Nitheesh NH

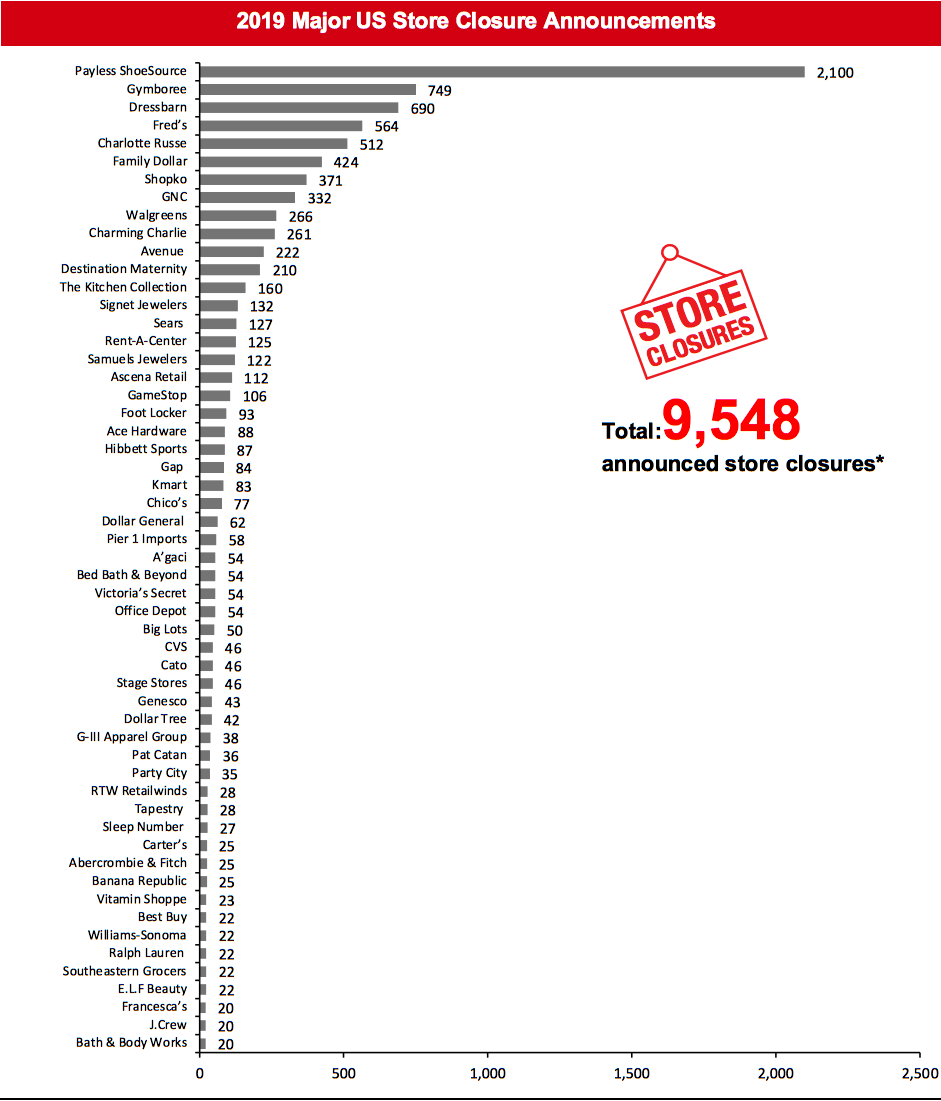

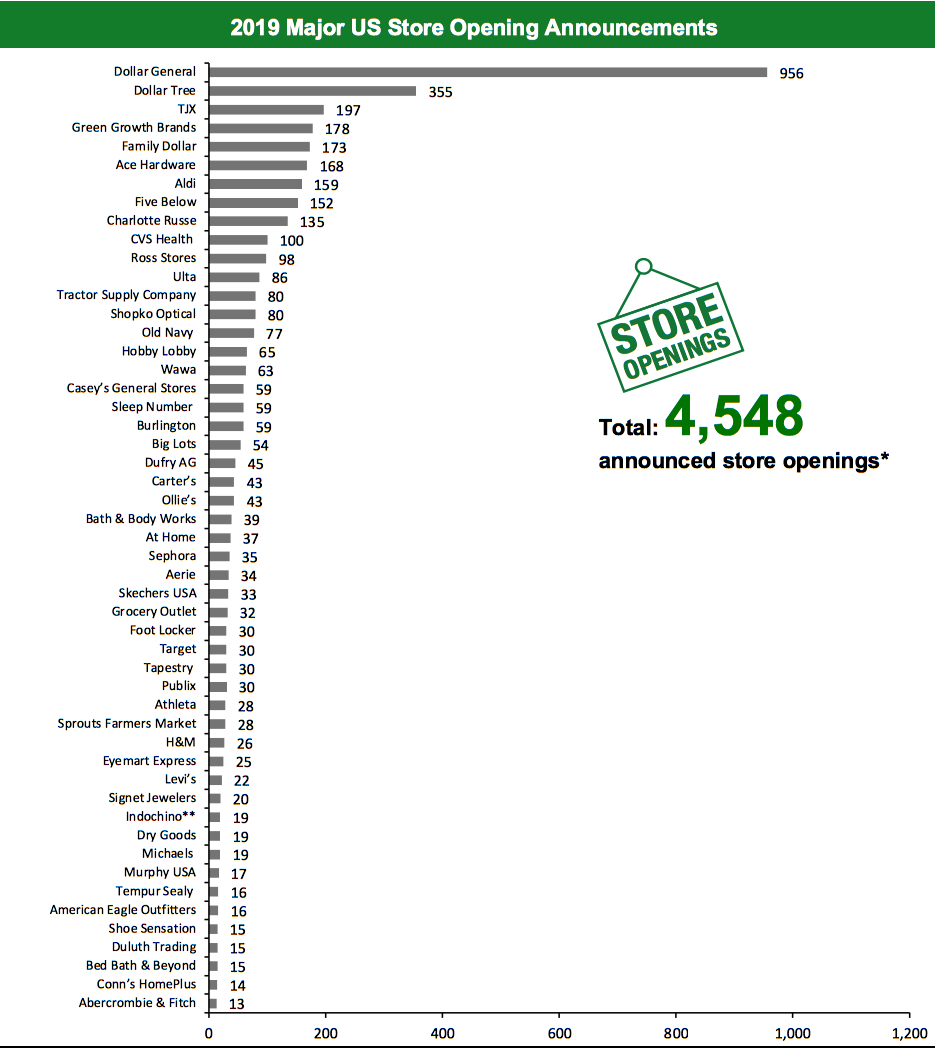

The US

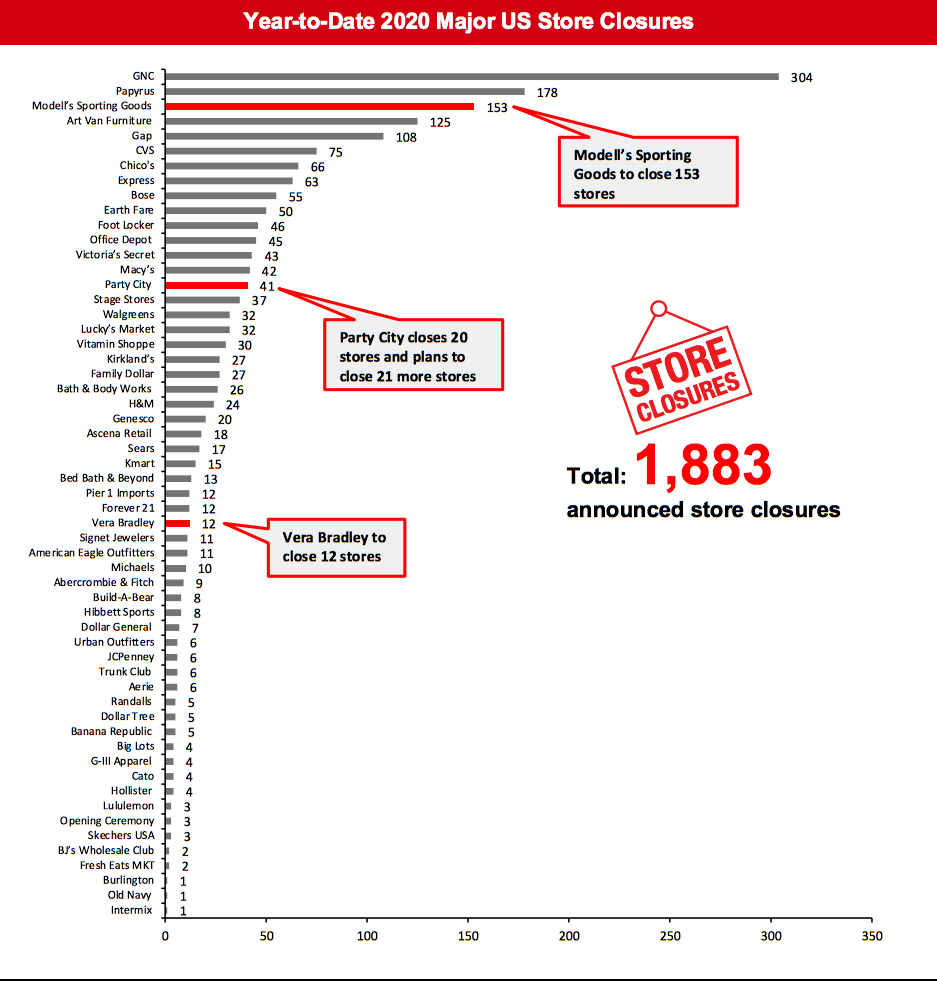

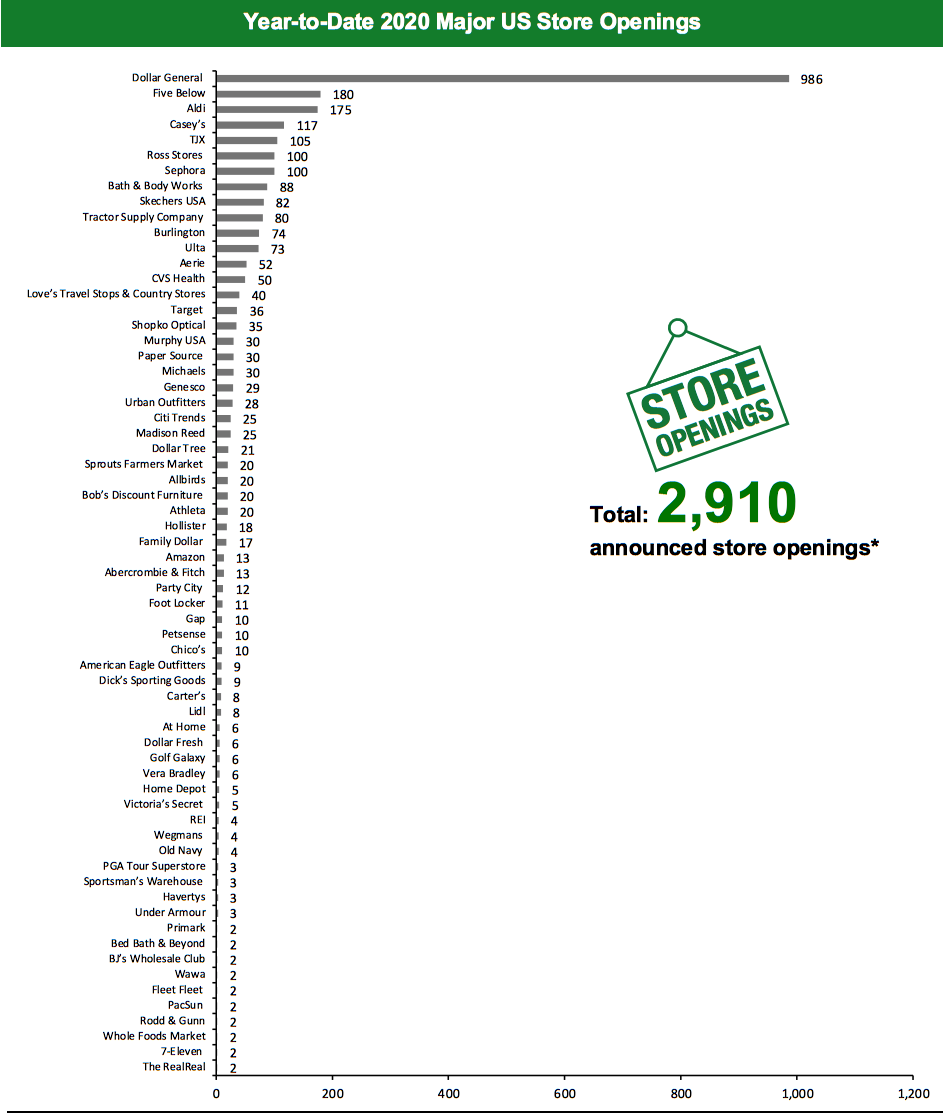

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,883 planned store closures and 2,910 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Banana Republic, Dollar General, Gap, Genesco, Intermix, Michaels, Old Navy, Party City, Ulta Beauty and Vera Bradley, and this has changed our 2019 US closure count to 9,548. We revised our 2019 openings count for Athleta, Banana Republic, Dollar General, Gap, Genesco, Michaels, Old Navy, Ulta Beauty and Vera Bradley, and this has changed our 2019 US openings count to 4,548.What Is Happening This Week in the US

Modell’s Sporting Goods Files for Chapter 11 Bankruptcy Modell’s Sporting Goods filed for Chapter 11 bankruptcy protection on March 11, 2020, with plans to close its 134 stores in the US. The retailer commenced liquidation sales at all stores on March 13, 2020. Company CEO Mitchell Modell stated that the return from liquidation of the first 19 stores (announced last month) managed by Tiger Capital Group has been “beyond spectacular.” Neiman Marcus To Close the Majority of its Last Call Stores Luxury department store chain Neiman Marcus announced on March 11, 2020 that it plans to close the majority of its Last Call off-price stores by the first quarter of fiscal year 2021 ending October 2020. The closures are part of the retailer’s plan to focus on full-price selling and grow its luxury customer base. Select Last Call stores will remain open to sell excess inventory from Neiman Marcus, according to a company press release. Neiman Marcus currently operates 22 Last Call stores, according to CNN.Quarterly Store Openings/Closures Settlement

Dollar General To Open 1,000 New Stores Dollar General has confirmed plans to open 1,000 new stores, remodel 1,500 and relocate 20 stores in fiscal year 2020, ending January 29, 2021. The retailer reported that it opened 975 stores and closed 67 stores in fiscal year 2019, ended January 31, 2020. Dollar General operated 16,278 stores, as of January 31, 2020. Gap Inc. Announces Plans To Close 170 Gap Stores and Open 20 Athleta Stores Clothing and accessories retailer Gap Inc. has announced plans to close 170 Gap stores globally and open 20 Athleta stores in North America during fiscal year 2020, ending January 30, 2021. The retailer opened 189 stores globally, including 29 Athleta stores in North America, in fiscal year 2019 ended February 1, 2020. It closed 177 stores globally, including 87 Gap stores in North America, in fiscal year 2019. Genesco To Open 32 Stores and Close 21 Specialty retailer Genesco has announced plans to open 32 stores and close 21 stores across Johnston & Murphy, Journeys and Schuh banners in fiscal year 2021, ending January 30. The retailer reported that it closed 15 and opened three stores during the fourth quarter of fiscal year 2020, ended February 1. Genesco operated 1,480 stores, as of February 1, 2020. The Michaels Companies Plans To Open 45 Michaels Stores and Close 10 Arts and crafts retailer The Michaels Companies has announced plans to open approximately 45 Michaels stores (including 16 relocations) and close 10 stores during fiscal year 2020, ending January 2021. The retailer reported that it opened 21 Michaels stores and closed five during fiscal year 2019, ended February 1, 2020. Part City Plans To Close 21 Stores and Open 12 Party supplies retailer Party City has announced plans to close 21 stores and open 12 in 2020. The retailer reported that it closed 20 stores in January 2020 and 35 stores in 2019. It also reported that it opened five stores in 2019. Party City operates 777 stores in the US, as of December 31, 2019. Ulta Beauty To Open 75 Net New Stores Beauty retailer Ulta Beauty has announced plans to open 75 net new stores, remodel or relocate 15 and execute 42 store refreshes in fiscal year 2020, ending January 2021. The retailer opened 86 and closed six stores in fiscal year 2019, ended February 1, 2020. The retailer operated 1,254 stores across the US, as of February 1, 2020. Vera Bradley To Close 12 Stores and Open Six Designer handbag and luggage retailer Vera Bradley has announced plans to close 12 full-line stores and open six new factory stores in fiscal year 2021, ending January 30. The retailer reported that it closed 11 underperforming full-line stores and opened six new factory stores in fiscal year 2020, ended February 1. Vera Bradley operated 88 full-line stores and 63 factory stores, as of February 1, 2020.Non-Store-Closure News

Party City Appoints Brad Weston as CEO Party City has appointed Brad Weston as its new CEO. Weston has served as President of Party City Holdings and CEO of Party City Retail Group. He has now also been nominated to the retailer’s board of directors. Weston succeeds Jim Harrison, who will be transitioning to the role of Vice Chairman, effective April 1, 2020.Temporary Store Closures Caused by Coronavirus

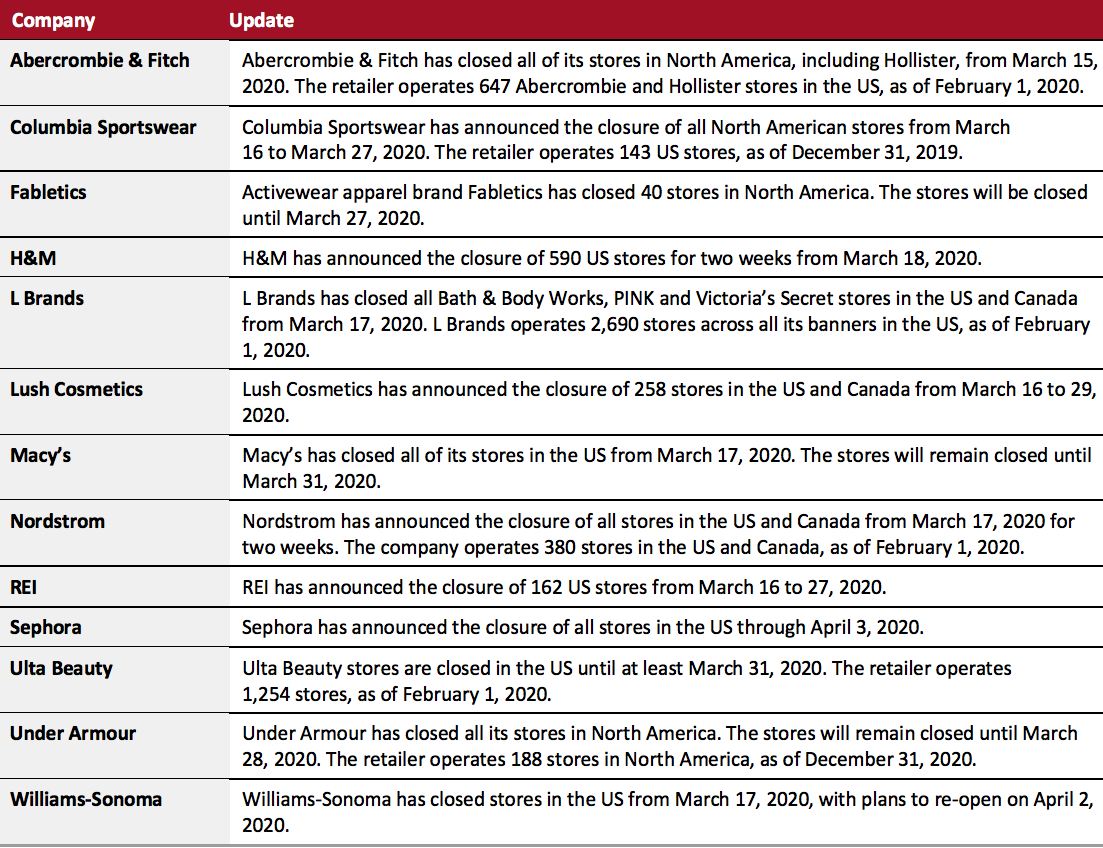

This section covers temporary store closures in the US that various retailers have announced as a result of the coronavirus outbreak. Some of the major retailers that have temporarily closed stores in the US this week are listed below.

Coresight Research insight: Many of the announced closures are ostensibly for 10 days to two weeks. We doubt that there will be widespread reopenings in early April, with the severe restrictions imposed by the outbreak likely to last several weeks or even months. Shoppers think so too: A new Coresight Research consumer survey, undertaken on March 17–18, found that only 7% of respondents think the serious disruption will last less than one month, and a further 32% think it will last one to two months; the remainder think it will last longer than two months (including 9% who don’t know).

Furthermore, we expect some retailers, including well-known names, to never reopen their doors. The enforced closures will hit poorly capitalized retailers, those already pinched badly by structural shifts and company-specific weaknesses, and those which are unable to translate whatever remaining consumer demand there is into sales on their websites. In short, we expect the outbreak to ruthlessly trim US retail.

[caption id="attachment_105990" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Adidas, Allbirds, Canada Goose, Casper, Chico’s, CVS, Everlane, Fabletics, Foot Locker, Glossier, Guess, J.Crew, Levi’s, Lululemon Athletica, Madewell, Neighborhood Goods, Nike, Outdoor Voices, Patagonia, Ralph Lauren, Reformation, Steve Madden, Uniqlo, VF Corp and Warby Parker, among others, have also announced temporary closures in the US.

[caption id="attachment_105705" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Adidas, Allbirds, Canada Goose, Casper, Chico’s, CVS, Everlane, Fabletics, Foot Locker, Glossier, Guess, J.Crew, Levi’s, Lululemon Athletica, Madewell, Neighborhood Goods, Nike, Outdoor Voices, Patagonia, Ralph Lauren, Reformation, Steve Madden, Uniqlo, VF Corp and Warby Parker, among others, have also announced temporary closures in the US.

[caption id="attachment_105705" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Banana Republic, Build-A-Bear, Chico’s, Gap, Genesco, GNC, Intermix, Michaels, Old Navy and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_105706" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Athleta, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Athleta, Genesco, Michaels, Old Navy, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Ulta Beauty openings refer to net new openings. *Total includes a small number of retailers that each announced fewer than 2 store openings and are not included in the chart

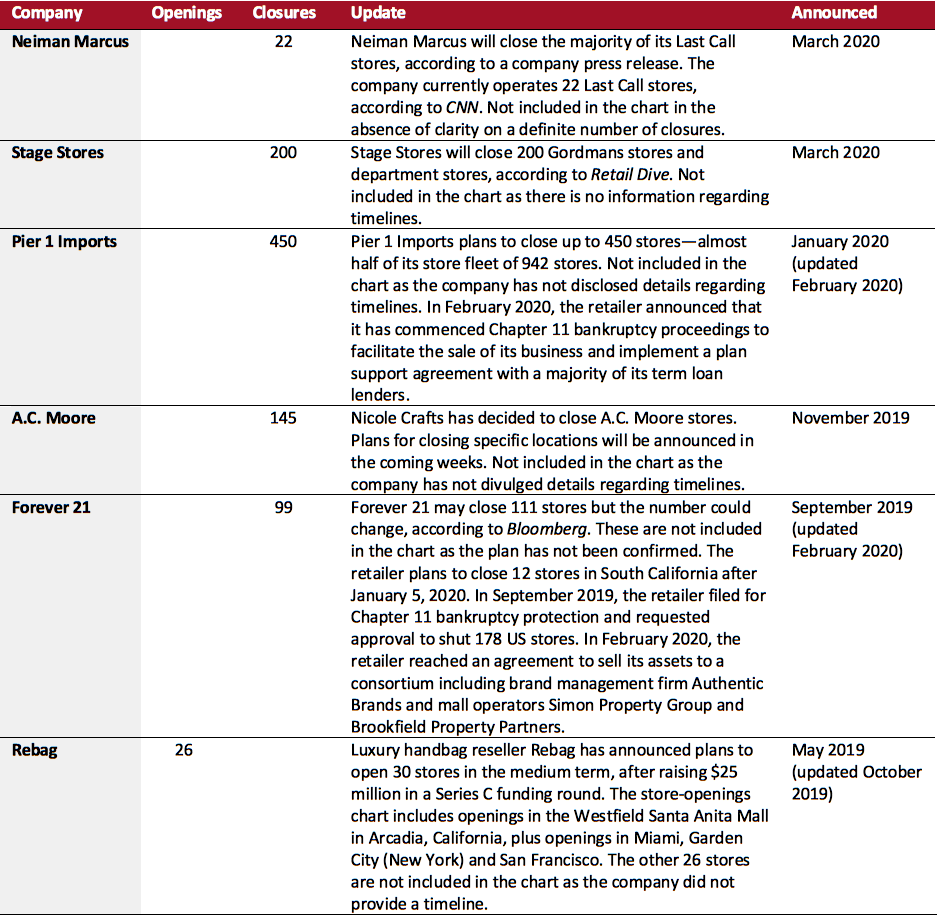

Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_105707" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105708" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105708" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Foot Locker, Gap, Genesco, Michaels, Old Navy, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction, Intermix and SIX:02 banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Banana Republic, Foot Locker, Gap, Genesco, Michaels, Old Navy, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 20 store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_105709" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Dufry AG, Foot Locker, Gap, Genesco, Michaels, Old Navy, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Athleta, Banana Republic, Dufry AG, Foot Locker, Gap, Genesco, Michaels, Old Navy, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 13 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

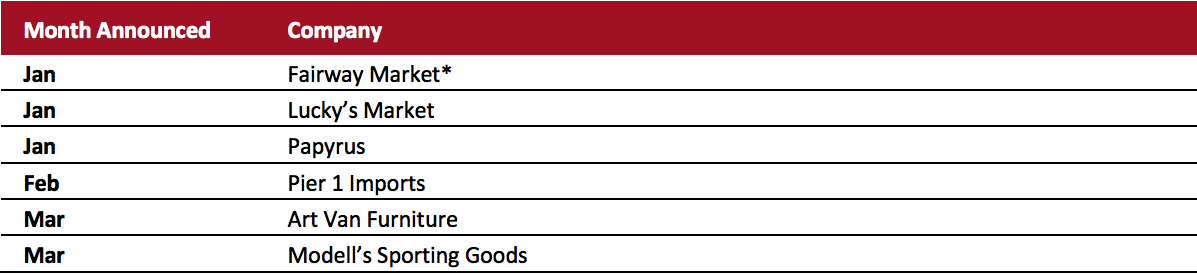

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_105710" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

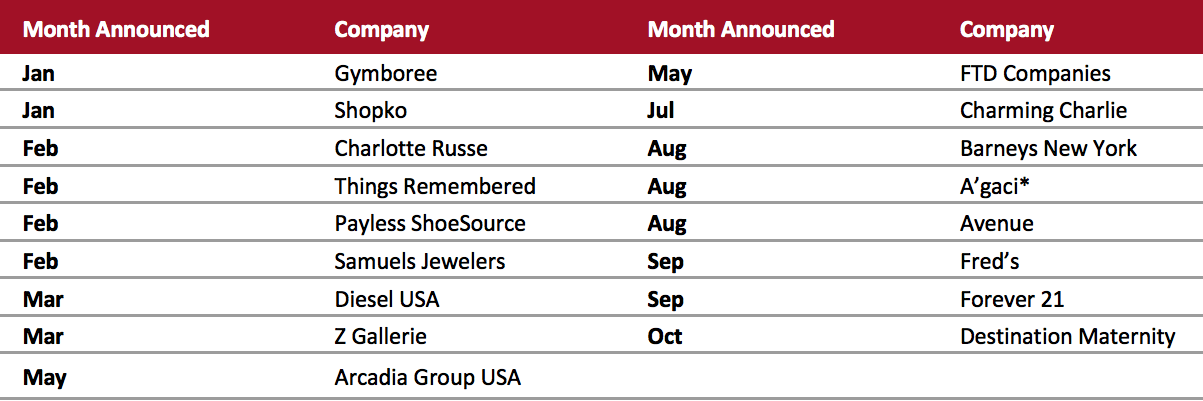

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_105711" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research

[/caption]

The UK

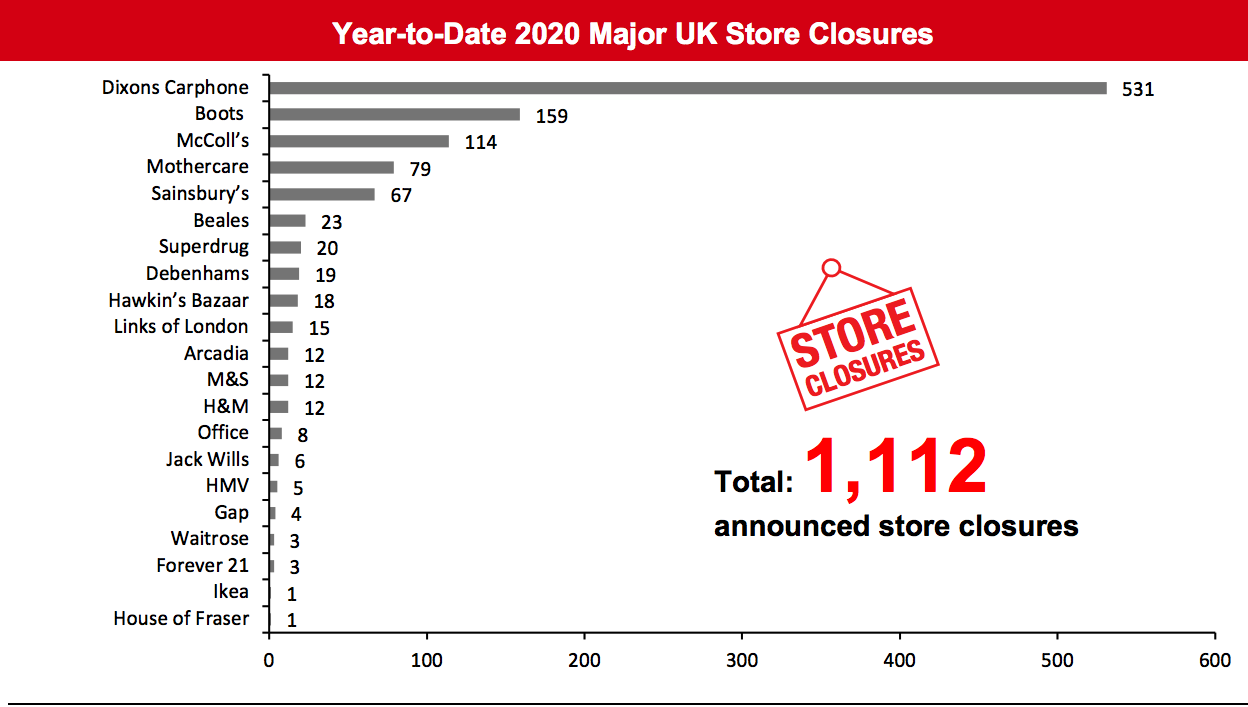

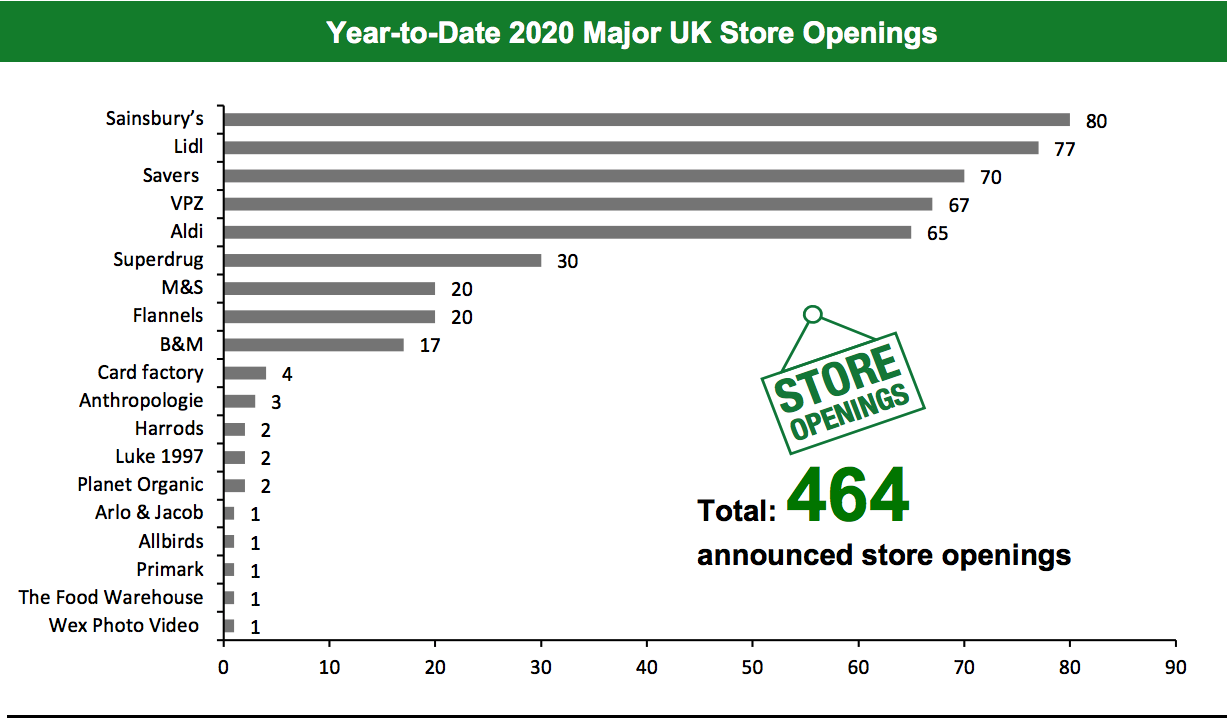

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 1,112 store closures and 464 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Beales To Shut Two Weeks Earlier Than Planned Department store retailer Beales has announced plans to shut its remaining 11 stores two weeks earlier than previously planned, owing to the coronavirus crisis. The stores set for closure are located in Beccles, Diss, Kendal and Southport among other locations. Beales operated 23 stores before it collapsed into administration in January this year. Dixons Carphone To Shut Carphone Warehouse Stores Dixons Carphone has announced plans to close 531 Carphone Warehouse standalone stores on April 3, 2020 in the UK. The retailer intends to shift its focus by selling mobile phones through its shop-in-shops at Currys PC World stores and online. Laura Ashley Collapses into Administration Fashion and homeware retailer Laura Ashley has collapsed into administration, with almost 2,700 jobs facing uncertainty. The retailer stated that the coronavirus outbreak had a “significant” impact on its business. Laura Ashley has hired PricewaterhouseCoopers (PwC) as administrators. The retailer operates 150 stores in the UK.Non-Store-Closure News

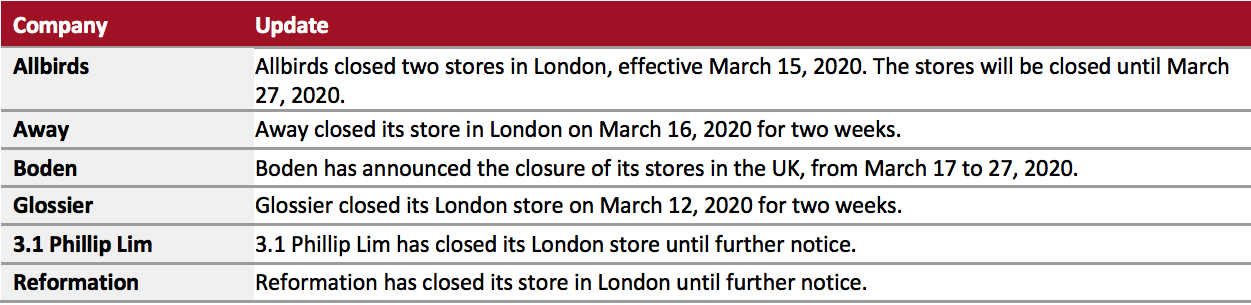

Amazon Appoints New UK Finance Chief Amazon has appointed Jeremy Martin as its new UK Finance Chief, according to The Telegraph. Prior to his current role, Martin was the European Finance Chief for Amazon’s fashion business. Martin succeeds Jeff Stauber, who has been appointed as the Finance Leader for Worldwide Amazon Logistics.Coronavirus Briefing: Temporary Store Closures Caused by Coronavirus

This section covers temporary store closures in the UK that various retailers have announced as a result of the coronavirus outbreak. Some of the retailers that have temporarily closed stores in the UK this week are listed below: [caption id="attachment_105712" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105713" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

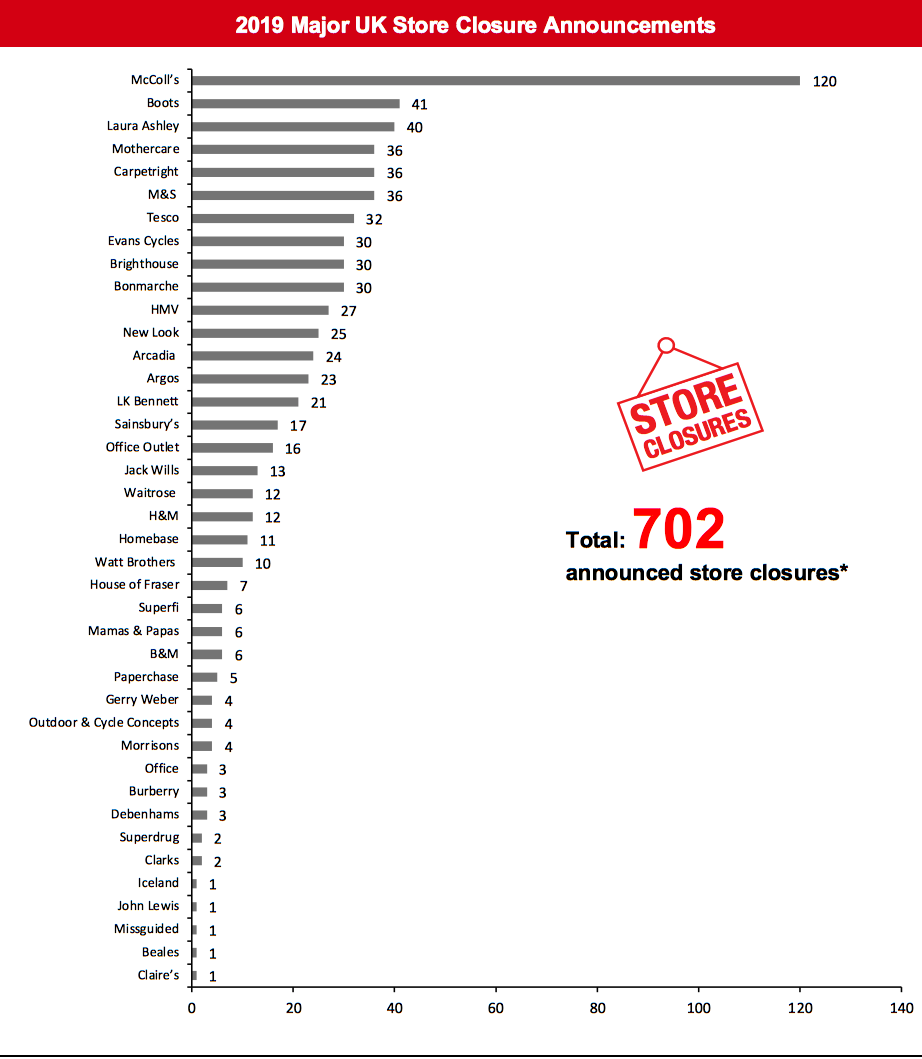

[caption id="attachment_105713" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_105714" align="aligncenter" width="700"]

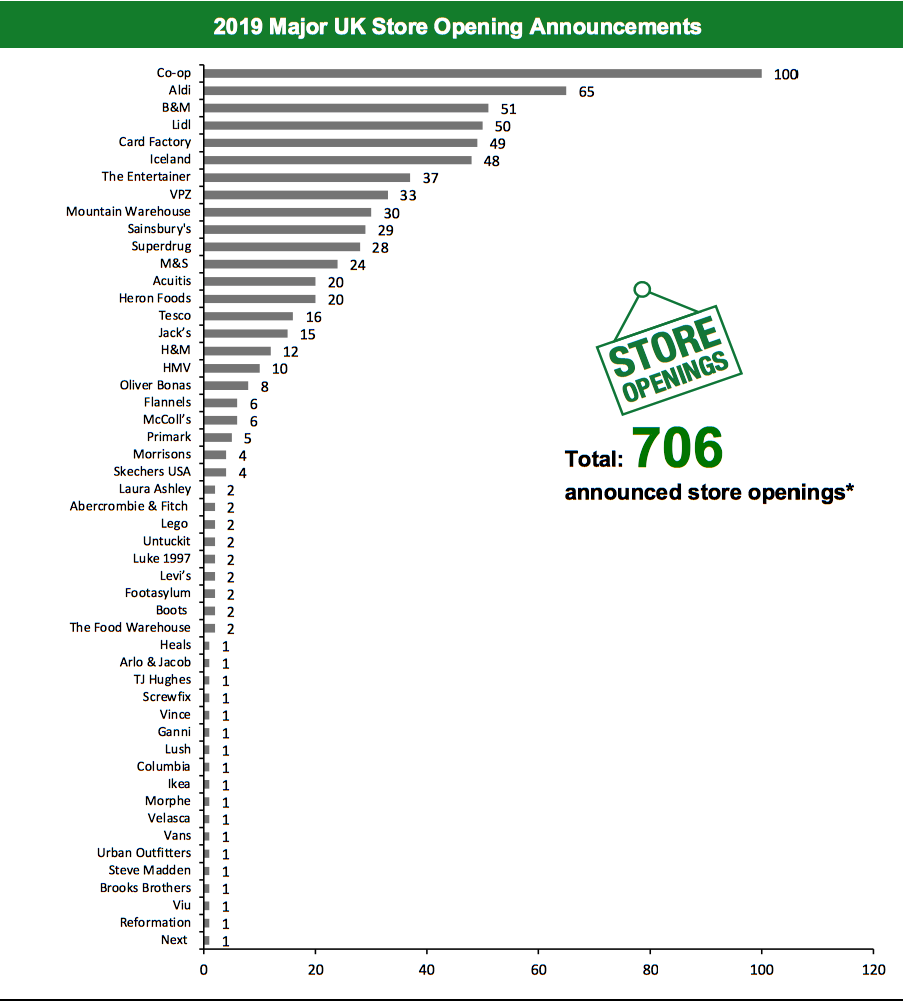

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

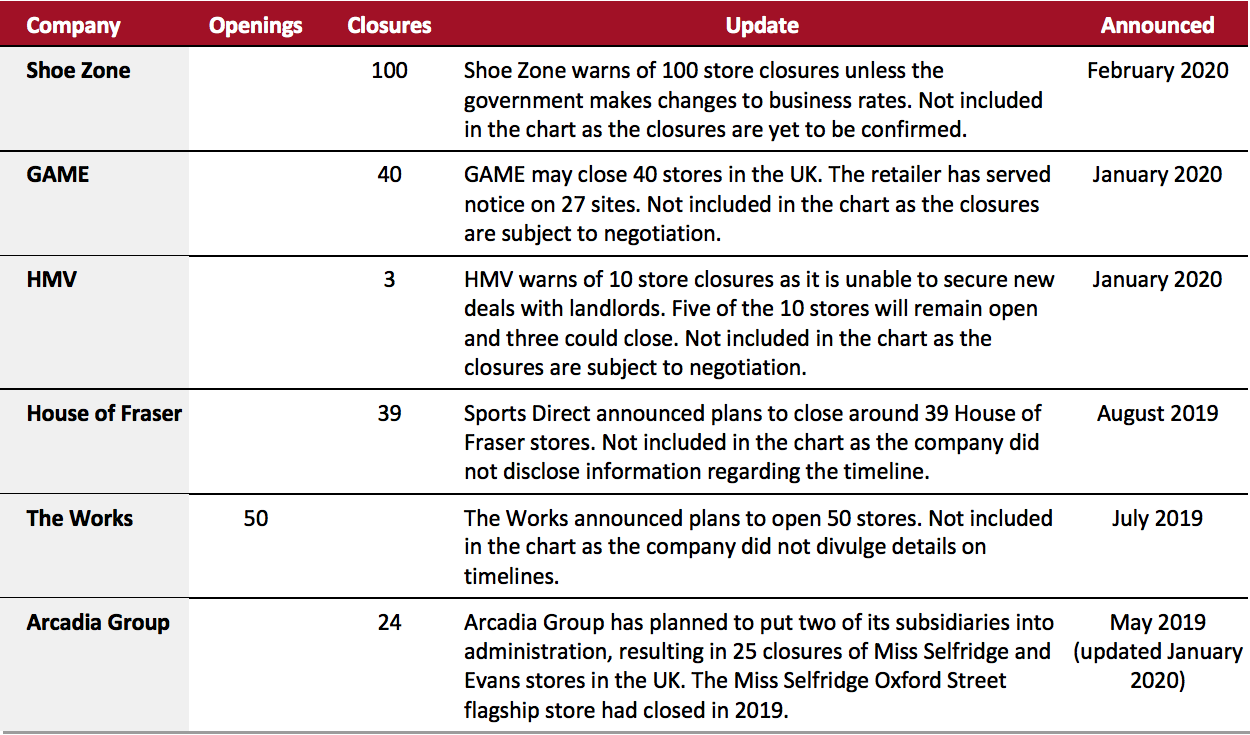

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_105715" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105716" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105716" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_105717" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.