Nitheesh NH

The US

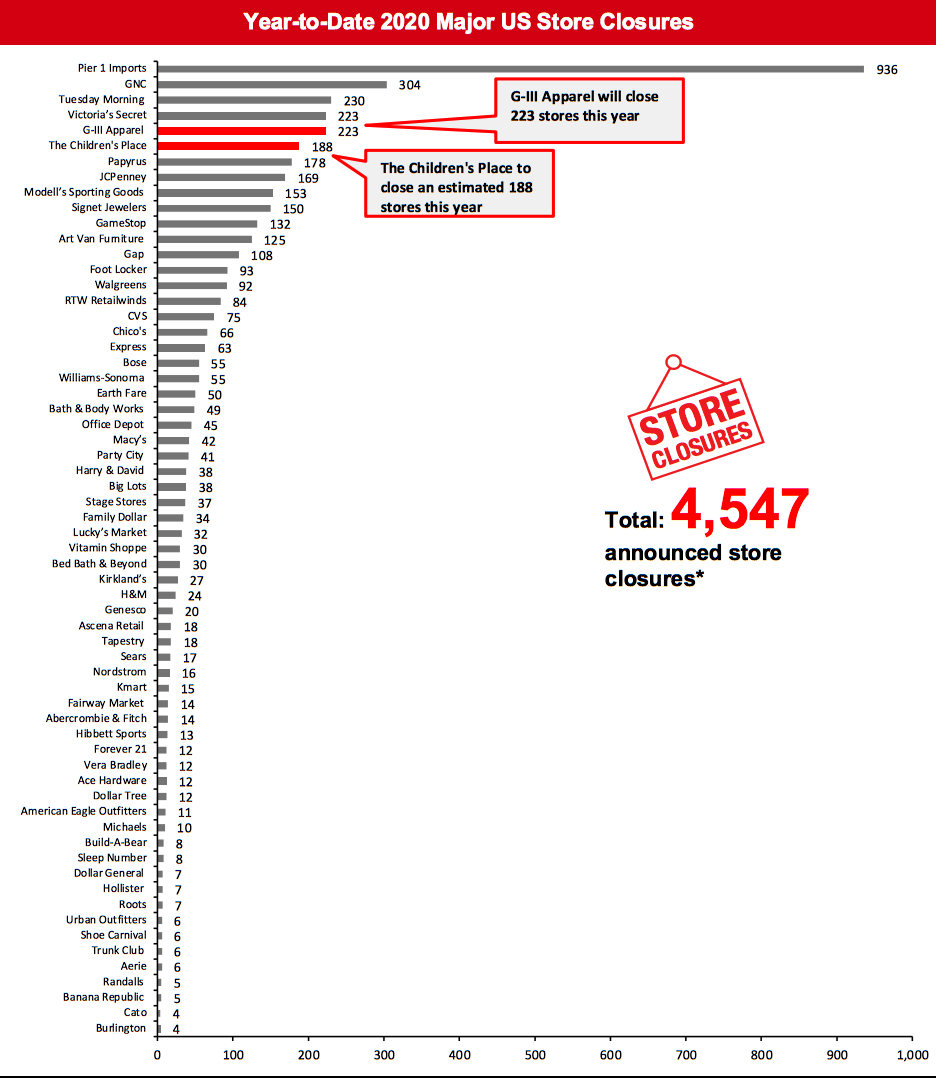

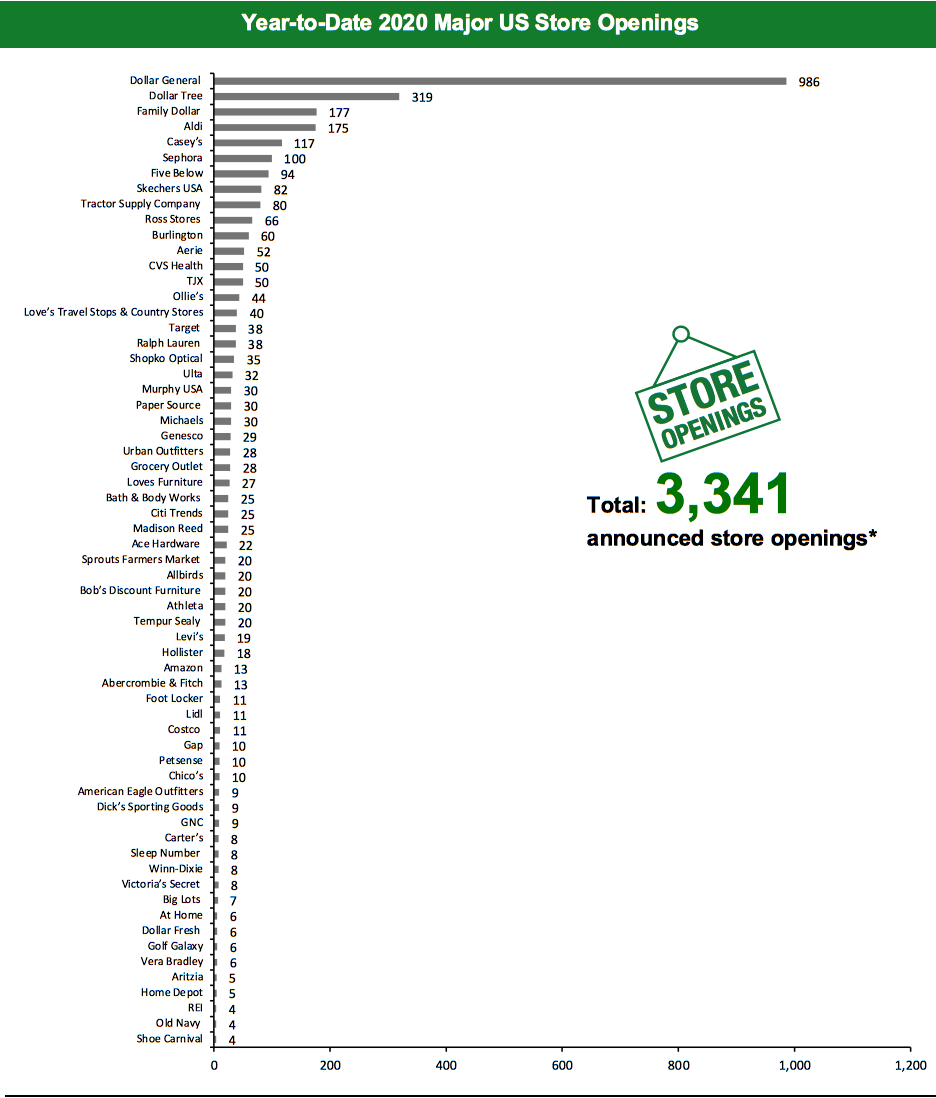

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 4,547 planned store closures and 3,341 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. This week, Party City revised down its plans of opening 12 stores to just two this year and said that the remaining 10 stores are likely to open in 2021. This has changed our 2020 US opening count to 3,341. The chart below depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=82]Source: Company reports/Coresight Research

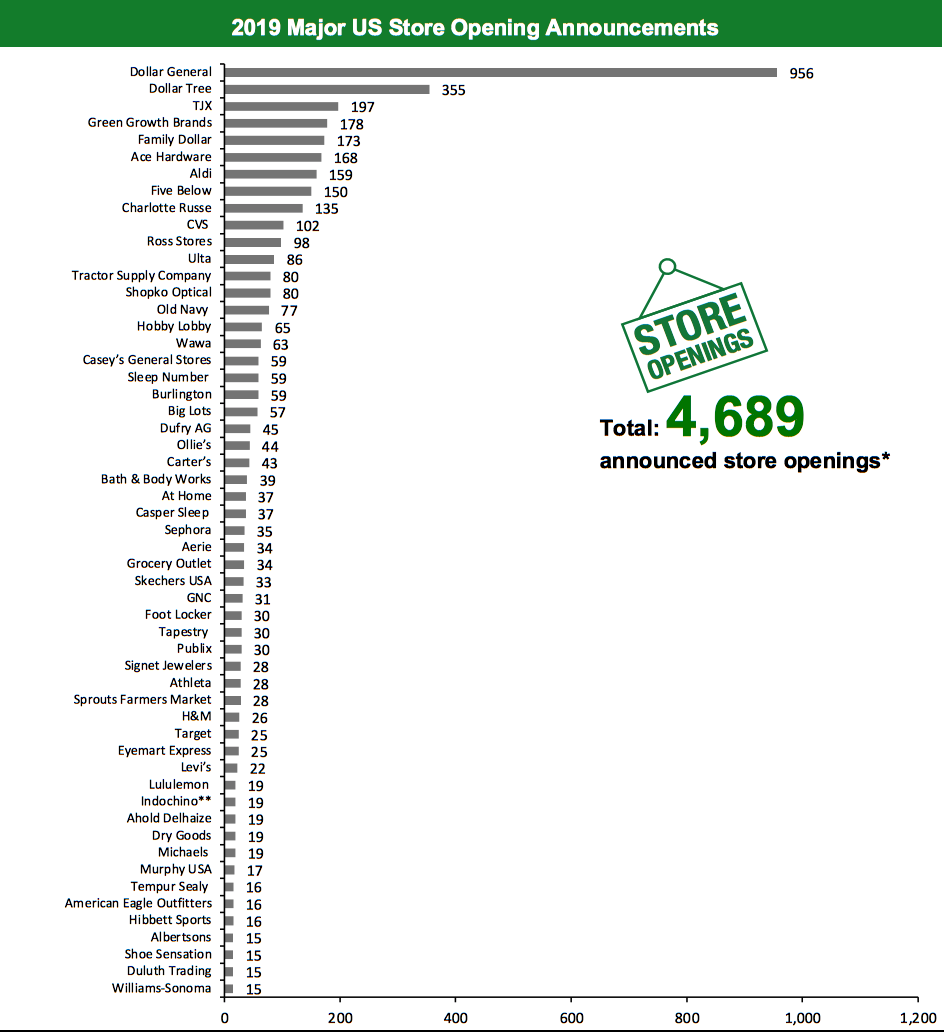

As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. We revised our 2019 openings count for Lululemon Athletica, and this has changed our 2019 US openings count to 4,689.Coronavirus Update: US States and Stores Are Reopening

Many US retailers have reopened stores, as many state governments have relaxed their lockdown restrictions. This week saw reopening updates from Lululemon Athletica and Party City, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Brooks Brothers May File for Bankruptcy Manhattan-headquartered clothing retailer Brooks Brothers is reportedly in talks with banks regarding raising financing for a potential bankruptcy that may happen as soon as July, according to CNBC. However, the retailer is currently overseeing a sale process that it initiated earlier this year and may go through with a sale without filing for bankruptcy. CEO Claudio Del Vecchio made a statement to the New York Times last week suggesting that he was not “eager” to file for bankruptcy but that he would not discount it. Coresight Research insight: In the past couple of weeks, we have published our upgraded 2020 store closures estimate and our post-crisis outlook for apparel, with both reflecting a weak outlook for the specialty retail sector. We expect apparel stores to be a major contributor to our upgraded estimate of 20,000–25,000 gross store closures this year. We also estimate that the apparel specialty sector will severely underpace spending on clothing this year: We estimate that the clothing and footwear specialty sector will see an approximate 21.5% fall in sales in 2020, versus an estimated 12% fall in total clothing spending. The glut of stories on apparel retailers this week is likely to be followed by more in the weeks to come. Chico’s To Close up to 60 Stores Women’s clothing and accessories retailer Chico’s FAS has announced that it expects to close around 50 to 60 more stores by the end of fiscal year 2020. The retailer also reported that it closed nine stores permanently during its first quarter, ended May 2, 2020. The retailer operates a total of 1,332 stores, as of May 2, 2020. Francesca’s May File for Bankruptcy Apparel and accessories retailer Francesca’s has warned in a Securities and Exchange Commission filing that it may be required to delay, reduce and/or cease its operations and/or seek bankruptcy protection. The retailer revealed in the filing that its liquidity has suffered considerably as a result of the coronavirus pandemic and that “there is no assurance that we will have sufficient liquidity to continue operations.” G-III Apparel Group Plans To Close 199 Stores Apparel retailer G-III Apparel Group has announced that it will close around 199 stores, which includes all 110 Wilsons Leather and all 89 G.H. Bass stores, as part of its restructuring plan. Prior to the latest announcement, the company had already closed 14 Wilsons Leather and 10 G.H. Bass stores earlier this year. After the company concludes its restructuring plan, it will operate 41 DKNY and 13 Karl Lagerfeld Paris stores along with e-commerce sites for Andrew Marc, DKNY, Donna Karan, G.H. Bass, Karl Lagerfeld Paris and Wilsons Leather. Guess Plans To Close 100 Stores in China and North America Apparel retailer Guess has announced that it will close around 100 stores in China and North America, which represents around 9% of its total store fleet. The closures will take place over 18 months and are being planned in line with the company’s store rationalization plan to enhance profitability. These closures are not included in our closures chart as the company did not divulge details on closures expected in each market. Inditex To Close up to 1,200 Stores and Pivot to E-Commerce Spanish multinational fashion group Inditex has announced that it will close around 1,000–1,200 stores globally over the next two years and will shift focus to its e-commerce operations. The development follows a 95% spike in online sales during the month of April, although this was largely induced by the lockdown. These closures have not been accounted for in our closures chart as it is unclear how many will transpire in the US. Coresight Research insight: Like rival H&M, Inditex has historically focused on stores at the expense of e-commerce or omnichannel services. The coronavirus crisis is prompting Inditex to follow H&M in rethinking this approach and focus on growing e-commerce (to 25% of sales by 2022) and focusing on higher-quality, better-located stores. Nevertheless, the company guided for still-positive growth in total floorspace, at 2.5% expansion annually. The Children’s Place Plans To Close 300 Stores over Two Years Children’s specialty apparel retailer The Children’s Place has announced that it plans to shut 300 stores, of which 200 will take place in fiscal year 2020 and 100 in fiscal year 2021. The planned closures align with the company’s plan to reduce dependence on its brick-and-mortar channel. Following these closures, the retailer expects its mall-based portfolio to account for less than 25% of its total revenue at the outset of fiscal year 2022.Quarterly Store Openings/Closures Settlement

Fossil Group Shuts 10 Stores Permanently Fashion accessories retailer Fossil Group has reported that it has shut 10 stores from its global fleet permanently in its first quarter of fiscal year 2020, ended April 4, 2020. The retailer operates 447 stores globally as of April 4, 2020, including 196 stores in the Americas. Lululemon Athletica Closes Six Stores and Opens Four Athletic apparel retailer Lululemon Athletica has reported that it closed six stores and opened four in its first quarter of fiscal year 2020, ended May 3, 2020. It closed four Lululemon stores and two Ivivva stores and opened 51 net new stores (including 19 net new stores in North America) during fiscal year 2020. The company operated 489 stores as of May 3, 2020. Party City Revises Store-Opening Plans Party-store retail chain Party City has reported that it plans to open two new stores in 2020 and that the remaining 10 stores that it originally planned to open this year are likely to open in 2021 instead. The retailer also plans to close around 21 stores this year, reconfirming what it stated in its previous update.Non-Store-Closure News

24 Hour Fitness Files for Bankruptcy Gym operator 24 Hour Fitness has filed for Chapter 11 bankruptcy protection and has decided to shutter 100 locations across the country. The company, which had recently begun reopening gyms under new safety guidelines, attributed the decision to the debilitating impact of the coronavirus pandemic on its business. Walmart Trials Self-Checkout-Only Store Walmart is testing out a self-checkout-only concept in its Fayetteville, Arkansas outlet with the objective of assessing whether the use self-checkout can speed up purchases while simultaneously offering a safe experience for shoppers through minimal interaction. Customers who prefer manual assistance, however, can avail the help of store employees to scan and bag their purchases at kiosks. [caption id="attachment_111761" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than four store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_111762" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.*Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=264]

Source: Company reports/Coresight Research

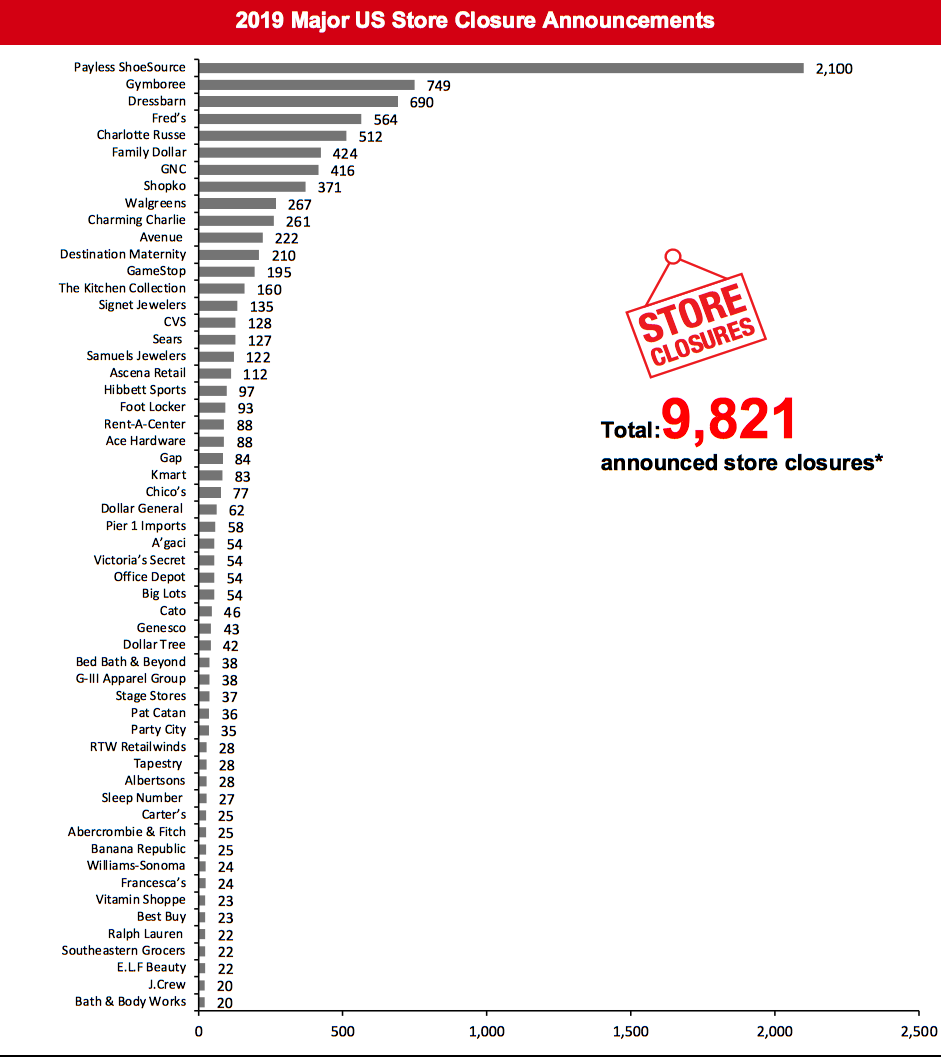

[caption id="attachment_111765" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_111766" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and are based on the proportion of existing stores in the US. Estimates of store openings for H&M, Lululemon Athletica and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=265]

Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research

2019 Major US Retail Bankruptcies [wpdatatable id=266]Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research

The UK

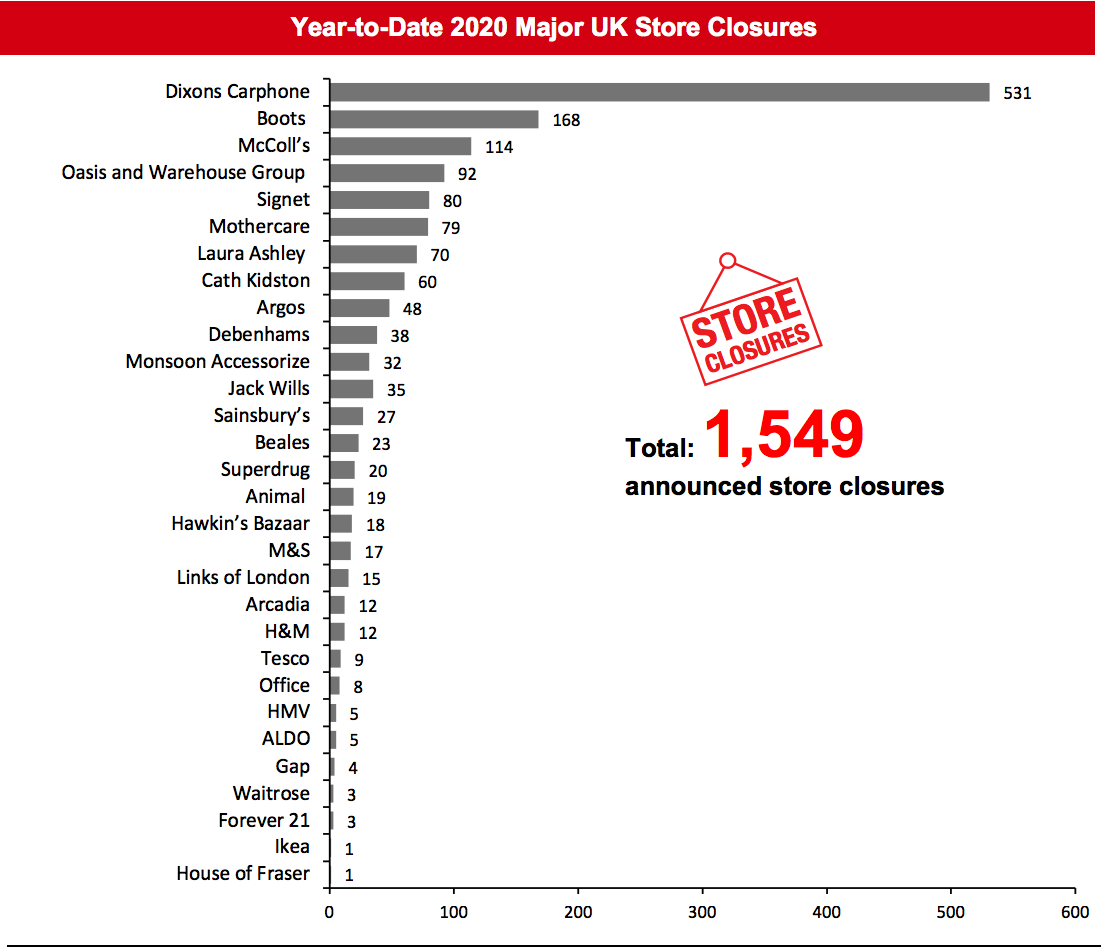

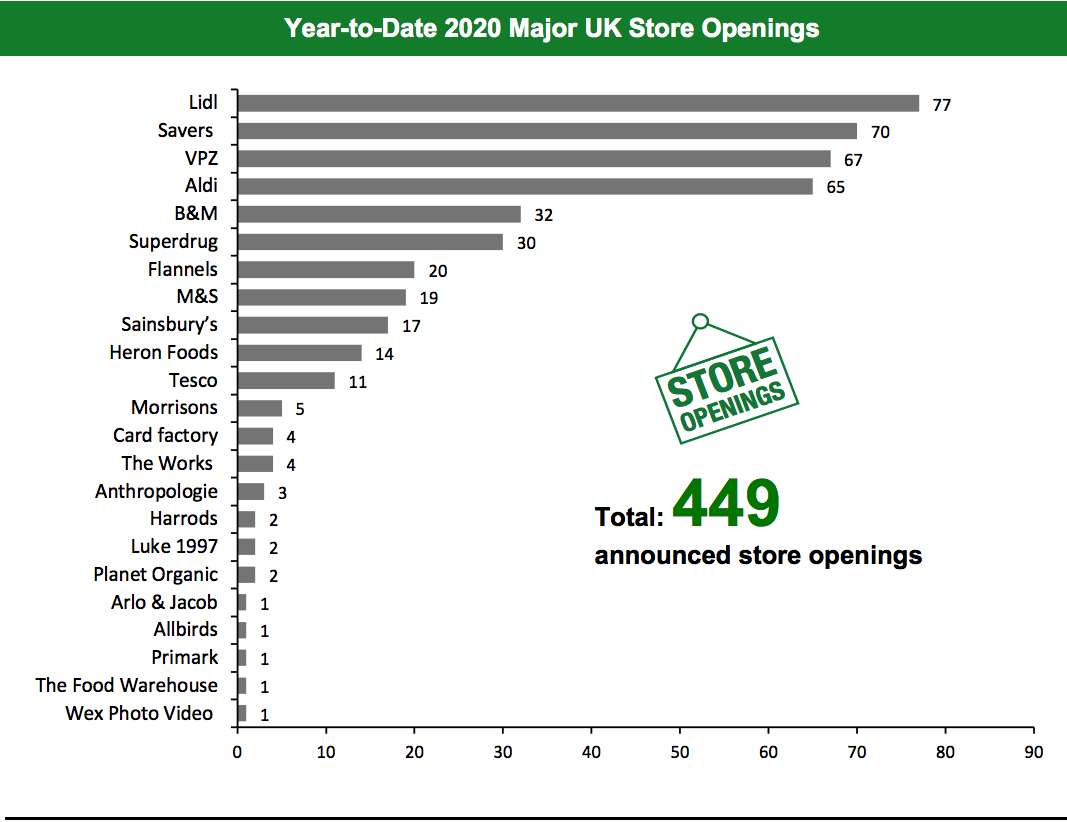

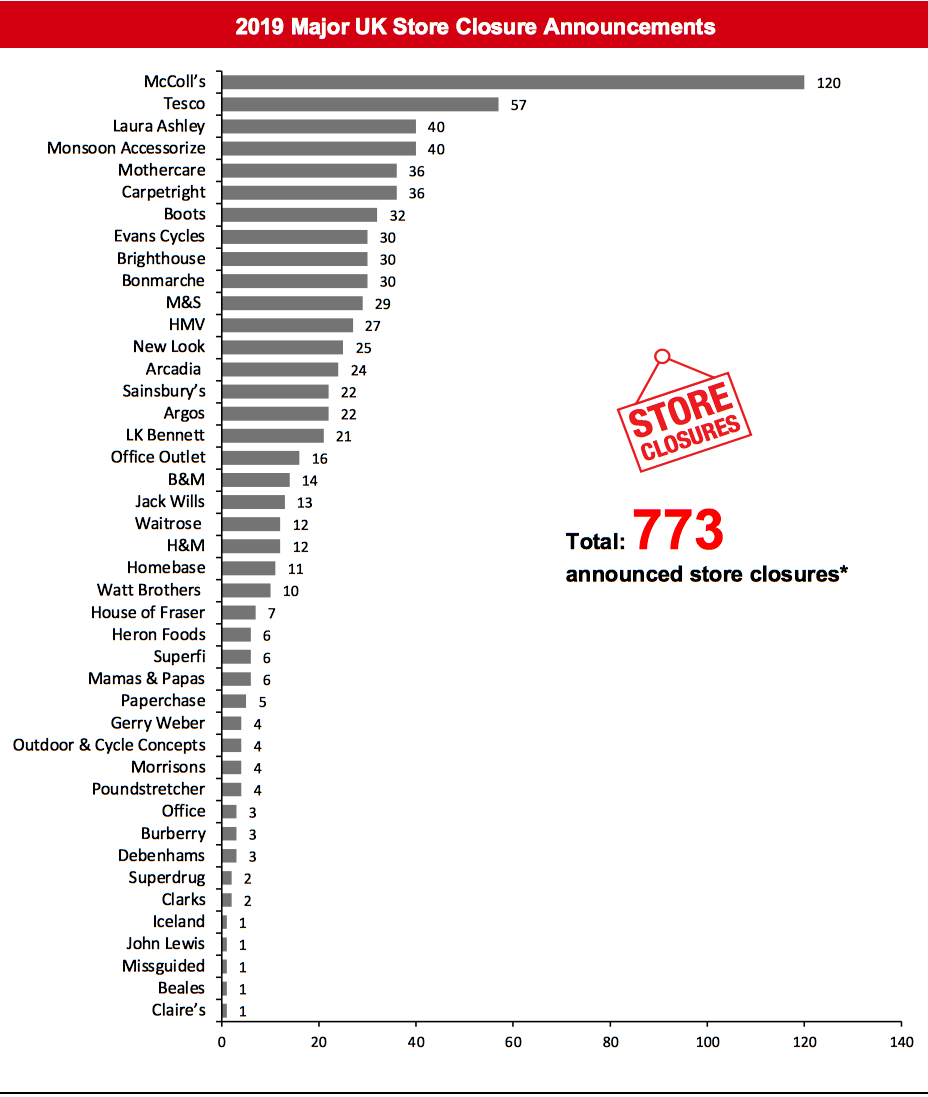

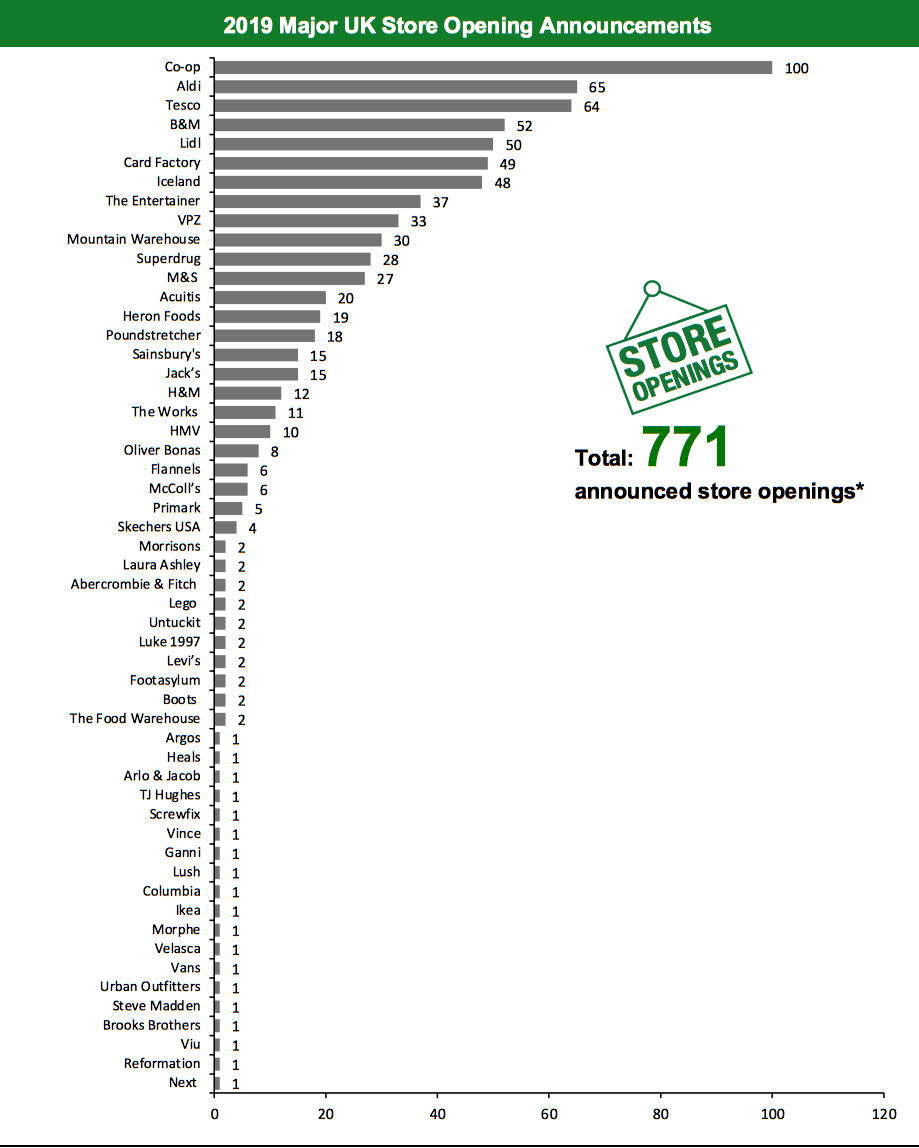

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,549 store closures and 449 store openings. Our data represent closures and openings by calendar year. This week, we have revised our 2019 closures count for B&M and Heron Foods, and this has changed our 2019 UK closure count to 773. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=83]Source: Company reports/Coresight Research

What Is Happening This Week in the UK

B&M Plans To Open 30 Net New B&M Stores and 15 Net New Heron Stores Variety retailer B&M has announced that it plans to open 30 net new B&M stores and 15 net new Heron stores in fiscal year 2021. It opened 51 and closed 15 B&M stores in fiscal year 2020 ended March 28, 2020. It also opened 18 and closed six Heron stores in fiscal year 2020. Coresight Research insight: We continue to see a long runway for expansion by B&M, via growing in underpenetrated regions and capturing share from rivals in the discount space through its high-quality offering (see Poundstretcher story below). Poundstretcher May Shutter Over 250 Stores Discount-store chain Poundstretcher is reportedly planning to close around 253 stores, which would represent more than half of its current fleet of 450 UK stores, according to Sky News. The company is looking for backing from landlords and other creditors towards a company voluntary arrangement through which it seeks slashed rents of more than 30% on 84 stores. An additional 23 stores could also close down as Poundstretcher considers putting a subsidiary group, which owns the properties, into administration. TM Lewin Considers Store Closures Menswear brand TM Lewin could close many stores if owner SCP Private Equity is unable to reach an agreement with landlords for rent cuts. SCP Private Equity acquired TM Lewin from Bain Capital last month for an undisclosed sum and has reportedly hired property consultant Cedar Dean to handle negotiations, according to The Telegraph. Travis Perkins To Close 165 Locations Builder’s merchant and home-improvement retailer Travis Perkins has announced that it will shut 165 stores and attributed this move to the weaker demand that it expects in the next two years owing to the coronavirus pandemic. Management said closures will be concentrated in its builder’s merchant businesses, which, as a B2B operation, we do not consider to be retail. These store closures have therefore not been included in our closures chart. We will include any retail store closures in our total if the company confirms such closures in future. [caption id="attachment_111772" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.McColl’s includes convenience stores and newsagents.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_111773" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research

[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=268]

Source: Company reports/Coresight Research

[caption id="attachment_111775" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_111776" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.