Nitheesh NH

The US

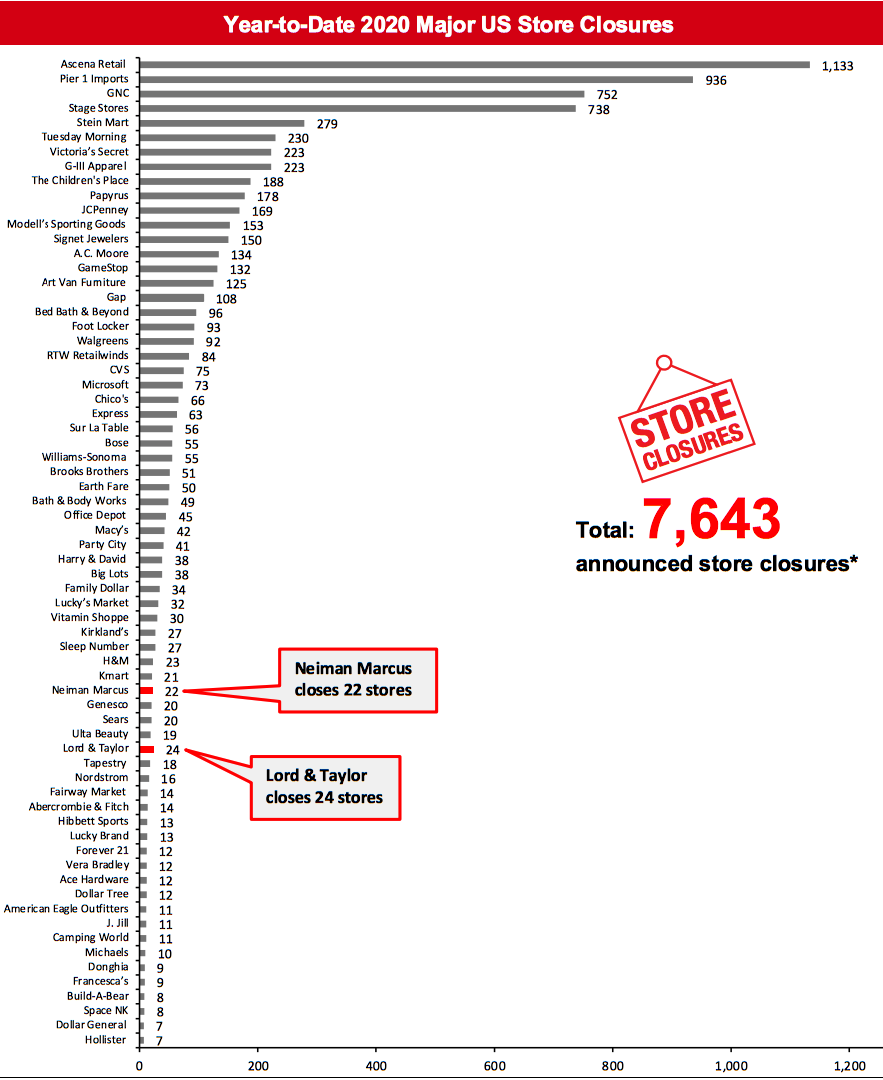

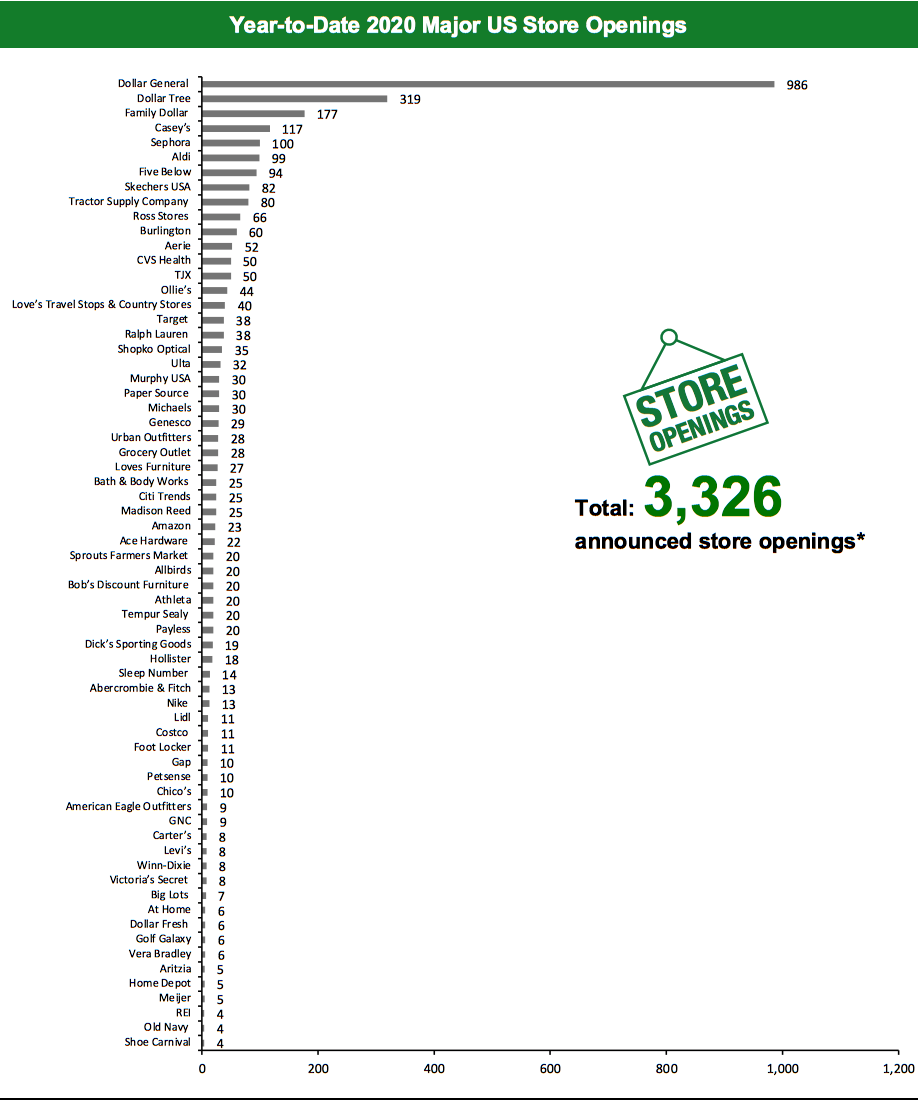

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 7,643 planned store closures and 3,326 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Lord & Taylor and Neiman Marcus, and this has changed our 2020 US closure count to 7,643 The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=106]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from La-Z-Boy and Best Buy, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Amazon May Open Three stores Amazon is reportedly widening its network of cashier-free grocery stores in Southern California, with city documents and media reports indicating that three new Amazon stores are set to open, one each in Fullerton, LA Verne and North Hollywood. KB US Holdings Files for Bankruptcy KB US Holdings, the parent company of East Coast supermarket chains Kings Food Markets and Balducci’s Food Lover’s Market, has filed for Chapter 11 bankruptcy. According to a press release, the company has accepted a stalking horse bid from TLI Bedrock, which is looking to acquire the company for $75 million in the next 60 days. The company is also seeking “higher and better” bids from other potential suitors as part of the bankruptcy proceedings. Kings Food Markets currently operates 25 supermarkets, and Baldcucci operates 10 stores. Lord & Taylor To Close 24 Stores Department store chain Lord & Taylor has announced that it will close 24 stores permanently. The chain had filed for Chapter 11 bankruptcy protection in the first week of August. It had earlier announced that store closing sales had already begun at 19 store locations out of 38 and has now added five more stores to the list this week: Huntington Station, New York; Livingston and Rockaway, New Jersey; Salem, New Hampshire; and Schaumburg, Illinois. Neiman Marcus Closes Its Store in Washington, D.C. Luxury department store retailer Neiman Marcus is closing its 130,000-square-foot store in Washington, D.C., making it the company’s fifth full-priced store to close after the retailer announced the closure of four department stores and 17 off-price stores in July. As the coronavirus began taking a heavy toll on retailers in the US, Neiman Marcus was among the first major retailers to file for Chapter 11 bankruptcy protection in May. Coresight Research insight: Apparel stores are the biggest contributor to store closures, by number of units. However, not all stores are equal, and department store closures tend to have far greater repercussions. Despite having lost much of their consumer appeal, department stores still serve as the anchors for most shopping malls, and those centers risk losing some of their appeal, and thus traffic, when department stores close. Moreover, co-tenancy clauses enable tenants of smaller, in-line stores to pay lower rent or terminate their leases when an anchor tenant leaves. The widespread sector closures are therefore one factor behind our view that one-quarter of all US malls could close in the next five years. Payless To Open More Than 300 Stores Discount footwear retailer Payless has re-entered the market. As part of its new omnichannel strategy, it plans to open 300–500 freestanding stores across North America over a period of five years. As reported by Women’s Wear Daily, Payless plans to open 30–45 stores in Texas and the US-Mexico border region by the end of next year. The retailer had filed for bankruptcy protection in February 2019, which led to the closure of more than 2,000 stores and the shutdown of its e-commerce operations.Quarterly Store Openings/Closures Settlement

L Brands Announces Store Closures and Openings Specialty fashion retailer L Brands, which owns the Victoria’s Secret, PINK and Bath & Body Works banners, has reported that it closed 186 US stores and opened nine stores in the second quarter of 2020, ended August 1, 2020. Estée Lauder To Close Stores Beauty brand owner Estée Lauder reported that it estimates the closure of 10–15% of its freestanding stores globally for its fiscal year ended June 30, 2021 as part of its “Post-COVID Business Acceleration Program.” The company expects this plan—which also includes cutting up to 2,000 jobs (around 3% of its current workforce) and investing in its digital capabilities—to yield benefits of up to $400 million per year. Foot Locker Opens Six New Stores and Closes One Footwear specialty retailer Foot Locker has reported that it has opened six stores and closed one store in its second quarter of fiscal year 2020, ended August 1, 2020. It has also remodeled and relocated 26 stores. The retailer owns and operates 872 stores in the US, as of August 1. The Children’s Place Closes 98 Stores Specialty retailer of children’s apparel and accessories The Children’s Place has reported that it permanently closed 98 locations and opened two in the second quarter of 2020, ended August 1, 2020. The retailer currently owns and operates 824 locations in the US, Canada and Puerto Rico. Urban Outfitters Closes Three Stores Apparel and lifestyle retail group Urban Outfitters has reported that it closed three stores and opened one new store in its second quarter, ended July 31, 2020.Non-Store-Closure News

Amazon’s Consumer CEO Resigns Jeff Wilke, the CEO of Amazon’s worldwide consumer business, has announced plans to retire from his role in the first quarter of 2021. Wilke was widely regarded as a potential successor to the company’s CEO Jeff Bezos, if the latter were to step down at any point. Wilke will be replaced by Dave Clark, who is currently the company’s Senior VP of worldwide operations. Jeff Wilke has been associated with Amazon since 1999 and was appointed as the CEO of the worldwide consumer unit in 2013. Amazon Becomes Toys “R” Us’ New E-Commerce Partner Amazon has replaced Target as the toy retailer Toys “R” Us’ new online sales partner. Amazon will handle the retailer’s digital and fulfillment services, which had been supported by Target since October 2019. The shoppers who visit the ToysRUs.com website will now be redirected to Amazon.com where they can complete their purchase. Toys “R” Us struggled to adapt its business to a digital landscape and had filed for Chapter 11 bankruptcy protection in September 2017. It subsequently decided in March 2018 that it would close all of its physical stores in the US and the UK. [caption id="attachment_115513" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115514" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=424]

Source: Company reports/Coresight Research

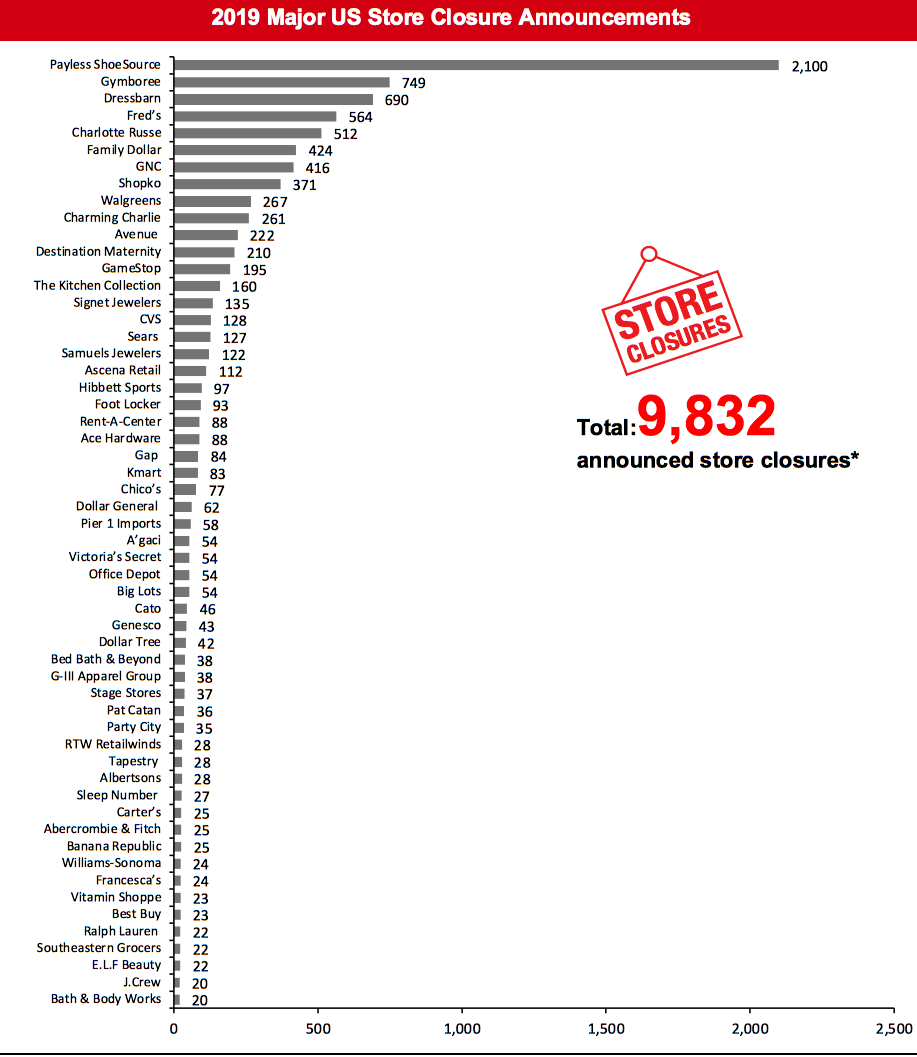

[caption id="attachment_115517" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115518" align="aligncenter" width="700"]

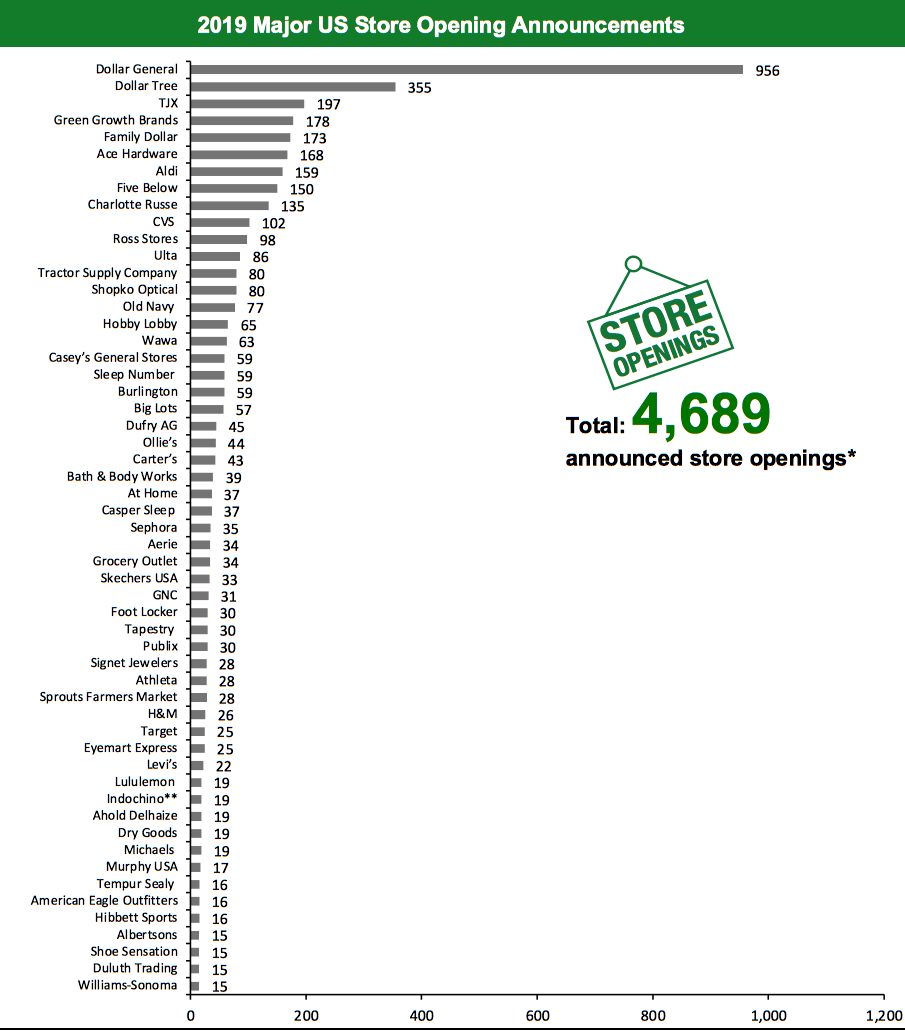

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=425]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. **J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=426]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

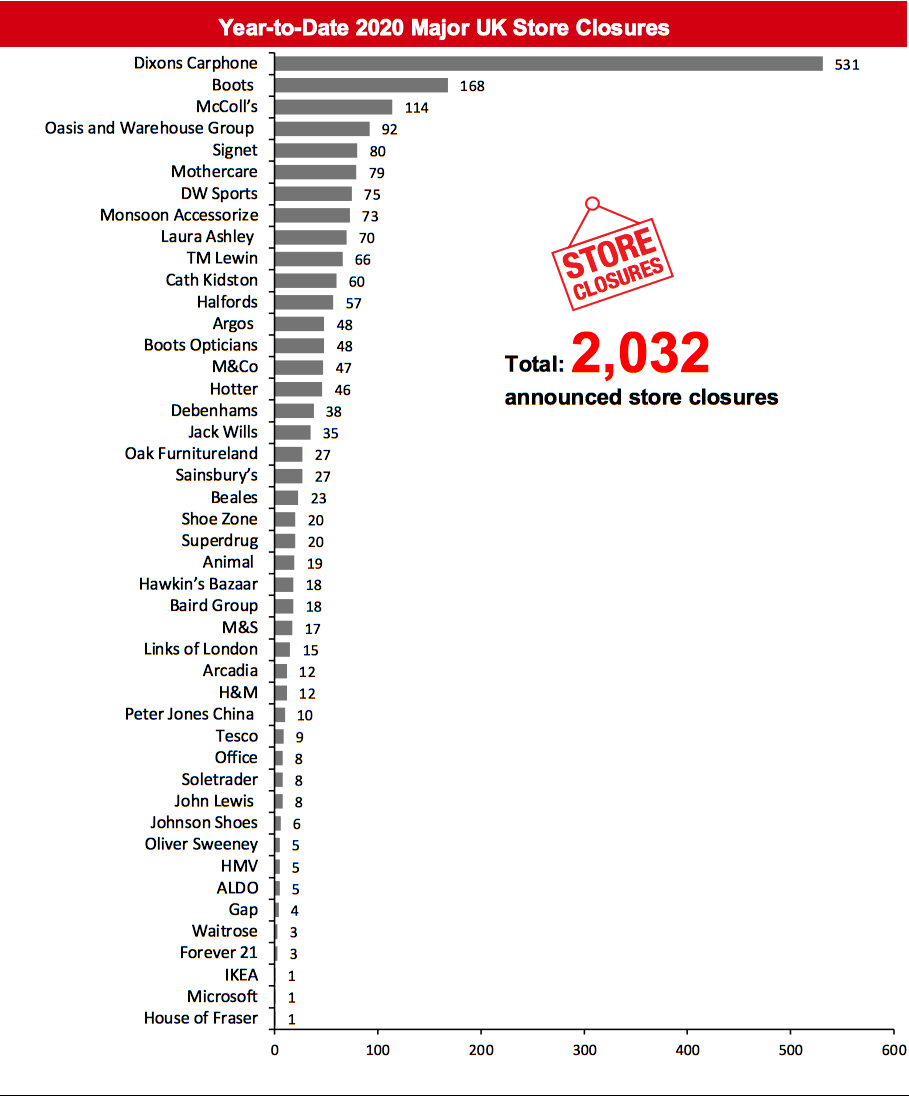

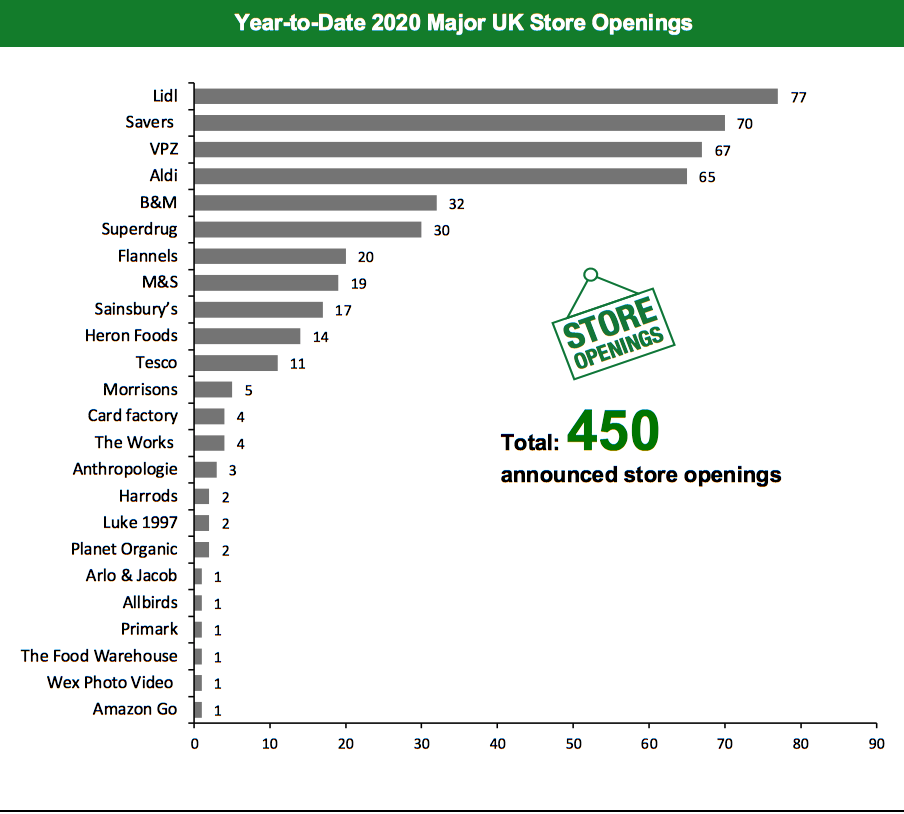

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 2,032 store closures and 450 store openings. Our data represent closures and openings by calendar year. The chart below depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=107]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Debenhams Owner Prepares for Administration Celine Group Holdings, parent company of Debenhams, has reportedly assigned the task of its own administration to advisers Philip Watkins and Philip Armstrong from FRP Advisory. This move will mean that Celine Group can avoid payment of overdue interest on £200 million ($263 million) of bonds, which was due on July 15, 2020. Frasers Group Set To Open New Stores and Close Others Sports goods and department store retailer Frasers Group is set to invest £100 million ($131.5 million) in expanding its online presence and opening stores in shopping centres. Frasers Group is on the lookout for leasehold sites in shopping centres. It plans to engage the sites for Flannels stores and Sports Direct shops, based on a higher-end concept that it is currently testing at a 90,000-square-foot site in Leicester, which will include an e-sports arena. However, Frasers Group said that it might close more House of Fraser stores as it warned of continued job losses.Non-Store-Closure News

Morrisons Launches “Morrisons on Amazon” Store Supermarket chain Morrisons, in partnership with Amazon, has launched a “Morrisons on Amazon” store, which facilitates consumers to place orders for all its groceries directly through the Amazon website and app. Once the order is placed, the retailer’s staff will pick the items from the local Morrisons store and the Amazon Flex delivery partner will deliver it to the consumer. Sweaty Betty May Sell Its business Women’s activewear retailer Sweaty Betty is reportedly preparing to sell its busines, which could be worth around £400 million ($524 million), according to Bloomberg. L Catterton, a consumer-focused private equity firm, is one of the largest backers of Sweaty Betty, which operates more than 60 stores across Canada, Hong Kong, the UK and the US. [caption id="attachment_115522" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Baird Group includes Ben Sherman, Jeff Banks and Suit Direct licensed stores among others.Source: Company reports/Coresight Research[/caption] [caption id="attachment_115523" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=428]

Source: Company reports/Coresight Research

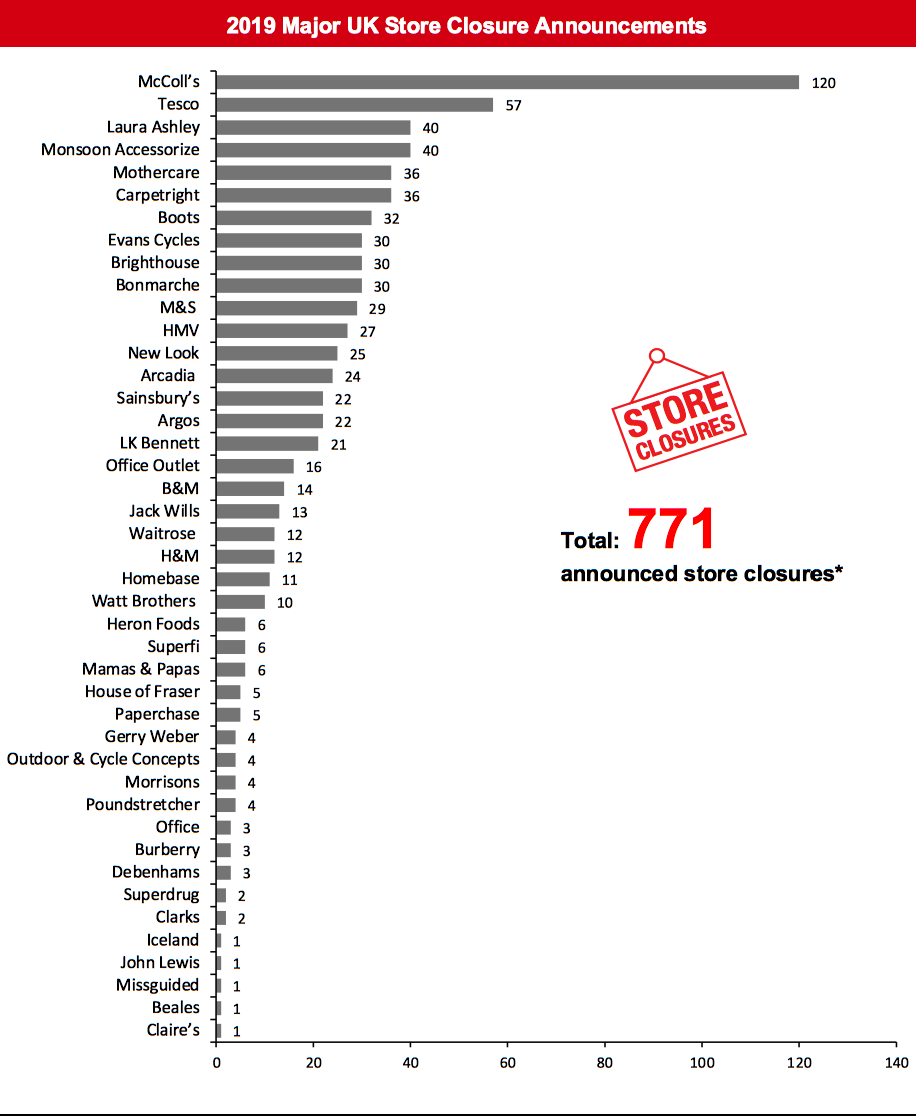

[caption id="attachment_115525" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_115526" align="aligncenter" width="700"]

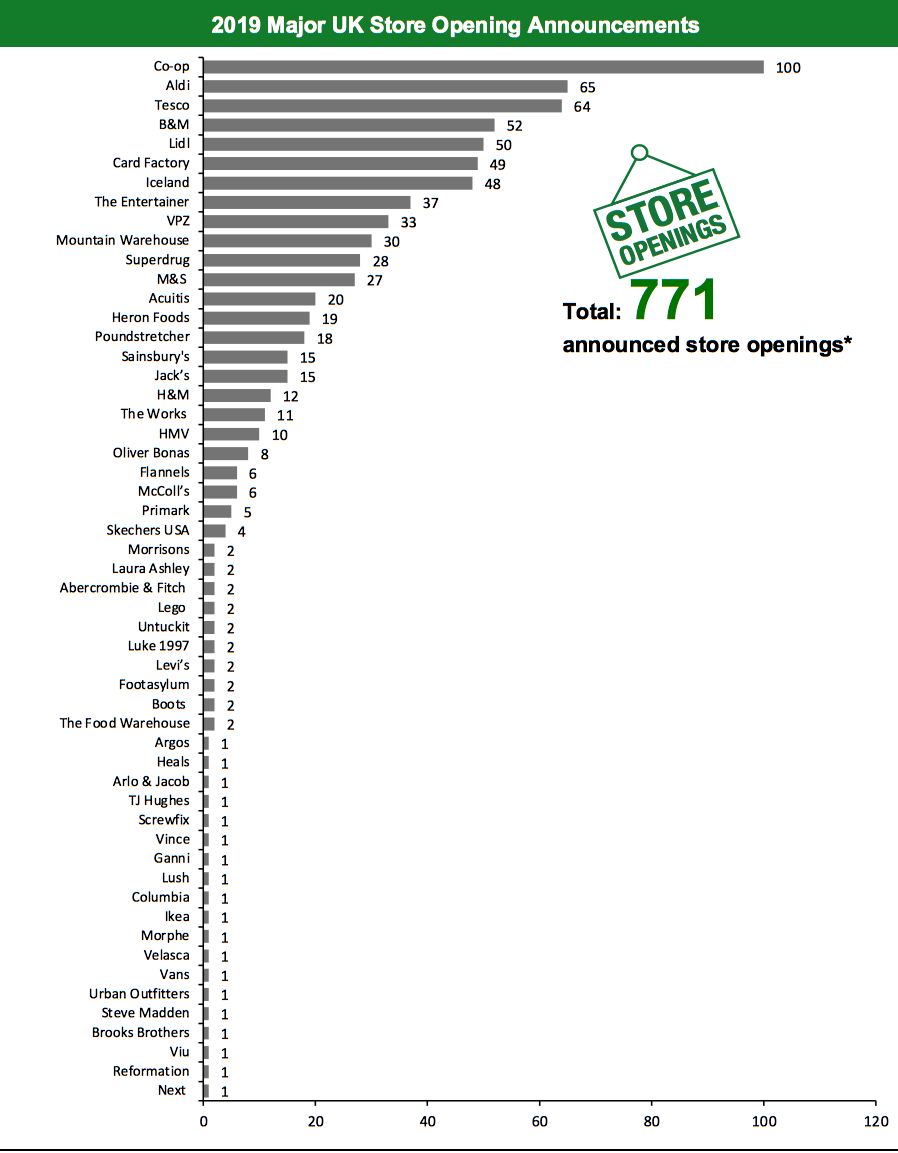

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.