Nitheesh NH

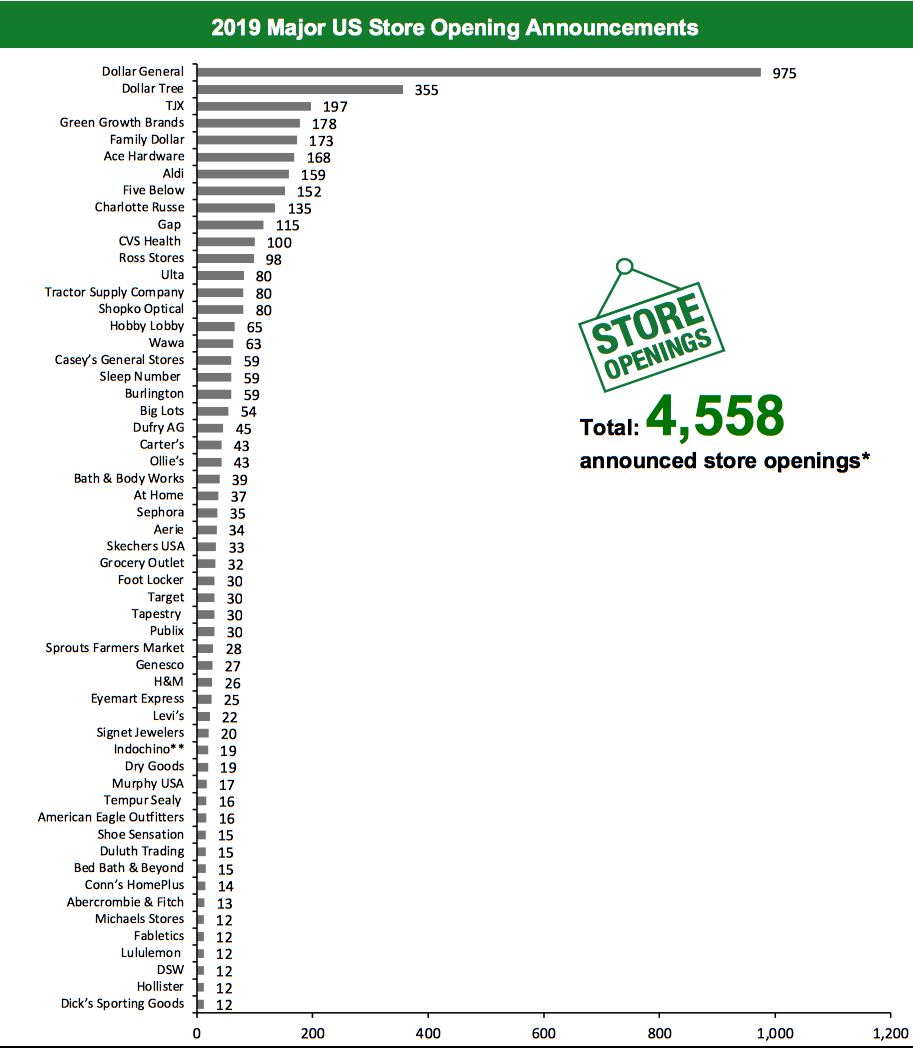

The US

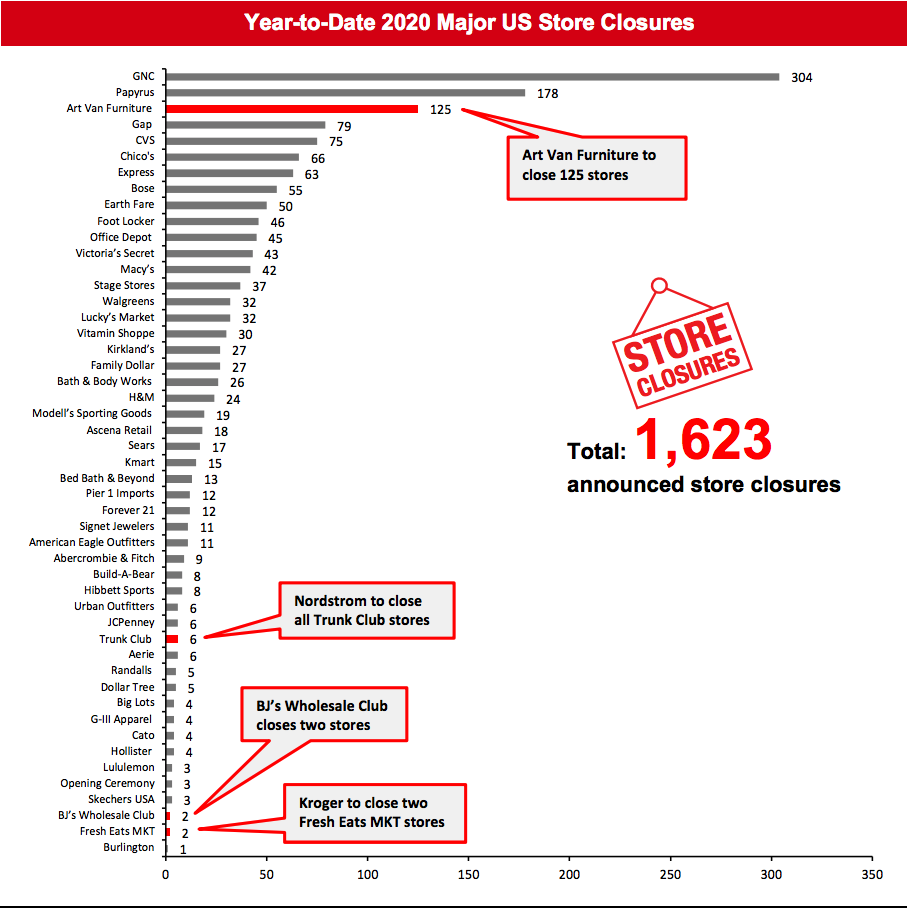

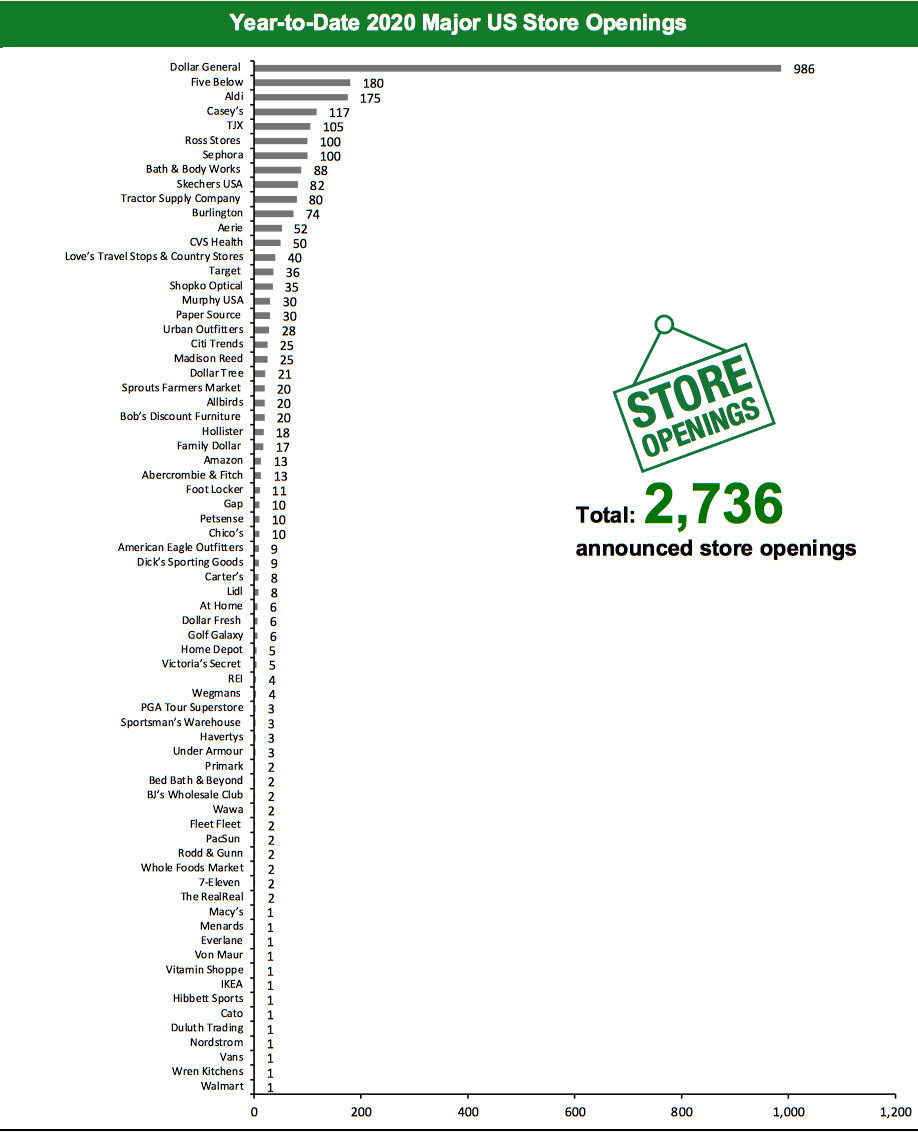

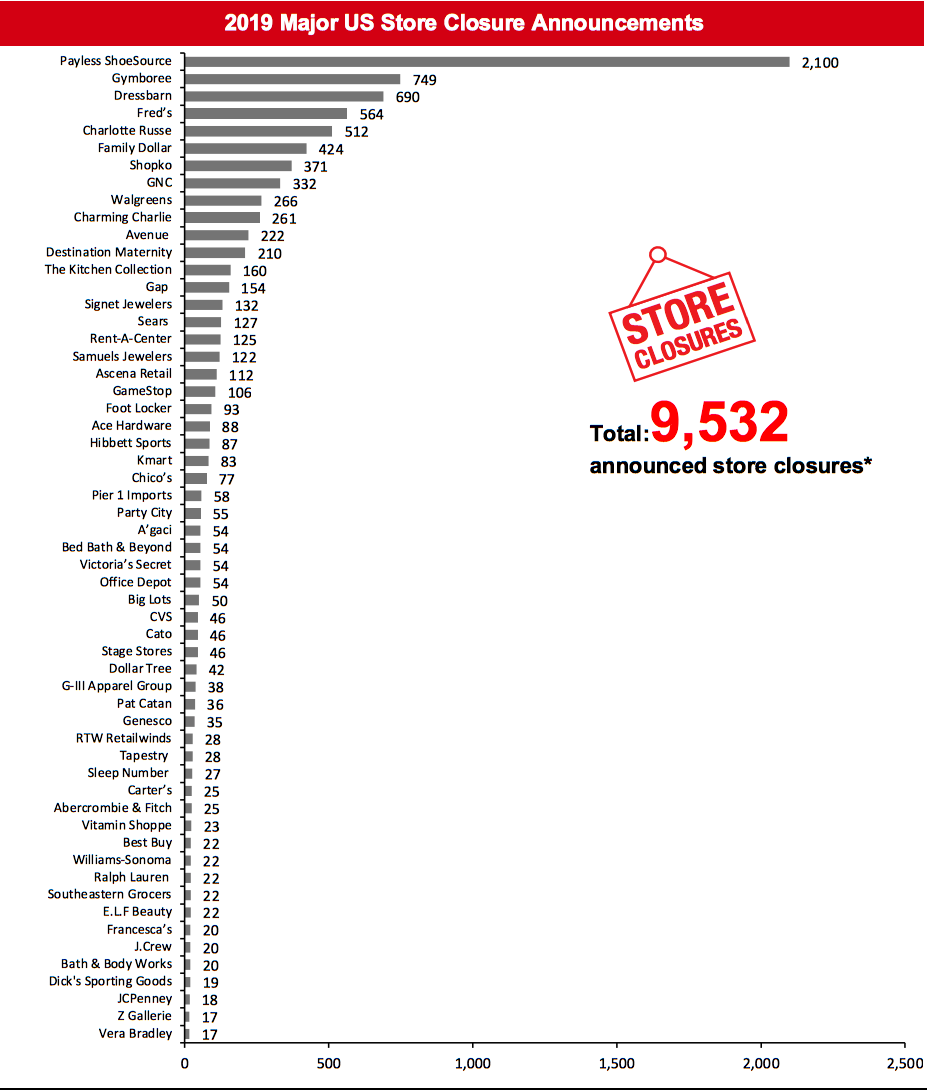

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,623 planned store closures and 2,736 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Abercrombie & Fitch, Aerie, American Eagle Outfitters, Ascena Retail Group, Burlington, Dick’s Sporting Goods, Dollar Tree, Dressbarn, Family Dollar and Hollister, and this has changed our 2019 US closure count to 9,532. We revised our 2019 openings count for Abercrombie & Fitch, Aerie, American Eagle Outfitters, Ascena Retail, Burlington, Dick’s Sporting Goods, Dollar Tree, Family Dollar and Hollister, and this has changed our 2019 US openings count to 4,558.What Is Happening This Week in the US

Art Van Furniture Files for Chapter 11 Bankruptcy Furniture and mattress retailer Art Van Furniture filed for Chapter 11 bankruptcy protection on March 9, 2020. The retailer intends to sell approximately 44 stores and two distribution centers operating under Wolf and Levin banners, and close its remaining 125 store locations through a going-out-of-business sale process. The retailer has commenced liquidation sales, and it expects to complete the store closing sales within six to eight weeks. Art Van Furniture operates 169 stores, comprising 92 furniture and mattress showrooms and 77 freestanding mattress and specialty locations. Coresight Research insight: Art Van Furniture has not been able to cope effectively with e-commerce disruption in the sector and increased competition, which has led to reduced foot traffic and negative year-over-year sales growth. Moreover, the retailer’s EVP and CFO David Ladd stated that the company incurred an $8 million tariff bill last year, which hit the company hard. Kroger Closes Two Fresh Eats MKT Stores Kroger closed its two Fresh Eats MKT concept grocery stores in Columbus, Ohio on March 4, 2020. According to a company spokesperson, the decision to wind down the concept stores followed a portfolio review process. Kroger launched its first Fresh Eats MKT concept store in May 2017. Nordstrom To Close All Trunk Club Stores Nordstrom has announced plans to close all six Trunk Club stores and absorb the locations within Nordstrom department stores. The stores earmarked for closure are located in Boston, Chicago, Dallas, Los Angeles, New York and Washington, D.C. In Nordstrom’s fourth-quarter 2019 earnings call, the company stated that Trunk Club services will be fully integrated into Nordstrom stores in order to “gain efficiencies.”Quarterly Store Openings/Closures Settlement

Abercrombie & Fitch To Open 40 Stores Abercrombie & Fitch has announced plans to open 40 stores globally in fiscal year 2020, ending January 2021. The retailer closed 29 Abercrombie and 14 Hollister stores in the US in fiscal year 2019, ended February 1, 2020. It opened 15 Abercrombie and 12 Hollister stores in the US during the same period. We have estimated the openings and closures count for Abercrombie & Fitch and Hollister banners based on the existing proportion of stores in the US. American Eagle Outfitters To Open 60 to 70 Aerie Stores Lifestyle clothing and accessories retailer American Eagle Outfitters has announced plans to open 60–70 Aerie locations in fiscal year 2020, ending January 2021. Of the new stores, 55–60 will be standalone stores and the remaining will be shop-in-shops. The retailer also announced plans to open 10–15 and close 10–20 stores under the American Eagle Outfitters banner in fiscal year 2020. The retailer reported that it opened 37 Aerie standalone stores and closed four in fiscal year 2019, ended February 1, 2020. We have estimated the openings and closures count for the American Eagle Outfitters banner based on the existing proportion of stores in the US. Ascena Retail Group Completes Wind-Down of Dressbarn, Closes 55 Stores Clothing retailer Ascena Retail Group has reported that it has completed the wind-down of its Dressbarn business and closed the remaining 544 Dressbarn stores by December 31, 2019. The retailer also reported that it closed 55 stores across the Ann Taylor, Catherines, Justice, Lane Bryant and LOFT banners, in the second quarter of fiscal year 2020, ended February 1. Ascena Retail operates 2,764 stores, as of February 1, 2020. BJ’s Wholesale To Open Two Stores Warehouse club chain BJ’s Wholesale Club has announced plans to open two clubs during the first half of 2020, in Chesterfield, Michigan and Pensacola, Florida. The retailer reported that it closed two clubs in New York and North Carolina during the fourth quarter of fiscal year 2019, ended February 1, 2020. Burlington Stores Plans To Open 80 New Stores; Shuts E-Commerce Site Off-price retailer Burlington Stores has announced plans to open 80 new stores and close or relocate 26 stores in fiscal year 2020, ending January 2021. The retailer also plans to shut down its e-commerce site in order to focus on its brick-and-mortar business. Burlington Stores reported that it opened one net new store and closed two stores during the fourth quarter of fiscal year 2019, ended February 1, 2020. The retailer operates 727 stores, as of February 1, 2020. Dick’s Sporting Goods Plans To Open 15 Stores Dick’s Sporting Goods plans to open nine Dick’s Sporting Goods and six Golf Galaxy stores in 2020. It also plans to relocate 14 Dick’s Sporting Goods stores and three Golf Galaxy stores this year. The retailer closed 21 stores and opened 12 stores in fiscal year 2019, ended February 1, 2020. The retailer operates 850 stores, as of February 1, 2020. Dollar Tree Plans To Renovate 1,250 Family Dollar Stores; Closes 423 Family Dollar Stores Dollar Tree has announced plans to renovate 1,250 Family Dollar stores to its H2 format in fiscal year 2020, ending January 2021. The company reported that it closed 423 Family Dollar stores and 44 Dollar Tree stores and opened 348 Dollar Tree stores and 170 Family Dollar stores in fiscal year 2019, ended February 1, 2020. Dollar Tree had announced in March 2019 that it planned to close up to 390 underperforming stores in 2019, as a part of its store optimization program. Coresight Research insight: Discount remains the channel that is bucking the store-closure trend, benefitting from shoppers’ willingness to trade the convenience of e-commerce for value. Off-price (see Burlington, above) and dollar stores remain predominantly offline and off-mall, with infill opportunities supporting expansion.Non-Store-Closure News

Coach CEO To Depart Tapestry-owned Coach has announced that its CEO and Brand President Joshua Schulman will step down from his role. Tapestry Chairman and CEO Jide Zeitlin will succeed Schulman for the coming three years. Schulman joined Coach as Brand President in 2017. Prior to joining Coach, he had worked for Jimmy Choo and Gap. Gap Appoints Sonia Syngal as CEO Gap Inc. has appointed Sonia Syngal, CEO of Old Navy since 2016, as its CEO, effective March 23, 2020. She will also join the company’s Board of Directors. Prior to serving as Old Navy’s CEO, she was EVP of Global Supply Chain and Product Operations of Gap Inc. Syngal joined Gap Inc. in 2004 and has served in various key leadership roles, including Managing Director of the company’s Europe business. [caption id="attachment_105144" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel, Hollister and H&M are based on the existing proportion of stores in the US. Aerie, Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_105145" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Gap, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Abercrombie & Fitch, Aldi, Casey’s, Dollar General, Foot Locker, Gap, Hollister and H&M among others. Estimates for Abercrombie & Fitch, American Eagle Outfitters, Bed bath & Beyond, Foot Locker, Hollister and Home Depot are based on the existing proportion of stores in the US. Aerie, Gap, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners. Source: Company reports/Coresight Research[/caption]

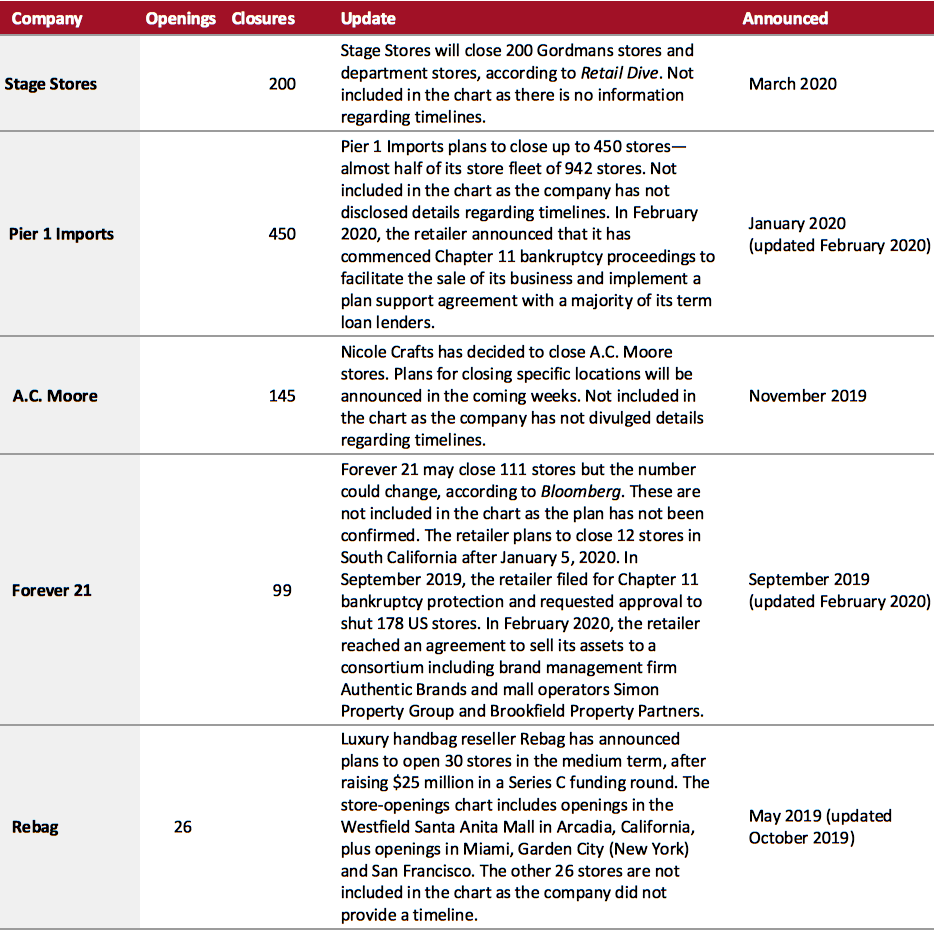

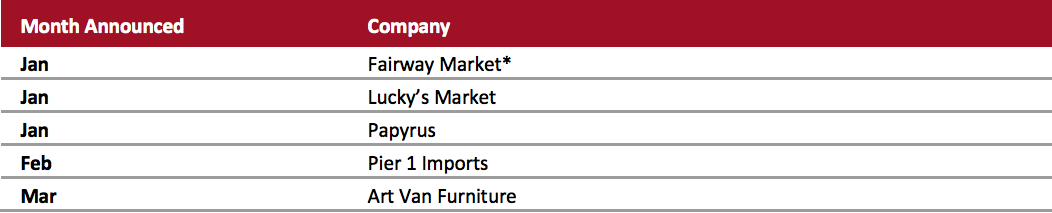

2020 Major US Uncharted Openings and Closures

The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_105146" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105147" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105147" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Foot Locker, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Foot Locker, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 16 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_105148" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Foot Locker, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Dick’s Sporting Goods includes Dick’s Sporting Goods and specialty concept banners. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Foot Locker, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 12 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_105149" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

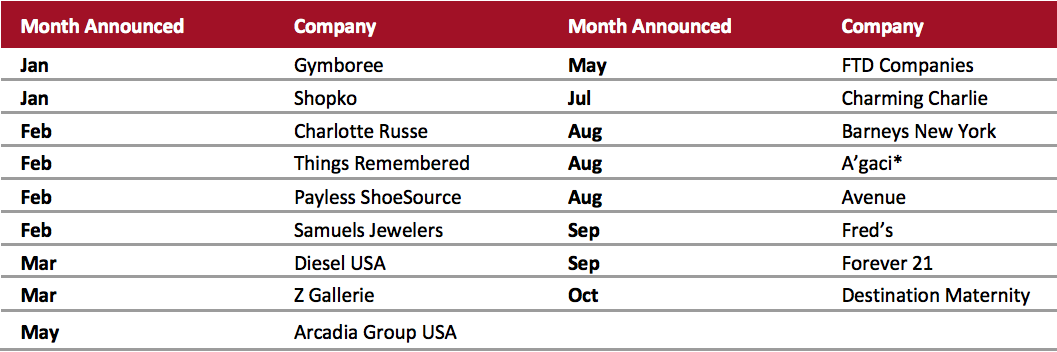

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_105150" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

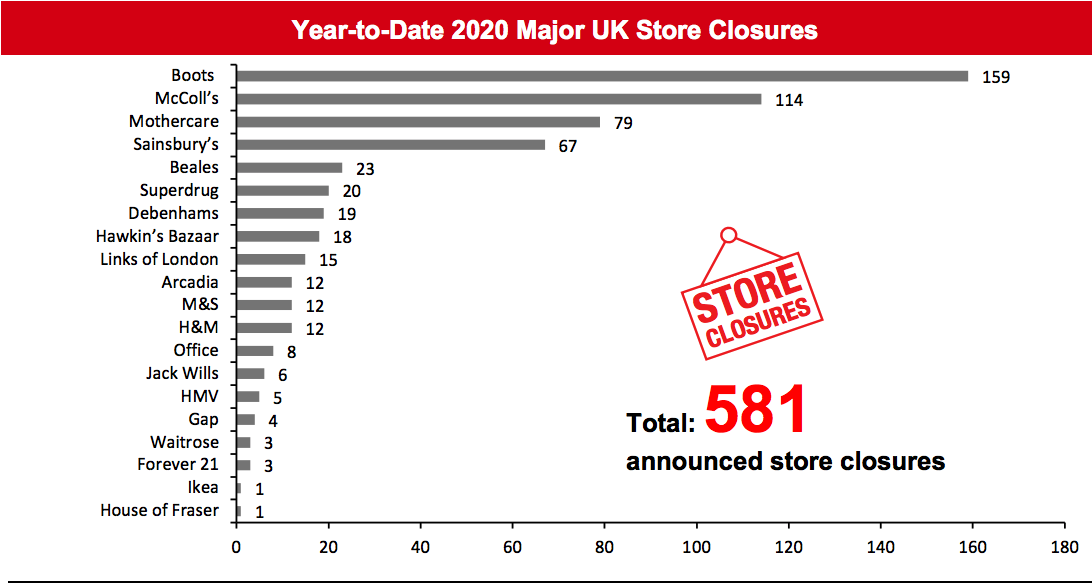

The UK

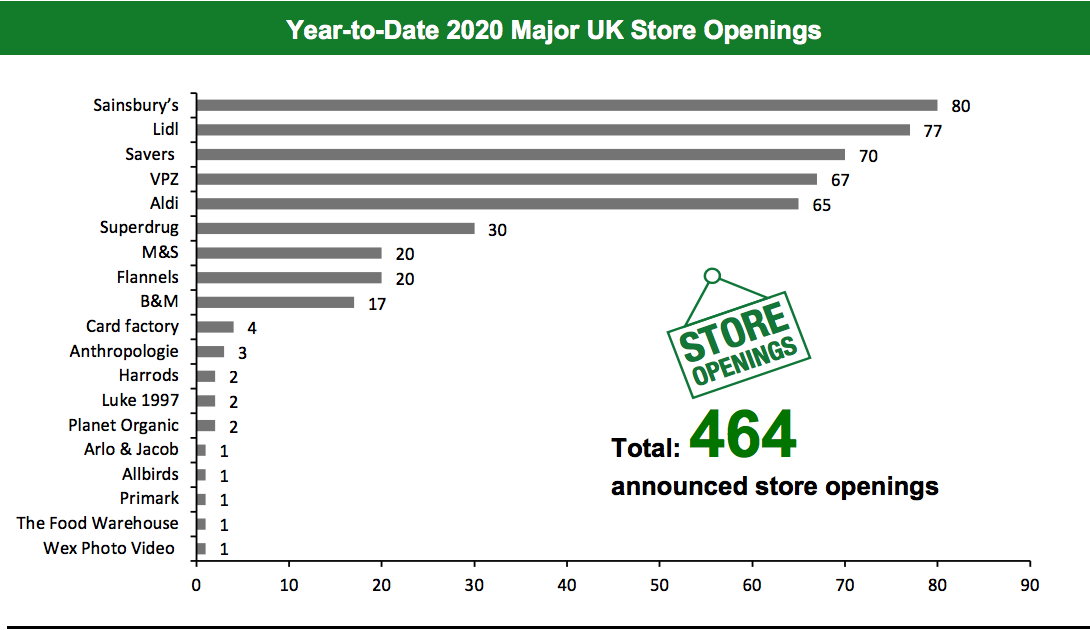

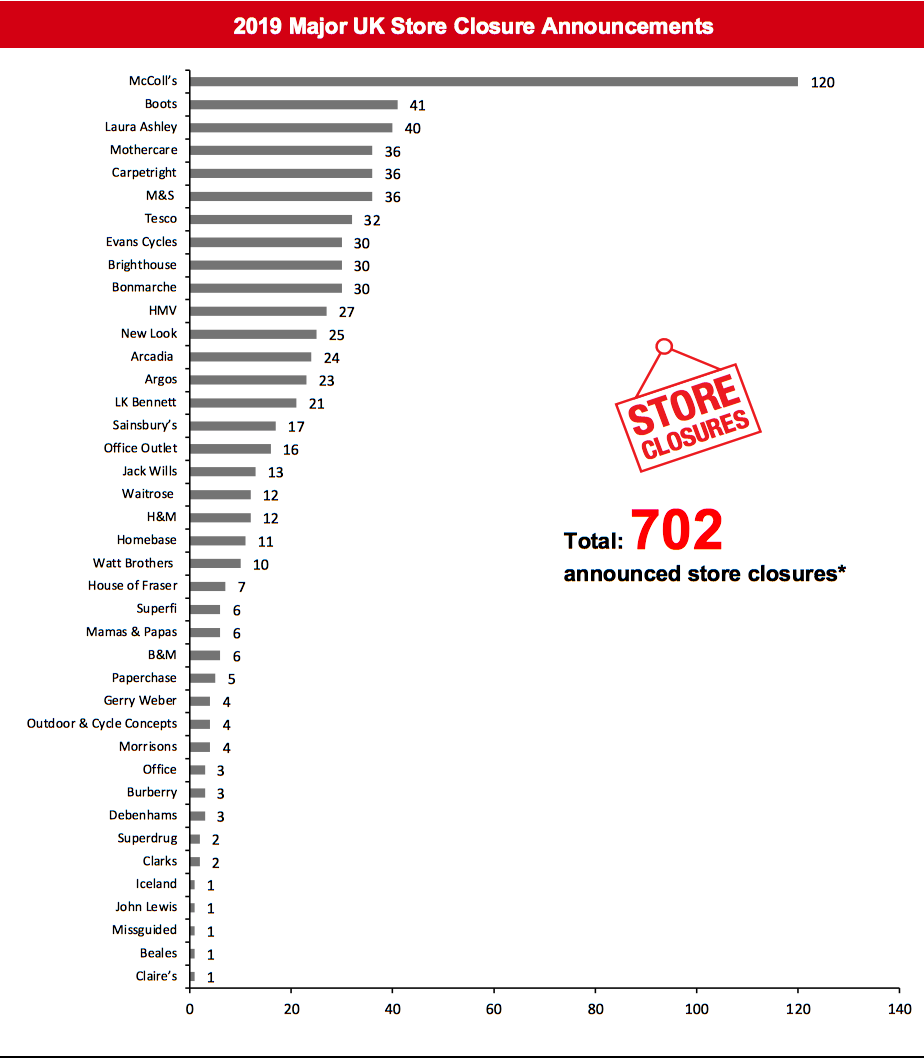

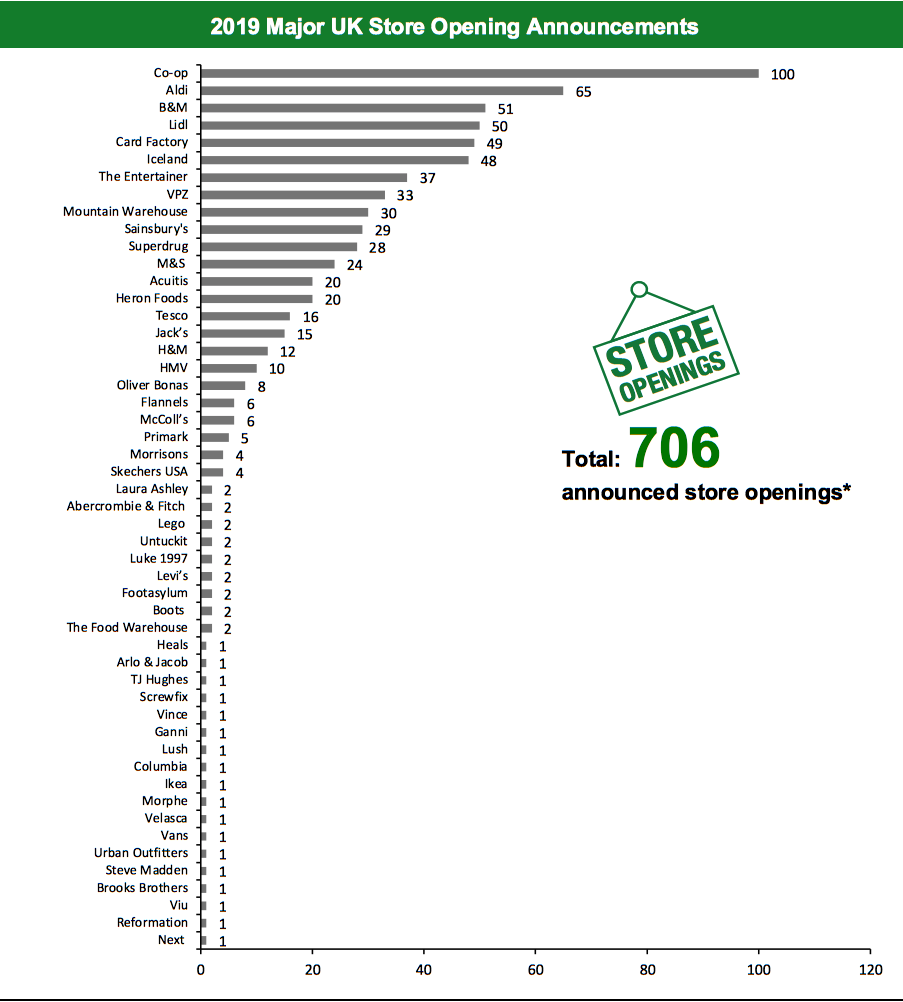

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 581 store closures and 464 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

John Lewis Partnership To Close Three Waitrose Stores John Lewis Partnership has announced plans to close three Waitrose grocery stores later this year. The stores slated for closure are located in Four Oaks, Helensburgh and Waterlooville. John Lewis Partnership’s new Chair Sharon White stated that the retailer has launched a strategic review of its store portfolio, under which it would look to “right size” its store portfolio by way of introducing new formats and locations, as well as implementing closures and repurposing and space reductions of existing stores.Non-Store-Closure News

ASOS Appoints New Chief People Officer Online fashion and cosmetic retailer ASOS has appointed Jo Butler as Chief People Officer, effective April 21, 2020. She will join the retailer’s executive committee and will report to CEO Nick Beighton. Butler has worked with companies including fast-food company Itsu, facility management company Mitie and supermarket chain Sainsbury’s. [caption id="attachment_105151" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_105152" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

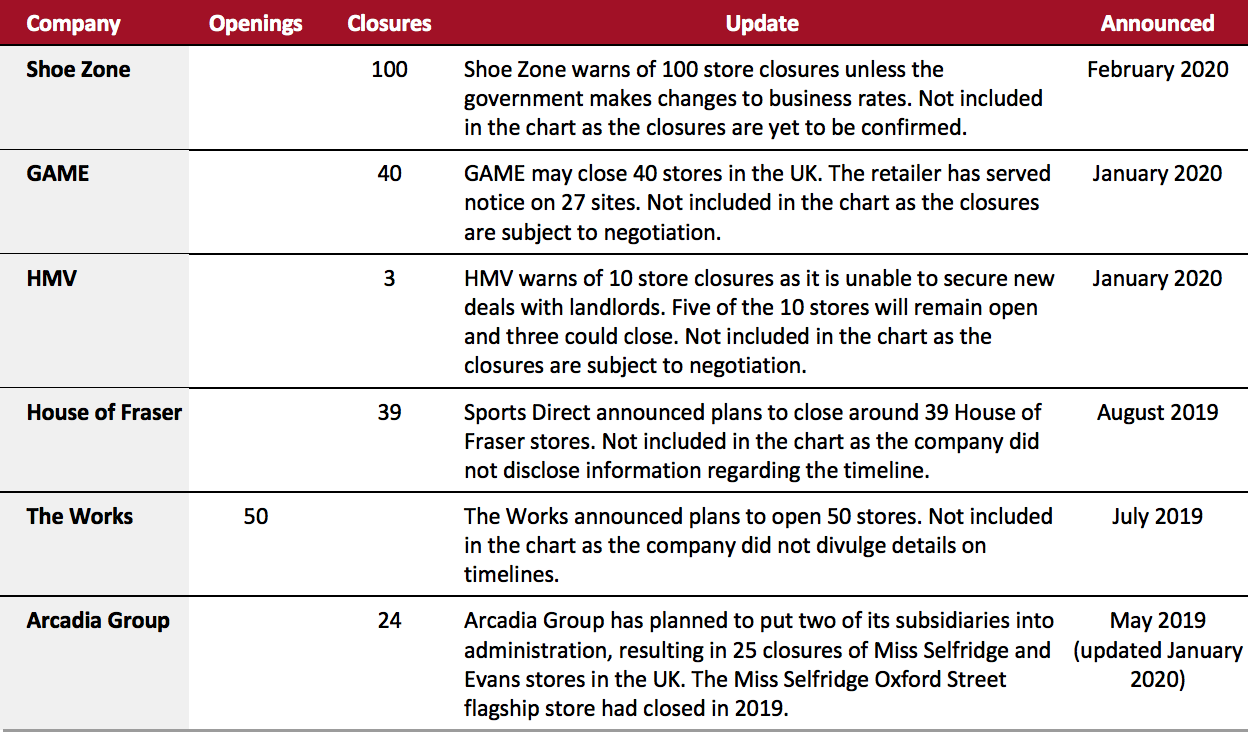

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_105153" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105154" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_105154" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_105155" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.