Nitheesh NH

The US

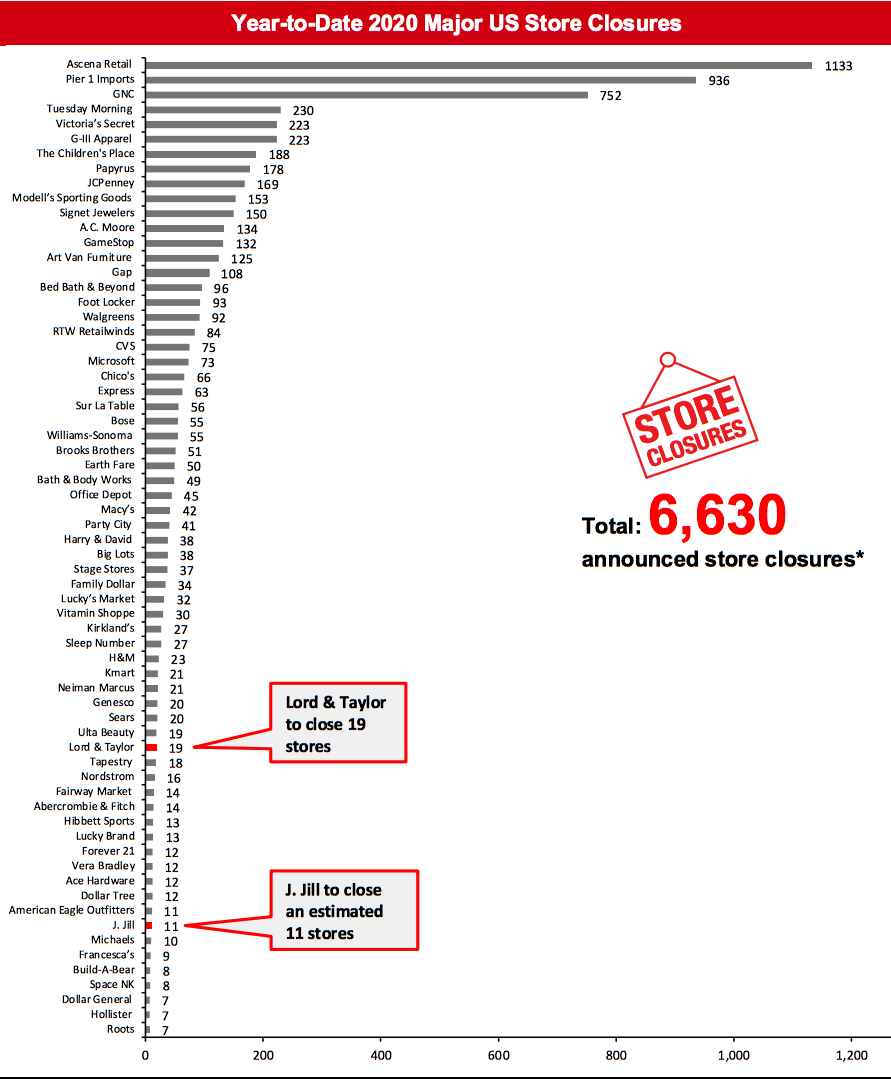

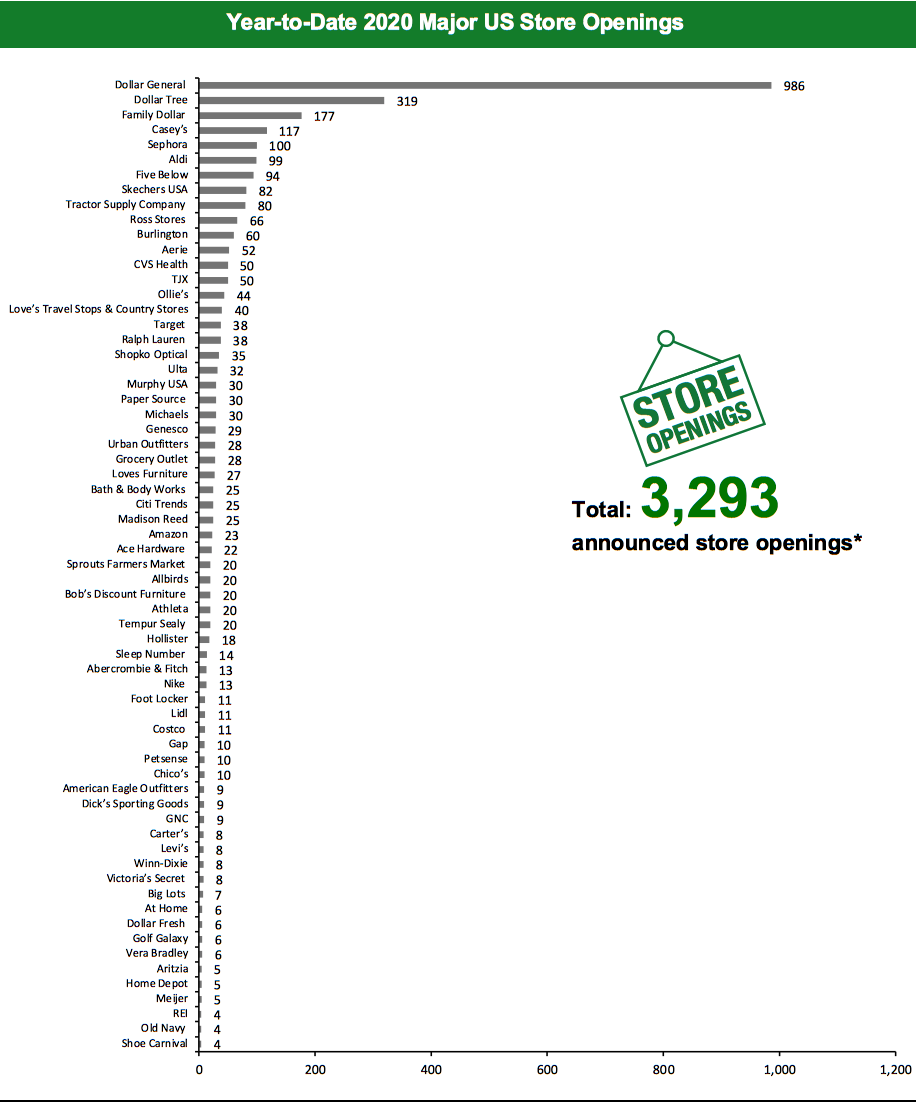

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 6,630 planned store closures and 3,293 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Crocs, J. Jill, Lord & Taylor, Sprouts Farmers Market and Steven Madden, and this has changed our 2020 US closure count to 6,630. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=100]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from The Container Store and Supreme, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Lord & Taylor Files for Bankruptcy and Will Close 19 Stores Le Tote, an online apparel rental firm and owner of department-store chain Lord & Taylor, has filed for Chapter 11 bankruptcy and plans to close 19 Lord & Taylor stores. Le Tote currently has 651 employees and operates 38 physical Lord & Taylor stores as well as the Lord & Taylor and Le Tote websites. Le Tote reported revenue of $253.5 million in 2019, and its funded debt obligations were about $137.9 million, according to its bankruptcy court filings. Coresight Research insight: In August 2019, Le Tote announced a $100 million agreement with HBC to acquire 38 of its Lord & Taylor stores. Le Tote was impacted by Covid-19 as stores were closed, and apparel rentals have also declined because consumers have less need for rotating apparel choices now; the majority of consumers are working from home and have fewer events to attend. Tailored Brands Files for Bankruptcy Tailored Brands, parent company of Men’s Wearhouse and Jos. A. Bank, has filed for Chapter 11 bankruptcy. The move comes after the company had warned just last week that it was likely to file for bankruptcy in its third quarter. The company has also entered into a restructuring support agreement with more than 75% of its creditors that is expected to reduce the its funded debt by at least $630 million. Tailored Brands had announced terms of the agreement in July 2020, which includes reducing its corporate head count by 20% and plans to permanently close up to 500 stores over an unspecified time period. Coresight Research insight: The Covid-19 pandemic accelerated the casualization of how consumers dress due to a widespread transition to working from home—meaning that there is less need for more formal business wear. The workplace was already moving to more casual dress policies as even traditional investment banking firms including Goldman Sachs and Morgan Stanley adopted a casual dress code policy. Men’s Wearhouse and Jos. A. Bank, which focus on more formal men’s business attire—including suits, sport coats, dress shirts, ties and dress pants—have been negatively affected by the Covid-19 acceleration of casual dressing, and we expect this trend to continue.Quarterly Store Openings/Closures Settlement

Crocs Closes Two Stores Casual-footwear retailer Crocs has reported that it closed two stores and opened one store during its second quarter of fiscal year 2020 ended June 30, 2020. The retailer owns and operates 165 stores in North America, as of June 30, 2020. J. Jill Plans To Close 11 Stores in Fiscal Year 2020 Women’s apparel retailer J. Jill has reported that it closed one store during its first quarter of fiscal year 2020, ended May 2, 2020, and plans to reduce its store count from 286 to 275 stores by the end of its fiscal year. The retailer also reported that the majority of the store closures are set to take place in the second quarter. Sprouts Farmers Market Opens Six Stores Grocery retailer Sprouts Farmers Market has reported that it opened six stores during its second quarter of fiscal year 2020, ended June 28, 2020. The retailer owns and operates 350 stores in the US, as of June 28, 2020. Steven Madden Opens Store Shoe and fashion accessories retailer Steven Madden has reported that it opened one store during its second quarter of fiscal year 2020, ended June 29, 2020. The retailer owns and operates 225 stores in North America, as of June 30, 2020.Non-Store-Closure News

7-Eleven To Buy Speedway for $21 Billion Convenience-store chain 7-Eleven has entered into an agreement to acquire convenience chain Speedway from Marathon Petroleum Corp. for $21 billion. As part of the deal, 7-Eleven will acquire around 3,900 Speedway stores in 35 states and incorporate approximately 40,000 Speedway employees. The deal is expected to close in the first quarter of 2021. 7-Eleven currently has over 9,800 stores in the US and Canada. Lidl US Chairman Resigns Discount grocery retailer Lidl has announced that Roman Heini, Chairman of Lidl US, has resigned. Heini joined the company from Aldi in early 2019 to lead the US Division. Current Lidl US President and CEO Johannes Fieber will take over Heini’s responsibilities in leading the company’s efforts to broaden its presence in the American grocery market. [caption id="attachment_114092" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_114093" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below details announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=369]

Source: Company reports/Coresight Research

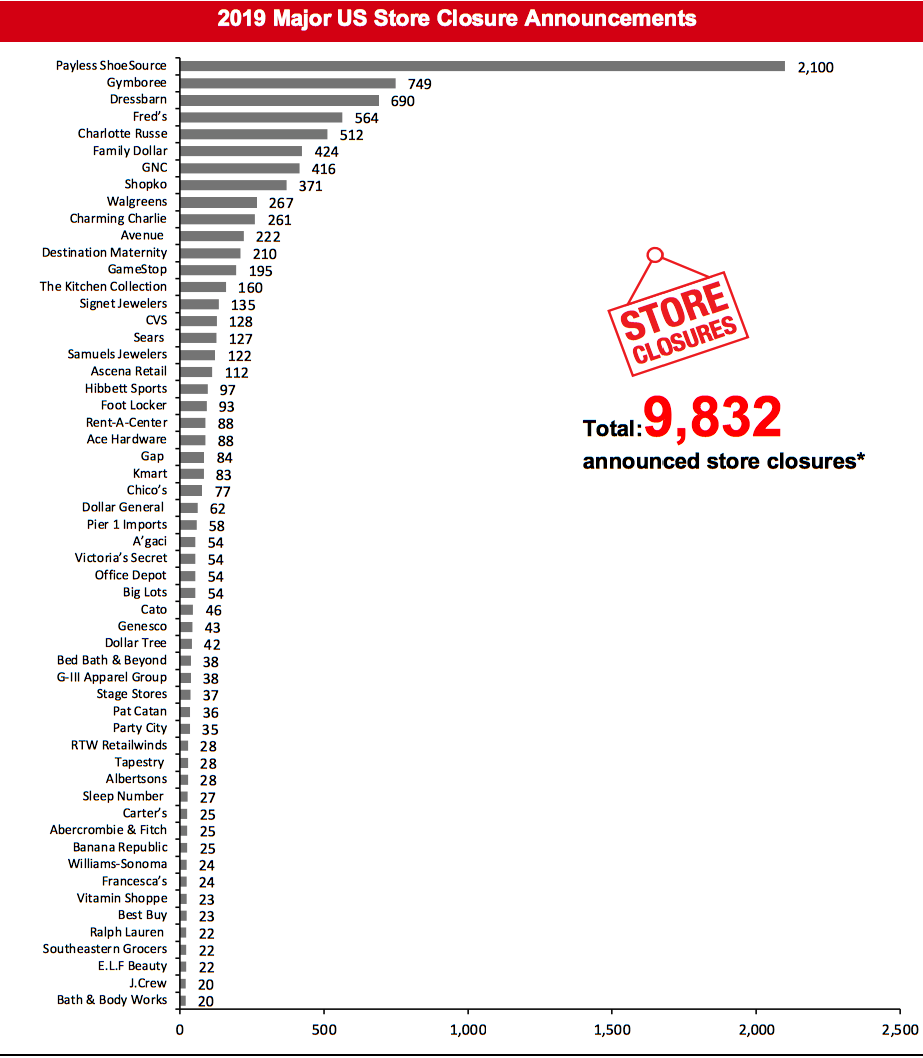

[caption id="attachment_114096" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_114097" align="aligncenter" width="700"]

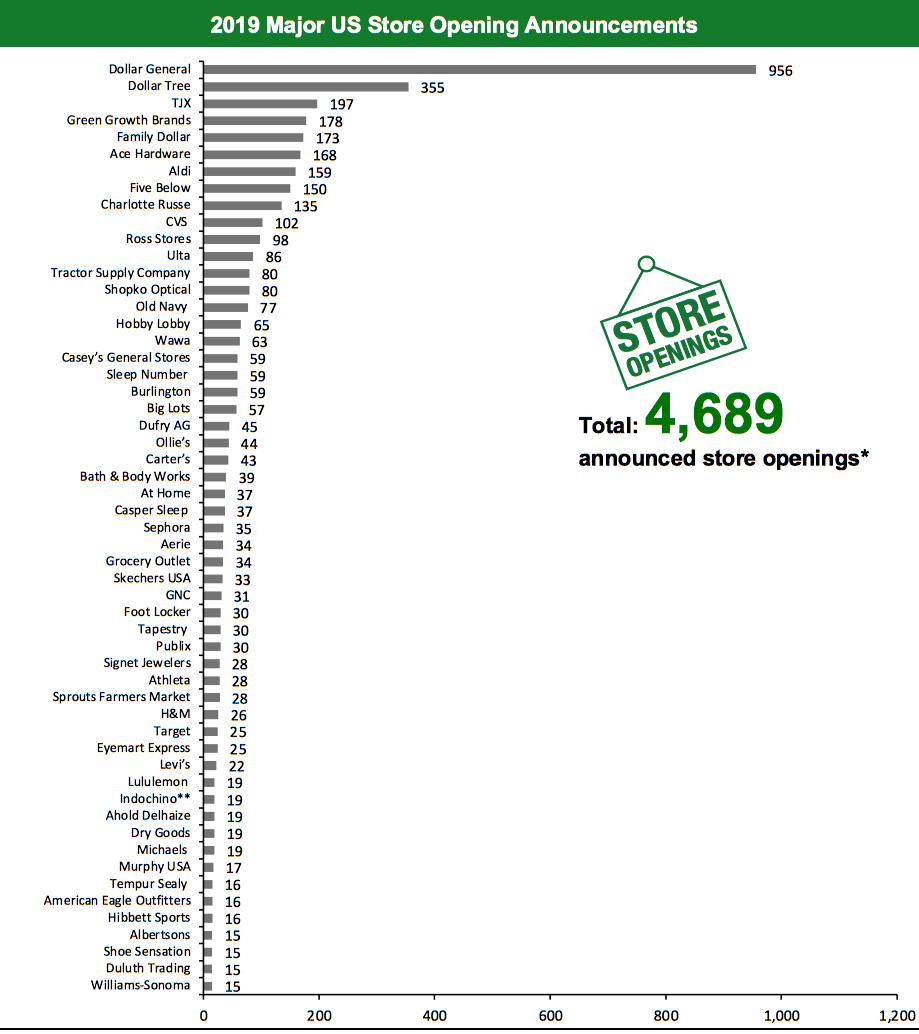

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=370]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. ****Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners. *****Le Tote includes Lord & Taylor banner. ******Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=371]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

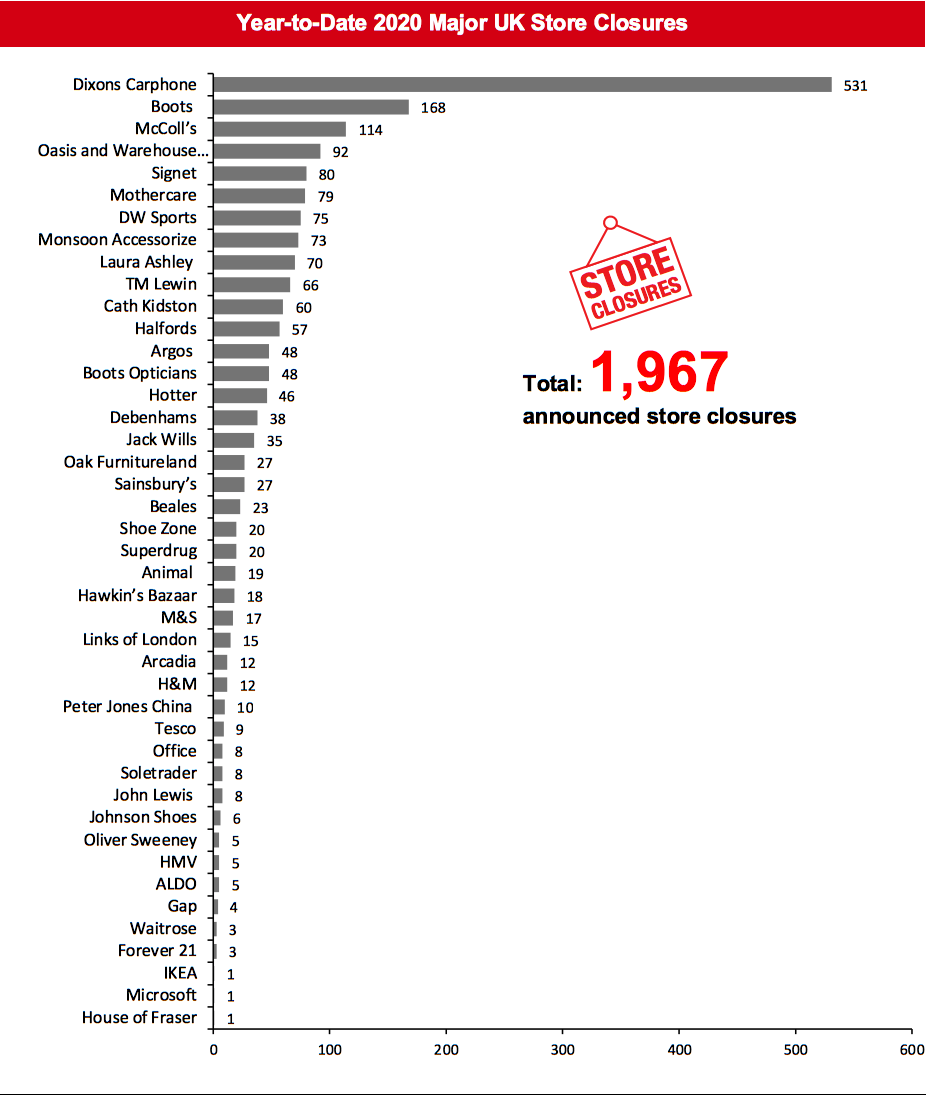

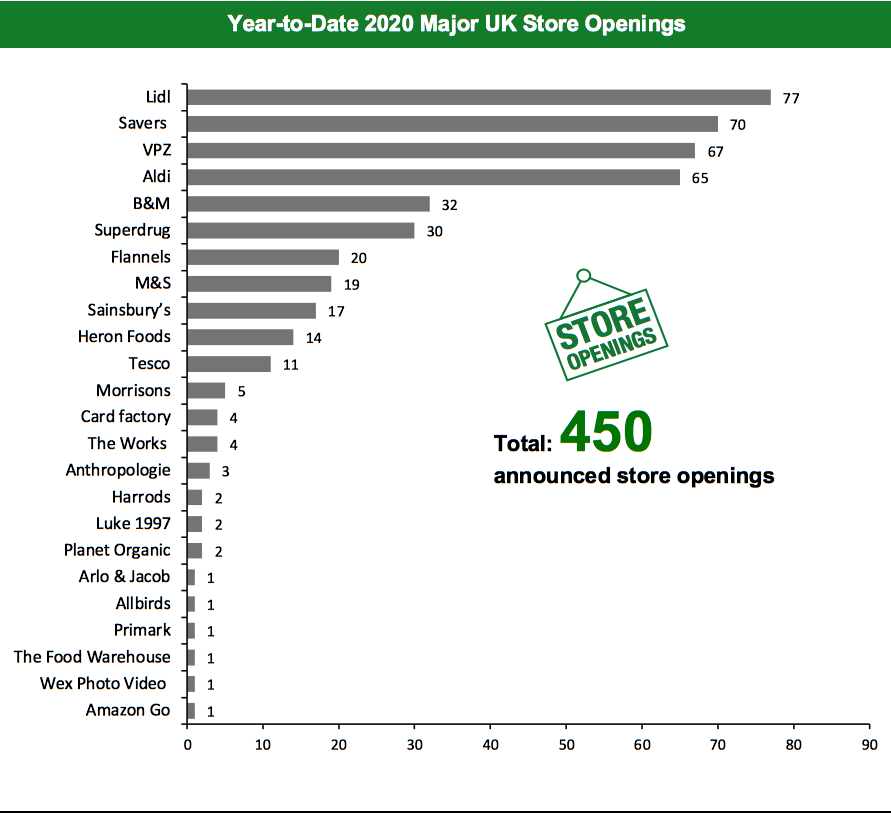

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,967 store closures and 450 store openings. Our data represent closures and openings by calendar year. This week, we have updated our 2020 UK closure count for DW Sports and Hotter. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=101]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Amazon Go To Launch in the UK Amazon has reportedly signed a deal to open around 10 Amazon Go stores in the UK and is in talks to open an additional 20 stores, with the majority set to be located near public transport hubs. The first of these is expected to open in London this year, but the locations and launch dates of the remaining stores are yet to be disclosed. Coresight Research insight: A surge in contact-light retail is one of our identified post-crisis global retail trends. Amazon Go (and perhaps Aldi, too—see story below) can capitalize on heightened interest from shoppers in contact-light modes—such as self-scan and contactless payments—by offering the ultimate no-contact experience. However, the capital-intensive nature of the format will restrict its presence to high-traffic areas. DW Sports Enters into Administration and Will Close All Stores Sports retailer and gym group DW Sports has entered into administration and plans to close all of its retail stores and cease trading through its website. The company operates 73 gyms and 75 stores across the UK and employs 1,700 staff. The company has appointed advisory firm BDO as administrators and plans to save as many gyms as possible. The company has already closed 25 of its stores, and the remaining 50 stores have begun closure sales. Hotter To Close 46 Stores Creditors of shoe retailer Hotter have approved a company voluntary arrangement (CVA) proposal that includes the permanent closure of 46 of its 80 stores across the UK. The retailer aims to reduce its store portfolio and change the terms of its current rental agreements. CEO Ian Watson said that the CVA was “an unfortunate but necessary step to avoid the likelihood of Hotter going into administration” and that it was “critical to ensure a viable future for the business.” Coresight Research insight: Hotter targets older consumers and, while those consumers can no longer be pigeonholed as holdouts against digital, they are less likely to be shopping online. Stores are more important to retailers serving this demographic, and these closures will hit Hotter’s ability to capture spend from older shoppers. M&Co Could Close 50 Stores as It Closes In on a Pre-Pack Administration Deal According to industry sources, the McGeoch family, owners of fashion retailer M&Co, plan to buy back the business through a pre-pack administration deal in an effort to save it from collapse. The deal could result in 50 stores being permanently closed. The retailer currently operates 262 stores and employs 2,700 people in the UK.Non-Store-Closure News

Aldi Plans To Launch Cashierless Stores Discount retailer Aldi plans to launch its own version of cashierless stores in the UK and is looking for partners to develop automatic product recognition technologies. The UK arm of the grocer has placed an international call out to tech startups specializing in computer vision and artificial intelligence that have developed technology to enable the automatic recognition of products, either through cameras in store, in shopping carts or via users’ smartphones. [caption id="attachment_114101" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_114102" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=373]

Source: Company reports/Coresight Research

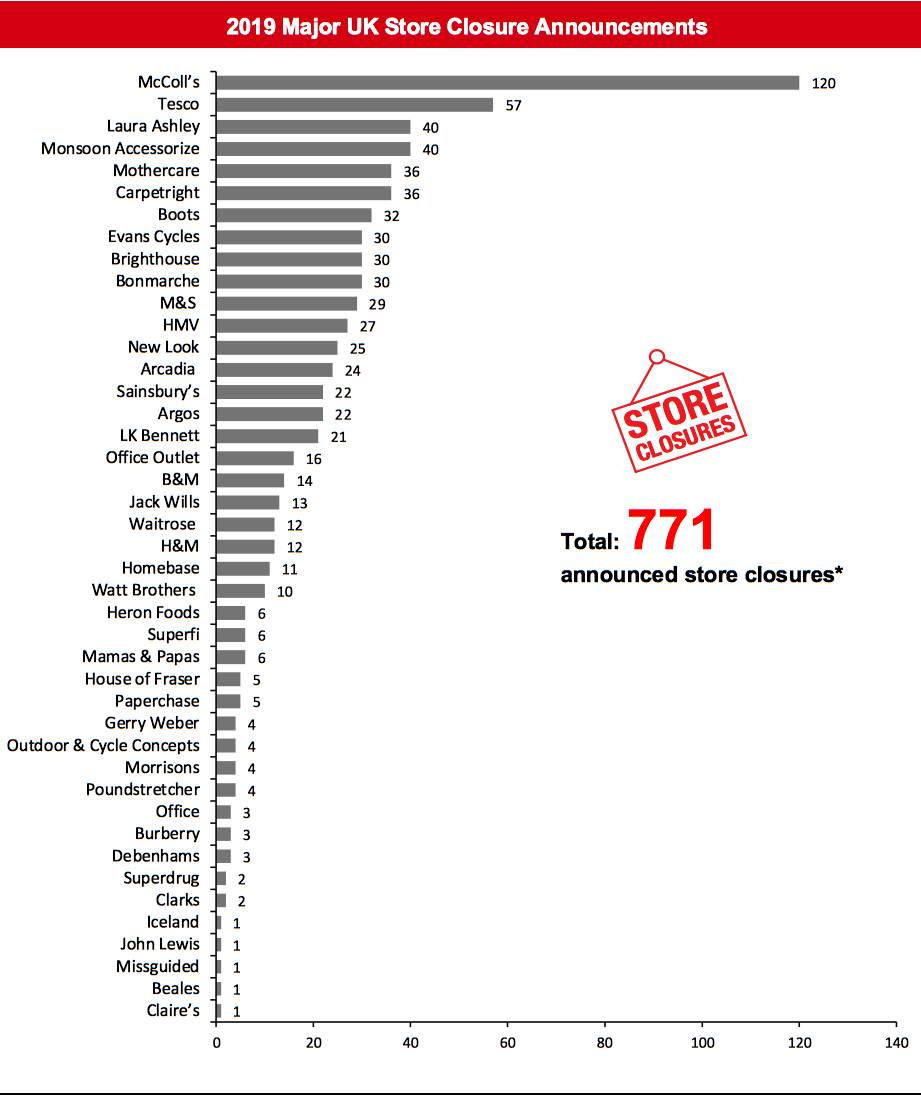

[caption id="attachment_114104" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_114105" align="aligncenter" width="700"]

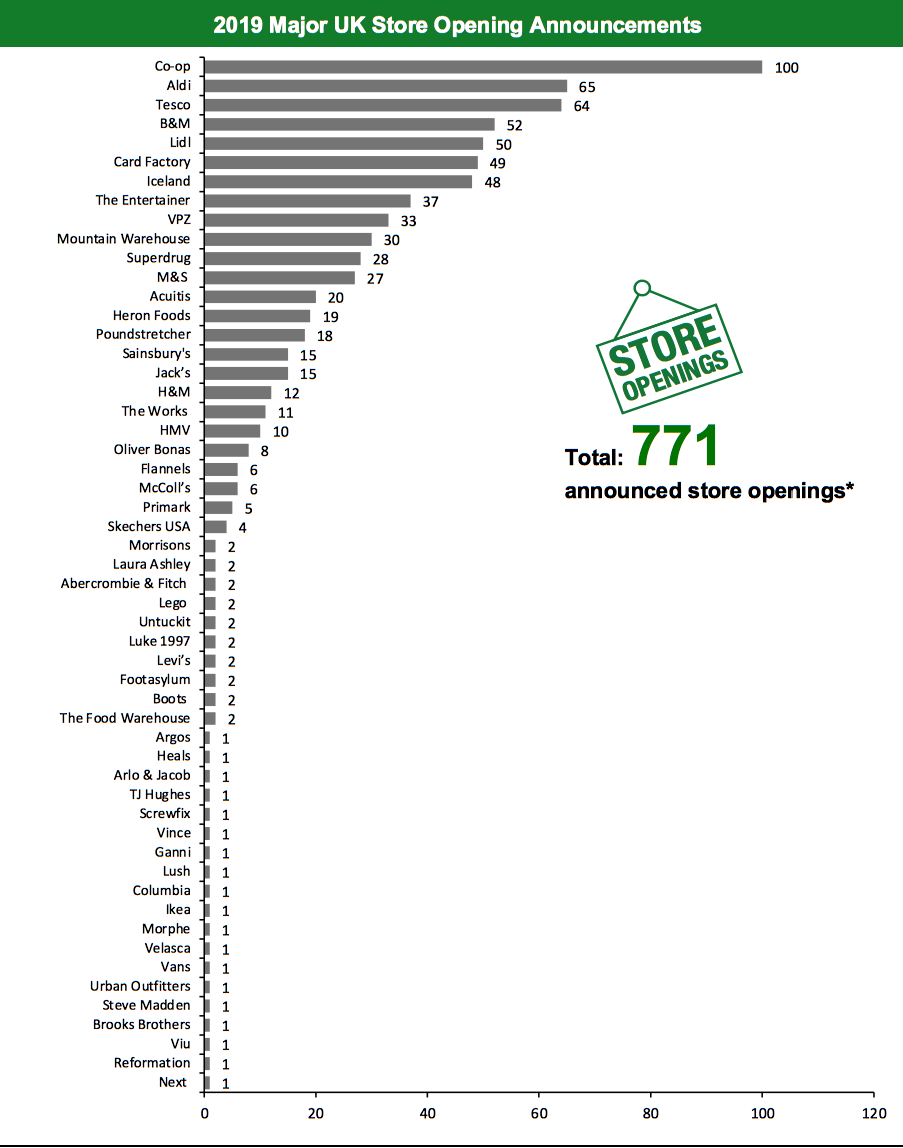

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.