Nitheesh NH

The US

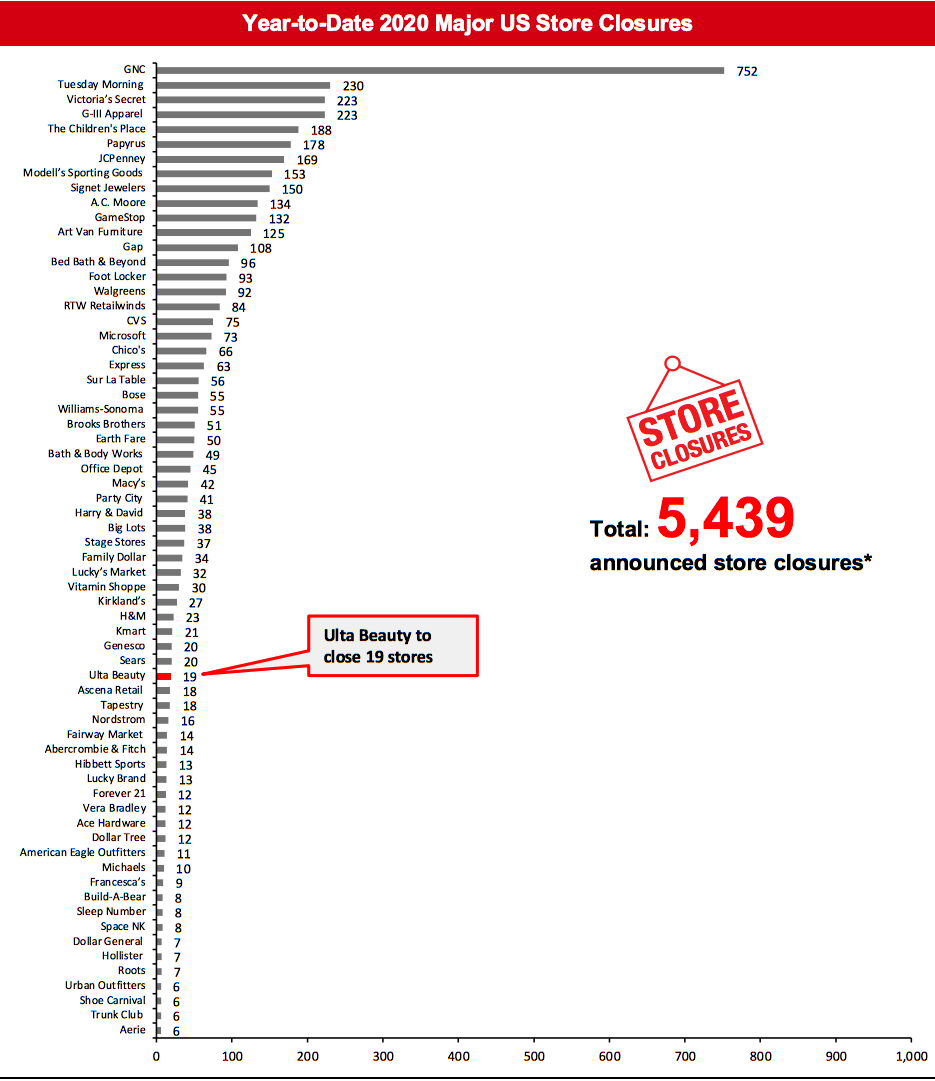

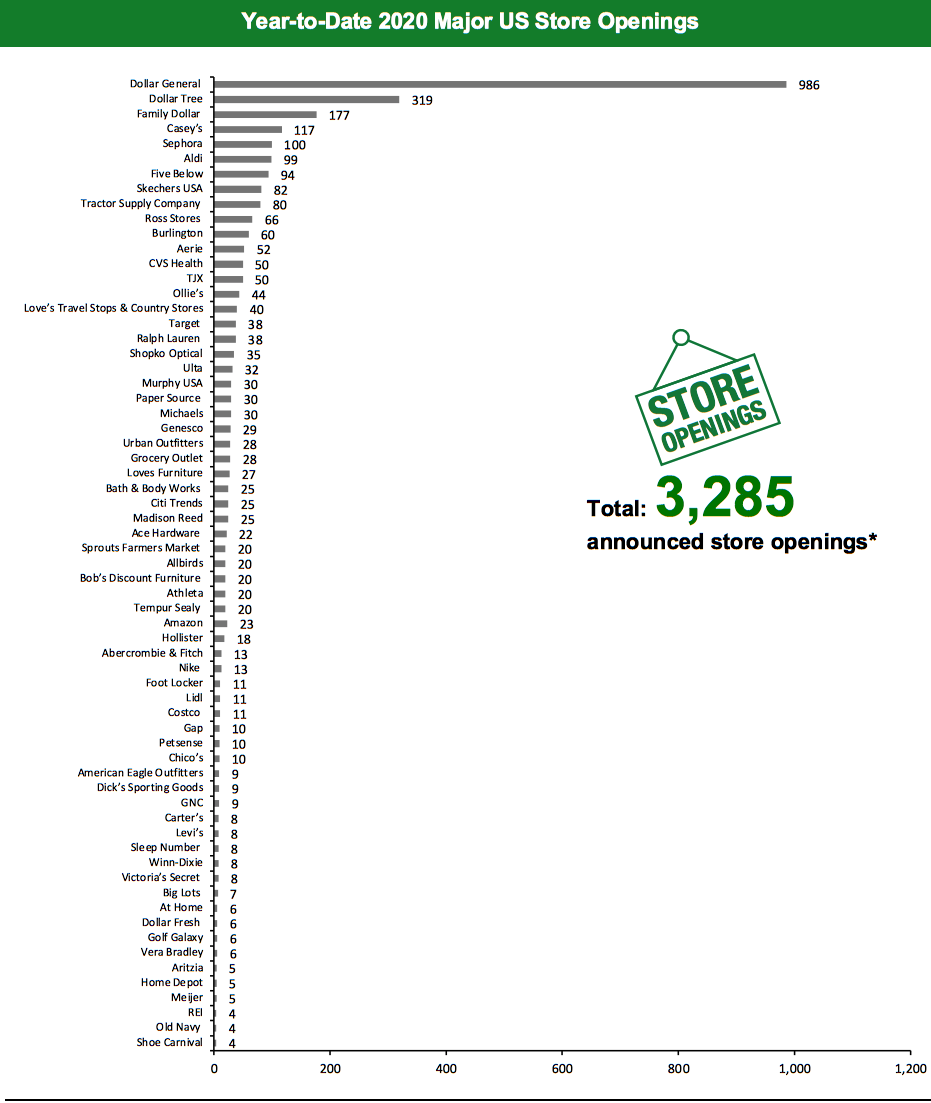

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 5,439 planned store closures and 3,285 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, we have updated our 2020 US closure count for Ulta Beauty, and this has changed our 2020 US closure count to 5,439. We also revised our US opening count for Aldi, and this has changed our 2020 US opening count to 3,285. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=96]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from Ralph Lauren, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Aldi Plans To Open 70 More Stores Discount retailer Aldi has announced plans to open 70 more stores before the end of the year. The retailer has already opened around 29 stores to date this year. In June 2017, the company had announced plans to open 2,500 stores across the country by the end of 2022. According to its website, Aldi currently operates 2,005 stores. Following the latest update this week, we have revised our store-opening estimate for Aldi. Amazon To Open Three Grocery Stores in the Philadelphia Area According to industry sources, Amazon plans to open three grocery stores in the Philadelphia metro area under a new unnamed banner. Amazon will take over a 36,000-square-foot portion of a former Giant store in Warrington, Pennsylvania and also plans to lease 41,000 square feet of a former Kmart site in Bensalem, Pennsylvania. The third location is expected to be in Center City, Philadelphia, but the company has not yet divulged details regarding these developments. Neiman Marcus May Close Four Stores Department-store chain Neiman Marcus may permanently close four Neiman Marcus stores—in Walnut Creek, California; Palm Beach, Florida; Bellevue, Washington; and Washington, D.C.—as part of its bankruptcy process. A company spokesperson said that Neiman Marcus is assessing its store footprint to ensure that it is optimal to enhance revenues, overall profitability and its omnichannel strategy, and that the assessment may include marketing of leases for certain locations. The company filed for bankruptcy in May this year and had announced that it would close a majority of its 22 Last Call stores. The Paper Store Files for Bankruptcy; Looks for a Buyer Gifts retailer The Paper Store has filed for Chapter 11 bankruptcy after facing a liquidity crisis in the wake of the enforced closures amid the coronavirus crisis. The company operates 86 stores in the Northeast and plans to sell itself in bankruptcy by late August 2020. When it filed for bankruptcy, the retailer had $45 million in funded debt, $13.5 million in unpaid bills to vendors, and $3.7 million in unpaid rent for April, May and June, among other liabilities. Tailored Brands To Reduce Staff and Close up to 500 Stores; Announces Leadership Changes Tailored Brands, owner of apparel brands Men’s Wearhouse and Jos. A. Bank, has announced various operating and organizational changes to deal with the business disruptions caused by the coronavirus pandemic. The company has identified up to 500 stores for closures over an unspecified time period and plans to reduce its corporate headcount by 20% by the end of its fiscal second quarter. The company also announced that Jack Calandra, EVP, CFO and Treasurer, will leave the company as of July 31, and has hired Holly Etlin, a Managing Director at AlixPartners, as Chief Restructuring Officer. Calandra’s responsibilities will be divided between Etlin and CEO Dinesh Lathi. Ulta Beauty To Close 19 Stores; Revises Store Openings for Fiscal Year Beauty retailer Ulta Beauty has announced that it will permanently close 19 stores over the second and third quarters of 2020 and has lowered the number of stores it expects to open in fiscal year 2020. In May 2020, the company had announced plans to open 30–40 stores in the fiscal year, but it has revised the number to only about 30 new stores. Ulta Beauty expects to resume new store openings in August and enter Canada in mid-2021. The locations of the store closures have not been disclosed by the company. As of May 2020, the company operated 1,264 retail stores. Coresight Research insight: We expect Ulta Beauty to continue to optimize its fleet as the color cosmetics market is impacted by changed consumer behavior due to the pandemic. With many consumers working from home, daily makeup routines have been disrupted, resulting in weakened demand for color cosmetics. Ascena Retail Group Files for Bankruptcy Ascena Retail Group, owner of apparel brands Ann Taylor Justice, Lane Bryant, LOFT and Lou & Grey chains, has filed for Chapter 11 bankruptcy and has entered a restructuring support agreement with over 68% of its secured term lenders. As part of the restructuring agreement, the company will strategically reduce its footprint by closing a significant number of Justice stores and a select number of Ann Taylor, Lane Bryant, LOFT and Lou & Grey stores. This includes the exit of all stores across brands in Canada, Mexico and Puerto Rico. The company also plans to close all Catherines stores, sell the Catherines intellectual property assets and to transition its e-commerce business to Australian retail company City Chic Collective Limited. The restructuring agreement is expected to significantly reduce the company’s debt by approximately $1 billion and provide increased financial flexibility. The company operates approximately 3,000 stores. We will update our 2020 closures chart when we have confirmed the number of closures and their timeframe.Non-Store-Closure News

Dollar Tree Names New CEO Dollar-store chain Dollar Tree has announced that CEO Gary Philbin will retire effective September 23, 2020, and the company has promoted current Enterprise President Michael Witynski to President and CEO. Witynski joined the company in 2010 as SVP of Stores and has been in his role as Enterprise President since December 2019. Philbin joined the company in 2001 and took over as CEO in 2017. Philbin will stay with the company as a board member and executive through September 23 to facilitate a smooth transition. Tapestry CEO Resigns Jide Zeitlin, CEO of fashion retailer Tapestry, has stepped down from his position following the emergence of personal misconduct allegations against him from a period before he joined the company. Zeitlin had been Tapestry’s Chairman since November 2014 and became CEO in September 2019. [caption id="attachment_113357" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113358" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=337]

Source: Company reports/Coresight Research

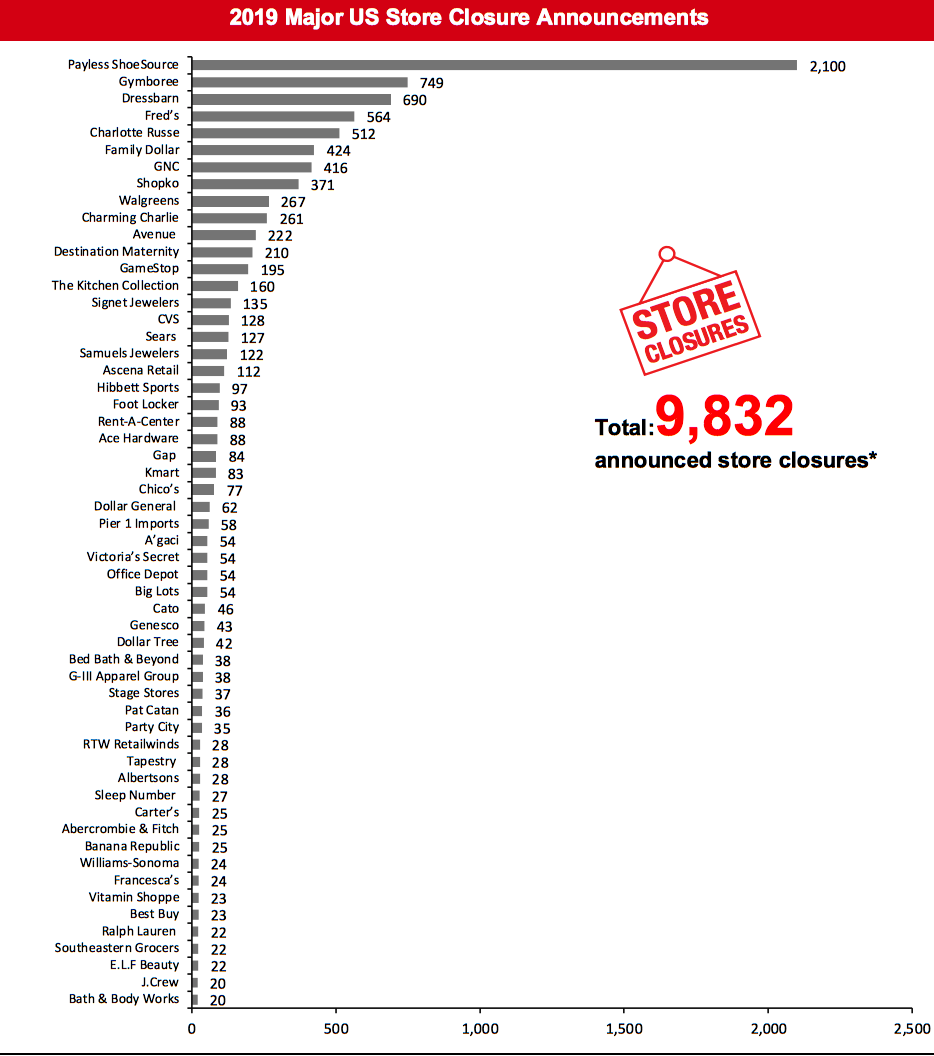

[caption id="attachment_113360" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113361" align="aligncenter" width="700"]

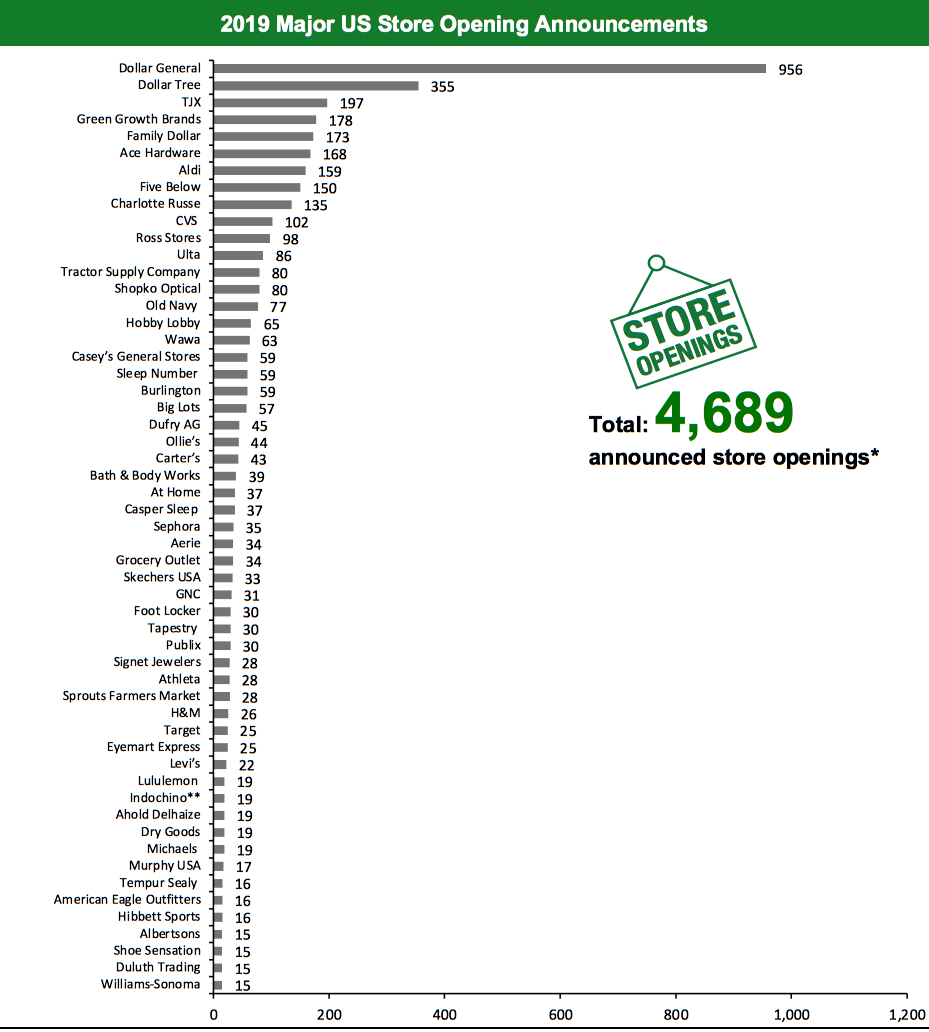

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=338]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=339]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

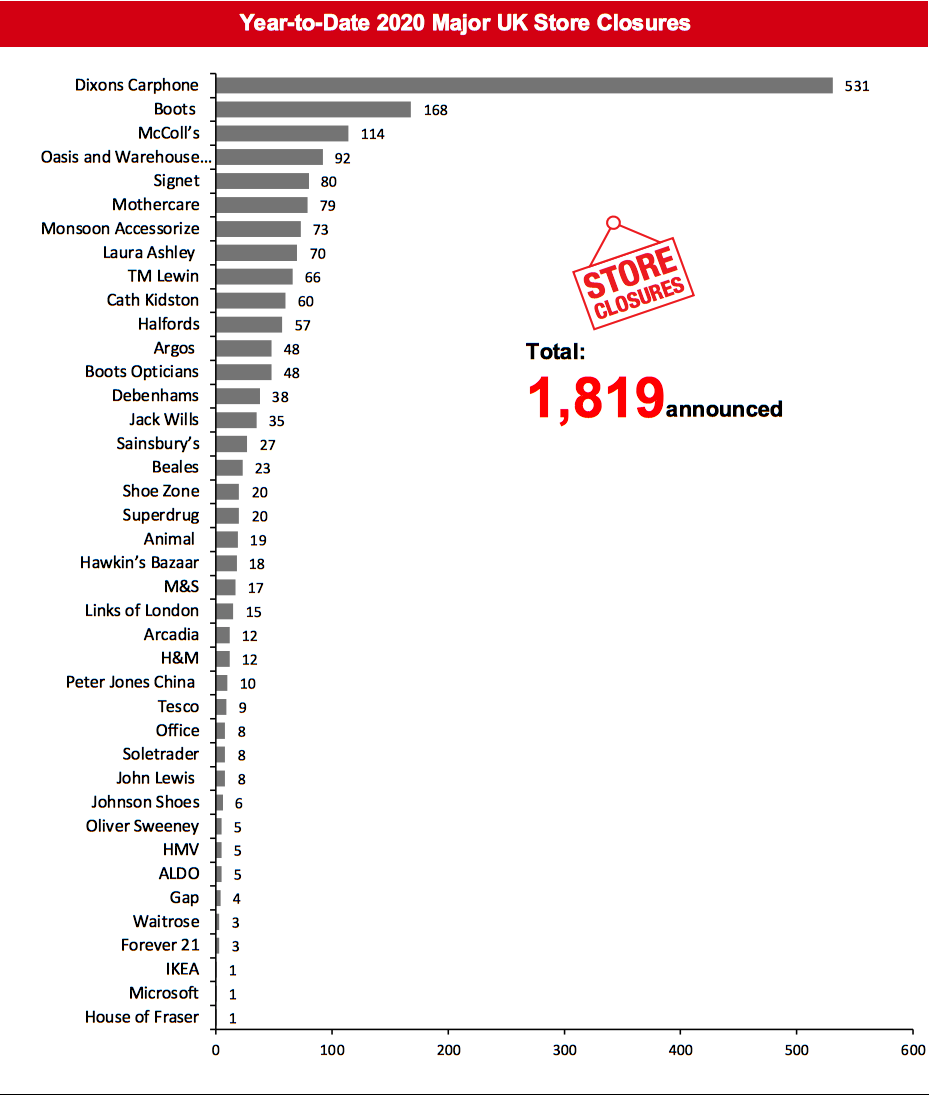

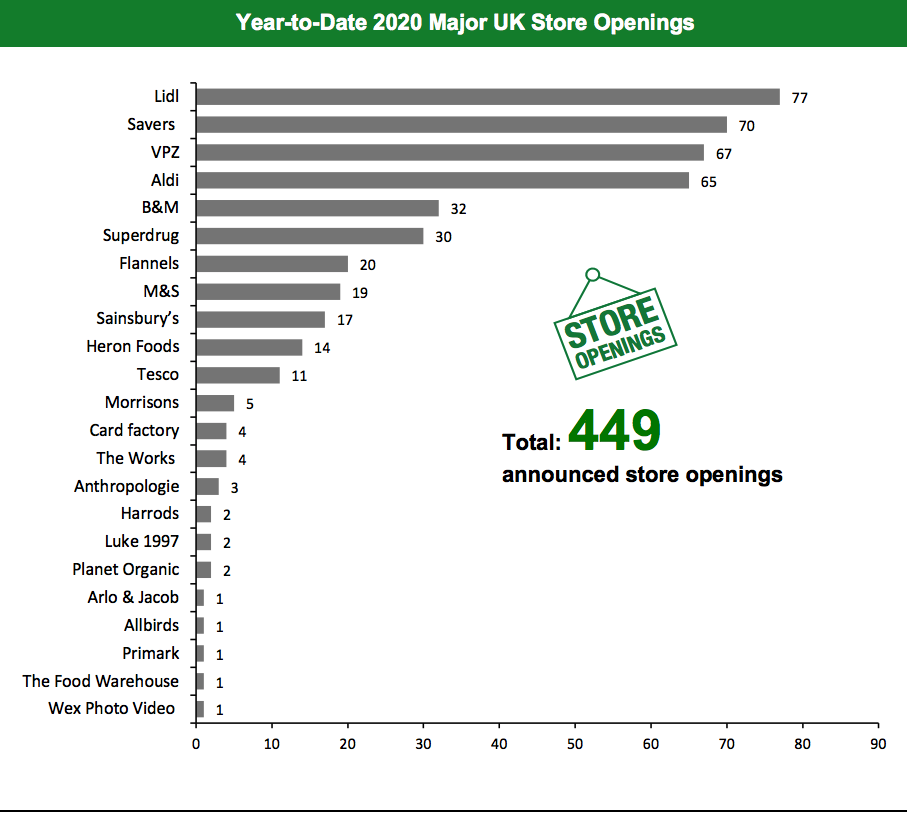

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,819 store closures and 449 store openings. Our data represent closures and openings by calendar year. This week, we have updated our 2020 UK closure count for Johnson Shoes and Oliver Sweeney, and this has changed our 2020 UK closure count to 1,819. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=97]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Johnsons Shoes To Close Six Stores as It Exits Administration Shoe retailer Johnsons Shoes will permanently shut six of its 12 stores after being bought out of administration by Newjohn Limited, part of independent retailer Daniel Footwear. The company’s existing stores in Farnham, Northwood, Staines, Teddington, Twickenham and Walton-on-Thames will continue to operate as Johnsons Shoes, while its remaining stores in Beaconsfield, East Sheen, Newbury, New Malden, Richmond and Windsor will permanently close. The retailer had filed for administration in May 2020, citing its struggles to deal with online competition and the impact of the coronavirus. Oliver Sweeny Closes All Stores as It Drafts Administrators Fashion retailer Oliver Sweeny has drafted in administrators for its retail segment Oliver Sweeney Trading Limited and will permanently close its five stores. The group’s online and wholesale business are not part of the administration and will continue to operate. The retailer had closed all of its stores in late March 2020, as a result of the coronavirus lockdown, and these will now be closed permanently as the company shifts to operating primarily online. Stella McCartney Plans To Size Down Its Staff and May Close Stores Fashion retailer Stella McCartney plans to lay off staff, reduce salaries for some employees for an extended period, and cut back on some activities to reduce costs amid the coronavirus crisis. The company also plans to reevaluate its store portfolio and may turn some stores into franchises or forge new wholesale partnerships. The company’s founder Stella McCartney, who is currently serving in an advisory position, has reportedly forgone her salary completely during the pandemic. Jigsaw Brings in Advisers over Potential Sale Fashion retailer Jigsaw has reportedly appointed advisers to put together a strategic review that could potentially lead to a sale of the business or the closure of a number of stores. The retailer has appointed KPMG to oversee rent negotiations with landlords, as well as Cavendish Corporate Finance to help assess interest from prospective buyers or new investors. The retailer currently has a store portfolio of 75 stores and employs around 900 people.Non-Store-Closure News

Bensons for Beds Appoints New Chairman Mattress retailer Bensons for Beds has appointed Chris Howell as its new Chairman in a bid to strengthen its executive team. Howell was previously the Chairman at Maxeda DIY Group in Benelux and Oceanico Group and has led and supported numerous private and publicly listed companies in executive, non-executive and advisory capacities. Howell had been working with Bensons for Beds in an advisory capacity for several months and will now work closely with CEO Mark Jackson and CFO John Sidebotham. [caption id="attachment_113365" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.*Source: Company reports/Coresight Research[/caption] [caption id="attachment_113366" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=341]

Source: Company reports/Coresight Research

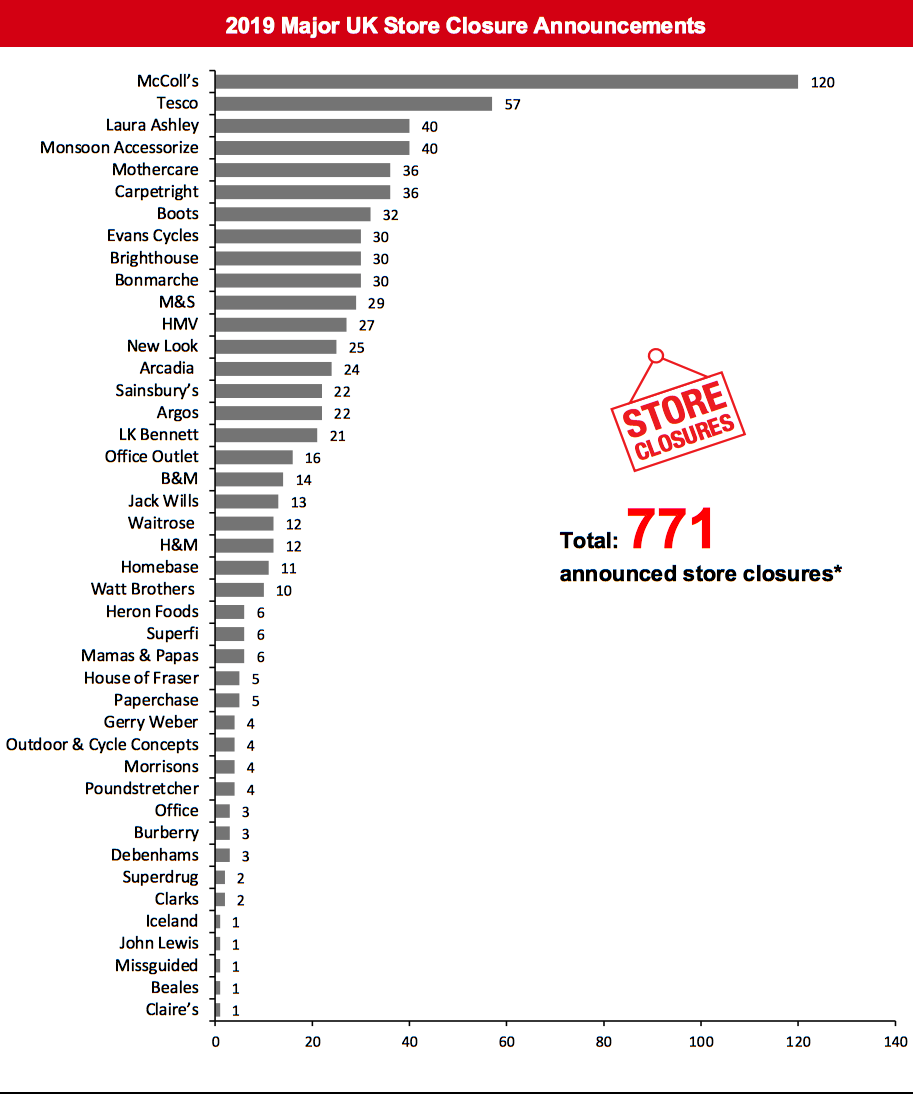

[caption id="attachment_113370" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113371" align="aligncenter" width="700"]

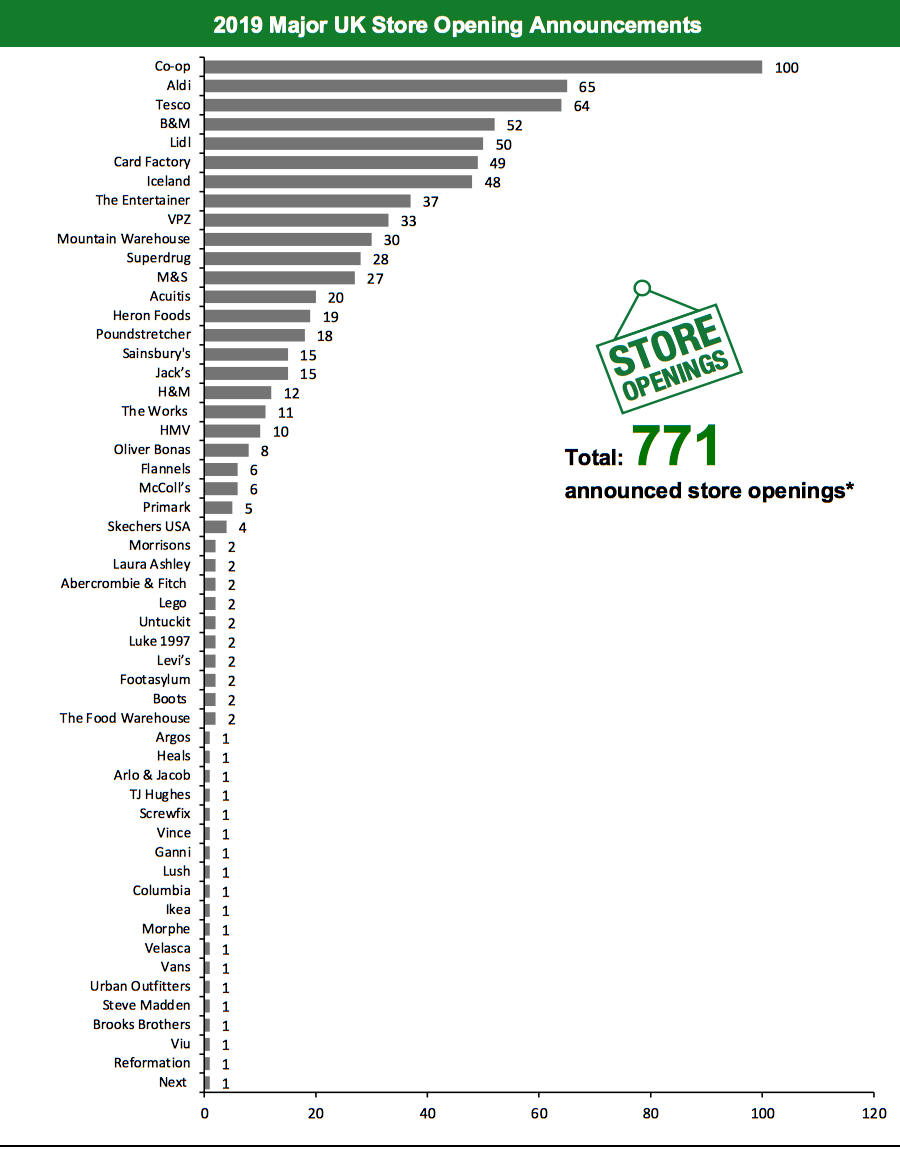

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.