Nitheesh NH

The US

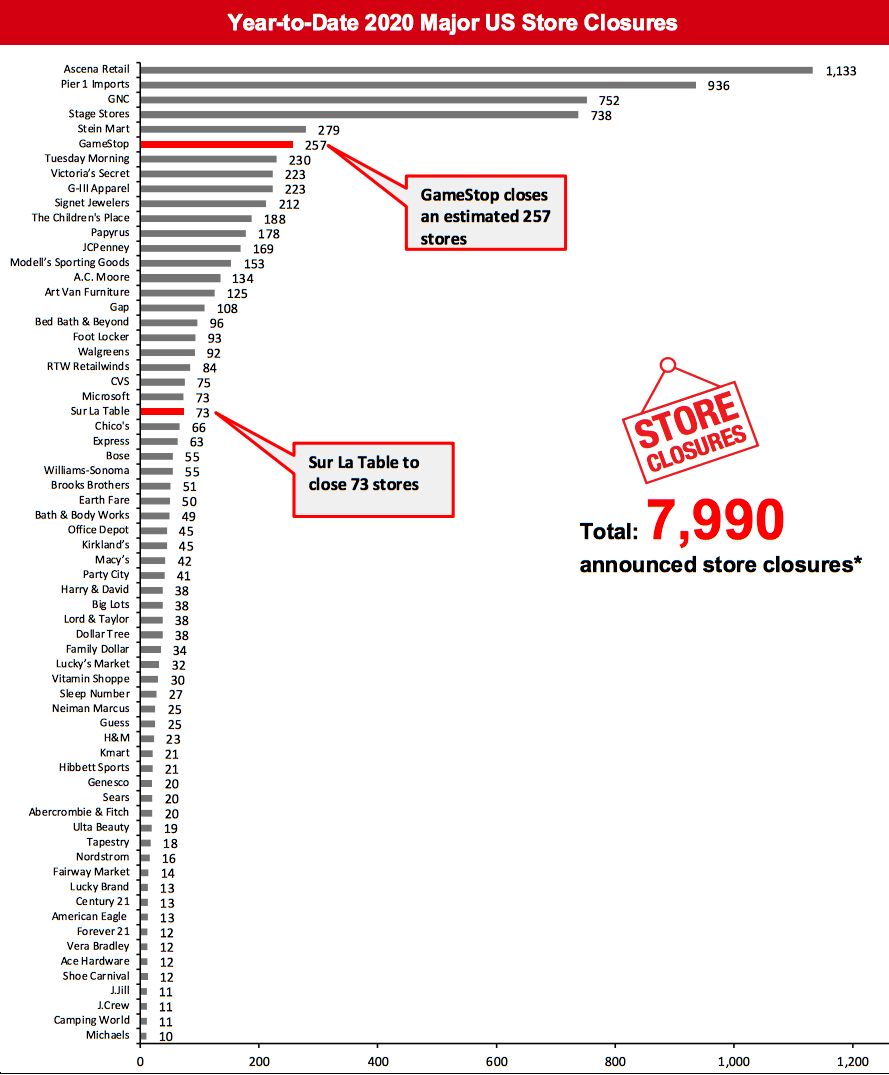

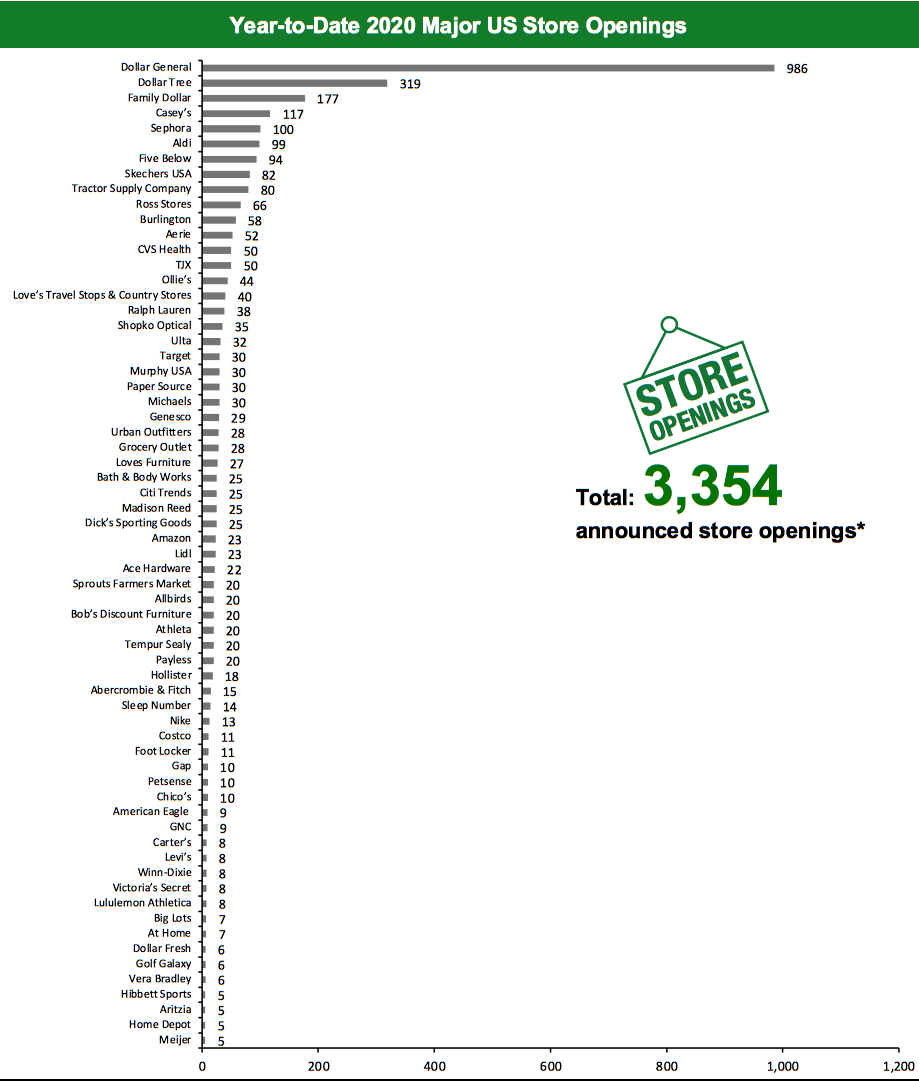

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 7,990 planned store closures and 3,354 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Century 21, J.Crew and Sur La Table, and this has changed our 2020 US closure count to 7,990. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=112]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from JCPenney and Urban Outfitters, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Century 21 To Close All Its Stores Discount department store chain Century 21 has announced that it has filed for bankruptcy and will close its remaining 13 stores. Most of the retailer’s stores are located in New York City, and it also has stores in Florida, New Jersey and Pennsylvania. Like many other department store chains, the retailer’s business was hit hard by the coronavirus pandemic, leading to a significant impact on sales. The company was banking on receiving about $175 million in business interruption insurance payments to help keep itself afloat, but its insurance providers declined to pay. Sur La Table To Close 17 More Stores Kitchenware products retailer Sur La Table has announced that it will close 17 additional retail locations. The retailer had earlier earmarked 56 stores for closure after filing for Chapter 11 bankruptcy protection in July, taking the year-to-date announced closures total to 73. The company has commenced liquidation sales in the additional closing store locations, and it expects sales to last for about five weeks or until all stock is sold.Quarterly Store Openings/Closures Settlement

American Eagle Outfitters Opens 16 Stores and Closes 11 Stores Specialty retailer American Eagle Outfitters reported that it has opened 16 and closed 11 stores globally in the second quarter, ended August 1, 2020. Year to date, the company has closed 13 American Eagle brand stores and five Aerie stores in the US, according to our estimates. Casey’s Opens Nine and Closes Two Stores Convenience store chain Casey’s reported that it opened nine and closed two stores in the second quarter, ended July 31, 2020. The company operates 2,214 stores as of July 31, 2020. We had already accounted for the openings in our chart. Francesca’s Opens One and Closes Four Stores Women’s specialty apparel retailer Francesca’s has reported that it opened one new store and permanently closed four stores in the second quarter, ended August 1, 2020. The company operates about 700 stores as of August 1, 2020. GameStop Closes 388 Stores Worldwide Video-game retailer GameStop reported that it closed a net total of 206 stores worldwide in the second quarter, ended August 1, 2020 and 388 stores year to date. The company operates 5,122 stores worldwide as of September 10, 2020, with more than 3,000 in the US alone. Our figure in the store-closures chart below is an estimate for the US. RH Closes One Store Upscale home-furnishings retailer RH reported that it closed one store in the second quarter, ended August 1, 2020. The retailer operates 121 stores as of August 1, 2020.Non-Store-Closure News

Brookfield Property Group and Simon Property Set To Take Over JCPenney Department store chain JCPenney has confirmed that mall owners Brookfield Property Group and Simon Property will take over its business, after managing to reach a sale agreement through a court-supervised process for $1.75 billion, which includes both cash and new term loan debt. Under the agreement, the signing parties may create a separate real estate investment trust and property holding company that will include 161 of the company’s real estate assets along with all of its owned distribution centers. The company had filed for bankruptcy in May with a plan to rationalize its network of 860 stores in phases. J.Crew Exits Bankruptcy Clothing retailer J.Crew has announced that it exited bankruptcy, with its lenders taking over controlling ownership and Anchorage Capital Group now becoming its majority owner through the conversion of about $1.65 billion in debt into equity. The plan provides the retailer a $400 million exit facility and $400 million of new term loans from its lenders. In addition to this, the retailer has access to a new $400 million asset-based credit facility due in 2025 from Bank of America, NA. J.Crew operates 170 namesake stores, 170 J.Crew factory outlet stores and 142 Madewell stores across the country, along with its websites. It exited the bankruptcy plan with 11 namesake stores down and up one Madewell location. Michaels Launches Concept Stores Arts and crafts retailer Michaels has remodeled two Texas stores as part of a strategy that caters to building a unique shopping experience for the new-age customer. The concept stores have new layouts that enable customers to easily view and navigate the full range of merchandise in the stores, and also provide shop-and-scan facilities for easy checkout. The new layout and checkout system is also designed to provide additional storage space that will facilitate curbside delivery and pickup of online orders. The store has a special feature termed as “maker space” that lets the customer watch an instructor-led project on display screens. [caption id="attachment_116355" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. *Total includes a small number of retailers that each announced fewer than ten store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_116356" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.*Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=460]

Source: Company reports/Coresight Research

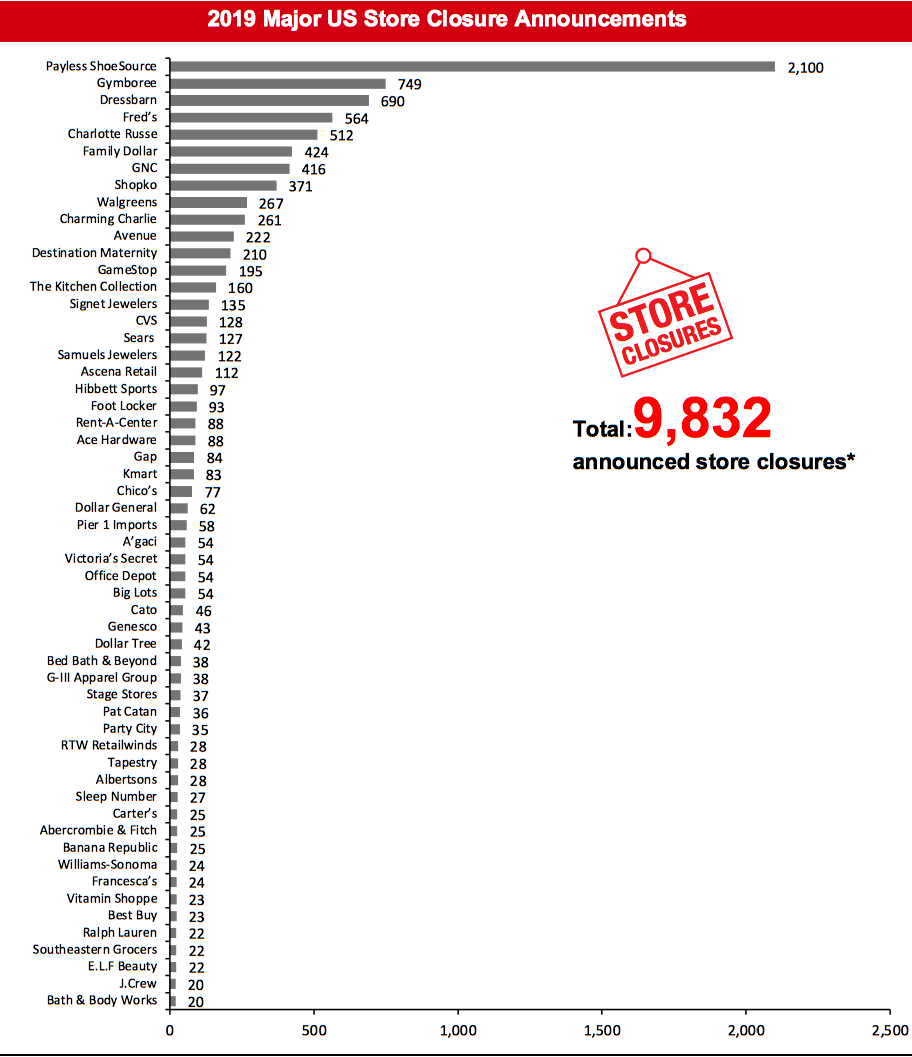

[caption id="attachment_116358" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_116359" align="aligncenter" width="700"]

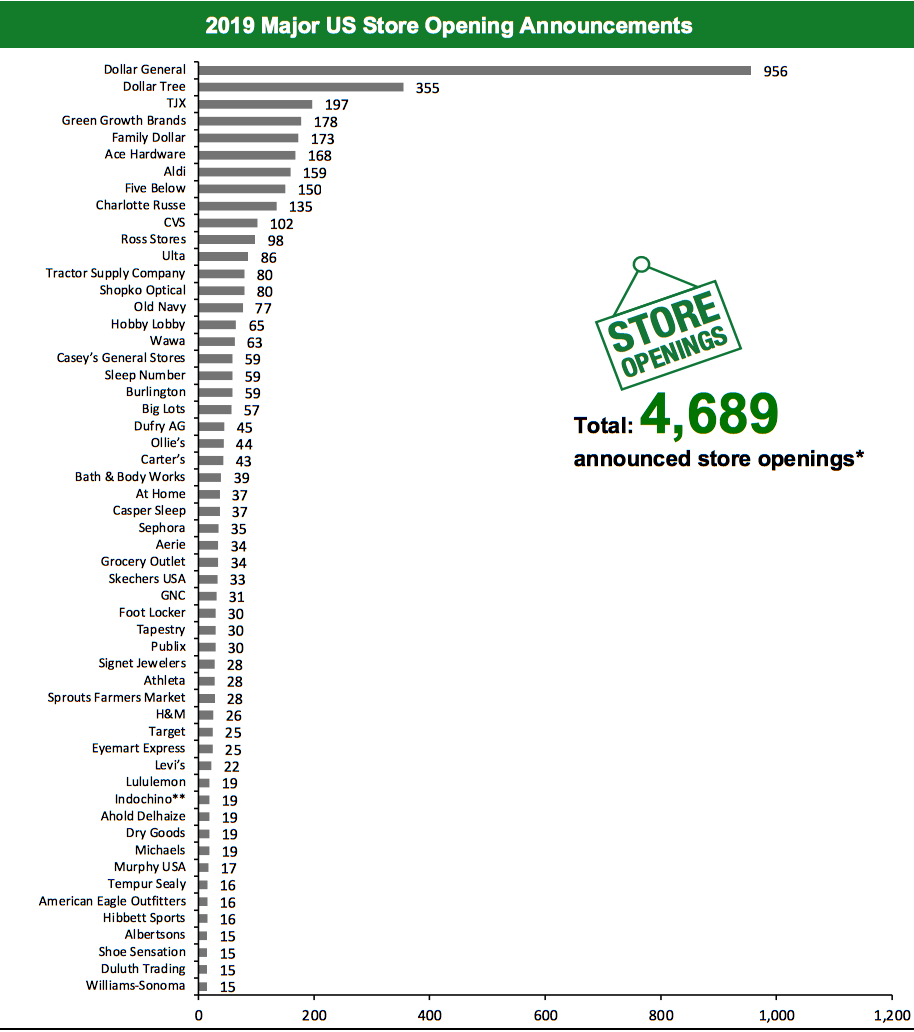

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=461]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=462]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

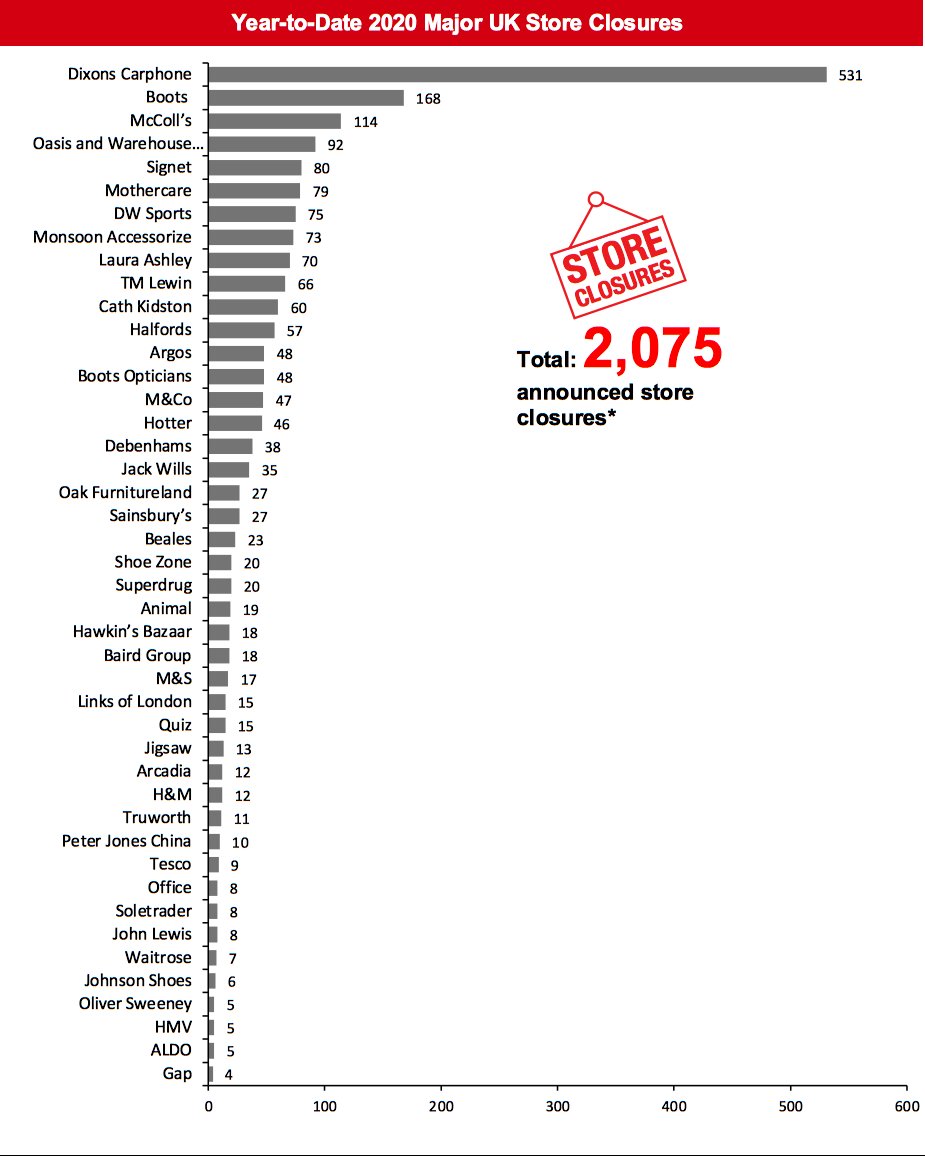

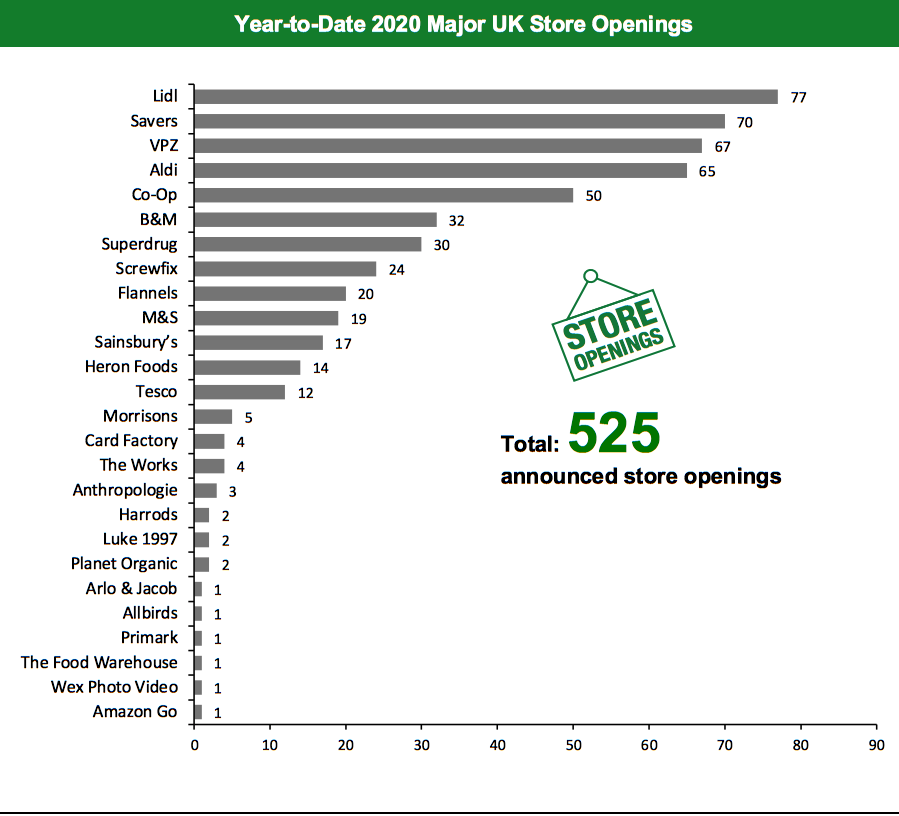

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 2,075 store closures and 525 store openings. Our data represent closures and openings by calendar year. This week, we have updated our 2020 UK closure count for Quiz and Waitrose and this has changed our 2020 UK closure count to 2,075. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=113]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Quiz To Close 15 Stores Fashion retailer Quiz has announced that it will shutter 15 stores permanently. In a trading update, the retailer announced that it expects to reopen 60 out of the 75 stores that it had operated prior to the coronavirus crisis. Waitrose To Close Four More Stores Supermarket chain Waitrose plans to close four more stores permanently across the UK. The closures will take place in December, putting about 124 jobs at risk. The plan to close stores in Caldicot, Ipswich Corn Exchange and Shrewsbury locations is part of the retailer’s restructuring, which began in 2017. The company announced that it will be selling its Wolverhampton store to Tesco and that 140 employees will be transferred to the new Tesco store in the same location; we count this as a closure for Waitrose and an opening for Tesco. The retailer had previously closed stores in Four Oaks, Helensburg and Waterlooville earlier this year, and including the latest round of closures, the retailer has announced seven closures year to date. The retailer clarified that its Ipswich supermarket in Futura Park will remain open.Non-Store-Closure News

L Brands To Partner with Next US specialty apparel retailer L brands has announced that it has entered into a partnership with clothing and home products retailer Next to operate its company-owned Victoria’s Secret business in the UK and Ireland (Victoria’s Secret UK). The joint venture (JV) agreement between Victoria’s Secret UK and Next, which is subject to regulatory clearance, states that Next will own 51% of the JV, and Victoria’s Secret will own 49%. This deal will safeguard around 500 jobs that were previously at risk. The UK division of Victoria’s Secret had entered into administration in June this year, with more than 800 jobs facing uncertainty. New Look’s Creditors Approve CVA Apparel retailer New Look has managed to get its company voluntary arrangement (CVA) proposal approved, thus avoiding a collapse and saving about 11,000 jobs. Following the CVA approval, New Look is now looking to switch more than 400 of its UK stores to a turnover-based rent model. The terms include enhanced landlord break clauses and a three-year rent holiday for its remaining 68 stores. [caption id="attachment_116364" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S, Sainsbury’s and Truworth. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S, Sainsbury’s and Truworth. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.*Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_116365" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=464]

Source: Company reports/Coresight Research

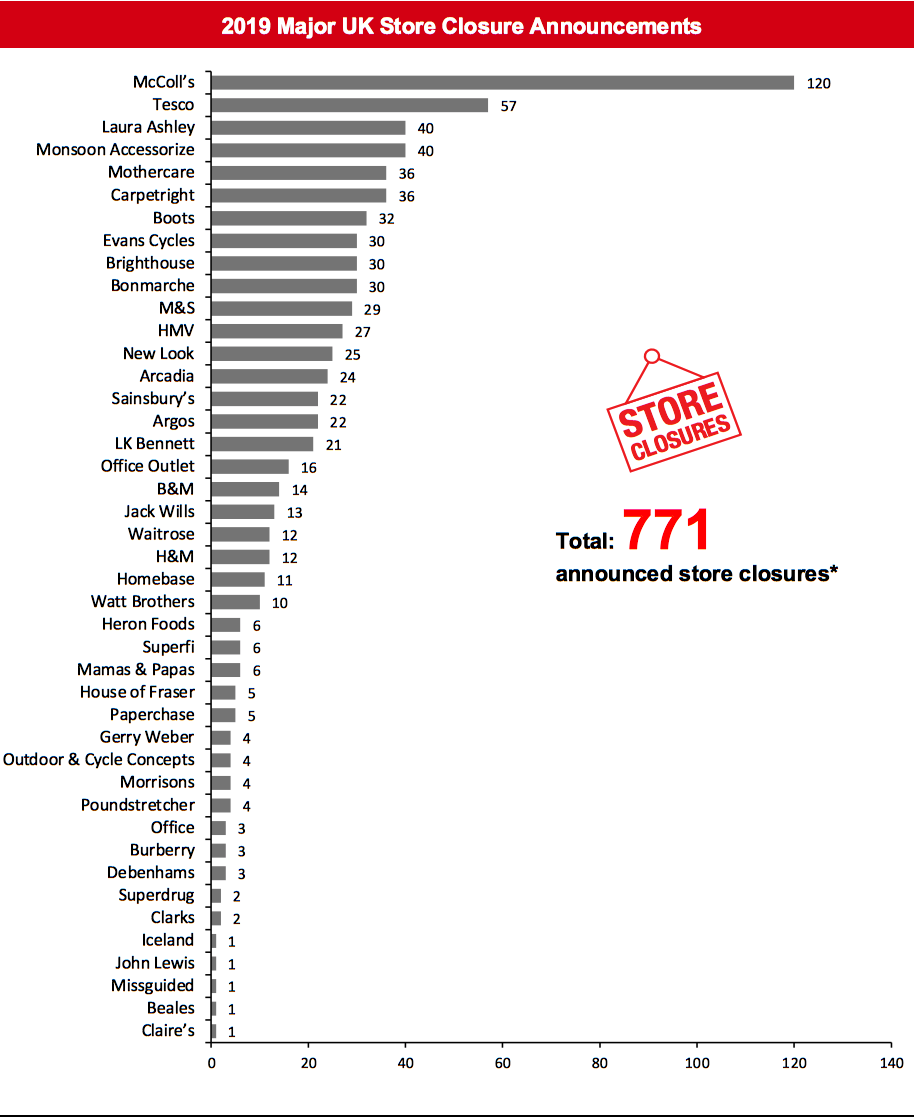

[caption id="attachment_116367" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

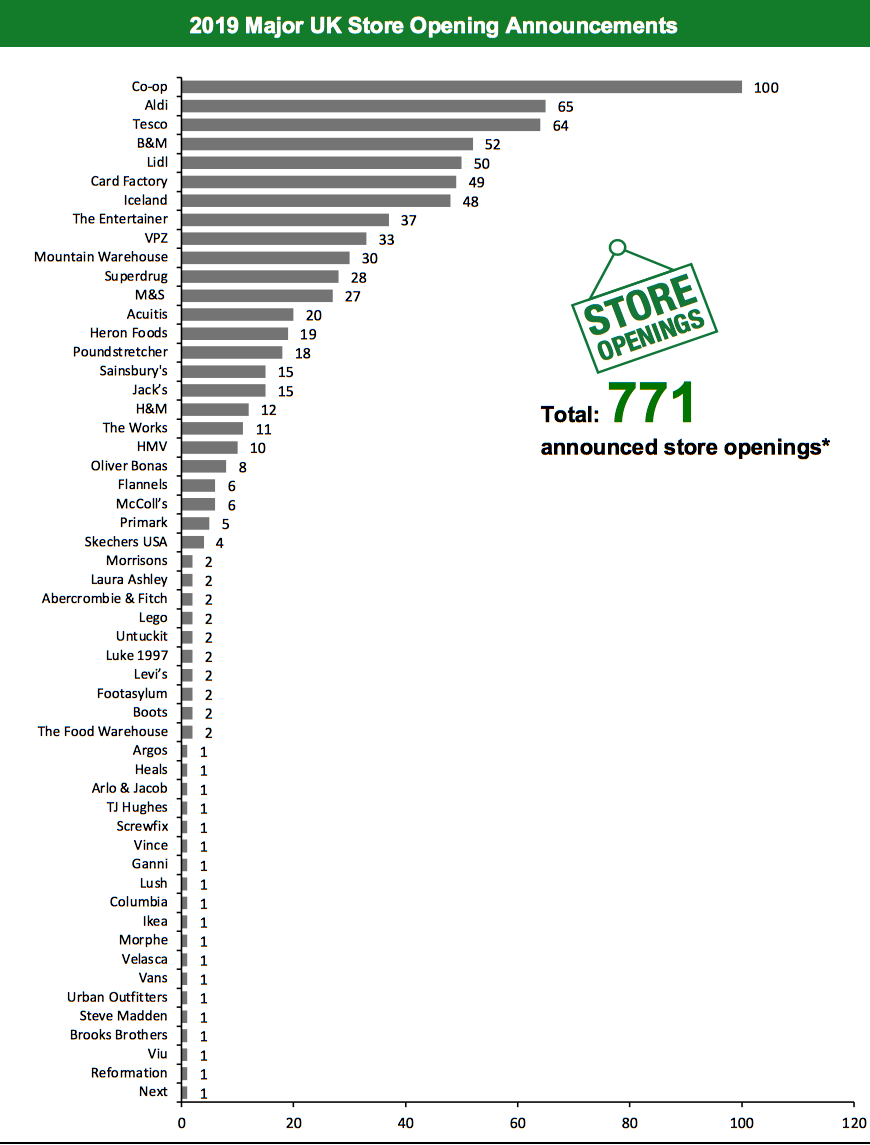

Source: Company reports/Coresight Research[/caption] [caption id="attachment_116368" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.