DIpil Das

The US

2020 Major US Store Closures and Openings

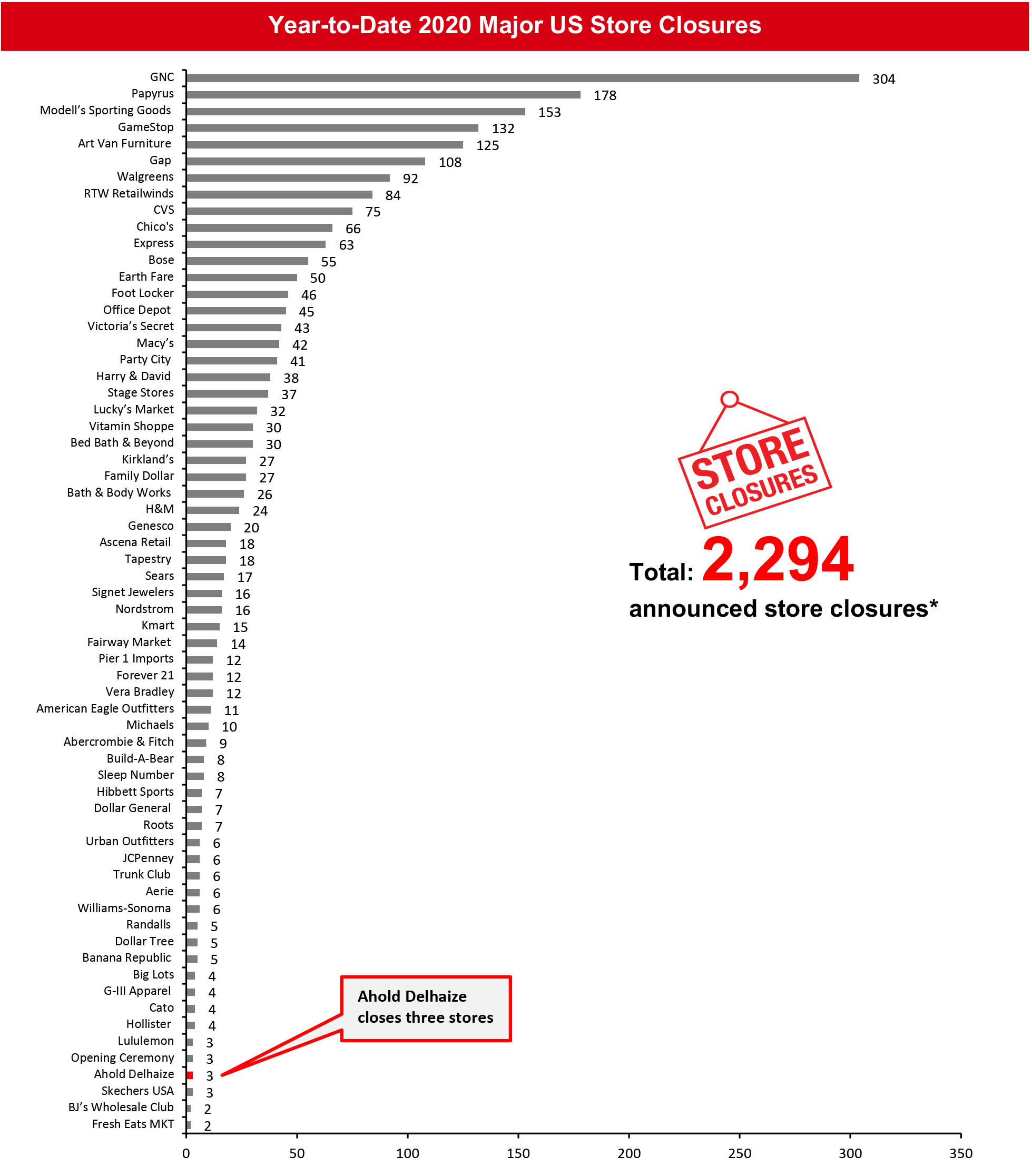

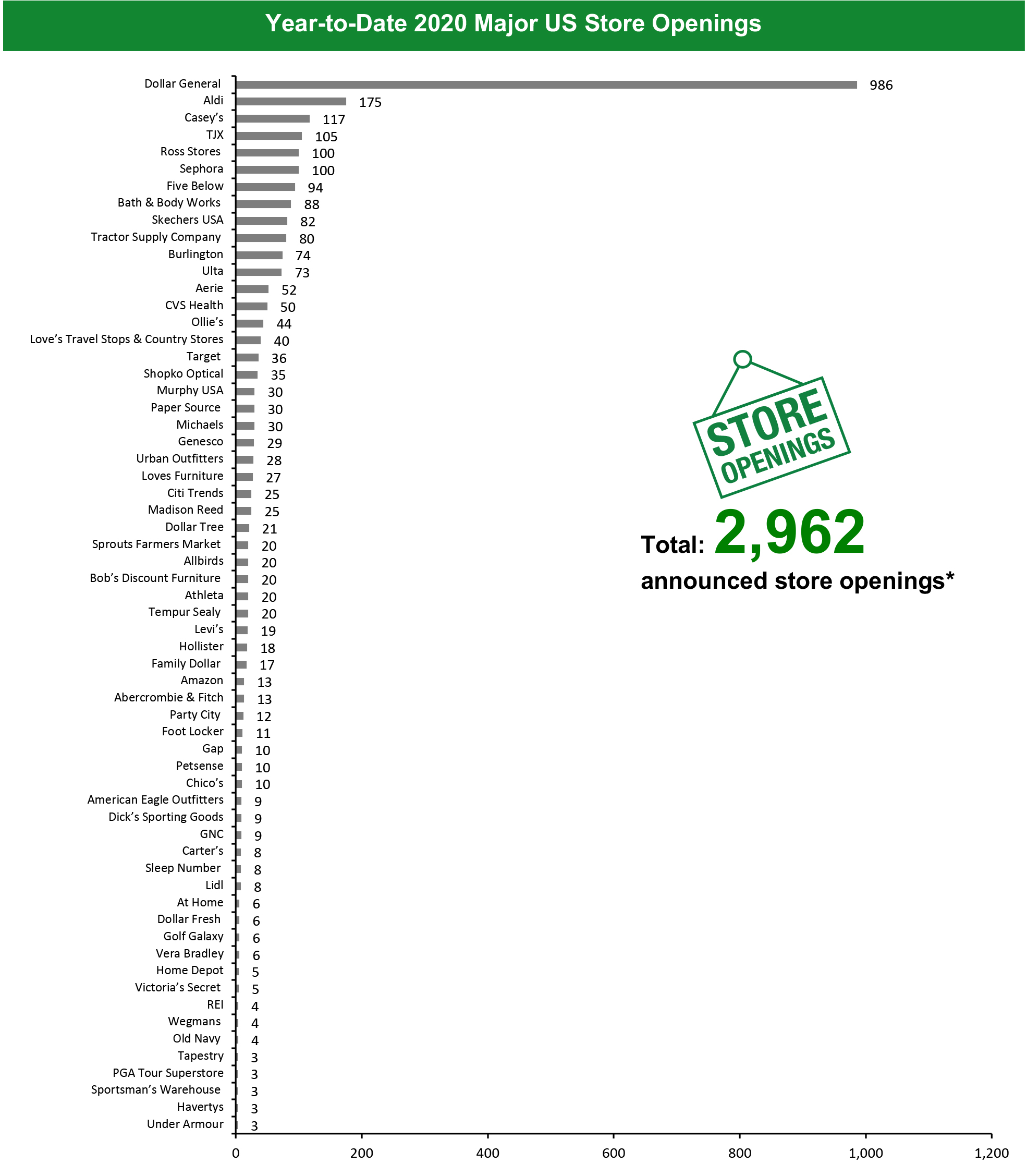

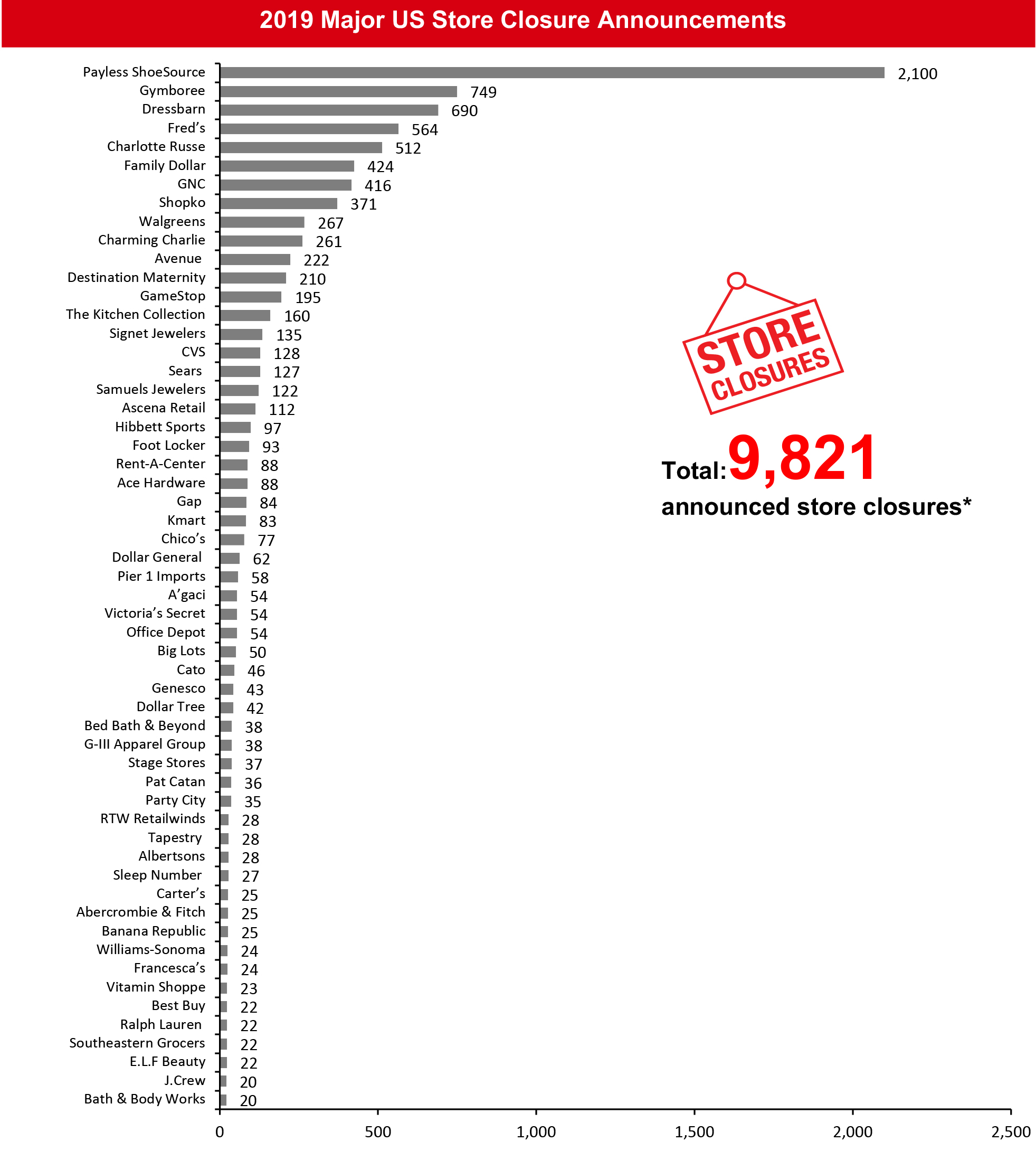

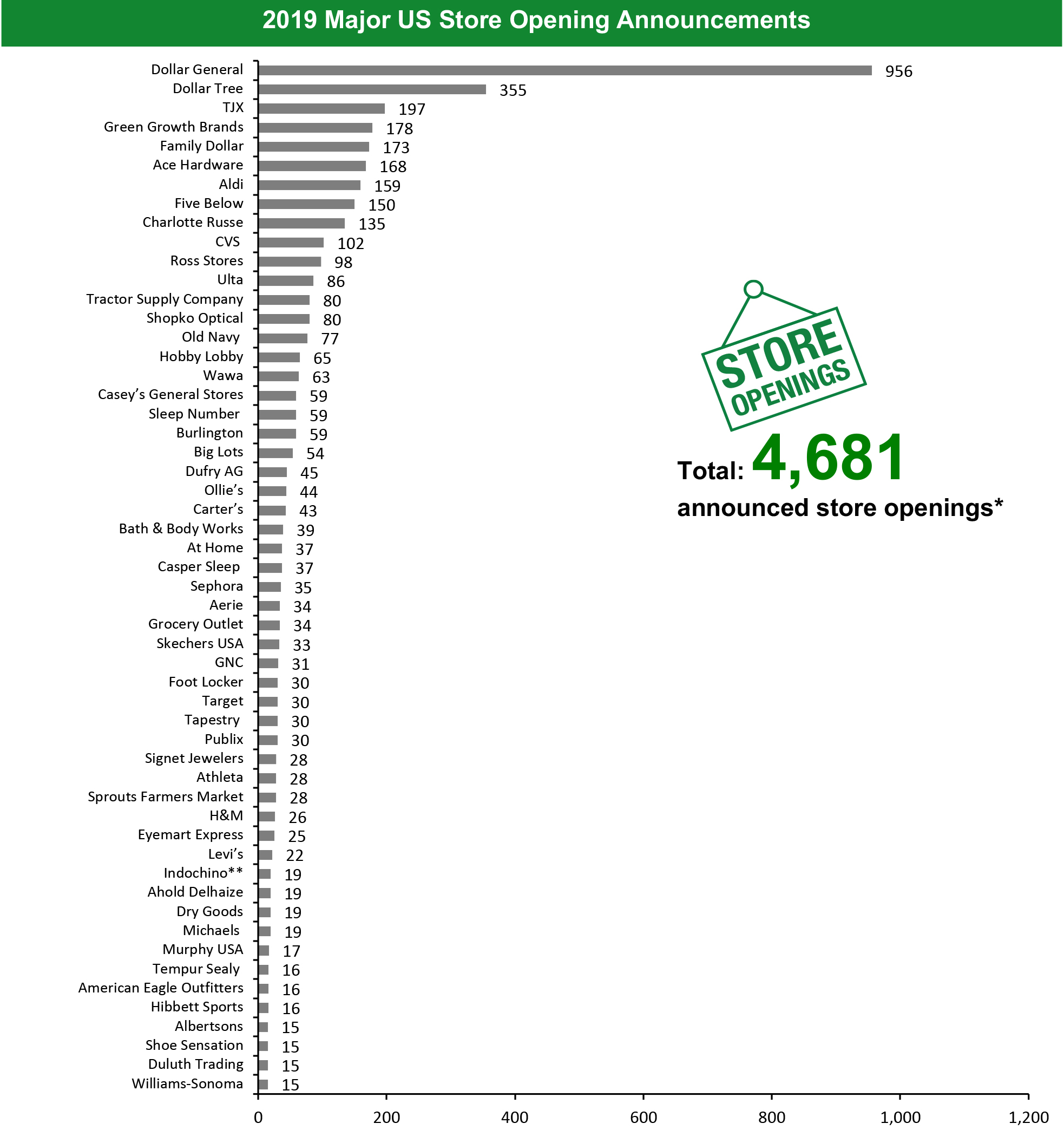

Year to date in 2020, US retailers have announced 2,294 planned store closures and 2,962 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020.This week, we have revised our 2019 closures count for Ahold Delhaize, CVS, Ethan Allen, Rent-A-Center and Stage Stores, and this has changed our 2019 US closure count to 9,821. We revised our 2019 openings count for Ahold Delhaize, CVS and Ethan Allen, and this has changed our 2019 US openings count to 4,681. Coronavirus Update: US States and Stores Reopening Many US retailers have already reopened their stores in select states, as some state governments have relaxed the lockdown restrictions. This week saw such announcements from Apple, Bed Bath & Beyond, Genesco and Vera Bradley, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states permitting the reopening of businesses.What Is Happening This Week in the US

GNC Eyes Bankruptcy Protection; Closes 117 Stores and Opens Nine Stores Health and wellness products retailer GNC said that it could file for Chapter 11 bankruptcy protection in order to implement a restructuring plan, as it would not be able to fulfill its debt payments due on May 16, 2020. During the first quarter of fiscal year 2020, ended March 31, the retailer closed 92 company-owned stores and 25 franchise stores, as well as opening six franchise stores and three company-owned stores in the US and Canada. The closures are part of GNC’s previously announced plans to close 900 stores in the US and Canada through 2021. JCPenney Inches Closer to Bankruptcy Department-store chain JCPenney could file for bankruptcy protection imminently, with plans to close about 200 of its 850 stores depending on negotiations with creditors, according to Reuters. JCPenney has not yet made a final decision and is exploring options, including negotiating with its creditors outside of bankruptcy court. It recently elected not to pay an approximately $17 million interest payment that was due on May 7, 2020, according to its 8-K securities filing. Loves Furniture To Rebrand 27 Art Van Furniture Stores Loves Furniture has purchased the leases and assets of 27 stores from the former Art Van Furniture portfolio. The 27 stores are expected to reopen under the Loves Furniture brand name in early June. The stores are located in Illinois, Maryland, Michigan, Ohio, Pennsylvania and Virginia. Of the 27 stores, 20 were Art Van stores and the remaining seven were Levin and Wolf stores. Art Van Furniture had filed for Chapter 11 bankruptcy protection in March this year. Stage Stores Files for Chapter 11 Bankruptcy Department-store chain Stage Stores has filed for Chapter 11 bankruptcy protection, with plans to liquidate its business in the coming weeks. The retailer is pursuing a sale of its business while simultaneously initiating a wind-down of its operations. Stage Stores stated that it would terminate the wind-down of operations at certain locations if it receives a suitable going-concern bid. It has planned a phased approach to reopen its stores in order to commence the liquidation of its inventory. Stage Stores currently operates 738 stores in the US. Coresight Research insight: In September 2019, Stage Stores revealed a plan to switch to the off-price format, with mass conversions to its off-price Gordmans banner. This appears to have been a last throw of the dice, given media reports in January about a possible bankruptcy and in March about a possible slew of store closures (see the Uncharted Openings and Closures table). Given such a background, it is unsurprising that the extreme conditions of the coronavirus crisis should tip the retailer over the edge. Sur La Table Prepares for Bankruptcy Kitchenware chain Sur La Table is reportedly preparing to file for bankruptcy protection, according to Bloomberg. The chain, which is owned by investment firm Investcorp, is also pursuing a sale of its business. Sur La Table was acquired by Investcorp in 2011 for $146 million, and it currently operates 125 stores.Quarterly Store Openings/Closures Settlement

Ahold Delhaize Closes Three Stores and Opens One Grocery retailer Ahold Delhaize closed three stores and opened one store in the US during the first quarter of fiscal year 2020, ended March 29. The retailer operates 1,971 stores across all its banners in the US including Food Lion, Hannaford, Stop & Shop and The Giant Company, as of March 29, 2020. Coresight Research insight: Reporting its first-quarter results, Ahold Delhaize provided further evidence of the recent strength in demand in grocery: US comp growth came in at 13.8%, peaking at 33.8% in March; US online saleswere up 42.3%. Casper Sleep Opens Two New Stores Mattress retailer Casper Sleep reported that it opened two new stores during the first quarter of fiscal year 2020, ended March 31. It has announced plans to reduce the number of store openings this year and expects capital expenditure to be below $15 million in 2020. Casper Sleep operates 59 stores, as of March 31, 2020. Ethan Allen Closes Seven Stores and Opens Six Furniture retailer Ethan Allen closed seven company-operated stores and opened six in the US during the nine months of fiscal year 2020, ended March 31. The retailer operates 138 company-operated stores in the US, as of March 31, 2020.Non-Store-Closure News

Target Plans To Acquire Deliv’s Technology Target is planning to acquire last-mile startup Deliv’s same-day delivery proprietary technology and some of its employees. The general merchandise retailer will utilize Deliv’s technology in research and development to improve its delivery processes. The deal between the two companies is expected to close in the coming weeks, but Target has not disclosed details regarding the value of the deal. Last week, The Wall Street Journal reported that Deliv would be winding down its operation on or before August 4, 2020. [caption id="attachment_109676" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. *Total includes a small number of retailers that each announced fewer than two store openings and are not included in the chart

Source: Company reports/Coresight Research [/caption] [caption id="attachment_109677" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, GNC, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings. *Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

Source: Company reports/Coresight Research [/caption]

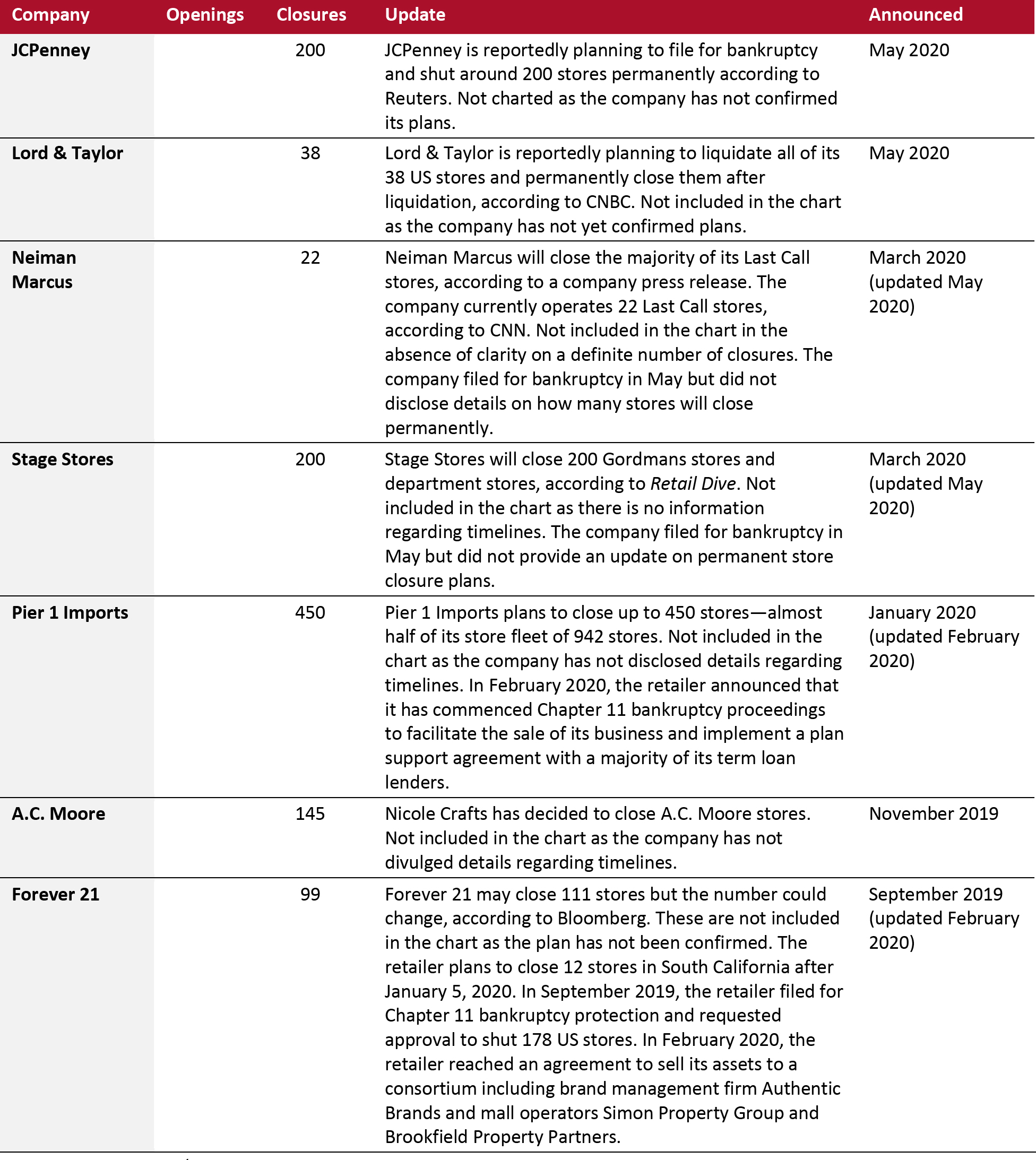

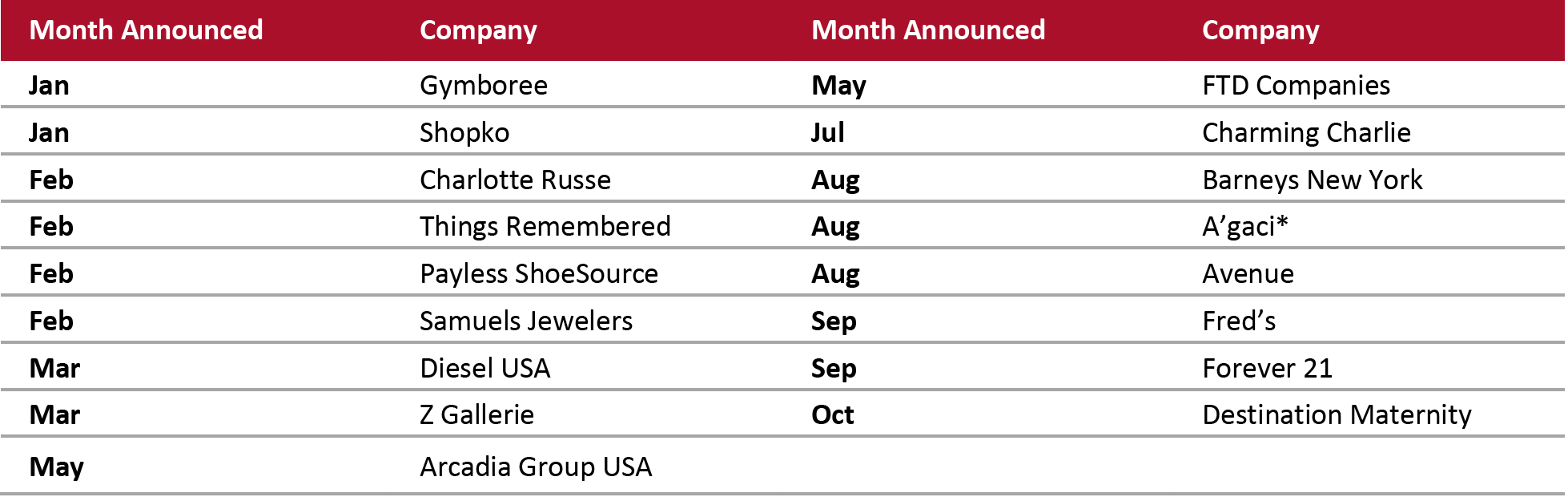

2020 Major US Uncharted Openings and Closures

The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location.

[caption id="attachment_109678" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109679" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_109680" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Ahold Delhaize includes Food Lion, Hannaford, Stop & Shop and The Giant Company banners. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. CVS includes retail drugstores, onsite pharmacy stores, specialty stores and pharmacies within Target stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 15 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research [/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_109681" align="aligncenter" width="700"]

J.Crew Group includes J.Crew and Madewell banners.

J.Crew Group includes J.Crew and Madewell banners. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

**True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_109682" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. Source: Company reports/Coresight Research [/caption]

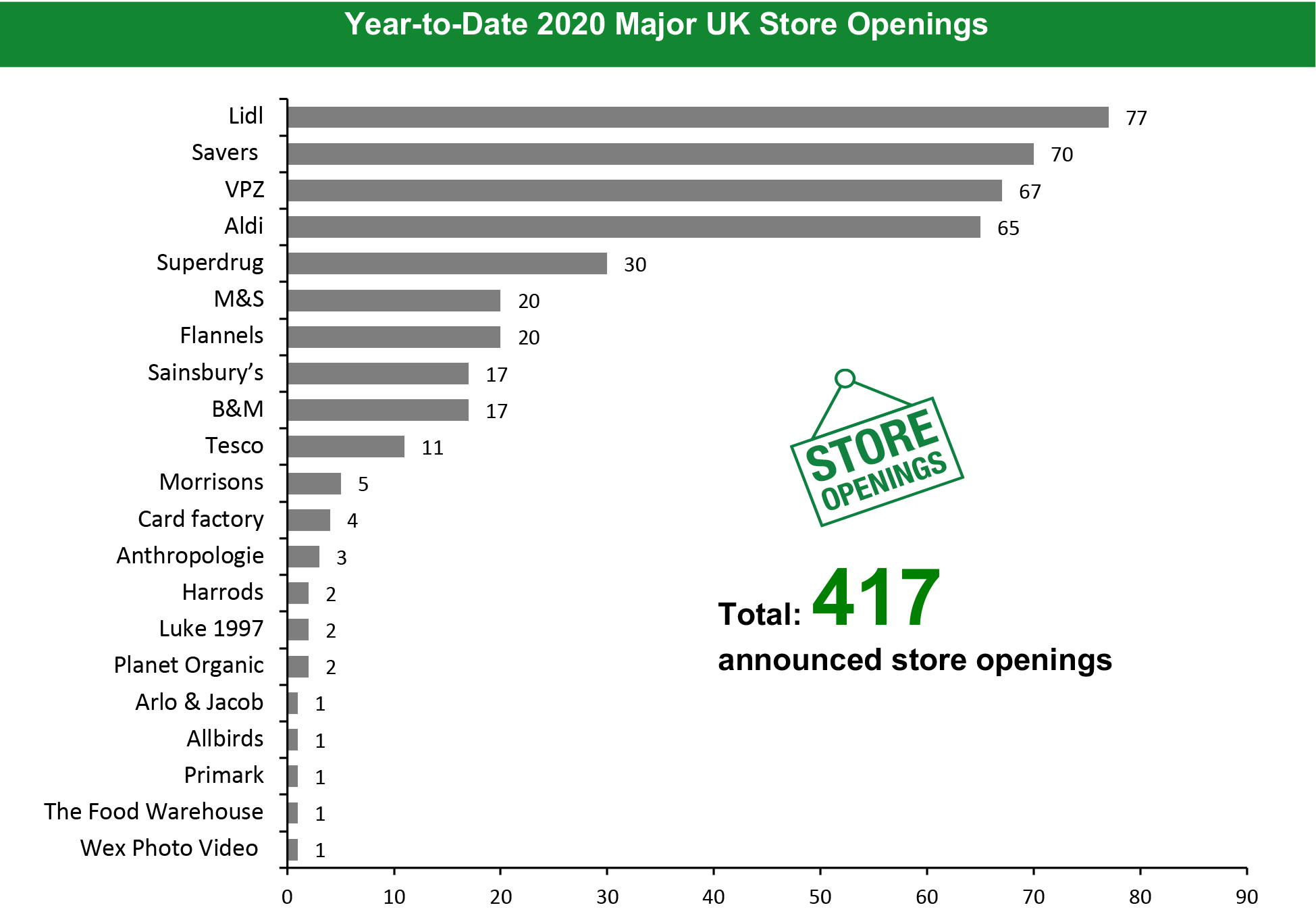

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,424 store closures and 417 store openings. Our data represent closures and openings by calendar year.What Is Happening This Week in the UK

Debenhams To Permanently Close Five More Stores Debenhams has announced plans to permanently close five more stores, with almost 1,400 jobs facing uncertainty. The five stores—located in Birmingham, Croydon, Glasgow, Leicester and Reading—will not reopen after the coronavirus lockdown restrictions are lifted. Last month, Debenhams collapsed into administration and subsequently announced plans to close 11 stores in the UK.Non-Store-Closure News

Clarks Drafts In Deloitte, KPMG and PwC Footwear retailer Clarks has reportedly sought the services of accountancy firms Deloitte, KPMG and PricewaterhouseCoopers (PwC) to manage the potential restructuring of its business amid the coronavirus crisis. KPMG has been hired as an advisor to the company while Deloitte has been hired by the retailer’s management team. PwC has been drafted in by Clarks to evaluate the impact of coronavirus on its business. Clarks stated that it is exploring all options to keep its business afloat. McColl’s CFO Resigns Convenience-store chain McColl’s CFO Robbie Bell has resigned from his role to join health and wellness retailer Holland & Barrett. He has also resigned from McColl’s Board of Directors. McColl’s has commenced the search for a new CFO, and Bell will remain in his role until a replacement is appointed. At Holland & Barrett, Bell will take over the reins from Greg Watts, who has served as CFO on an interim basis since October 2019. [caption id="attachment_109683" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents. Source: Company reports/Coresight Research [/caption] [caption id="attachment_109684" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

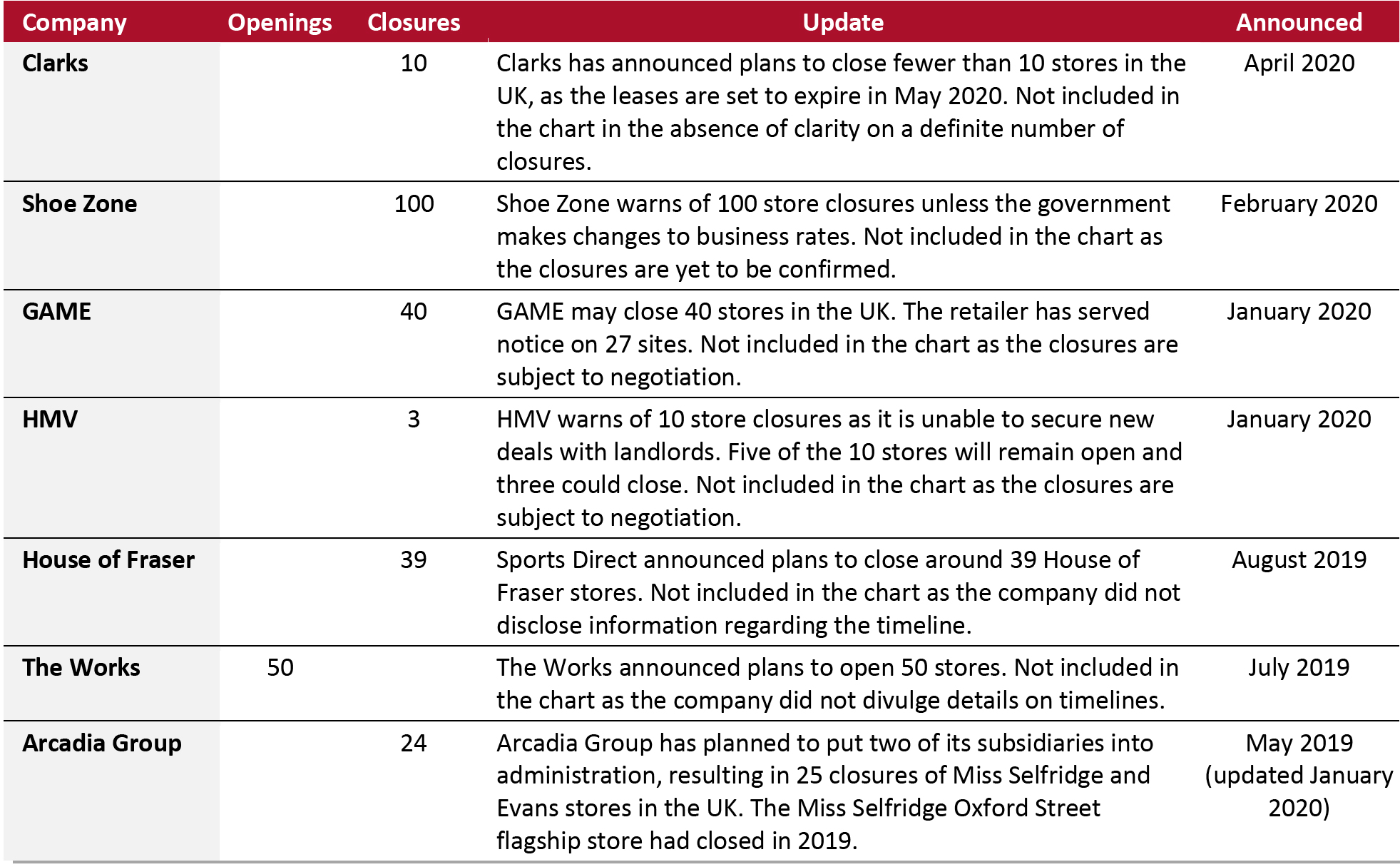

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK. Source: Company reports/Coresight Research [/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_109685" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109686" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

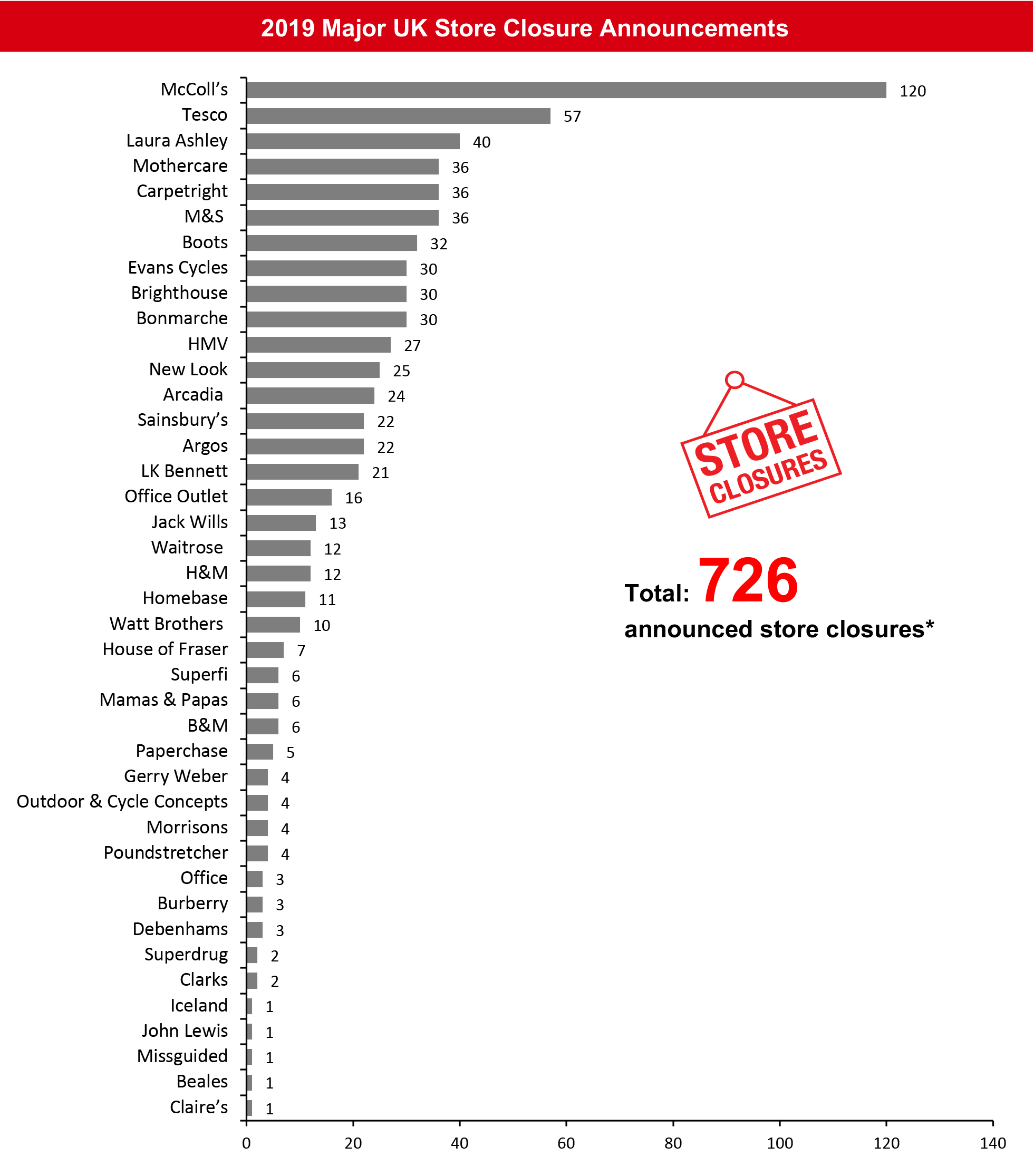

[caption id="attachment_109686" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_109687" align="aligncenter" width="700"]

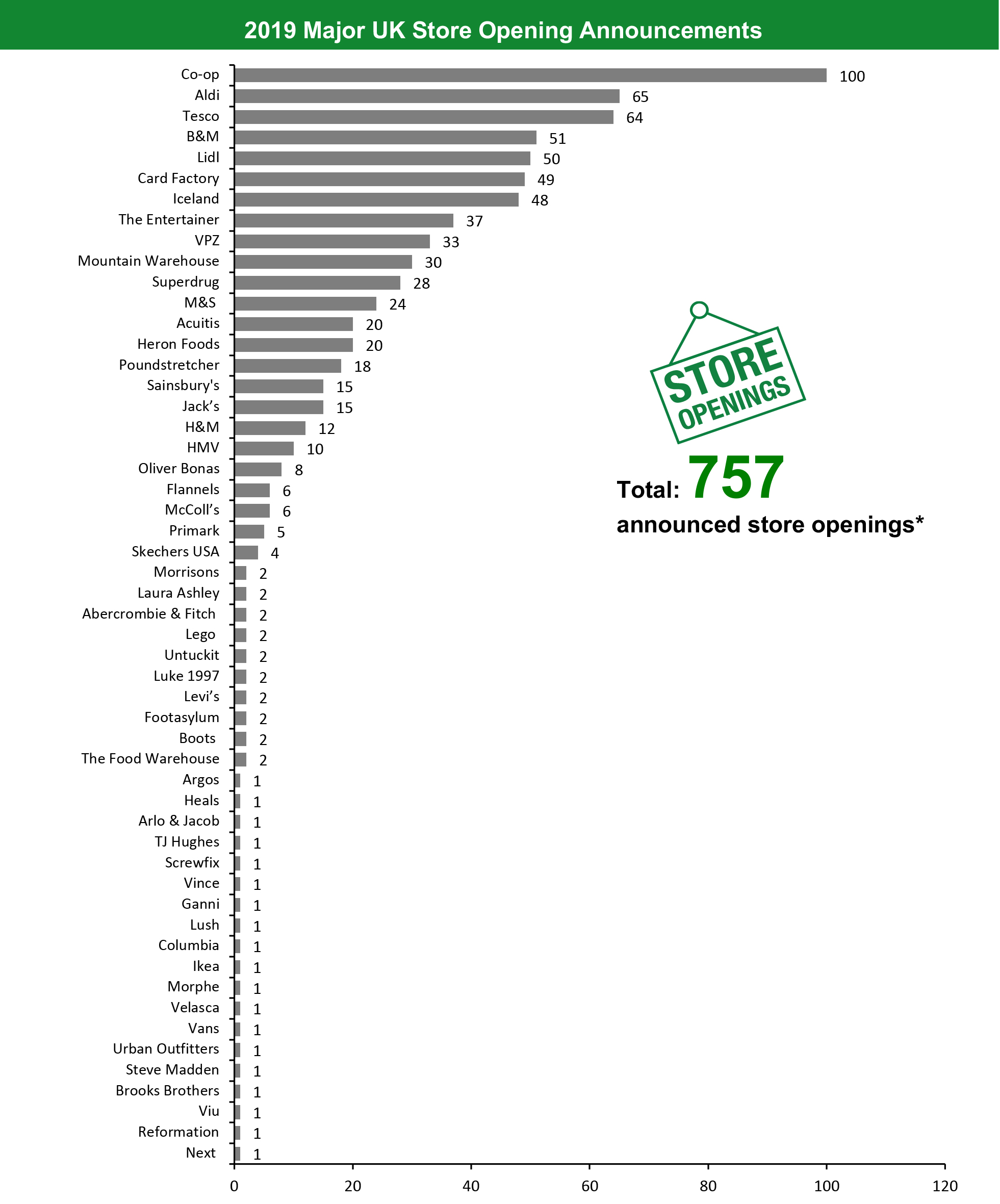

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research [/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.