Nitheesh NH

The US

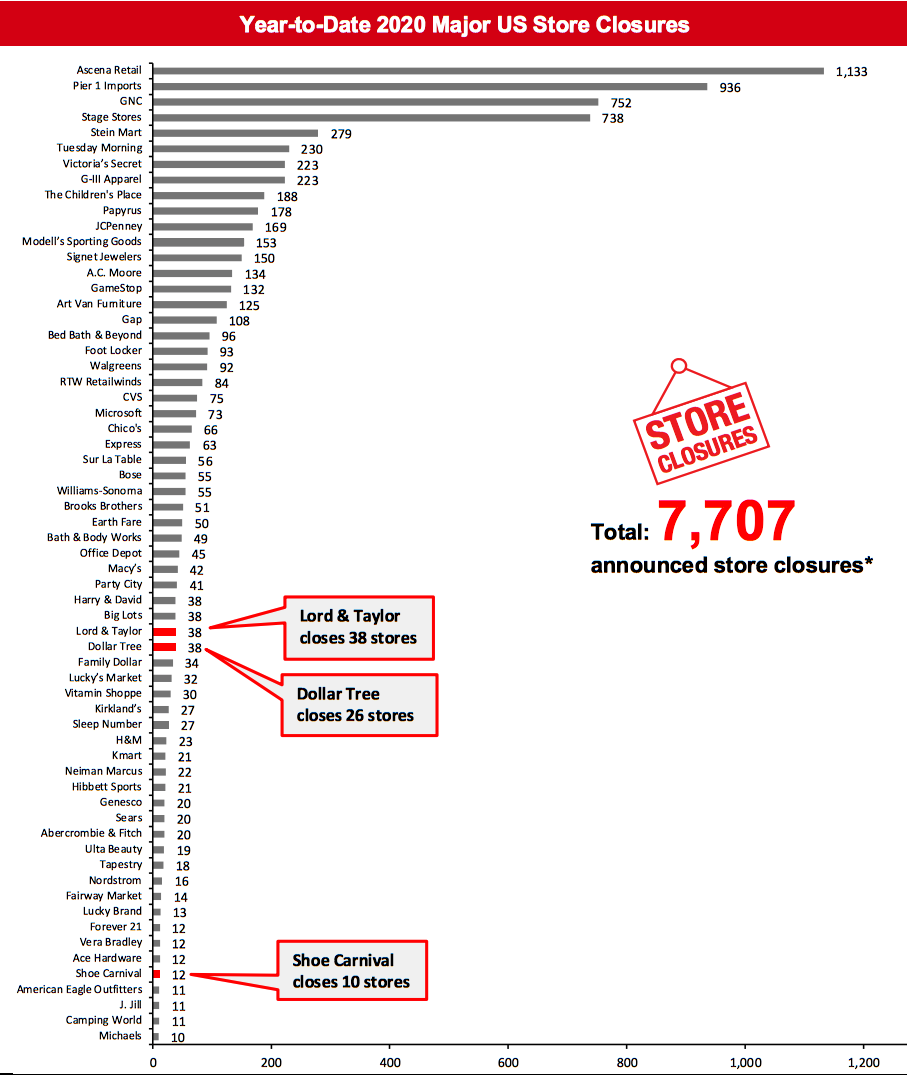

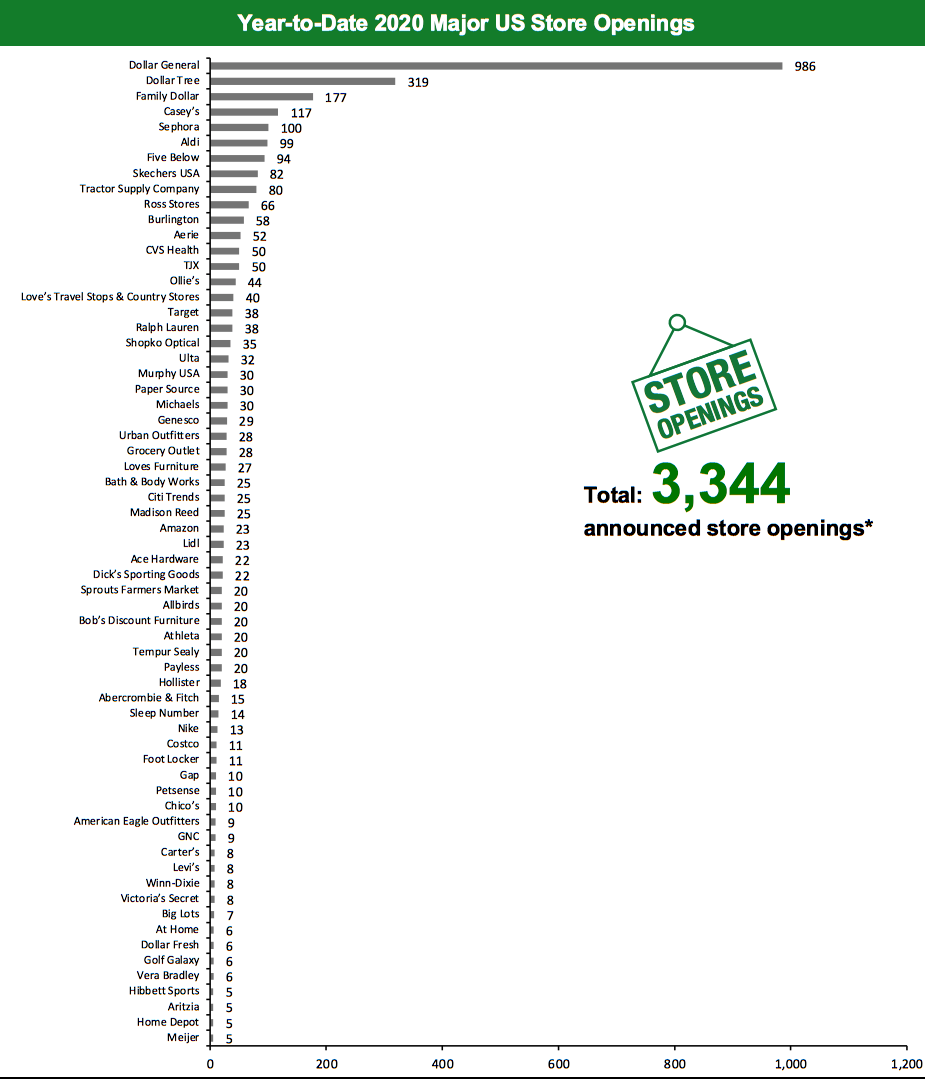

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 7,707 planned store closures and 3,344 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Abercrombie & Fitch, Dollar Tree, Dick’s Sporting Goods, Hibbett, Lord & Taylor and Shoe Carnival, and this has changed our 2020 US closure count to 7,707. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=108]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from Cato and Neighborhood Goods, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Amazon Opens First Amazon Fresh Physical Grocery Store Amazon has opened its first Amazon Fresh physical grocery store in Woodland Hills, California, which offers a seamless shopping experience to the consumer. Spread across 35,000 square feet, the high-tech store also provides same-day delivery and pick-up services. The store will feature Amazon’s new automated “Dash Carts,” which have inbuilt scales to weigh items, enabling shoppers to check out without having to make contact with a cashier. Shoppers can also access their Alexa shopping lists from their Amazon profile by scanning a QR code. Coresight Research insight: In the wake of the coronavirus crisis, consumers are averse to crowds and are looking at ways to make their shopping journeys safe and efficient. They are also allocating some additional spending to food at home and cutting back on discretionary spending. Amazon’s timing of opening its Fresh store addresses both these consumer trends: It has leapfrogged the transition to contact-light in-store shopping experiences and is making fresh food and essentials accessible through a neighborhood-format store. JCPenney Set To Close Additional Stores Department store chain JCPenney is set to close additional stores after discussions over its potential acquisition by three prospective bidders including Simon Property Group and Brookfield have stalled. Following filing for bankruptcy in May, the company had previously announced plans to shut more than 150 locations. The company has not yet divulged details on the list of additional stores to be closed. Lord & Taylor To Close All 38 Stores Department store chain Lord & Taylor has announced that it is liquidating all of its assets and shutting all 38 remaining stores. The company had filed for bankruptcy in August and planned to keep 14 stores open, while 24 stores were to shut permanently. Lord & Taylor opened its first store nearly 200 years ago, in 1826. The company’s existing inventory and new arrivals will be offered for sale at deep discounts. The company will also sell its in-store fixtures, equipment and furniture. Lidl To Open 50 Stores and Close Two Stores Discount retailer Lidl has announced plans to open 50 stores by the end of 2021 in locations including Delaware, Georgia, Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina and Virginia. Lidl plans to invest over $500 million in new stores, creating close to 2,000 new jobs. The company will close two stores in Havelock and Shelby, North Carolina, as part of its efforts to prioritize the most convenient locations. Southeastern Grocers To Reduce Its Store Count Supermarket chain Southeastern Grocers plans to sell 23 Bi-Lo and Harveys Supermarket stores to Alex Lee, the North Carolina-based owner of Lowes Foods and Merchants Distributors as part of its efforts to reduce its store count. The company had filed for bankruptcy in 2018. Leading up to the bankruptcy filing, Southeastern Grocers had closed 94 stores and then further shuttered 22 stores, including seven Winn Dixie locations, eight months after emerging from financial reorganization.Quarterly Store Openings/Closures Settlement

Abercrombie & Fitch Co. Opens Two and Closes Six Stores Specialty apparel retailer Abercrombie & Fitch Co. has reported that it opened two and closed six stores in the second quarter of 2020, ended August 1, 2020. Burlington Plans To Open 62 Stores In its earnings call for the second quarter ended August 1, 2020, off-price retailer Burlington announced that it plans to open 62 new stores and close or relocate 26 stores, for a total of 36 net new stores in fiscal 2020. Chico Closes Nine Stores Specialty retailer Chico has reported that it closed nine stores in the second quarter of 2020, ended August 1, 2020. Dollar Tree Opens 131 Stores and Closes 26 Stores Dollar store chain Dollar Tree has reported that it has opened 131 stores, expanded or relocated 22 stores and closed 26 stores in the second quarter, ended July 31, 2020. The company operates 15,479 stores across 48 states, as of July 31, 2020. Dollar General Opens 250 stores Dollar store chain Dollar General has reported that it has opened 250 stores in the second quarter, ended July 31, 2020. It has also remodeled 492 stores and relocated 26 stores. The company operates 16,720 stores in 46 states, as of July 31, 2020. Dicks Sporting Goods Opens Three Stores and Closes Two Omnichannel sporting goods retailer Dick’s Sporting Goods has reported that it opened three stores and closed two in the second quarter, ended August 1, 2020. The company operates 726 stores. Gap Closes 95 Stores Apparel retailer Gap has reported that it closed 95 stores in the second quarter, ended August 1, 2020. Hibbett Sports Opens Three and Closed Eight stores Sporting goods retailer Hibbett Sports reported that it opened three and closed eight stores in the second quarter, ended August 1, 2020. It has also rebranded four Hibbett stores to City Gear stores. The company operates 1,077 stores in 35 states as of August 1, 2020. Ollie’s Bargain Outlet Opens Six Stores Discount store chain Ollie’s Bargain Outlet reported that it opened six stores in the second quarter, ended August 1, 2020. The company operates 366 stores in 25 states, as of August 1, 2020. Shoe Carnival Opens Two and Closes 10 Stores Footwear and accessories retailer Shoe Carnival has reported that it opened two new stores and closed 10 stores in the second quarter, ended August 1, 2020. Williams Sonoma Closes Five and Opened Three Stores Home-furnishings and kitchenware retailer Williams Sonoma has reported that it opened three stores and closed five during its second quarter, ended August 2, 2020.Non-Store-Closure News

RTW Retailwinds Sells Its E-Commerce Business Specialty womenswear retailer RTW Retailwinds has sold its e-commerce business to Saadia Group for a cash purchase price of $40 million. The sale includes all related intellectual property including its websites Nyandcompany.com, Fashiontofigure.com and its rental subscription businesses at Nyandcompanycloset.com and Fashiontofigurecloset.com. RTW Retailwinds had filed for Chapter 11 bankruptcy in July this year. Walgreens Appoints New President Drugstore chain Walgreens has appointed John Standley, the former CEO of Rite Aid, as its President. The company stated that Standley will lead operations and be responsible for the development, growth and management of the business. His operational experience shall effectively contribute to the key strategic priorities: creating neighborhood health destinations, driving cost transformation, accelerating digitalization and restructuring Walgreens’ retail offering. [caption id="attachment_115745" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.*Total includes a small number of retailers that each announced fewer than ten store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115746" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=430]

Source: Company reports/Coresight Research

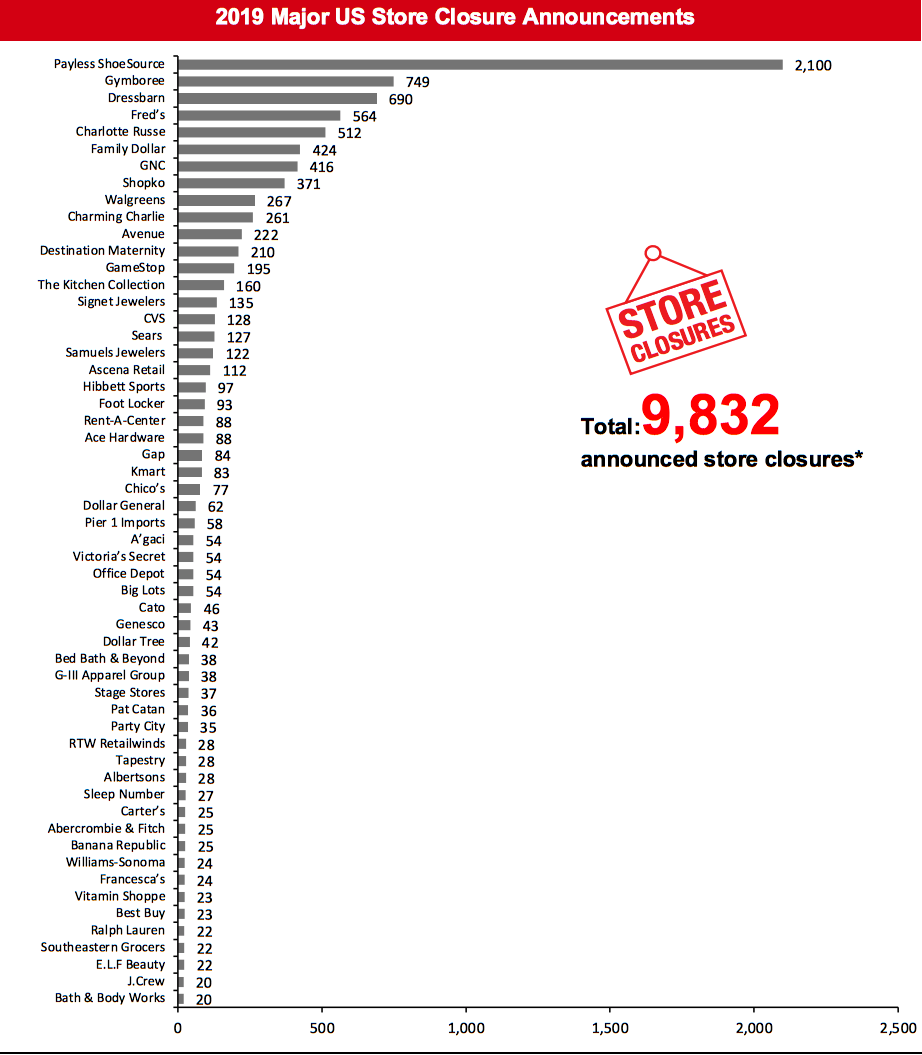

[caption id="attachment_115748" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115749" align="aligncenter" width="700"]

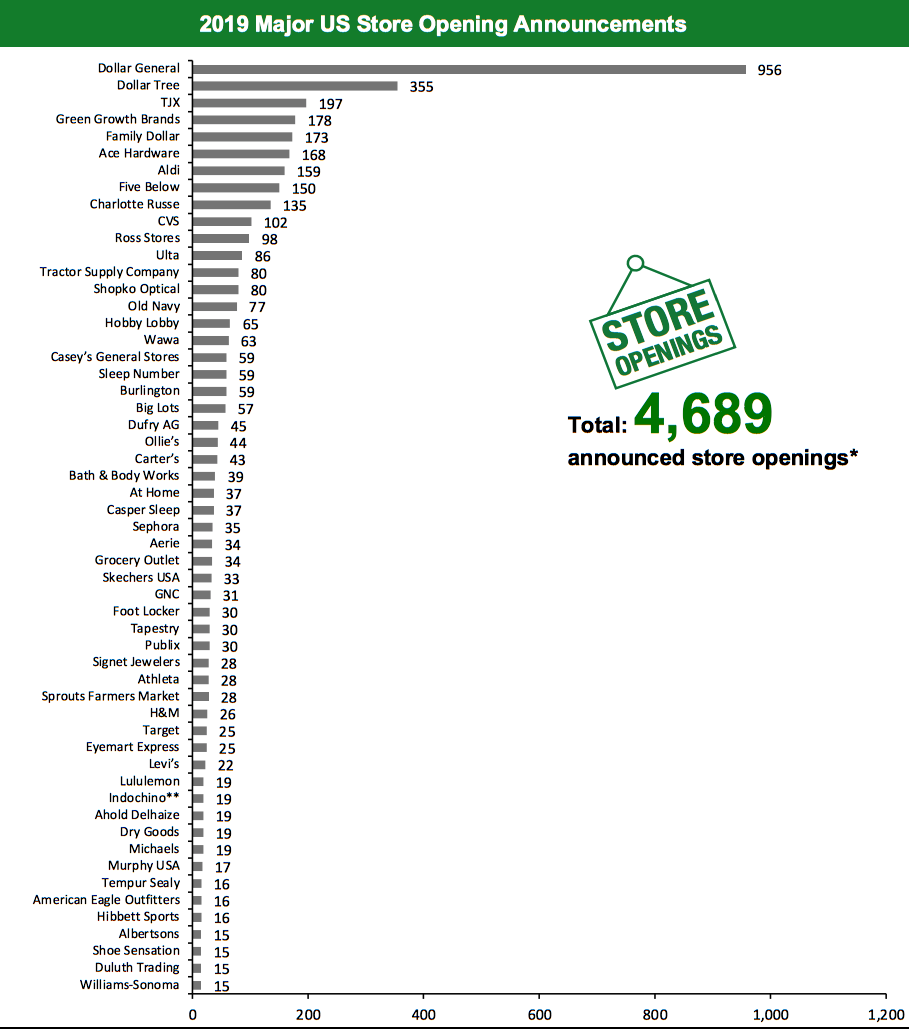

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=431]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=432]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

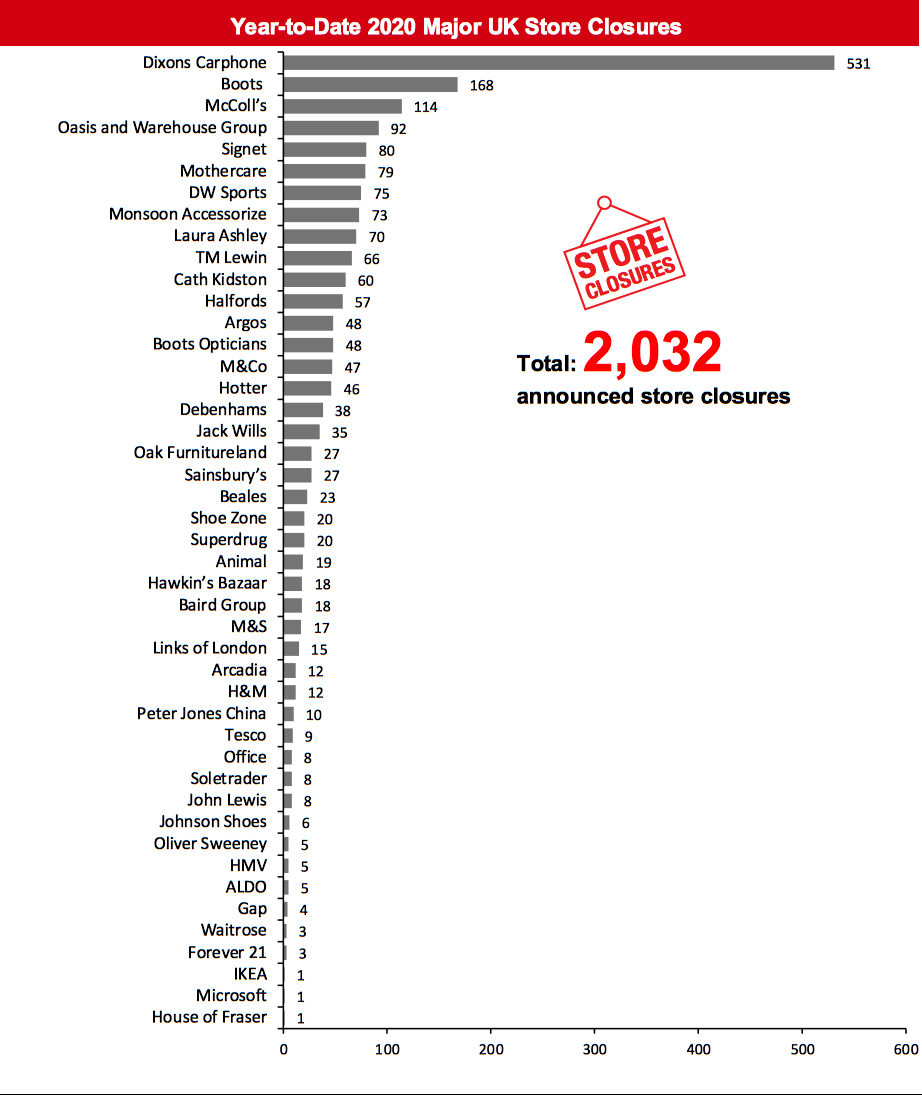

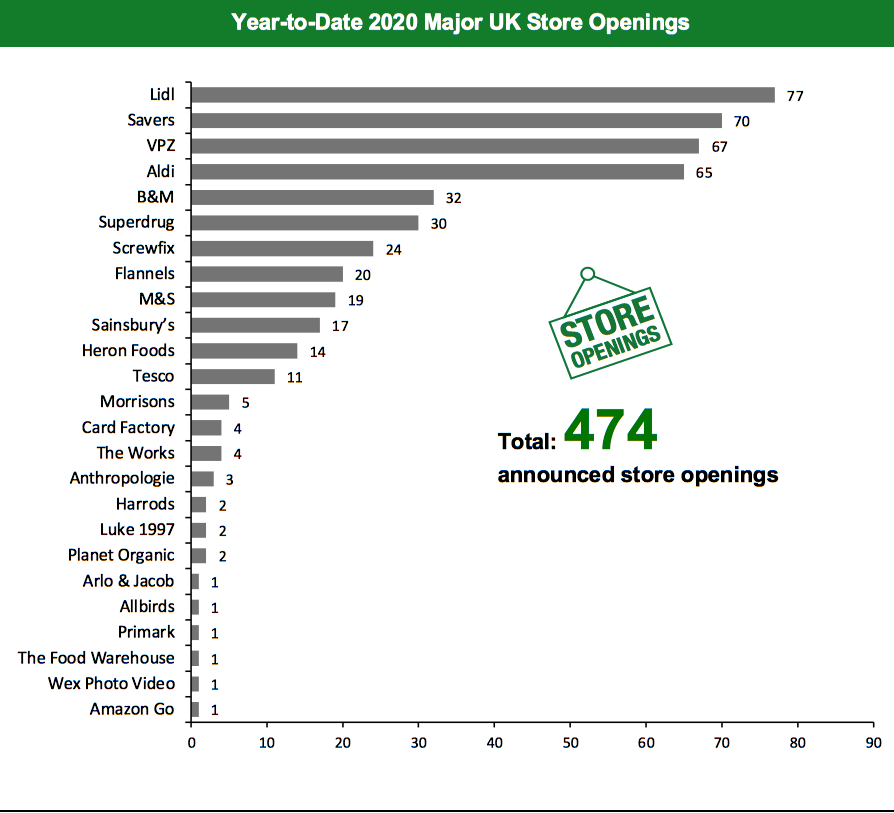

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 2,032 store closures and 474 store openings. Our data represent closures and openings by calendar year. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=109]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Screwfix To Open 30 New Stores Screwfix, a multichannel retailer of trade tools, accessories and hardware products, has announced that it will open 30 new stores and provide up to 300 jobs in areas such as retail management, as well as supervisory and service assistance roles, by the end of January 2021. The growth of the business amid the challenges of Covid-19 indicates increasing demand for convenience. Moss Bros Mulls CVA Moss Bros, a specialty apparel retailer, has decided that it will undergo a restructuring process after experiencing a drop in sales due to the ban on large weddings and cancellations of large-scale events such as Royal Ascot. The retailer has solicited the service of advisers from KPMG to advise on a company voluntary arrangement (CVA) to permanently close some of its 125 stores and work out rents on others.Non-Store-Closure News

H&M Appoints New CTO H&M Group, in an endeavor to step up its digital transformation scheme, has appointed Alan Boehme as its Chief Technology Officer. He will co-lead a new division called Business Tech along with Chief Product Officer Daniel Claesson. This division will focus on improving H&M Group’s innovation and digital capabilities. Ocado Appoints New CFO Online grocery retailer Ocado has announced that CFO Duncan Tatton-Brown has resigned after eight years with the company. Stephen Daintith, who currently holds the position of CFO at Rolls-Royce Holdings, will replace Tatton-Brown. [caption id="attachment_115753" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.Source: Company reports/Coresight Research[/caption] [caption id="attachment_115754" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=434]

Source: Company reports/Coresight Research

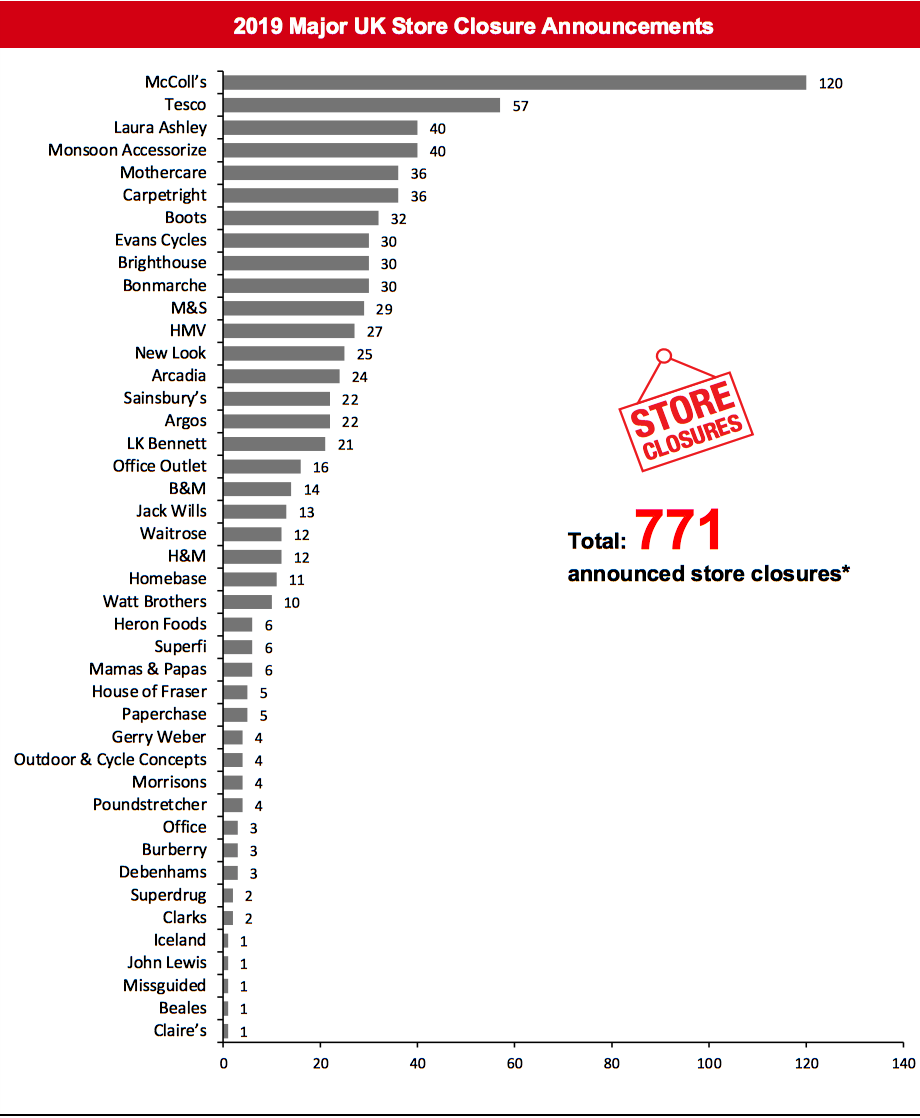

[caption id="attachment_115756" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115757" align="aligncenter" width="700"]

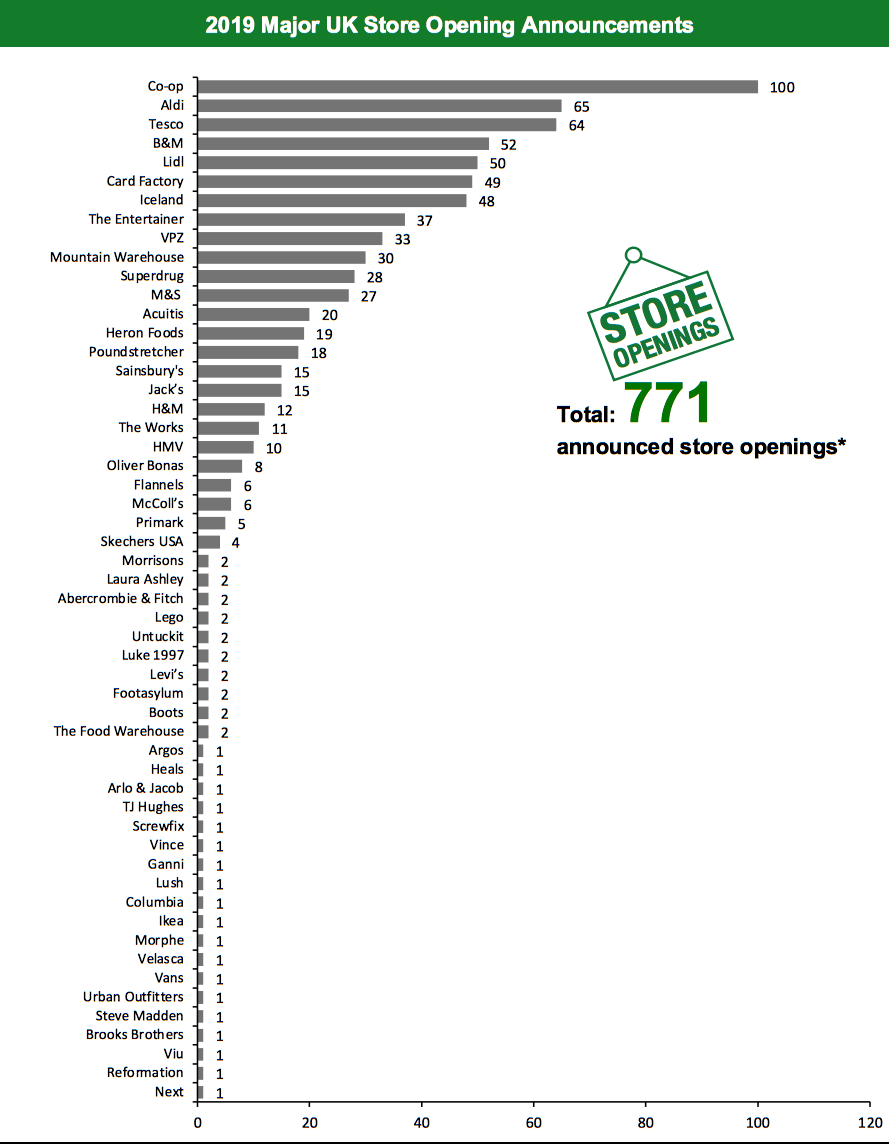

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption]