albert Chan

The US

2020 Major US Store Closures and Openings

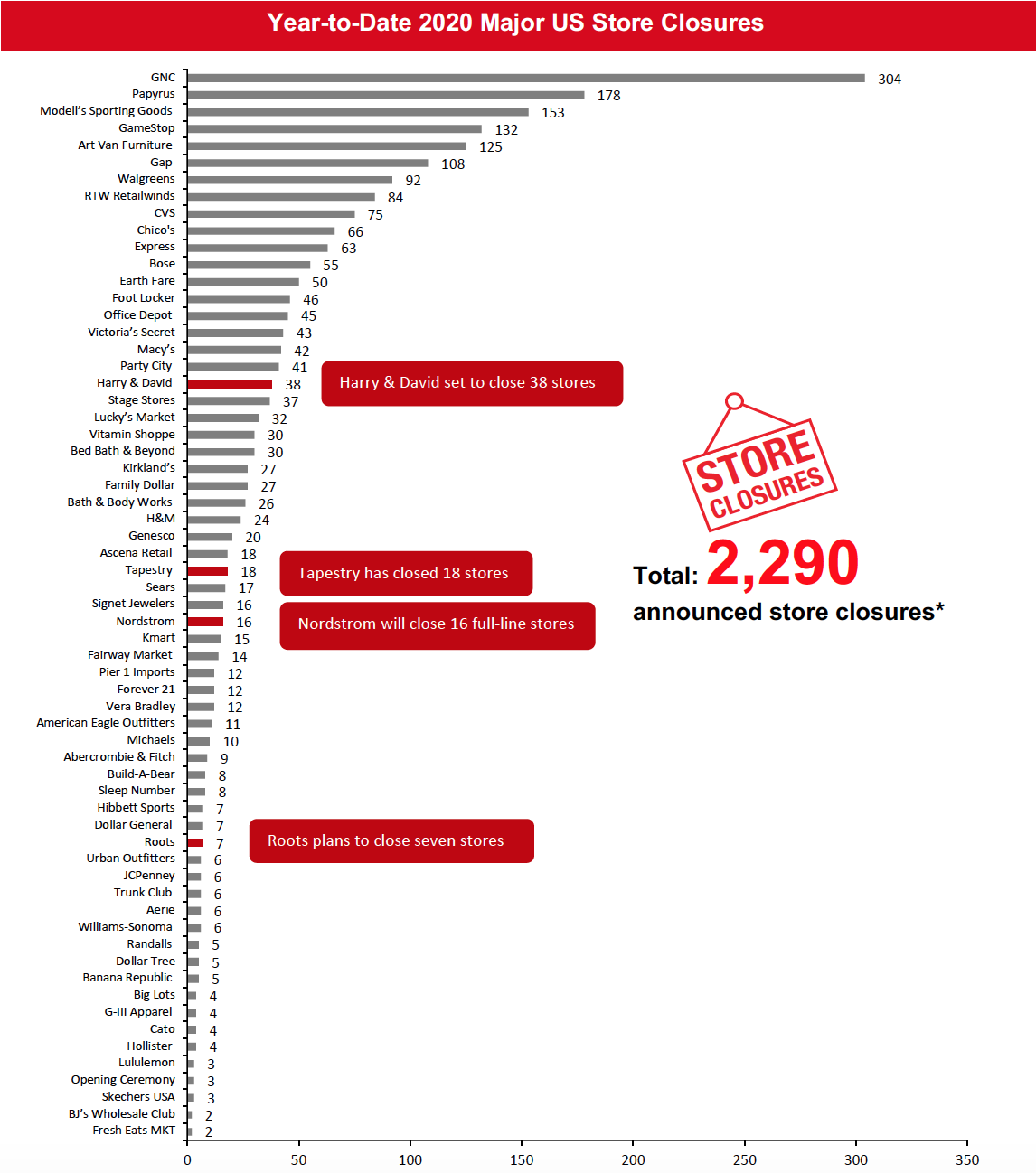

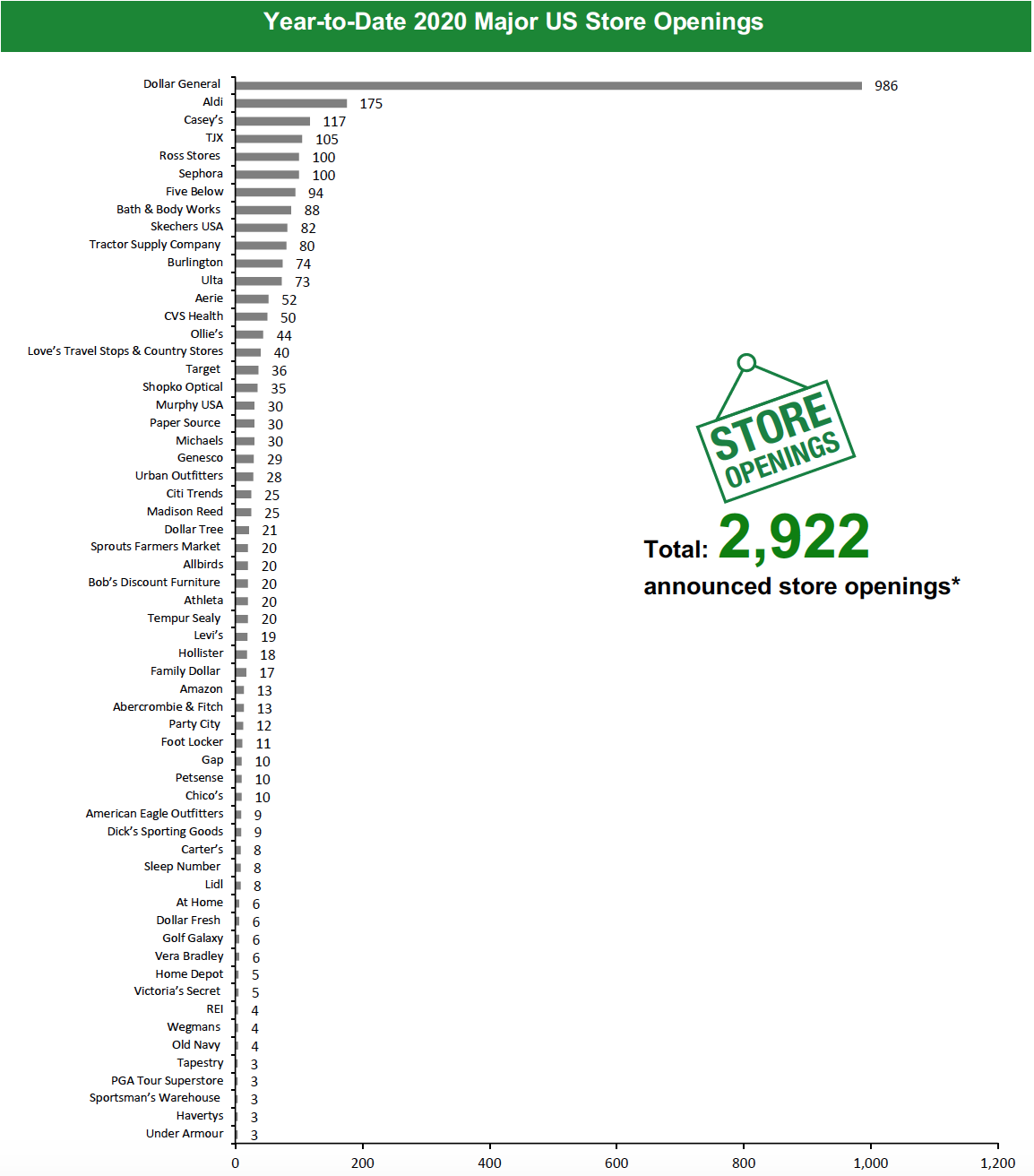

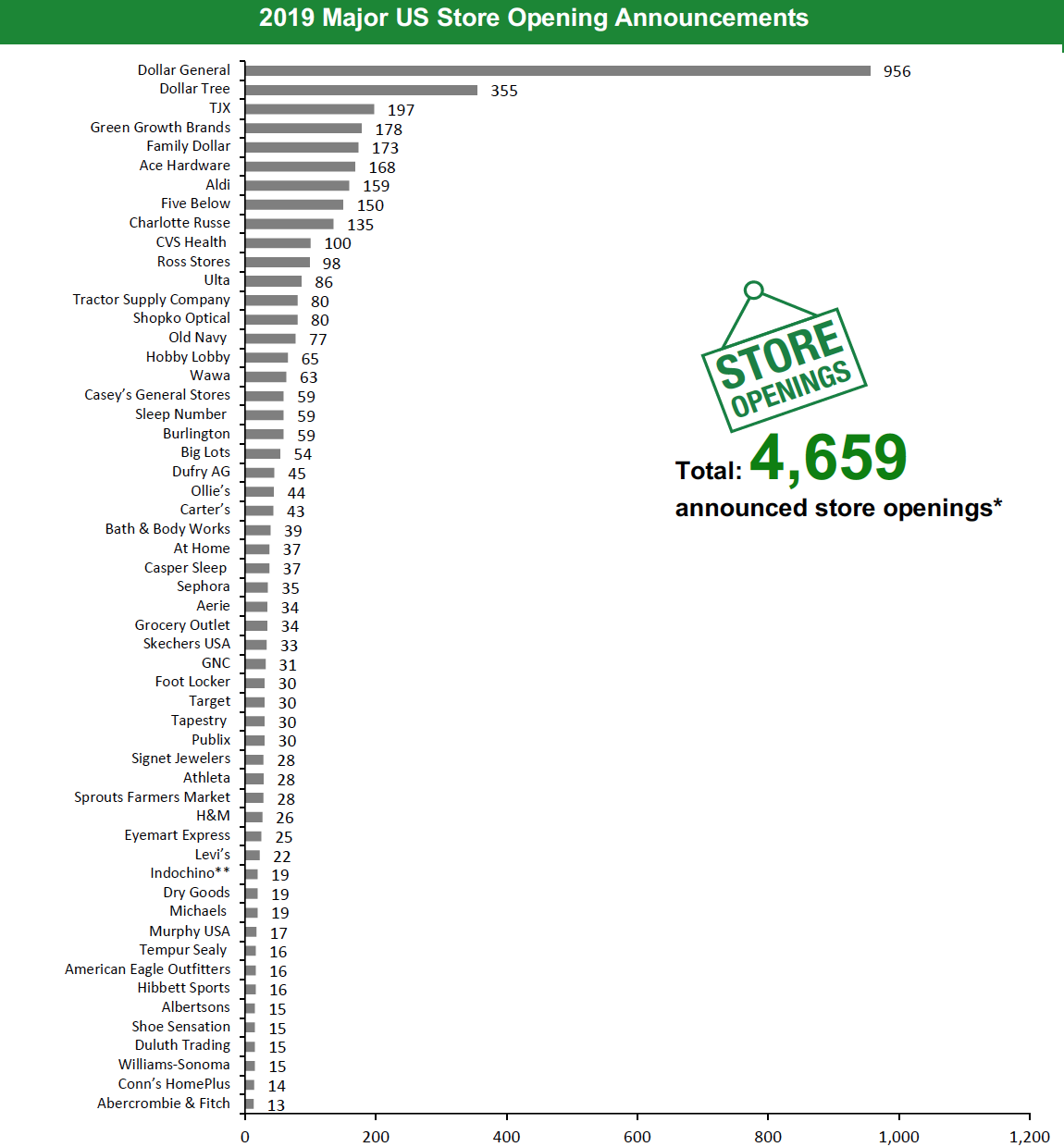

Year to date in 2020, US retailers have announced 2,290 planned store closures and 2,922 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.

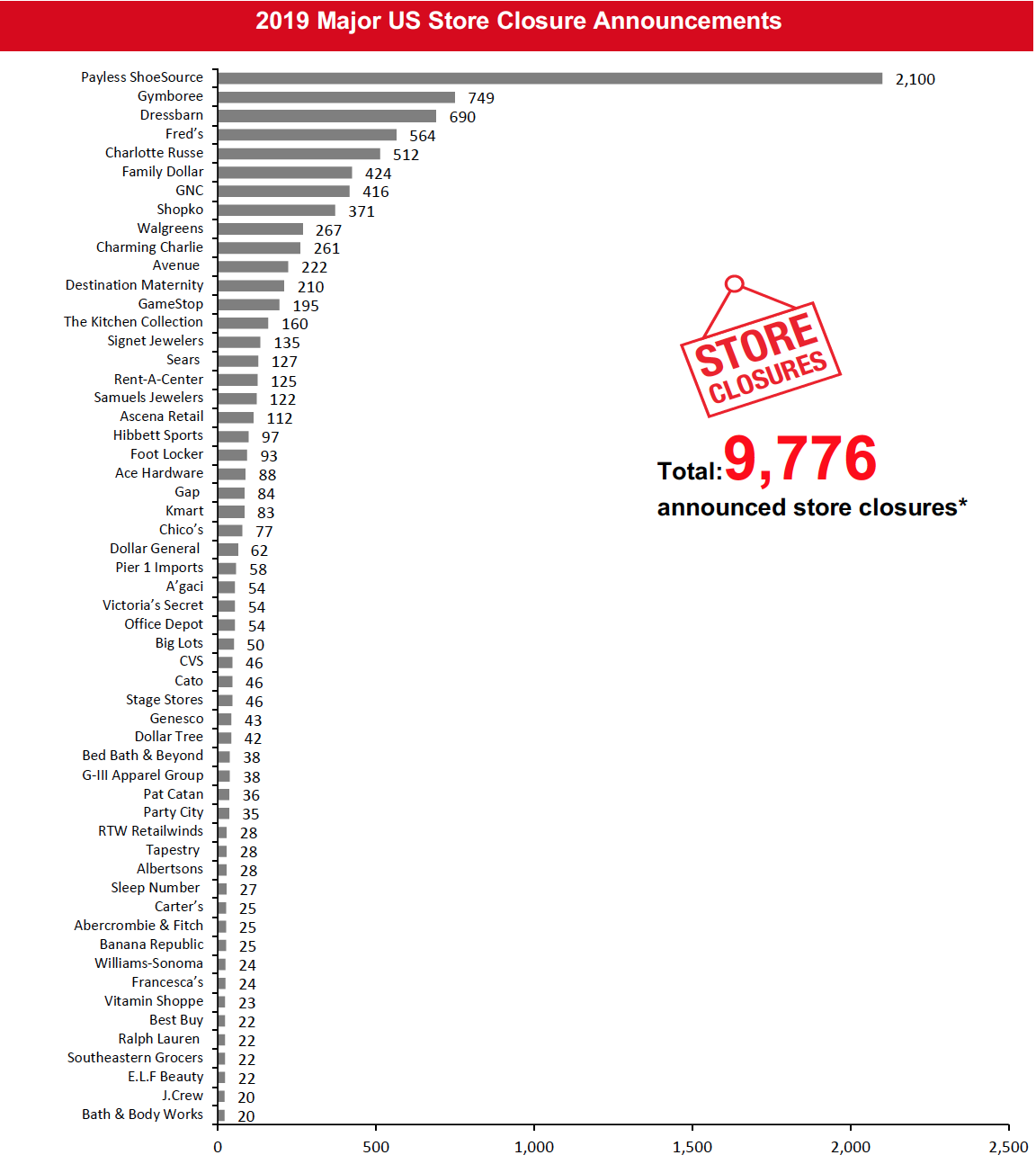

As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Albertsons, Five Below and Francesca’s, and this has changed our 2019 US closure count to 9,776. We revised our 2019 openings count for Albertsons and Francesca’s, and this has changed our 2019 US openings count to 4,659.

Coronavirus Update: US States and Stores Reopening

Many US retailers have already reopened their stores in select states, as some state governments have relaxed the lockdown restrictions. This week saw such announcements from Chico’s, Express and Urban Outfitters, among others.

See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states permitting the reopening of businesses.

What Is Happening This Week in the US

Five Below Lowers Store Opening Target for Fiscal Year 2020

Discount store chain Five Below has lowered its store opening target for fiscal year 2020, ending January 30, 2021, to 100–120 new stores compared to its original target of 180 stores. The decision comes as a part of the chain’s response to mitigate the financial impact of the current coronavirus crisis. Earlier this year, the retailer had announced plans to open 180 new stores in fiscal year 2020.

Coresight Research insight: The focus has been on the impact of the coronavirus on store closures, but we expect to see meaningful impacts on store openings too. As we have noted before, retailers with aggressive store-opening plans are likely to undershoot their targets, given the logistical disruption from the crisis and the need to conserve cash. In aggregate, these adjustments will make a small contribution to the streamlining of physical retail on the other side of the crisis.

Harry & David To Close 38 Stores

Gift-basket retailer Harry & David has announced its decision to close 38 stores in the US, with plans to focus on its e-commerce business. The retailer plans to close these stores over the next several months, according to The Wall Street Journal. The only store that will remain open is located in Medford, Oregon.

J.Crew Files for Chapter 11 Bankruptcy

Chinos Holdings, parent company of specialty retailer J.Crew Group, filed for Chapter 11 bankruptcy protection on May 4, 2020. According to a company release, J.Crew stated that it has reached an agreement with its lenders whereby the lenders will convert approximately $1.65 billion of the retailer’s debt into equity. The retailer intends to restructure its debt and position its J.Crew and Madewell brands for long-term profitable growth. As a part of the agreement, Madewell will remain part of the J.Crew Group, although the retailer had previously planned to spin off the former as a public company.

Coresight Research insight: J.Crew is the first major retailer to file for bankruptcy during the coronavirus pandemic. The retailer was once well known for its preppy styles, but this is no longer a market differentiator. Furthermore, J.Crew does not have a strong buying audience, and its prices are known to be high. The retailer has been struggling in recent years, and the coronavirus pandemic propelled the retailer into further struggles.

J.Hilburn Files for Chapter 11 Bankruptcy

Men’s custom-apparel brand J.Hilburn has filed for Chapter 11 bankruptcy protection, with plans to reorganize its business, according to Dallas News. Last month, the retailer laid off an undisclosed number of employees from its Dallas headquarters due to the coronavirus crisis. J.Hilburn operates four stores in Bellevue, Boston, Dallas and New York.

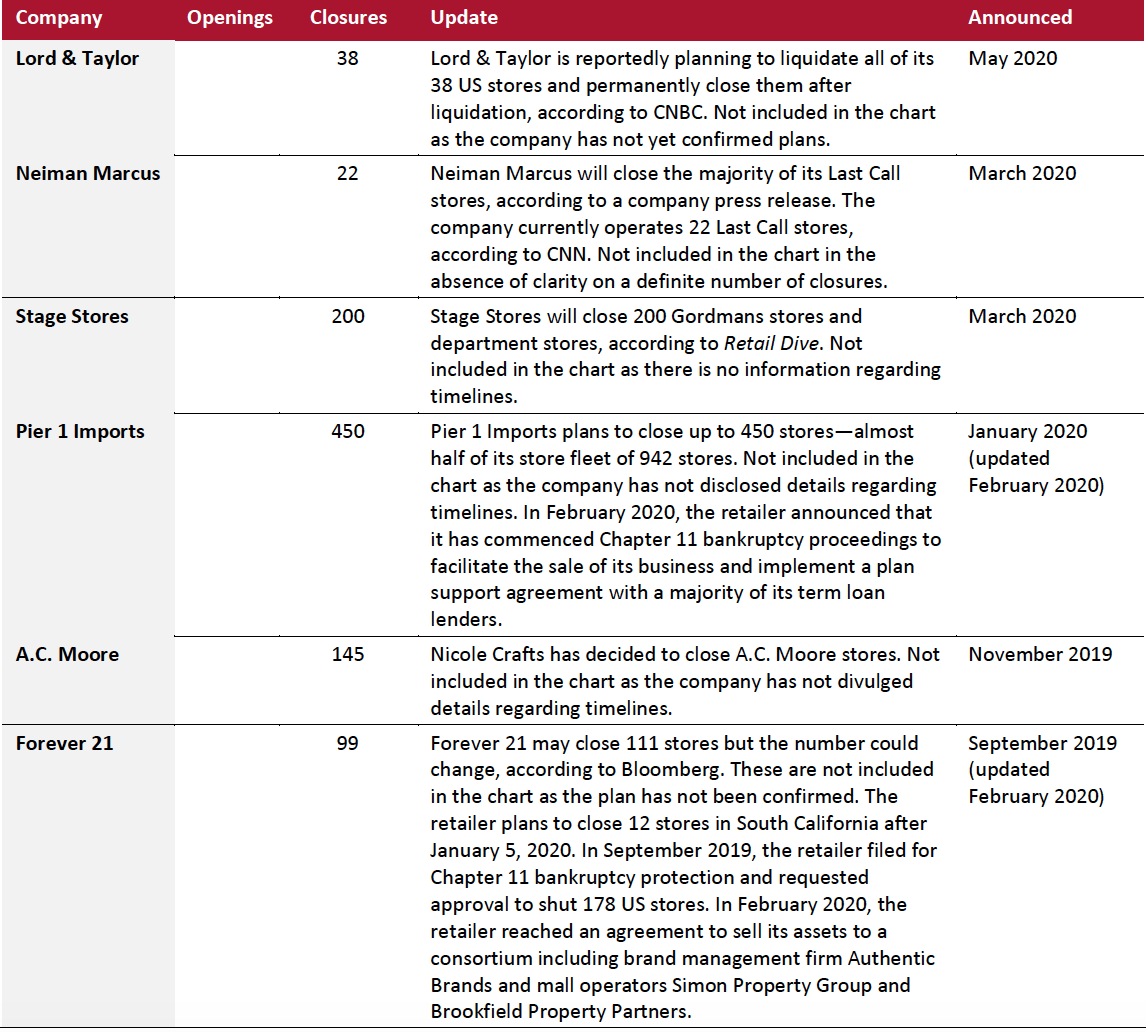

Lord & Taylor To Liquidate All Stores

Luxury department-store chain Lord & Taylor is reportedly planning to liquidate all of its 38 US stores after the coronavirus lockdown is lifted, according to CNBC. The retailer has selected liquidators to manage its going-out-of-business sales and is preparing for a bankruptcy filing from which it does not expect to emerge, according to the CNBC report. A spokesperson from parent company Le Tote declined to comment on the matter but said that the retailer is exploring various options. We have not included the closure count in the chart as the company has not yet confirmed plans.

Neiman Marcus Files for Bankruptcy As we go to press, Neiman Marcus has filed for Chapter 11 bankruptcy protection. The company has entered into an agreement with a majority of its creditors to substantially reduce its debt and provide financing; it expects to emerge from bankruptcy in the fall, at which point its creditors will become majority owners in the business. The company has 43 department stores.Nordstrom To Close 16 Full-Line Stores

Luxury department-store chain Nordstrom has announced plans to permanently close 16 full-line stores, succumbing to the retail disruption caused by the coronavirus pandemic. It is also restructuring its regions, support roles and corporate structure, which it expects will result in expense savings of $150 million. In a company statement, Nordstrom said that it has been investing in digital and physical capabilities to adapt to rapidly changing consumer expectations. The retailer also stated that it had experienced significant online traffic throughout the coronavirus crisis.

Coresight Research insight: These closures represent the first contraction announced in the department-store sector due to the coronavirus as the sector continues to right-size, finding the optimal number of stores post pandemic. The sector was showing signs of struggle pre-coronavirus, and we believe this may have quickened some of the closure announcements.

Roots To Close Seven Stores

Clothing retailer Roots has announced plans to close seven of its nine stores, including stores in Boston, Chicago and Washington, as well as a pop-up store in New York. The decision comes as the seven stores continue to suffer losses amid the challenging retail environment triggered by the coronavirus pandemic.

Quarterly Store Openings/Closures Settlement

Albertsons Companies Opens 14 New Stores

Grocery-store chain Albertsons opened 14 new stores in fiscal year 2019, ended February 29, 2020, bringing its total store count to 2,252 stores across the US. During the nine months ended November 30, 2019, the chain closed 21 stores and opened 12 new stores.

Francesca’s Closes 21 Boutiques and Opens Five

Specialty retailer Francesca’s closed 21 boutiques and opened five during fiscal year 2019, ended February 1, 2020. The retailer revealed that it will continue to focus on optimizing its store fleet in fiscal year 2020, ending January 30, 2021, by reviewing the lease expense of its existing boutiques as well as negotiating with landlords on rent reductions for its underperforming boutiques.

Sprouts Farmers Market Opens Seven Stores

Supermarket chain Sprouts Farmers Markets has reported that it opened seven stores in 2020 as of May 5. These openings are part of the chain’s previously announced plans to open 20 stores this year.

Coresight Research insight: These openings were announced alongside Sprouts’ first-quarter earnings, in which it reported comparable sales growth of 10.6% for the quarter, with the coronavirus impact contributing an estimated 9.6% of that comp uplift. Sprouts reported comp growth of 7.2% in April, supported by online grocery sales growing fully 950% year over year as the company rolled out pickup services across its store estate in partnership with Instacart.

Tapestry Closes 18 Stores and Opens Three

Luxury fashion retailer Tapestry has reported that it closed 12 Coach stores, five Kate Spade and one Stuart Weitzman store, and opened three Kate Spade stores in North America during the third quarter of fiscal year 2020, ended March 28. The retailer also stated that it plans to delay or cancel new store openings in order to prioritize digital investments, as a part of its strategy to reinforce liquidity and financial stability.

Non-Store-Closure News

Bed Bath & Beyond Appoints Gustavo Arnal as CFO

Bed Bath & Beyond has appointed Gustavo Arnal as EVP, CFO and Treasurer, effective May 4, 2020. Arnal succeeds CFO and Treasurer Robyn D’Elia, who is parting ways with the retailer. Arnal joins Bed Bath & Beyond from Avon, where he served as Group CFO. He has also held senior positions at Procter & Gamble and Walgreens Boots Alliance.

Brooks Brothers Seeks Buyer

Menswear retailer Brooks Brothers is reportedly seeking a buyer for its business, according to Bloomberg. The retailer has extended its sale process, which began last year, according to sources familiar with the matter. The potential transaction with the buyer could be part of a bankruptcy filing, depending on the number of stores that the buyer plans to acquire. The retailer has about $600 million in debt, and many of its 250 US stores were underperforming even before the coronavirus crisis.

[caption id="attachment_109202" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Papyrus includes American Greetings, Carlton Cards, Paper Destiny and Papyrus banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.*Total includes a small number of retailers that each announced fewer than two store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_109203" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Tapestry, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than three store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_109204" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109205" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109205" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_109206" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 13 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption]

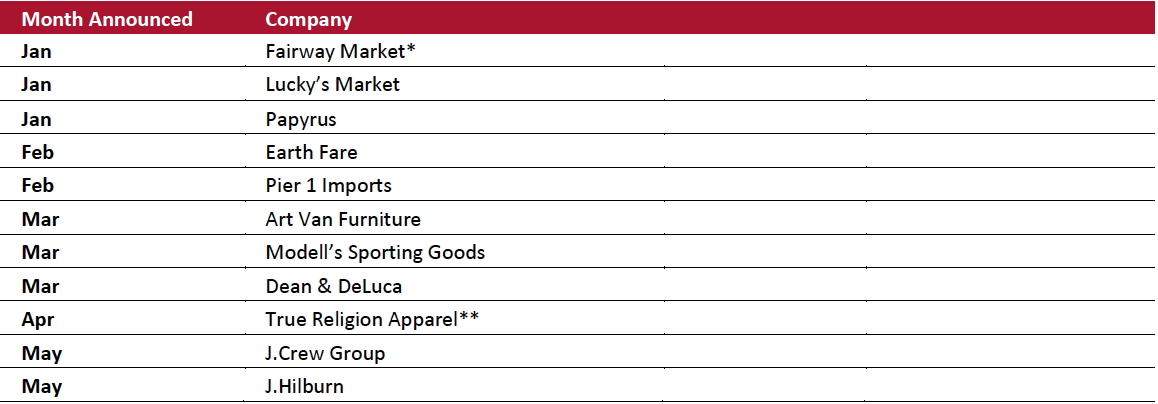

2020 Major US Retail Bankruptcies

[caption id="attachment_109207" align="aligncenter" width="700"] J.Crew Group includes J.Crew and Madewell banners.

J.Crew Group includes J.Crew and Madewell banners.*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

**True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

Source: Company reports/Coresight Research[/caption]

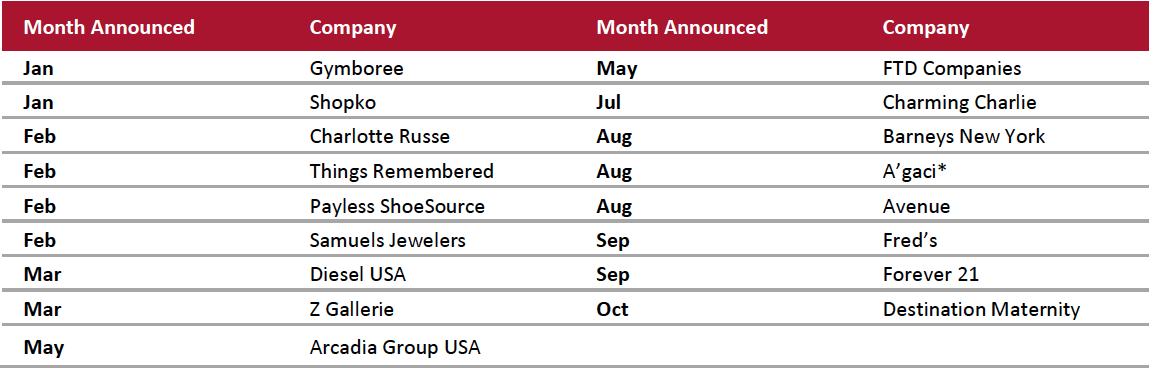

2019 Major US Retail Bankruptcies

[caption id="attachment_109208" align="aligncenter" width="700"] *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

The UK

2020 Major UK Store Closures and Openings

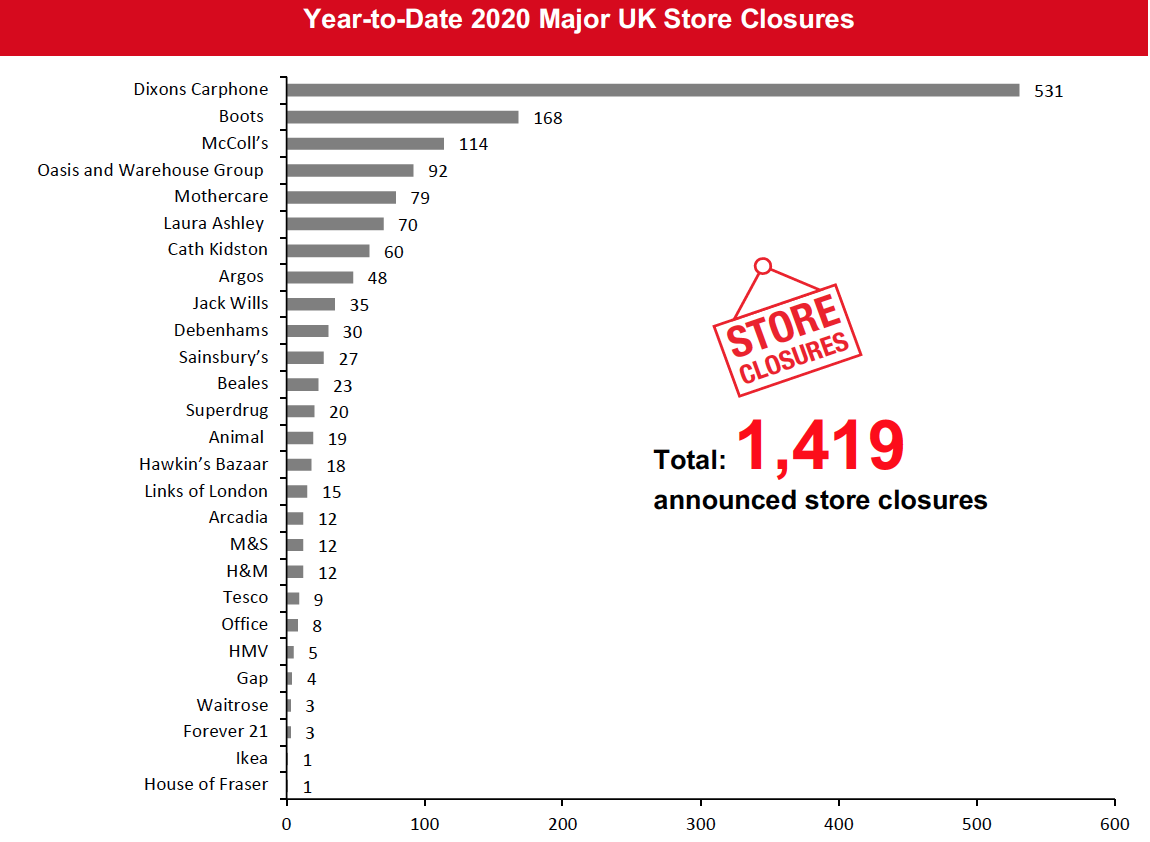

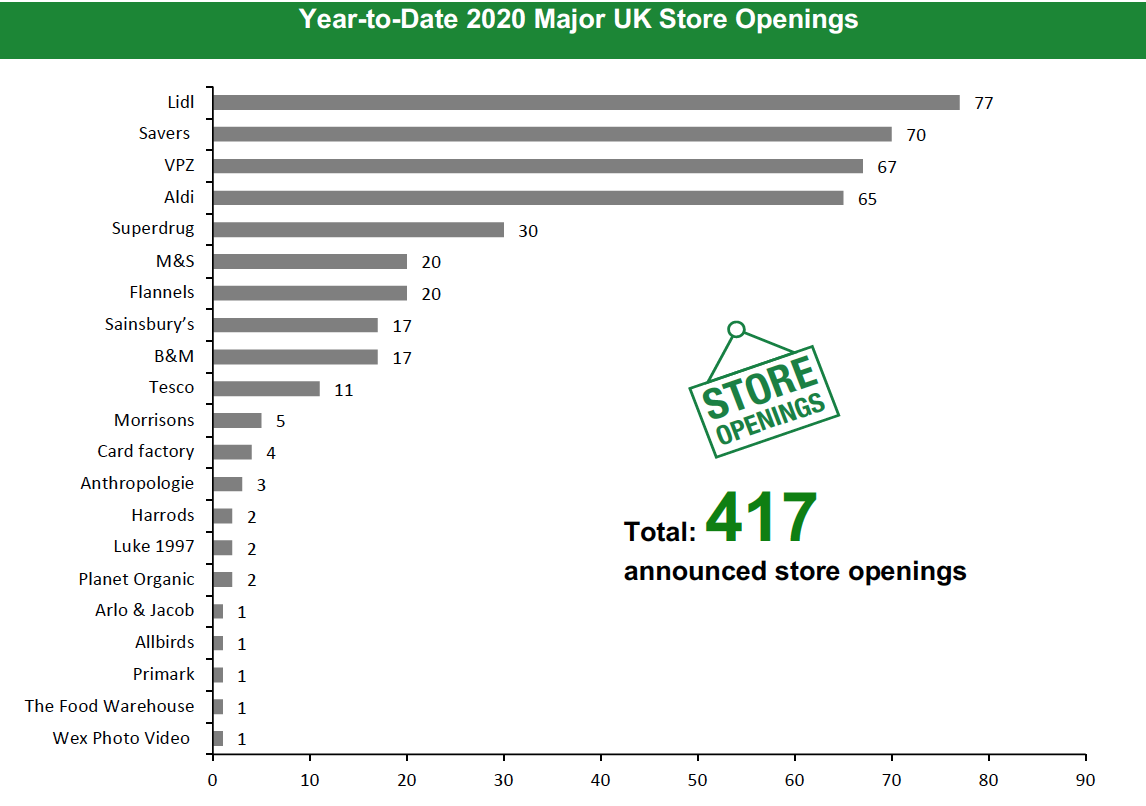

For 2020, major retailers in the UK have announced 1,419 store closures and 417 store openings. Our data represent closures and openings by calendar year.

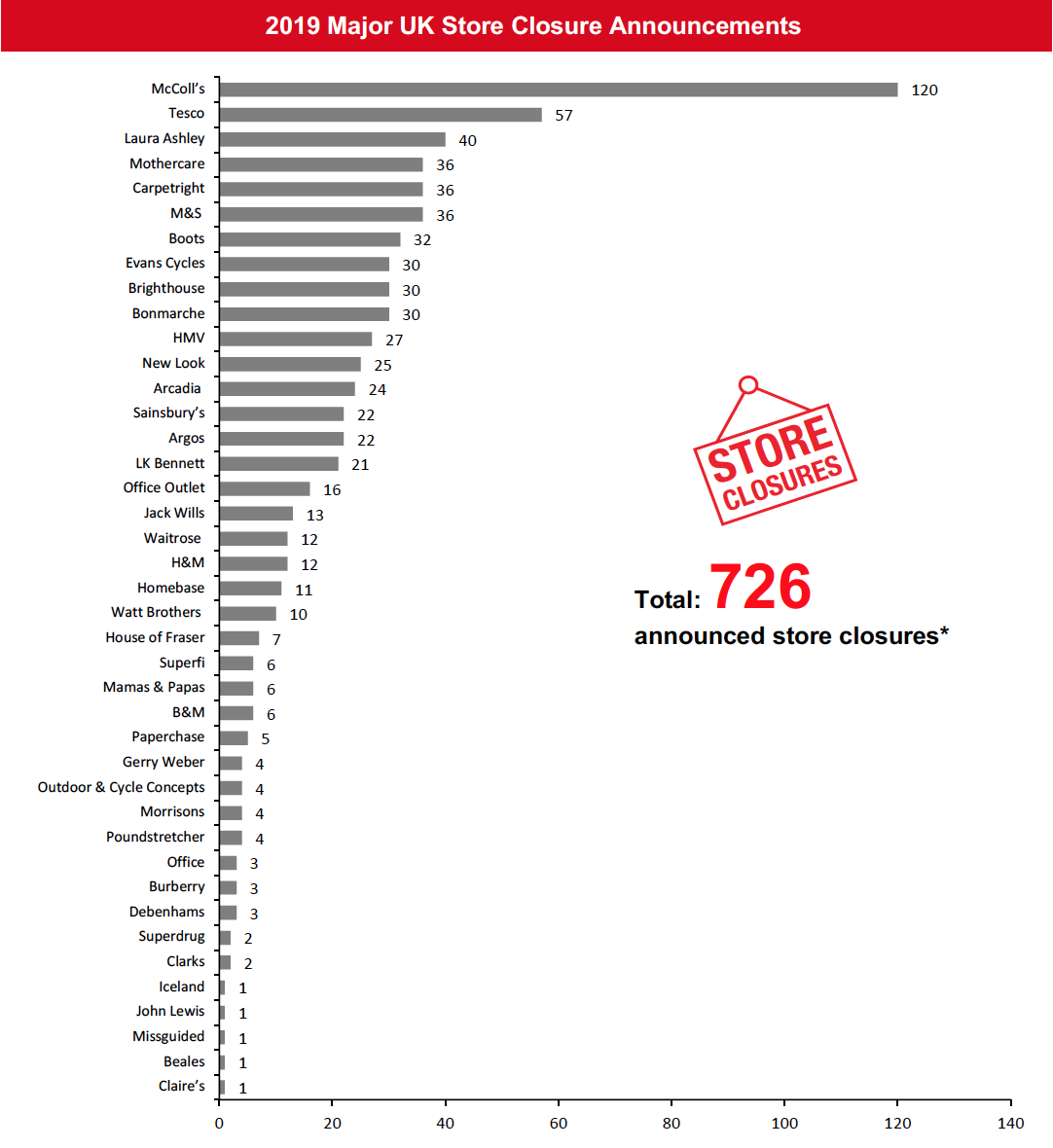

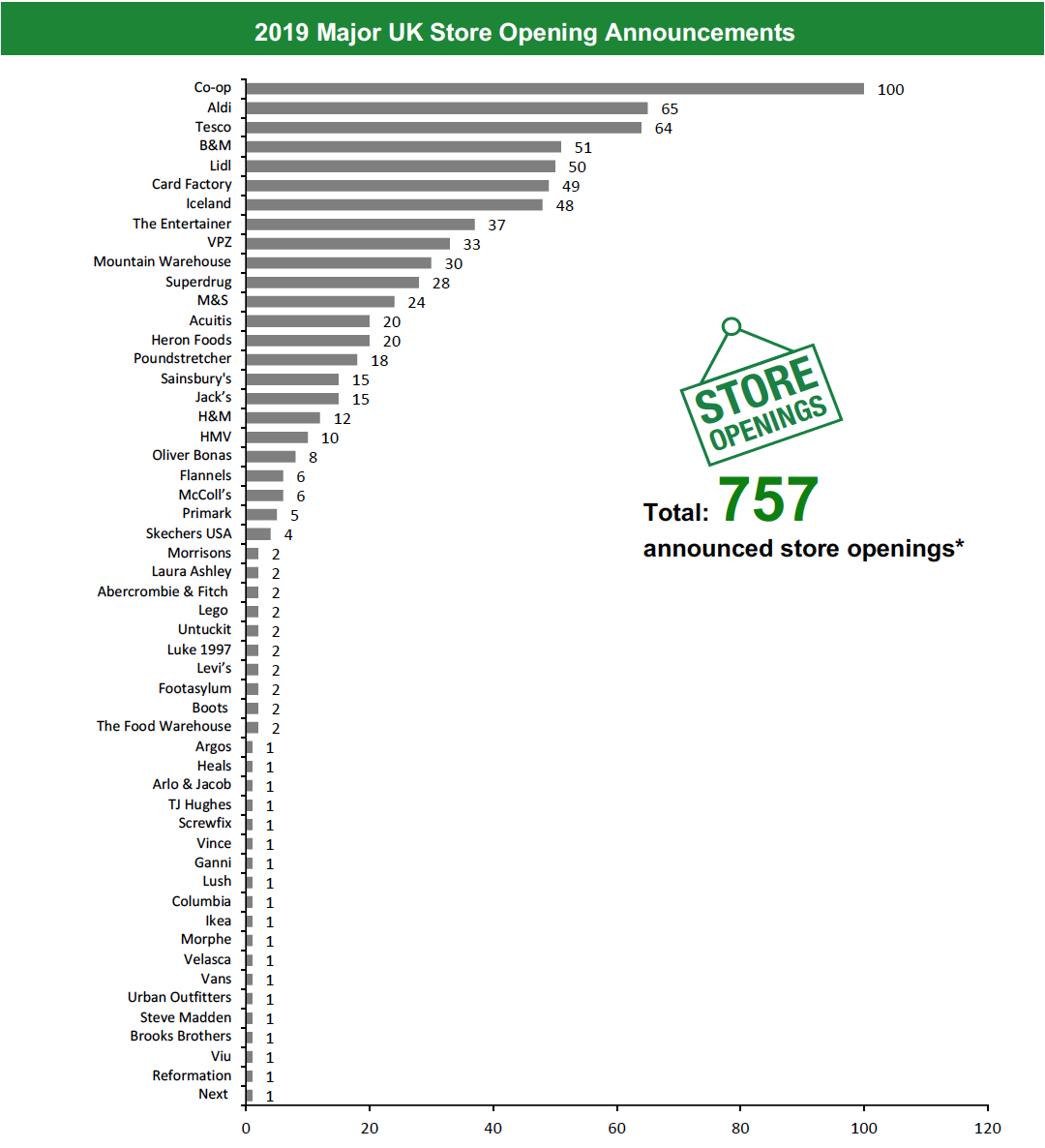

This week, we have revised our 2019 closures count for Argos and Sainsbury’s, and this has changed our 2019 UK closure count to 726. We also revised our 2019 openings count for Argos and Sainsbury’s, and this has changed our 2019 UK openings count to 757.

What Is Happening This Week in the UK

Sainsbury’s To Close 50 Argos Stores

Supermarket chain Sainsbury’s has announced plans to close 50 Argos standalone stores, 14 Sainsbury’s convenience stores and eight Sainsbury’s supermarkets during fiscal year 2020/21, ending March 2021. The chain intends to open 15 Sainsbury’s convenience stores and two supermarkets in fiscal year 2020/21. It also expects to open 35–40 Argos shops within in Sainsbury’s stores. The chain closed 27 Sainsbury’s convenience stores, 25 Argos standalone stores and two Sainsbury’s supermarkets, and opened 13 Sainsbury’s convenience stores, two supermarkets and one Argos standalone store in fiscal year 2019/20, ended March 7, 2020.

Coresight Research insight: Sainsbury’s reported that Argos sales were up 9% year over year in the seven weeks ended April 25, despite recently trading online only as all nonessential stores were forced to close (Argos continues to offer buy-and-collect services from its stores within Sainsbury’s supermarkets, but its 573 standalone Argos stores are shut). Despite that recent uplift, Sainsbury’s management guided for low-teens-percentage sales declines at Argos during the lockdown period in its current half year as lockdown-related general-merchandise purchases ease. In the context of operating online-only, this is still a very strong top-line performance and one that could fuel further closures in the Argos chain.

The Oasis and Warehouse Group To Close All Stores

Joint administrators from Deloitte have announced that all of The Oasis and Warehouse Group’s stores and online websites will “close indefinitely,” after failing to find a buyer for its businesses. The group owns fashion retail chains Oasis and Warehouse as well as Bastyan Fashions and The Idle Man. The administrators said that investment and advisory firm Hilco Capital purchased the group’s stock but not the rest of its business. The Oasis and Warehouse Group operates about 92 stores and over 400 concessions. The company fell into administration on April 15, 2020.

Non-Store-Closure News

Trouva CEO Resigns

Online marketplace Trouva has announced that its Co-Founder and CEO Mandeep Singh has resigned from the role after six years with the company. Co-Founder Alex Loizou, who had been serving as Chief Technology Officer and Chief Product Officer, has taken over as Singh’s successor. Singh will remain as a director of the company but will not be involved in the daily operations of Trouva.

[caption id="attachment_109209" align="aligncenter" width="705"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_109210" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

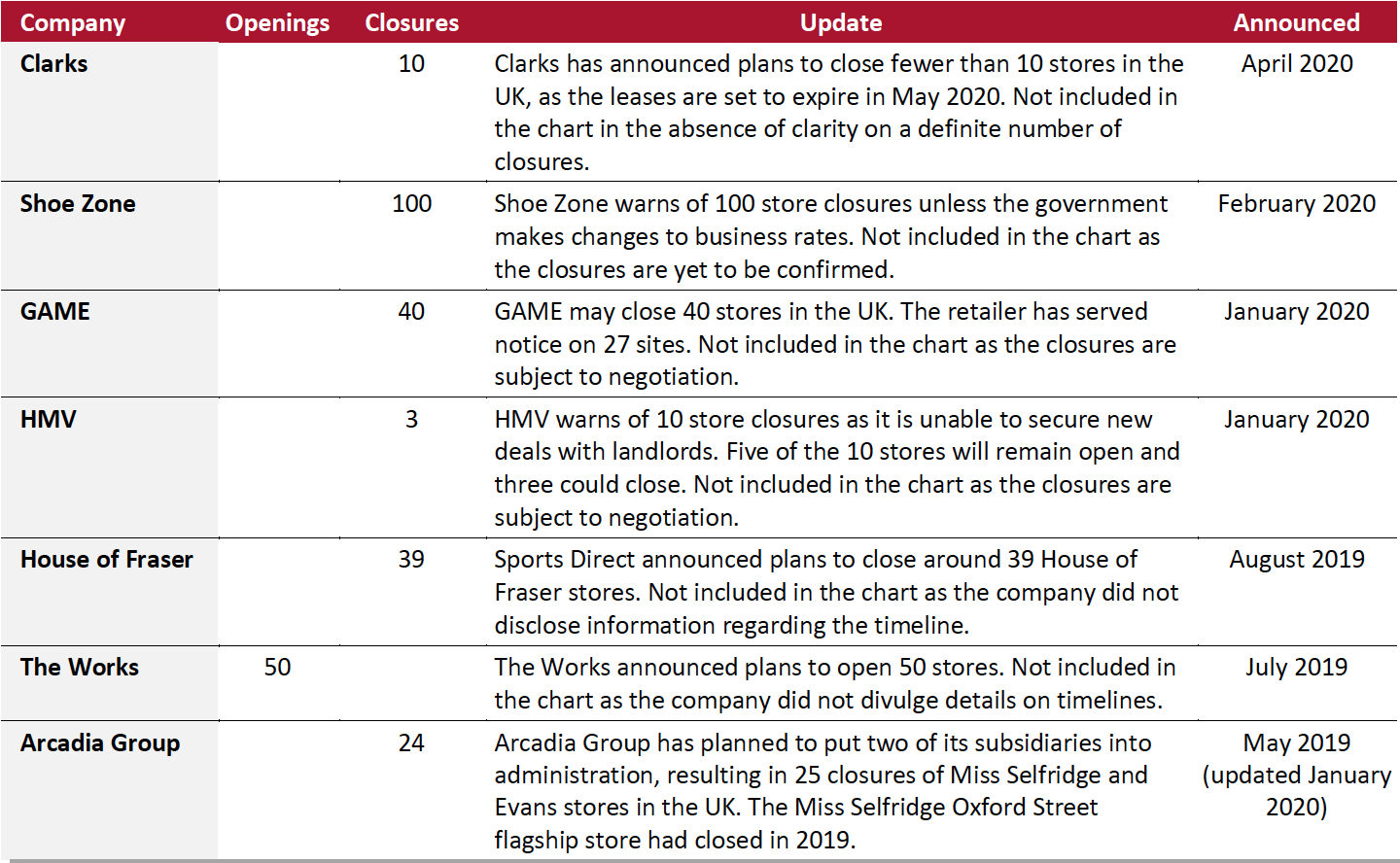

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_109211" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109212" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_109212" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_109213" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.