Nitheesh NH

The US

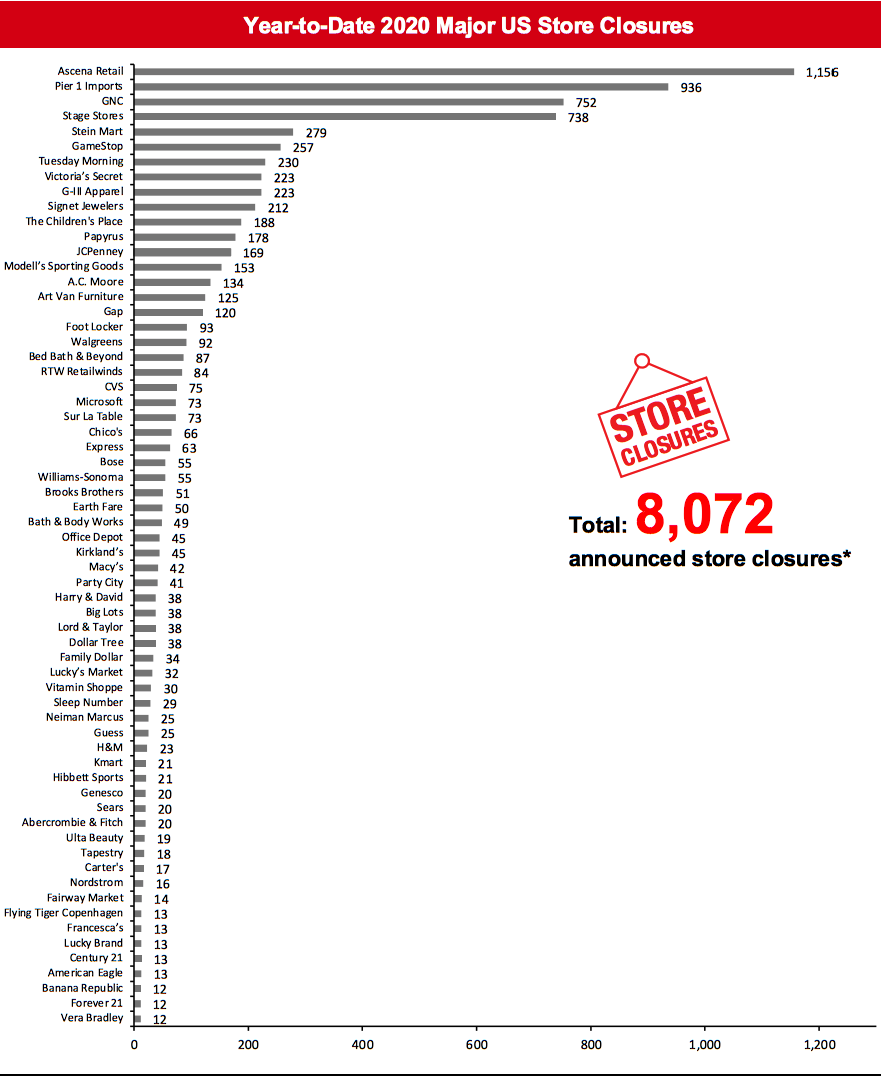

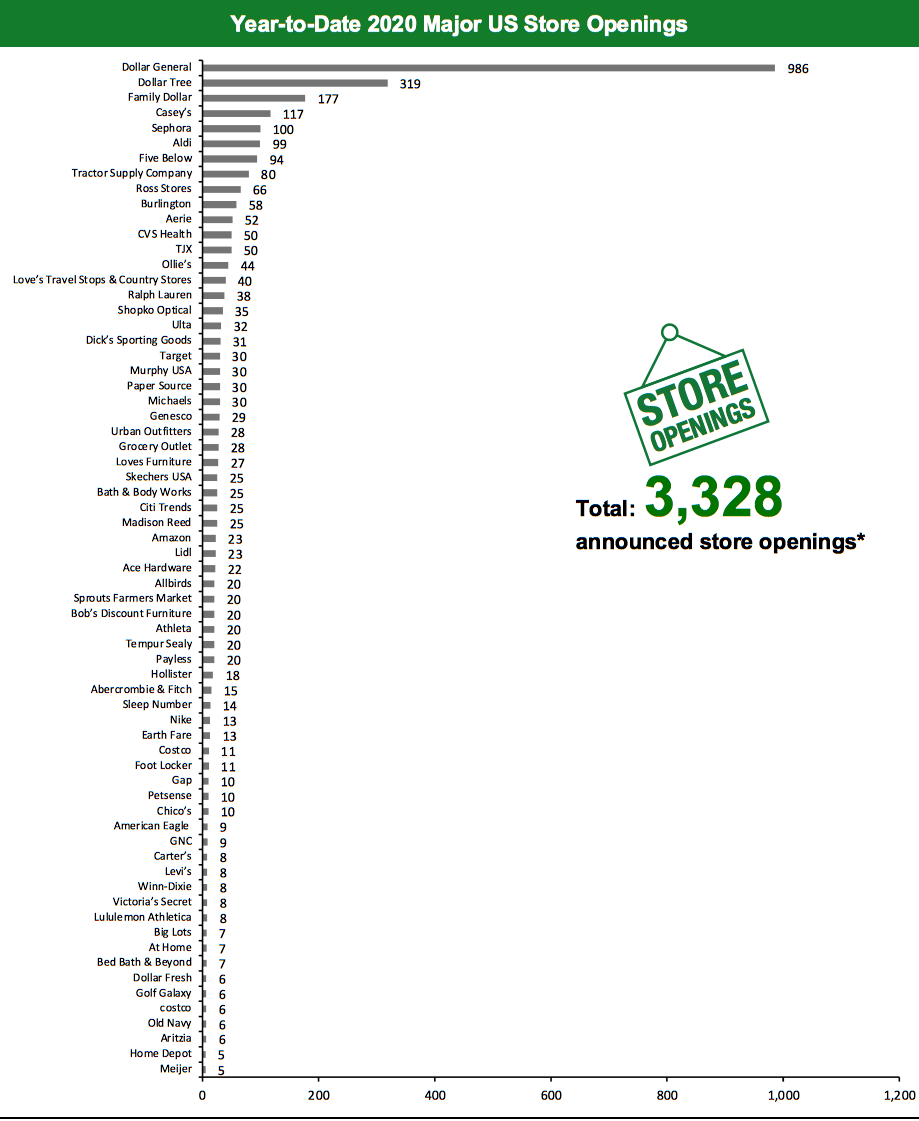

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 8,072 planned store closures and 3,328 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we made revisions to the closures count for Murphy USA and openings count for Skechers, which has changed the US closure count to 8,072 and reduced the openings count to 3,328. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=130]Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

What Is Happening This Week in the US

Nordstrom Plans To Open Two Stores in Los Angeles Department store chain Nordstrom has announced plans to open two new Nordstrom Local stores in the Los Angeles Area. The stores will open in Newport Beach on November 6 and in Manhattan Beach in the coming months. While we added the Newport Beach store opening to our openings chart, we have not accounted for the store opening in Manhattan Beach as it is unconfirmed whether it will open this year. Pet Valu To Shut All Stores Pet food and supplies chain Pet Valu plans to shut down its operations in the US. The retailer will close all of its 358 US stores and warehouses, stop accepting orders on its website and shutter its office in Wayne, Pennsylvania. Liquidation sales at its stores commenced on November 5, according to the company. The timing of the closures will depend on inventory sales, according to a company representative. We have therefore added these closures to the uncharted table of closures and will track developments on this front through the year before including them in the main closures chart. 7-Eleven May Close up to 300 Stores as Part of Speedway Acquisition Convenience store chain 7-Eleven may close up to 300 stores as part of its acquisition of convenience store chain Speedway, according to Reuters. 7-Eleven Inc.’s parent company, Seven & I, signed a $21 billion deal to acquire the 3,900-store strong Speedway chain in August 2020, which is expected to be finalized in the first quarter of 2021. The deal would leave Seven & I with some overlap between 7-Eleven and Speedway stores: The company is seeking to address this by divesting up to 300 stores, possibly ahead of any regulatory requirements. As the plan is unconfirmed by the company and the closures are more likely to occur in 2021 if confirmed, we have added these closures to the uncharted closures table.Quarterly Store Openings/Closures Settlements

Murphy USA Opens Four Stores Convenience store and gas station chain Murphy USA has announced that it opened four new stores and closed one store in the quarter ended September 30, 2020. The company had previously sold nine stores in its second quarter ended June 30, taking the year-to-date closures to 10. While we accounted for the openings previously, we have updated the closures chart this week. The company currently operates 1,488 stores, including 1,151 Murphy USA sites and 337 Murphy Express sites, as of September 30, 2020. Skechers Opens 12 Stores Footwear retailer Skechers has announced that it opened 12 new company-owned domestic stores in the quarter ended September 30, 2020. Including these openings that have been accounted for previously, the company has opened 25 stores, year to date. The company currently operates 522 stores as of September 30, 2020. Sprouts Farmers Market Opens Six Stores Grocery retailer Sprouts Farmers Market has announced that it opened six stores in the quarter ended September 27, 2020. We have already accounted for these openings. The company operates 356 stores as of September 27, 2020.Non-Store-Closure News

CBL and PREIT File for Bankruptcy Mall owners CBL and Pennsylvania Real Estate Investment Trust (PREIT) have filed for Chapter 11 bankruptcy protection. CBL operates 107 properties, totaling 66.7 million square feet of retail space across 26 states. PREIT operates 22.5 million square feet of retail space, including 19 malls. In its bankruptcy filings, CBL listed its estimated assets and liabilities in the range of $1–10 billion. PREIT listed its assets in the range of $0.5–1 million and liabilities in the range of $1–10 billion. JCPenney Signs Asset Purchase Agreement with Brookfield, Simon and First Lien Lenders JCPenney has entered into an asset purchase agreement (APA) with Brookfield Asset Management, Simon Property Group and a majority of the company’s debtor-in-possession (DIP) and first lien lenders. As part of the APA, Brookfield and Simon will acquire substantially all of JCPenney’s retail and operating assets through a combination of cash and new-term loan debt. The company’s DIP and first lien lenders will acquire 160 of the company’s real estate assets and all of its owned distribution centers. Rue21 Hires New CEO Women’s apparel retailer Rue21 has hired Bill Brand as its new CEO. Brand will take over from Interim CEO John Fleming. Brand most recently served as President of shopping channel company HSN and previously served as Chief Retail Officer at cruise-line company Carnival. [caption id="attachment_118872" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.*Total includes a small number of retailers that each announced fewer than 12 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_118873" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.*Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=536]

Source: Company reports/Coresight Research

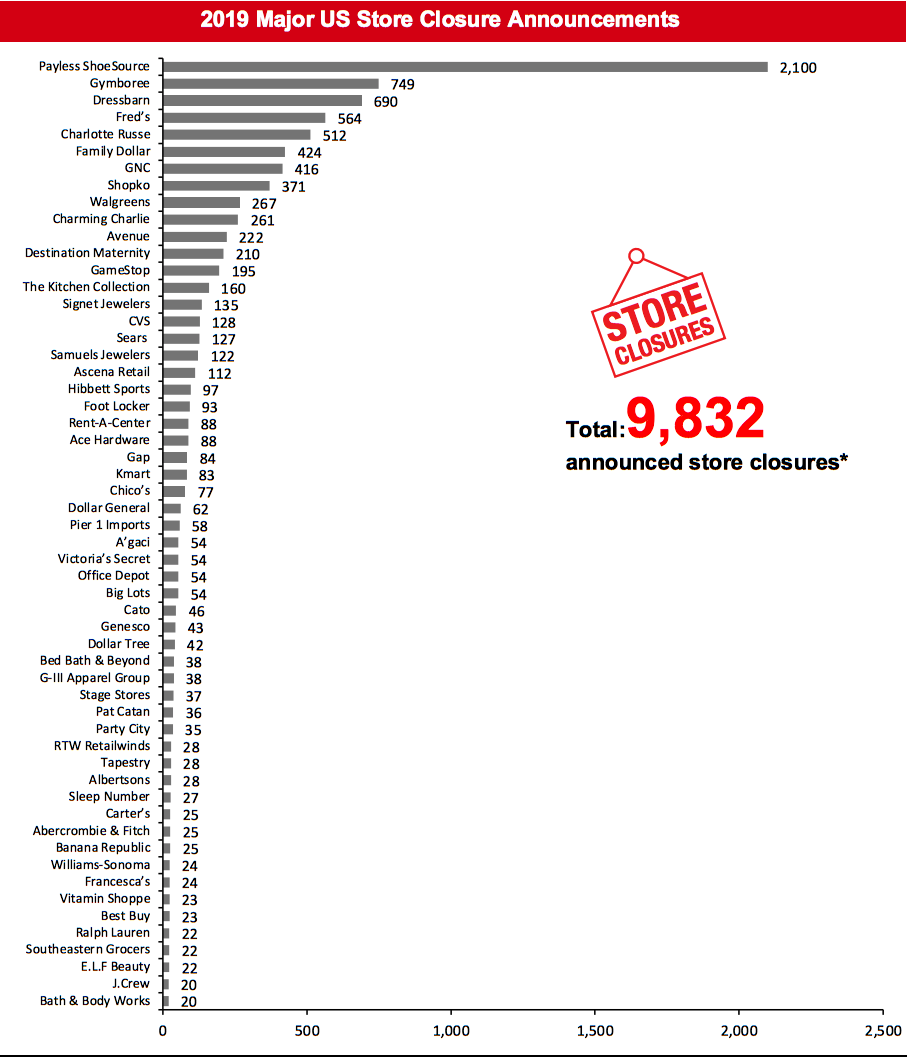

[caption id="attachment_118875" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_118876" align="aligncenter" width="700"]

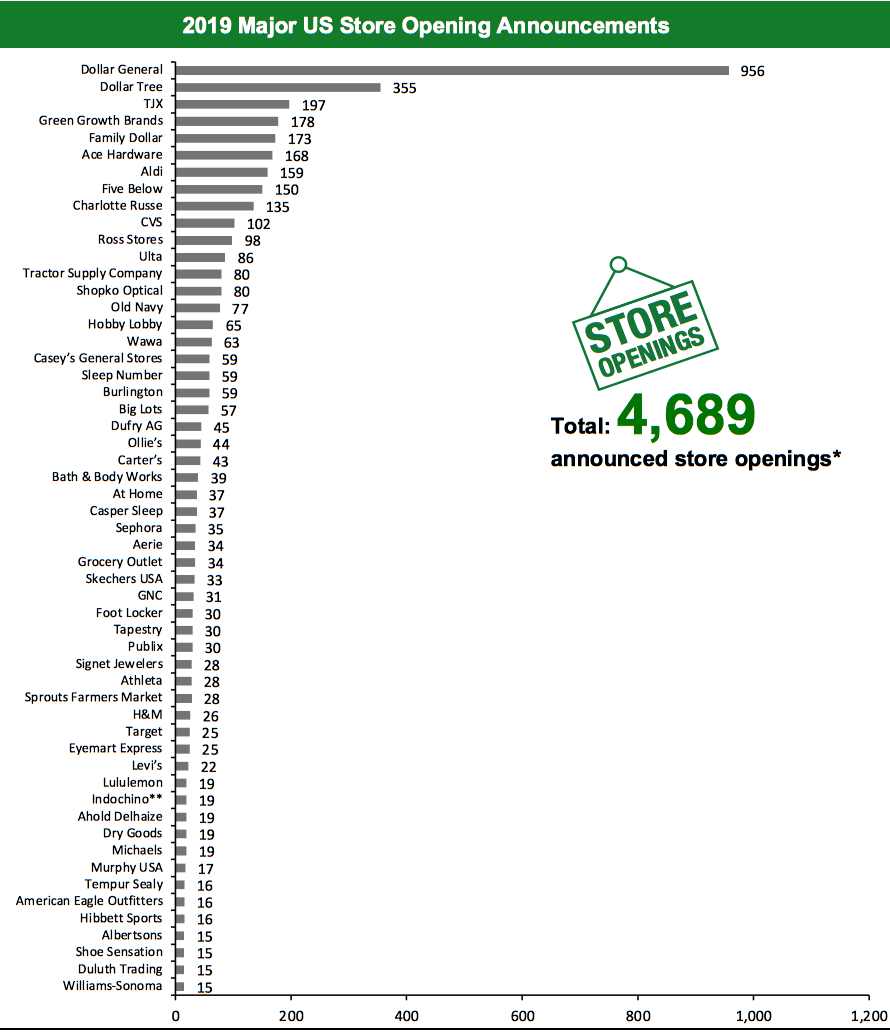

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes T.J. Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes T.J. Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=537]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=538]Revenue figure depicted for Gymboree is for the nine-month period ended November 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

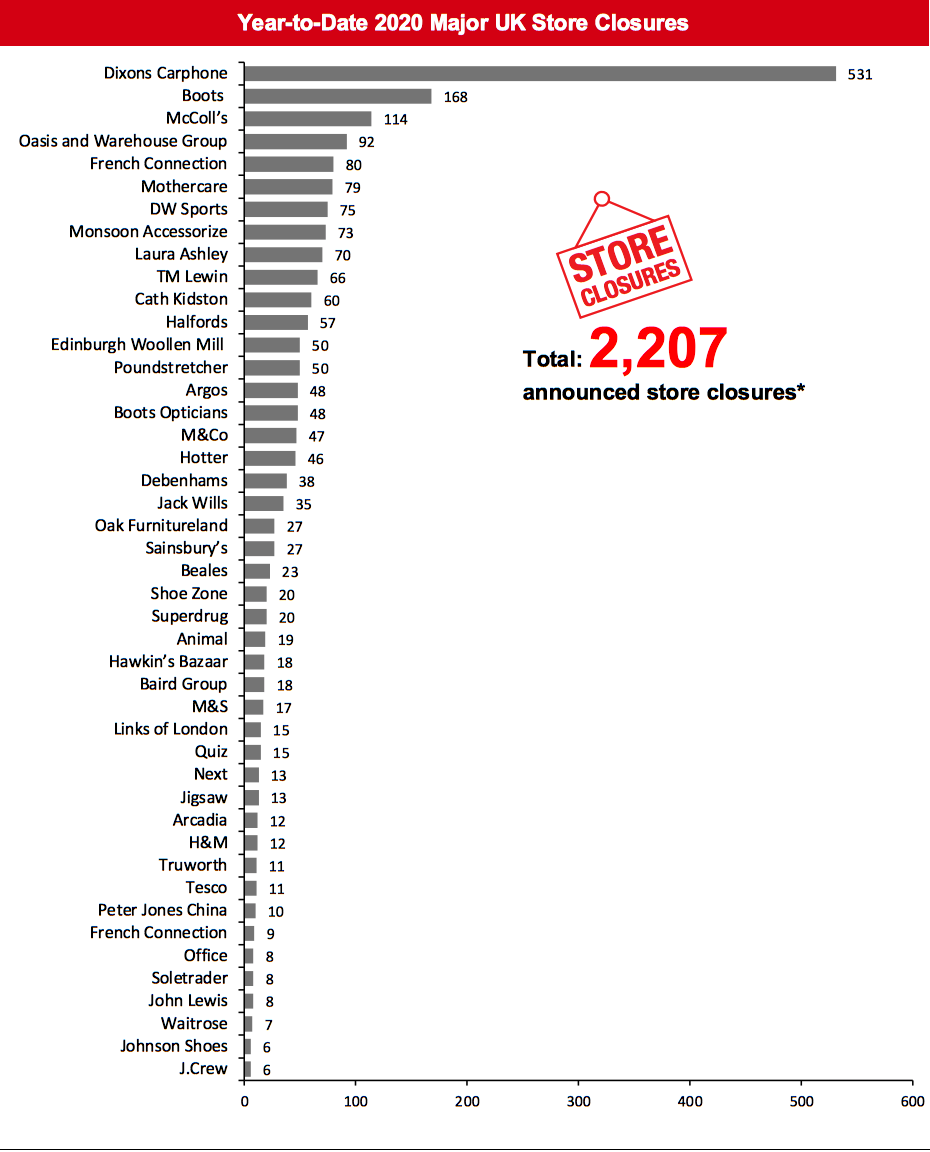

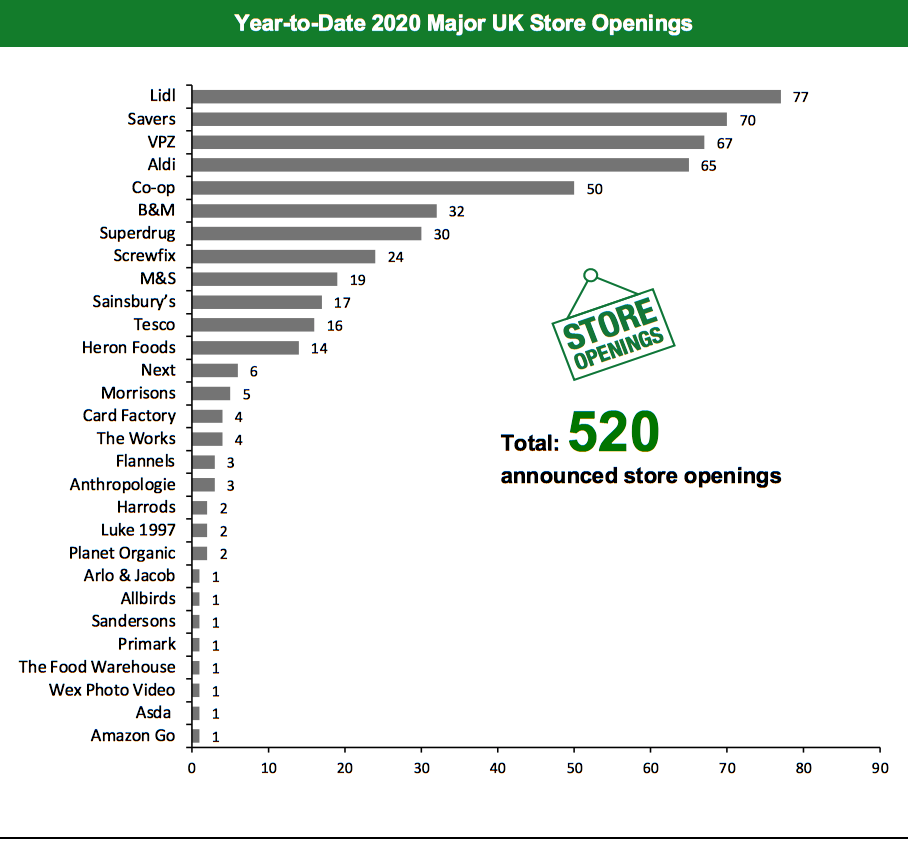

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 2,207 store closures and 520 store openings. Our data represent closures and openings by calendar year. This week, there have been no updates to our 2020 UK closure and openings counts, which remain at 2,207 and 520 respectively. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=131]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Shoe Zone May Close up to 90 Stores Footwear retailer Shoe Zone has announced that the return of business rates in April could see it close up to 20% of its store portfolio over the next two years. The retailer’s CEO Anthony Smith said that if business rates are introduced, Shoe Zone will be forced to close up to 45 stores prior to April 2020 and a further 45 stores in the 12 months following. It has already closed around 20 stores earlier this year.Non-Store-Closure News

Superdry Appoints Interim CFO Apparel retailer Superdry has hired Benedict Smith as Interim CFO, effective November 2, 2020. Smith takes over from Nick Gresham, who stepped down from the role in October 2020. Smith currently serves as a non-executive director for McColl’s and has previously held CFO roles at department store chain Harrods and footwear retailer Hunter Boot. Next Partners with Laura Ashley Apparel retailer Next has partnered with home-furnishing retailer Laura Ashley to sell its home products through Next’s 500 UK stores and via its website in an effort to revive the heritage brand. Laura Ashley collapsed into administration in March 2020. It was bought out of administration in April by investment firm Gordon Brothers in a deal that included the retailer’s global brand, its archives and related intellectual property, but excluded Laura Ashley’s 147 stores and its manufacturing and logistics operations in the UK and Ireland. [caption id="attachment_118880" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S, Sainsbury’s and Truworth. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S, Sainsbury’s and Truworth. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.*Total includes a small number of retailers that each announced fewer than six store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_118881" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK. Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=540]

Source: Company reports/Coresight Research

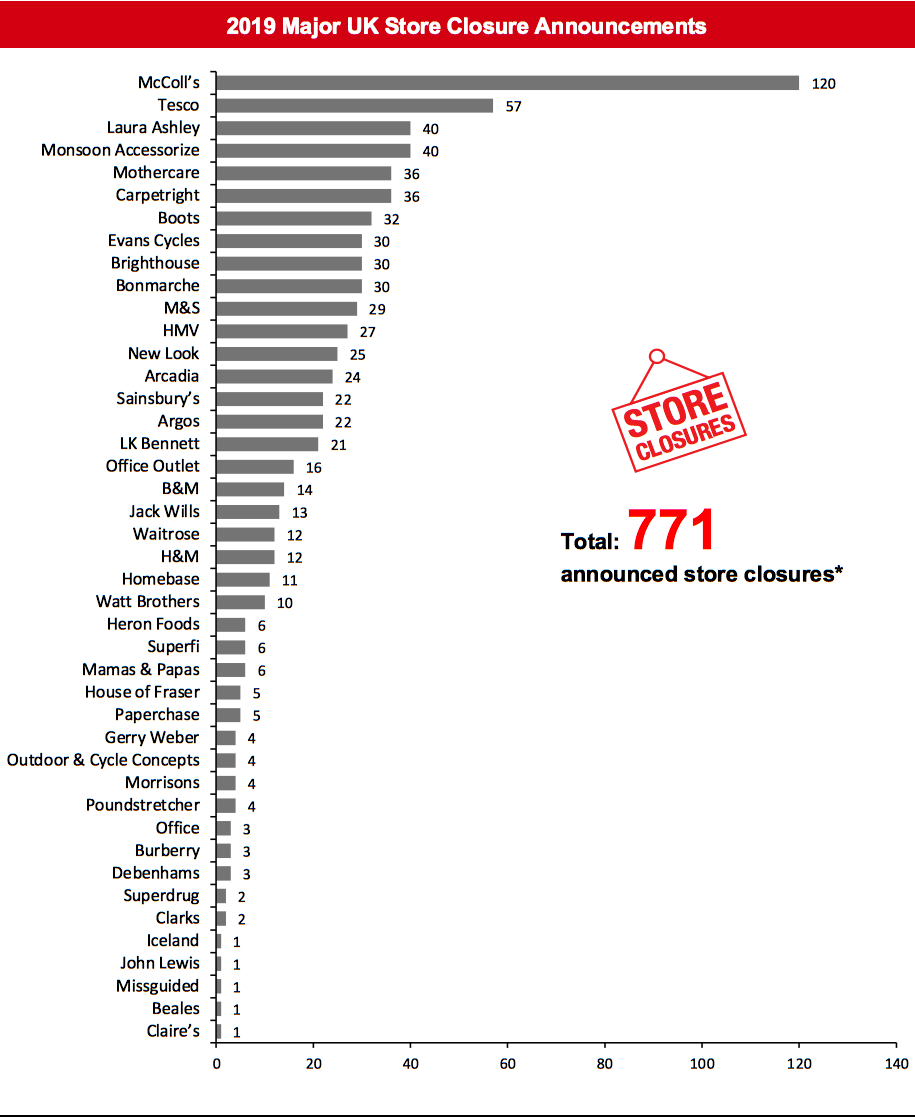

[caption id="attachment_118883" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_118884" align="aligncenter" width="700"]

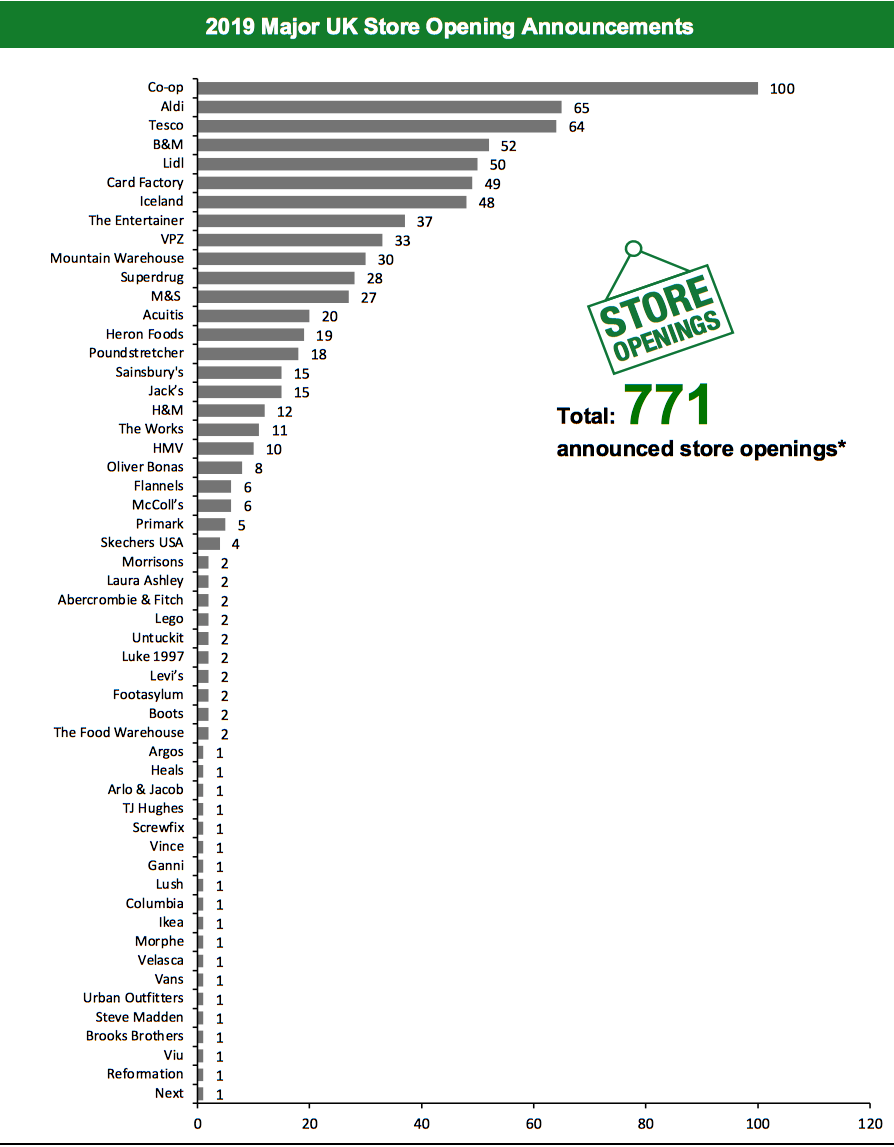

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.