Nitheesh NH

The US

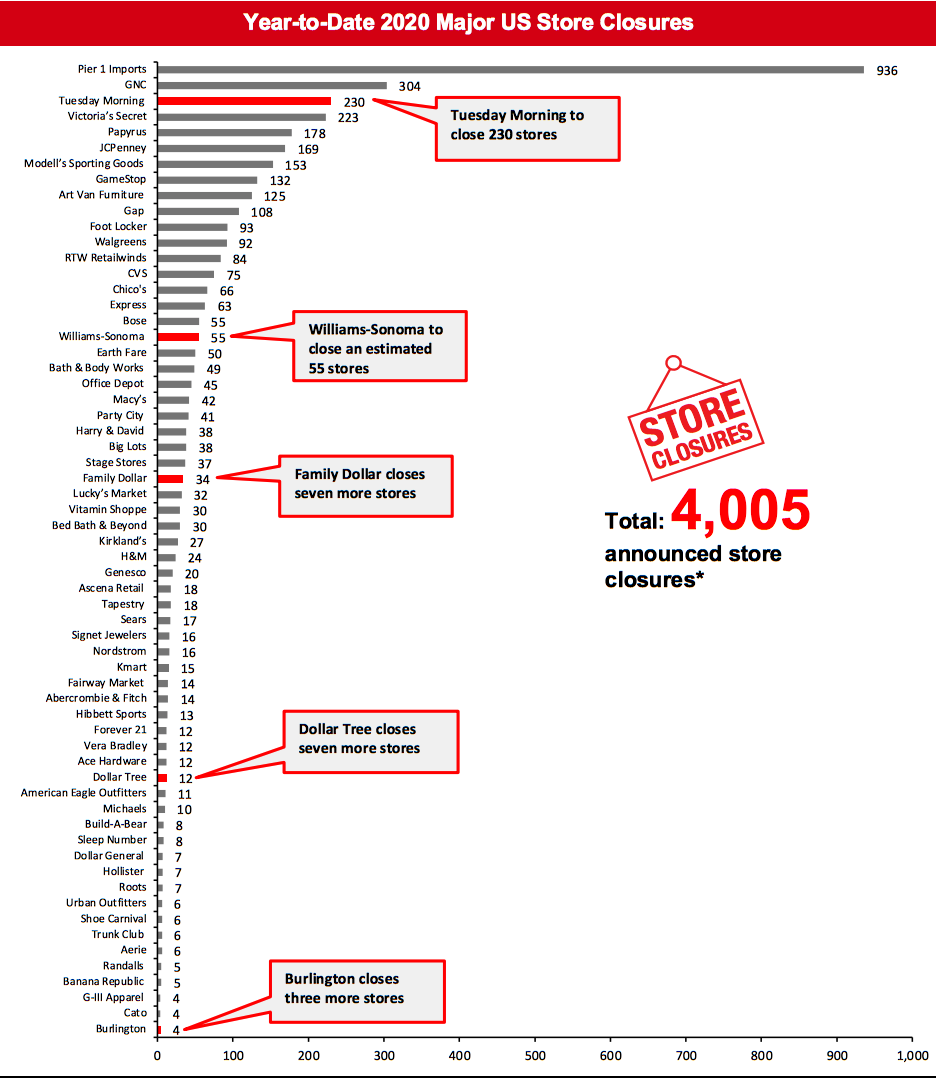

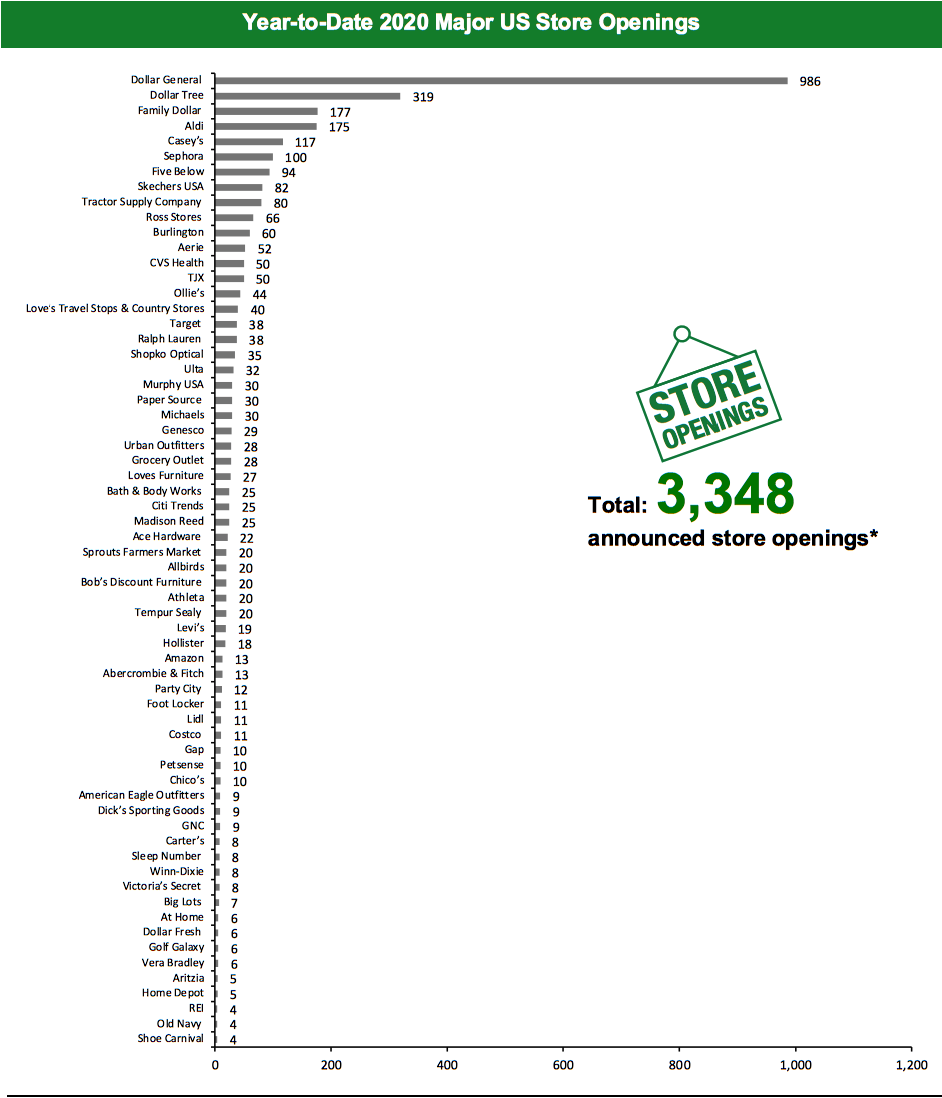

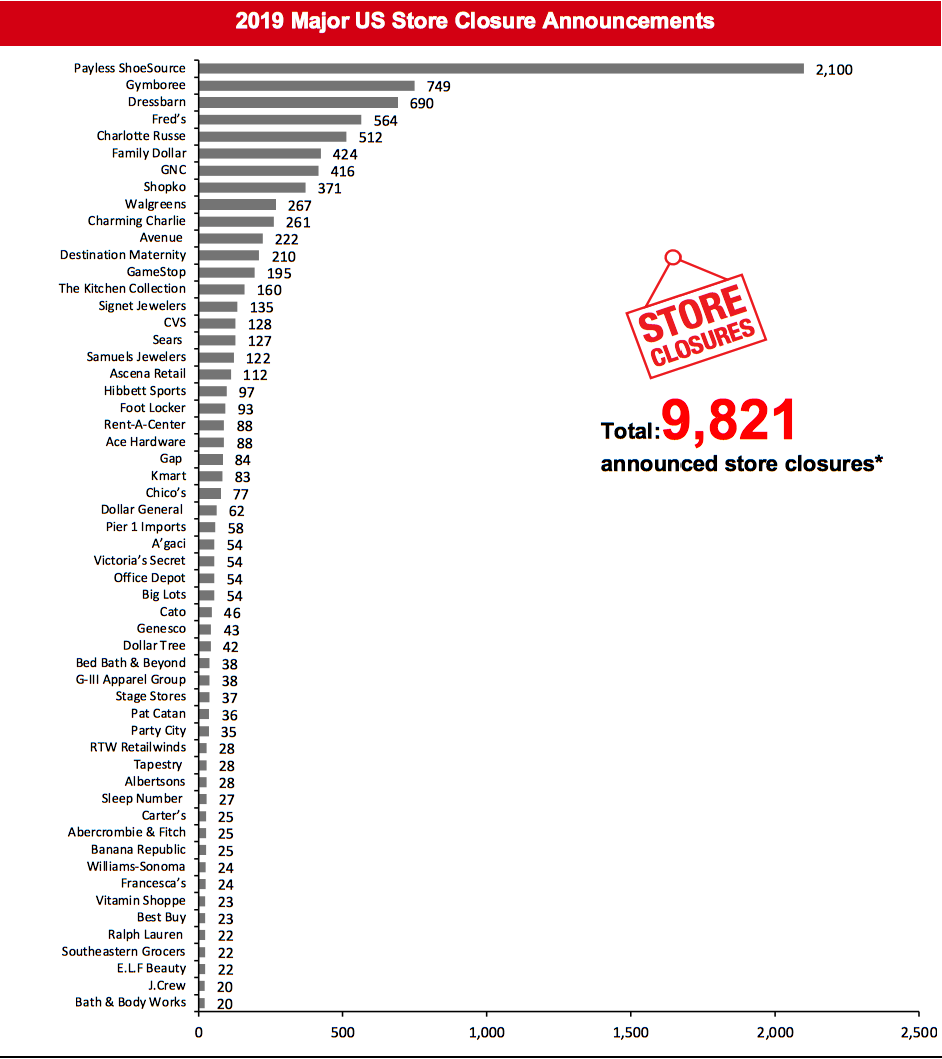

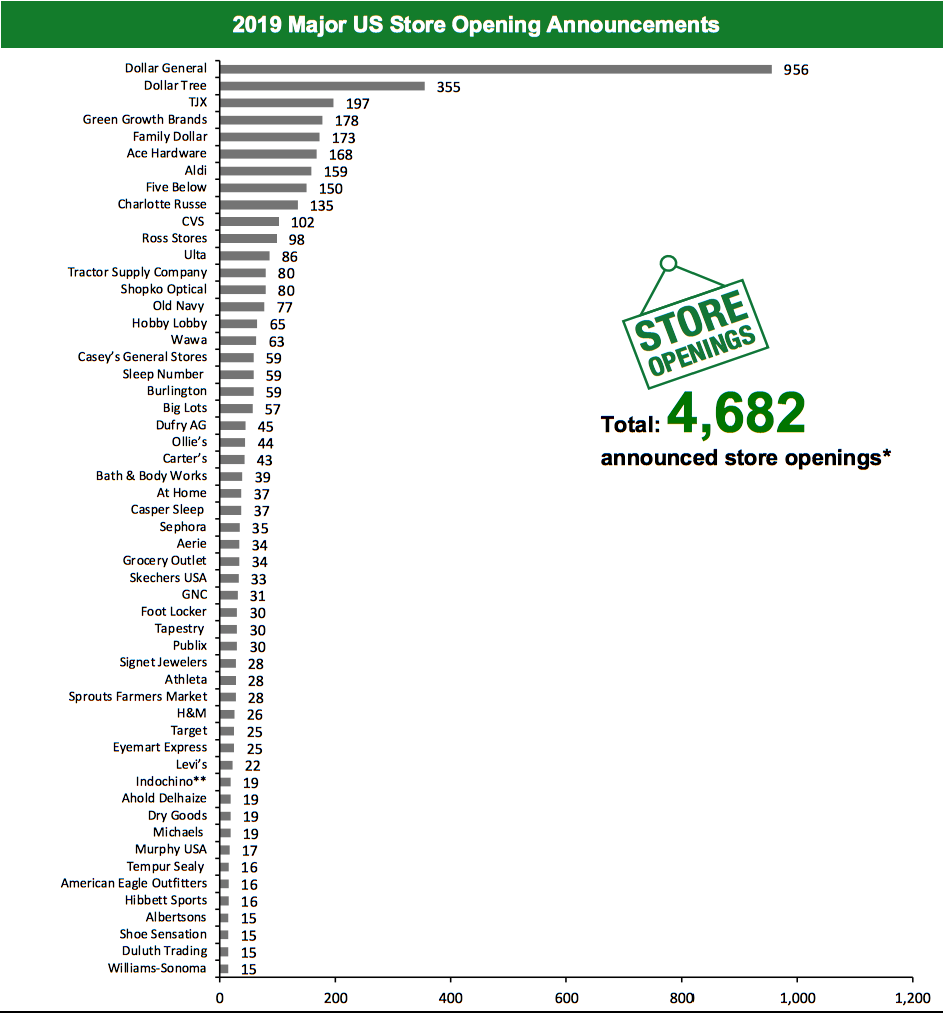

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 4,005 planned store closures and 3,348 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. The below chart depicts the week-by-week totals of US store closures and openings year to date in 2020. US Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=79] Source: Company reports/Coresight Research As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Big Lots, and this has changed our 2019 US closure count to 9,821. We revised our 2019 openings count for Aritzia and Big Lots, and this has changed our 2019 US openings count to 4,682.Coronavirus Update: US States and Stores Are Reopening

Many US retailers have already reopened their stores in select states, as some state governments have relaxed their lockdown restrictions. This week saw such announcements from Dick’s Sporting Goods and Sally Beauty, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states that are permitting the reopening of businesses.What Is Happening This Week in the US

Burlington Stores Lowers Store-Opening Target for Fiscal Year 2020 Off-price retailer Burlington Stores has lowered its store-opening target for fiscal year 2020, ending January 30, 2021, to 64 new stores, from its original target of 80 new stores. The retailer opened 12 new stores, relocated 10 stores and closed three stores during the first quarter of fiscal year 2020, ended May 2, bringing its total store count to 736 stores. Coresight Research insight: Reporting its first-quarter 2020 results, Burlington noted that sales in its reopened stores had been up year over year. Management pointed to pent-up demand and compelling promotions. Even accounting for those factors, growing sales in such a tough market looks remarkable and hints at green shoots of recovery for brick-and-mortar retail post lockdown. Dollar Tree Reduces Store-Opening Target Dollar Tree, Inc. has lowered its store opening target for fiscal year 2020, ending January 30, 2021, to 500 stores—325 Dollar Tree stores and 175 Family Dollar stores—compared to its original target to open 550 stores. The retailer opened 67 Dollar Tree stores and 32 Family Dollar stores and closed seven Dollar Tree stores and seven Family Dollar stores during the first quarter of fiscal year 2020, ended May 2. Coresight Research insight: Dollar stores have fared well during the Covid-19 crisis, fuelled initially by strong demand for essential categories. However, Dollar Tree and Dollar General last week reported strengthening demand for discretionary categories: Dollar Tree, Inc. management noted a boost for nonessential products after Easter; at Dollar General (see story below), management pointed to strengthening discretionary demand after stimulus measures were rolled out. Lidl Opens 100th US Store Lidl has opened its 100th US store in Suwanee, Georgia on May 27, 2020. The retailer had opened a store in Peachtree Corners, Georgia on May 13, 2020. Lidl is also building a regional distribution center in Covington, Georgia to expand its distribution in the US. Coresight Research insight: Two years behind schedule, Lidl US has reached its 100-store milestone. After a spell of slow progress, we have seen Lidl increase its store fleet partly by converting some Best Market stores to the Lidl banner; Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018. The economic shock of the coronavirus crisis is likely to fuel some trading down in grocery, including between retailers—and we see this supporting growth at hard discounters Aldi and Lidl as well as differentiated value retailers such as Grocery Outlet. Read more here. Southeastern Grocers To Open Eight Winn-Dixie Stores Supermarket chain Southeastern Grocers has announced plans to convert eight newly acquired grocery stores to Winn-Dixie stores in Florida this year. The chain has acquired four Earth Fare stores, located in Boynton Beach, Jacksonville, Lakewood Ranch and Viera, and four Lucky’s Market stores, located in Fort Myers, Gainesville, Lake Mary and Melbourne. Tuesday Morning Files for Bankruptcy; Plans To Close 230 Stores Off-price retailer Tuesday Morning has filed for Chapter 11 bankruptcy protection, with plans to reorganize its business in order to realign its store footprint. The retailer intends to close 230 of its 687 stores in a phased approach, and it has requested court approval to close at least 132 stores in the first phase. Tuesday Morning has obtained a commitment from its lenders to provide $100 million in debtor-in-possession financing to the company to enable it to navigate through the reorganization process. The retailer expects to emerge out of bankruptcy with approximately 450 stores by early fall of 2020. Ulta Beauty Lowers Store-Opening Target Ulta Beauty has lowered its store-opening target for fiscal year 2020, ending January 30, 2021. The retailer currently expects to open 30–40 stores compared its original target of opening 75 net new stores. As of May 2, 2020, the retailer operates 1,264 stores in the US. Wegmans To Open Three Stores Supermarket chain Wegmans has announced plans to open three stores this year. The stores will open in Tysons Corner in Virginia, West Cary in North Carolina and Westchester County in New York. All the new stores will offer online ordering with curbside pickup and delivery. Williams-Sonoma Expects To Close Approximately 64 Stores Home-furnishings retailer Williams-Sonoma has announced that it expects to close about 64 stores in fiscal year 2020, ending January 2021. Prior to the coronavirus crisis, the retailer had intended to close approximately 32 stores, but now it expects the store closure count to be double. We have estimated the store closure count based on the existing proportion of stores in the US. Coresight Research insight: Williams-Sonoma, in its recent first-quarter earnings call, stated that the coronavirus pandemic has accelerated its shift to digital and that it will continue to invest in strengthening its digital-first model. However, the company maintained that stores remain integral to its business. William-Sonoma disclosed that over the next three years, 293 store leases are up for renewal, while 416 leases are up for renewal over a five-year period. The retailer stated that it will review each lease carefully and renew those where its landlords have partnered with Williams-Sonoma during the crisis and where the economics are favorable.Quarterly Store Openings/Closures Settlement

Abercrombie & Fitch Closes Eight Stores Lifestyle retailer Abercrombie & Fitch has reported that it closed five Abercrombie stores and three Hollister stores and opened one Abercrombie store in the US, as of May 27, 2020. The retailer operates 388 Hollister stores and 252 Abercrombie stores in the US, as of May 27, 2020. Coresight Research insight: In another sign of recovering demand, Abercrombie & Fitch last week reported that sales productivity in reopened North America stores stood at 80%—as with Burlington Stores, this suggests some apparel banners, at least, are seeing solid post-lockdown demand. Aritzia To Open Five Stores Women’s fashion brand Aritzia plans to open five new stores in the US through December 2020. It also plans to expand one of its locations in the US. Aritzia operates 96 boutiques in the US and Canada, as of March 1, 2020. Big Lots Opens Six Stores and Closes Six Big Lots has reported that it opened six stores and closed six stores during the first quarter of fiscal year 2020, ended May 2. The retailer operates 1,404 across the US, as of May 2, 2020. Costco To Open Eight New Stores Warehouse-club chain Costco has announced plans to open eight new stores and relocate two stores in the fourth quarter of fiscal year 2020, ending August 30. The chain also reported that it opened two new stores in the third quarter of fiscal year 2020, ended May 10. Dick’s Sporting Goods Opens Three Stores and Closes Two Sporting-goods retailer Dick’s Sporting Goods reported that it opened two Golf Galaxy stores and one namesake store in the first quarter of fiscal year 2020, ended May 2. The retailer also reported that it closed two stores in the first quarter of fiscal year 2020. The retailer operates 851 stores, as of May 2, 2020. Dollar General Opens 250 New Stores Dollar General has reported that it opened 250 new stores, remodeled 481 stores and relocated 17 stores during the first quarter of fiscal year 2020, ended May 1. In March this year, the retailer had announced plans to open 1,000 new stores, remodel 1,500 and relocate 80 stores in fiscal year 2020, ending January 29, 2021. The retailer operates 16,500 stores in the US, as of May 1, 2020. Ollie’s Bargain Outlet Opens 17 Stores Discount-store chain Ollie’s Bargain Outlet opened 17 stores and permanently closed one store during the first quarter of fiscal year 2020, ended May 2. The retailer announced that it remains on track to open 47–49 stores this year. Ollie’s Bargain Outlet operates 360 stores, as of May 2, 2020. Ralph Lauren To Open 90–100 Stores Lifestyle retailer Ralph Lauren has announced plans to open approximately 90–100 stores in fiscal year 2021, ending March 27. As of March 28, 2020, the retailer operates 300 retail stores in North America and 530 stores globally. We have estimated the opening count based on the existing proportion of stores in the US.Non-Store-Closure News

Casey’s Appoints Adrian Butler as Chief Information Officer Convenience-store chain Casey’s has appointed Adrian Butler to the newly created role of Chief Information Officer (CIO). Butler has 20 years’ experience in the field of information technology in the retail, food service and hospitality sectors. Prior to joining Casey’s, he served as the SVP and CIO of food and beverage company Dine Brands Global. [caption id="attachment_110844" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than four store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110845" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. *Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [wpdatatable id=225 table_view=regular] Source: Company reports/Coresight Research [caption id="attachment_110847" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110848" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

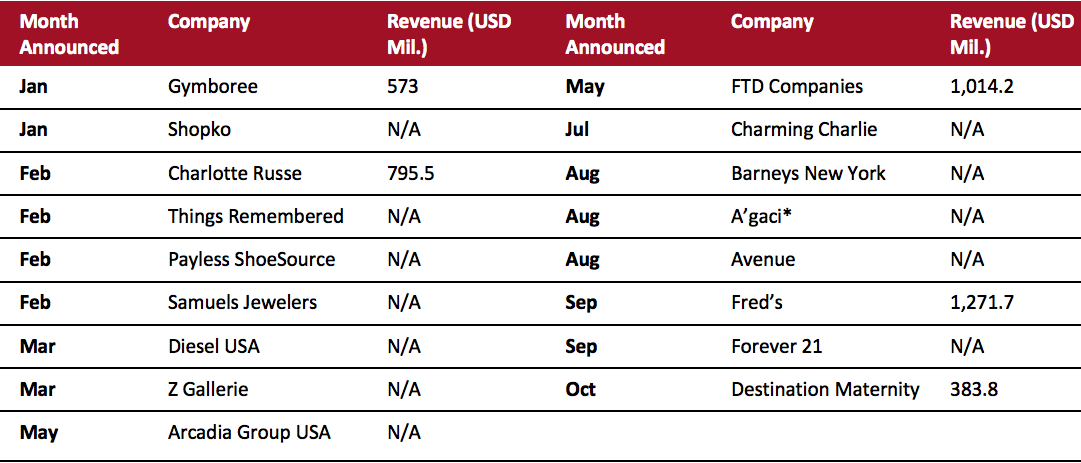

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [wpdatatable id=231] Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J.Crew Group includes J.Crew and Madewell banners. N/A – Not Available Source: Company reports/Coresight Research 2019 Major US Retail Bankruptcies [caption id="attachment_110850" align="aligncenter" width="700"]

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

N/A – Not Available

Source: Company reports/Coresight Research[/caption]

The UK

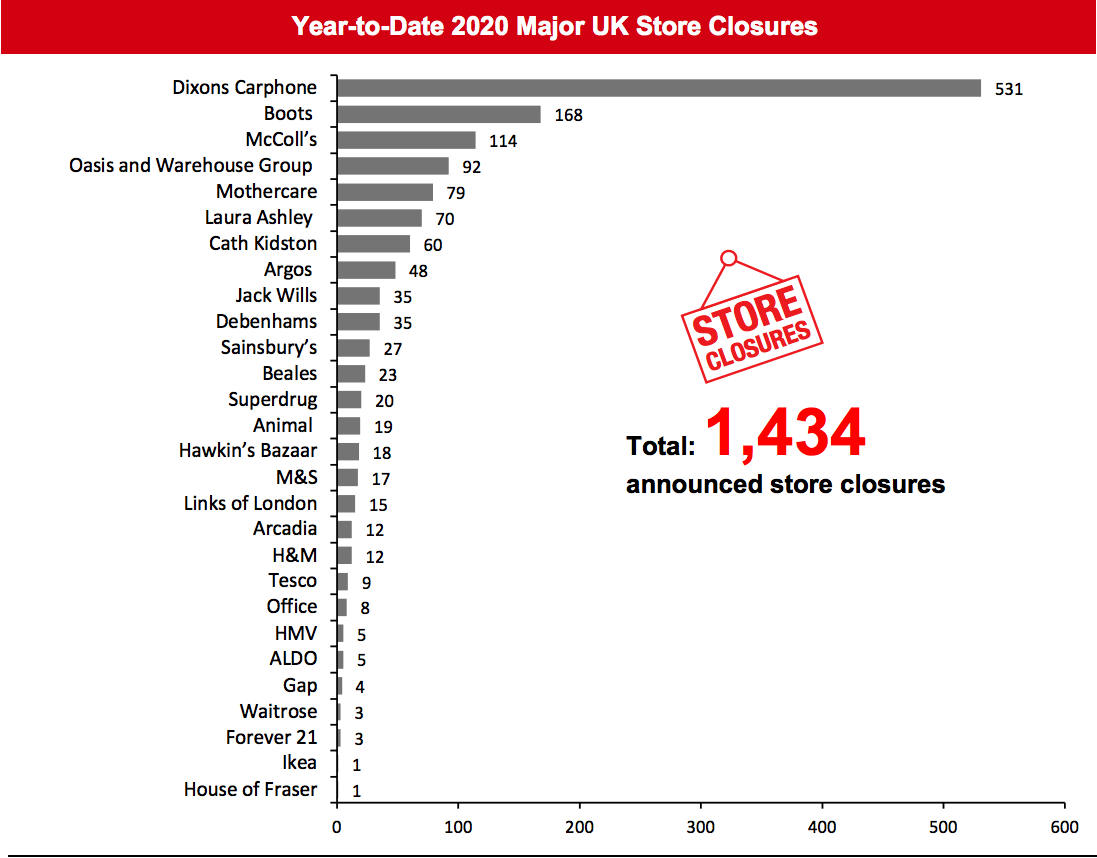

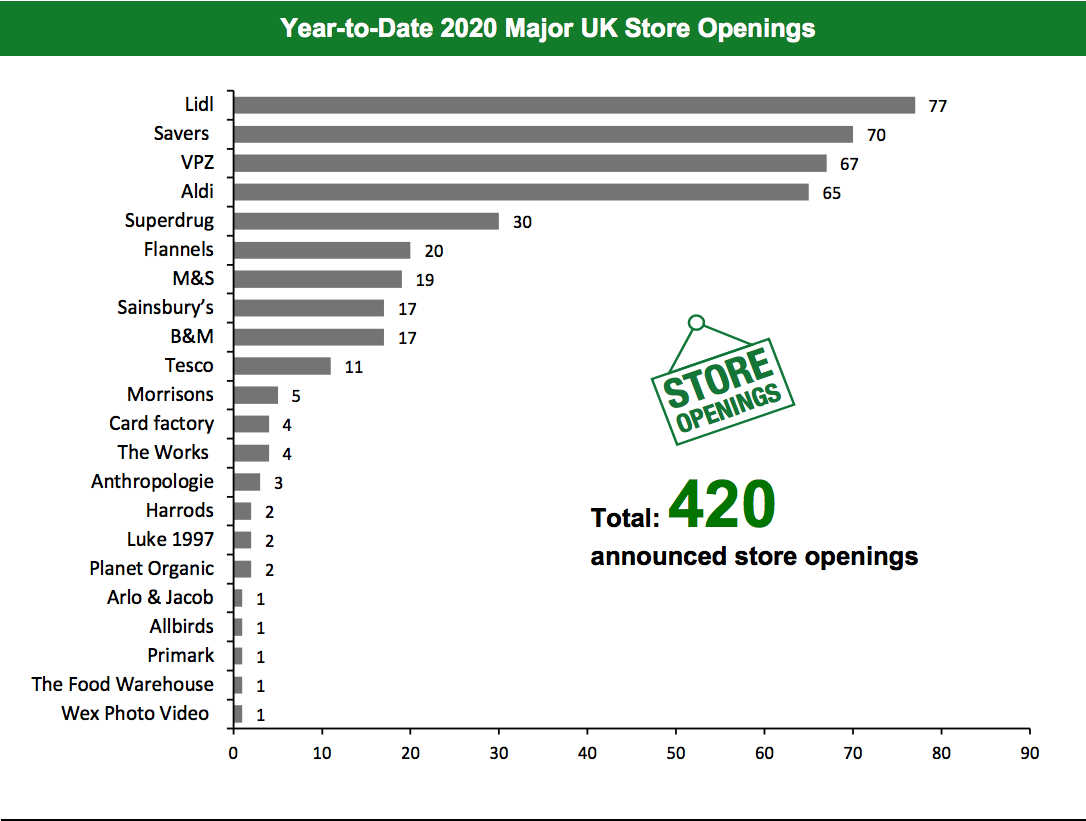

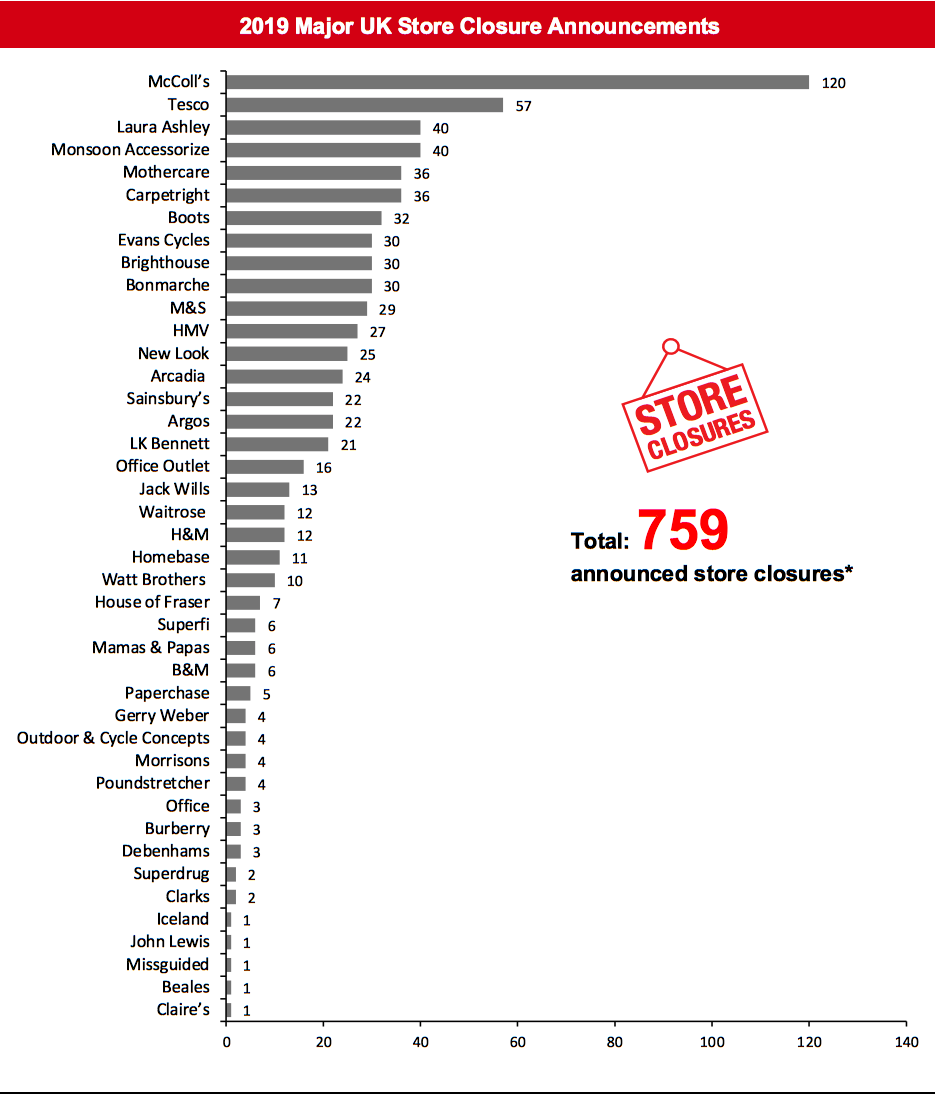

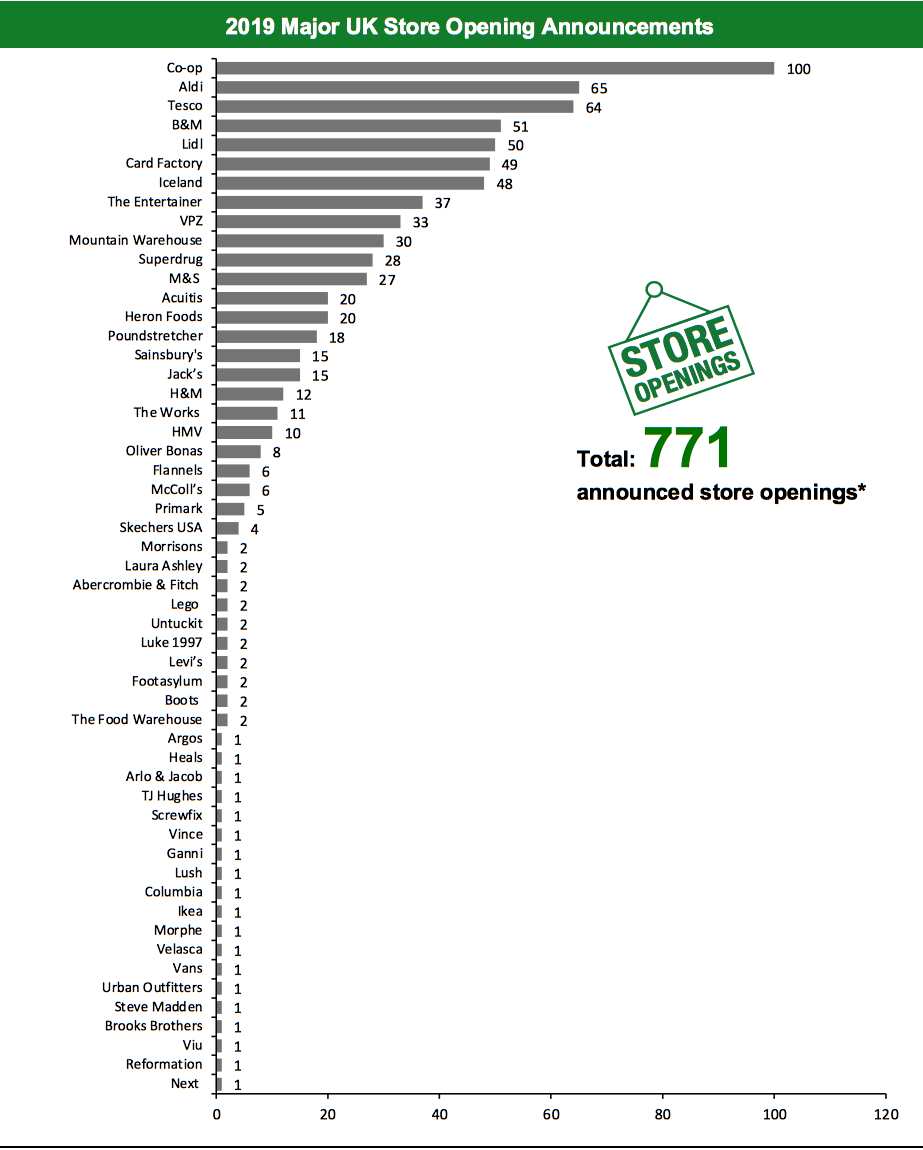

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,434 store closures and 420 store openings. Our data represent closures and openings by calendar year. This week, we have revised our 2019 closures count for Monsoon Accessorize, and this has changed our 2019 UK closure count to 759. We revised our 2019 openings count for The Works, and this has changed our 2019 UK openings count to 771. The below chart depicts the week-by-week totals of UK store closures and openings year to date in 2020. UK Announced Store Closures and Openings: Week-by-Week Comparison [wpdatachart id=78] Source: Company reports/Coresight ResearchWhat Is Happening This Week in the UK

ALDO UK Enters Administration; Closes Five Stores The UK arm of Canadian footwear retailer ALDO has entered into administration and permanently closed five of its UK stores. Administrators from accounting firm RSM are exploring options for the remaining eight stores. Last month, ALDO had filed for bankruptcy protection in Canada. Monsoon Accessorize Could File for Administration; Warns of Store Closures Monsoon Accessorize, parent company of fashion retailers Accessorize and Monsoon, is reportedly planning to file a notice of intention to appoint administrators imminently, according to Sky News. The retailer has warned of store closures if landlords do not reduce rents. In July 2019, Monsoon Accessorize launched a company voluntary arrangement and closed 40 stores. The company operates a total of 220 stores across the UK.Non-Store-Closure News

Tesco CFO Alan Stewart To Resign Tesco has announced that its CFO Alan Stewart has decided to retire, with plans to part ways with the company on April 30, 2021. In this role, Stewart led the corporate restructuring and financial transformation of the business. He joined Tesco in September 2014 from Marks & Spencer. Tesco’s Board of Directors will begin an internal and external search to identify a successor. [caption id="attachment_110852" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_110853" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [wpdatatable id=230 table_view=regular] Source: Company reports/Coresight Research [caption id="attachment_110855" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110856" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.