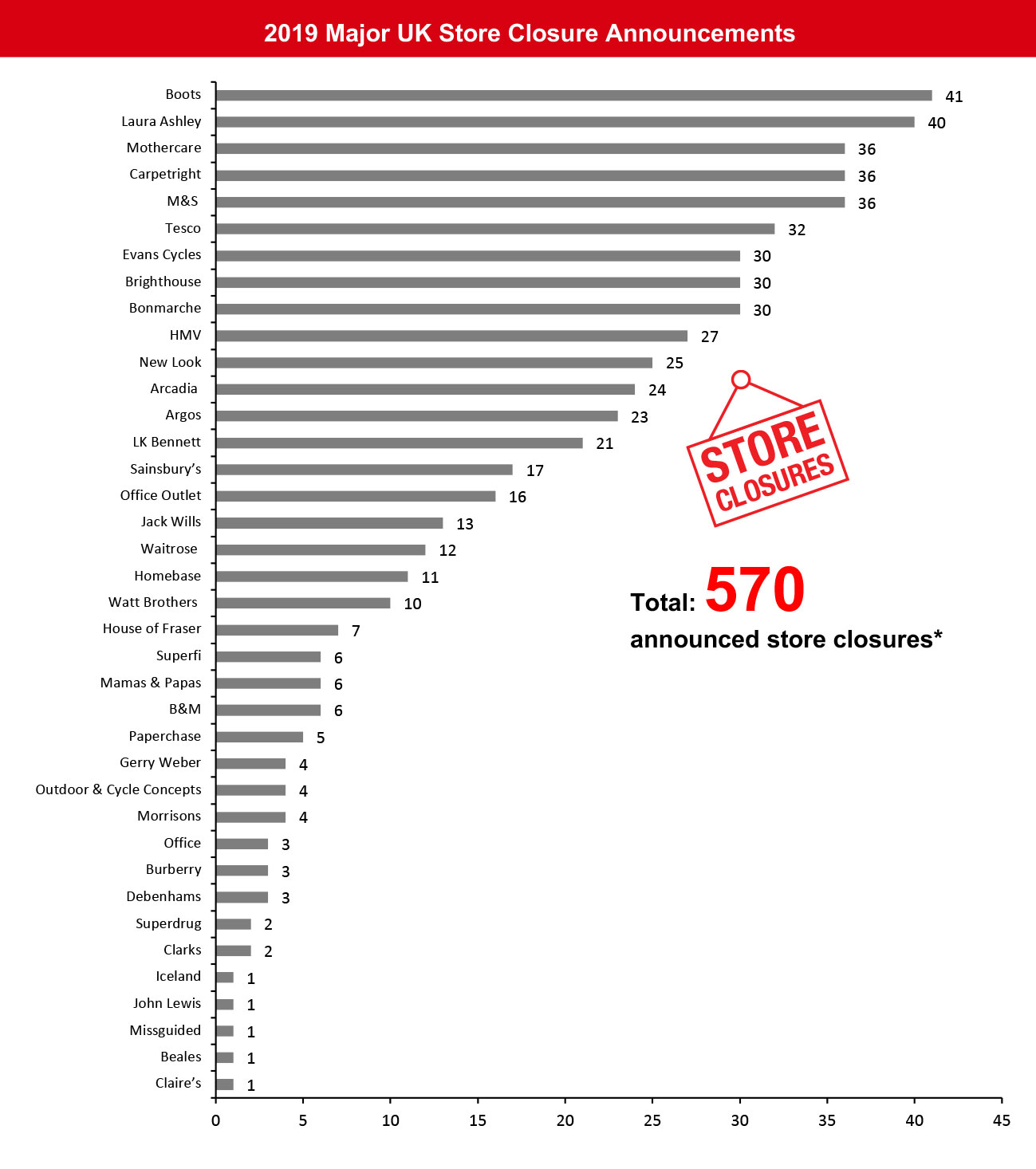

[caption id="attachment_103041" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart. Source: Company reports/Coresight Research [/caption] [caption id="attachment_103042" align="aligncenter" width="700"]

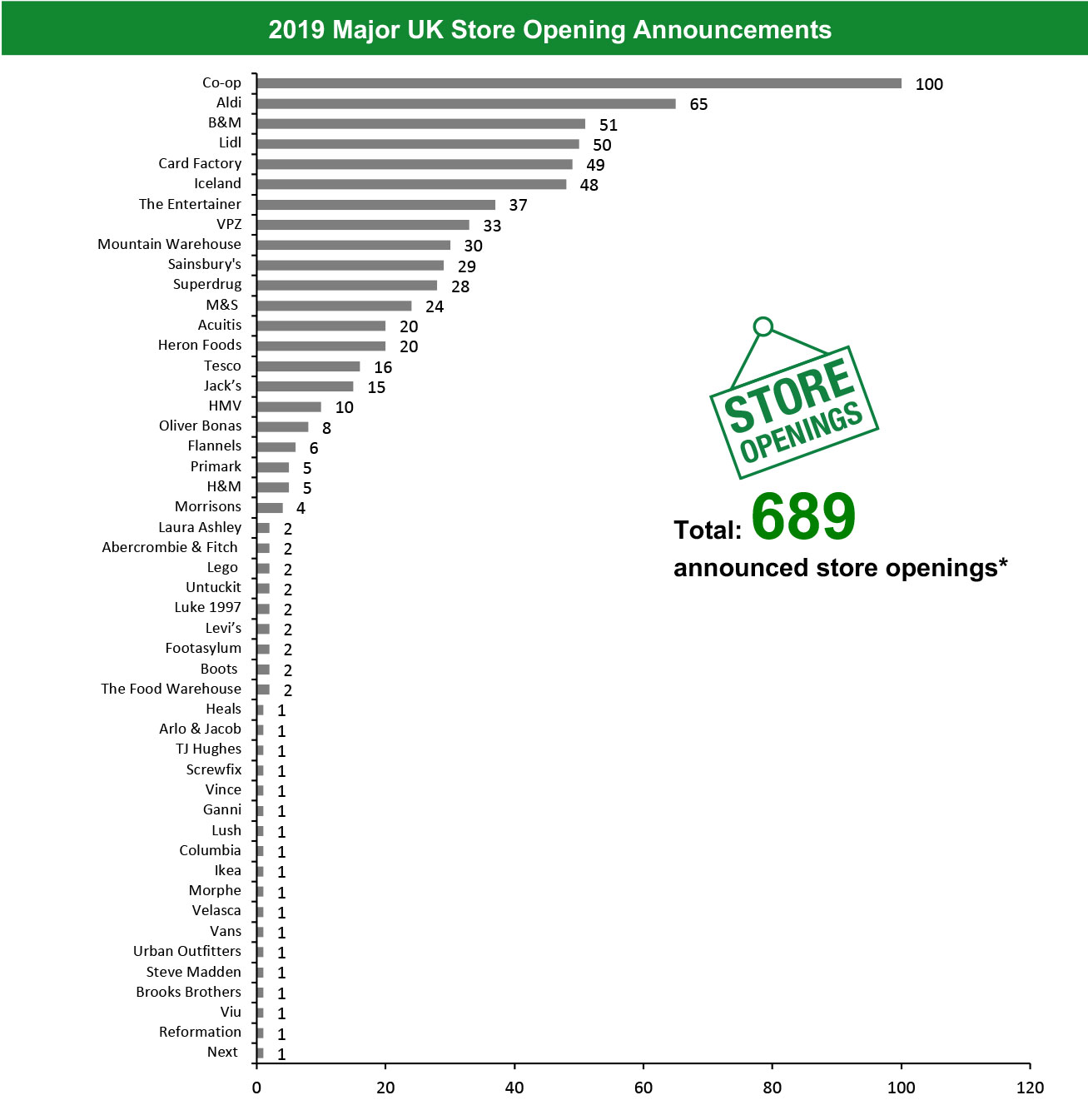

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart. Source: Company reports/Coresight Research [/caption]

Notes

Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.