Nitheesh NH

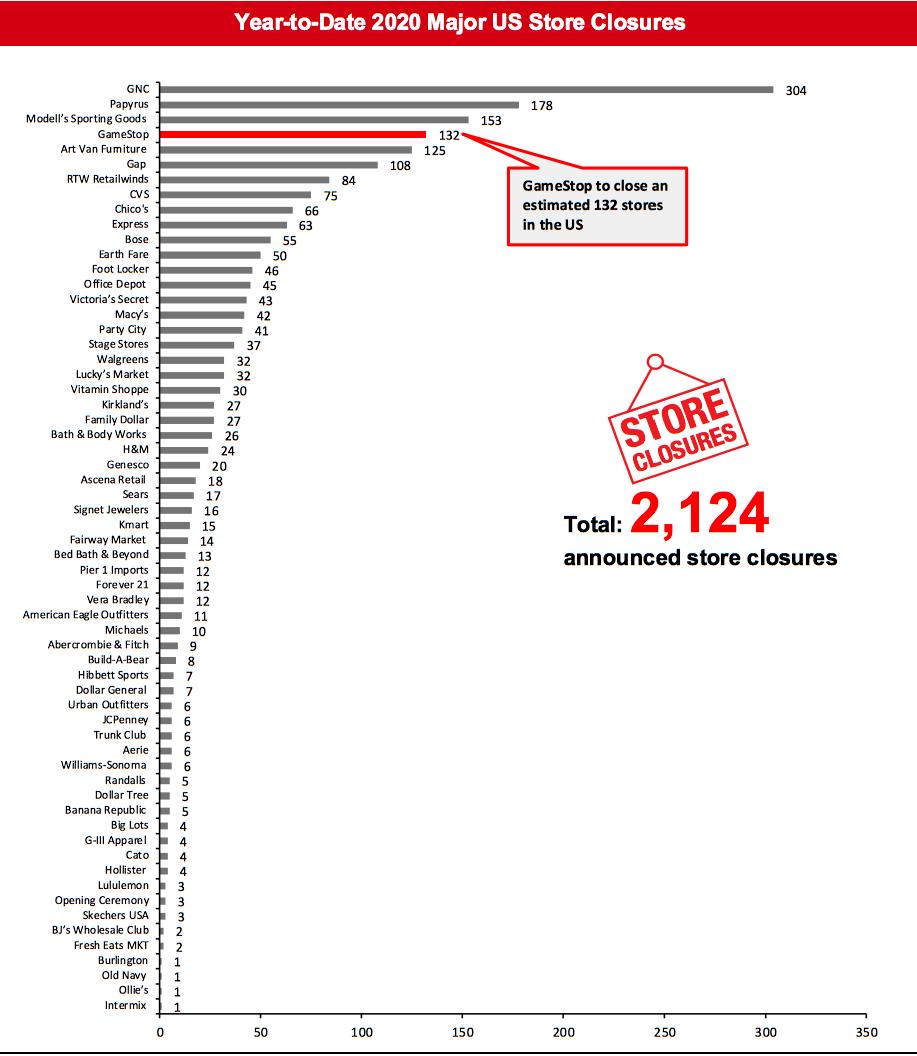

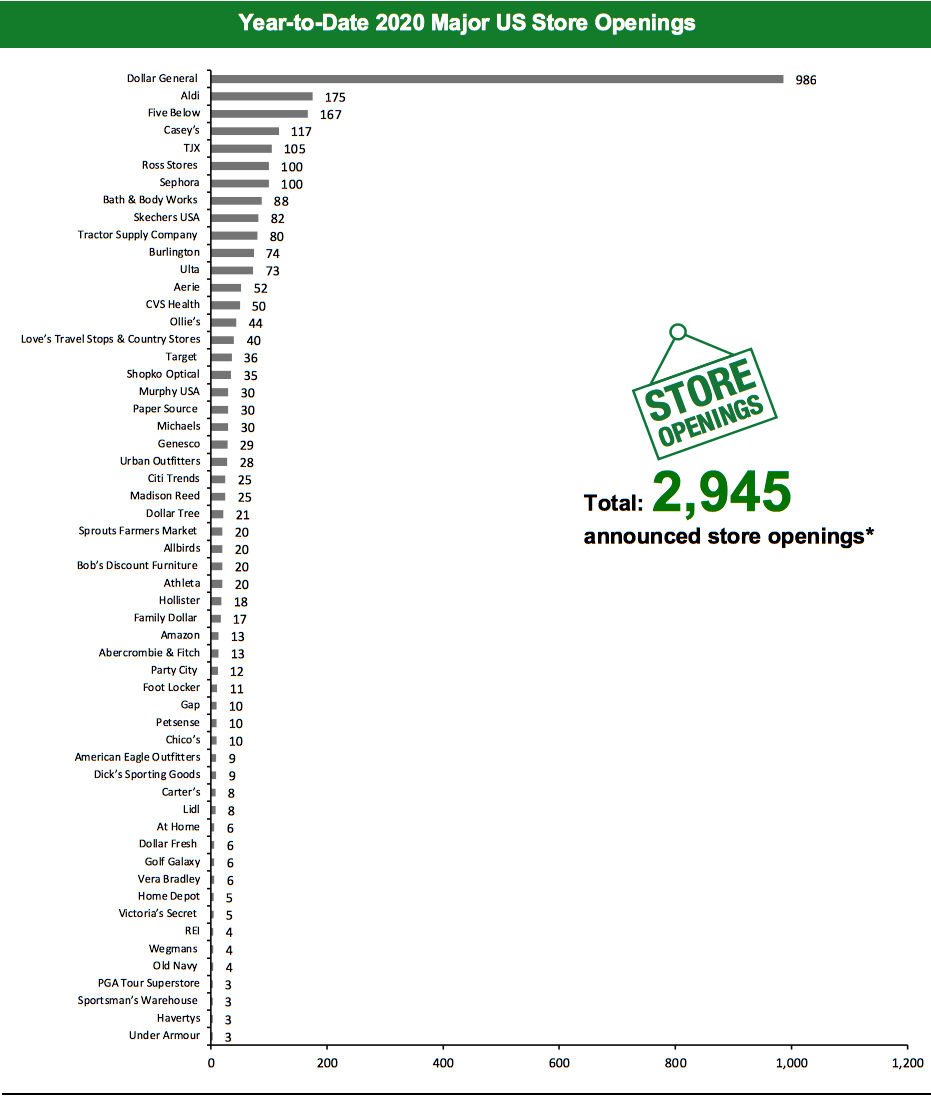

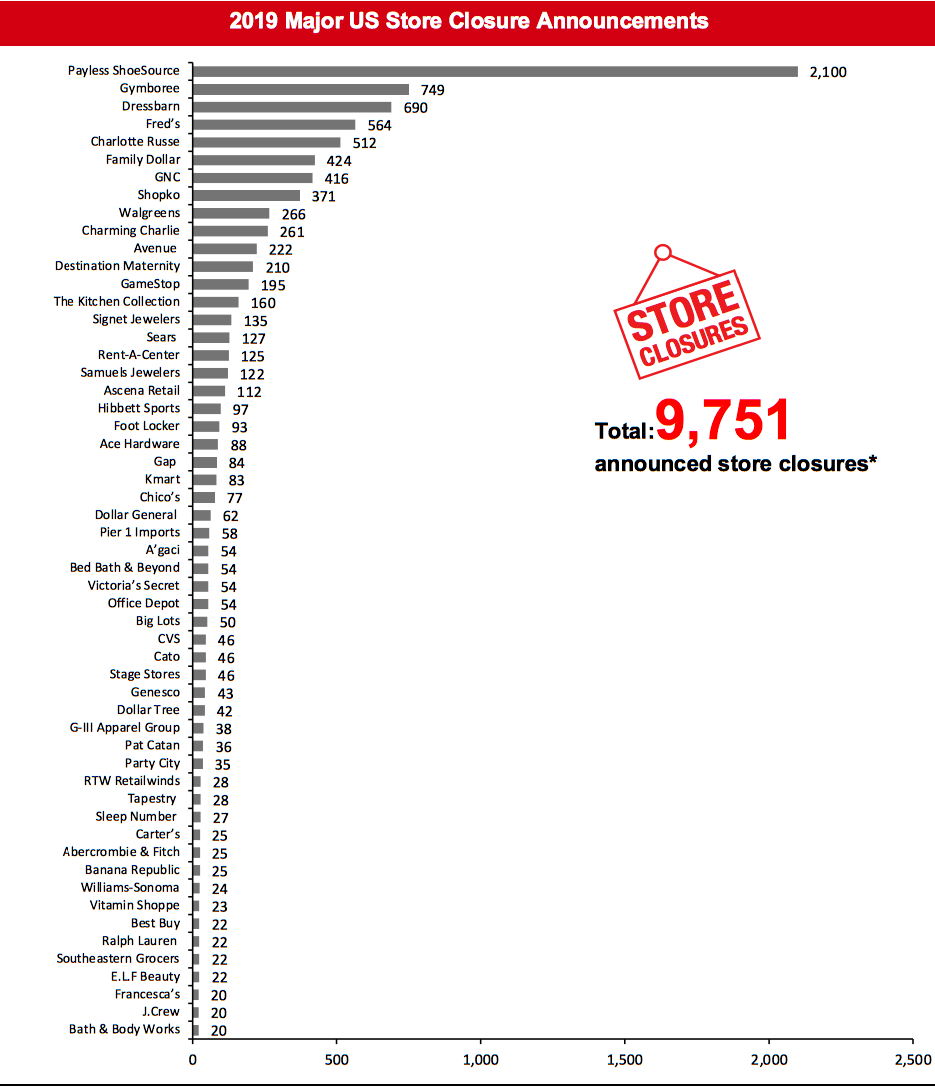

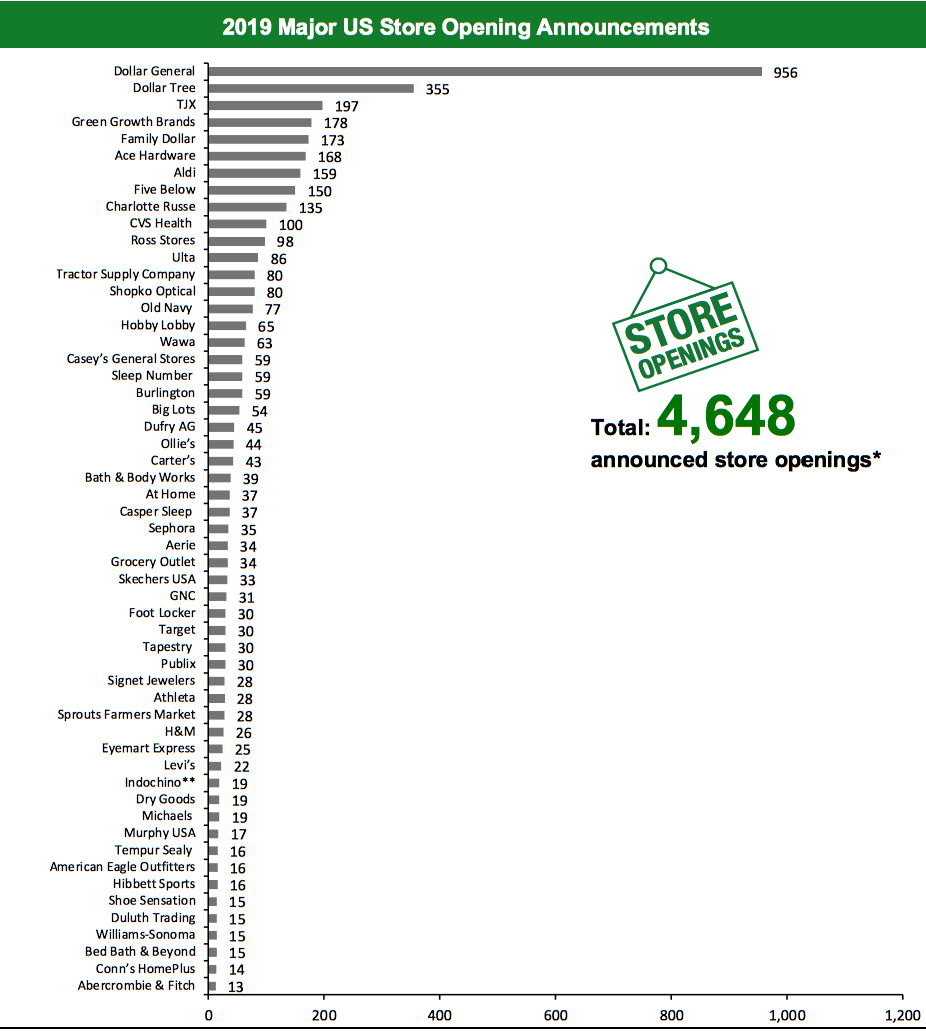

The US

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 2,124 planned store closures and 2,945 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for GameStop, GNC, RH, Shoe Carnival and Williams-Sonoma, and this has changed our 2019 US closure count to 9,751. We revised our 2019 openings count for GameStop, GNC, RH, Shoe Carnival and Williams-Sonoma, and this has changed our 2019 US openings count to 4,648.Coronavirus Update: Temporary Store Closures Caused by the Coronavirus

Many US retailers have already extended the temporary closure of their stores as a result of the coronavirus pandemic by postponing the planned re-opening dates. This week saw such announcements from Abercrombie & Fitch, Cato, Kohl’s and Urban Outfitters, among others. See the Coresight Research Coronavirus Tracker for regularly updated details of announced temporary store closures or reduced opening hours by major US retailers.What Is Happening This Week in the US

Fairway Market Announces the Sale of Two Store Leases to Amazon New York-based grocery chain Fairway Market has announced the sale of its two New Jersey store leases to Amazon. The grocery chain has also announced that Village Super Market won the bid for five Fairway Market stores and its production and distribution center, and Seven Seas won the bid for Fairway’s Georgetown store in Brooklyn. Fairway Market filed for Chapter 11 bankruptcy protection in January this year, with plans to sell all 14 stores under a court-supervised process. Modell’s Sporting Goods Bankruptcy Proceedings Put On Hold Modell’s Sporting Goods’ Chapter 11 bankruptcy proceedings have been suspended until April 30, 2020. The retailer stated that the coronavirus outbreak has impacted its liquidation sales. Modell’s filed for Chapter 11 bankruptcy on March 11, 2020, with plans to close its remaining 134 US stores.Quarterly Store Openings/Closures Settlement

GameStop Announces Plans To Close At Least 320 Stores Globally Gaming merchandise retailer GameStop has announced plans to close at least 320 stores globally in fiscal year 2020, ending January 2021. The retailer closed 210 stores and opened six stores in the US during fiscal year 2019, ended February 1, 2020. GameStop operates 3,642 stores across the US, as of February 1, 2020. Our charted closure count is estimated based on the existing proportion of stores in the US. GNC Holdings Closes 416 Stores Health and nutrition products retailer GNC closed 356 company-owned stores and 60 franchise stores, and opened 25 company-owned stores and six franchise stores in the US and Canada during fiscal year 2019, ended December 31, 2019. The closures are part of the retailer’s previously announced store optimization plan to close up to 900 stores in the US and Canada by 2021. RH Closes Five Galleries and Opens Two Home-furnishings retailer RH has reported that it closed five galleries and opened two in fiscal year 2019, ended February 1, 2020. The retailer operates 83 retail locations globally and 78 US retail locations, as of February 1, 2020. Coresight Research insight: While most major US furniture retailers have been moving toward omnichannel models, RH remains firmly focused on brick-and-mortar stores. As we noted in a recent report, RH has done little in recent years to enhance its digital marketing, social media presence (the company’s Twitter account appears to have last posted in 2011 and its Facebook account in 2014) and mobile optimization (the company’s website was not optimized for smartphone viewing in February 2020). In the near term, in the context of forced store closures due to the coronavirus, these digital shortcomings will likely prove to be a weakness for RH. Shoe Carnival Mulls 2020 Store Growth Plans; Closes Six Stores Footwear retailer Shoe Carnival has announced that it is re-evaluating its store expansion plans of opening six to eight new stores in 2020, owing to the uncertain environment triggered by the coronavirus pandemic. The retailer reported that it closed six stores and opened one during fiscal year 2019, ended February 1, 2020. Shoe Carnival operates 392 stores across the US, as of March 25, 2020. Signet Jewelers Closes 138 Stores Signet Jewelers reported that it closed 138 stores and opened 38 in North America during fiscal year 2020, ended February 1. The retailer operates 2,757 stores in North America under Jared, Kay, Peoples, Piercing Pagoda, Zales and other regional banners, as of February 1, 2020.Non-Store-Closure News

Hibbett Sports Appoints New CFO Sporting goods retailer Hibbett Sports has appointed Robert J. Volke as its new CFO, effective April 13, 2020. Volke will succeed Scott R. Humphrey, who has been serving in the capacity of Interim CFO since September 2019. Volke has served as Interim CFO at Fleet Farm since August 2018 and previously held various positions at Tractor Supply Company, from May 2017 to August 2018. [caption id="attachment_107077" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GameStop, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy, Signet Jewelers and Williams-Sonoma closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_107078" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Athleta, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Athleta, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.*Total includes a small number of retailers that each announced fewer than 3 store openings and are not included in the chart

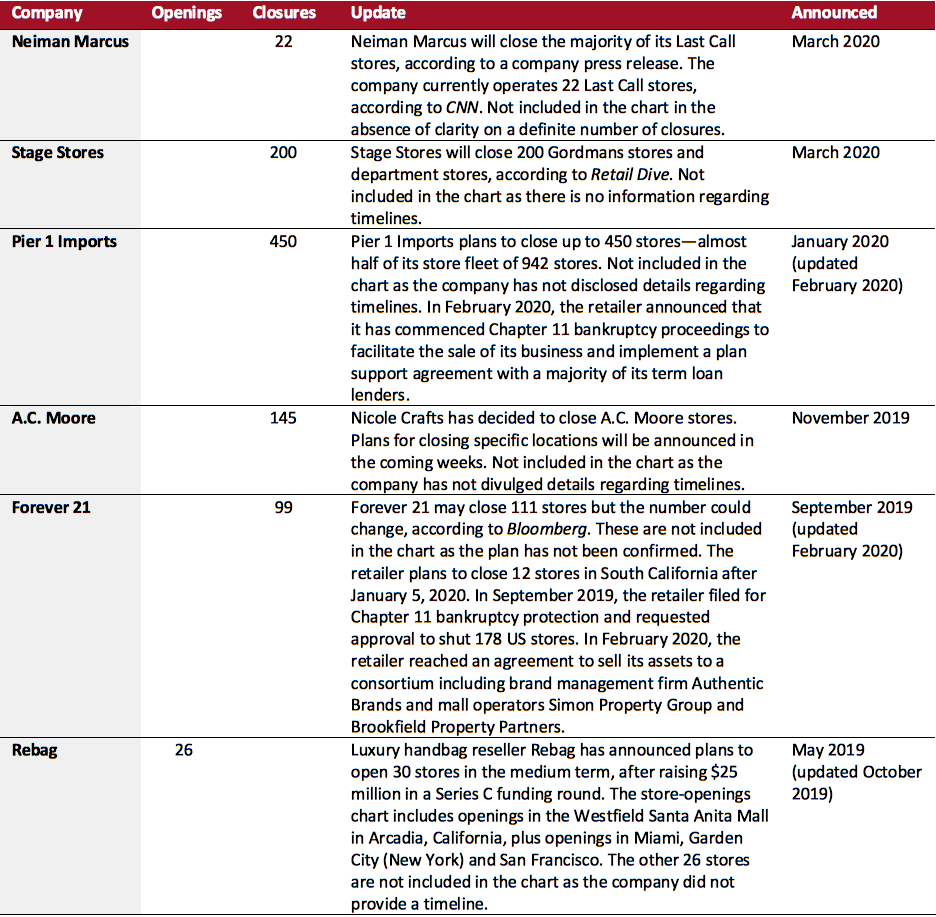

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_107079" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_107080" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_107080" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry and Williams-Sonoma closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_107081" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Signet Jewelers includes Jared, Kay, Peoples, Zales and regional banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Casper Sleep, Dufry AG, Foot Locker, Gap, Genesco, GNC, Michaels, Old Navy, Ralph Lauren, Signet Jewelers, Tapestry, Tempur Sealy and Williams-Sonoma openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 13 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

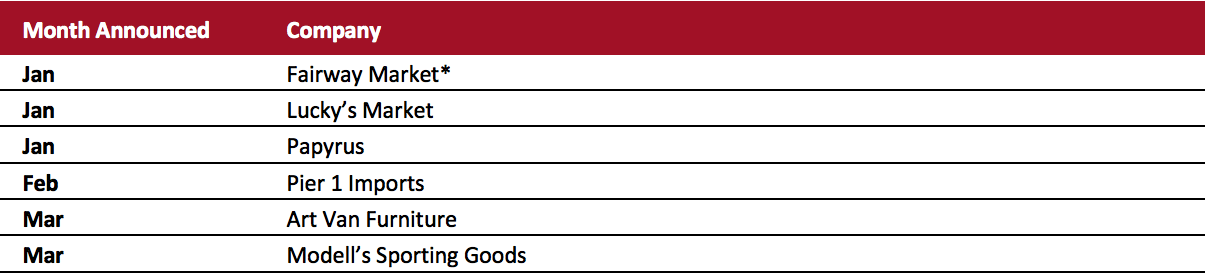

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_107082" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

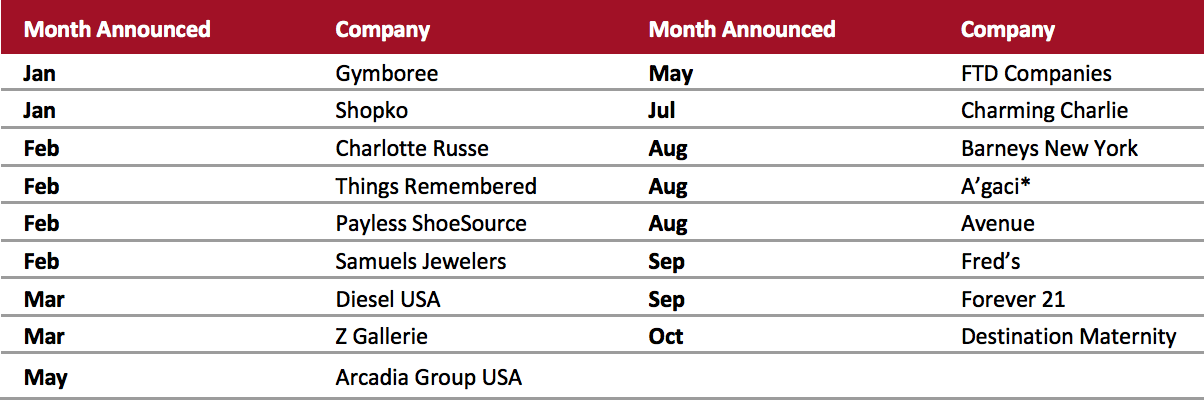

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_107083" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

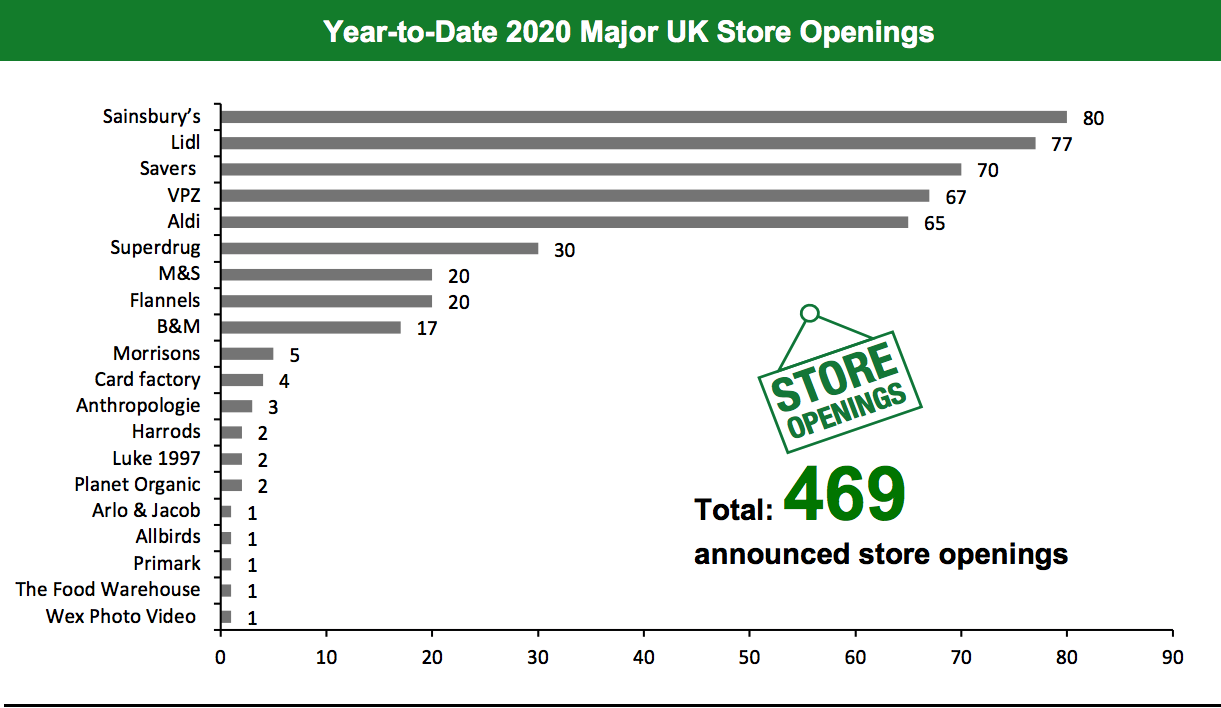

The UK

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,211 store closures and 469 store openings. Our data represents closures and openings by calendar year.Coronavirus Update: Temporary Store Closures Caused by the Coronavirus

Poundland and Schuh are the latest retailers to temporarily close stores in the UK due to the crisis triggered by the coronavirus pandemic. In addition, retailers such as Next, River Island, Schuh and TK Maxx have temporarily suspended online and warehouse operations.What Is Happening This Week in the UK

BrightHouse Collapses into Administration Rent-to-own home products retailer BrightHouse has collapsed into administration, with almost 2,400 jobs facing uncertainty. The accelerated collapse into administration came as investors withdrew their support for a proposed restructuring of BrightHouse’s business. The retailer currently operates 240 stores across the UK. Frasers Group Announces the Closure of a Further 16 Jack Wills Stores Frasers Group (formerly Sports Direct) has announced the closure of an additional 16 Jack Wills stores in the UK. The stores set to close are located in Belfast, Bicester Village, Bristol Cribbs, Chelmsford, Leeds, Plymouth and Watford, among other locations. Last week, Frasers Group announced plans to close 13 Jack Wills stores, amid the coronavirus outbreak.Non-Store-Closure News

Ted Baker Promotes CFO Rachel Osborne to CEO Luxury clothing retailer Ted Baker has promoted CFO Rachel Osborne as its new CEO. Osborne joined the retailer in November 2019 as CFO and was appointed as Interim CEO in December 2019. Prior to joining Ted Baker, Osborne held various roles at Debenhams, Domino’s, John Lewis, Kingfisher, PepsiCo and Vodafone. [caption id="attachment_107084" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_107085" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_107086" align="aligncenter" width="700"]

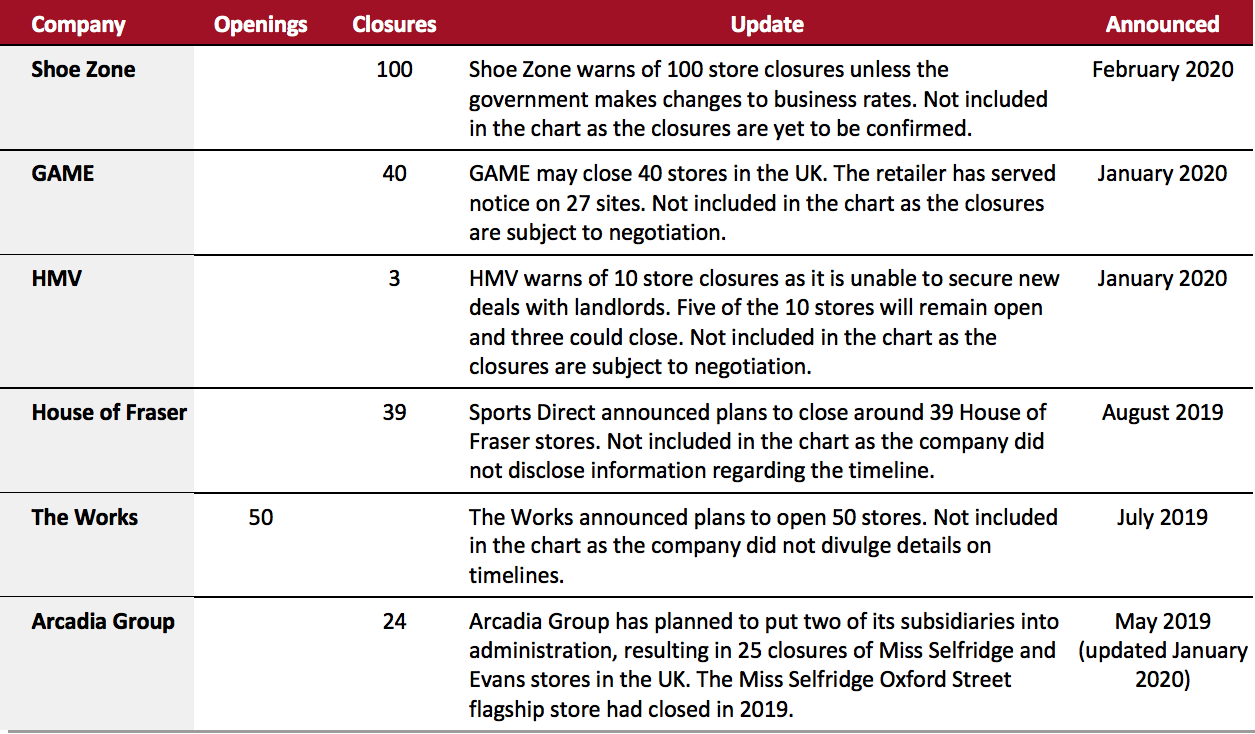

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_107087" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

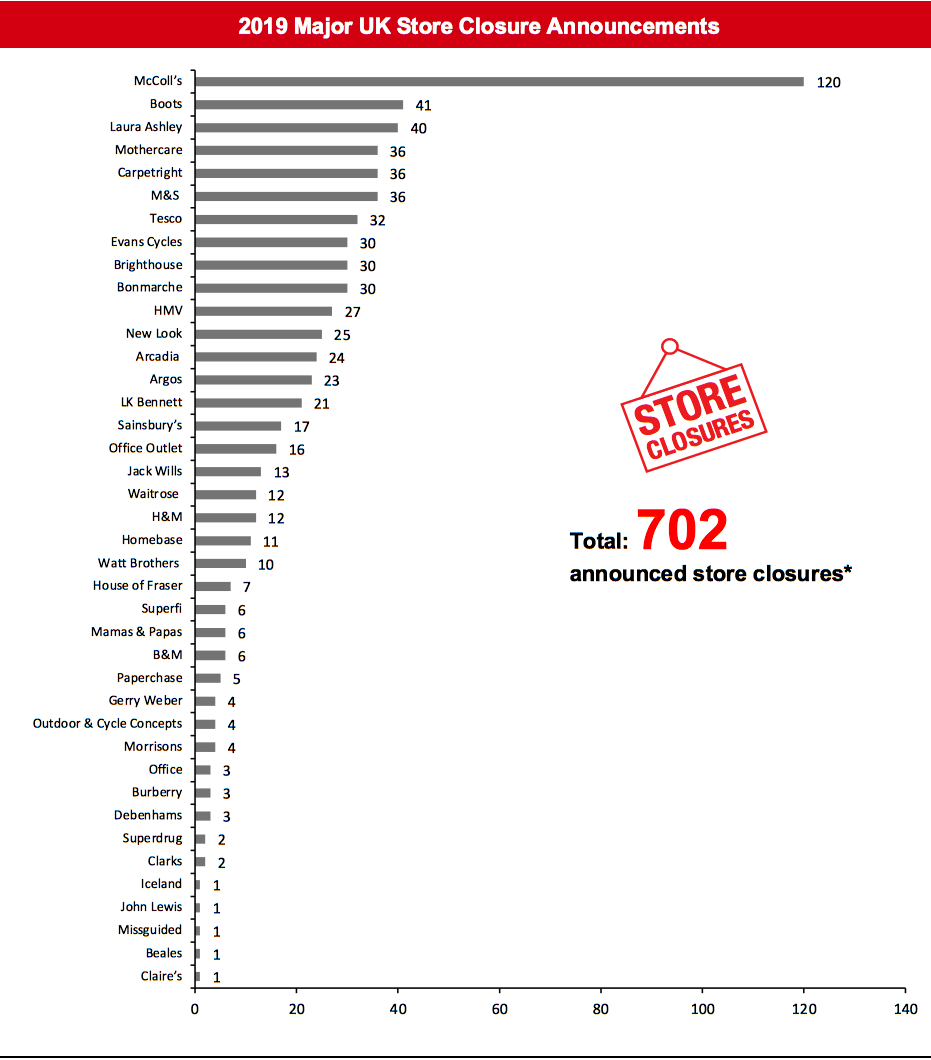

[caption id="attachment_107087" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_107088" align="aligncenter" width="700"]

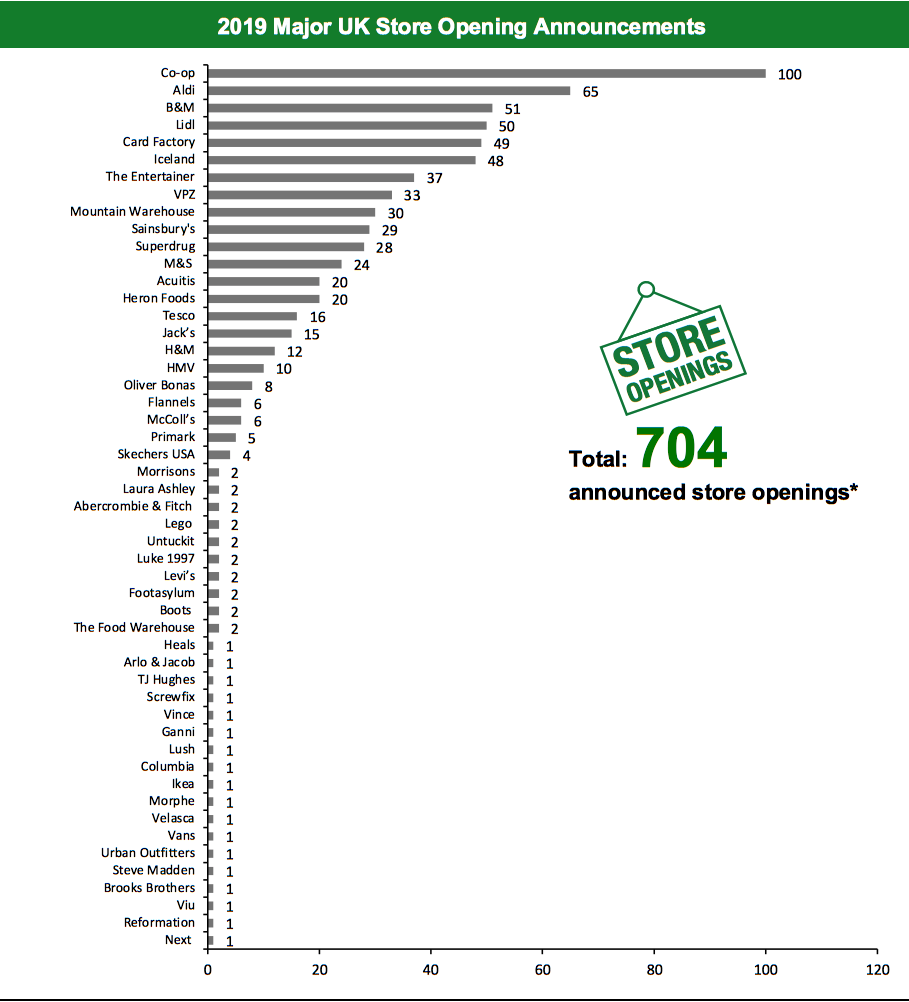

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.