Nitheesh NH

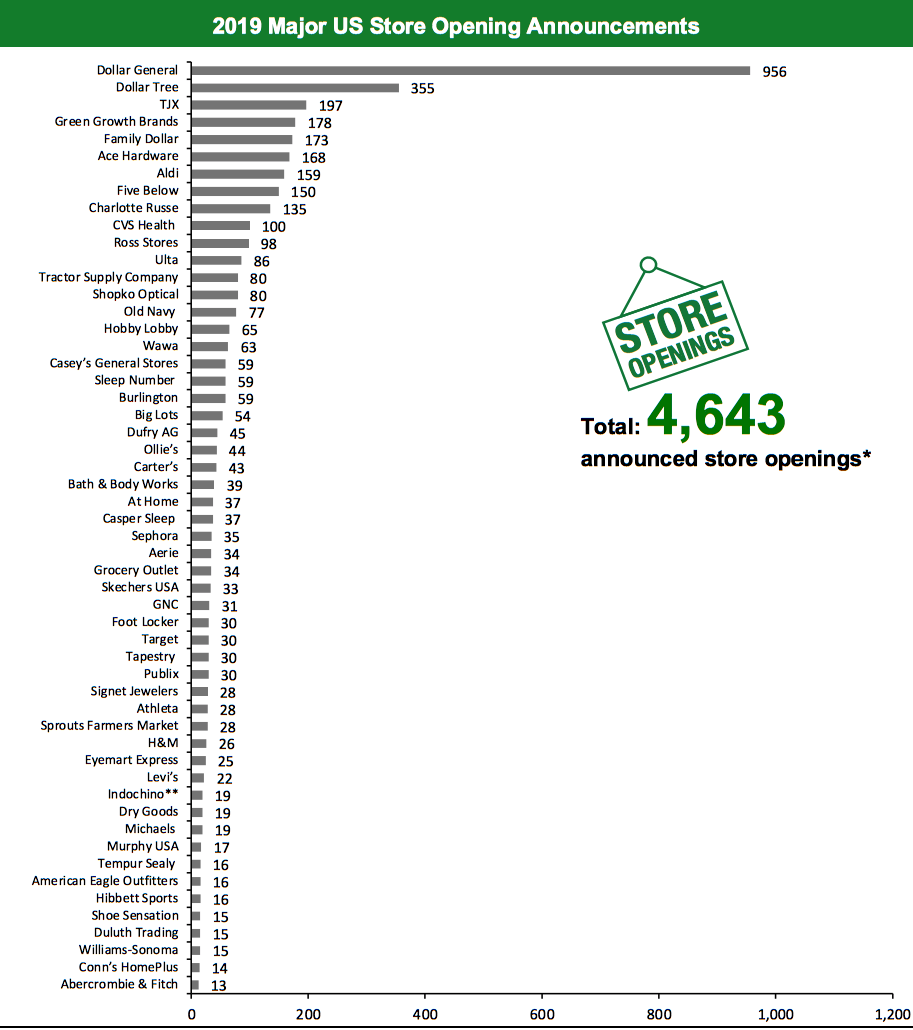

The US

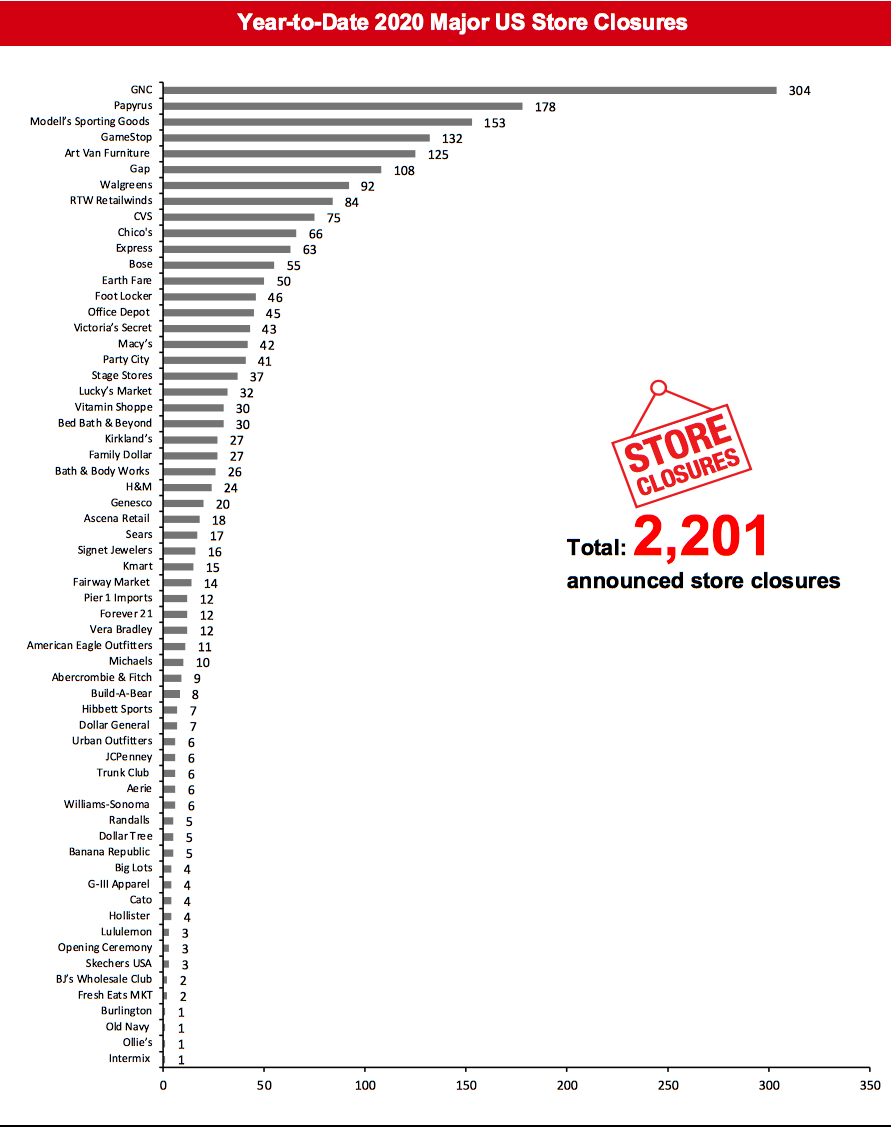

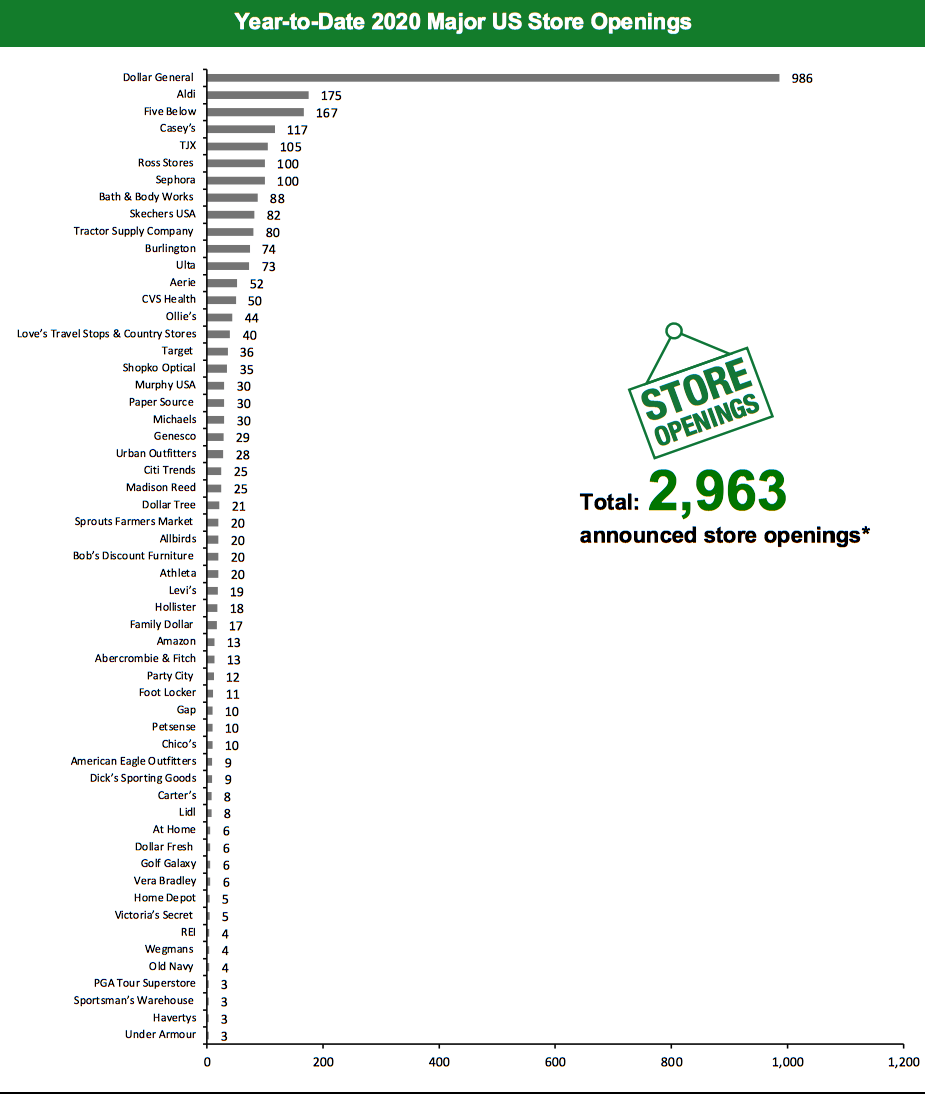

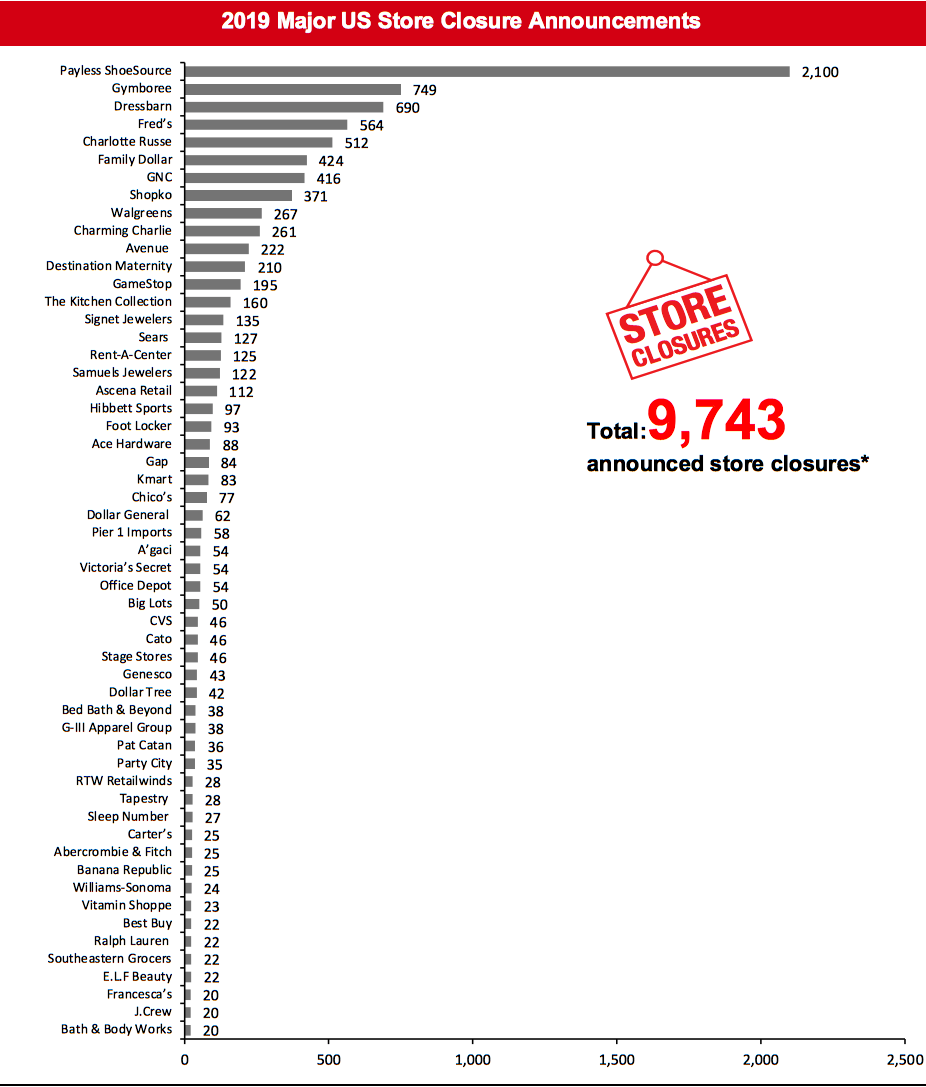

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 2,201 planned store closures and 2,963 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Bed Bath & Beyond, and this has changed our 2019 US closure count to 9,743. We also revised our 2019 openings count for Bed Bath & Beyond, and this has changed our 2019 US openings count to 4,643.What Is Happening This Week in the US

Dollar General Opens Its First Washington Store Dollar General has announced that it recently opened its first Washington store, thus expanding its retail footprint to 46 US states. The retailer plans to open more stores in Washington and has six stores under construction currently. In March this year, the retailer had announced plans to open 1,000 new stores, remodel 1,500 and relocate 80 stores in fiscal year 2020, ending January 29, 2021. Dollar General operates 16,368 stores in the US, as of February 28, 2020. JCPenney Misses $12 Million Interest Payment, Threatening Bankruptcy Department-store chain JCPenney elected not to pay an approximately $12 million interest payment that was due on April 15, 2020, according to its 8-K securities filing. Additionally, Moody’s downgraded JCPenney on April 13, 2020 and reported that while the company’s liquidity is adequate, “widespread store closures as a result of the coronavirus pandemic and the continued suppression of consumer demand is expected to pressure EBITDA.” The company is reportedly in talks with AlixPartners to manage its debt. Lord & Taylor Mulls Filing for Bankruptcy Department-store chain Lord & Taylor is reportedly considering filing for bankruptcy protection, according to Reuters. The coronavirus outbreak has forced the chain to temporarily close all of its 38 US stores. A spokesperson from Le Tote, parent company of Lord & Taylor, said that the chain is exploring various options, including negotiating relief from creditors. Online clothing rental subscription-service company Le Tote purchased Lord & Taylor from Hudson’s Bay Company in August 2019. Neiman Marcus May File for Bankruptcy Imminently Luxury department-store chain Neiman Marcus is reportedly close to filing for bankruptcy protection within a few days, according to an April 21 report from Reuters. The retailer has temporarily closed 43 Neiman Marcus stores as well as its Last Call and Bergdorf Goodman stores due to the coronavirus pandemic. Last month, Neiman Marcus announced plans to permanently close the majority of its Last Call stores. Coresight Research insight: JCPenney, Lord & Taylor and Neiman Marcus were already pressured prior to the coronavirus pandemic. Now all three are experiencing increased pressure on their balance sheets due to limited revenue streams—some 70–80% of their revenues come from (shuttered) physical stores. Raley’s Opens Flagship Store Supermarket chain Raley’s has opened a new flagship store in Sacramento, California. The 55,000-square-foot store can process up to 250 orders per day for pickup or delivery via Raley’s eCart online platform. The new flagship store is a replacement of the existing Raley’s Land Park store, which will remain open until all inventory is sold.Quarterly Store Openings/Closures Settlement

Bed Bath & Beyond Closes 26 Stores Bed Bath & Beyond has reported that it closed 26 stores and opened two stores during its fourth quarter of fiscal year 2019, ended February 29, 2020. The closures include 17 Cost Plus World Market stores, five Bed Bath & Beyond stores and two stores each of Buy Buy BABY and Harmon Face Values. The retailer operates 1,500 stores across all its banners in the US and Canada, as of February 29, 2020.Non-Store-Closure News

American Eagle Outfitters Appoints Mike Mathias as CFO Clothing and accessories retailer American Eagle Outfitters has appointed Mike Mathias as Executive Vice President and Chief Financial Officer (CFO), effective immediately. Mathias will succeed the retailer’s current CFO Bob Madore. Madore will remain with the retailer in a senior advisory role through September 2020. Mathias joined American Eagle Outfitters in 1998 and has most recently served as Senior Vice President and Head of Financial Planning since 2017. Under Armour Designates Lisa Collier as New Chief Product Officer Under Armour has appointed Lisa Collier as Chief Product Officer (CPO), effective April 27, 2020. She will join Under Armour from denim retailer Not Your Daughter’s Jeans (NYDJ), where she served as President and CEO from 2016 to 2019. Collier will succeed Kevin Eskridge, who resigned as CPO and will part ways with the company in August 2020. [caption id="attachment_108281" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Bed Bath & Beyond, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_108282" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Foot Locker, Hollister, Home Depot and Levi’s are based on the existing proportion of stores in the US. Aerie, Athleta, Bed Bath & Beyond, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than 3 store openings and are not included in the chart

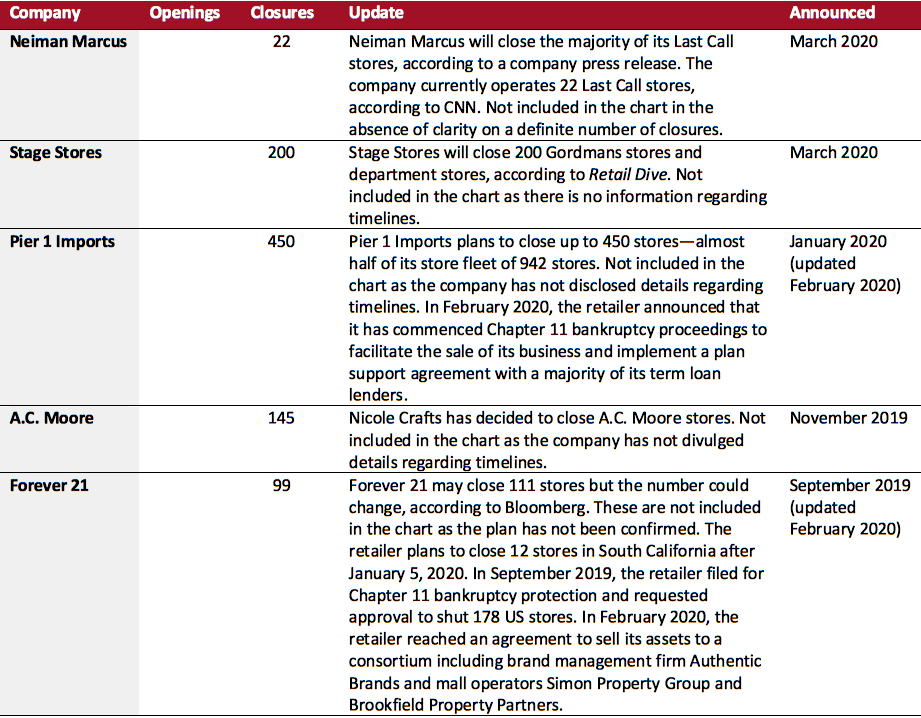

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_108283" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108284" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108284" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Bed Bath & Beyond, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_108285" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Bed Bath & Beyond, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 13 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

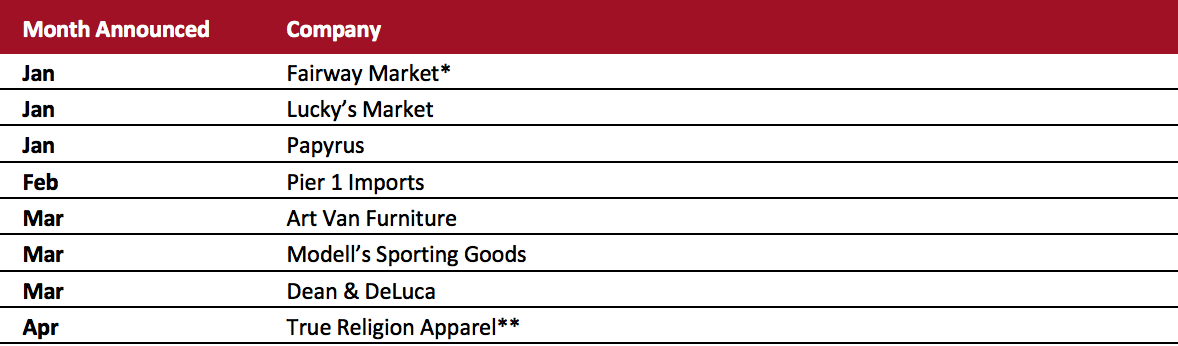

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_108286" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

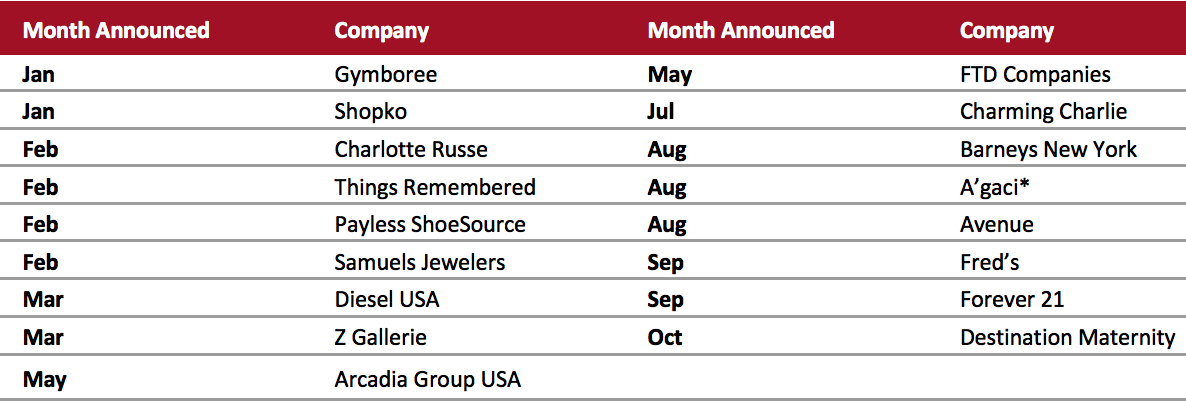

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_108287" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

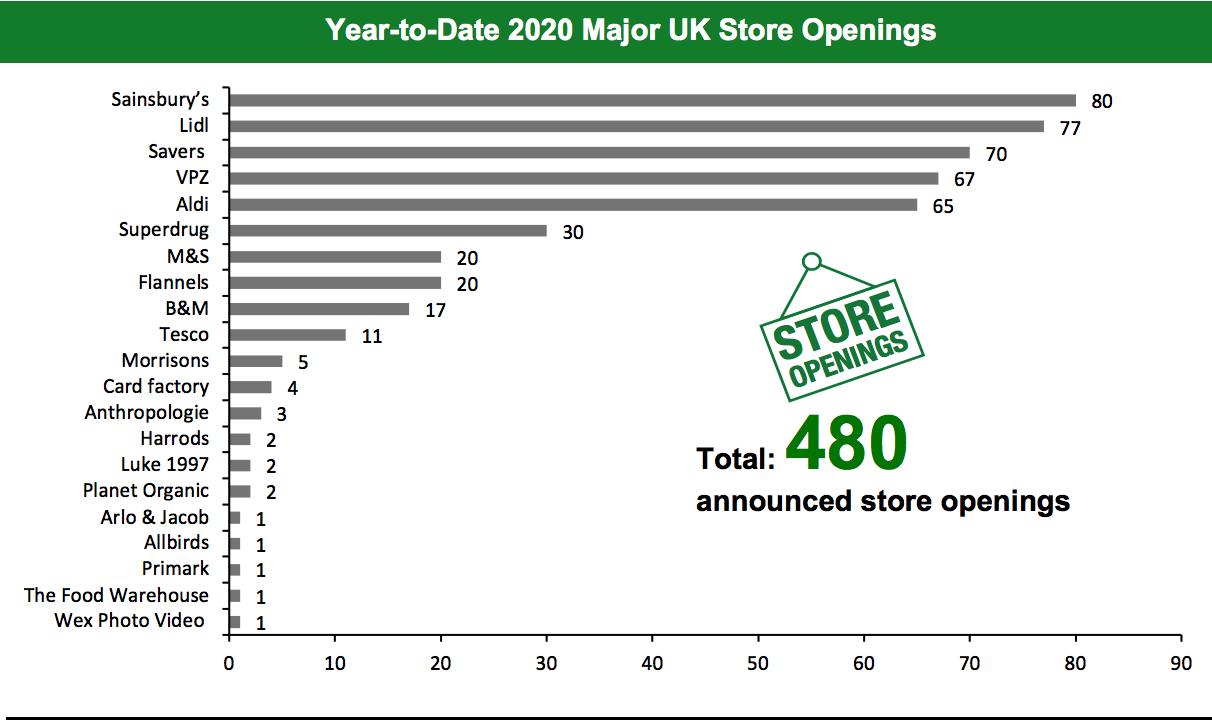

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,296 store closures and 480 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Arcadia Group Could Shutter More Than 100 Stores Multinational fashion retail conglomerate Arcadia Group is serving notice on its landlords and may permanently shut over 100 stores where its leases are scheduled to expire or have rolling breaks, according to the BBC. However, the retailer is continuing to negotiate with property owners regarding rent terms, which, if successful, may avert permanent closures. Arcadia Group, which recently furloughed around 14,500 employees amid the coronavirus pandemic, has not made any statement regarding plans to close stores. The group owns Dorothy Perkins, Miss Selfridge, Topman and Topshop and currently operates 550 UK stores, all of which are temporarily closed due to the coronavirus lockdown. We have not included the closure count in the chart as the company has not confirmed plans. Cath Kidston To Permanently Close 60 Stores Apparel, accessories and home-furnishings retailer Cath Kidston has announced plans to permanently close all of its 60 UK stores. The stores are already closed currently on account of the coronavirus lockdown, but the retailer has confirmed that they will not reopen after the lockdown is lifted. The news comes after Cath Kidston’s parent company Baring Private Equity Asia bought back the retailer’s brand, online and wholesale business from administrators Alvarez & Marsal in a pre-pack administration deal. The deal does not include Cath Kidston’s 60 UK stores. Earlier this month, the retailer filed a notice of intent to appoint administrators. Debenhams To Close Seven Stores Department-store chain Debenhams has announced plans to permanently close seven stores, affecting around 422 employees. The stores set for closure are located in Leamington Spa, Salisbury, South Shields, Stratford-upon-Avon, Truro, Warrington and Westfield London. Debenhams closed 19 stores in January this year and three in December 2019, as part of its store optimization plan to close 50 stores in the UK, which was announced last year. The retailer stated that it plans to close the remaining 28 stores as part of its CVA remains, but some of the seven stores slated for closure could be on the list of the 28 stores.Non-Store-Closure News

Ted Baker Plans To Launch First-Ever Digital Pop-Up Store Ted Baker has announced plans to launch its first-ever digital pop-up store, called Ted’s Bazaar, on May 1, 2020. Ted’s Bazaar will offer limited-edition products such as beanies, mugs, tea-towels and t-shirts, with rainbow designs, emojis and slogans to symbolize the retailer’s support of key workers during the coronavirus crisis. The retailer plans to donate 100% of its profits from the pop-up store to charity. [caption id="attachment_108288" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced fewer than 3 store openings and are not included in the chart

Source: Company reports/Coresight Research[/caption] [caption id="attachment_108289" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

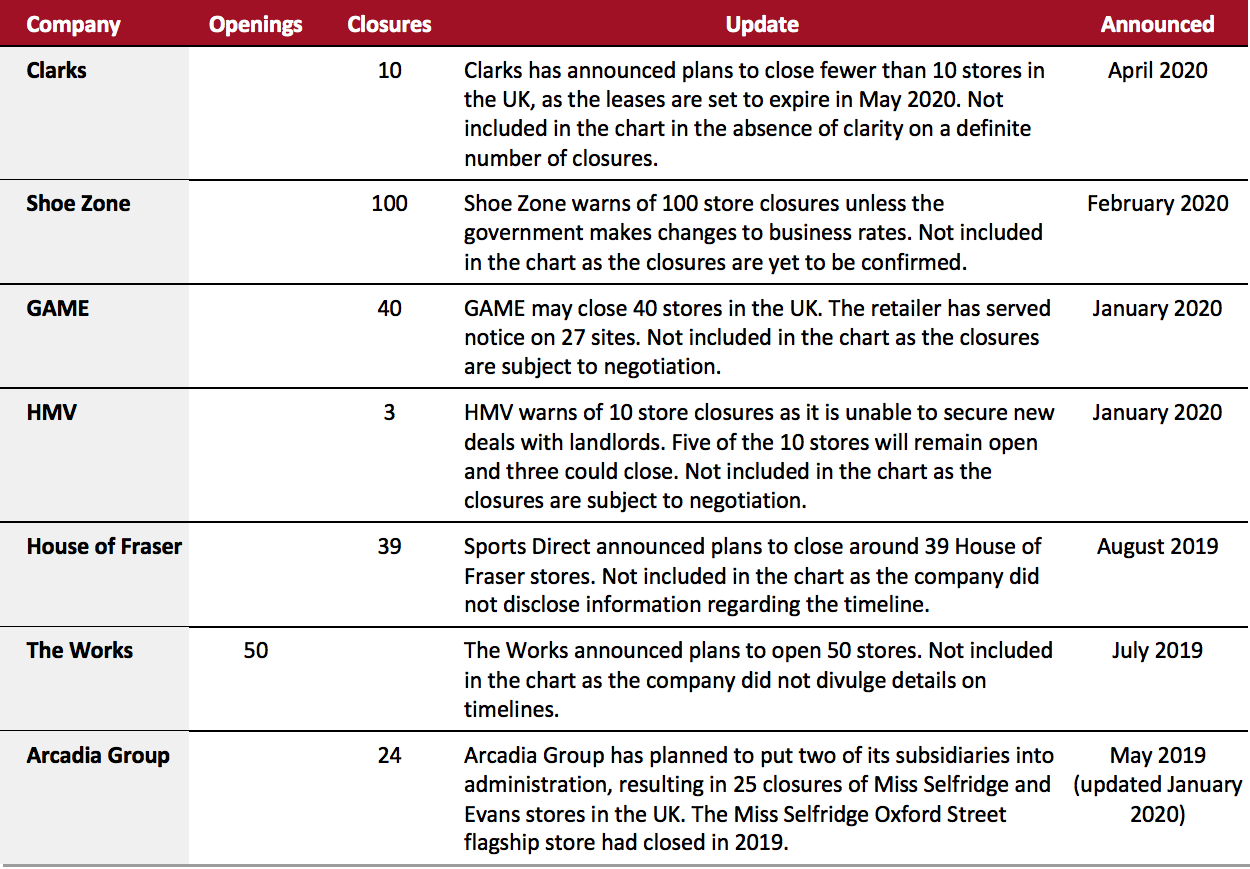

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_108290" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_108291" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

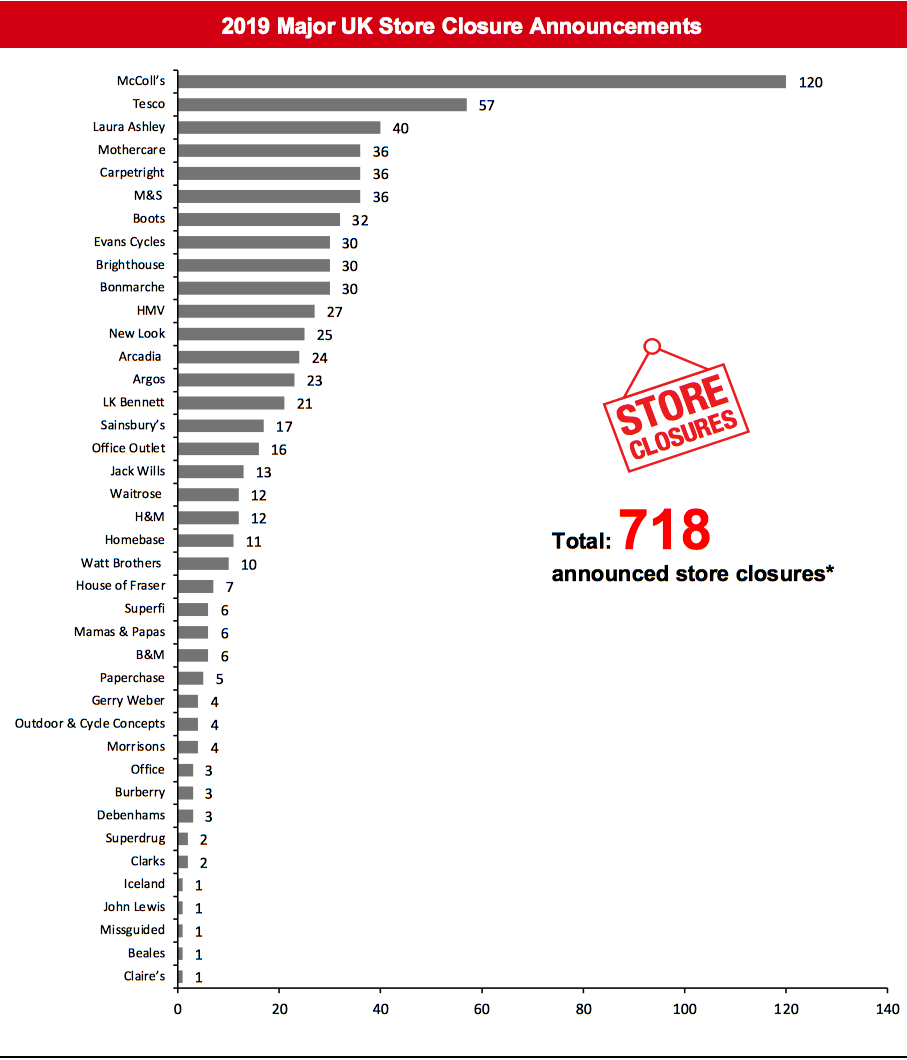

[caption id="attachment_108291" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_108292" align="aligncenter" width="700"]

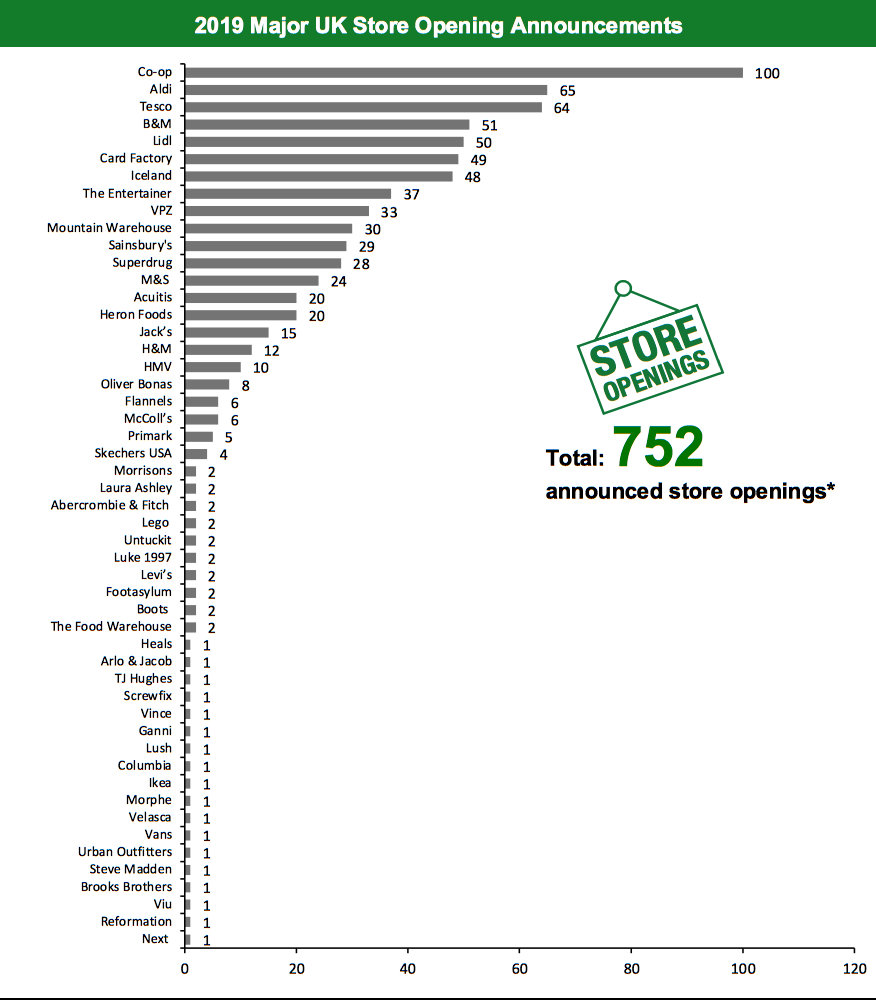

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.