Nitheesh NH

The US

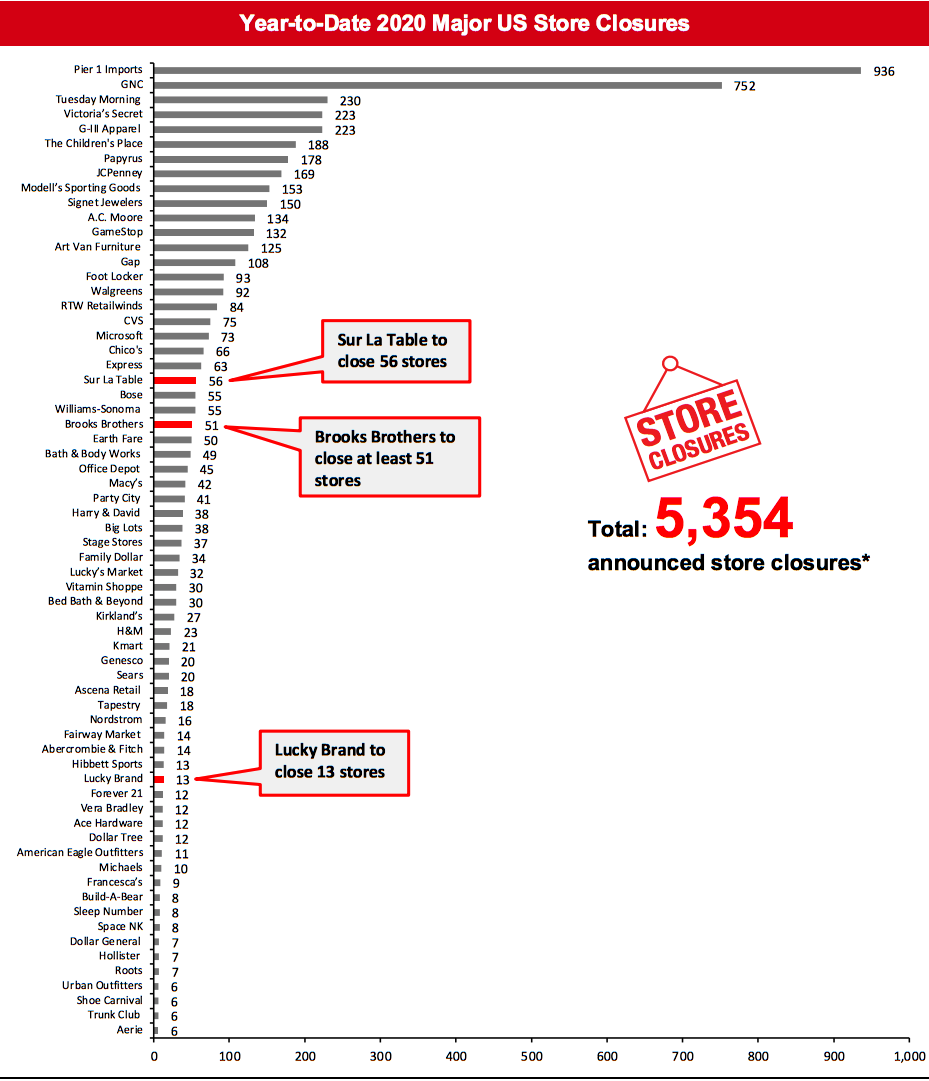

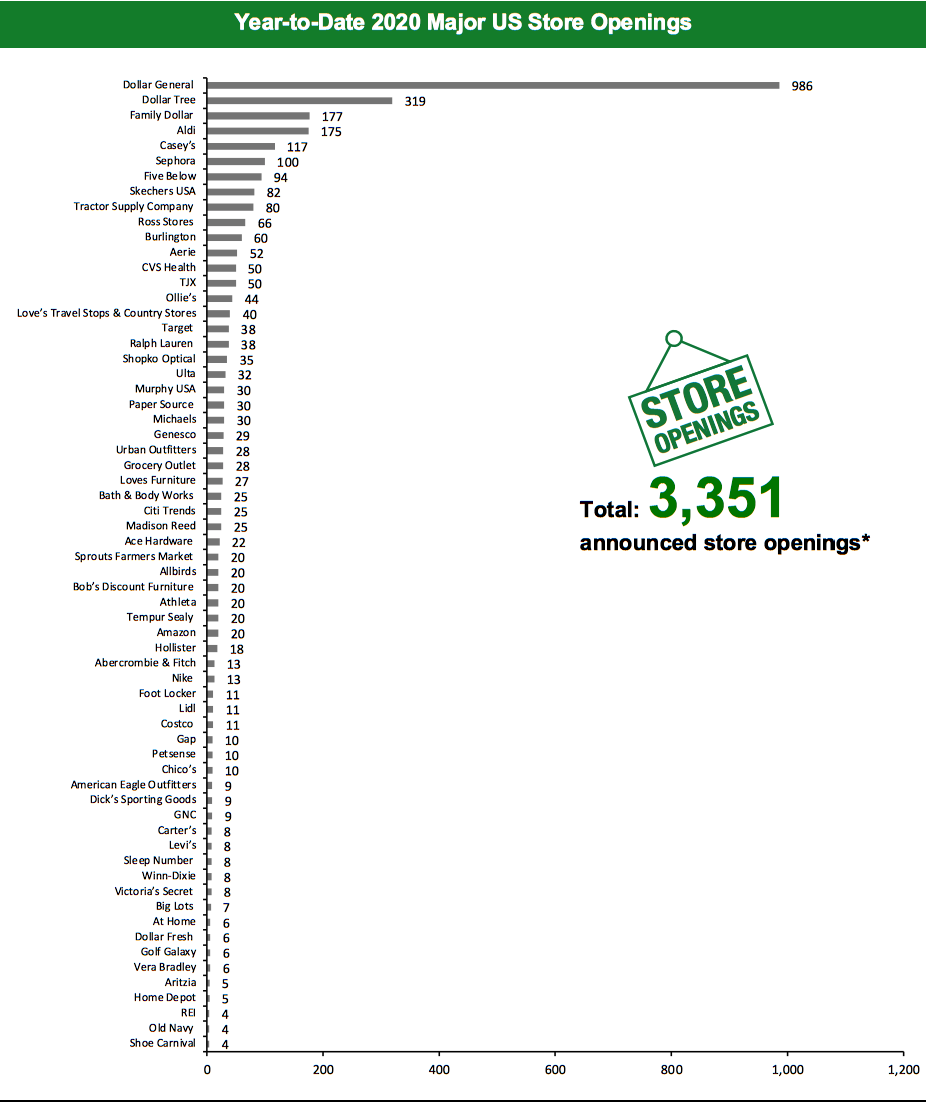

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 5,354 planned store closures and 3,351 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=92]Source: Company reports/Coresight Research

Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as state governments have relaxed their lockdown restrictions. This week saw reopening updates from Apple and Levi’s, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Bed Bath & Beyond To Close 200 Stores Shortly before we went to press, Bed Bath & Beyond announced plans to close 200 stores over the next two years. The company operates stores in the US and Canada. We will update our store-closures total and chart to include these numbers in next week’s report. Amazon To Open More Grocery Stores Amazon has announced plans to open its second Amazon Go Grocery store in Redmond, Washington. According to the company website, this store is “coming soon.” Amazon also plans to open an Amazon Go Grocery store in Washington, DC. A company spokesperson has confirmed that Amazon also plans to open grocery stores in Woodland Hills and Irvine in California and in the Chicago suburbs of Naperville and Schaumburg, as well as two new-concept supermarkets in North Hollywood, California and Oak Lawn, Illinois. Coresight Research insight: We have long argued that a cross-channel model is essential in grocery—as Amazon discovered, an online-only model greatly inhibits a company’s potential market share. Amazon is now doubling down on brick-and-mortar in grocery with a range of banners and formats. Even while its non-Whole Foods footprint remains limited, these steady encroachments will concern incumbent grocery rivals. Ascena Retail May File for Bankruptcy Imminently Apparel retailer Ascena Retail could file for bankruptcy within a few days, according to Bloomberg. It plans to close or sell some of its brands, including Catherines and Justice. As a part of the bankruptcy proceeding, the retailer could close about 1,200 of its 3,000 stores. The closures are not added to our 2020 store-closures chart as the retailer has not yet confirmed plans. Brooks Brothers Files for Bankruptcy; Will Close At Least 51 Stores Apparel retailer Brooks Brothers filed for Chapter 11 bankruptcy protection on July 8, 2020 and plans to close at least 51 stores, a decision that it attributed to the coronavirus pandemic. The retailer operates over 200 stores in North America and 500 stores globally. G-Star Raw US Files for Bankruptcy Denim brand and retailer G-Star Raw has filed for Chapter 11 bankruptcy protection in the US, with the coronavirus pandemic having severely impacted its business. The company said that it plans to restructure its store portfolio in the US and intends to continue with a smaller retail footprint in order to survive the current market situation. In the court filings, G-Star Raw revealed its plans to reduce its retail footprint from 31 to around seven stores, implying that some 24 stores may close, but this number could change if some landlords agree to make concessions. We have not included these in our 2020 store-closures chart as the closures are subject to negotiation. Lucky Brand Files for Bankruptcy; Plans To Close 13 Stores Apparel retailer Lucky Brand has filed for Chapter 11 bankruptcy protection, with plans to close at least 13 stores. The retailer is also pursuing a sale of its business to reduce its debt caused by the coronavirus pandemic. Lucky Brand will continue to operate its e-commerce platform, the majority of its stores and wholesale business during the bankruptcy proceedings. It has received financial commitments from a few of its existing lenders that will enable the retailer to operate during the bankruptcy process. As of May 2020, Lucky Brand operates 112 specialty stores and 98 outlet stores in North America. Sur La Table Files for Bankruptcy Kitchenware products retailer Sur La Table announced on July 8, 2020 that it has filed for Chapter 11 bankruptcy protection, with plans to restructure its business and close about 56 of its 121 stores. It is also pursuing a sale of its business, subject to court approval. Sur La Table has secured debtor-in-possession financing in order to operate during the bankruptcy proceedings.Quarterly Store Openings/Closures Settlement

Capri Holdings Could Close 170 Stores Luxury brand owner Capri Holdings has announced that it could close up to 170 stores, mostly Michael Kors, over the next two years. The company is in the process of reviewing its store portfolio and assessing store profitability to further streamline its operations. Capri Holdings stated that the final details will be provided when the assessment of the plan is complete. The closures are not included in our 2020 store-closures chart as the closure plans are not yet confirmed. Levi’s Lowers Store-Opening Target Levi’s has lowered its store-opening target for fiscal year 2020, ending November 29, to 70 new stores from its original target of opening 100 stores globally. To date in fiscal year 2020, the retailer has opened 30 stores, primarily outside the US. Levi’s stated that most of the stores it is opening this year will be digitally enabled to provide its customers an enhanced brand experience. We have revised our charted opening count based on the existing proportion of stores in the US.Non-Store-Closure News

Crate & Barrel CEO To Depart Home-furnishings retailer Crate & Barrel has announced that its CEO Neela Montgomery will part ways with the company on August 1, 2020 to pursue new opportunities. Montgomery had informed the company’s board about her decision late last year. She was appointed as the CEO of Crate & Barrel in 2017. Prior to that, she was an Executive Board Member of Crate & Barrel’s parent company Otto Group. [caption id="attachment_112652" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than six store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112653" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than four store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=306]

Source: Company reports/Coresight Research

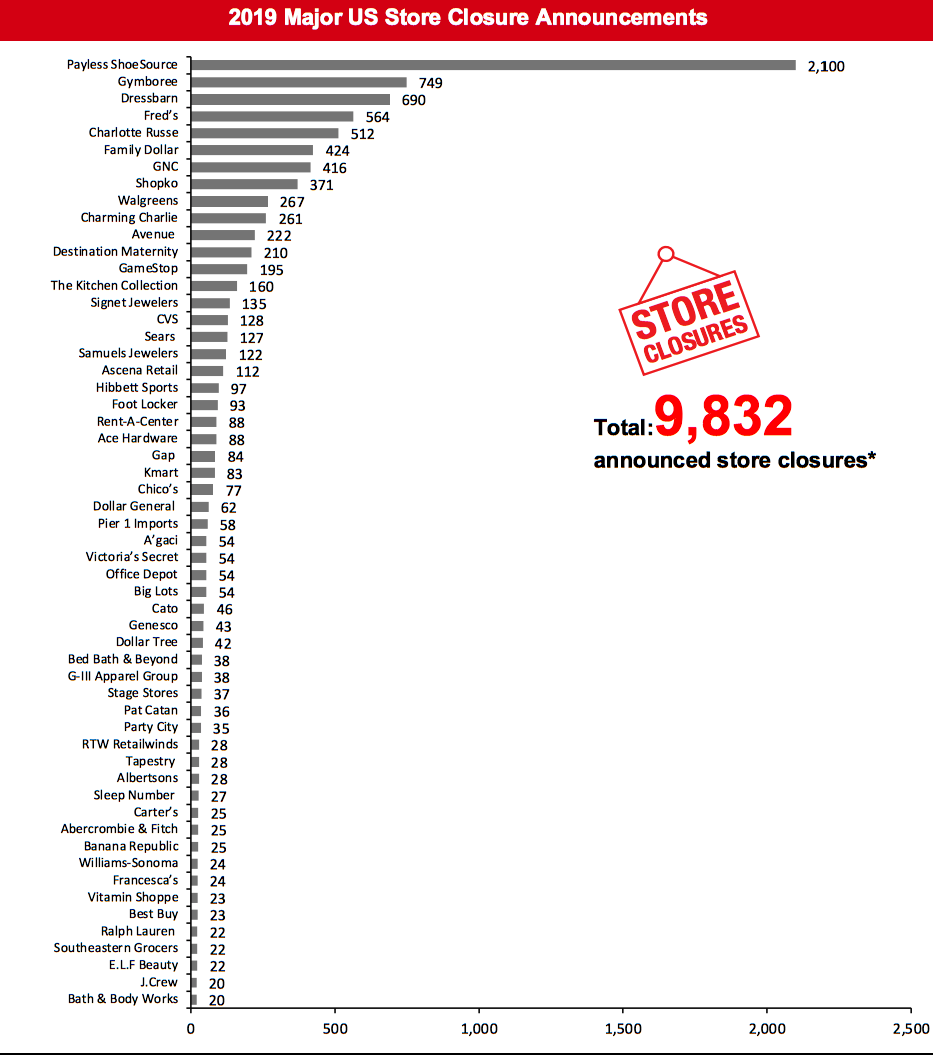

[caption id="attachment_112656" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112657" align="aligncenter" width="700"]

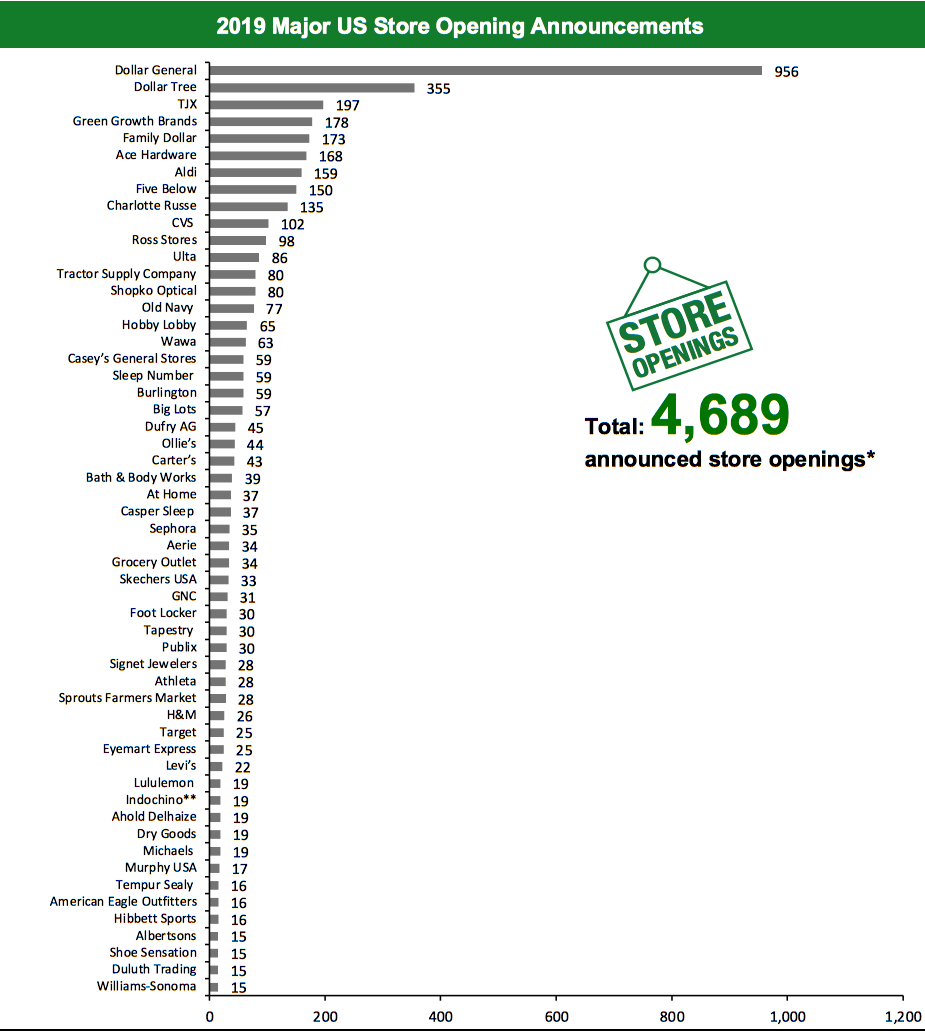

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=307]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=308]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

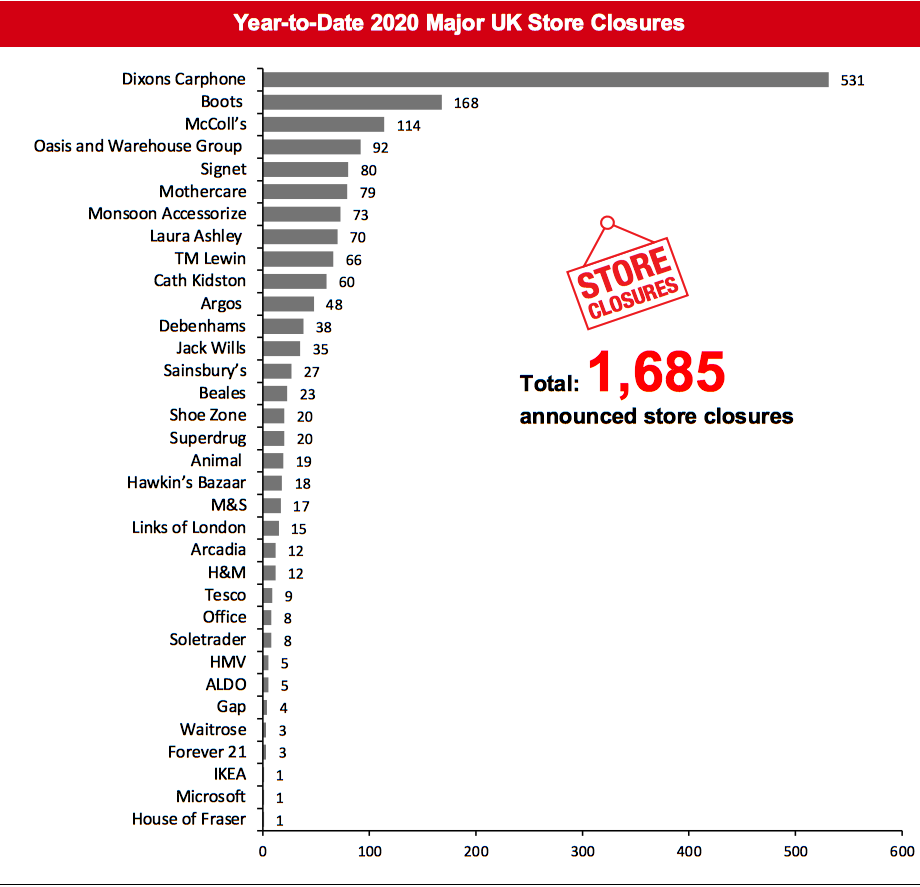

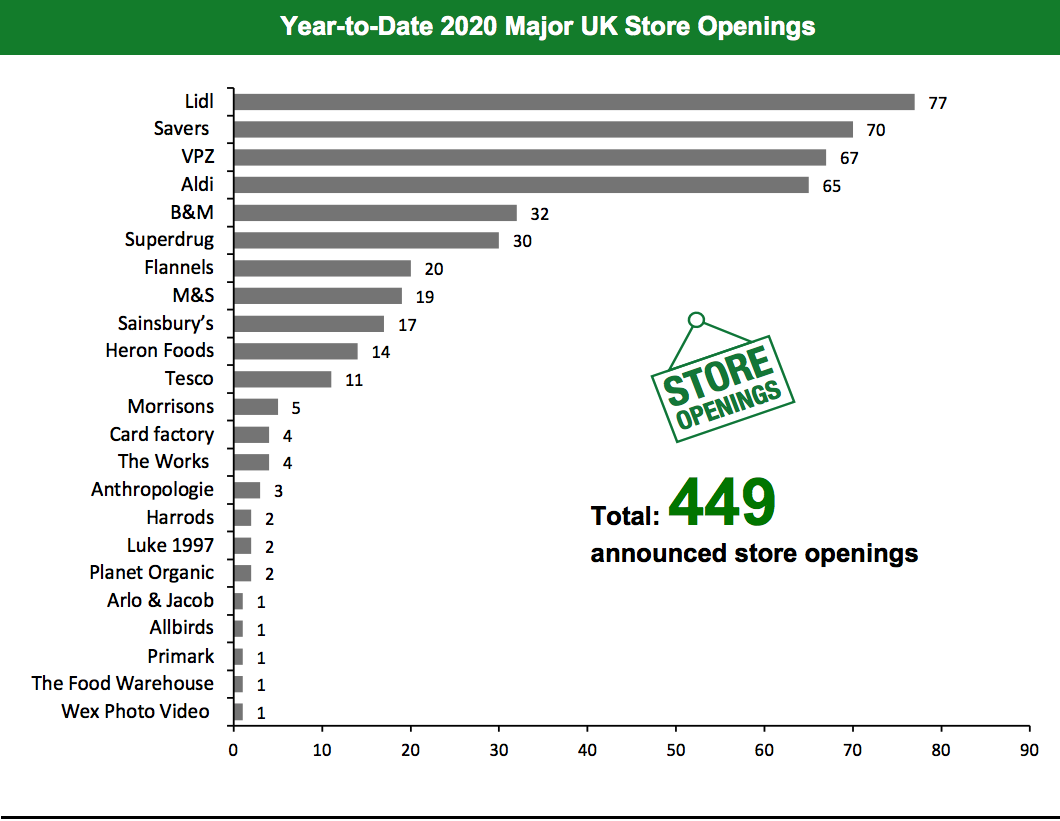

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,685 store closures and 449 store openings. Our data represent closures and openings by calendar year. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=93]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

John Lewis Partnership To Close Eight Stores Shortly before we went to press, the John Lewis Partnership announced that it will permanently close eight stores under its John Lewis department-store banner; the stores will not reopen after being closed due to the coronavirus pandemic. Four of the stores are “At Home” furnishings and electrical-goods stores (Croydon, Swindon, Tamworth and Newbury), two are small travel stores (Heathrow Airport, London St. Pancras railway station) and two are full-range department stores (Watford and Birmingham, with the latter opened only in 2015). Currently, the company has reopened 32 of its 50 stores after the lifting of lockdown restrictions. We will update our store-closures total and chart to include these numbers next week. Coresight Research insight: Covid-19 aside, White inherited challenges related to John Lewis’ restructuring and underlying performance when she took the chairmanship in February. White’s appointment of new executive directors for Waitrose and John Lewis (the latter, Pippa Wicks, announced only recently) is welcome. At John Lewis, White and Wicks will face the challenges of softened post-crisis demand, strong price competition, the fallout from months-long store closures and structural shifts (to e-commerce and value players) that the coronavirus crisis may accelerate. So far, we are impressed at how White is confronting the challenges at John Lewis. However, we think the chain will need to consider whether its “Never Knowingly Undersold” price promise is fit for an age of increasing retail distress, as well as structural shifts online. Boots To Close 48 Optician Stores Also just before we published, Boots, owned by Walgreens Boots Alliance, announced plans to close 48 Boots Opticians stores and cut 4,000 jobs. Boots UK comparable sales fell by 48% and Boots Opticians comp sales fell by 72% in the third quarter. We will update our store-closures total and chart to include these numbers in next week’s report. Little Mistress To Open 10–15 Stores Womenswear retailer Little Mistress is seeking 10–15 stores in the UK for immediate opening, according to Drapers. CEO and Founder of Little Mistress, Mark Ashton, said that the new stores will include both permanent leases and pop-up store options in locations that include Cardiff, Birmingham, Liverpool, Manchester and Sheffield. The openings are not included in our 2020 store-openings chart, as the company has not provided a breakdown on the number of permanent leases and pop-up stores. Soletrader To Close Eight Stores Footwear retailer Soletrader will permanently close eight of its 37 stores in the UK after its parent company Twinmar Limited placed it into creditors’ voluntary liquidation. The remaining 29 stores are set to reopen in July. The retailer said the closures will place the Twinmar Group in “a strong position for a future beyond Covid-19, as the retail industry comes to terms with the macroeconomic consequences of the current crisis.”Non-Store-Closure News

Poundland To Open Six Shop-in-Shops Discount retailer Poundland has announced plans to expand its Pep&Co “shop-in-shop” concept to an additional six stores. The Pep&Co shop-in-shops will open in Poundland stores located in Cortonwood Shopping Park, Kings Lynn Retail Park, Peterborough Hereward Cross Centre, Princess Alice Retail Park and Peterborough Retail Park this month, and in Shirley Parkgate Shopping Centre in August. Poundland launched its Pep&Co shop-in-shop concept in 2019. [caption id="attachment_112661" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.*

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.*Source: Company reports/Coresight Research[/caption] [caption id="attachment_112662" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=310]

Source: Company reports/Coresight Research

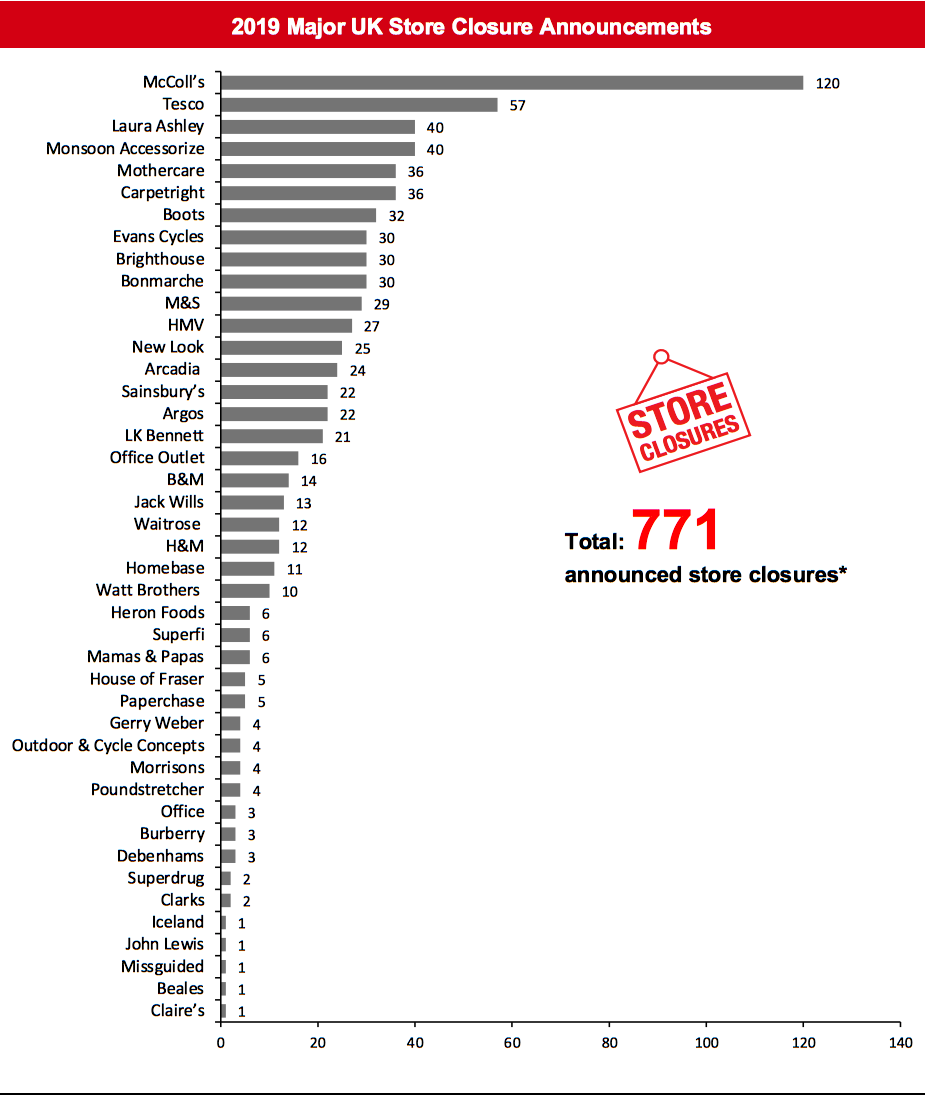

[caption id="attachment_112664" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.<br*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.<br*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.Source: Company reports/Coresight Research[/caption] [caption id="attachment_112665" align="aligncenter" width="700"]

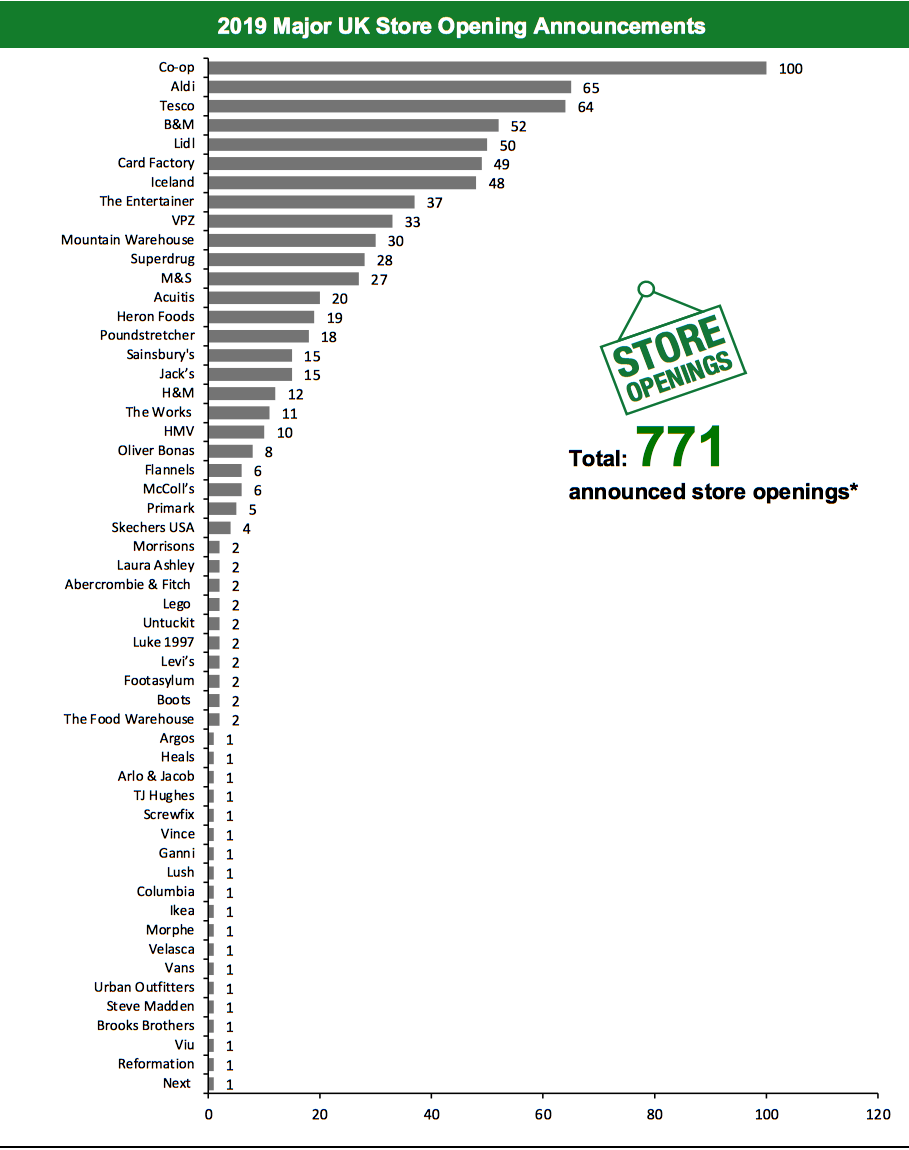

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.