Nitheesh NH

The US

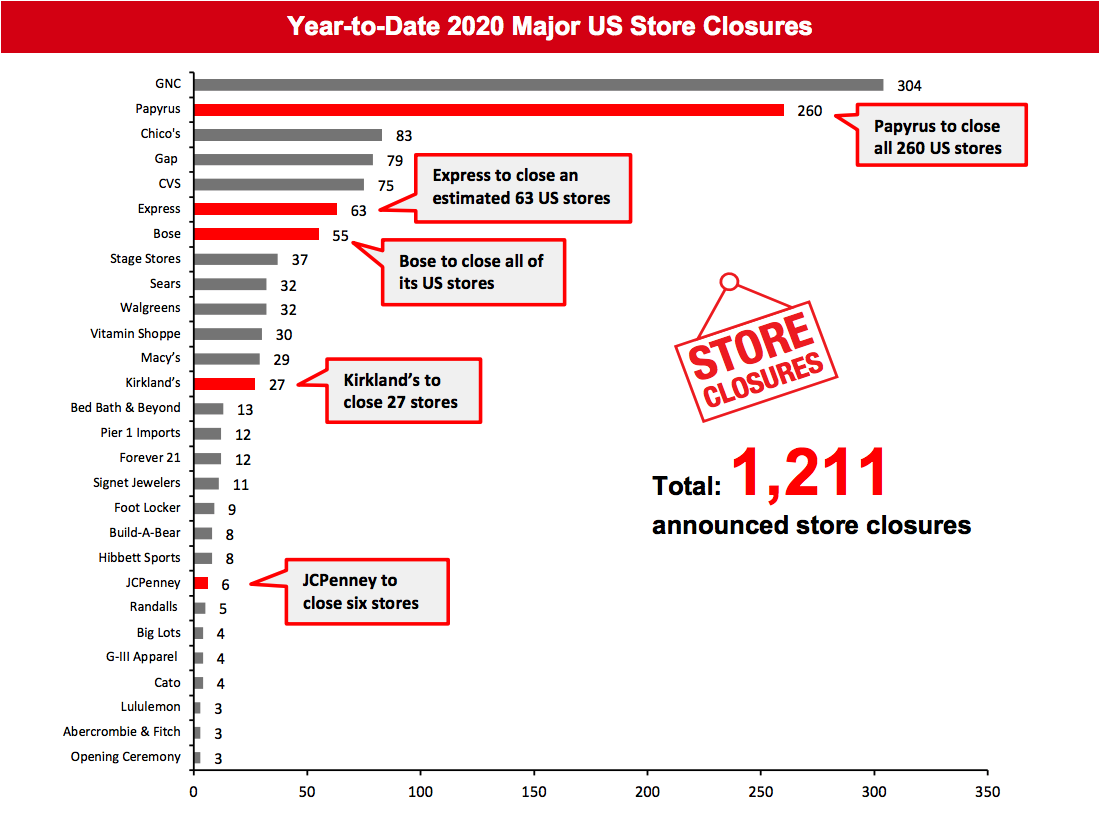

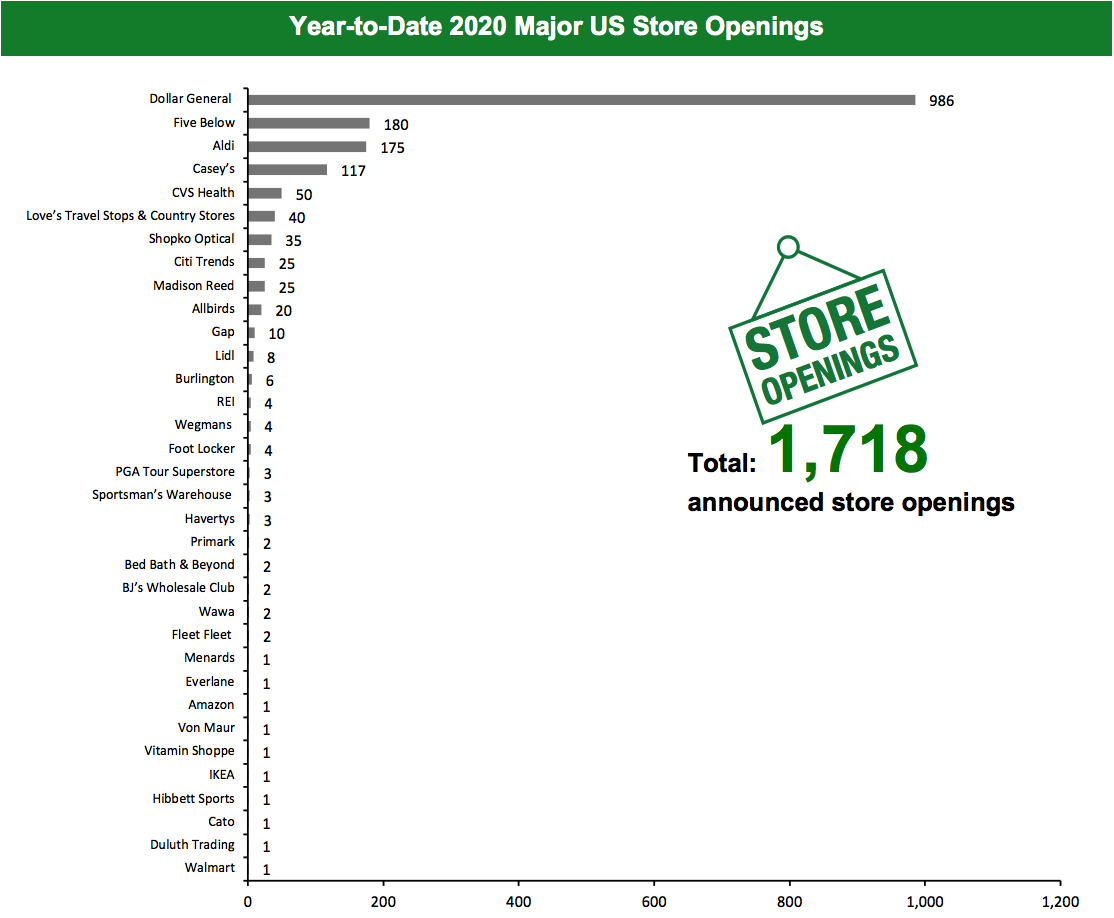

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,211 planned store closures and 1,718 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. We have revised our closure count for Walgreens in the 2019 closure chart this week, and this has changed our 2019 US store closure count to 9,368.What Is Happening This Week in the US

Bose To Shutter All US Stores Audio equipment retailer Bose has announced plans to close 119 stores located in Australia, Europe, Japan and North America over the next few months. Around 130 retail locations in Greater China and the UAE will remain open in addition to stores located in India, Southeast Asia and South Korea. Bose currently operates 55 stores in the US, according to its website. Casey’s To Open 350 Stores over the Next Three Years Convenience-store chain Casey’s has announced plans to open around 350 stores over the next three years. The retailer has a large fleet of stores located around its two distribution centers, and the company sees significant infill opportunities—especially in midsize and suburban markets—to support its outward expansion, according to a statement from Brian Johnson, Senior Vice President of store development, earlier in January. Casey’s operates 2,181 stores in the US, as of October 31, 2019. Coresight Research insight: The US is in the early stages of online grocery adoption. As penetration increases, convenience stores will benefit from consumers using this channel for top-up purchases, to avoid lengthier shopping trips to larger stores. Express To Close 91 Stores by 2022 Apparel and accessories retailer Express has announced that it will close 91 stores by 2022. Of these, 31 will shutter by the end of January 2020, another 35 will close by the end of January 2021, while the remaining stores will close through the rest of 2021. The retailer also confirmed that it closed nine stores last year. Coresight Research insight: Store fleet rationalization is projected to generate $15 million in savings for Express in tandem with an estimated $90 million of lost sales, according to CEO Timothy Baxter’s statement during the Analyst Day at the New York Stock Exchange, on January 22. With seven months in the CEO role, Baxter is rapidly adding talent (appointing a new supply chain officer and president of e-commerce) and executing a turnaround for the business. Express management said that it saw positive sales results in response to new product introduced in November and December 2019, and that new product introduced after Christmas “added meaningful incremental sales.” Fleet Feet To Open Two New Stores Specialty running shoe and apparel retailer Fleet Feet has announced plans to open two new stores in Texas—one each in Plano and San Antonio. The Plano store, which will be located at the Preston Towne Crossing retail center, will open in April this year. Following the openings, the retailer will operate 12 stores in Texas. JCPenney To Shutter Six Stores Department store chain JCPenney has announced plans to close six stores by April 24, 2020, as a part of its store portfolio review. The stores earmarked for closure are located in Chapel Hill Mall in Ohio, Green Acres Mall in New York, Myrtle Beach Mall in South Carolina, North Hills Shopping Center in North Carolina, Southgate Mall in Montana and Tulsa Promenade in Oklahoma. Kirkland’s Plans To Close 27 Stores in Early 2020 Home décor and furniture retailer Kirkland’s has announced plans to close 27 stores in early 2020, as a part of its transformation plan to become more profitable. The retailer has reduced expenses at its corporate office as it is also aiming to effectively manage its operating and infrastructure costs. Kirkland’s currently operates 432 stores across 37 states in the US. Love’s Travel Stops & Country To Open 40 Locations Travel stop and convenience store retailer Love’s Travel Stops & Country has announced plans to open 40 store locations in 2020. In line with its store expansion plan, the retailer will also add approximately 40 Love’s Truck Care centers and Speedcos service centers. The retailer operates more than 500 locations across 41 states in the US. PGA Tour Superstore Furthers Store Expansion Golf- and tennis-focused apparel and accessories retailer PGA Tour Superstore plans to open three stores in 2020—one each in Florida, New Jersey and Ohio. In addition to these three openings, the company plans to accelerate its store growth strategy by 50% in the coming three years. PGA Tour Superstore currently operates 41 stores across 16 US states. Schurman Retail Group To Close All Papyrus Stores Schurman Retail Group is reportedly closing all Papyrus stationery stores across the US, according to Retail Dive. Liquidation sales have begun in some of its stores, but the retailer has not publicly confirmed the store closures. However, Dominique Schurman, COO of Schurman Retail Group, has reportedly sent out an email communication to employees informing them of the planned closures. Papyrus currently operates 260 stores across the US, according to its website. Sportsman’s Warehouse Expands Retail Footprint Sporting goods retailer Sportsman’s Warehouse has announced plans to open three new stores this year. The company will open one store in Colorado and two in California, with further openings to be announced in the future. Following these three openings, the retailer will operate 107 stores across 27 US states. Walmart Opens Cashierless Neighborhood Market Store Walmart has opened a new Neighborhood Market store in Coral Way, Florida. The cashierless store offers services including online grocery pickup, same-day delivery and a “Check Out With Me” option. The latter allows store associates to help a shopper check out anywhere in the store using a handheld device. In addition to these services, the new store features a pharmacy, a full-service deli and a redesigned department for fresh produce. Coresight Research insight: This new cashierless concept forms part of Walmart’s strategy to deliver convenience and speedy checkout along with value pricing. It is likely to gain traction among younger shoppers and potentially attract new customers.Quarterly Store Openings/Closures Settlement

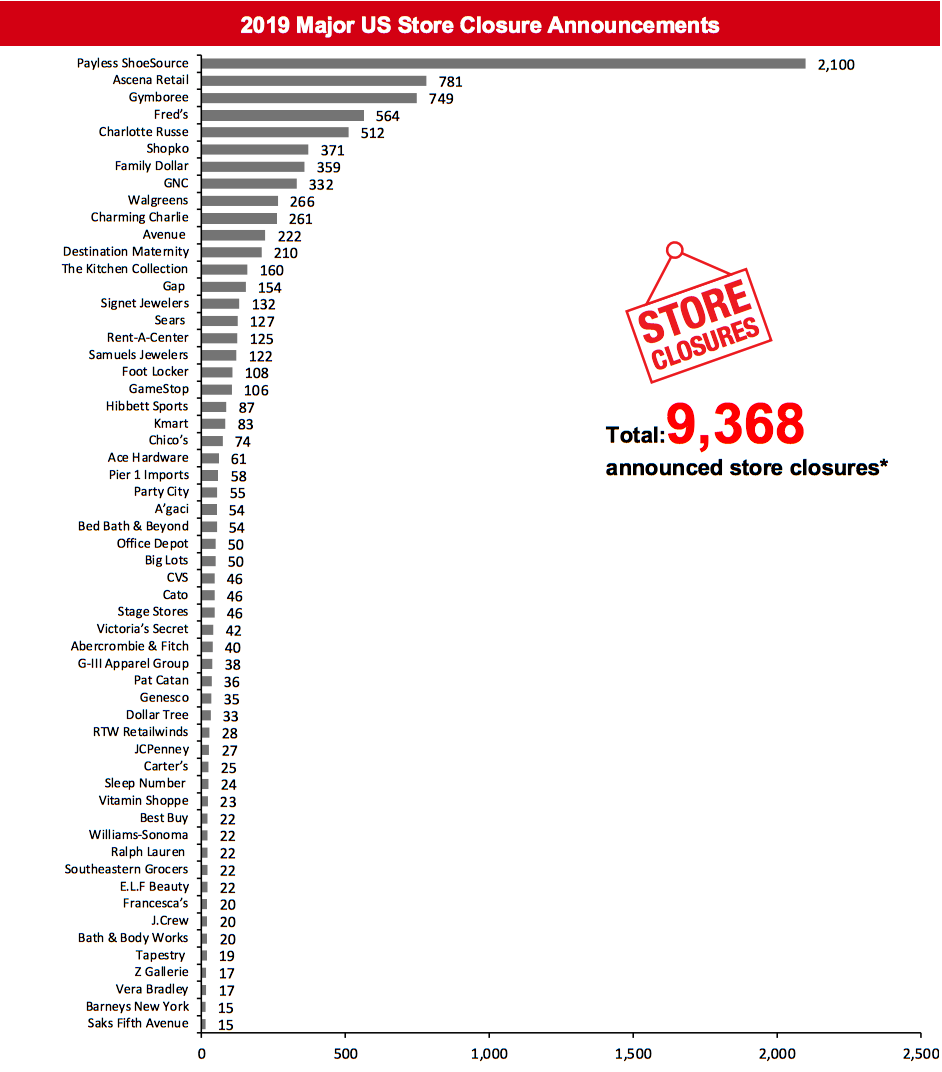

Walgreens Boots Alliance Confirms Closing of 114 Stores Walgreens Boots Alliance has reported that it closed 114 of the planned 200 Walgreens stores, as of November 30, 2019. In August 2019, it had announced plans to shut 200 US stores as a part of the company’s cost-management program. We have revised the Walgreens closure count in the 2019 US Closures chart based on the recent development.Non-Store-Closure News

Gap Inc. Reverses Old Navy Spin-Off Plan On January 16, 2020, Gap Inc. announced that it would no longer separate its Old Navy brand into a standalone company—reversing the original plan that was revealed in February 2019. The separation plan was designed to allow Old Navy to expand and help Gap Inc. to consolidate its heritage brands—such as Banana Republic and Gap—with newer brands such as Athleta and Hill City. [caption id="attachment_102656" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_102657" align="aligncenter" width="700"]

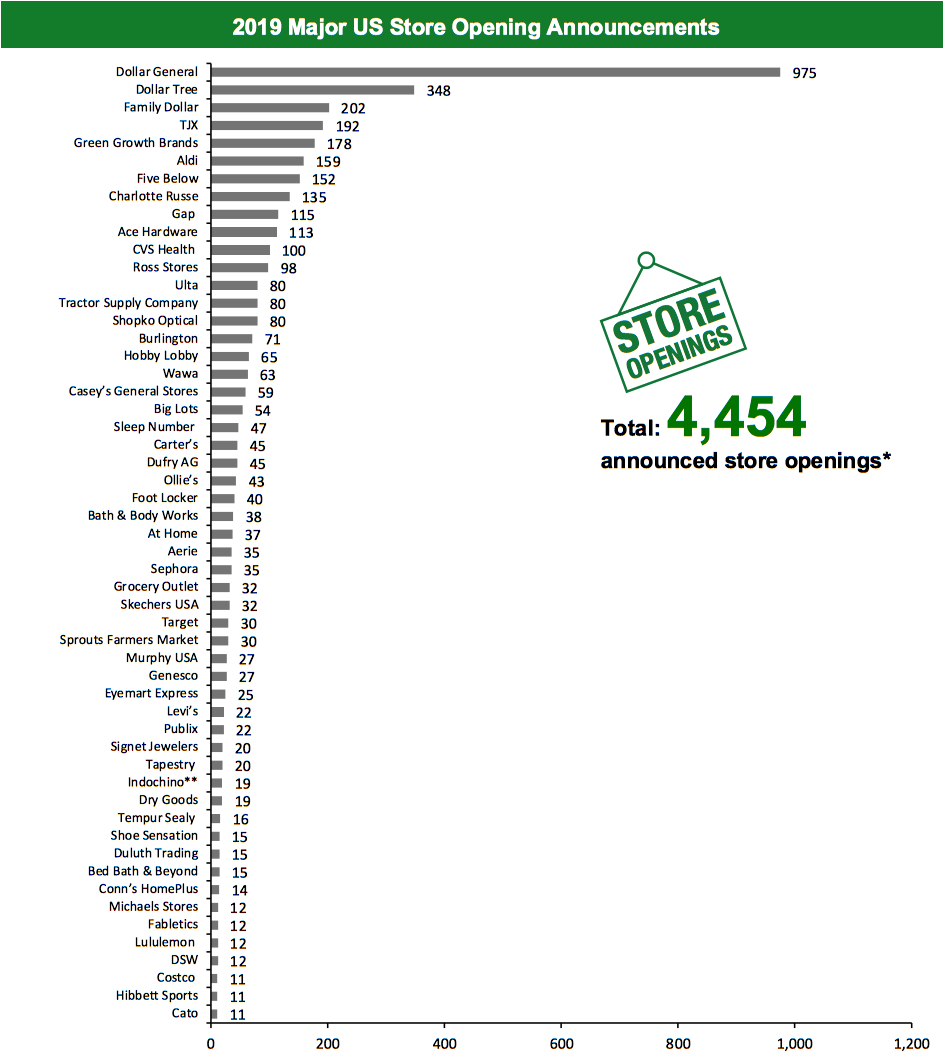

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

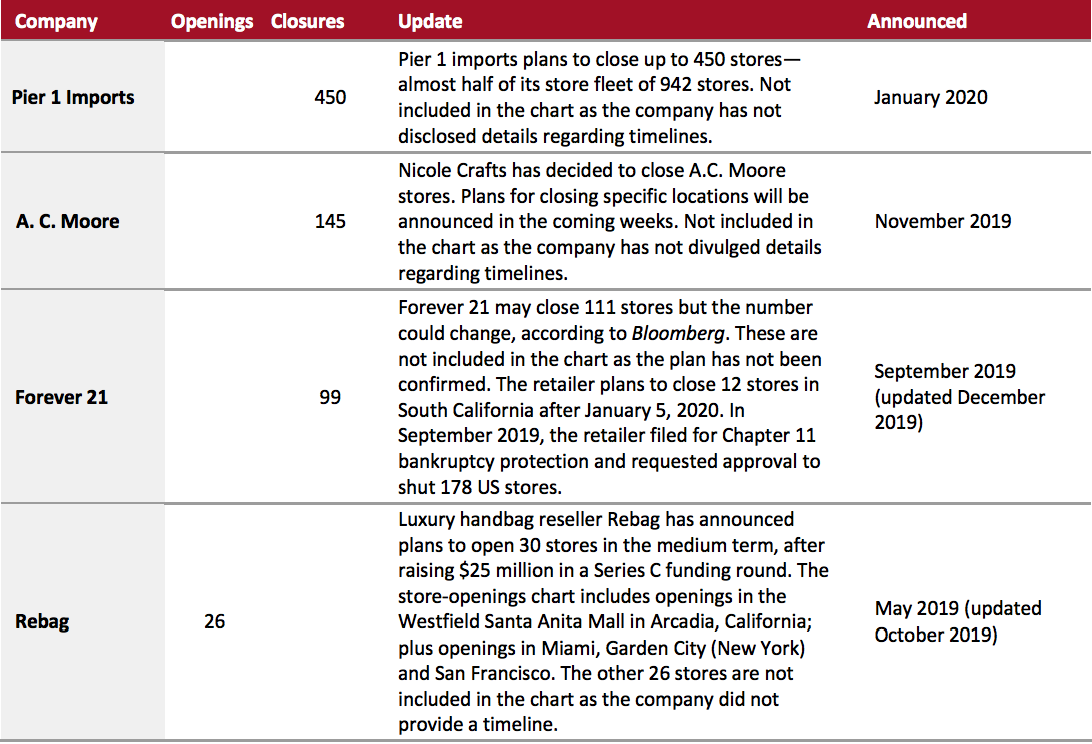

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_102658" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102659" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102659" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_102660" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

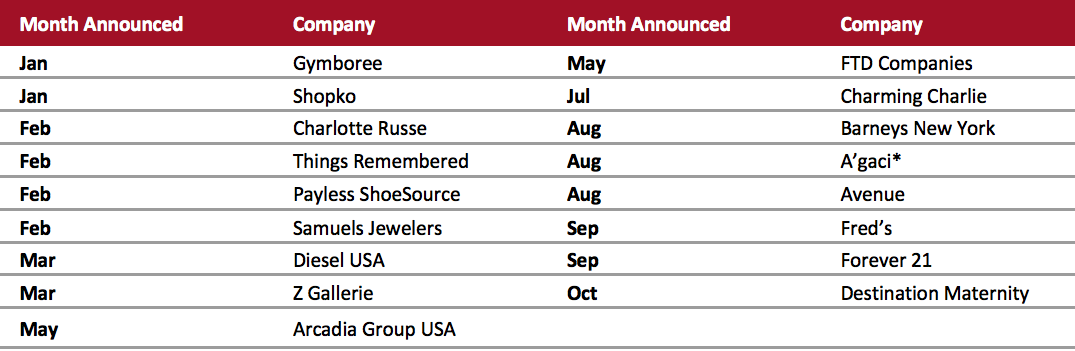

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_102661" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

The UK

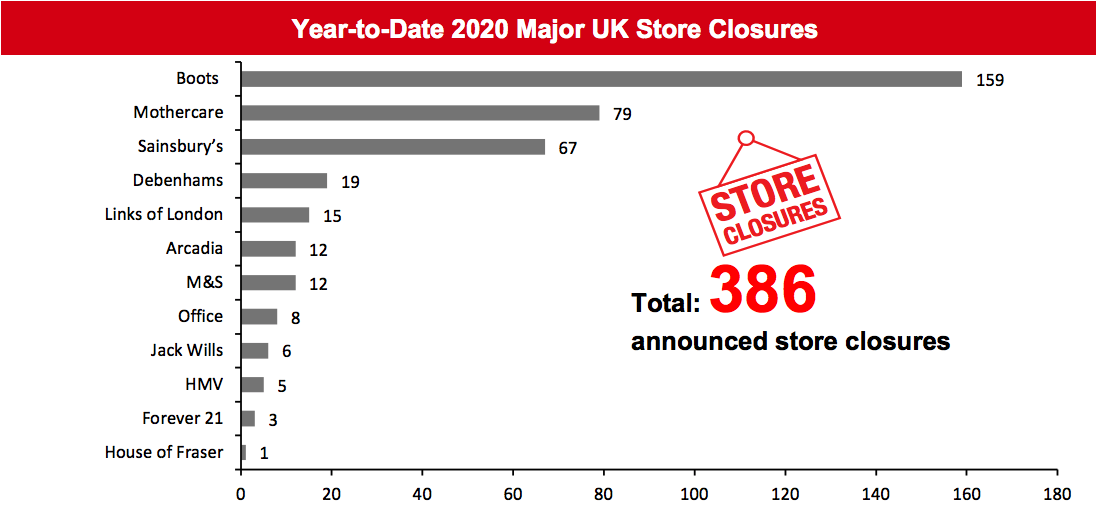

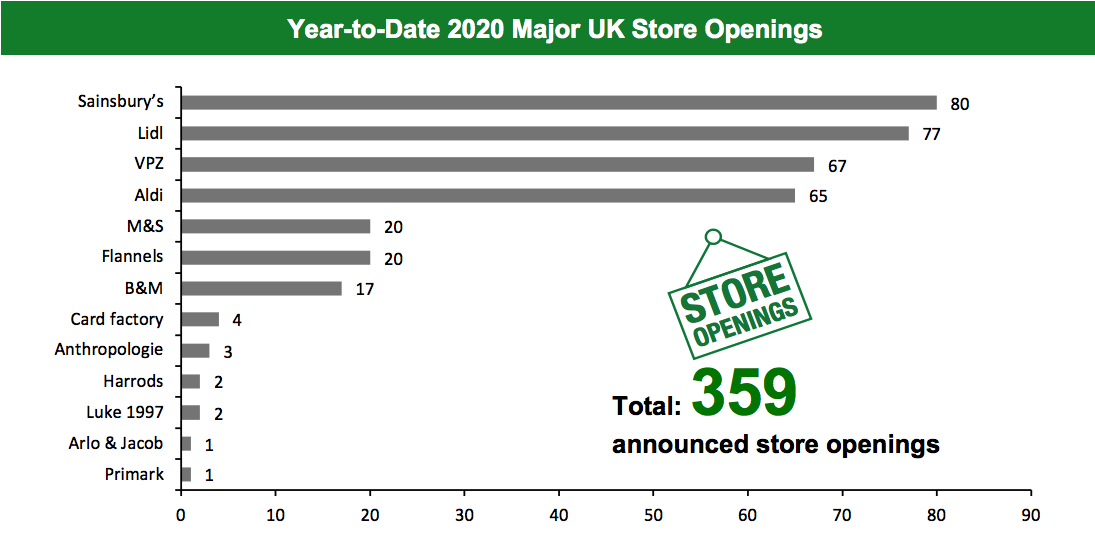

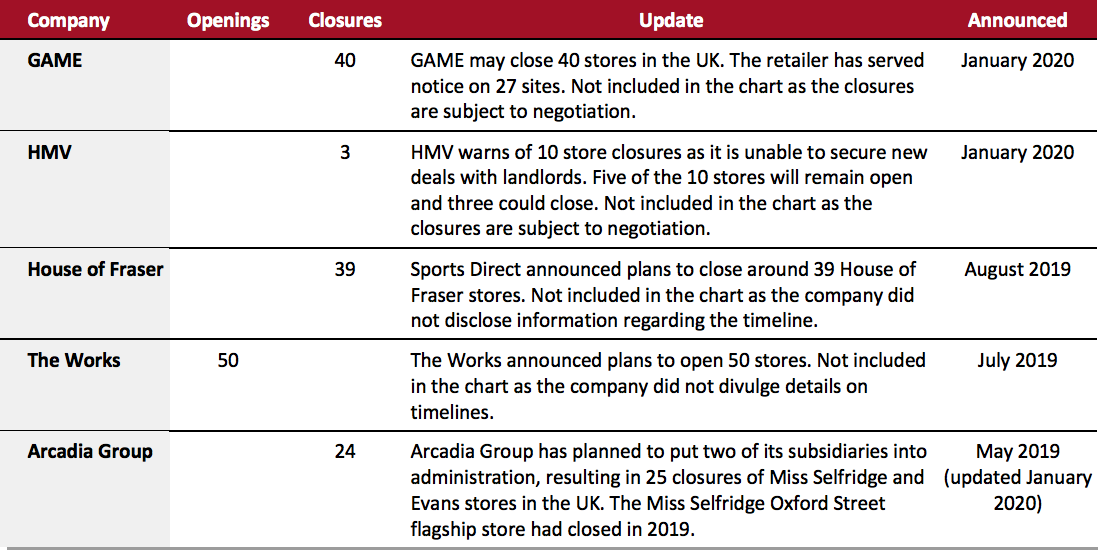

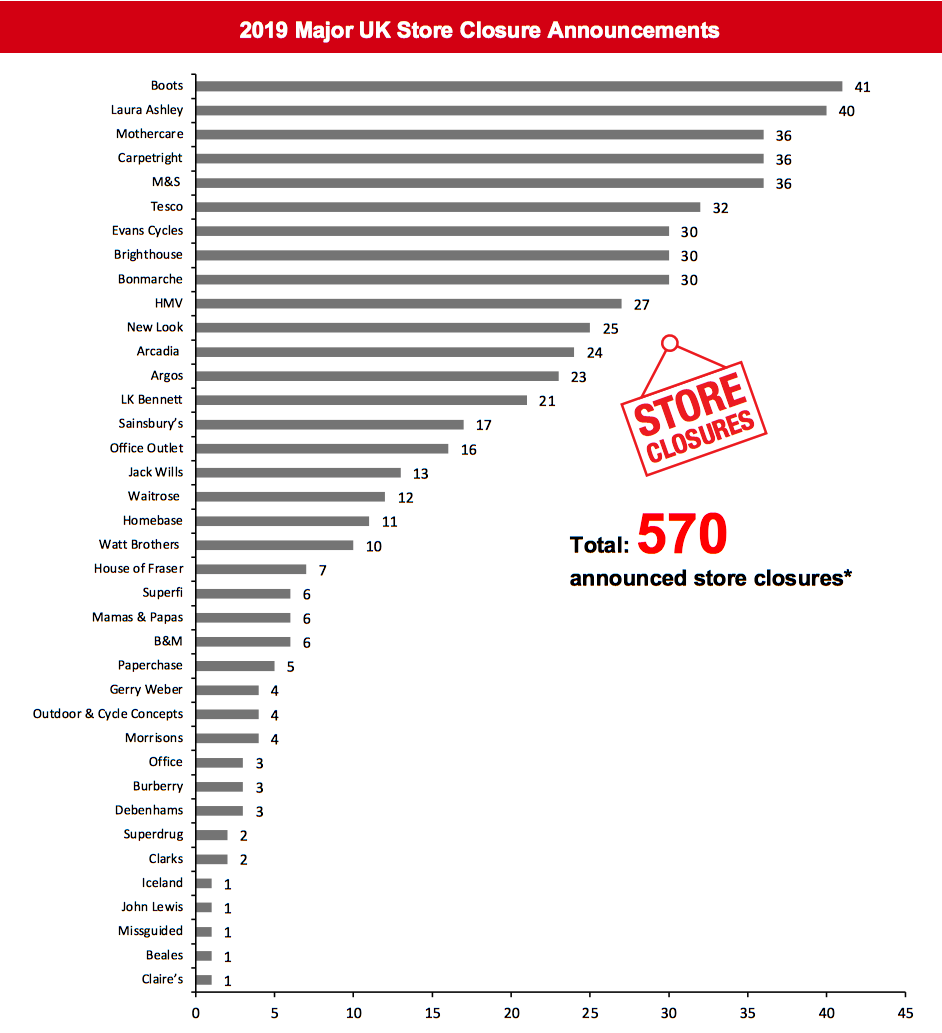

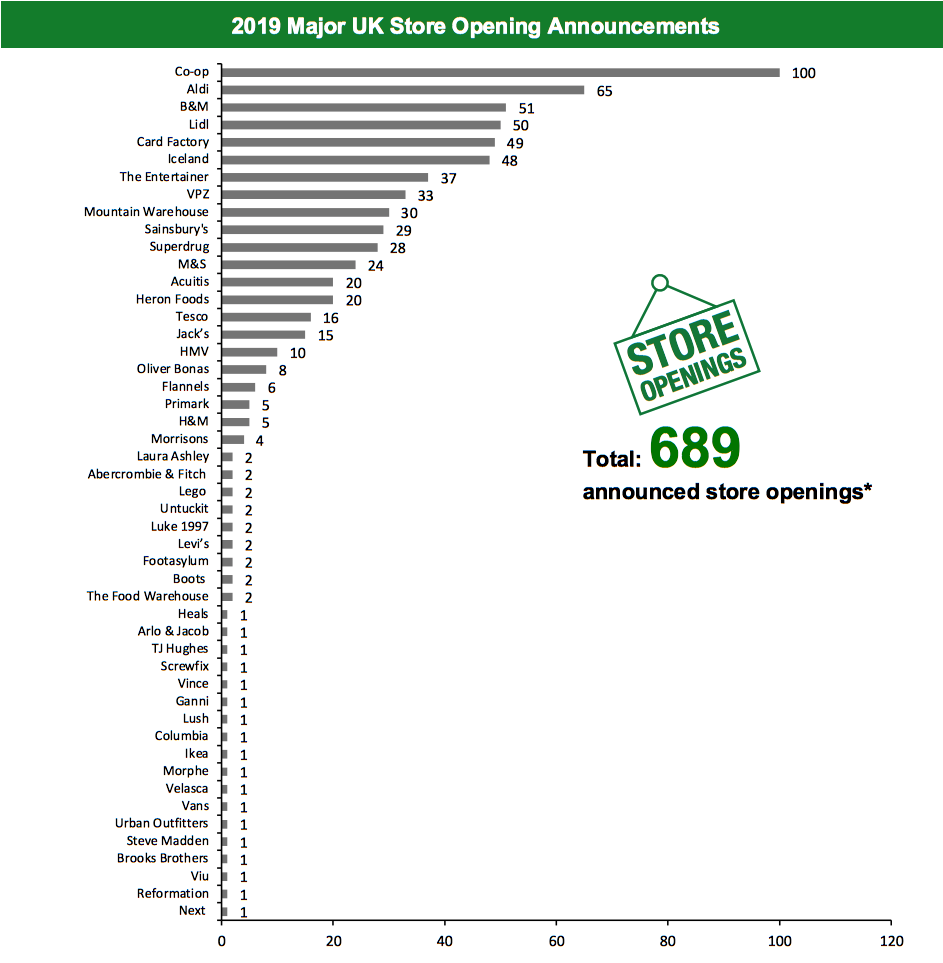

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 386 store closures and 359 store openings. Our data represents closures and openings by calendar year. We have revised our closure count for Boots in the 2019 closure chart this week, and this has changed our 2019 UK store closure count to 570.What Is Happening This Week in the UK

Anthropologie Store Opens in Winchester Fashion retailer Anthropologie, a subsidiary of Urban Outfitters, has opened a new 6,000-square-foot store in Hampshire, as a part of its “local store” strategy program. In line with this plan, the retailer also plans to open two more stores—one in Oxford and another whose location is yet to be announced. Anthropologie operates 13 stores in the UK, including six in London. Arcadia Shuts 12 Stores Arcadia Group has announced that it has closed 12 stores since the beginning of January 2020. Stores located in Aylesbury, Blackburn, Bolton, Newbury, Wolverhampton and Worthing have shut down. Recently, the company announced plans to close its Topshop and Topman store in the Westfield Stratford City shopping center. Since Christmas 2019, Arcadia has closed 26 concessions inside Debenhams locations. Beales Collapses into Administration Department store retailer Beales has collapsed into administration, with 23 stores and more than 1,000 jobs facing uncertainty. The retailer’s administrators KPMG has announced that Beales has been unable to find a buyer for its business. Although the website has shut down, the retailer’s stores will continue trading for now. Beales is also negotiating with its landlords for rent reductions. Last week, the retailer had warned that it could collapse into administration if it does not find a buyer. Frasers To Open Landmark Store at Meadowhall Sheffield Frasers Group has confirmed that it will open a new Frasers store at Meadowhall shopping center, Sheffield. The first phase of the 65,000-square-foot store will open in winter 2020, and the entire project is expected to be completed in 2021. This new store will replace the retailer’s existing House of Fraser store in Meadowhall. Jack Wills To Close Six Stores Clothing retailer Jack Wills has announced that it will close six stores within the next month, as it was unable to negotiate lower rents with landlords. The stores slated for closure are located in Bournemouth, Camberley, Cheltenham, Soho, Truro and Witney. The latest batch of closures follows the 13 stores that closed in 2019 after Frasers Group acquired Jack Wills. The acquisition occurred in August 2019 via a pre-pack administration deal. Walgreens Boots Alliance Confirms Closure of 28 Boots Stores Walgreens Boots Alliance reported that it has closed 28 of the planned 200 Boots stores, as of November 30, 2019. In June 2019, the chain announced plans to close 200 Boots stores in the UK over a period of 18 months.Non-Store-Closure News

Dune CEO James Cox Resigns Dune Group has announced that CEO James Cox will step down from his role, effective March 9, 2020. Cox will remain on the board as a Non-Executive Director. Executive Chairman and Founder Daniel Rubin will succeed James Cox as CEO. Cox joined the company in 2010 as Group Finance Director and was appointed as COO in 2013. The company promoted him to the role of CEO in July 2017. Dixons Carphone Appoints Chief Supply Chain Officer Electrical and telecommunications retailer Dixons Carphone has appointed Lindsay Haselhurst as its Chief Supply Chain Officer, effective January 27, 2020. In this new role, Haselhurst will focus on building the supply chain and the end-to-end customer experience. She previously worked as the Global Supply Chain and Logistics Director at home-improvement retail group Kingfisher. [caption id="attachment_102662" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.Source: Company reports/Coresight Research[/caption] [caption id="attachment_102663" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_102664" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102665" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102665" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_102666" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.