Nitheesh NH

The US

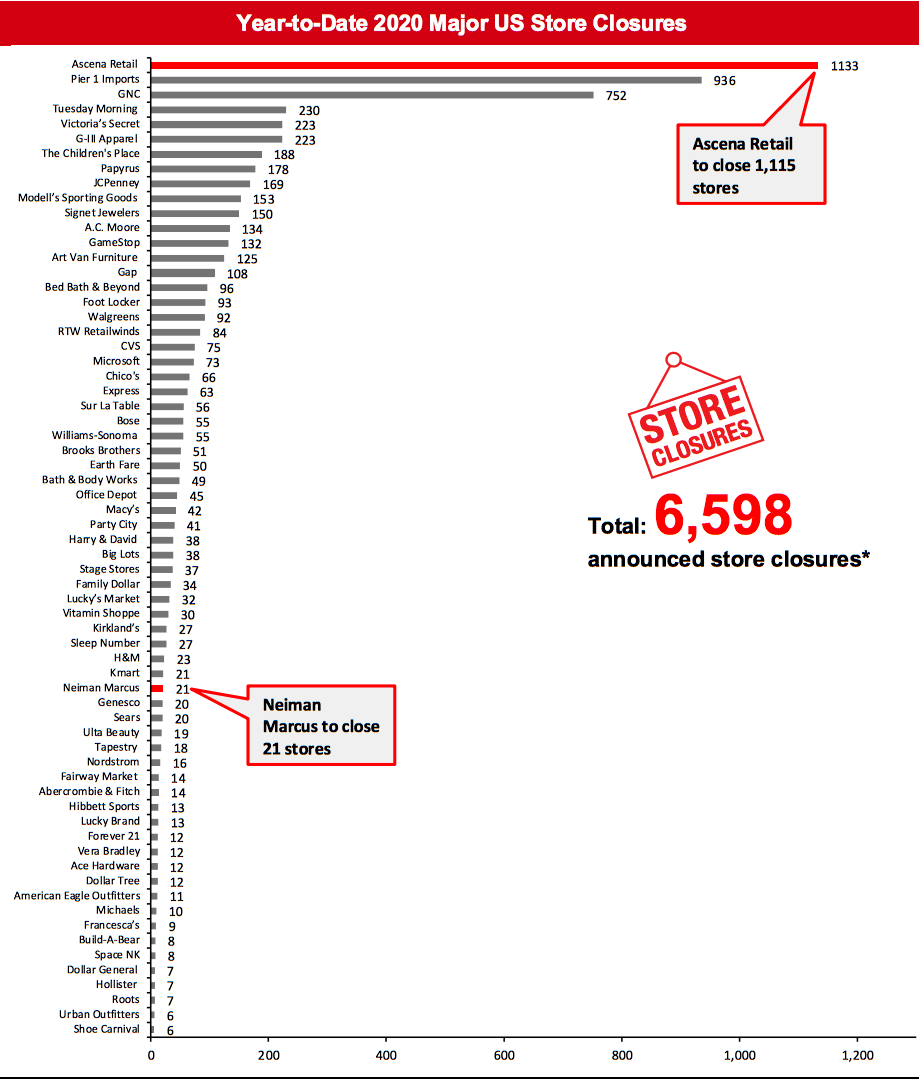

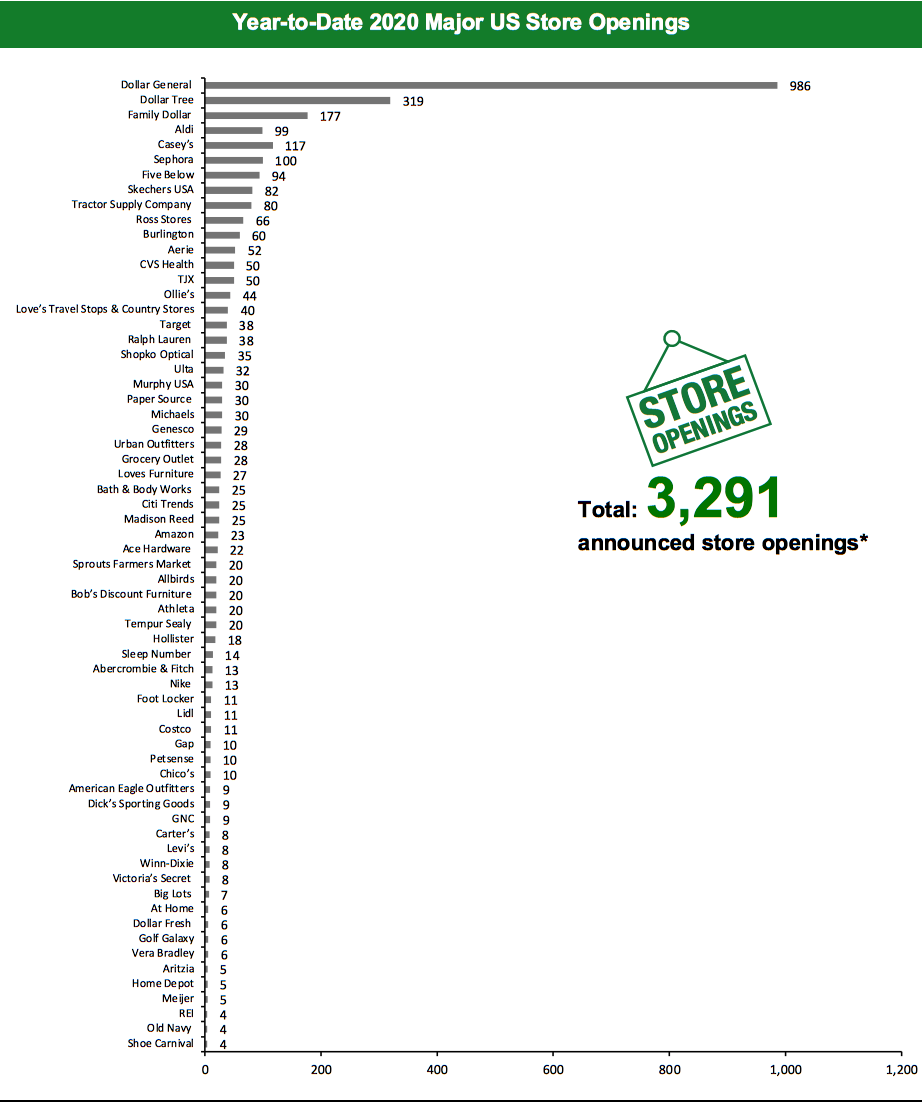

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 6,598 planned store closures and 3,291 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Ascena Retail Group, Neiman Marcus and Sleep Number, and this has changed our 2020 US closure count to 6,598. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=98]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from Allbirds and Carter’s, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Ascena Retail To Close Over 1,000 Stores in the US Ascena Retail Group, owner of apparel brands Ann Taylor, Catherines, Justice, Lane Bryant, LOFT and Lou & Grey had filed for Chapter 11 bankruptcy on July 23, 2020, which we recorded last week. The company plans to close 1,115 US stores out of its over 2,800 stores, according to court documents. The stores earmarked for closure are 618 Justice stores, all 264 Catherines stores, 157 Lane Bryant stores, 38 Ann Taylor stores, 30 LOFT stores and eight Lou & Grey stores. Ascena Retail also plans to close all stores across brands in Canada, Mexico and Puerto Rico. In addition to closing all Catherines stores, the company plans to sell the Catherines intellectual property assets and e-commerce business to Australian retail company City Chic Collective Limited. This week, we have updated the closures chart following the company’s confirmation of the details. Coresight Research insight: Ascena Retail was beginning to struggle prior to Covid-19, with consumers’ preferences gradually shifting away from business professional attire, ever-changing styles in the kids’ space and more fashion options in the inclusive, plus-size fashion category. The Justice brand (Ascena Retail’s Kids Fashion segment) had comp sales of (15)% in 2Q20 (reported on March 9, 2020) compared to 2% in 2Q19. The Kids Fashion segment comprised 23% of Ascena Retail’s total sales in 2Q20. The brand is closing 75% of its stores (618 of its 820 stores). In Ascena Retail’s Plus Fashion segment, the Catherines brand underperformed, with (1)% comp sales in 2Q20 compared to (4)% in 2Q19. The company is closing all Catherines stores. Lane Bryant, Ascena Retail’s other Plus Fashion brand, is performing comparatively better—with 10% comps in 2Q20 compared to (8)% in 2Q19. The company is closing about 22% of its Lane Bryant fleet (157 stores out of 715). The Plus Fashion segment accounted for 26% of Ascena Retail’s total sales in 2Q20. Ascena Retail’s Premium Fashion segment accounted for 51% of total sales in 2Q20. Ann Taylor comps were 3% in 2Q20 vs 10% in 2Q19, and LOFT comps were (1)% in 2Q20 vs 10% in 2Q19. The company is closing the fewest stores in this category: 38 Ann Taylor Stores, which is 13% of the brand’s fleet; and 30 LOFT stores, which is 4% of the brand’s fleet. Moving forward, Coresight Research believes that Ascena Retail will focus on its Premium Fashion segment and on pivoting its product designs from professional to casual, in order to more closely align with today’s consumer demand. Neiman Marcus Confirms 21 Store Closures in Bankruptcy Proceedings In its recent bankruptcy filings, department-store chain Neiman Marcus has confirmed that it is permanently closing 21 stores. The stores earmarked for permanent closure are four Neiman Marcus stores and 17 Last Call stores. The company filed for bankruptcy in May this year and had announced that it would close the majority of its 22 Last Call stores, then announced last week that it may close four Neiman Marcus stores. Tailored Brands May File for Bankruptcy in the Third Quarter Tailored Brands, owner of apparel brands Men’s Wearhouse and Jos. A. Bank, has stated in a recent filing that it is likely to pursue a reorganization under applicable bankruptcy laws, possibly as soon as during its third quarter of fiscal year 2020, which begins on August 2, 2020. Just last week, the company had announced various operating and organizational changes in response to the impact of the coronavirus pandemic, including reducing its corporate head count by 20% and plans to close up to 500 stores over an unspecified time period.Quarterly Store Openings/Closures Settlement

Skechers Opens Three Stores Lifestyle and performance-footwear retailer Skechers has reported that it closed one store and opened three stores during its second quarter of fiscal year 2020, ended June 30, 2020. The retailer owns and operates 510 stores in the US, as of June 30, 2020. Sleep Number Closes 19 Stores Mattress retailer Sleep Number has reported that it closed 19 stores and opened six during its second quarter of fiscal year 2020, ended June 27, 2020. The retailer owns and operates 598 stores in the US, as of June 27, 2020. Tractor Supply Opens 18 Stores Rural lifestyle retailer Tractor Supply Company has reported that it closed three stores and opened 21 stores during its second quarter of fiscal year 2020 ended June 27, 2020. The company opened 18 Tractor supply stores and three new Petsense stores, and closed three Petsense stores. The retailer owns and operates 2,061 stores across its Tractor Supply and Petsense banners in the US, as of June 27, 2020.Non-Store-Closure News

Walgreens CEO To Step Down Walgreens Boot Alliance has announced that Stefano Pessina, CEO and Executive Vice Chairman, plans to step down from his position as CEO. Pessina will remain in the role until the company appoints a replacement and will then transition to the role of Executive Chairman. Current Executive Chairman James Skinner will transition out of his role but will remain on the board. Pessina has held the position of CEO since 2015 following the merger between Walgreens and Alliance Boots. Sycamore Partners Bids To Buy JCPenney for $1.75 Billion Private-equity firm Sycamore Partners has reportedly made an offer of $1.75 billion to buy department-store chain JCPenney out of bankruptcy, according to industry sources. Sycamore plans to merge JCPenney with its own department-store chain Belk. Belk currently has 300 stores, which are mostly located in the South of the US. The deal is still subject to approval from the court as well as from JCPenney’s lenders, creditors and board. JCPenney had filed for bankruptcy in March 2020, and bids to buy the company out of bankruptcy began on July 22, 2020. Other notable bidders for the company include Hudson’s Bay Company, which offered $1.7 billion, and mall operators Simon Property and Brookfield Property with a combined $1.65 billion offer. [caption id="attachment_113768" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113769" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=356]

Source: Company reports/Coresight Research

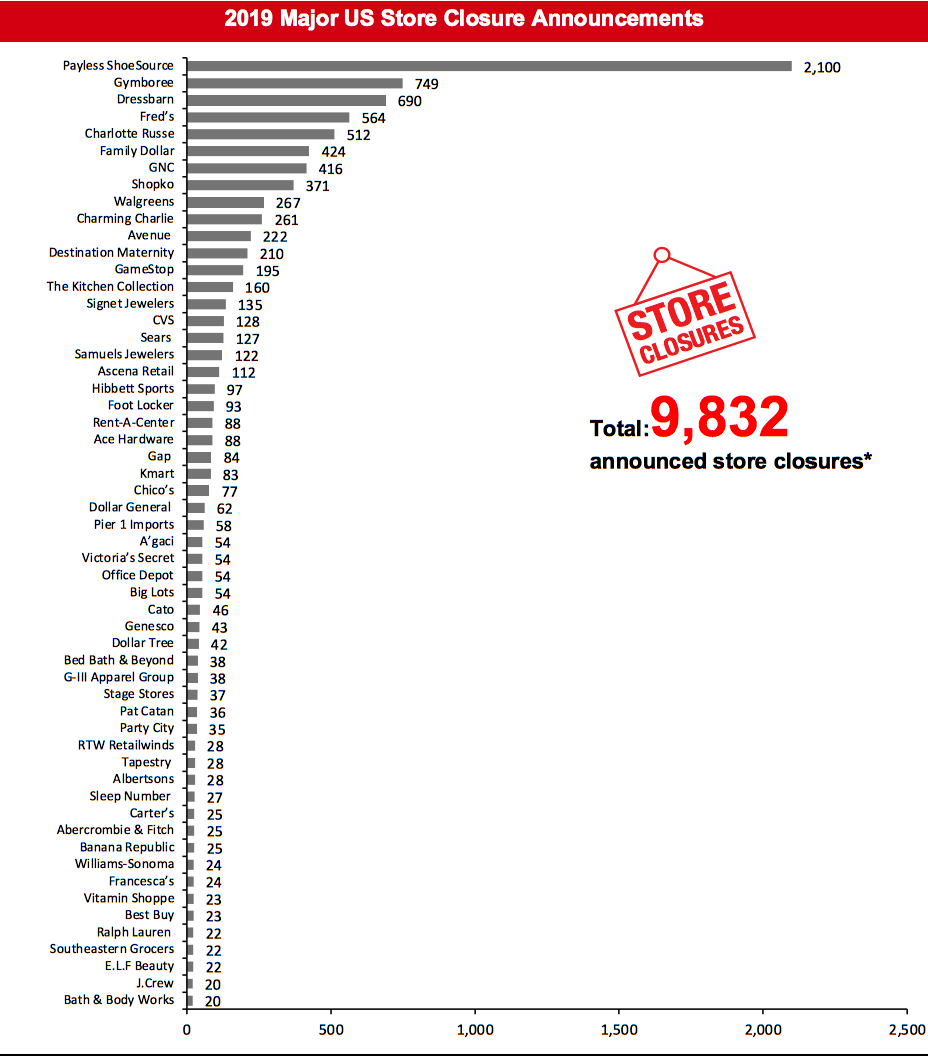

[caption id="attachment_113771" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113772" align="aligncenter" width="700"]

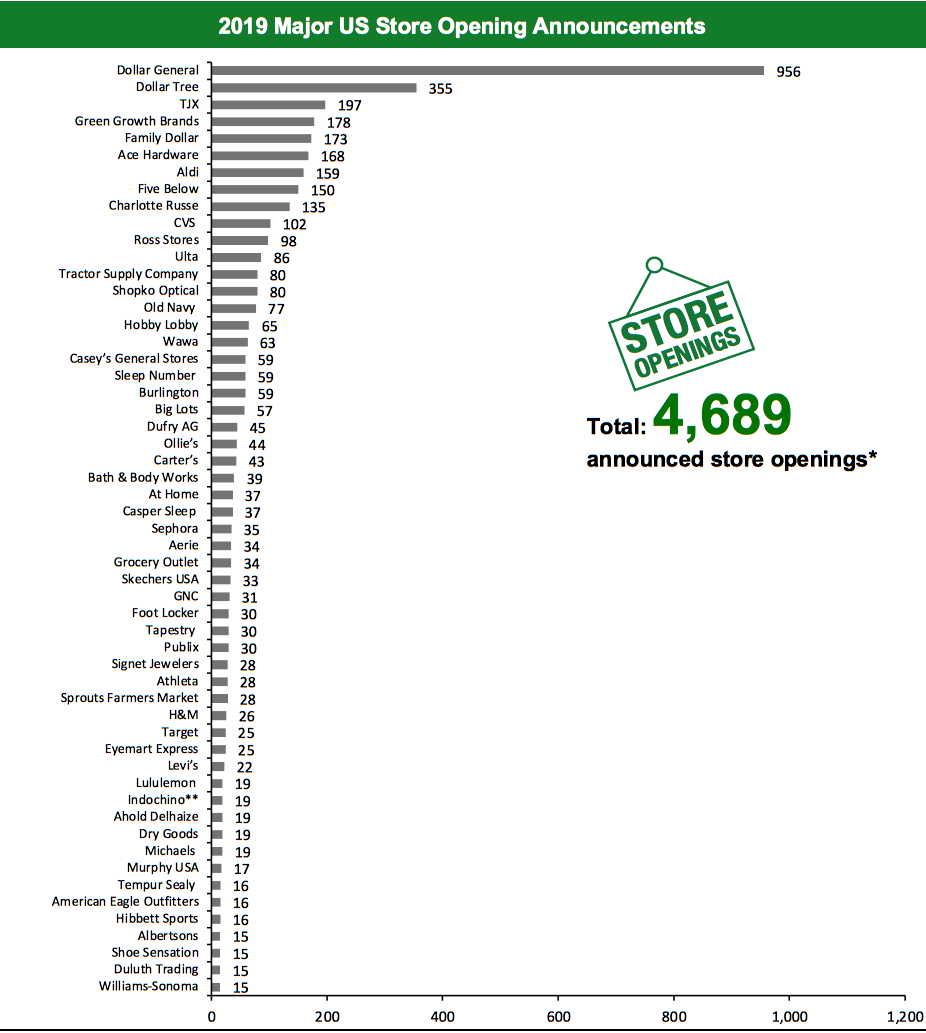

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=357]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. ****Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=358]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

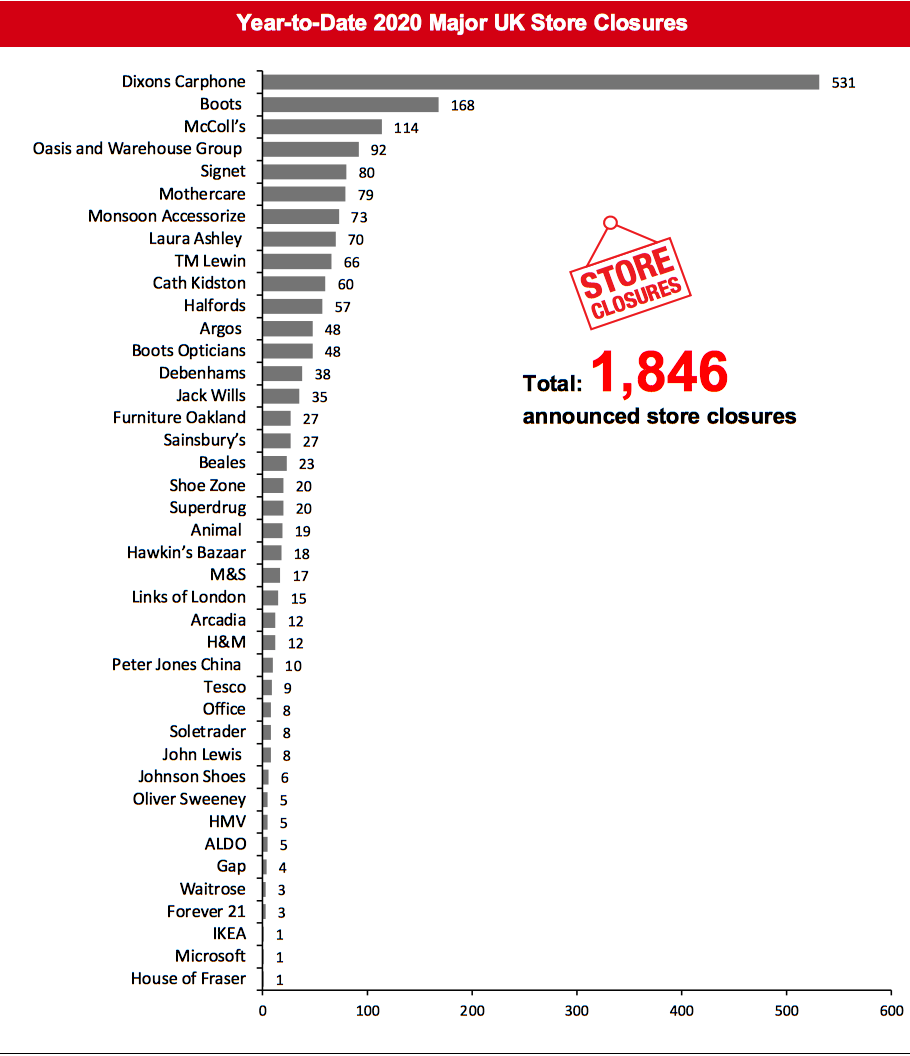

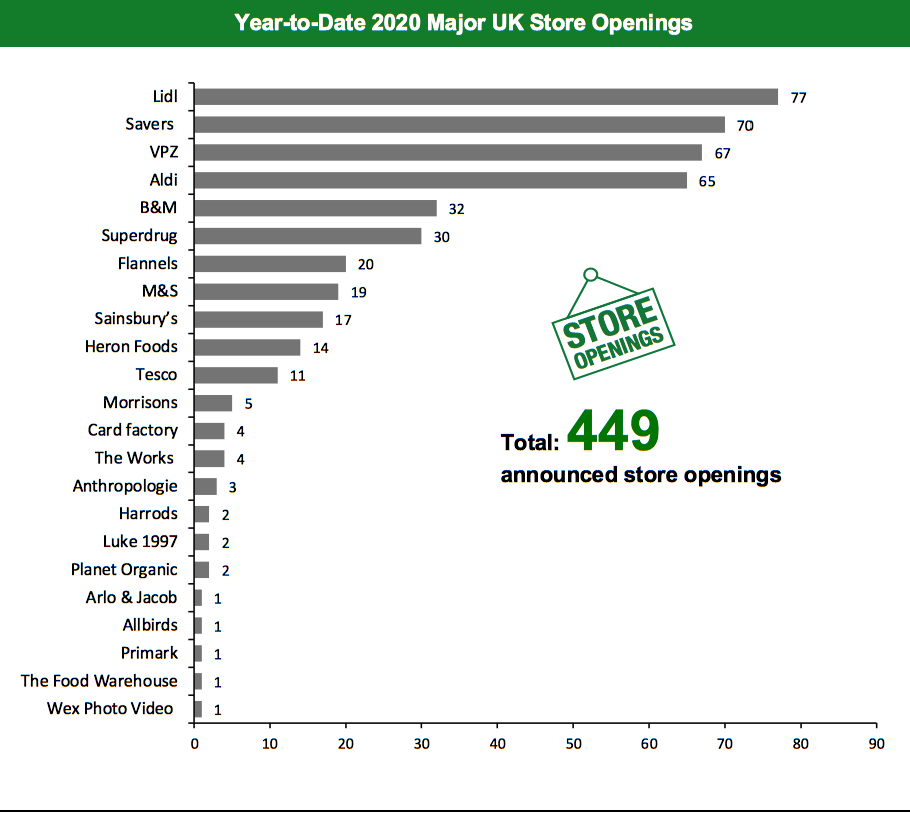

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,846 store closures and 449 store openings. Our data represent closures and openings by calendar year. This week, we have updated our 2020 UK closure count for Oak Furnitureland. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=99]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Oak Furnitureland To Close 27 Stores Furniture retailer Oak Furnitureland plans to close 27 out of its 105 stores in the UK, placing 163 employees at risk of redundancy. The planned closures are part of a strategic review of the retailer’s business. In June 2020, the retailer was rescued from collapse as investment firm Davidson Kempner Capital Management acquired it via a prepack administration deal. Ben Sherman May Close 18 Stores The Baird Group, a licensee of apparel retailers Ben Sherman, Jeff Banks and Suit Direct, has launched a company voluntary arrangement (CVA) proposal, which includes plans to close 18 of its 47 Ben Sherman stores, rent reductions and 262 redundancies mainly in Debenhams concession stores. The CVA proposal needs approval from at least 75% of creditors, and a vote is slated to take place on August 10, 2020.Non-Store-Closure News

Debenhams Looks for Buyers Department-store chain Debenhams is on the lookout for potential buyers as it looks to exit administration. The company has appointed investment bank Lazard to handle any talks with potential buyers. A Chinese consortium as well as Frasers Group owner Mike Ashley are reportedly among potential investors. The company had filed for administration in April and is currently in a “light touch” administration wherein its directors are still running the business rather than the administrators. [caption id="attachment_113780" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_113781" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=360]

Source: Company reports/Coresight Research

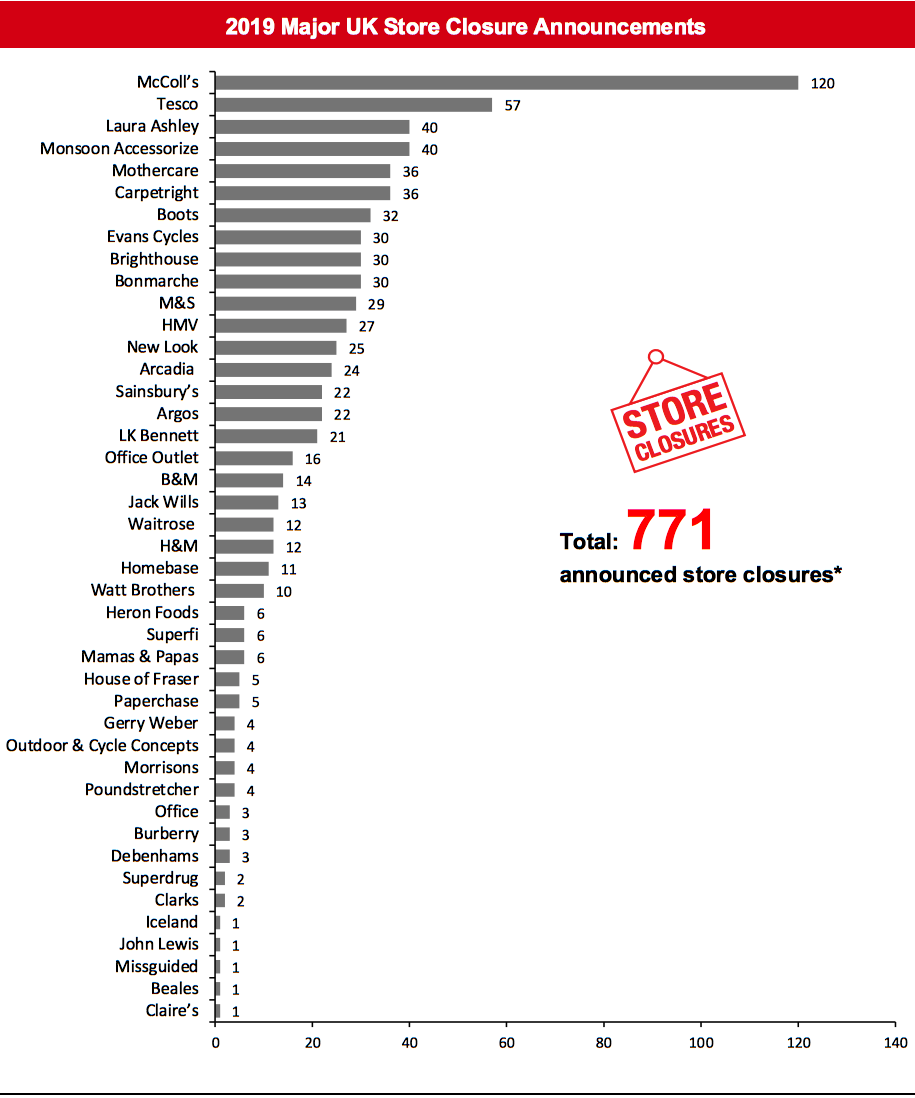

[caption id="attachment_113784" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113785" align="aligncenter" width="700"]

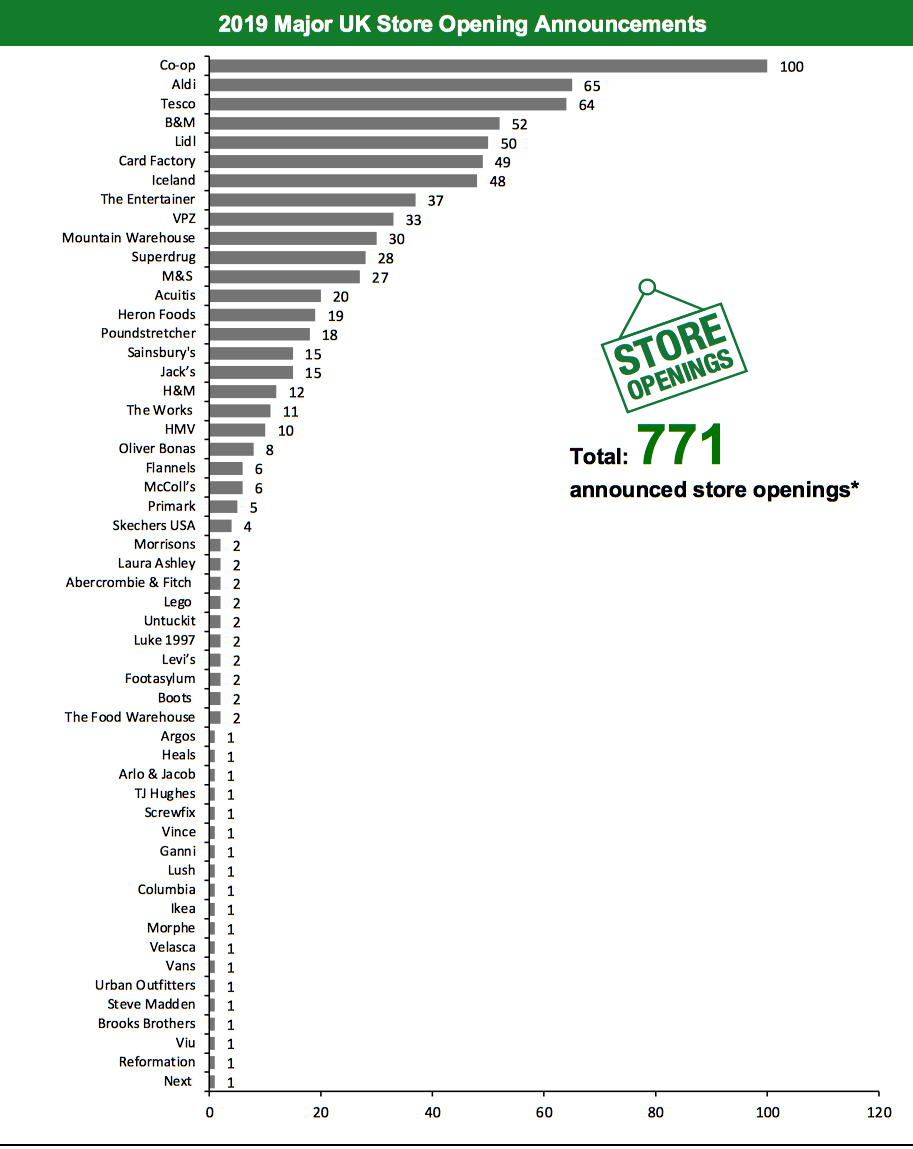

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.