Nitheesh NH

The US

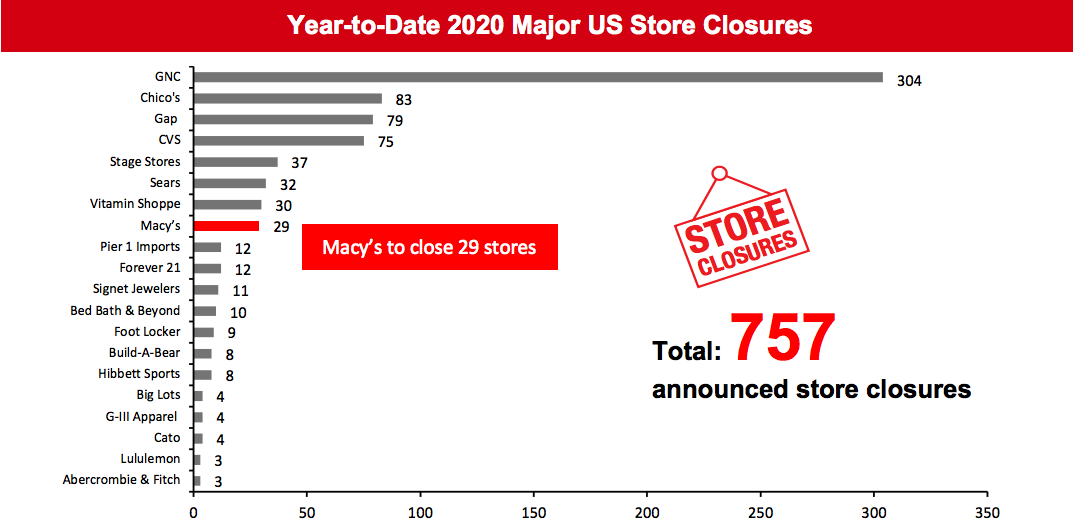

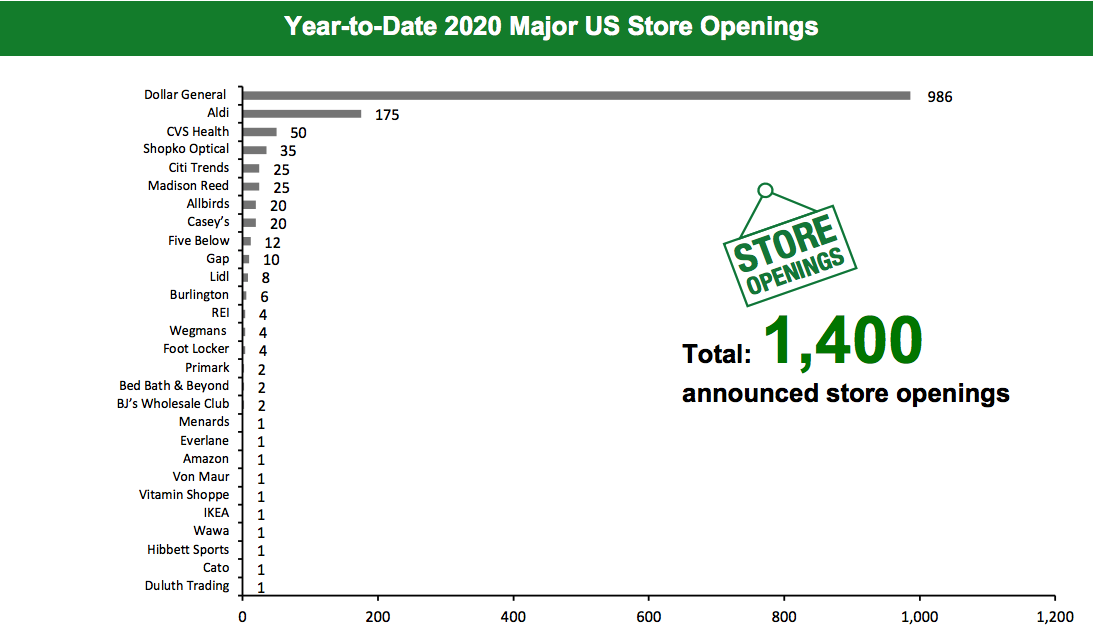

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 757 planned store closures and 1,400 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.What Is Happening This Week in the US

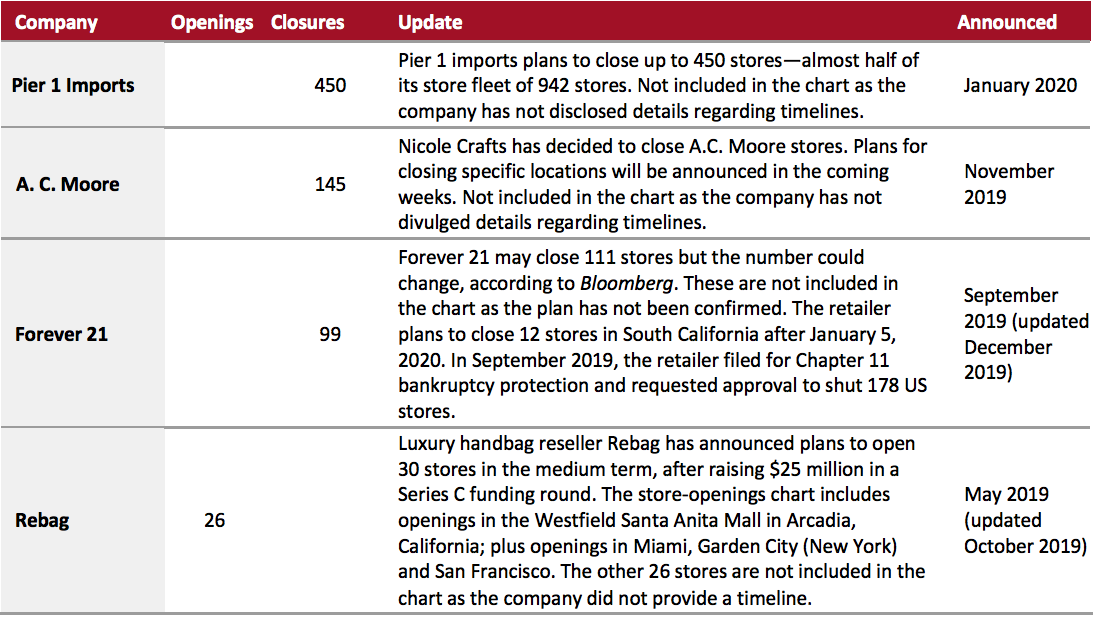

Macy’s To Close 29 Stores Department-store chain Macy’s has confirmed plans to shut 28 Macy’s stores and one Bloomingdale’s store in the coming weeks. According to a company spokesperson, the retailer will provide details on its growth strategy and three-year plan at its Investor Day, which will be held on February 5, 2020. The stores earmarked for closure include those located in Macon Mall in Georgia, Ohio Valley Mall in Ohio, RiverGate Mall in Tennessee, University Mall in Illinois and Westfield Meriden Mall in Connecticut. In September 2019, Macy’s announced plans to close its downtown Seattle store in February 2020. Coresight Research insight: Macy’s reported that its comparable sales over the nine-week holiday period ending January 4, 2019 decreased by 0.7% on an owned basis and fell by 0.6% on an owned plus licensed basis. Despite the company completing the closure of 100 stores nationwide last year, the sluggish comps over the holiday may have prompted a round of closures of slower-performing Macy’s stores in weaker economic areas, presumably where the company was already considering closures. Pier 1 Imports To Shut Nearly 450 Stores Home décor and furniture retailer Pier 1 Imports has confirmed plans to close up to 450 locations—almost half of its total store fleet—and is reportedly close to filing for bankruptcy. The retailer also plans to close certain distribution centers and shrink its corporate headcount. As of November 30, 2019, Pier 1 Imports operates 942 stores in Canada and the US. These closures do not feature in our closures chart as the retailer has not yet disclosed information regarding the timeline. Coresight Research insight: The furniture retail industry is in a relatively early stage of disruption, with a growing number of options for shoppers. This is impacting traditional brick-and-mortar furniture retailers as alternative brands that offer design services and optionality are capturing consumer interest. Examples include IKEA, digitally native retailer Wayfair and Williams-Sonoma’s West Elm collaboration with Rent the Runway, which is testing rental services.Non-Store-Closure News

Forever 21 To Re-Launch International Online Store Fast-fashion retailer Forever 21 is set to re-launch its international online store in partnership with cross-border e-commerce platform Global-e. The new online store will target shoppers in Asia, Canada and Latin America. It will support payments in more than 95 currencies and facilitate shoppers to check out and make returns in 21 different languages. [caption id="attachment_102186" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_102187" align="aligncenter" width="700"]

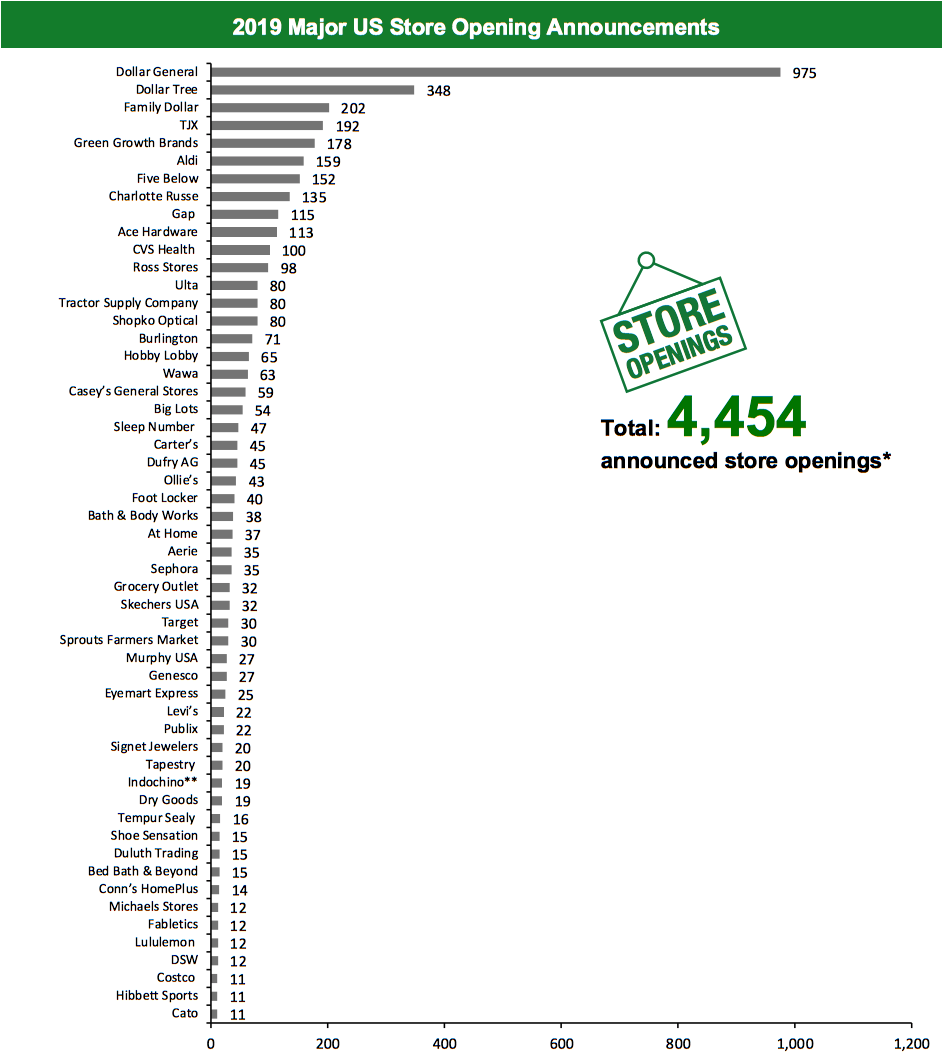

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_102188" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102189" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

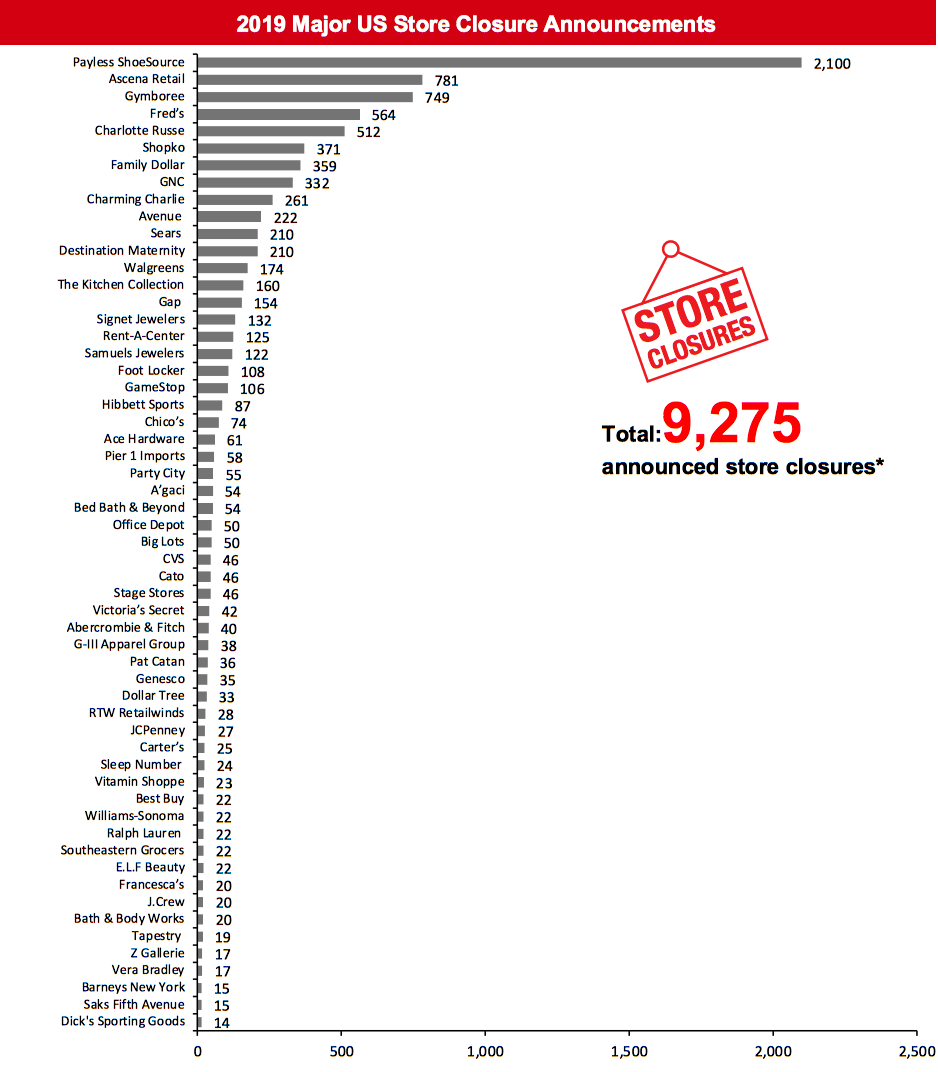

[caption id="attachment_102189" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_102190" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

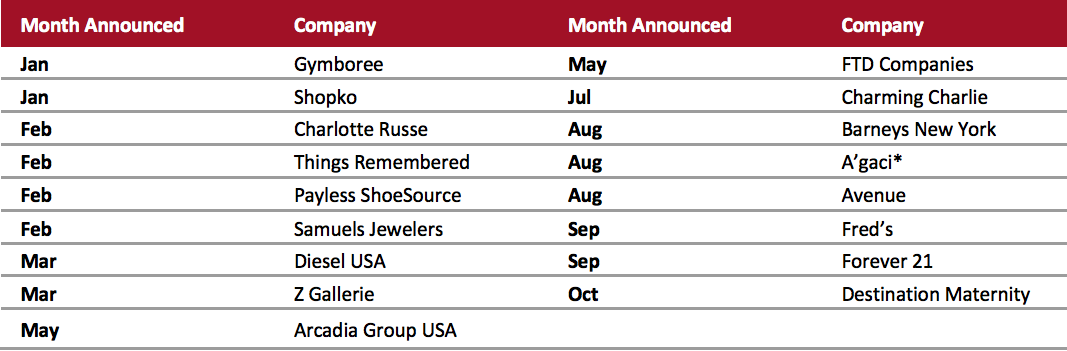

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_102191" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

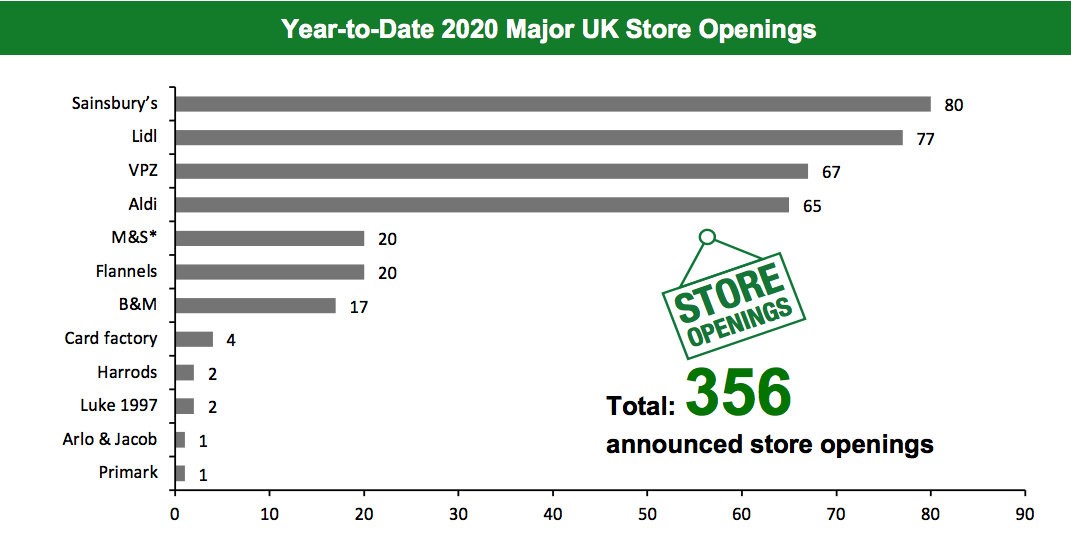

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 247 store closures and 356 store openings. Our data represents closures and openings by calendar year. We have revised our closure count for Debenhams this week, which has affected our total UK store-closure count from last week. We have also updated our store-opening count for Marks & Spencer, impacting on the total UK store-opening count from last week.What Is Happening This Week in the UK

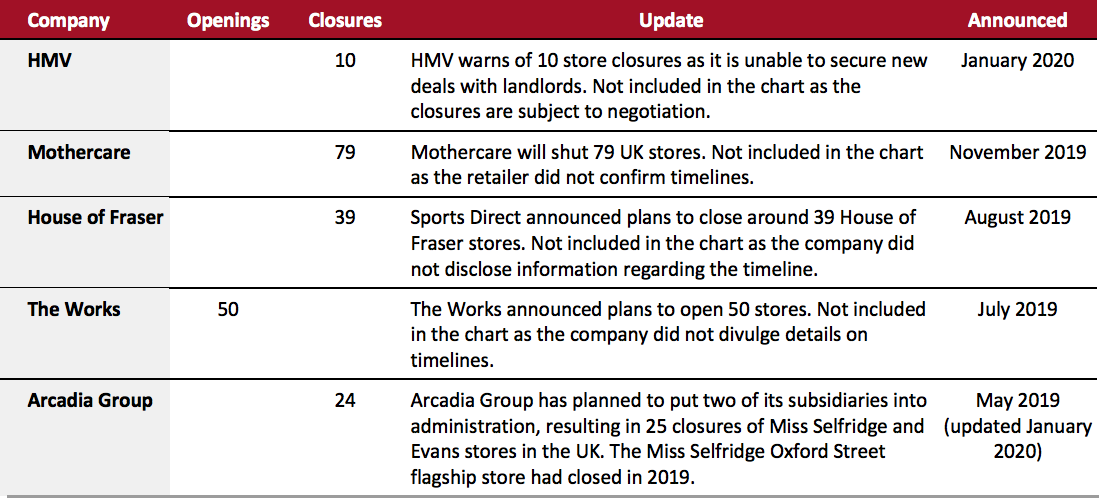

Arcadia To Close Topshop and Topman Store in Westfield Stratford Arcadia Group has confirmed plans to close its Topshop and Topman store in London’s Westfield Stratford City, although the exact closure date is yet to be revealed. The Westfield Stratford store closure is not a part of Arcadia’s Company Voluntary Agreement (CVA) that was approved in June 2019. Arcadia closed 23 Topshop and Topman stores across the UK and Ireland as a part of its CVA. It had also planned to put two of its subsidiaries into administration, resulting in a further 25 closures of Miss Selfridge and Evans stores in the UK. Debenhams To Shutter 19 Stores Department-store chain Debenhams has announced plans to close 19 stores this month, starting on January 11. The stores earmarked for closure include those in Greater Manchester, Kent, Norfolk, Oxfordshire and Portsmouth among others. These closures are part of the retailer’s plans to shutter a total of 50 UK stores by 2022 as part of its store optimization plan. No more closures are planned to take place until 2021. HMV To Close Three Stores; Warns of 10 More Closures Entertainment retailer HMV has announced that three HMV stores will close this month. The stores set to close are located in Bury St Edmunds, Byres Road and Nuneaton. The retailer also warned that there could be a further 10 store closures if it is unable to secure new deals with landlords. The additional 10 stores that may close are located in the Bullring in Birmingham, Cribbs in Bristol, Ocean Terminal in Edinburgh, into Braehead Shopping Centre in Glasgow, Grimsby, Leeds, Merryhill near Dudley, Reading, Sheffield’s Meadowhall mall and Worcester, but are not included in the closures chart as they are subject to negotiation.Non-Store-Closure News

Debenhams Appoints New Chief Marketing Officer Debenhams has appointed Abigail Comber as its new Chief Marketing Officer (CMO), effective January 7, 2020. Comber was a veteran at British Airways with 24 years of service most recently in the roles of the Head of Customer Experience and Global Head of Brand and Marketing. In her new role as CMO, she will be responsible for the marketing functions of Debenhams, which is currently being handled by Interim Director of Marketing Erin Brookes. Watches of Switzerland COO Resigns Jewelry retailer Watches of Switzerland has announced that its COO Tony Broderick will step down from his role in April 2020. Broderick joined the retailer as COO in 2009 and has served on the Board of Directors since 2000. Amid Broderick’s resignation, the retailer has appointed Craig Bolton as its new UK Executive Director with immediate effect. [caption id="attachment_102192" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store.*We have revised our closure count for Debenhams this week.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_102193" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.*We have revised our opening count for Marks & Spencer this week.

Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_102194" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_102195" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

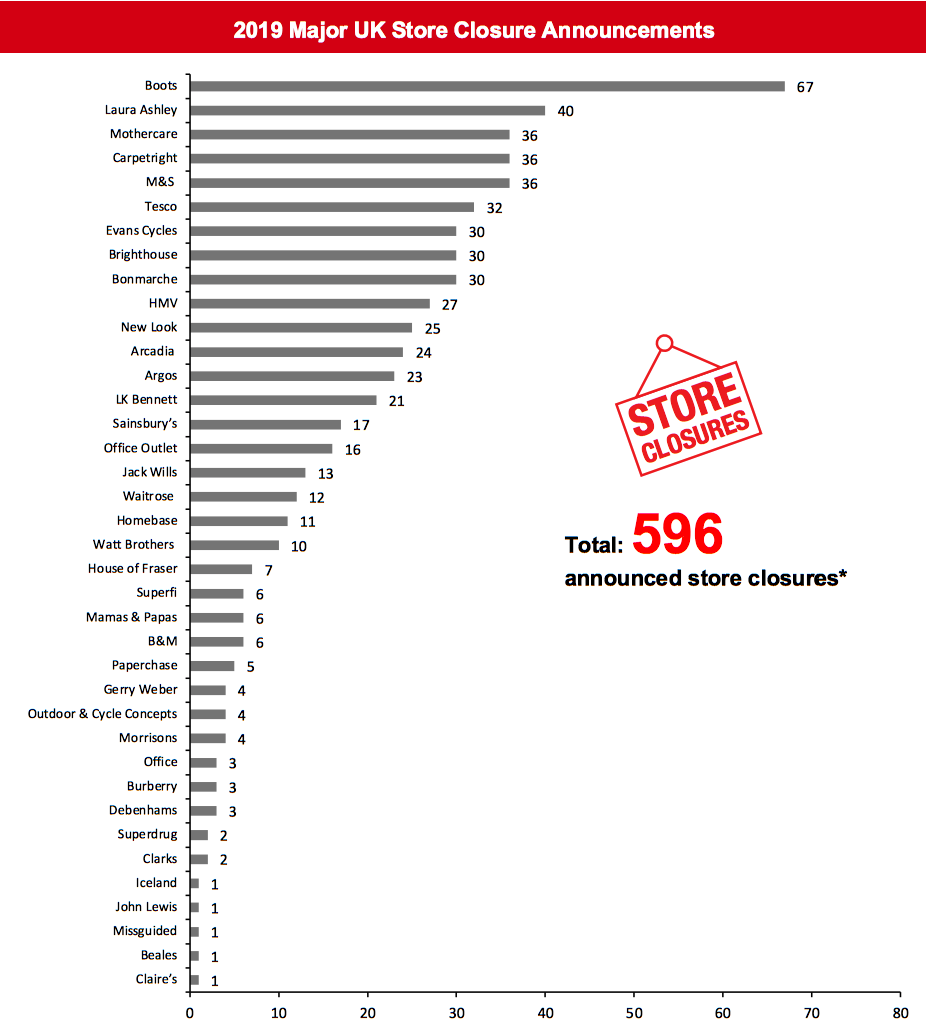

[caption id="attachment_102195" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_102196" align="aligncenter" width="700"]

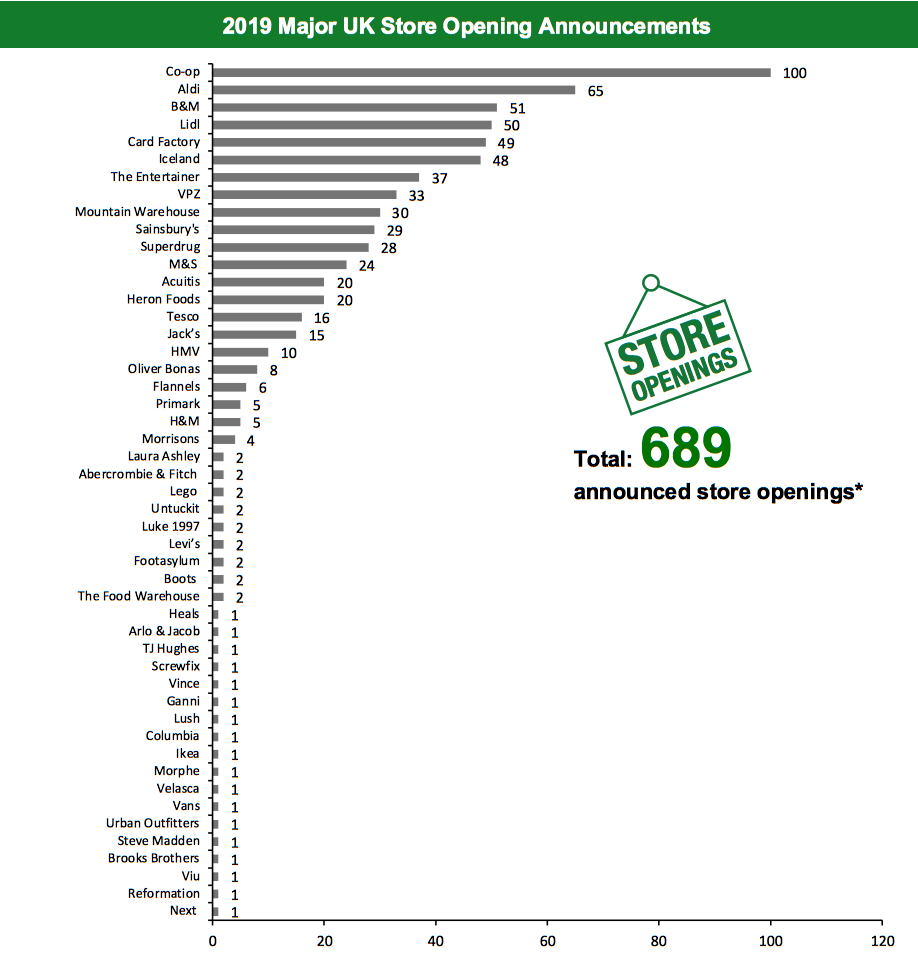

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.