Nitheesh NH

The US

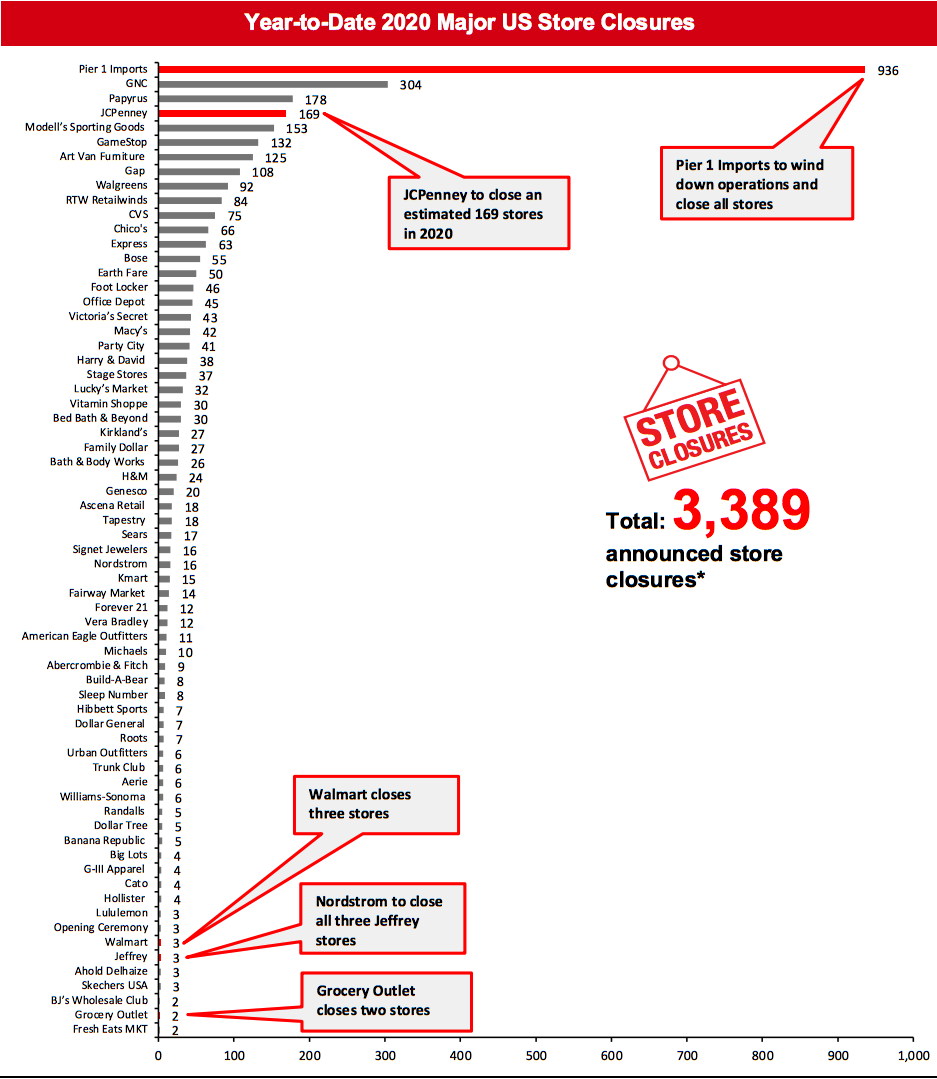

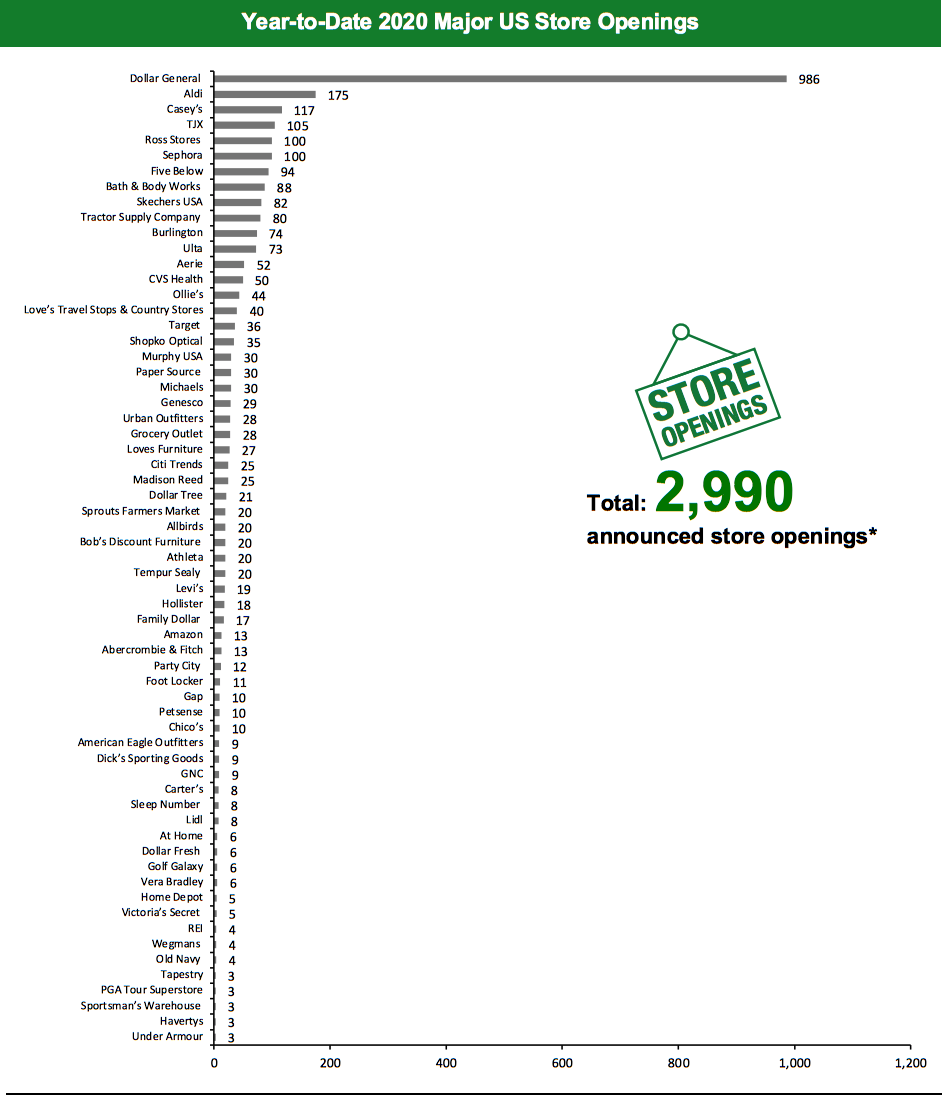

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 3,389 planned store closures and 2,990 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.Coronavirus Update: US States and Stores Reopening

Many US retailers have already reopened their stores in select states, as some state governments have relaxed the lockdown restrictions. This week saw such announcements from Children’s Place, Dillard’s and L.L.Bean, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states permitting the reopening of businesses.What Is Happening This Week in the US

Centric Brands Files for Chapter 11 Bankruptcy Protection Lifestyle brands collective Centric Brands has filed for Chapter 11 bankruptcy protection, with plans to restructure its business. The company has entered into an agreement with its lenders to secure $435 million debtor-in-possession financing so that it can operate during the restructuring process. Centric Brands has revealed that it intends to emerge from Chapter 11 as a private company. As of September 30, 2019, Centric Brands operated 97 retail stores and 337 partner shop-in-shops. JCPenney Files for Chapter 11 Bankruptcy; Plans To Close 242 Stores Department-store chain JCPenney has filed a voluntary reorganization petition under Chapter 11 bankruptcy protection to help its business navigate through the coronavirus crisis. The retailer has entered into a restructuring support agreement with its lenders to implement a financial restructuring plan in order to reduce its debt. JCPenney has announced plans to rationalize its store portfolio by closing 242 stores—192 stores in fiscal year 2020, ending January 30, 2021, and 50 stores by the end of the second quarter of fiscal year 2021, ending July 31, 2022. Coresight Research insight: With $11.2 billion in fiscal-year 2019 revenue, JCPenney is the largest retailer to file for Chapter 11 bankruptcy protection during the coronavirus pandemic. The retailer has been struggling with sluggish sales, with comparable sales declining 7.7% in fiscal year 2019. The retailer’s online revenue, which totaled approximately 19% of revenue in fiscal year 2019, was insufficient to cover costs. Nordstrom To Close Jeffrey Stores Luxury department-store chain Nordstrom has announced plans to permanently close all three Jeffrey specialty stores, in addition to the 16 full-line stores already earmarked for closure as per the retailer’s announcement in early May 2020. Furthermore, Founder of Jeffrey stores and Nordstrom’s current Designer Fashion Director Jeffrey Kalinsky has announced plans to retire from Nordstrom. In 2005, Nordstrom purchased Jeffrey stores and appointed Kalinsky as Director of Designer Merchandising. Office Depot Plans To Restructure Its Business and Close Stores Office-products retailer Office Depot has announced plans to restructure its business in order to realign its focus on business-to-business solutions and IT service business units. As part of the restructuring plan, the retailer intends to close or consolidate retail stores and distribution facilities, as well as make around 13,100 employee positions redundant by the end of 2023. Office Depot has not revealed details regarding the timeline and number of store closures. Pier 1 Imports Plans To Wind Down Operations Home décor and furniture retailer Pier 1 Imports has announced that it is seeking court approval to begin the wind down of its business operations “as soon as reasonably possible”, after it was unable to find a buyer for its business. The retailer intends to close all its remaining stores and sell its inventory, intellectual property and e-commerce business under a court-supervised process. It will commence liquidation of its inventory after stores reopen in the US. Pier 1 Imports filed for Chapter 11 bankruptcy protection in February this year and had announced plans to close up to 450 stores. The retailer currently operates 541 stores in the US.Quarterly Store Openings/Closures Settlement

Grocery Outlet Plans To Open 28–30 Stores Supermarket chain Grocery Outlet has announced plans to open 28–30 stores this year. It opened 10 new stores and closed two during the first quarter of fiscal year 2020, ended March 28. Grocery Outlet operates 355 stores across six US states, as of March 28, 2020. Coresight Research insight: Distinctive or high-quality discount grocery formats stand to gain as recession-hit shoppers look for cheaper options but with some discrimination. Grocery Outlet was opening stores apace even before the coronavirus crisis, and the trading down trend is likely to provide added support for openings. Walmart Closes Three Stores Walmart has reported that it closed two supercenters and one Neighborhood Market store in the US during the first quarter of fiscal year 2021, ended April 30, 2020. The retailer also remodeled about 80 stores in the US during the same period.Non-Store-Closure News

Casey’s Appoints Ena Williams as COO and Steve Bramlage as CFO Convenience-store chain Casey’s has appointed Ena Williams as COO and Steve Bramlage as CFO, effective June 1, 2020. Williams, who most recently served as CEO of medical equipment provider National HME, will join the newly created role of COO at Casey’s. Bramlage most recently served as CFO of food, facilities and uniform service provider Aramark Corporation. He will succeed former CFO Bill Walljasper, who announced his retirement earlier this year. [caption id="attachment_110052" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, JCPenney, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than two store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110053" align="aligncenter" width="700"]

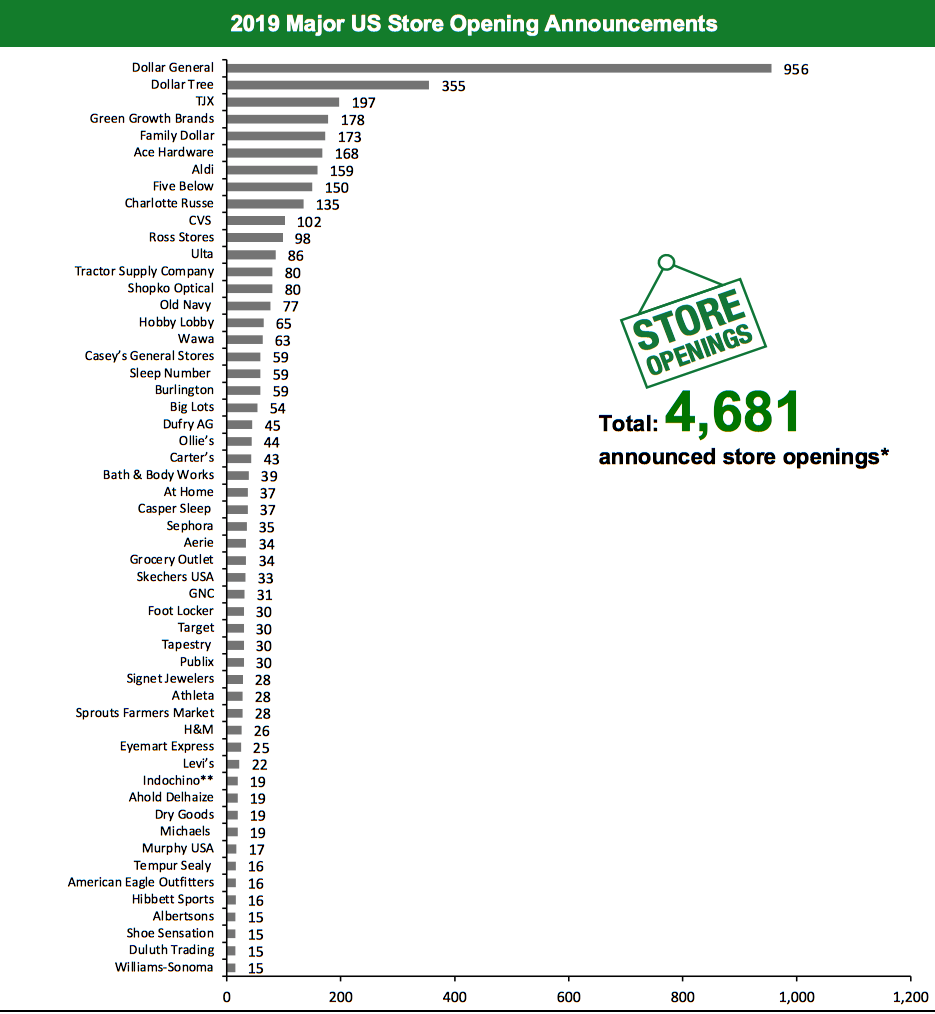

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

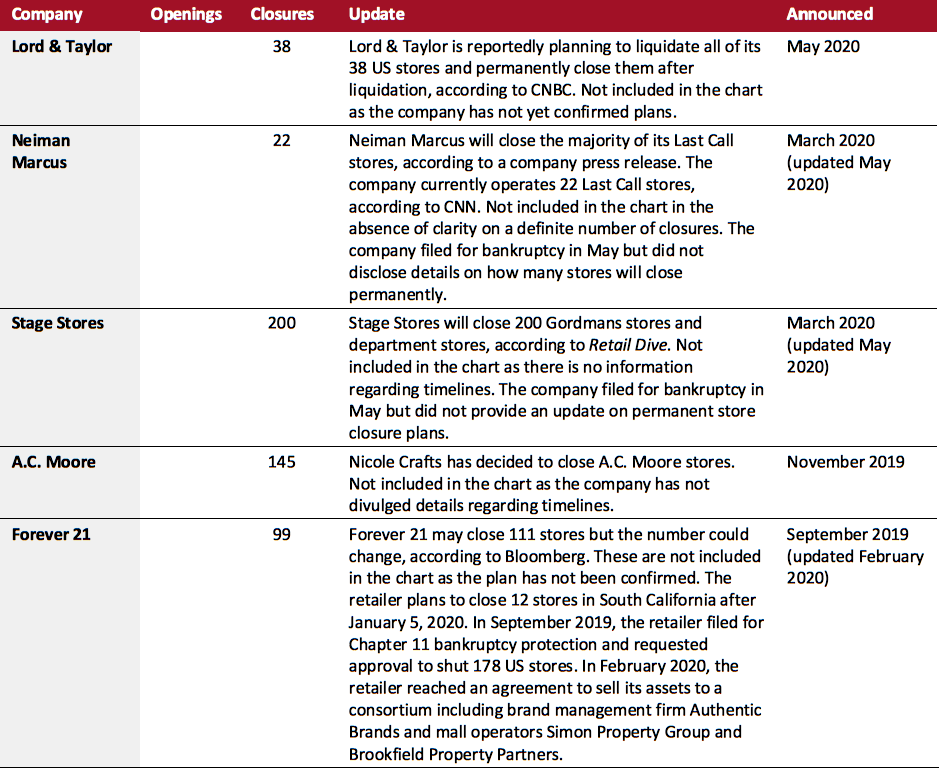

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_110054" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110055" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

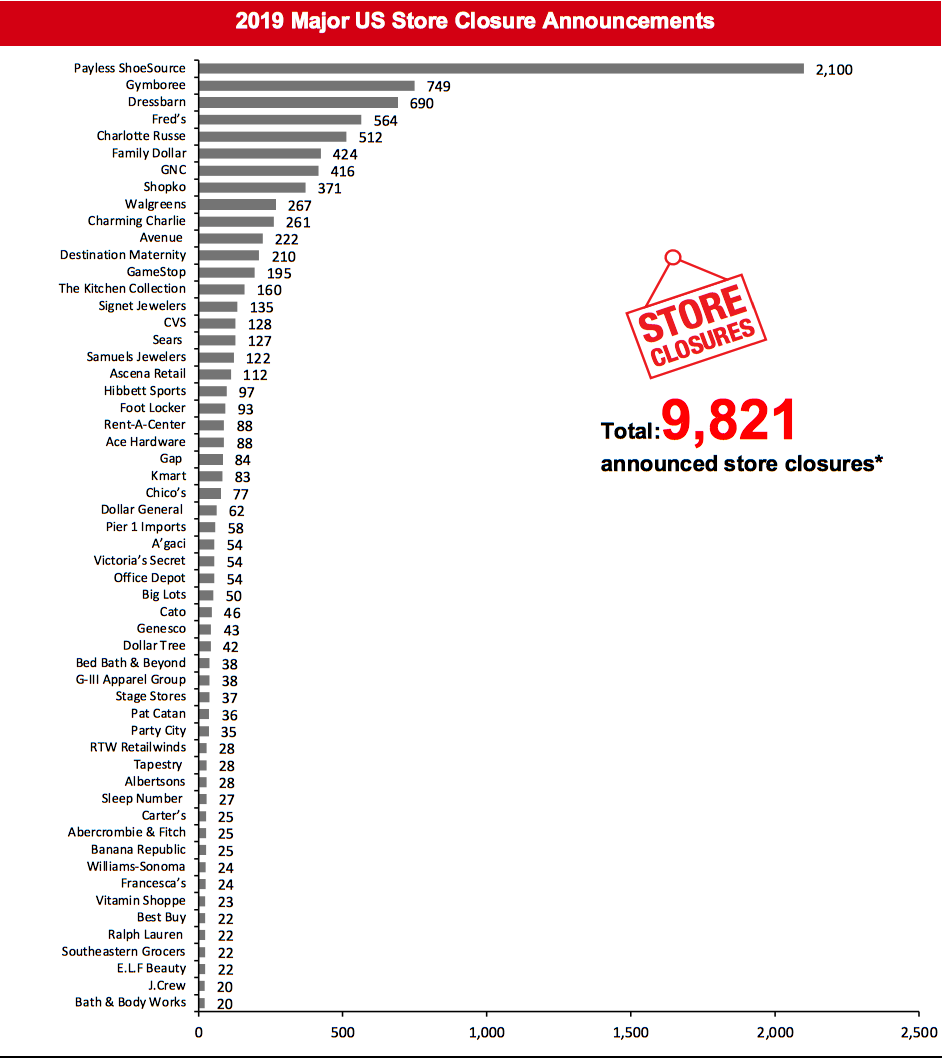

[caption id="attachment_110055" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110056" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_110057" align="aligncenter" width="700"]

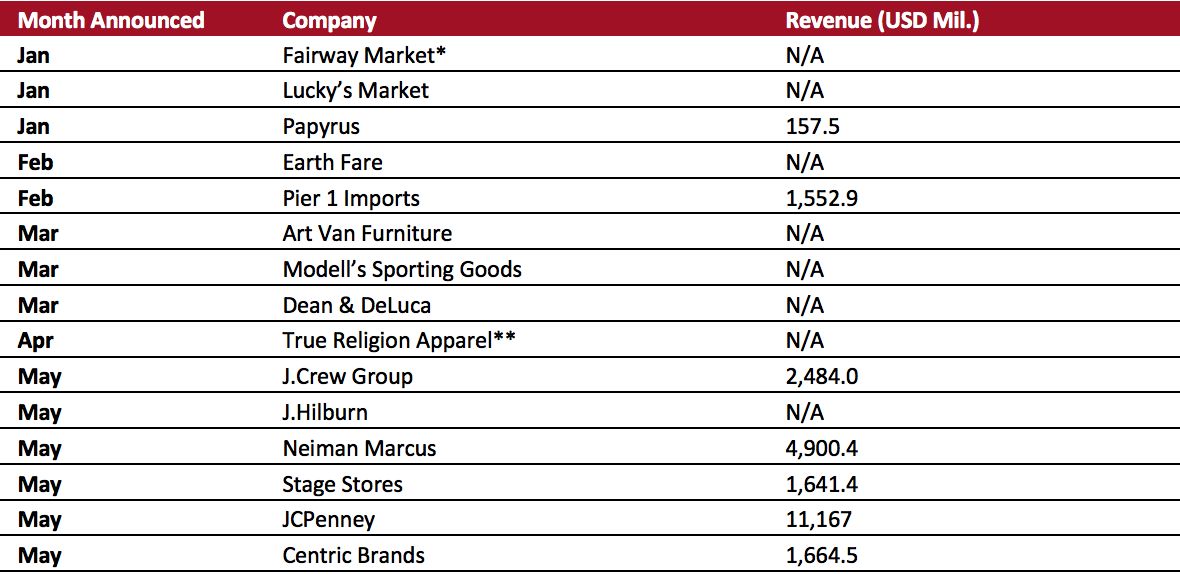

J.Crew Group includes J.Crew and Madewell banners.

J.Crew Group includes J.Crew and Madewell banners. Revenue figure depicted for Centric Brands is for the nine-month period ended Sep 30, 2019.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

**True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

N/A – Not Available,br.Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_110058" align="aligncenter" width="700"]

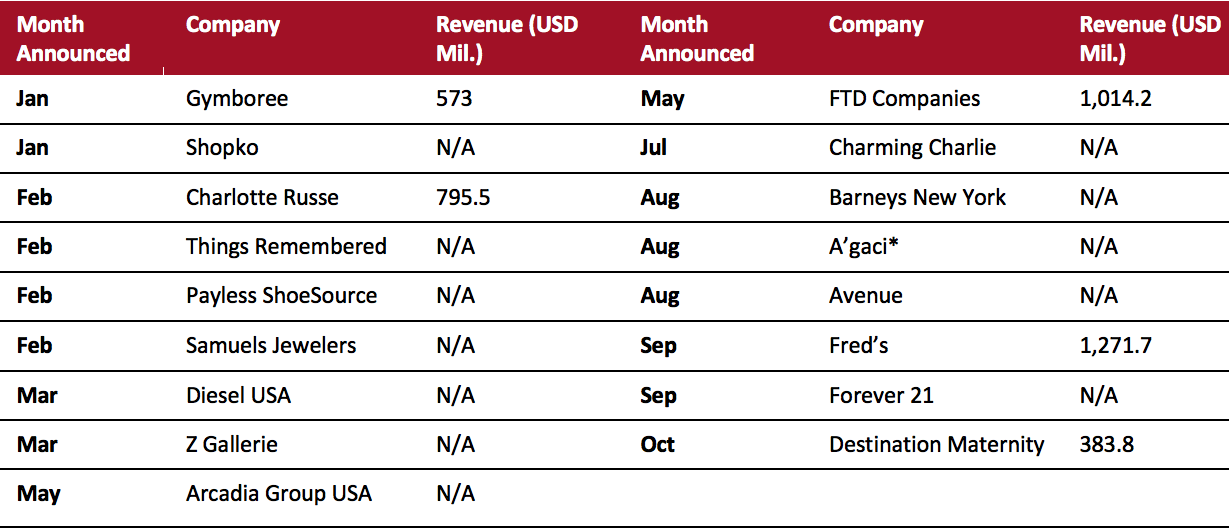

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.

Revenue figure depicted for Gymboree is for the nine-month period ended Nov 3, 2018.*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

N/A – Not Available

Source: Company reports/Coresight Research[/caption]

The UK

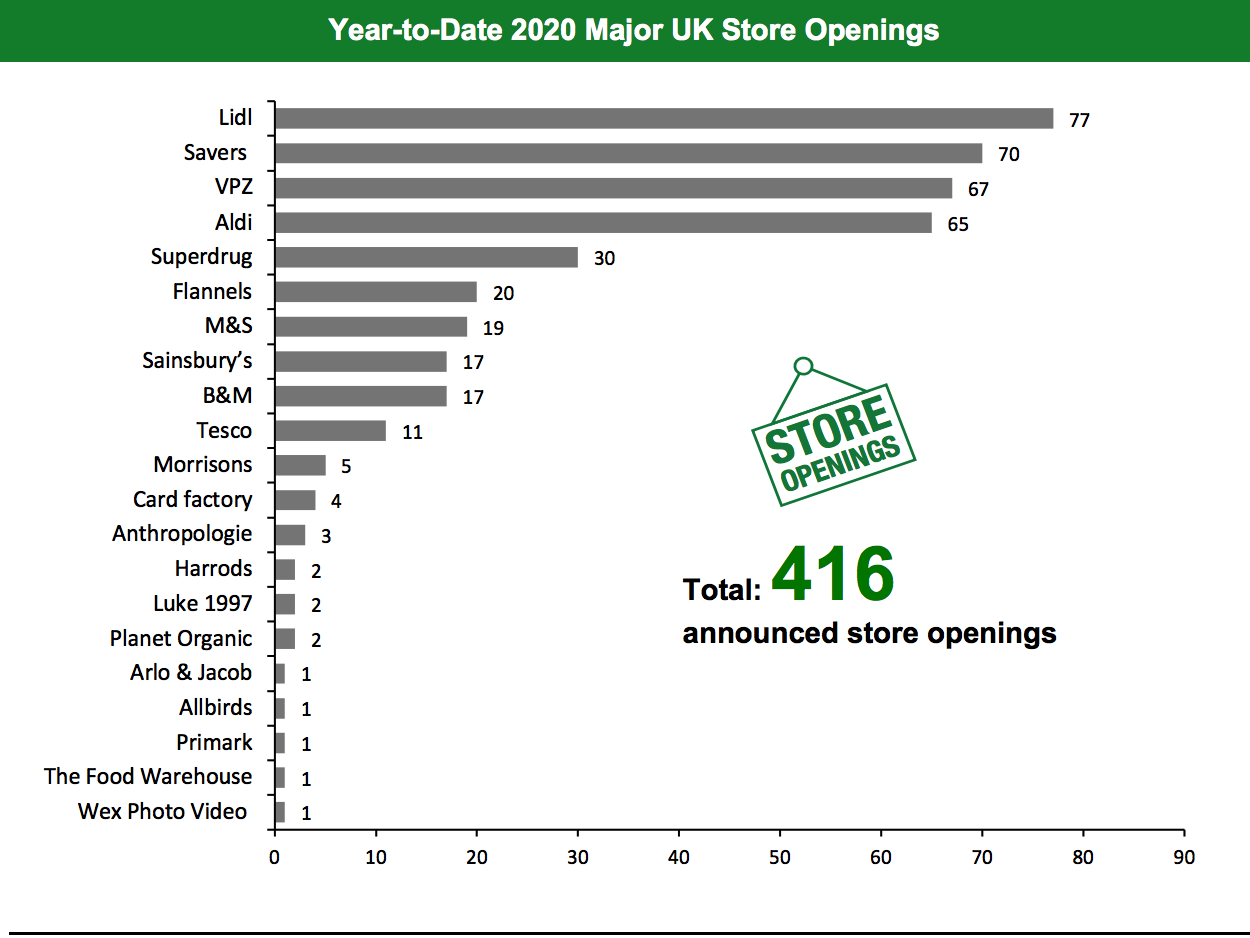

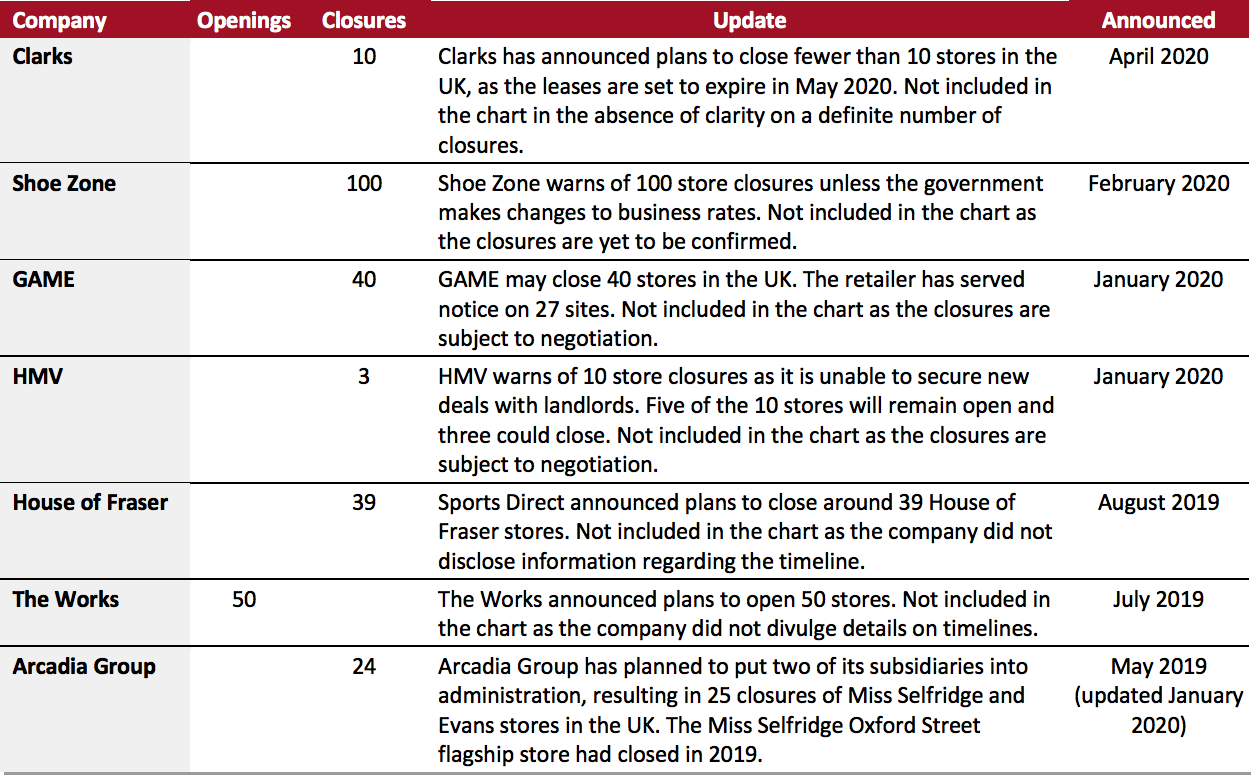

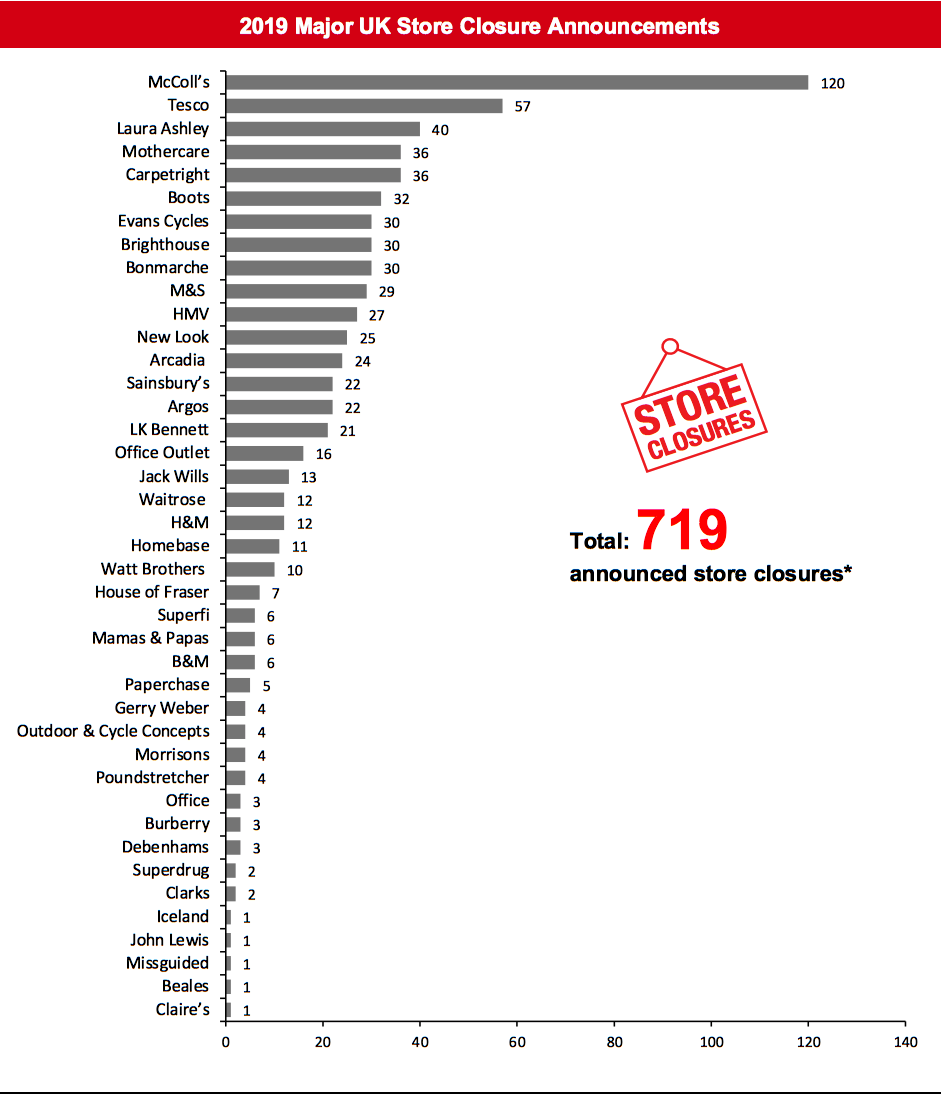

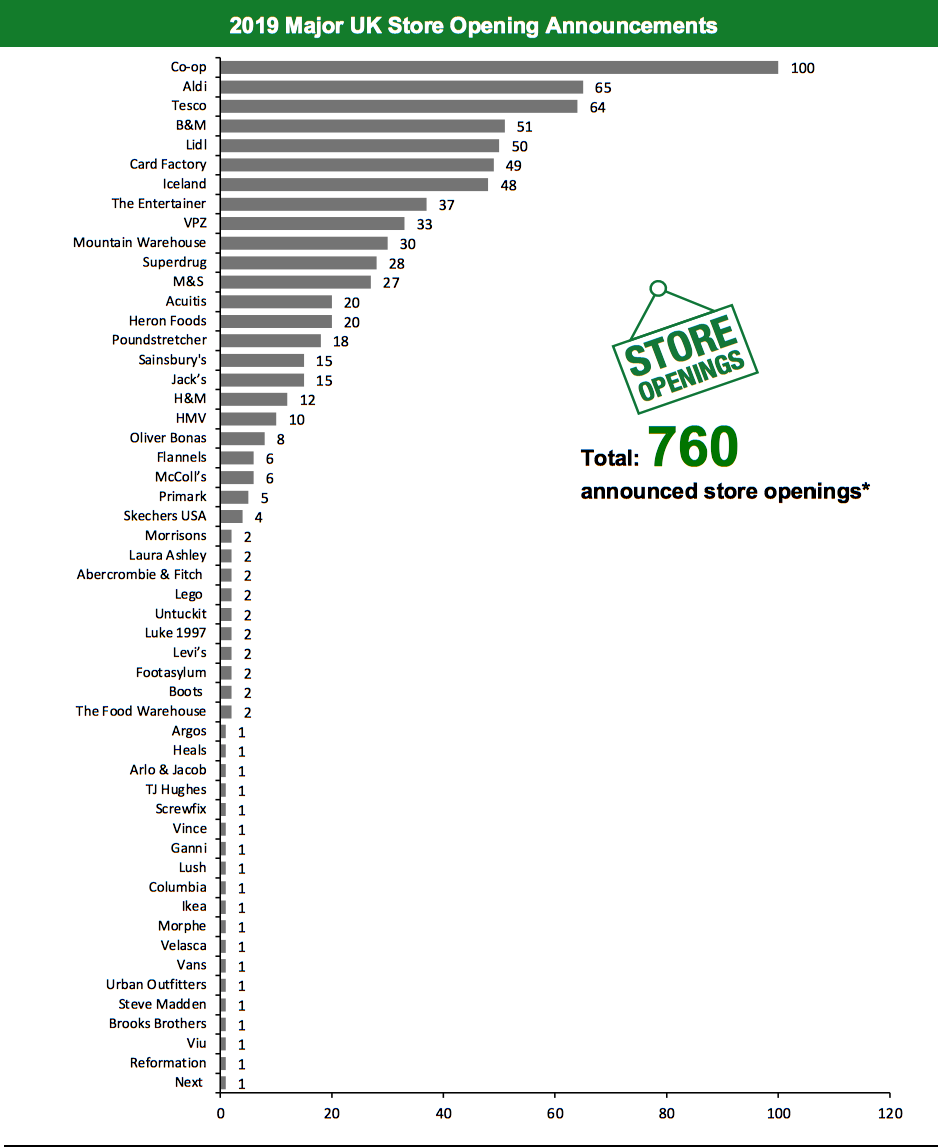

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,429 store closures and 416 store openings. Our data represent closures and openings by calendar year. This week, we have revised our 2019 closures count for Marks and Spencer, and this has changed our 2019 UK closure count to 719. We also revised our 2019 openings count for Marks and Spencer, and this has changed our 2019 UK openings count to 760.What Is Happening This Week in the UK

Antler Files for Administration Luggage retailer Antler has filed for administration after its sales were hit hard following store closures triggered by the coronavirus lockdown. The retailer has appointed financial firm KPMG as administrators. It operates 18 standalone stores and one concession. Antler was purchased by fashion icon Michael Lewis from private-equity firm Endless in February this year. Johnson Shoes Company Enters Administration Johnson Shoes Company, parent company of footwear retailers Johnson Shoes and Bowleys Fine Shoes, has filed for administration and is simultaneously seeking a buyer for its business. The retailer said that it filed for administration due to the challenges faced by online competition and the impact of the coronavirus pandemic. It had appointed Ian Defty and Richard Toone from CVR Global as joint administrators on April 23, 2020. Johnsons Shoes Company operates 12 stores across London and Southeast England. Marks and Spencer Closes 25 Stores and Opens 20 Marks and Spencer reported that it closed 25 stores and opened 20 stores in the UK during its fiscal year ended March 28, 2020. It also reported that it closed 54 stores of the previously announced plans to close 110 stores by March 2024. The retailer operates 1,038 stores in the UK, as of March 28, 2020.Non-Store-Closure News

Ted Baker Appoints David Wolffe as CFO Luxury clothing brand Ted Baker has appointed David Wolffe as its new CFO, effective immediately. Wolffe, who joined Ted Baker as an interim CFO in January this year, has also joined the retailer’s Board of Directors. He succeeds Rachel Osborne, who was promoted to CEO of Ted Baker in March 2020. [caption id="attachment_110059" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_110060" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_110061" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110062" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_110062" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_110063" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.