Nitheesh NH

The US

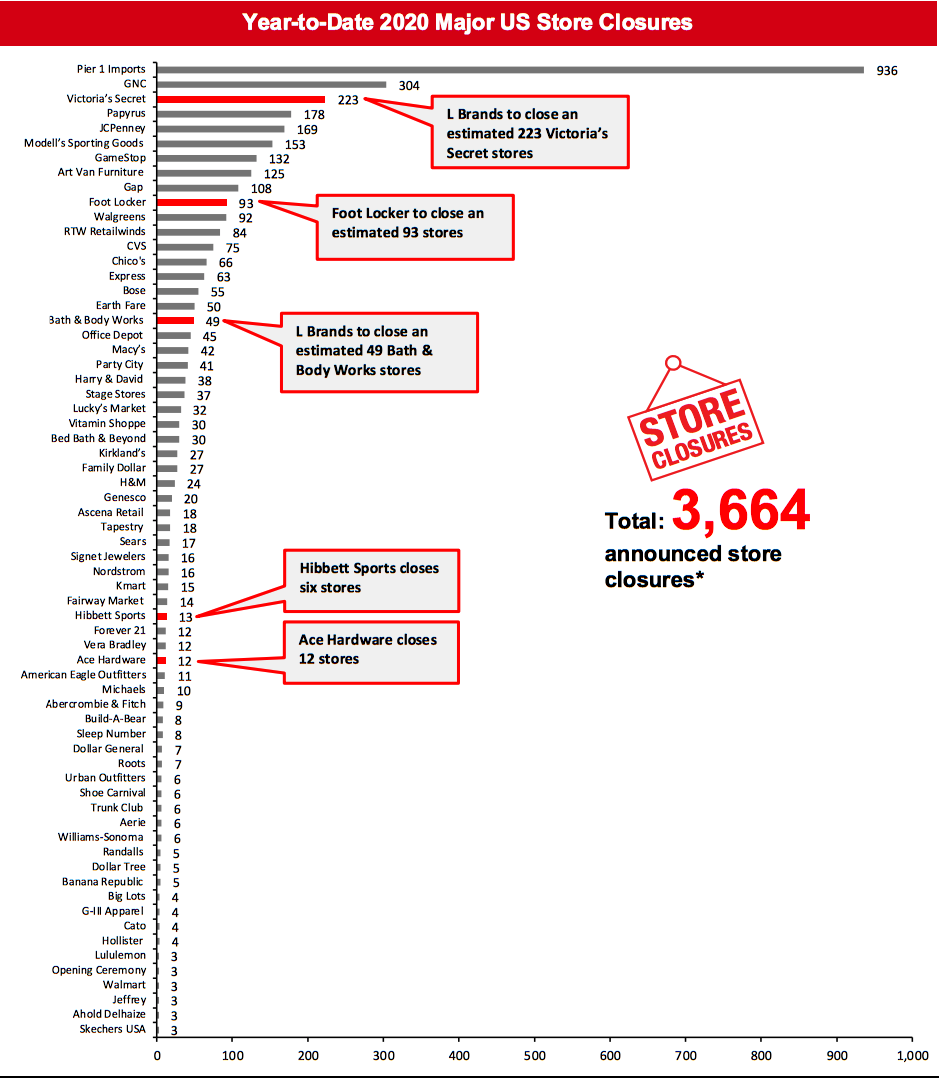

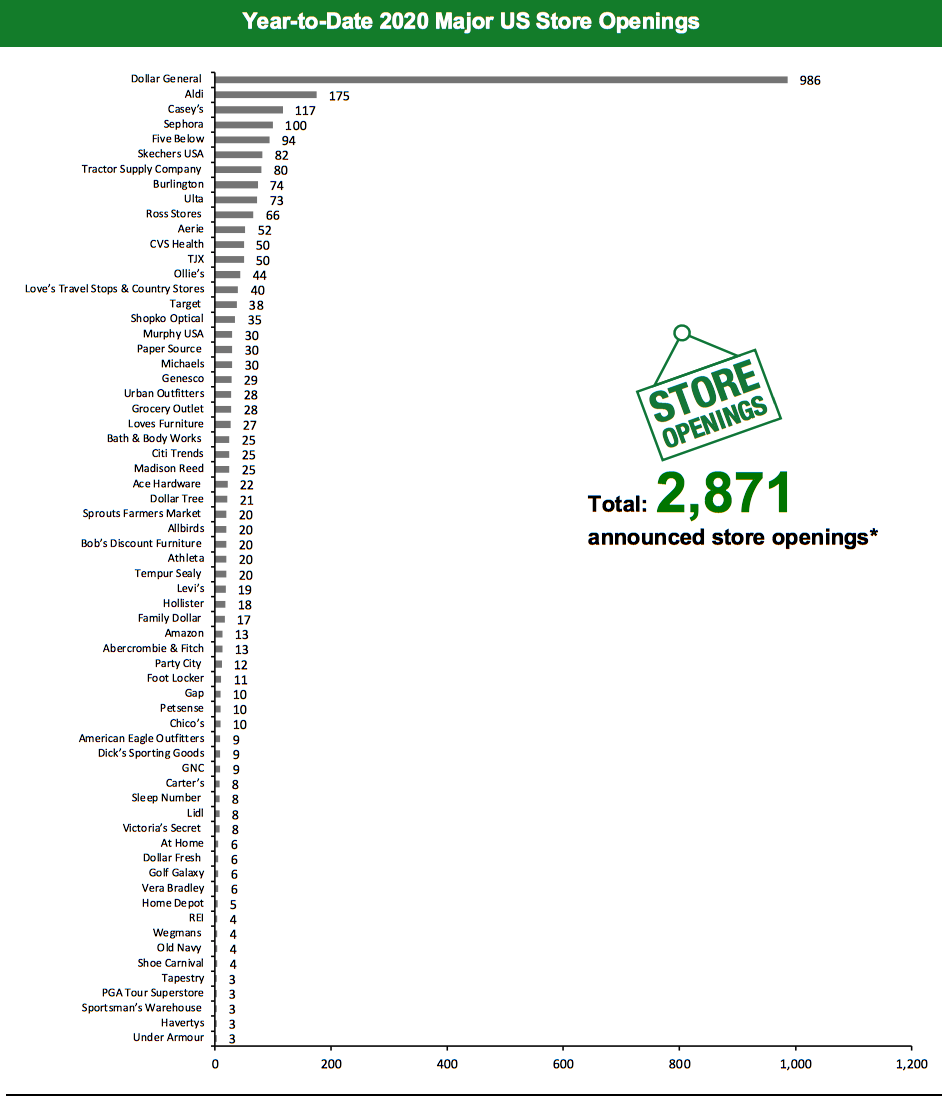

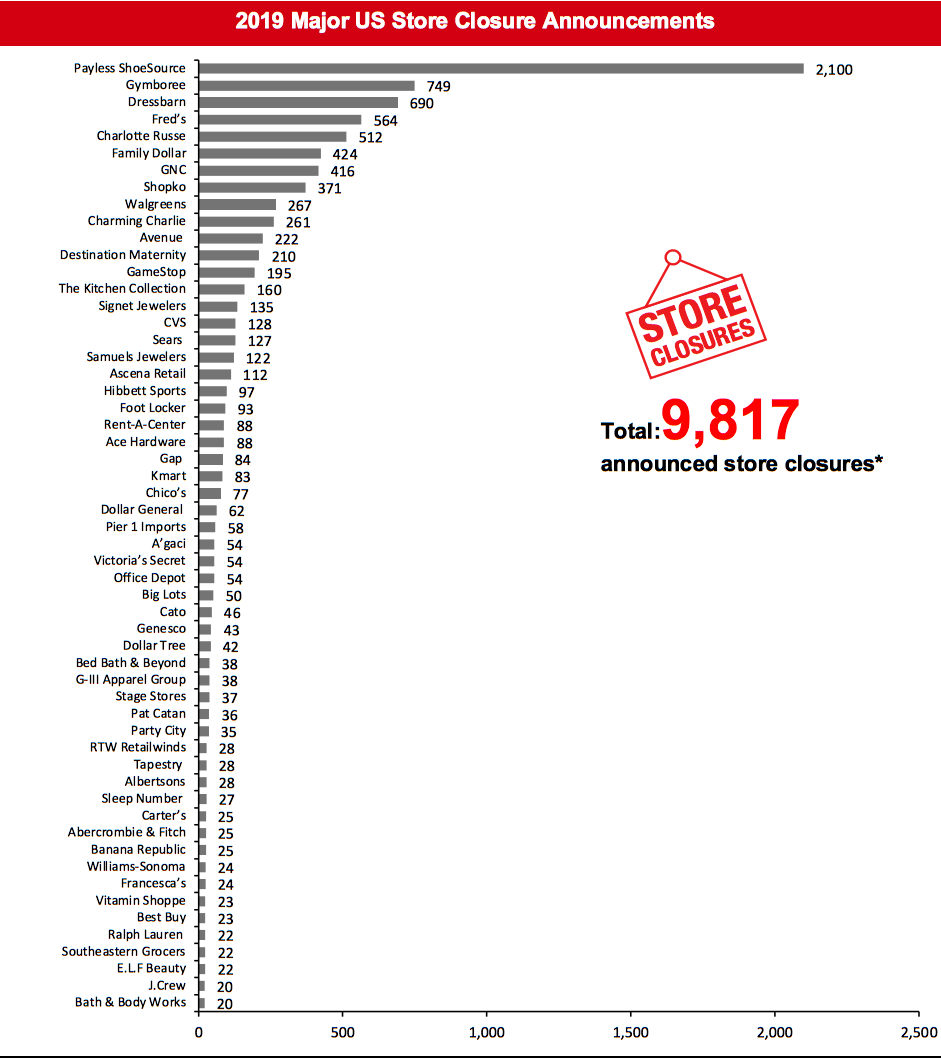

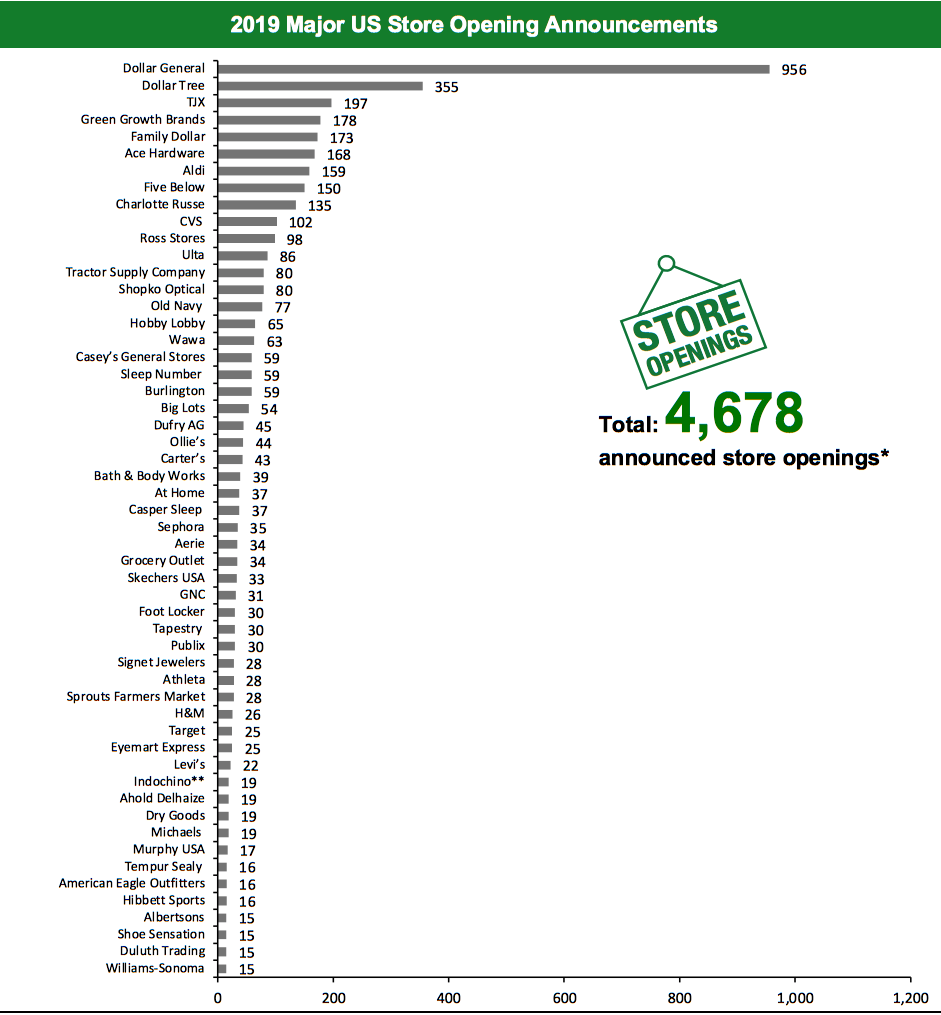

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 3,664 planned store closures and 2,871 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. The US store openings count fell this week as retailers such as , Ross Stores and TJX cut back their store opening targets for the current fiscal year. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Best Buy, Lowe’s and Target, and this has changed our 2019 US closure count to 9,817. We revised our 2019 openings count for Best Buy and Target, and this has changed our 2019 US openings count to 4,678.Coronavirus Update: US States and Stores Reopening

Many US retailers have already reopened their stores in select states, as some state governments have relaxed the lockdown restrictions. This week saw such announcements from Foot Locker and L Brands, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states permitting the reopening of businesses.What Is Happening This Week in the US

L Brands Revises Store Rationalization Plan; Announces Plans To Close 288 Stores and Open 35 has revised its store rationalization plan for the fiscal year 2020, ending January 30, 2021. The retailer plans to close 235 Victoria’s Secret stores, 50 Bath & Body Works and three PINK stores, and open 26 Bath & Body Works stores, seven Victoria’s Secret and two PINK stores in the US. The retailer had previously announced plans to open 95 Bath & Body Works stores, three Victoria’s Secret and two PINK stores, and close 40 Victoria’s Secret stores and 25 Bath & Body Works stores in the US during fiscal year 2020. On May 4, 2020, L Brands had announced plans to establish its Bath & Body Works business as a public company and operate the Victoria’s Secret Lingerie, Victoria’s Secret Beauty and PINK businesses as a separate standalone company. Raley’s Opens New Store Supermarket chain Raley’s has opened a new store under the Bel Air Markets banner. The 35,000-square-foot store is located in Sacramento County, California. In April 2020, Raley’s opened a 55,000-square-foot flagship store in California. The chain currently operates 126 stores across all its banners in the US. TJX Lowers Store Opening Target for Fiscal Year 2021 Off-price retailer The TJX Companies has announced plans to lower its store-opening target for fiscal year 2021, ending January 30, to approximately 50 stores compared to its original target of 110 stores. The decision comes as a part of the retailer’s response to mitigate the financial impact of the coronavirus crisis. In March this year, the retailer had announced plans to open 50 Marshalls and T.J. Maxx, 50 HomeGoods and Homesense and approximately 10 Sierra stores in fiscal year 2021. Coresight Research insight: While much attention has been on the impact of the crisis on store closures, we have been looking at the likely impact on store openings too. We expect a number of retailers with aggressive store-opening plans to undershoot their targets, given the disruption from the crisis and the need to conserve cash. However, we expect off-price to remain an outperforming segment, with consumer demand fueling further expansion of players such as TJX and Ross Stores (see story below) over the medium term. The economic shock of the crisis is likely to push a greater share of discretionary spending toward off-pricers.Quarterly Store Openings/Closures Settlement

Ace Hardware Opens 22 Stores and Closes 12 Hardware retailer Ace Hardware has reported that it opened 22 new stores and closed 12 stores during the first quarter of fiscal year 2020, ended March 28. The retailer operates 4,566 stores in the US and 5,381 stores globally, as of March 28, 2020. Foot Locker Increases Store-Closure Target Sportswear retailer Foot Locker has increased its global store-closure target for fiscal year 2020, ending January 30, 2021, to 170 stores from its previously announced store-closure target of 150 stores. We have revised our closure count based on the existing proportion of stores in the US. Hibbett Sports Closes Six Stores Sporting-goods retailer Hibbett Sports has reported that it closed six stores, rebranded two Hibbett Sports stores to City Gear stores and opened one new store during the first quarter of fiscal year 2021, ending May 2, 2020. The retailer operates 1,078 US stores, as of May 2, 2020. Ross Stores Opens 27 Stores; Lowers Store Opening Target for 2020 Off-price department-store chain Ross Stores opened 20 Ross Dress for Less stores and seven dd’s Discounts stores in the first quarter of fiscal year 2020, ended May 2. The chain has announced plans to lower its store-opening target for 2020 to 66 stores versus its previously announced plans to open 100 stores. The chain expects to open 39 stores in the fall of 2020. Shoe Carnival Closes Two Stores Footwear retailer Shoe Carnival closed two stores during the first quarter of fiscal year 2020, ended May 2. The closures are a part of the retailer’s plans to close seven to 10 stores in fiscal year 2020, ending January 30, 2021. Shoe Carnival also expects to open four stores in fiscal year 2020.Non-Store-Closure News

Ahold Delhaize USA Appoints Ira Kress as President of Giant Food Ahold Delhaize USA has announced the appointment of Ira Kress as President of Giant Food, effective immediately. Kress has been serving as Interim President of Giant Food since last summer. He joined the company in 1984 and has over 36 years of experience in the retail industry. Kress also serves as a board member of Johns Hopkins Pediatric Oncology Advisory Council and the Ahold Delhaize USA Family Foundation. [caption id="attachment_110363" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than three store closures and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110364" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

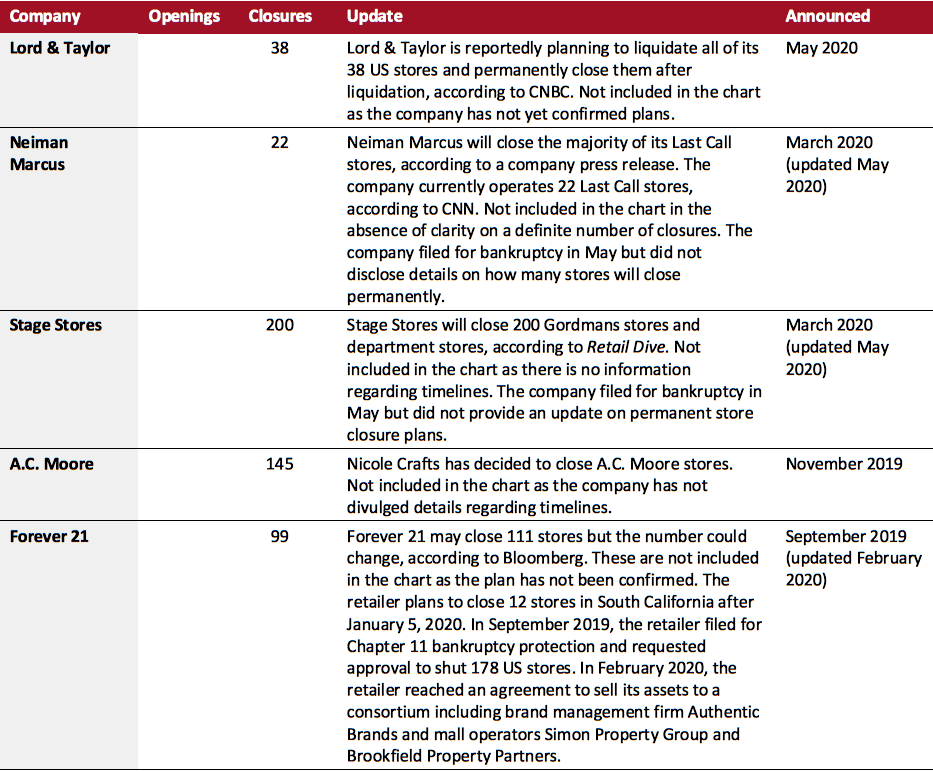

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_110365" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110366" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110366" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110367" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

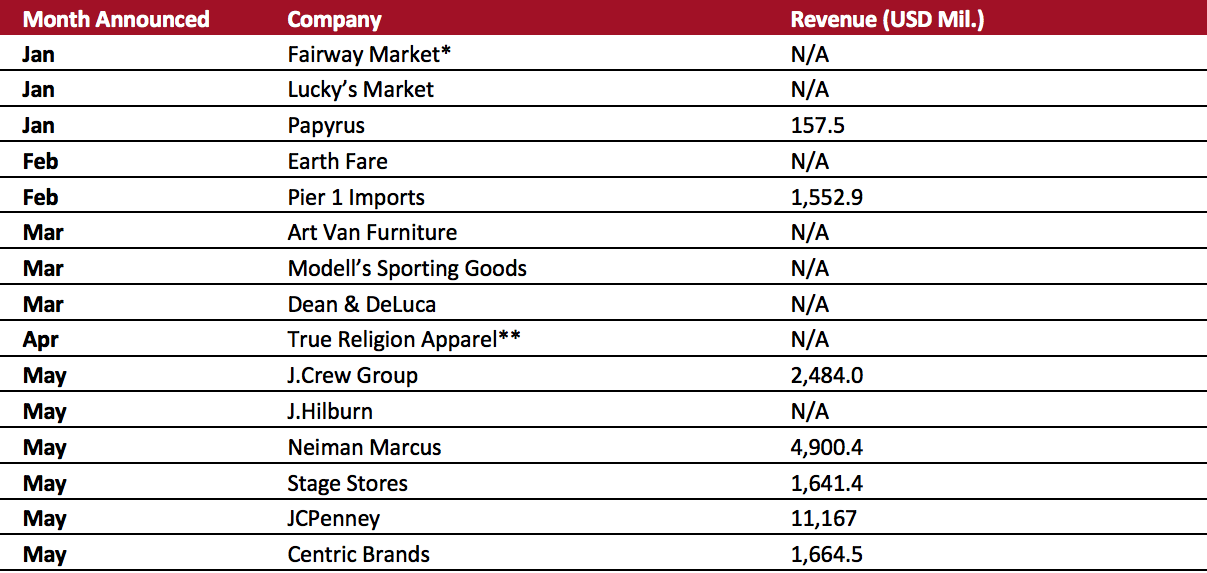

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_110368" align="aligncenter" width="700"]

J.Crew Group includes J.Crew and Madewell banners.

J.Crew Group includes J.Crew and Madewell banners.Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

**True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

N/A – Not Available

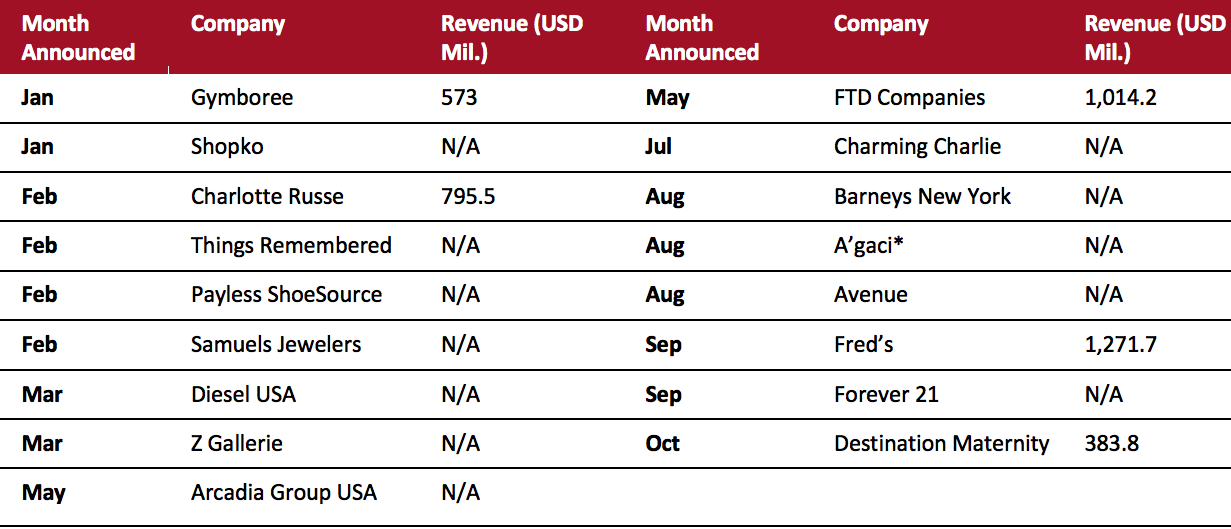

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_110369" align="aligncenter" width="700"]

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available

Source: Company reports/Coresight Research[/caption]

The UK

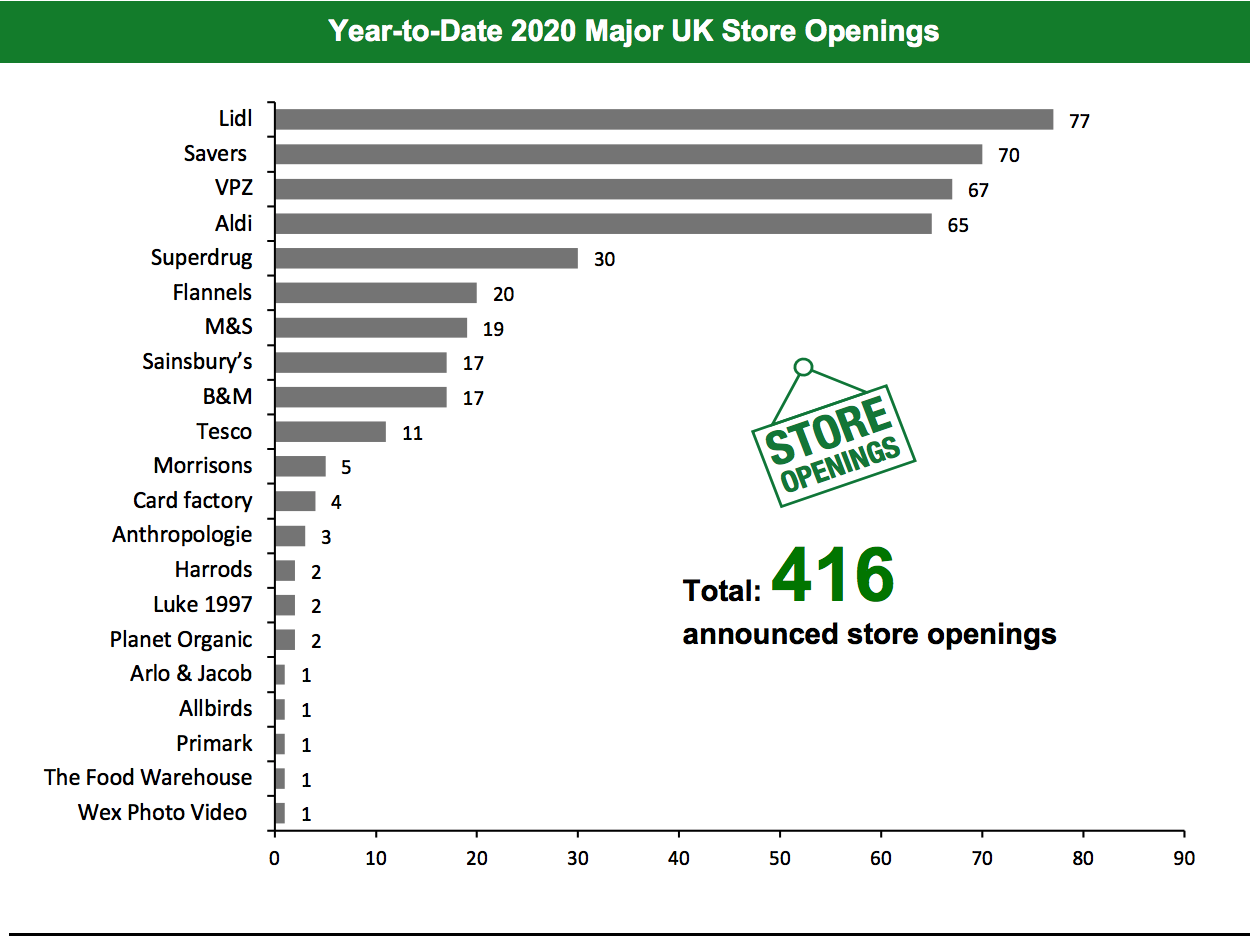

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,429 store closures and 416 store openings. Our data represent closures and openings by calendar year.What Is Happening This Week in the UK

No major retailers reported opening or closure announcements in the past week.Non-Store-Closure News

Co-op Partners with Buymie Consumer co-operative group Co-op has partnered with Irish grocery delivery platform Buymie to provide same-day delivery services to over 200,000 households across Bristol, England. Customers can order from over 4,000 Co-op products via the Buymie app and personalize their online home grocery delivery. Customers can choose convenient delivery slots to have their orders delivered in as little as an hour or schedule a delivery for anytime up to a week later. [caption id="attachment_110370" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.McColl’s includes convenience stores and newsagents.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110371" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

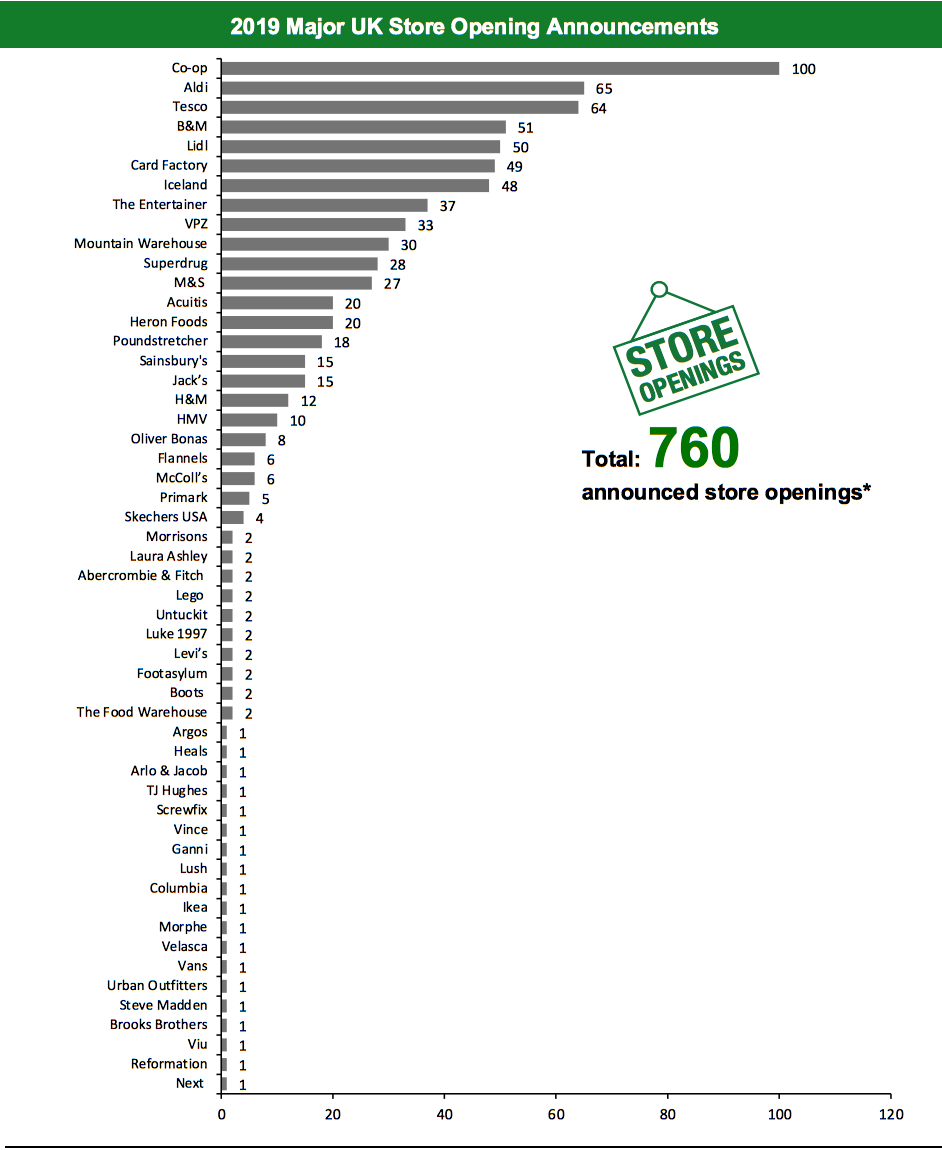

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_110372" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110373" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

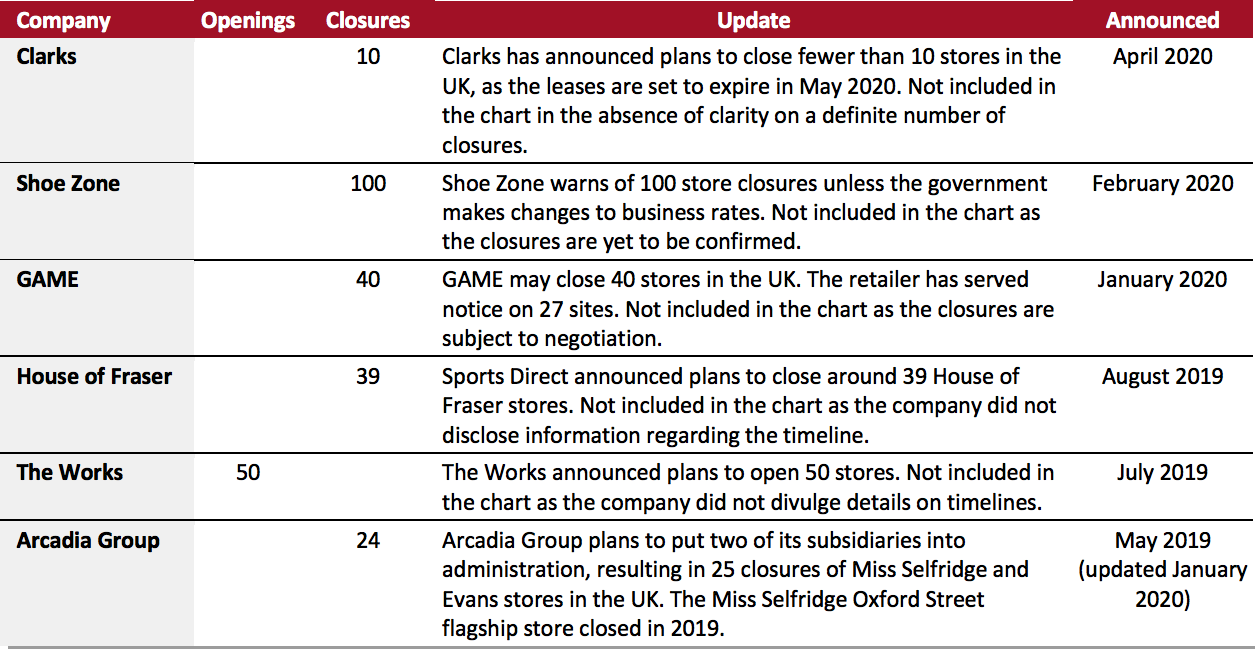

[caption id="attachment_110373" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110374" align="aligncenter" width="700"]

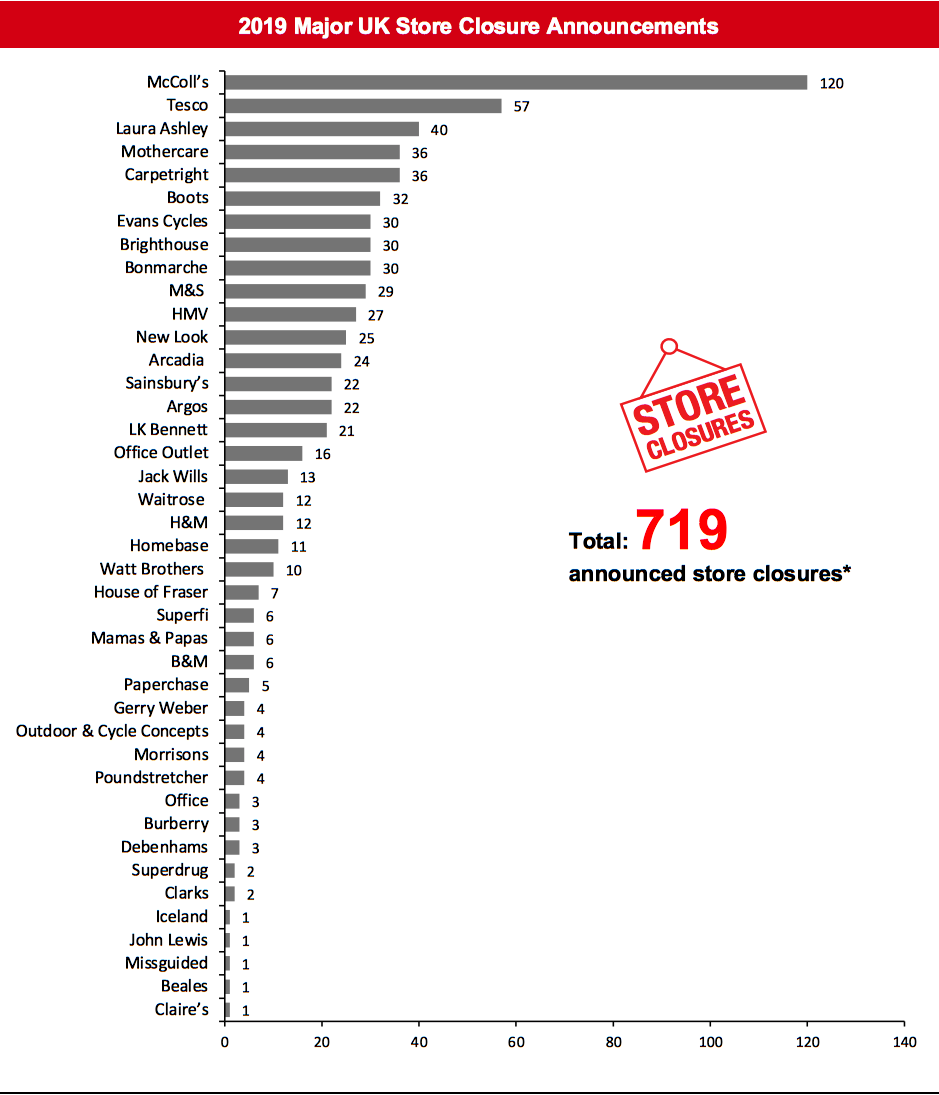

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.