Nitheesh NH

The US

2020 Major US Store Closures and Openings

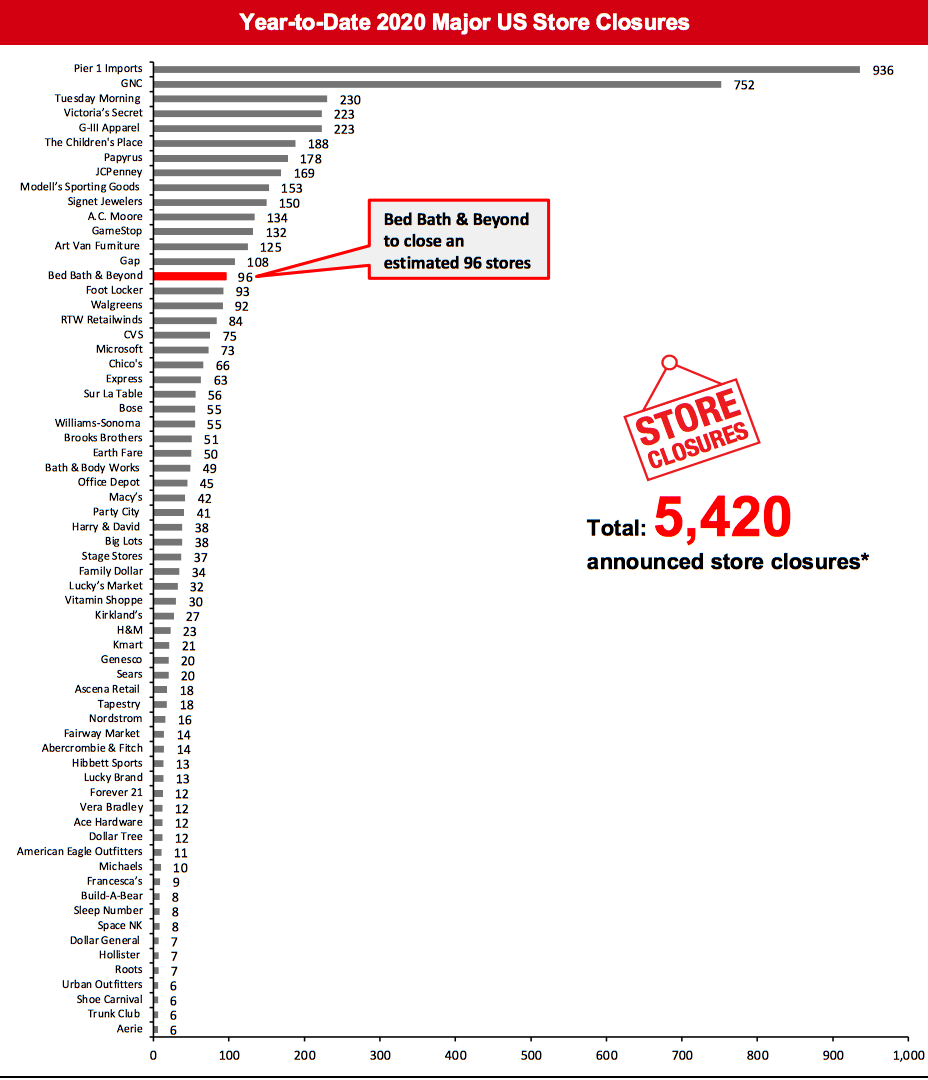

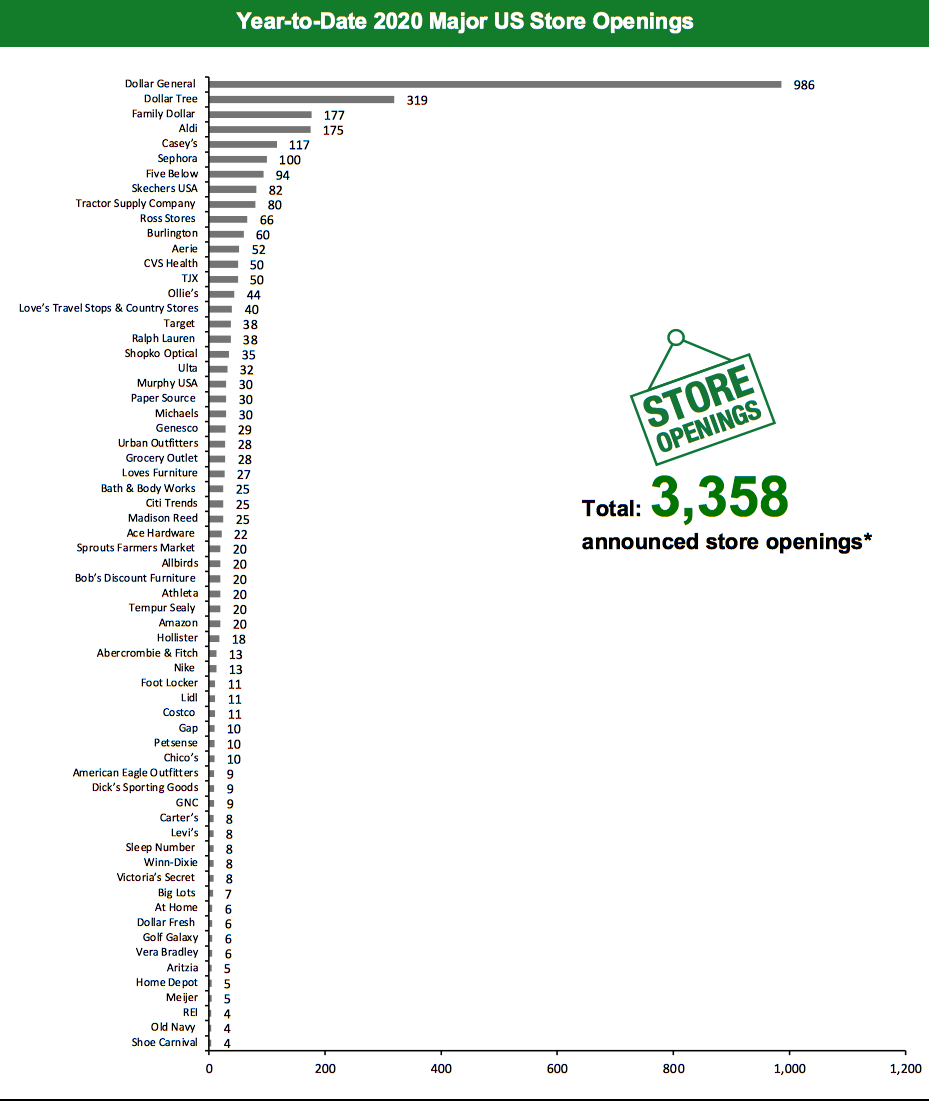

Year to date in 2020, US retailers have announced 5,420 planned store closures and 3,358 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.

This week, we have updated our 2020 US closure count for Bed Bath & Beyond, and this has changed our 2020 US closure count to 5,420.

The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020.

US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=94]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from Fabletics and RTW Retailwinds, among others.

See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.

What Is Happening This Week in the US

Meijer Opens Five New Stores Supermarket chain Meijer has opened five new supercenters in the Midwest. The stores each span 159,000 square feet and are located in Sycamore, Illinois; Bad Axe, Michigan; Brimfield and Lorain, Ohio; and Manitowoc, Wisconsin. The company has implemented standard coronavirus-related safety measures and health precautions in the new stores and has allotted specific shopping hours to senior citizens, customers with health conditions and essential service workers as well as their own associates. Coresight Research insight: The top five retailers in our 2020 store-openings chart are grocery-focused retailers, including dollar stores. In a fragmented grocery market, there remain opportunities for expansion and consolidation. Muji USA Files for Bankruptcy The US arm of Japanese retailer Muji has filed for Chapter 11 bankruptcy in the US and plans to close some unprofitable stores and renegotiate rents in the US after the coronavirus pandemic forced it to shut its 18 stores in the country in March. According to its bankruptcy filing, the business has liabilities in the range of $50–100 million. PVH Corp. To Close 162 Heritage Brand Outlet Stores In response to the coronavirus pandemic, fashion retailer PVH Corp. plans to streamline its North American operations by exiting its 162-outlet Heritage Brands retail business (not included in our closures chart as the company has not divulged clear details regarding the timeline) and reducing its office workforce by approximately 450. The Heritage Brands retail stores are expected to operate through mid-2021. Stefan Larsson, President of PVH Corp., stated that the decision to streamline its operations is strategically important for the long-term health of the company. RTW Retailwinds Files for Bankruptcy Specialty apparel retailer RTW Retailwinds has filed for Chapter 11 bankruptcy protection and expects to close a significant portion, if not all, of its 378 stores. The company will continue to operate its business in the short term by reopening certain stores that were closed due to the coronavirus lockdown, but it is evaluating any and all strategic alternatives, including the potential sale of its e-commerce business and related intellectual property.Non-Store-Closure News

Bed Bath & Beyond Appoints William-Sonoma Veteran as SVP of Owned Brands Bed Bath & Beyond has appointed Neil Lick as SVP of Owned Brands. Lick will lead a newly formed team to develop a portfolio of “customer-inspired” owned brands from 2021. Lick joins Bed Bath & Beyond from Williams-Sonoma, where he worked for 22 years at various leadership positions across merchandising, inventory management and product development verticals. [caption id="attachment_112988" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112989" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=317]

Source: Company reports/Coresight Research

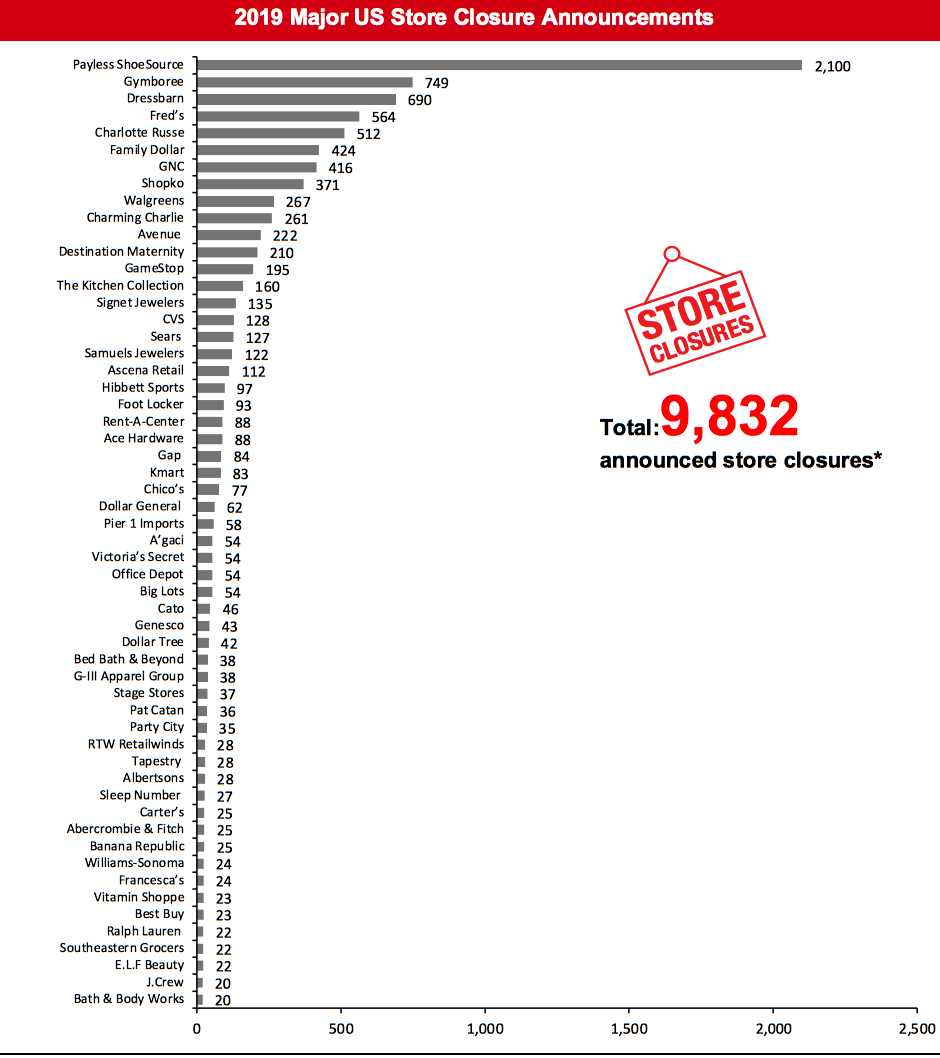

[caption id="attachment_112994" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112995" align="aligncenter" width="700"]

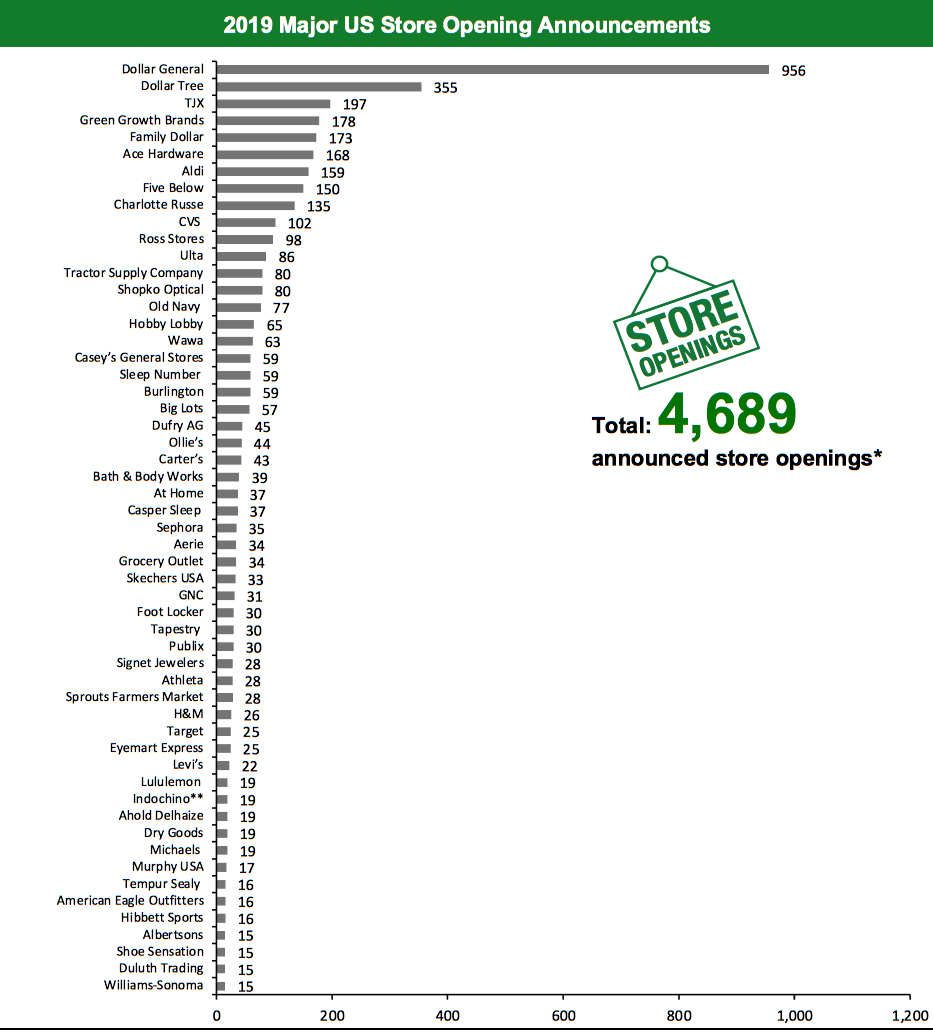

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=318]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=319]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

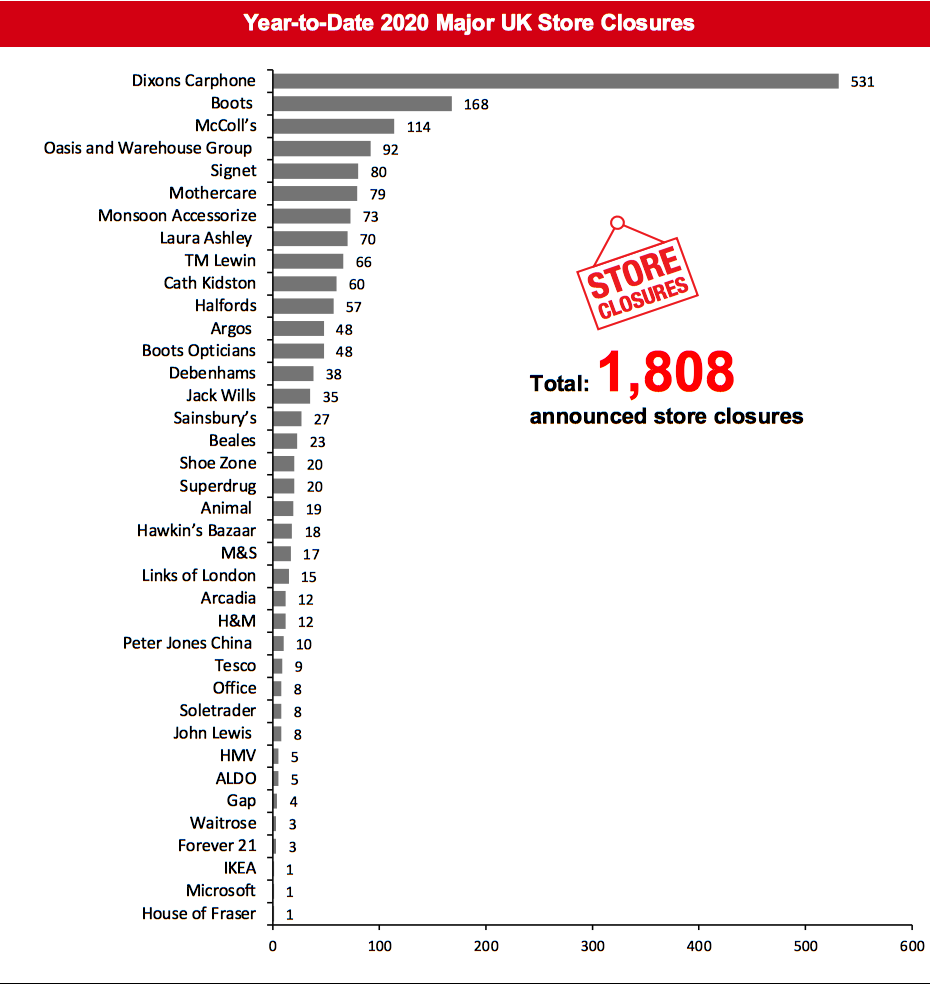

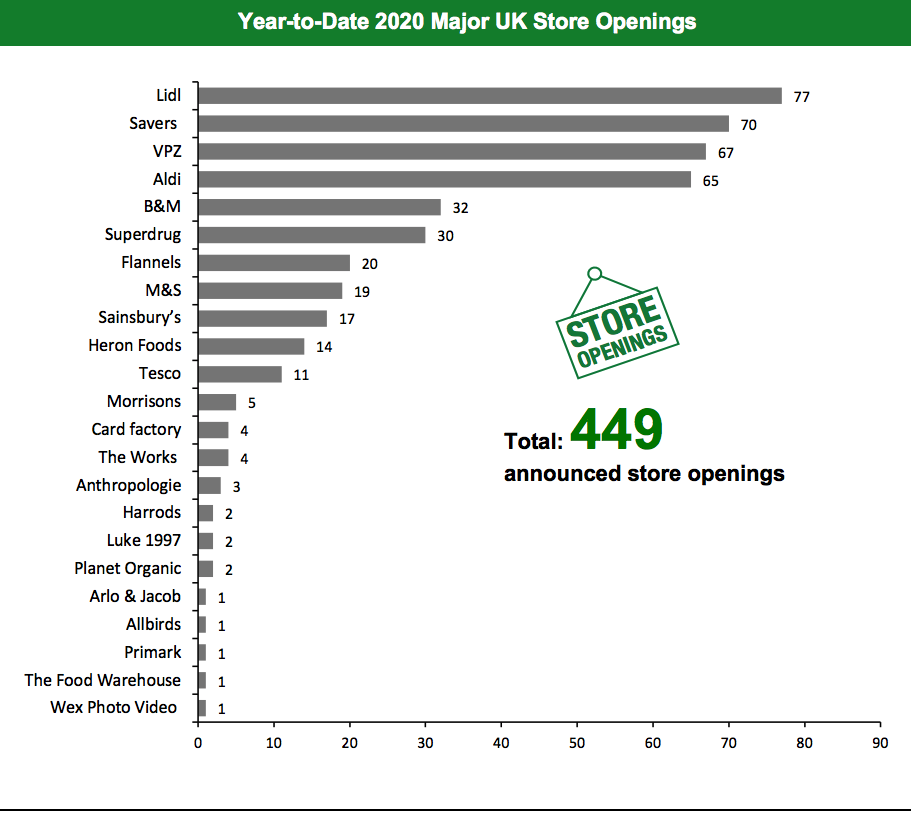

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,787 store closures and 449 store openings. Our data represent closures and openings by calendar year. This week, we have updated our 2020 UK closure count for Boots Opticians and John Lewis. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=95]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Halfords To Close 60 Locations Motoring and outdoor-goods retailer Halfords plans to close 60 of its locations, including garages and retail stores, due to the impact of the coronavirus pandemic. The company is also reportedly in the process of renegotiating store leases that are due for renewal. In April 2020, Halfords announced that it would shut down its Cycle Republic chain, comprising 22 stores, by the first half of its ongoing financial year ending April 2021. The company’s store portfolio consists of 454 retail stores and 321 garages, according to its latest annual report. We have estimated the number of retail store closures based on the existing proportion of stores and garages that the retailer operates and included the previously announced 22 store closures. Lidl Plans To Open 25 Stores Discount supermarket chain Lidl plans to open 25 stores in the next six months, creating up to 1,000 new jobs by the end of 2020. The company currently has over 800 stores and had announced plans in February to invest £1.3 billion ($1.6 billion) in the UK in 2021 and 2022 to take its store count to 1,000 stores by the end of 2023. The first batch of new stores are set to open in the coming weeks in Coleford, Harrow Weald, Llandudno Junction and Selhurst. Peter Jones China Enters Administration Gift and homeware retailer Peter Jones China has entered insolvency after a period of weak trading and cashflow pressure due to the coronavirus lockdown. The company has 10 stores in Yorkshire and will not be able to reopen and trade, according to administrators KPMG. Of the 70 employees, 67 were made redundant following the administrators’ appointment, and the remaining staff are assisting the administrators with the winding down of the business.Non-Store-Closure News

Wilko Hires New CFO Mixed-goods retailer Wilko has hired Karen Mackay as group CFO. Mackay will join the company in September 2020 and will be responsible for the retailer’s finance, IT, corporate services, health and safety, and loss prevention functions. She succeeds Alex Russo, who left the retailer to join rival B&M as its new CFO in March, 2020. Mackay most recently served a five-year term as CFO of healthcare firm Optegra. [caption id="attachment_113000" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_113001" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=321]

Source: Company reports/Coresight Research

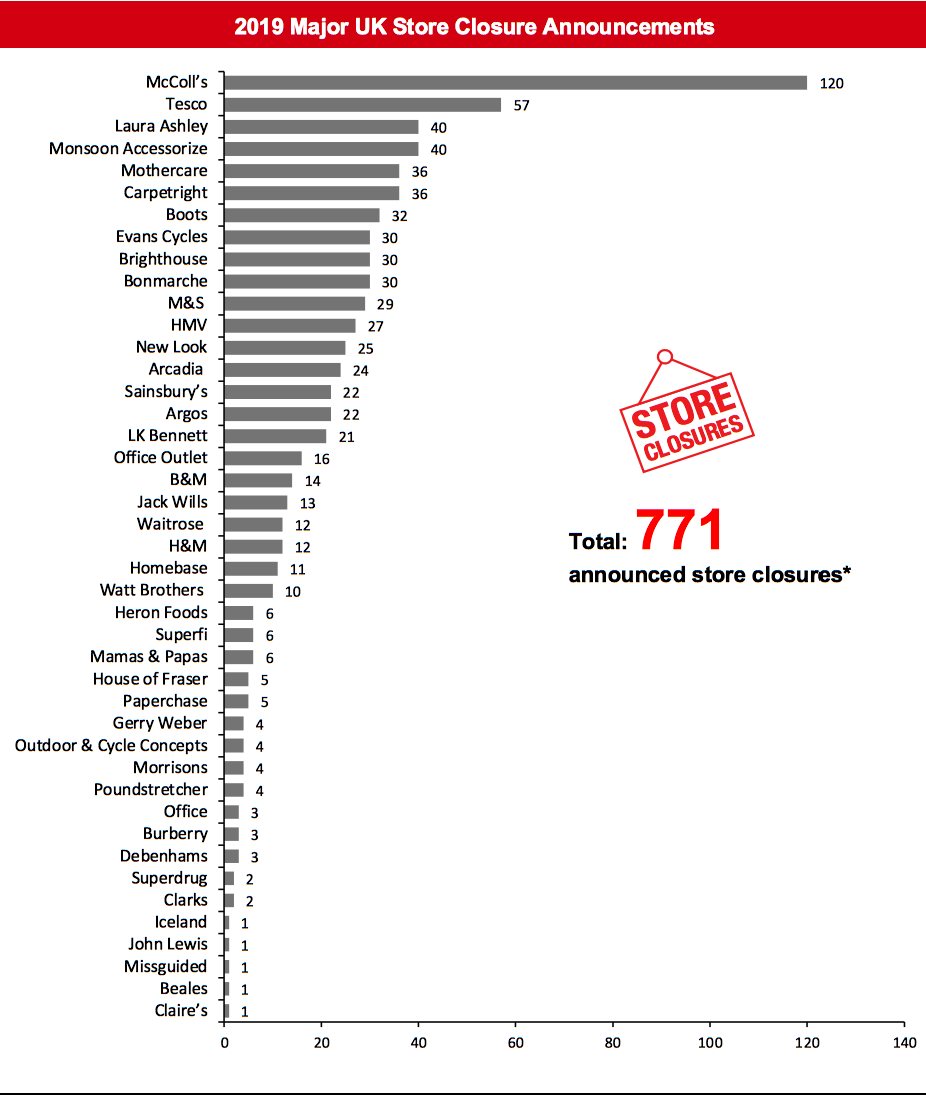

[caption id="attachment_113003" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_113005" align="aligncenter" width="700"]

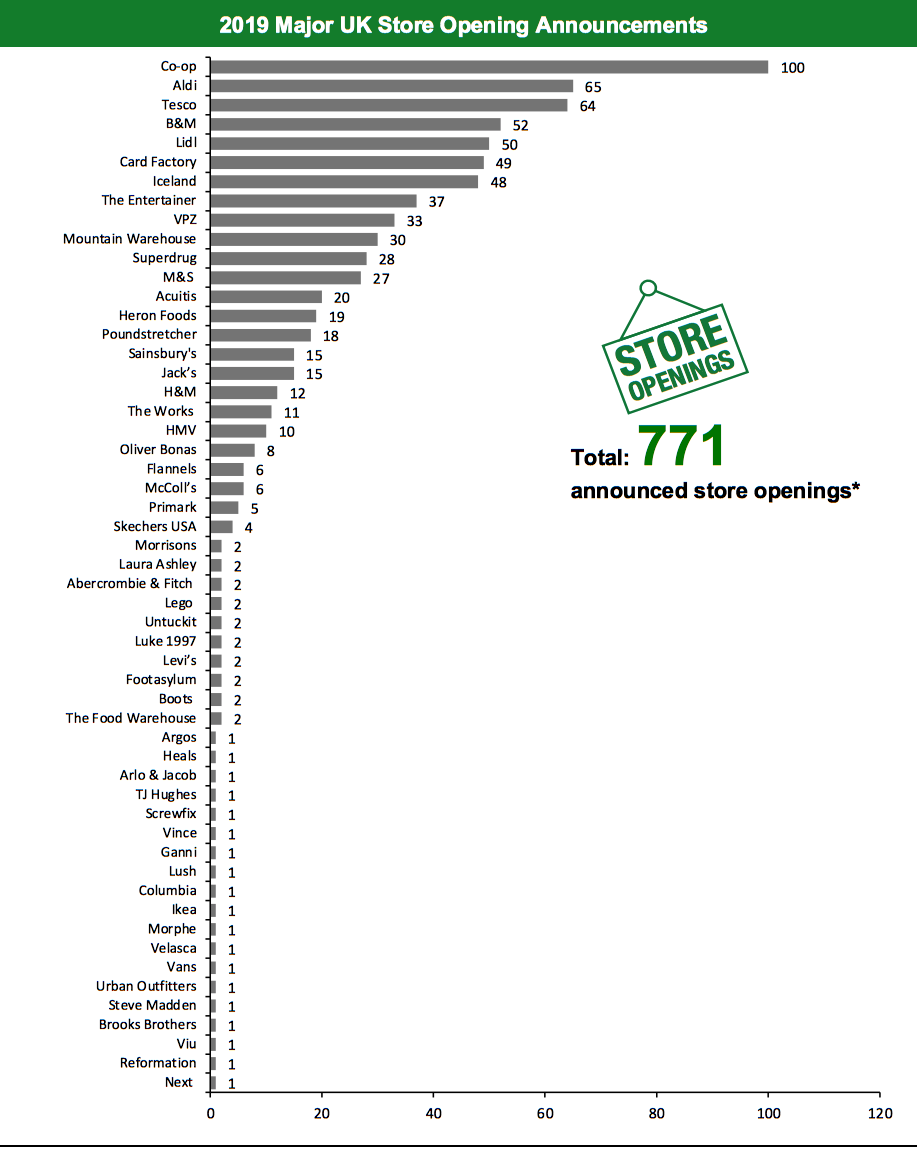

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.