Nitheesh NH

The US

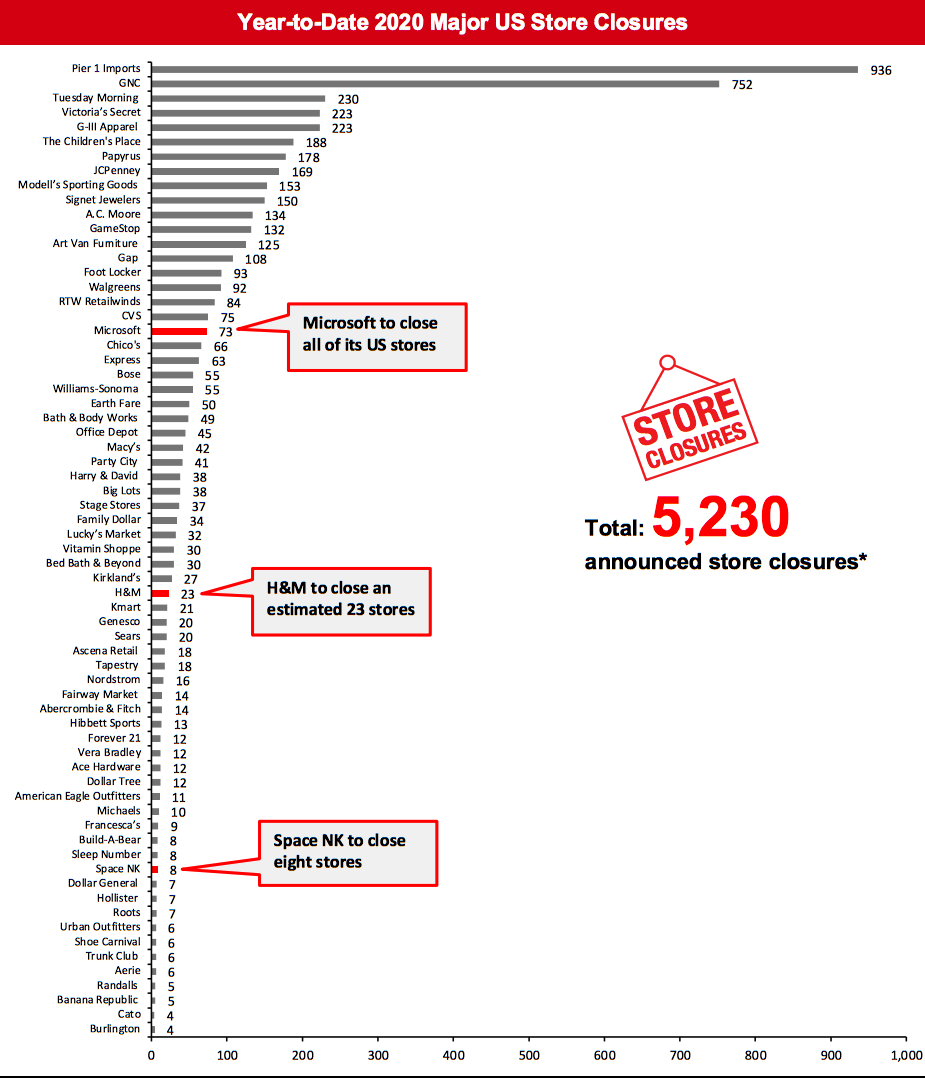

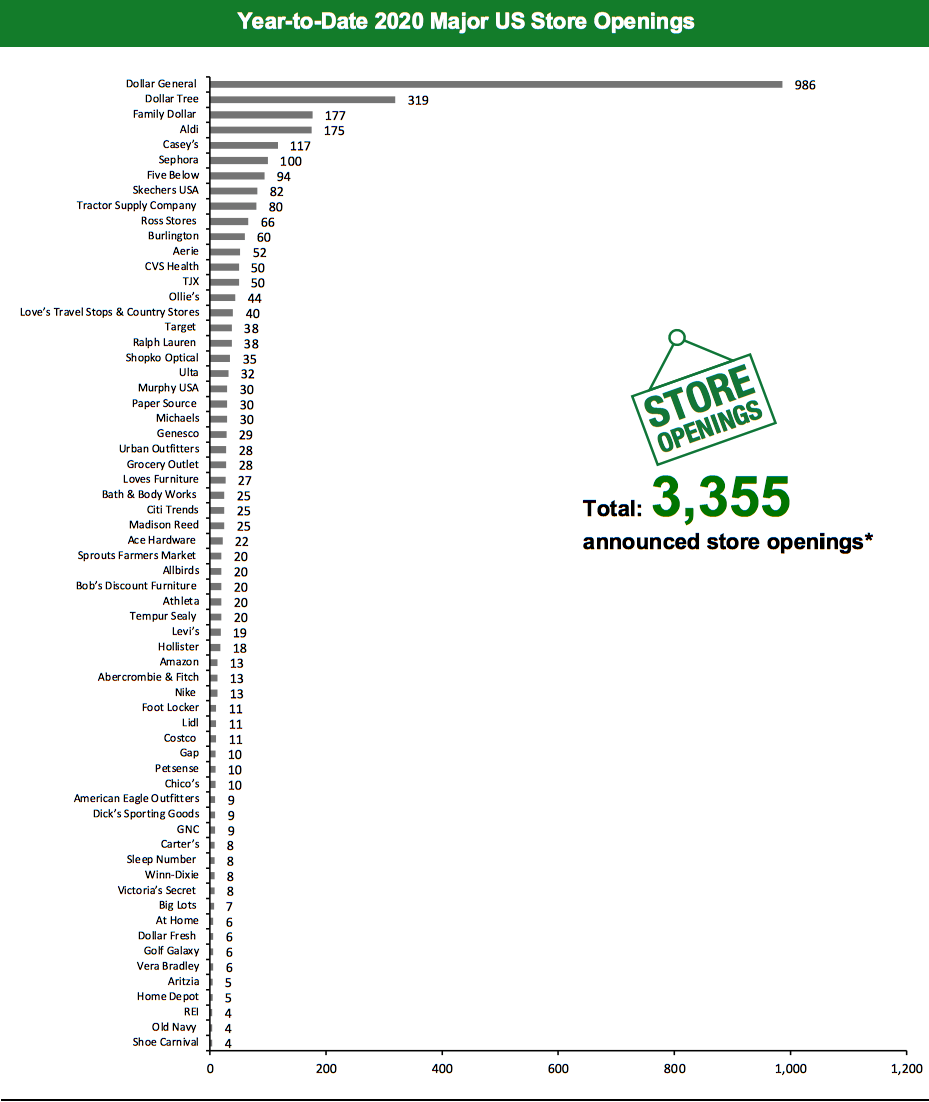

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 5,230 planned store closures and 3,355 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=90]Source: Company reports/Coresight Research

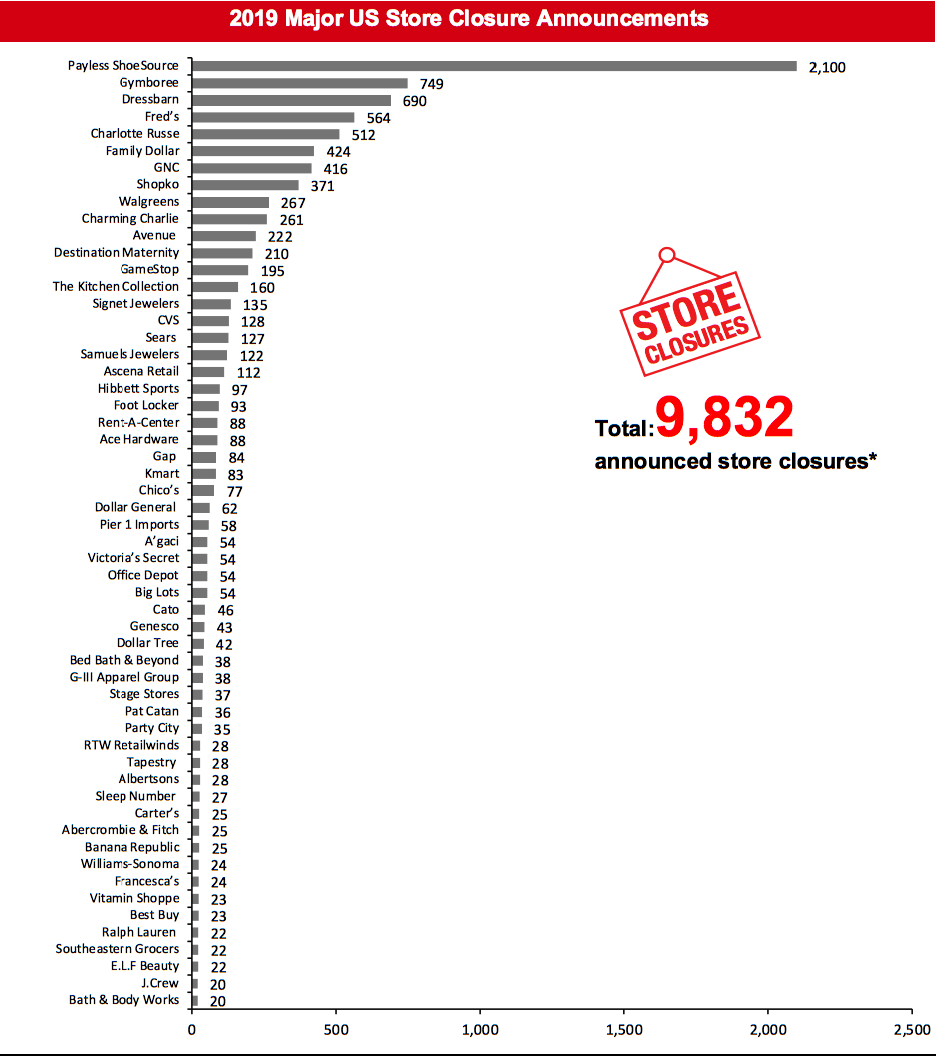

As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for A.C. Moore, and this has changed our 2019 US closure count to 9,832.Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as many state governments have relaxed their lockdown restrictions. This week saw reopening updates from Capri Holdings, Chico’s and NIKE, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Microsoft To Close All of Its US Stores Microsoft has announced a strategic change in its retail operations whereby it will close all its retail store locations but will continue to invest in its digital storefronts. The company has 73 store locations in the US and one in the UK, which were temporarily closed in late March due to the coronavirus pandemic. Following the permanent store closures, the company’s retail team members will continue to serve customers from Microsoft corporate facilities and will provide sales, training and support remotely. Coresight Research insight: We see this move as the vanguard of a trend away from experiential retail—at least in the near to medium term. In a “mask economy,” we see the offline channel shifting its focus back to product: less shopping, more buying. As part of the move toward contact-light retail, the “experience” that shoppers appreciate from physical stores will now be that of getting a product in as friction-free a process as possible, rather than in-store classes, one-to-one services or other events that draw crowds or require physical contact. Sears and Kmart To Close Stores Transformco, parent company of Kmart and Sears, is reportedly closing more Kmart and Sears stores, according to Retail Dive. The potential closures include Kmart stores in California, New Hampshire, North Dakota, Minnesota and Pennsylvania, Sears stores in Ohio and Texas, and a Sears Hometown store in South Dakota. In November 2019, Transformco had announced plans to close 96 Kmart and Sears stores by February 2020. Space NK To Close All Stores Luxury beauty retailer Space NK will close all of its eight US stores over the next three months, according to WWD. The retailer plans to focus on its wholesale business in the US, including its partnerships with Bloomingdale’s and Nordstrom. It intends to transition to a full-service wholesale business by March 2021. The retailer’s website will continue to operate. Coresight Research insight: As with Microsoft, the challenges of squaring a close-contact, service-rich, in-store offering with a mask economy look to be a challenge for retailers such as Space NK.Quarterly Store Openings/Closures Settlement

H&M Revises Store Opening and Closure Plan Swedish clothing retailer H&M has revised the number of store closures and reduced the pace of store openings for fiscal year 2020, ending November 30. The retailer now plans to close 170 stores and open around 130 stores globally compared to its previously announced plans to close 175 and open 200 new stores globally. The retailer had previously announced that it will open most of its stores in Asia (excluding China), Eastern Europe, Russia and South America and close stores mainly in China, Europe and the US. We have estimated the closure count based on the existing proportion of stores in the US. Coresight Research insight: This plan will see H&M reducing its total store count for the first time in many years—a watershed moment and one following rival Inditex’s recent announcement of plans to close 1,000–1,200 stores in the next two years (albeit Inditex plans to still grow total floor space). Both retailers have historically focused on physical stores at the expense of e-commerce or omnichannel services; the current crisis is prompting an acceleration of their shifts toward digital. They will not be the only ones: Our recent estimate of 20,000–25,000 gross US store closures this year was predicated in part on retailers reassessing their need for physical space in the wake of lockdowns, prompting shoppers to switch to online and retailers to understand what their sales-retention rates could be in the absence of stores. NIKE To Open 150–200 Stores NIKE has announced plans to open 150–200 small-footprint, digitally enabled stores in North America and the Europe, Middle East and Africa (EMEA) in the next couple of years. The retailer believes that there is an opportunity to provide a monobrand experience, especially in the women’s and apparel product categories. We have estimated the opening count based on the existing number of stores in the US.Non-Store-Closure News

Simon Property Group Reopens 199 Retail Properties Simon Property Group has reopened 199 of its 204 US retail properties across 37 US states following Covid-19 lockdowns, which represent over 95% of the company's property net operating income. The properties are located in states where governments have enabled the reopening of businesses, and the company’s remaining five properties are expected to reopen within the next week. Simon Property Group reported that more than 18,000 stores across its US portfolio have reopened and are reporting higher-than-expected conversion rates and sales. [caption id="attachment_112347" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than four store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112348" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=292]

Source: Company reports/Coresight Research

[caption id="attachment_112350" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112351" align="aligncenter" width="700"]

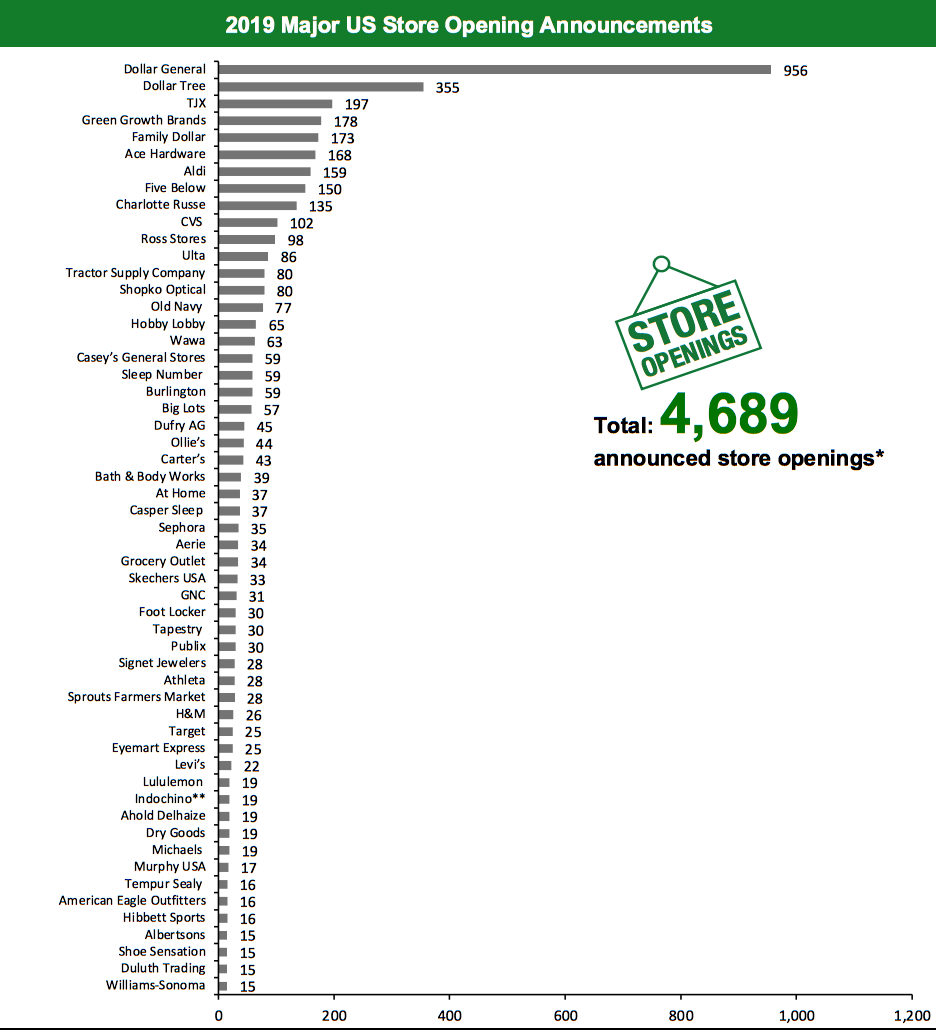

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=293]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=294]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

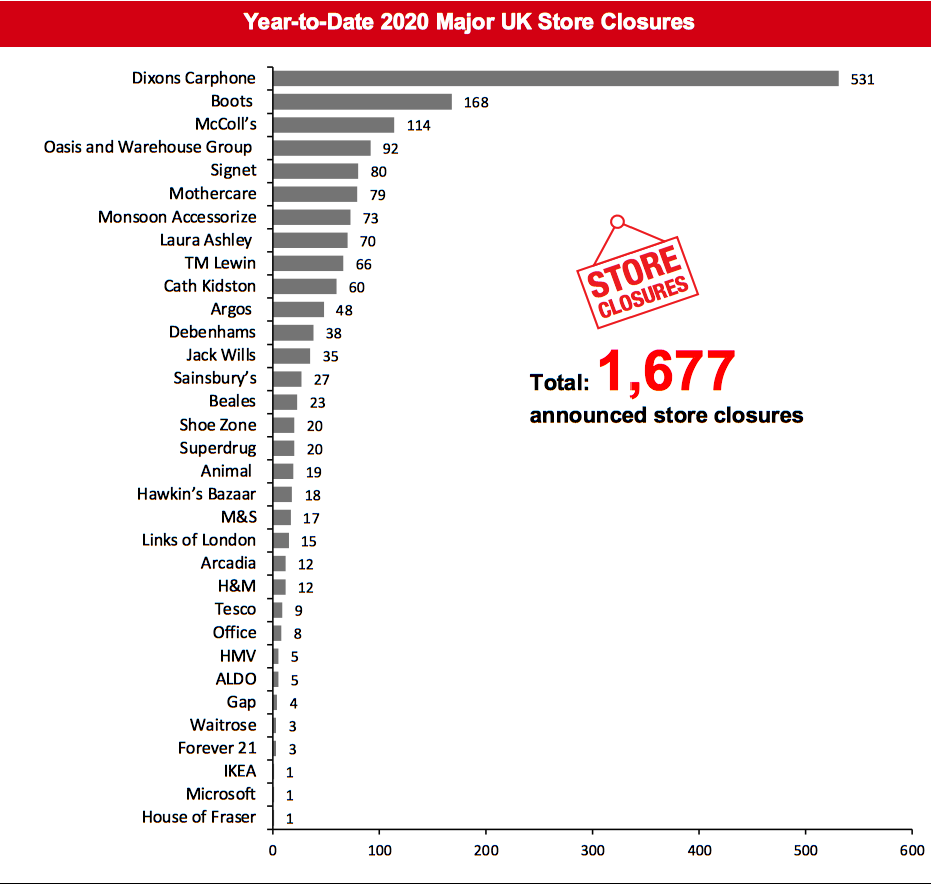

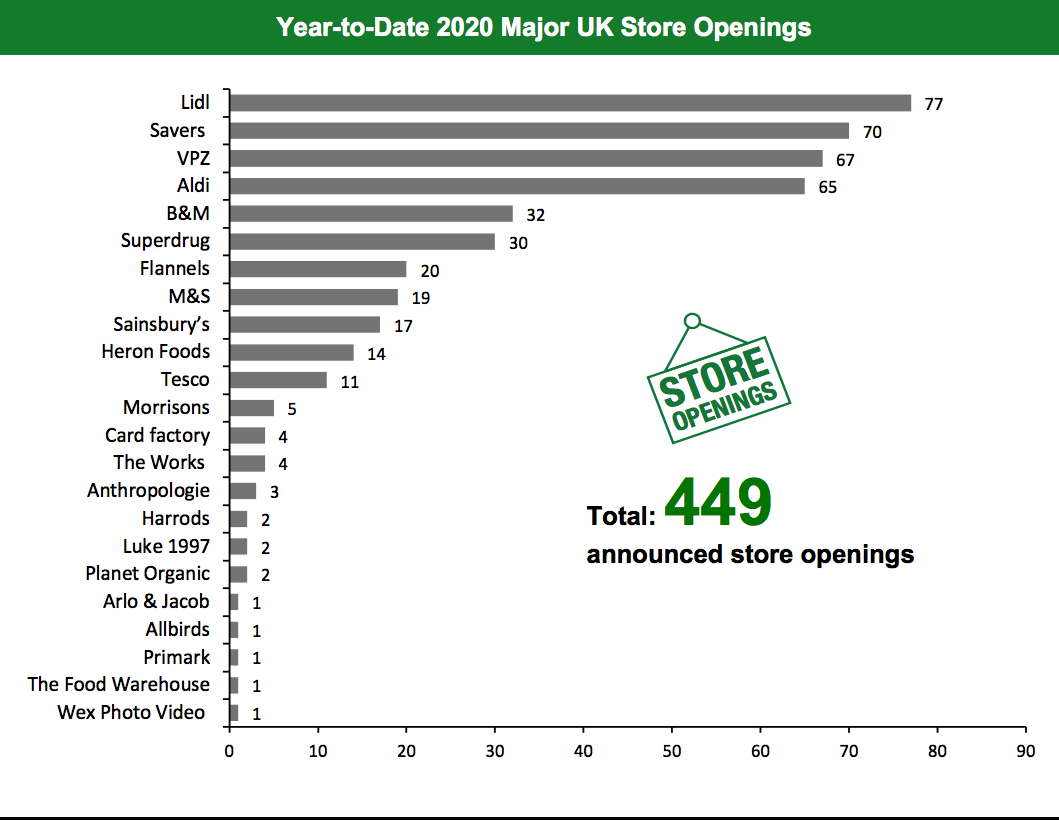

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,677 store closures and 449 store openings. Our data represent closures and openings by calendar year. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=91]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

Harveys Furniture Enters Administration; Alteri Investors Buys Bensons for Beds from Administration Harveys Furniture has entered into administration resulting in the loss of 240 jobs. The retailer operates 20 stores and three manufacturing sites, which will continue to trade until it finds a buyer. Blue Group, owner of Harveys Furniture and Bensons for Beds, has appointed PwC as administrators and is undergoing a financial restructuring of its business. Bensons for Beds, which currently operates 243 stores including shared units with Harveys, has been bought back by Blue Group’s owner Alteri Investors via a pre-pack administration deal, according to Sky News. Following the deal, about 50 Bensons for Beds stores may close permanently. The closures are not included in the chart as the plan is not yet confirmed. Monsoon Accessorize To Close 73 Stores Monsoon Accessorize, parent company of fashion retailers Accessorize and Monsoon, has revealed that it will permanently close around 73 stores. It will reopen 57 more stores in addition to the 100 stores announced last week, after it successfully negotiated with many landlords to base rent deals on turnover. FRP Advisory, which has been appointed as administrators, has stated that about 157 of the retailer’s 230 stores will reopen by the end of July 2020. TM Lewin To Close All of Its 66 Stores Menswear retailer TM Lewin has entered into administration, with plans to close all of its 66 stores. The retailer’s owner Torque Brands has bought back only TM Lewin’s assets and none of its stores via a pre-pack administration deal. The brand will continue to sell online and share the same IT, manufacturing and distribution systems as other brands under the same owner as Torque Brands looks to minimize costs. Coresight Research insight: Harveys/Bensons was acquired by Alteri only in November 2019 (story above); TM Lewin was acquired by Torque Brands only in May 2020. It would be cynical to suggest that the current crisis has provided an opportunity to shed unwanted operations and costs, but there are real questions over why a business acquired in May, when the severity of the current crisis was already clear, needs to be placed into administration in June—and why owners that acquired a business so recently can shed liabilities and retain ownership through a “pre-pack” administration.Non-Store-Closure News

Card Factory CEO Resigns Karen Hubbard, CEO of gift-store chain Card Factory, has decided to step down from her position. The retailer’s current chairman Paul Moody will take over as Executive Chair as the company begins to search for Hubbard’s replacement. Hubbard has served as CEO for four years and decided to step down as the retailer prepares to unveil a new business strategy; she felt it would be an “appropriate time for the retailer to transition to new leadership.” New Look Warns Landlords of Pre-Pack Administration Fashion retailer New Look has hired consultancy firm CBRE to negotiate with its landlords to move its 500-strong store estate across to turnover-based rents, which have become increasingly popular since the coronavirus pandemic. Should the negotiations fail, there is a chance that the retailer will fall into pre-pack administration, putting its 12,000 employees in the UK and Ireland at risk of redundancy. [caption id="attachment_112355" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.*Source: Company reports/Coresight Research[/caption] [caption id="attachment_112356" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=296]

Source: Company reports/Coresight Research

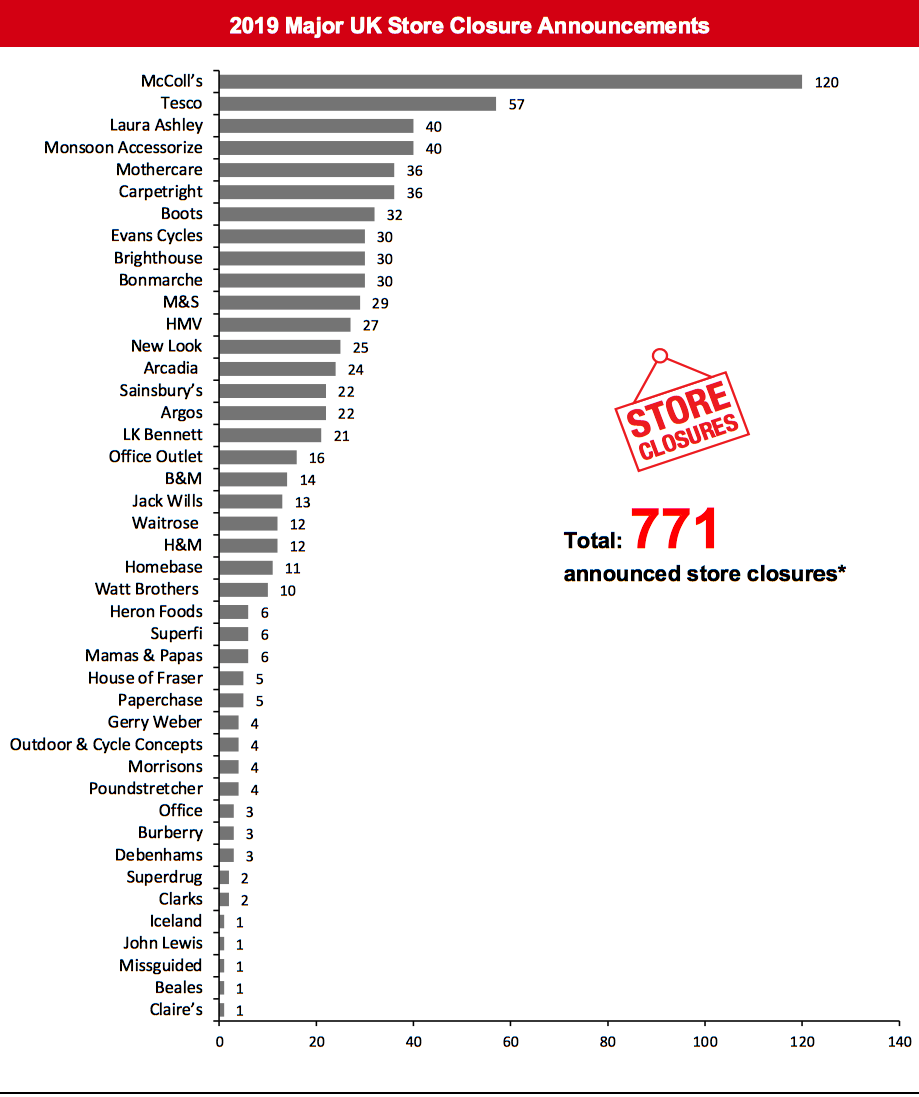

[caption id="attachment_112358" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_112359" align="aligncenter" width="700"]

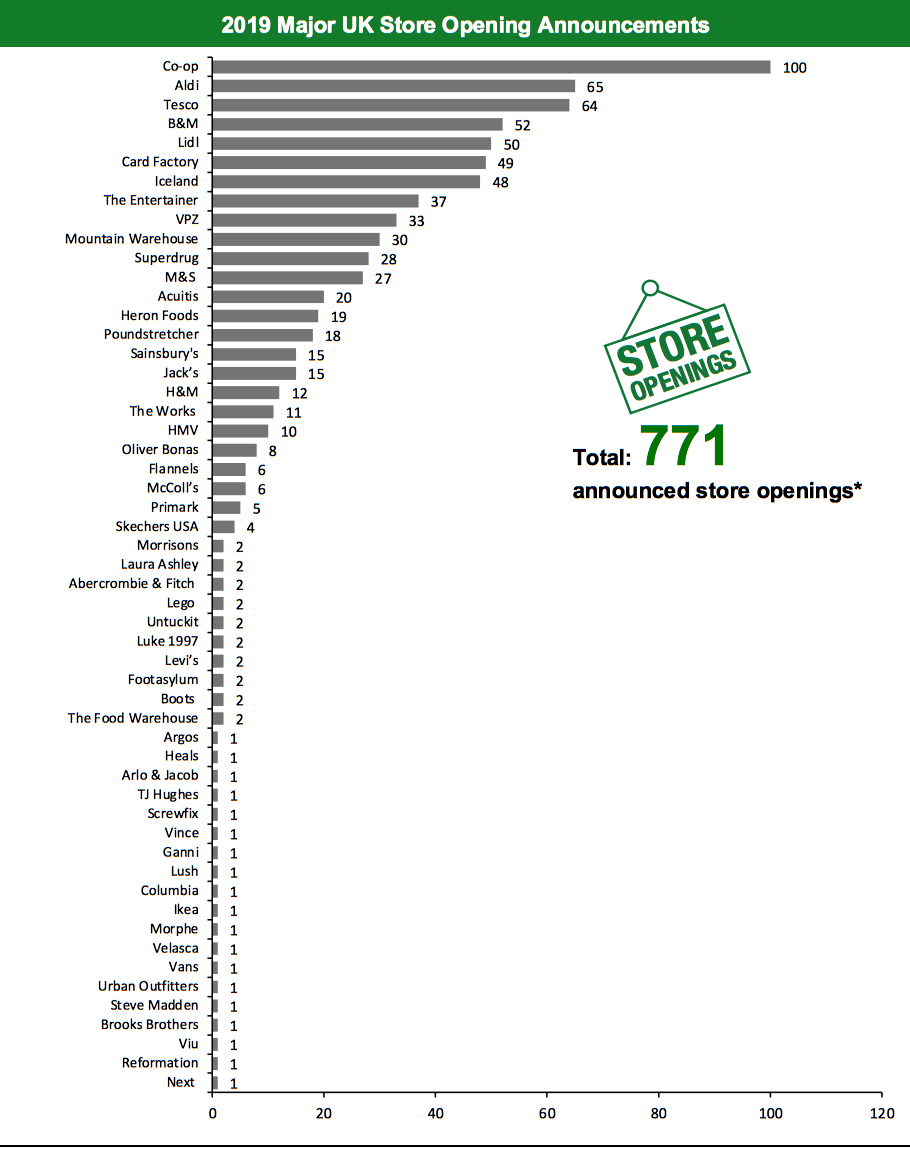

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.