Nitheesh NH

The US

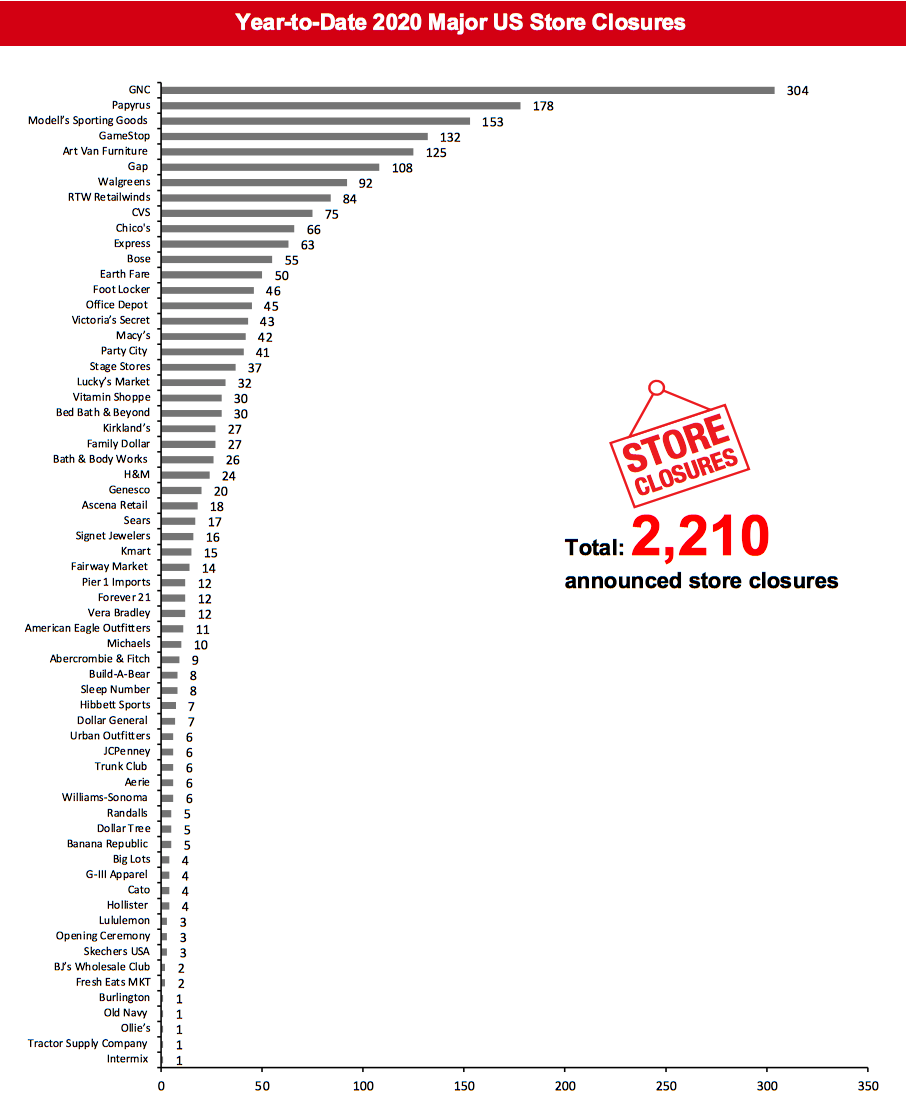

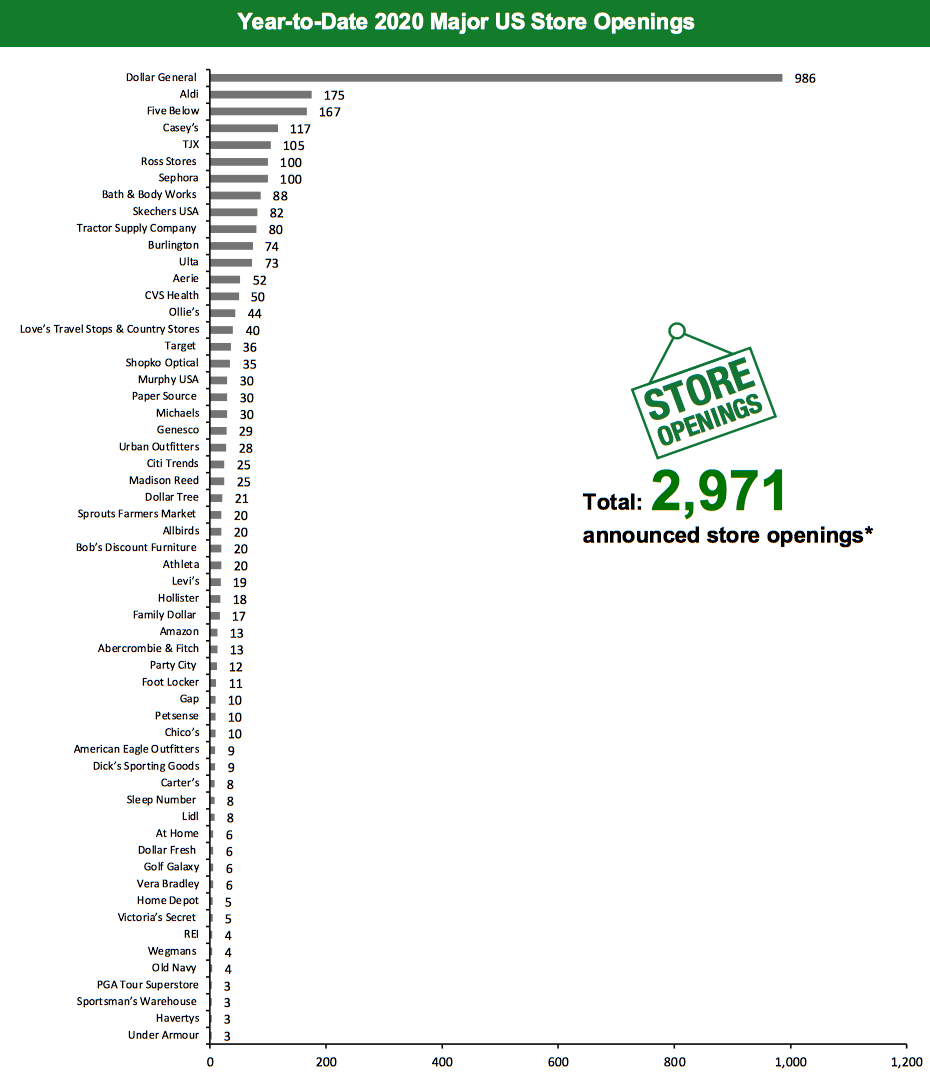

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 2,210 planned store closures and 2,971 openings. Our data represent closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.Coronavirus Update: US States and Stores Reopening

Many US retailers have already reopened their stores in select states, as some state governments have relaxed the lockdown restrictions. This week saw such announcements from Dick’s Sporting Goods, David’s Bridal and Ethan Allen, among others. Among the US states that have allowed businesses to reopen are Alaska, Oklahoma and South Carolina. See the Coresight Research Coronavirus Tracker for regularly updated details of announced store reopenings and US states permitting the reopening of businesses.What Is Happening This Week in the US

Gap Inc. May Close Some Stores Permanently Clothing and accessories retailer Gap Inc. has revealed that it could terminate leases and permanently close some of its stores, as it continues to negotiate with landlords on lease terms and rents. The company also stated that it has suspended rent payments from April 2020, which amount to approximately $115 million per month in North America. Gap Inc. operates 2,785 stores across all its banners in North America, as of February 1, 2020. Coresight Research insight: Gap had already announced a substantial number of closures: It is in sixth position in the year-to-date announced closures chart below (which doesn’t include nonconfirmed closures). We expect a number of major retailers to use the coronavirus shutdown as an opportunity to slim down their store estates, even where those retailers are not facing distress—reshaping estates for a future molded by structural shifts, a likely acceleration in online shopping and depressed consumer demand in the medium term. Coming on top of a wave of expected bankruptcies, this trend will fuel a surge in total store closures for the year. JCPenney Seeks Bankruptcy Funding; Moves Closer to Filing for Bankruptcy Department-store chain JCPenney is reportedly in talks with its existing lenders Wells Fargo & Co., Bank of America Corp. and JPMorgan Chase & Co. for bankruptcy funding, according to The Wall Street Journal. The retailer is seeking a debtor-in-possession loan package of $800 million to $1 billion in order to keep its business operational during the bankruptcy process. JCPenney recently elected not to pay an approximately $12 million interest payment that was due on April 15, 2020, according to its 8-K securities filing.Quarterly Store Openings/Closures Settlement

Skechers USA Opens 14 Stores and Closes Three Performance and lifestyle footwear retailer Skechers USA reported that it opened 14 company-operated stores and closed three during the first quarter of fiscal year 2020, ended March 31. Earlier this year, the retailer had announced plans to open 75–85 new stores in 2020. Skechers USA operates 508 company-operated stores in the US, as of March 31, 2020. Sleep Number Closes Eight Stores and Opens Eight Bedding and mattress retailer Sleep Number has reported that it closed eight stores and also opened eight stores during its first quarter of fiscal year 2020, ended March 28. The retailer operates 611 stores in the US, as of March 28, 2020. Tractor Supply Company Opens 10 New Stores Tractor Supply Company opened 10 new stores and closed one store during the first quarter of fiscal year 2020, ended March 28. The openings are a part of the retailer’s previously announced plans to open 80 new Tractor Supply stores in 2020. Tractor Supply Company operates 1,863 stores in the US, as of March 28, 2020.Non-Store-Closure News

Simon Property Group To Reopen 49 Sites Real-estate company Simon Property Group is set to reopen 49 of its malls and outlet centers from May 1 through May 4, 2020, according to CNBC. The sites that will reopen include Broadway Square in Texas, Haywood Mall in South Carolina, Lenox Square in Georgia and West Town Hall in Tennessee. The malls and outlet centers will be open for limited business hours, and the company stated that coronavirus safety measures and protocols are in place. [caption id="attachment_108766" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_108767" align="aligncenter" width="700"]

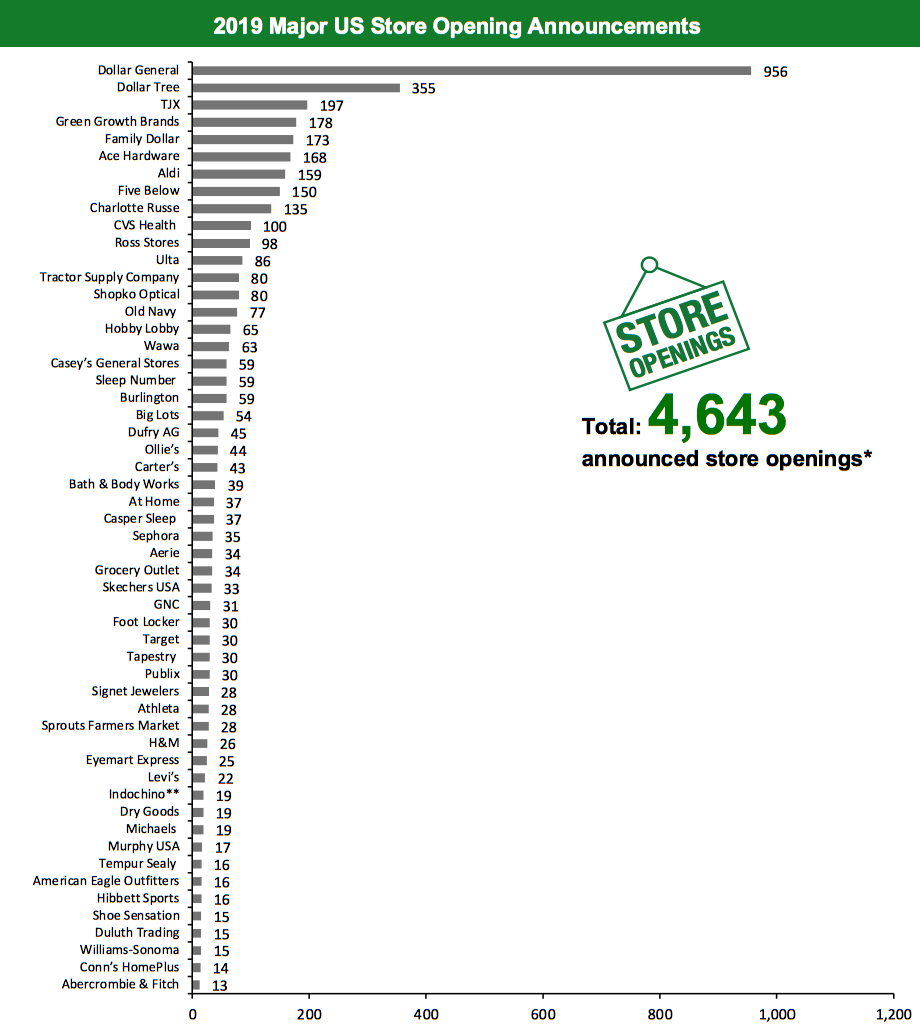

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than 3 store openings and are not included in the chart

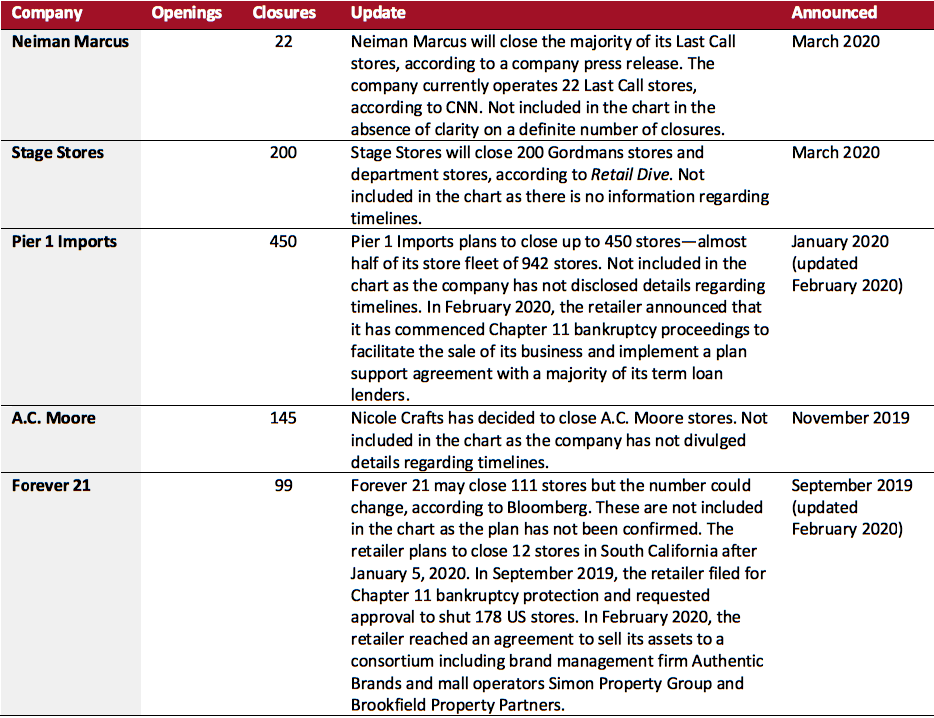

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_108768" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108769" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

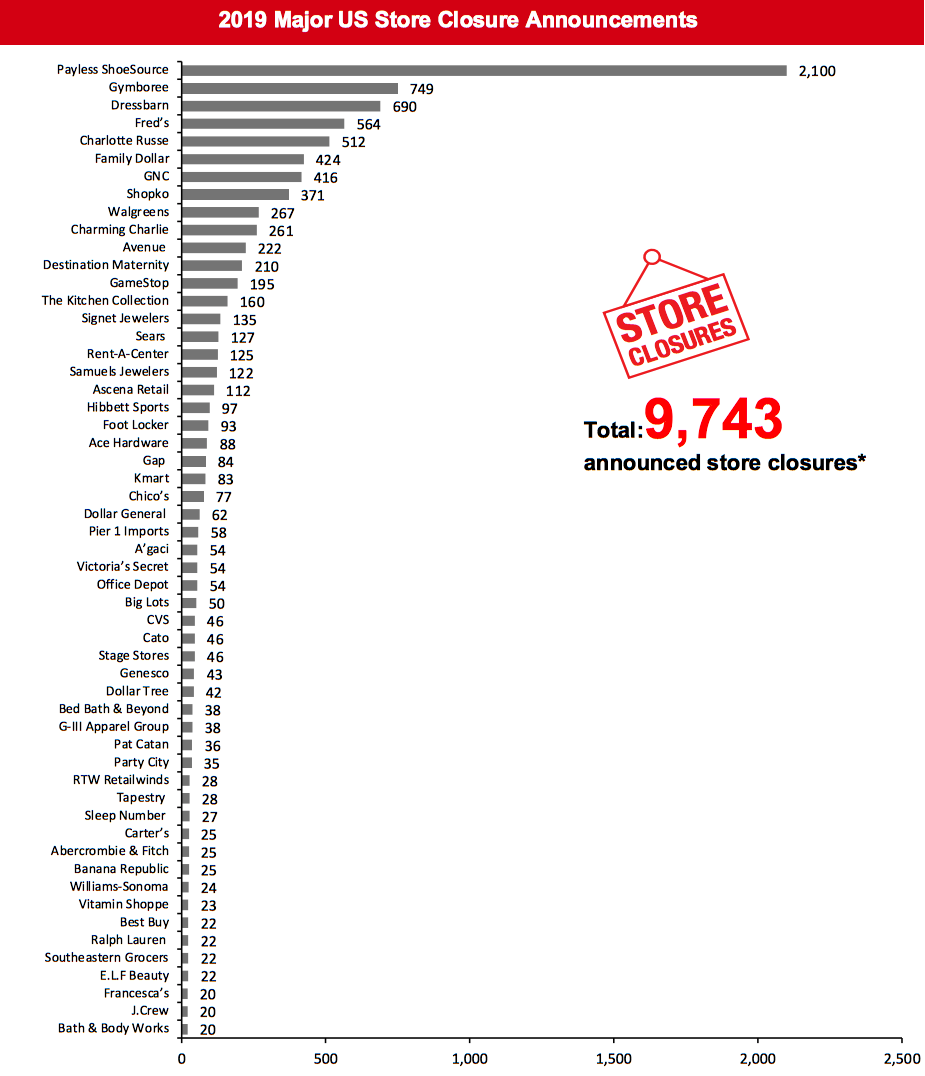

[caption id="attachment_108769" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_108770" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 13 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_108772" align="aligncenter" width="700"]

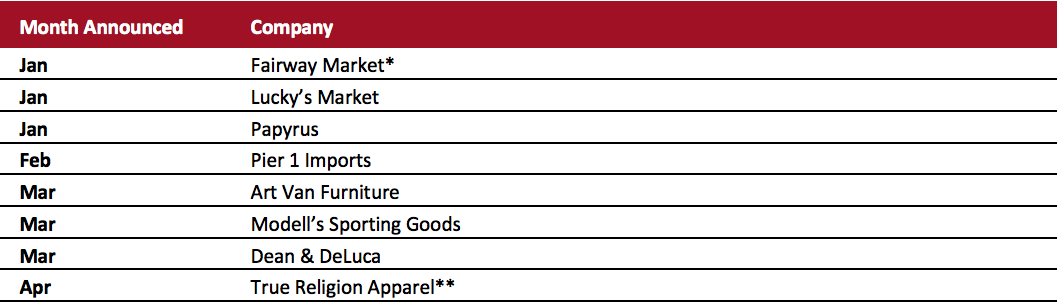

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

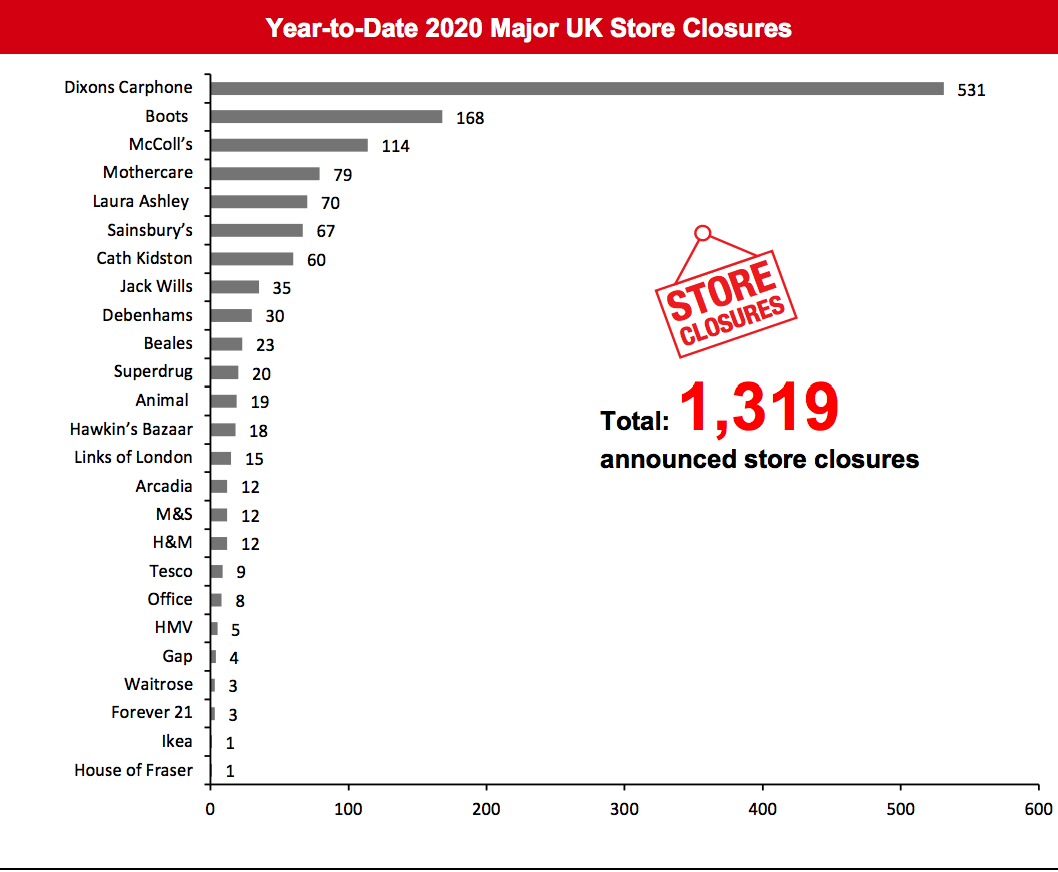

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_108773" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

The UK

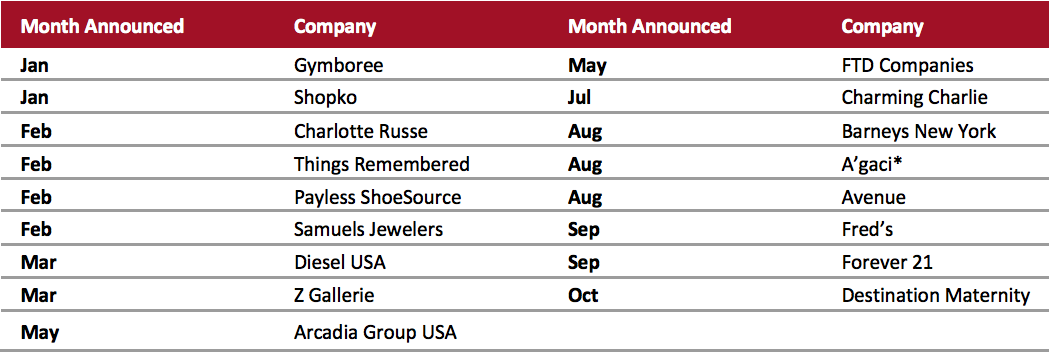

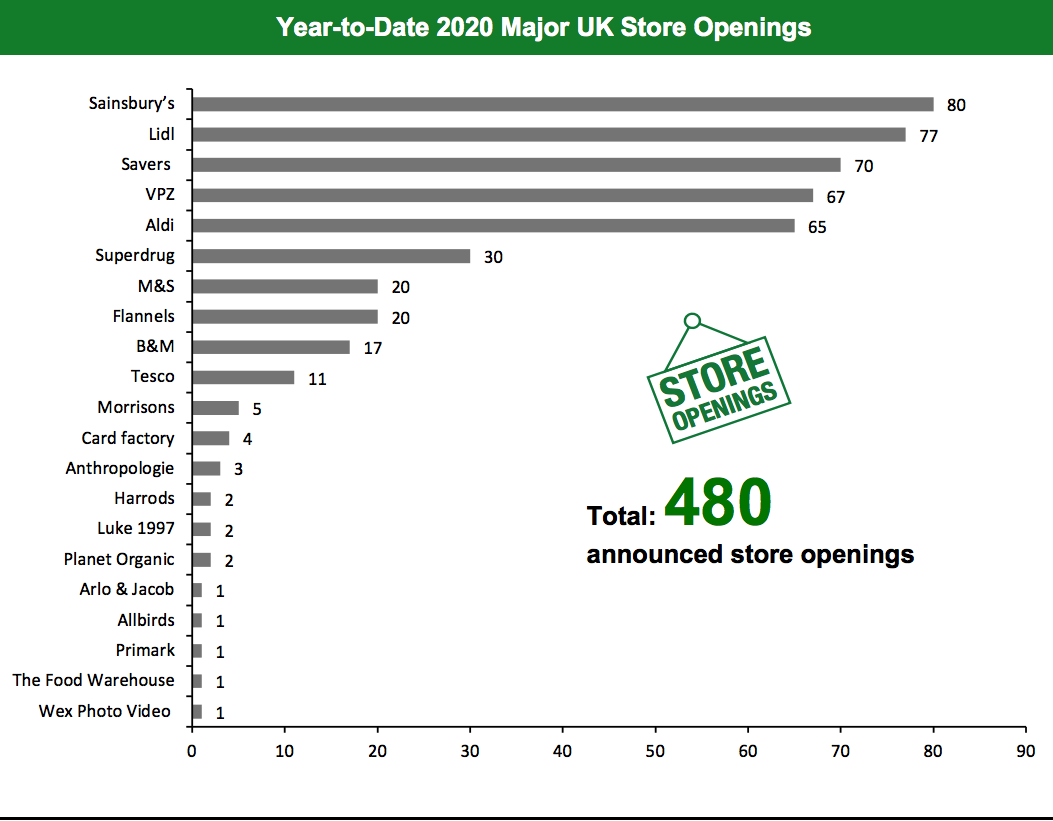

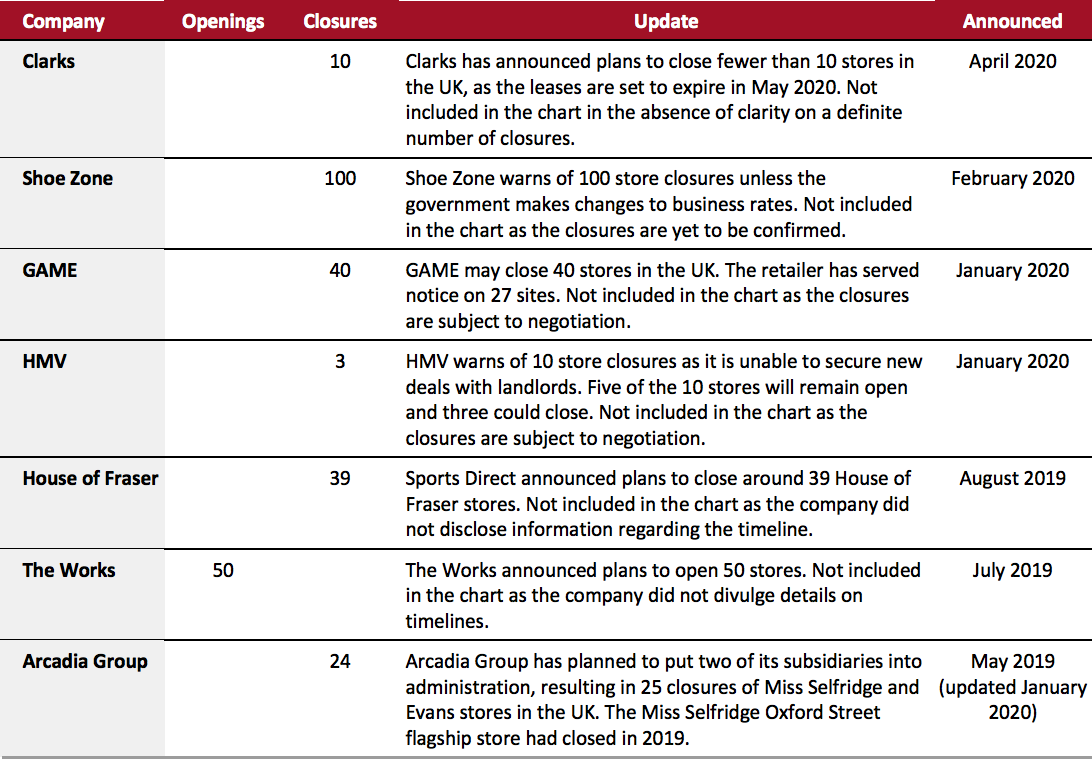

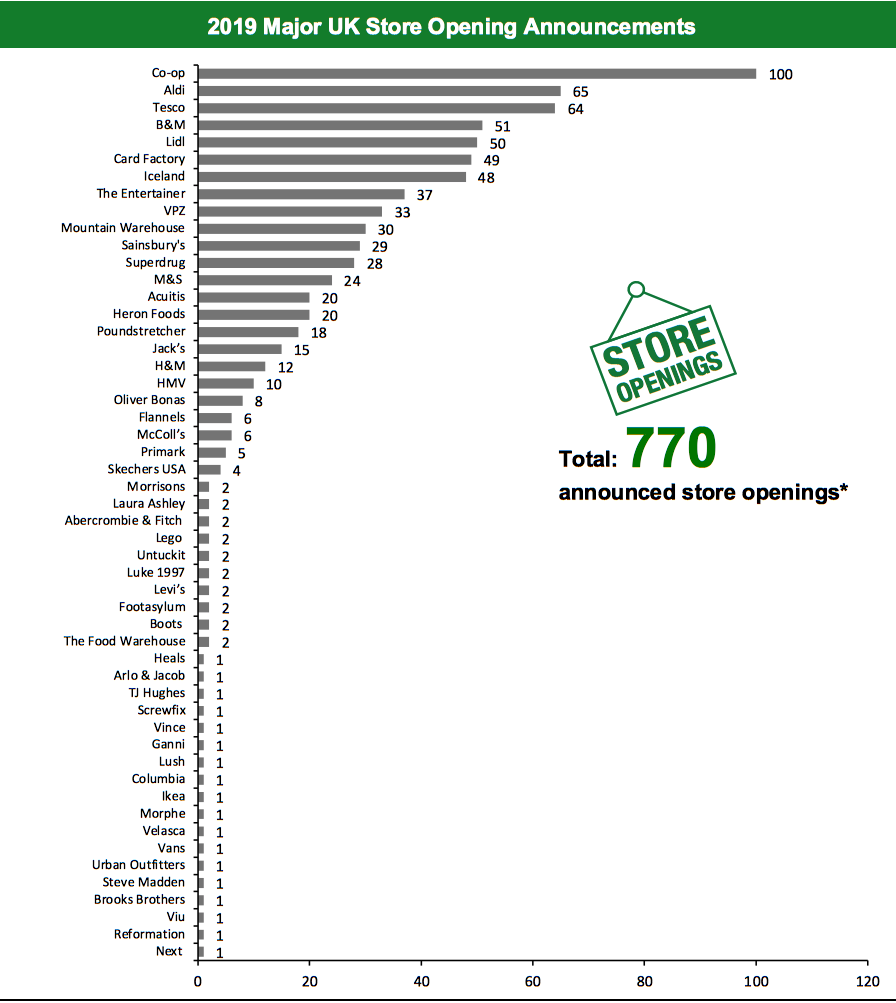

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,319 store closures and 480 store openings. Our data represent closures and openings by calendar year. This week, we have revised our 2019 closures count for Poundstretcher, and this has changed our 2019 UK closure count to 722. We also revised our 2019 openings count for Poundstretcher, and this has changed our 2019 UK openings count to 770.What Is Happening This Week in the UK

Animal To Close All Stores Surfing-inspired fashion brand Animal has announced plans to close all of its stores, concessions and its website by the end of January 2021. The retailer’s parent company H Young Holdings attributed its decision to close its Animal business to a challenging retail environment, which had “further worsened” due to the coronavirus pandemic. Animal operates about 21 stores in the UK. Debenhams Forewarns Closures in Wales; Plans To Close Four Stores in England Debenhams has warned that its Welsh stores might close permanently unless the government reverses its decision on business rates relief. The Welsh government had initially stated that it would grant a rates holiday to all retail, leisure and hospitality firms for one year, but later decided against offering relief to properties worth £500,000 ($619,760) and above, making Debenhams ineligible. The retailer’s five stores in Wales are located in Cardiff, Llandudno, Newport, Swansea and Wrexham. The retailer has business rates liabilities in Wales of £2.35 million ($2.9 million) for four of its Welsh stores, according to real-estate services provider Altus Group. It has also emerged that Debenhams will close four stores in England—located in Borehamwood, Kidderminster, Southampton and Swindon—in addition to the seven closures announced last week. Gordon Brothers Rescues Laura Ashley From Administration Restructuring and investment firm Gordon Brothers has acquired the Laura Ashley brand, its archives and its intellectual property rights from administrators PricewaterhouseCoopers (PwC). Gordon Brothers intends to maintain a streamlined network of Laura Ashley stores in the UK and Ireland. It also intends to focus on building e-commerce and expanding its portfolio of licensees and franchisees globally. Laura Ashley collapsed into administration in March 2020. John Lewis May Not Reopen a Few Stores Department-store chain John Lewis is evaluating the possibility of keeping some of its underperforming stores permanently shut after the coronavirus lockdown is lifted, according to The Times. Parent company John Lewis Partnership is reportedly considering an outside investor to finance and launch a joint venture in order to reduce its dependence on retailing. The company’s 50 John Lewis stores have been closed since March 23, while its Waitrose grocery stores remain open. Poundstretcher Appoints Administrators Discount-store chain Poundstretcher has reportedly appointed KPMG as administrators to carry out a review of its finances, according to Sky News. The retailer said that a cost-reduction strategy is integral for the company to continue its operations. Poundstretcher operates around 450 stores in the UK, the majority of which have remained open during the coronavirus lockdown. It opened 72 stores and closed 16 during its fiscal year ended March 31, 2019.Non-Store-Closure News

John Lewis Reopens Lancashire Factory John Lewis has reopened its Herbert Parkinson textiles factory in Lancashire to manufacture gowns for NHS frontline workers during the coronavirus crisis. Factory employees will make around 8,000 protective gowns for the Northumbria NHS Foundation Trust. John Lewis also plans to donate more than 20,000 meters (roughly 65,600 feet) of cotton fabric to make scrubs for NHS workers. [caption id="attachment_108774" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_108775" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

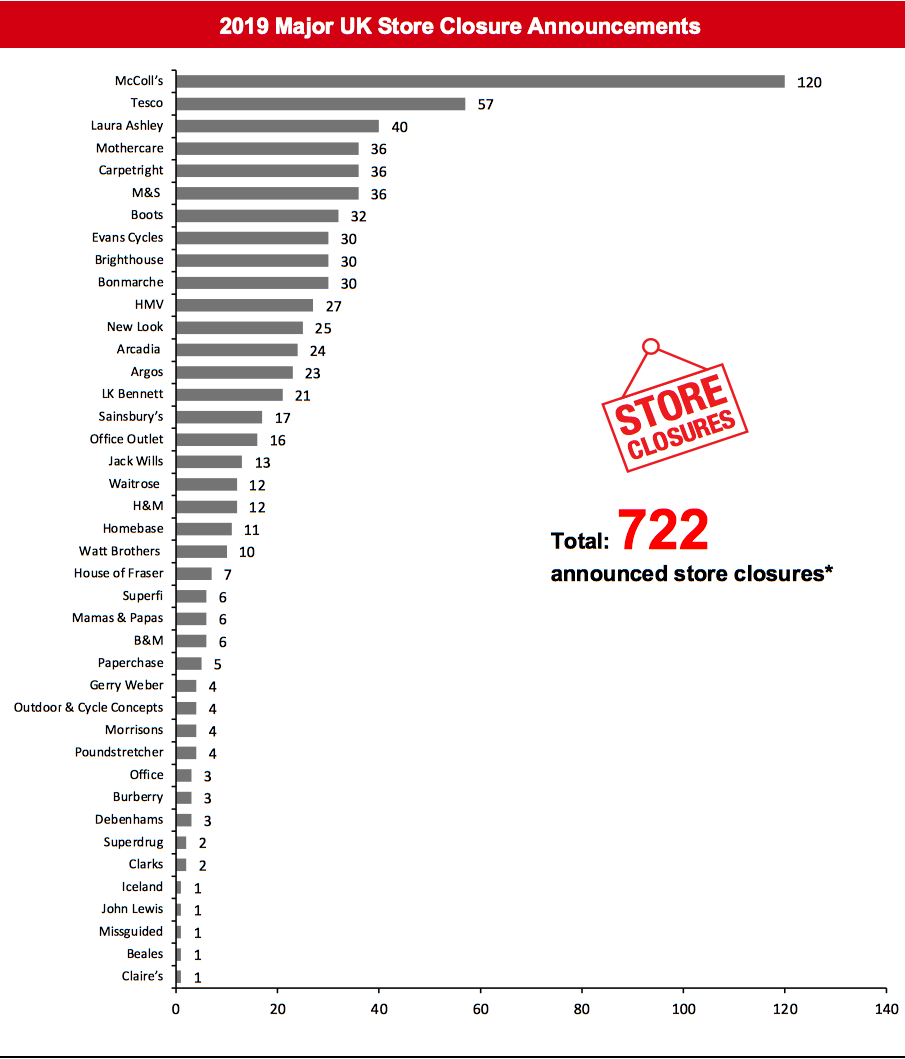

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_108776" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108777" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108777" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_108778" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.