Nitheesh NH

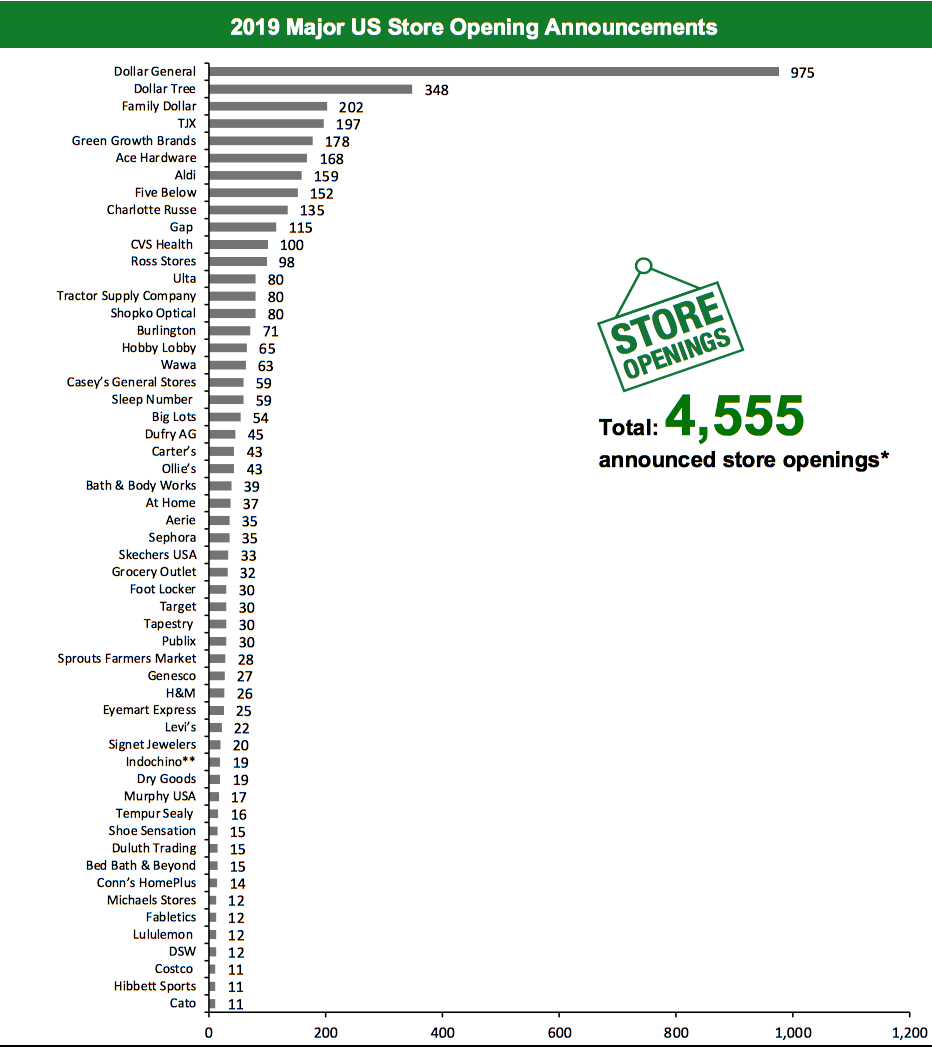

The US

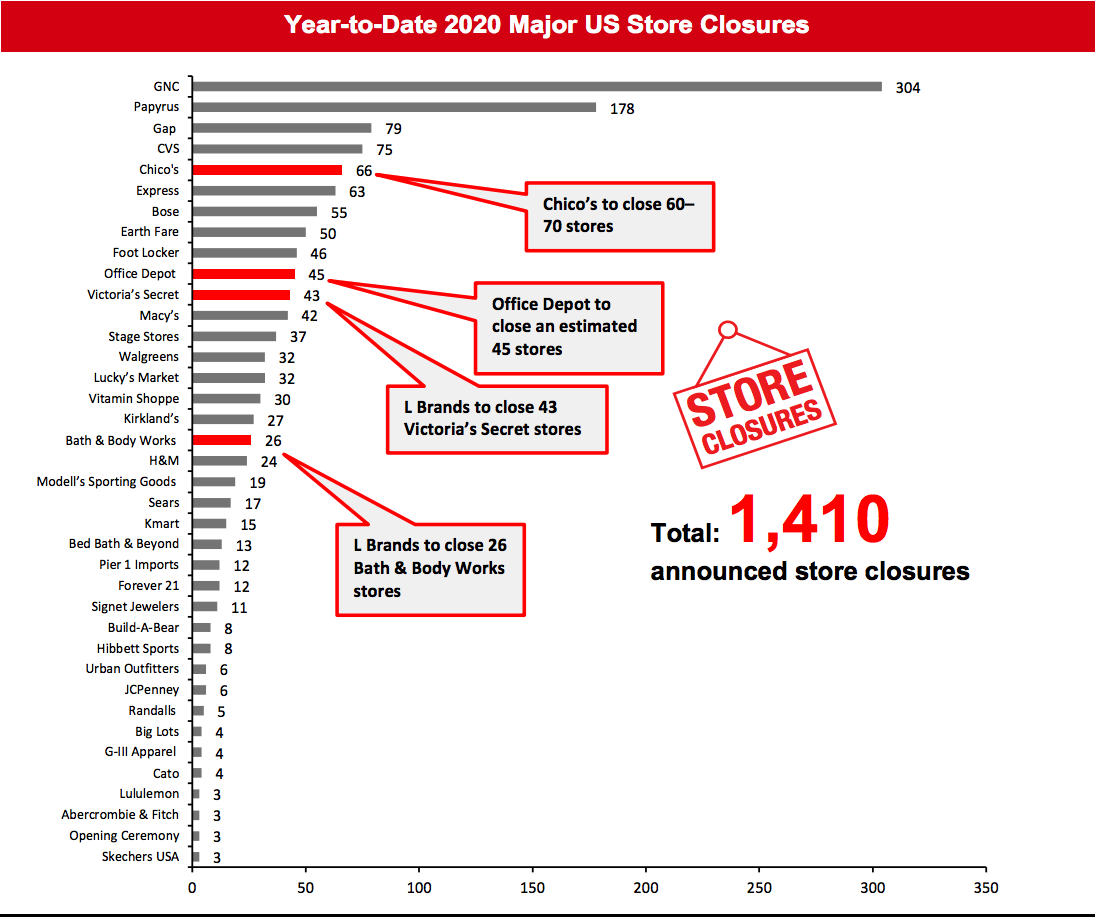

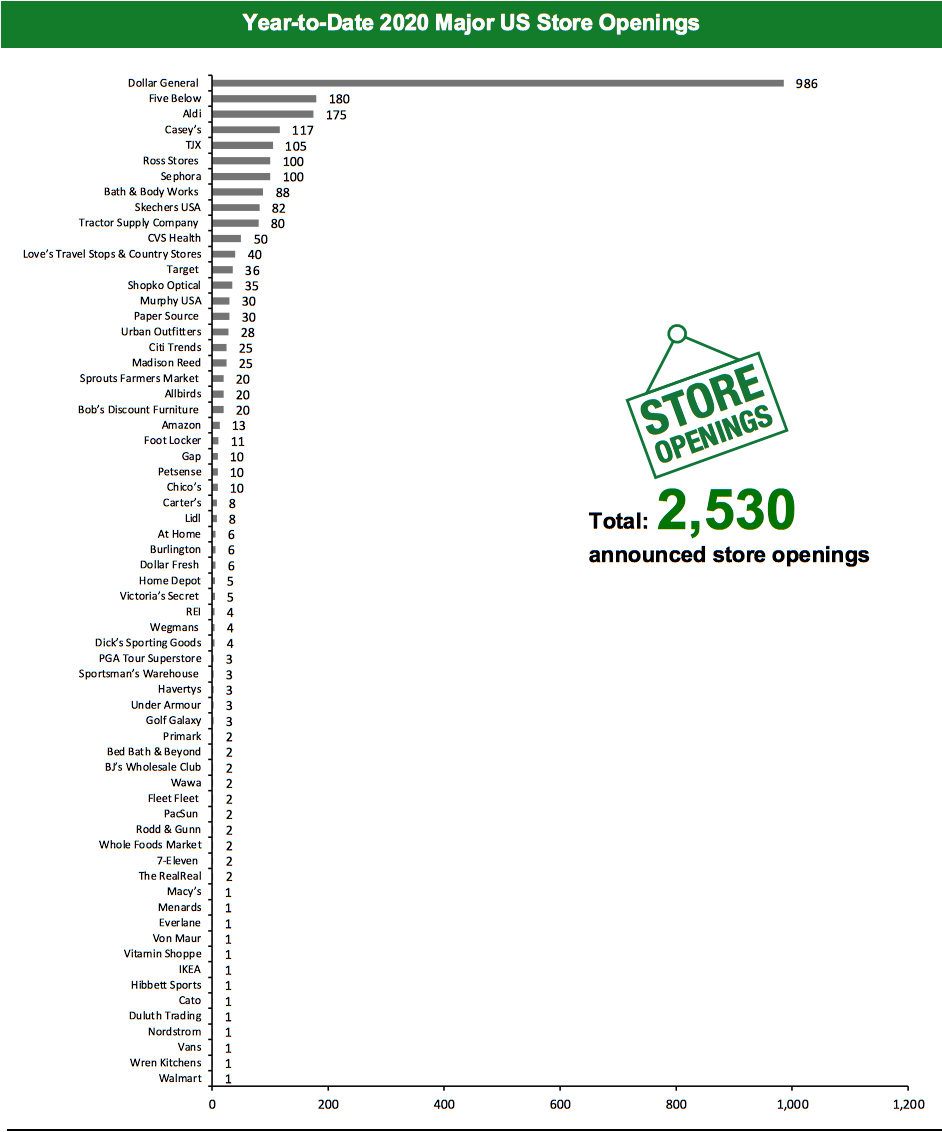

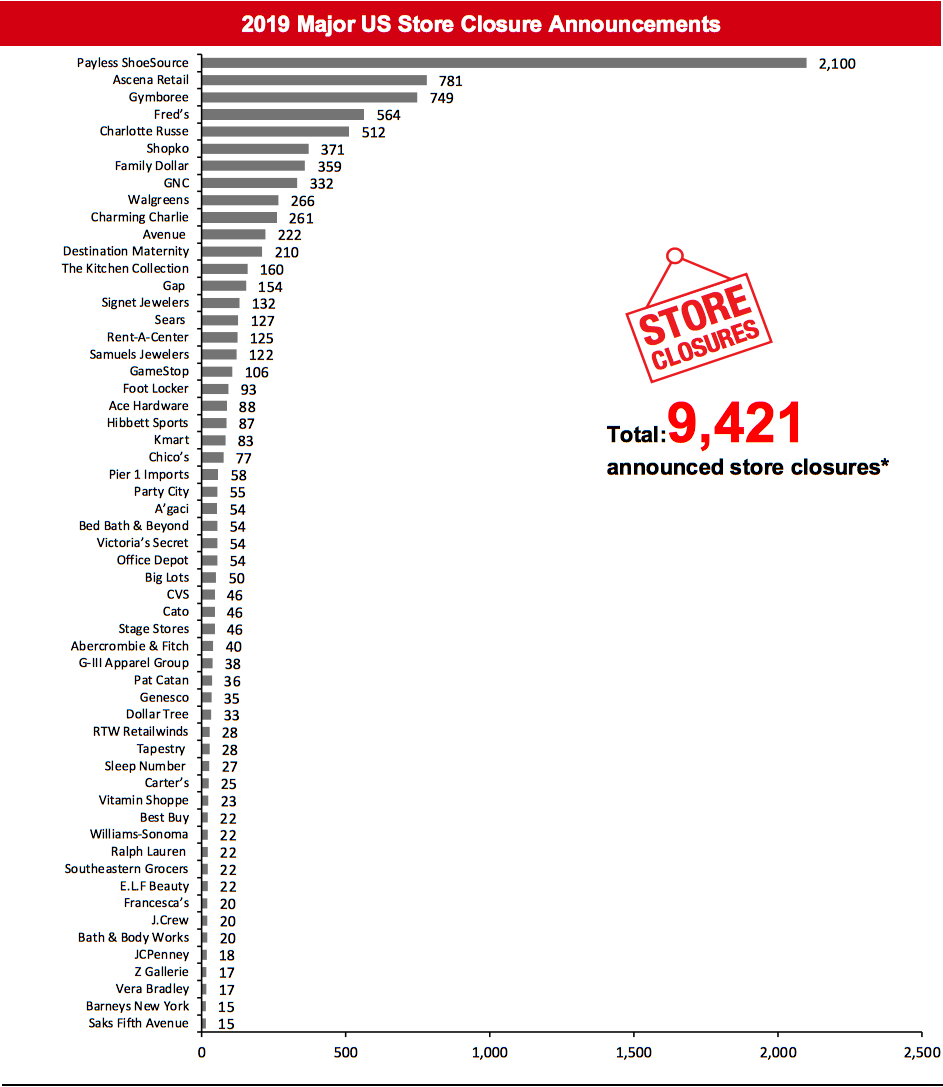

2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 1,410 planned store closures and 2,530 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for Ace Hardware, Bath & Body Works, Chico’s, Foot Locker, JCPenney, Office Depot, Publix Super Markets, Sleep Number and Victoria’s Secret, and this has changed our 2019 US closure count to 9,421. We revised our 2019 openings count for Ace Hardware, Bath & Body Works, Chico’s, Foot Locker, Publix Super Markets, Sleep Number, TJX and Victoria’s Secret, and this has changed our 2019 US openings count to 4,555.What Is Happening This Week in the US

Dick’s Sporting Goods To Open Four More Stores Sporting goods retailer Dick’s Sporting Goods has announced plans to open two Dick’s Sporting Goods stores and two Golf Galaxy stores in March 2020. The namesake stores will open at Hamilton Place Mall in Tennessee and Valley Mall in Maryland. The Golf Galaxy stores will open at Swedesford Plaza in Pennsylvania and Warwick Mall in Rhode Island. As of November 2, 2019, the retailer operates 855 stores in the US. Paper Source To Rebrand 30 Papyrus Stores Stationery and gift retailer Paper Source has acquired 30 closed Papyrus stores. Paper Source will rebrand these stores within three months, with the first batch to open this month, according to the press release. In January 2020, Papyrus filed for Chapter 11 bankruptcy protection with plans to shut 254 retail stores—including 178 stores in the US. 7-Eleven Expands New Concept Store Convenience-store chain 7-Eleven has expanded its new “Evolution” concept to Washington DC. The lab store allows customers to experience the retailer’s latest innovations. 7-Eleven will open a similar store in San Diego, California, in the coming months, with plans to further expand its Evolution concept stores across the US in 2020. The company opened the first Evolution concept store in Dallas in March 2019. Stage Stores To Close 200 Stores Department store chain Stage Stores will close around 200 Gordmans stores and department stores, according to Retail Dive. In line with its plan to make a significant transition to an off-price business model, Stage Stores had announced in September 2019 that it plans to convert all of its department stores to off-price stores in February 2020 and close 40 stores during fiscal year 2020, ending January 2021. As of November 2, 2019, Stage Stores operates 617 departments stores and 158 Gordmans off-price stores. We have not included the closures in the chart as the company has not divulged information regarding the timeline. Target To Expand Small-Format Stores General merchandise retailer Target has announced plans to expand its small-format stores by opening 36 locations in the US this year. The retailer opened its 100th small-format store last year. As of November 2, 2019, Target operates 1,862 stores in the US.Quarterly Store Openings/Closures Settlement

Chico’s Plans To Close 60 to 70 Stores Women’s clothing and accessories retailer Chico’s has announced plans to close 60 to 70 stores and open 10 new Soma stores in fiscal year 2020, ending January 2021. In January 2019, the retailer had announced plans to close 250 stores over a period of three years, as a part of its retail fleet-optimization plan. Chico’s reported that it closed 83 stores and opened six new stores in fiscal year 2019, ended February 1, 2020. Coresight Research insight: Soma, Chico’s intimates brand, is showing strong growth, with the most recent comparable sales growth reaching 9.4% and representing the sixth consecutive quarter of positive growth. In addition to opening 10 new stores, the retailer plans to expand its Soma brand by launching solution-oriented products and extended sizing options. Foot Locker To Close 150 Stores; To Open 20 Power Stores Sportswear retailer Foot Locker has announced plans to close 150 stores in fiscal year 2020, ending January 2021. The stores to be closed are mostly in North America and EMEA (Europe, Middle East and Africa) regions, mainly Foot Locker US and Foot Locker Europe locations, as well as Runners Point stores. The retailer has also announced plans to open approximately 20 Power Stores in the US and international markets. We have estimated our opening and closure count based on the existing proportion of stores in the US. Coresight Research insight: Foot Locker is focusing on its Power Stores, which are new-format, community-centered stores measuring approximately 8,500 square feet—around four times the size of the retailer’s mall-based sites. Power Stores include brand connections to the local neighborhoods and are intended to serve as hubs for local sneaker culture, art, music and sports. As part of its fleet-optimization plans, Foot Locker is closing underperforming stores and focusing on these larger stores. JCPenney Plans To Close at least Six Stores in 2020; Closes 18 Stores in Fiscal Year 2019 Department store chain JCPenney has announced plans to close at least six stores this year. The company will reveal more details regarding future real-estate plans at its Analyst Day on April 7, 2020. JCPenney has reported that it closed 18 full-line stores in fiscal year 2019, ended February 1, 2020. The retailer operates 846 stores in the US, as of February 1, 2020. L Brands Plans To Open 70 Net New Bath & Body Works Stores Fashion retailer L Brands has announced plans to open 95 Bath & Body Works off-mall stores and close 25 stores in the US during fiscal year 2020. The company also plans to close 40 Victoria’s Secret stores and open three Victoria’s Secret and two PINK stores in the US. In January 2020, L Brands announced the sale of a 55% stake in Victoria’s Secret to private equity firm Sycamore Partners for approximately $525 million. The transaction is expected to close in the second quarter of fiscal year 2020. L Brands reported that it closed 52 Victoria’s Secret and 20 Bath & Body Works stores in the US in fiscal year 2019, ended February 1, 2020. It also opened 38 Bath & Body Works, four Victoria’s Secret and three PINK stores in the US. Coresight Research insight: The planned opening of 70 new Bath & Body Works stores is L Brands’ success story after it announced the sale of the majority ownership of Victoria’s Secret. We expect L Brands to increasingly focus on the home, fragrance and gifting categories, as well enter the beauty and skincare market. Nordstrom To Open Off-Price Store in Washington Nordstrom has revealed plans to open an off-price store at Tacoma Mall in Washington during fall 2020. As of February 1, 2020, the retailer operates 110 full-line stores and 242 off-price stores in the US. Office Depot To Close 90 Stores Office Depot has announced plans to close 90 underperforming retail stores in 2020 and 2021, as a part of its business acceleration program. The retailer closed 54 stores in fiscal year 2019, ended December 28. As of that date, the retailer operates 1,307 stores in the US. Publix Super Markets Opens 35 Stores and Closes Seven Supermarket chain Publix Super Markets has reported that in 2019, it opened 35 supermarkets, including five replacements, and closed seven. One of the locations that closed was replaced in the same year, and five of the others will be replaced in the future. As of December 28, 2019, the chain operates 1,239 supermarkets in the US. Ross Stores To Open 100 Stores Department store retailer Ross Stores has announced plans to open approximately 75 Ross Dress for Less stores and 25 dd’s Discounts stores in fiscal year 2020, ending January 30, 2021. The retailer expects to open 21 Ross stores and seven dd’s Discounts stores during the first quarter of fiscal year 2020, ending May 2, 2020. Coresight Research insight: Ross Stores, an off-price leader, has steadily grown its physical footprint over the past five years, opening 100 stores nearly every year during that period. In its third-quarter 2020 earnings report, management stated that it feels “comfortable with 100 stores per year.” Of the company’s fleet, dd Discounts—which was launched in 2004 and is aimed at a younger demographic—has grown the fastest: The dd Discounts store fleet has nearly doubled since fiscal year 2014 to 237 stores by the end of 2019. Sleep Number Opens 59 Stores and Closes 27 Bedding and mattress retailer Sleep Number has reported that it opened 59 stores and closed 27 stores across the US in 2019—12 of these were opened and three closed during the fourth quarter, ended December 28, 2019. Sleep Number operates 611 stores in the US, as of December 28, 2019. The RealReal To Open Two Stores Luxury goods reseller The RealReal has opened a flagship store in San Francisco’s Union Square district. The 8,000-square-foot store is the retailer’s fourth physical location, in addition to its stores in Los Angeles and New York. The company intends to open a flagship store in Chicago during the second half of 2020. TJX Plans To Open 110 Stores Off-price department store chain TJX has announced plans to open 50 Marshalls and T.J. Maxx stores, 50 HomeGoods and Homesense stores and approximately 10 Sierra stores in fiscal year 2021, ending January 30, 2021. The company has also reported that it opened 60 HomeGoods, 39 Marshalls, 21 T.J. Maxx, 16 Homesense and 11 Sierra stores in the US during fiscal year 2020. Urban Outfitters Plans To Open 30 Stores Fashion and homeware retailer Urban Outfitters has announced plans to open 30 stores in North America and close nine stores globally during fiscal year 2021, ending January 2021. As of October 31, 2019, the retailer operates 179 Urban Outfitters, 203 Anthropologie and 134 Free People stores in the US. We have estimated our closure count based on the existing proportion of stores in the US.Non-Store-Closure News

Fresh Market Appoints New CEO Supermarket chain Fresh Market has appointed Jason Potter as its new CEO, effective March 2, 2020. Potter succeeds Larry Appel, who served as CEO of Fresh Market for more than two years. Potter completed a 26-year stint at food retailer Sobeys, and he most recently served as the Executive Vice President of Operations at Sobeys. [caption id="attachment_104874" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Bed Bath & Beyond, Foot Locker, Gap, GNC, H&M, Kmart, Sears and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC, G-III Apparel and H&M are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Macy’s includes Macy’s and Bloomingdale’s banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_104875" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond, Foot Locker and Home Depot are based on the existing proportion of stores in the US. Gap, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.

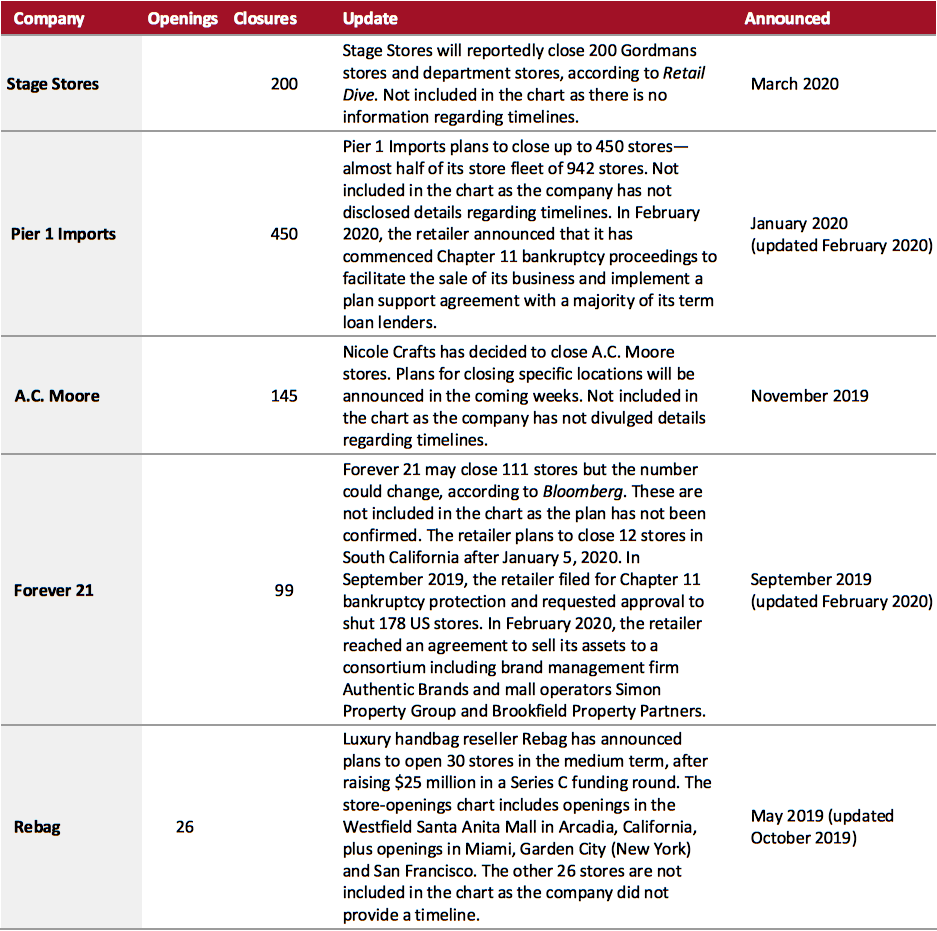

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Casey’s, Dollar General, Foot Locker, Gap and H&M among others. Estimates for Bed bath & Beyond, Foot Locker and Home Depot are based on the existing proportion of stores in the US. Gap, Sephora, Under Armour and Urban Outfitters openings refer to North America openings. Amazon includes Amazon 4-Star and Amazon Go Grocery banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners. TJX includes HomeGoods, Homesense, Marshalls, Sierra and T.J. Maxx banners.Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_104876" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104877" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104877" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Foot Locker, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC and GIII-Apparel are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Foot Locker, Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_104878" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Foot Locker, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Foot Locker, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

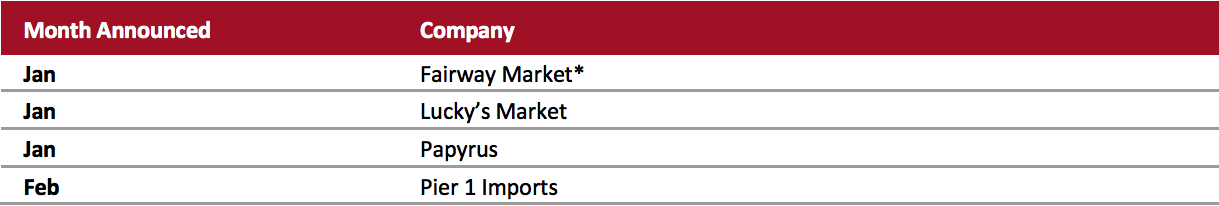

Source: Company reports/Coresight Research[/caption] 2020 Major US Retail Bankruptcies [caption id="attachment_104879" align="aligncenter" width="700"]

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016.

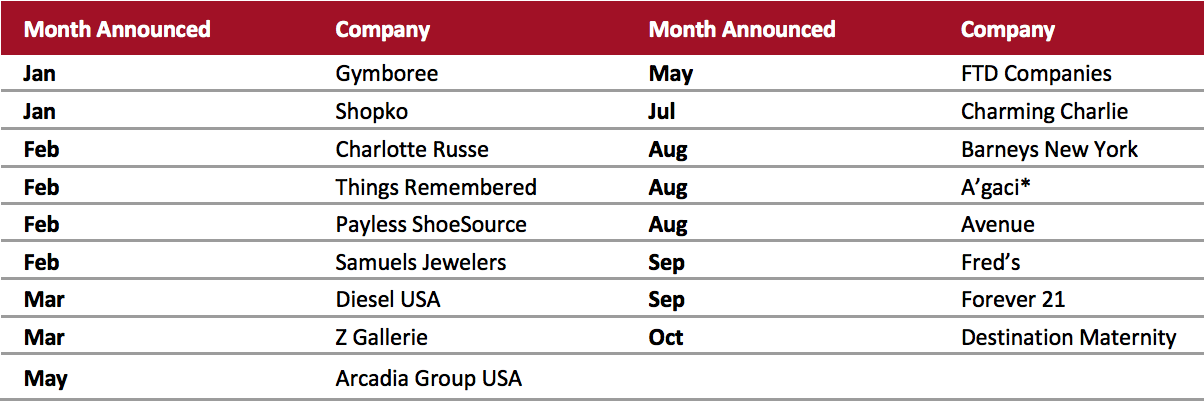

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_104880" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

The UK

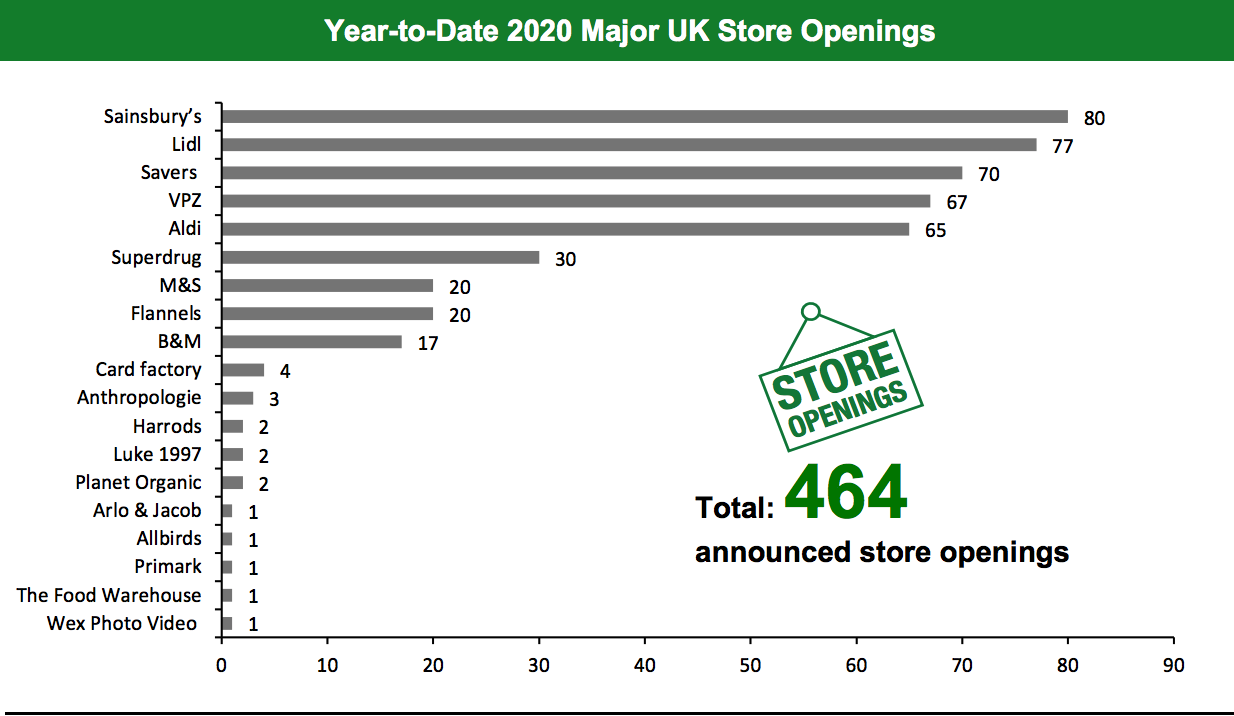

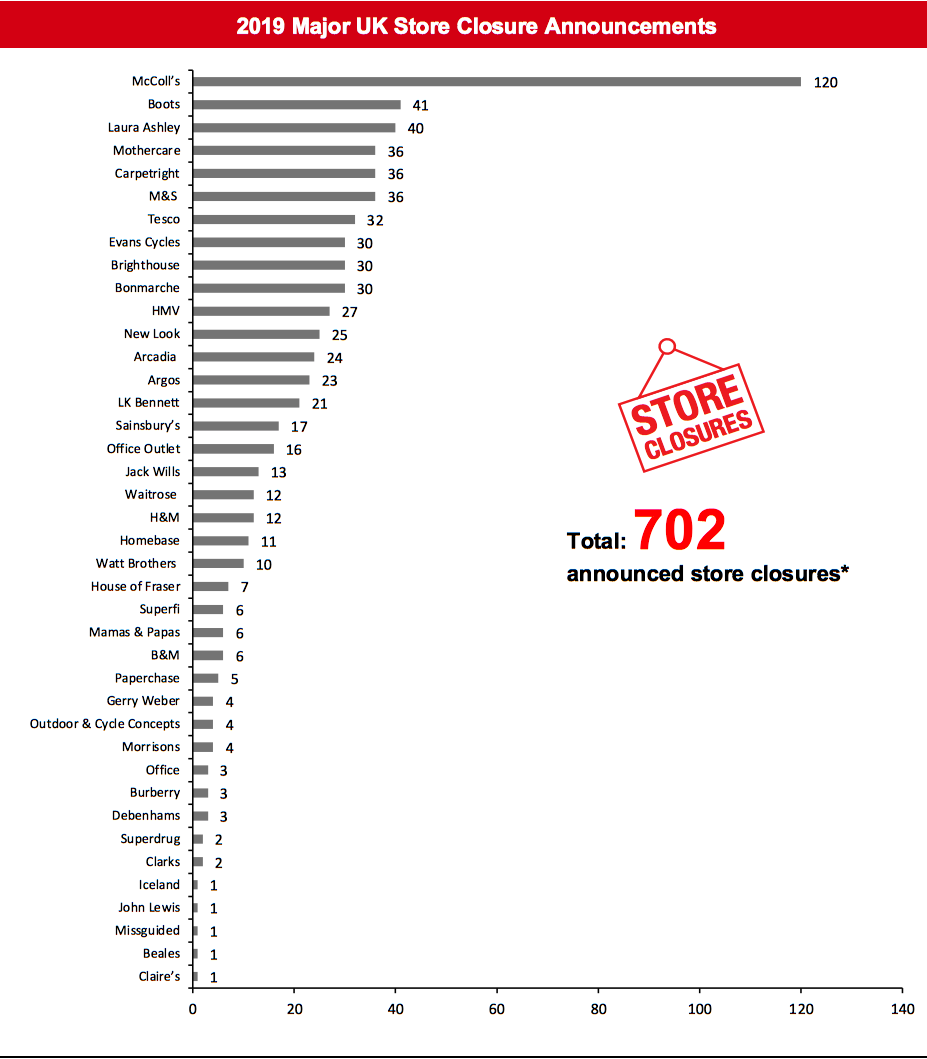

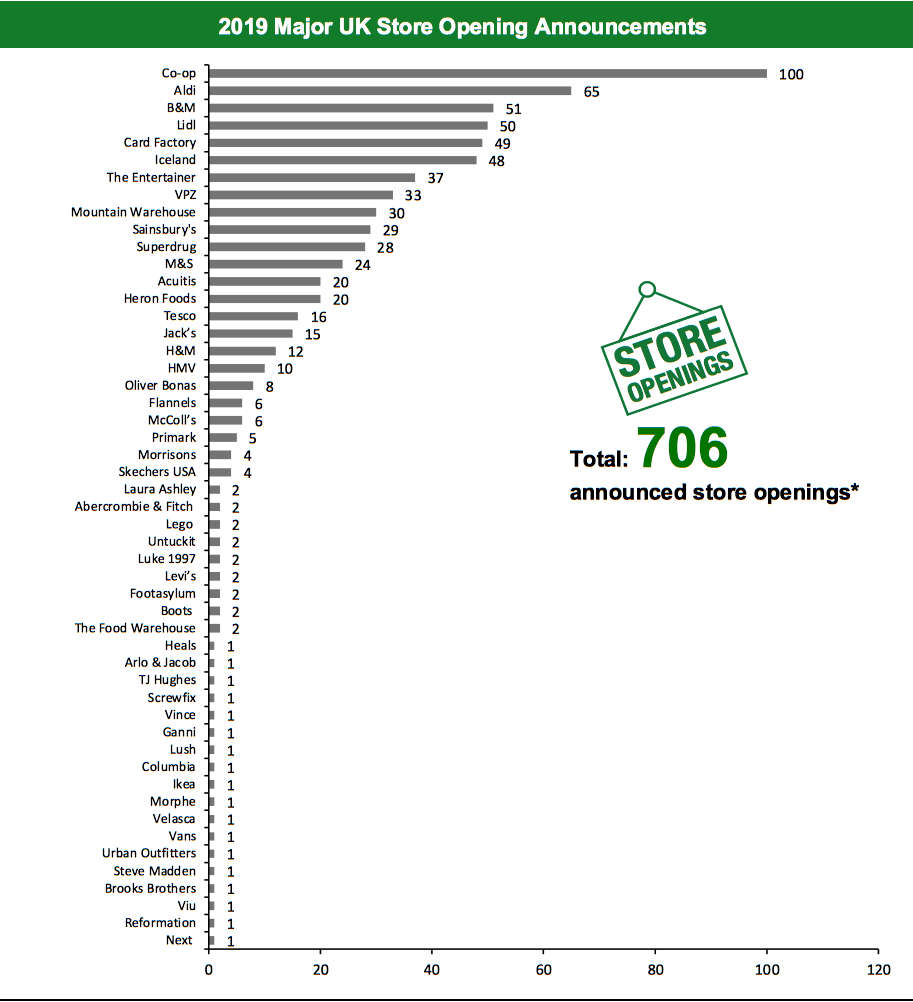

2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 578 store closures and 464 store openings. Our data represents closures and openings by calendar year. As part of our methodology, we update the 2019 closures and openings numbers on an ongoing basis when we obtain confirmed information from company releases and filings, and these adjustments will continue through 2020. This week, we have revised our 2019 closures count for McColl’s, and this has changed our 2019 UK closure count to 702. We also revised our 2019 openings count for McColl’s, and this has changed our 2019 UK openings count to 706.What Is Happening This Week in the UK

AS Watson Holdings To Open 50 Savers and 30 Superdrug Stores Savers and Superdrug have reportedly announced plans to open 50 Savers and 30 Superdrug stores across the UK this year, according to The Grocer. Parent company AS Watson Holdings is currently undertaking plans to close 20 Superdrug stores and re-open them as more discount-focused Savers stores. BrightHouse Nears Administration Rent-to-own retailer BrightHouse is reportedly nearing administration, with around 2,400 jobs facing uncertainty. The retailer has put accounting firm Grant Thornton on standby to potentially undertake the administration process according to Sky News. BrightHouse stated that it needs the support of its stakeholders and that it is currently negotiating with them. The retailer currently operates over 240 stores in the UK. McColl’s To Close Over 330 Stores Convenience store and newsagent retailer McColl’s Retail Group has announced plans to close over 330 stores in the coming three to four years. As a part of the store optimization program, the retailer plans to reduce its store estate to 1,100 larger and convenience-focused stores. The company closed 120 underperforming newsagents and smaller convenience stores in 2019. McColl’s operates 1,443 convenience stores and newsagents, as of November 24, 2019.Non-Store-Closure News

B&M Appoints Alex Russo as CFO B&M has announced the appointment of Alex Russo as Executive Director and CFO. Russo will assume his new position on a mutually agreed start date no later than June 2021 and will succeed Paul McDonald, who is retiring from B&M after serving more than 10 years in the role. Russo is currently the Group Finance Director of homeware and household goods retailer Wilko. Prior to joining Wilko, Russo had served as the CFO of supermarket retailer Asda for four years. [caption id="attachment_104881" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, H&M, M&S and Sainsbury’s. Arcadia refers to Topshop and Topman banner store. McColl’s includes convenience stores and newsagents.Source: Company reports/Coresight Research[/caption] [caption id="attachment_104882" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

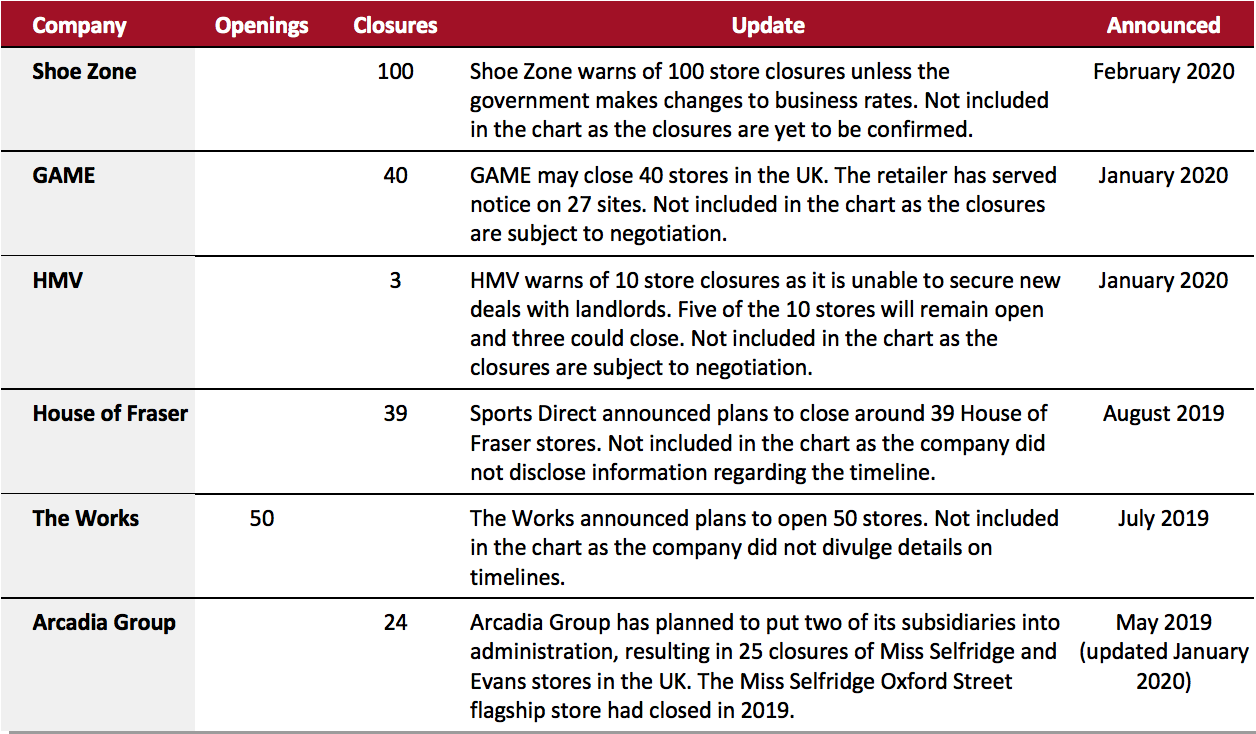

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, H&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_104883" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104884" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_104884" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. Arcadia includes Topshop, Topman and Miss Selfridge banners. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_104885" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands. McColl’s includes convenience stores and newsagents.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.