Nitheesh NH

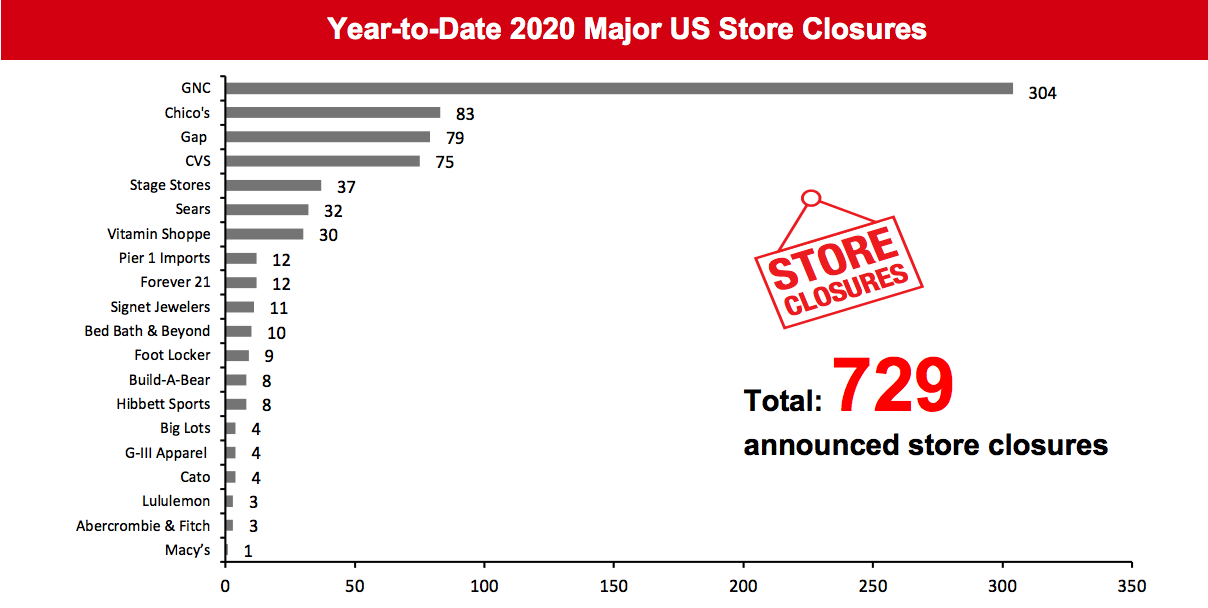

The US

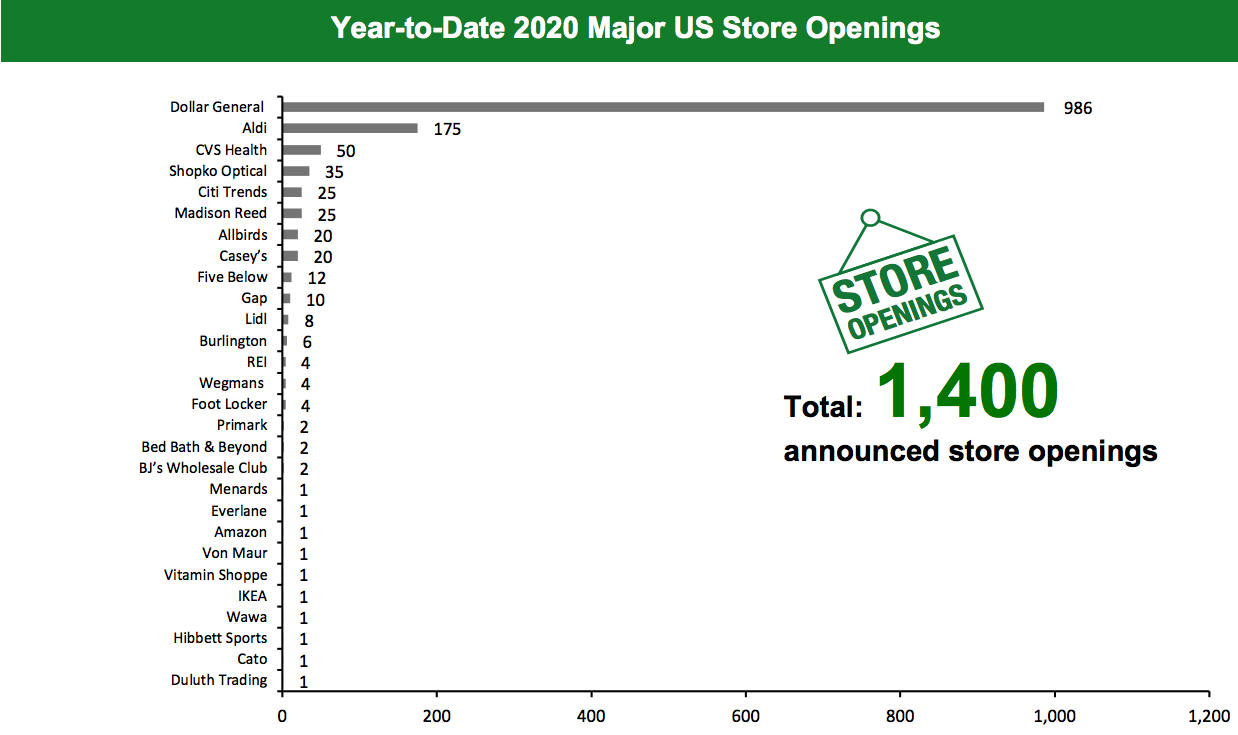

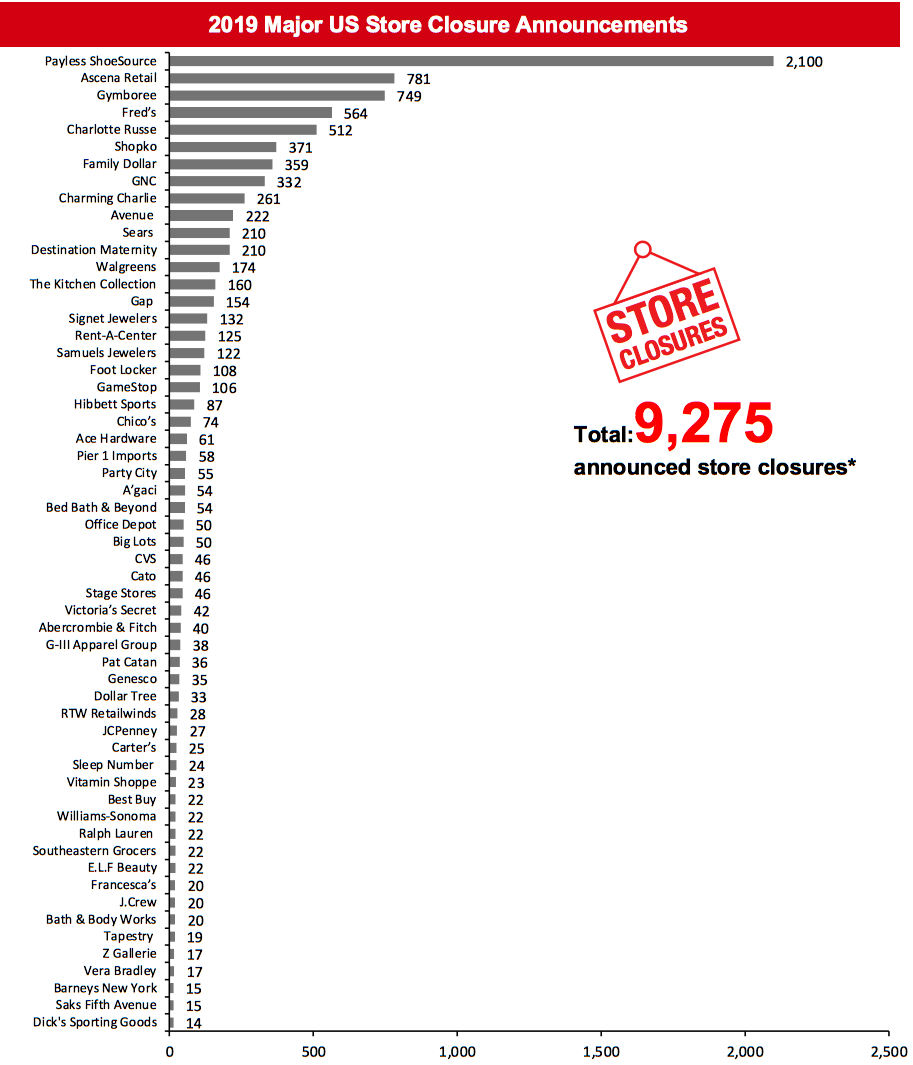

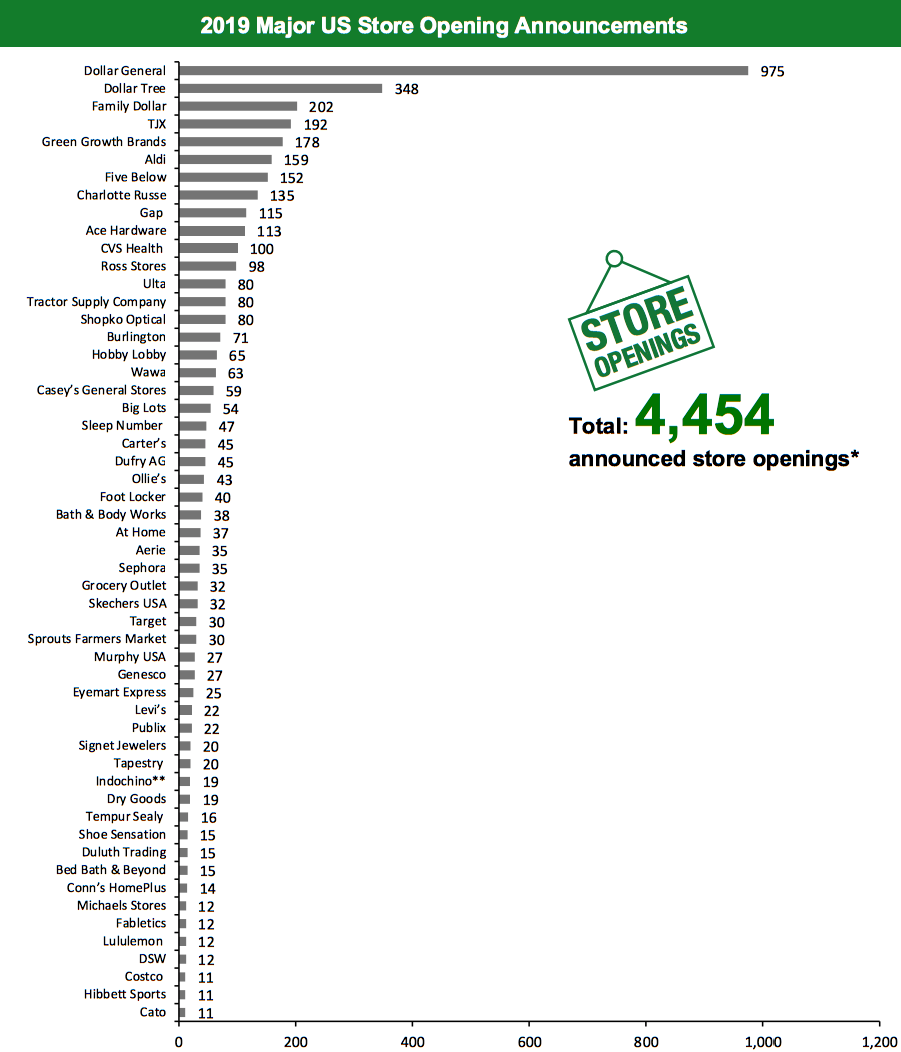

2019 Summary In the US, we recorded a total of 9,275 store closures by major retailers in 2019. We also recorded a total of 4,454 store openings in 2019. 2020 Major US Store Closures and Openings Year to date in 2020, US retailers have announced 729 planned store closures and 1,400 openings. Our data represents closures and openings by calendar year, so these totals include announcements made in 2019 of closures and openings expected to fall in 2020.What Is Happening This Week in the US

No major retailers reported opening or closure announcements in the past week.Non-Store-Closure News

Michaels Companies Names New CEO Arts and crafts retailer Michaels Companies has announced that it has appointed Ashley Buchanan as President and CEO and as a member of the company’s board of directors, effective January 6, 2020. Buchanan will succeed Mark Cosby, who will continue to serve as CEO during the transition period until April 1, 2020. Buchanan joined Walmart in 2007 and most recently served as COO and Chief Merchandising Officer for Walmart US e-Commerce. [caption id="attachment_101823" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Foot Locker, Gap, GNC and Signet Jewelers among others. Estimates for Bed Bath & Beyond, Foot Locker, GNC and G-III Apparel are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Gap, GNC and Signet Jewelers closures pertain to North America closures. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon closures pertain to its Ivivva banner. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners.Source: Company reports/Coresight Research[/caption] [caption id="attachment_101824" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.

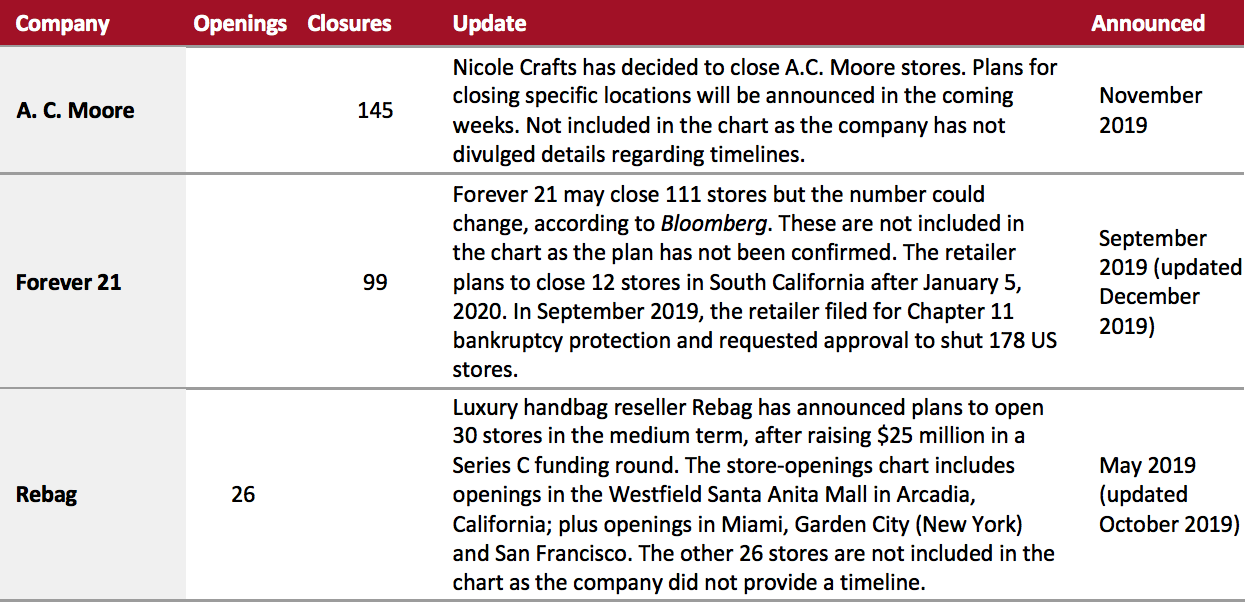

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for Aldi, Dollar General, Foot Locker and Gap among others. Estimates for Bed bath & Beyond and Foot Locker are based on the existing proportion of stores in the US. Gap openings pertain to North America openings. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Hibbett Sports includes Hibbett and City Gear banners.Source: Company reports/Coresight Research[/caption] 2020 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_101825" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101826" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101826" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101827" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

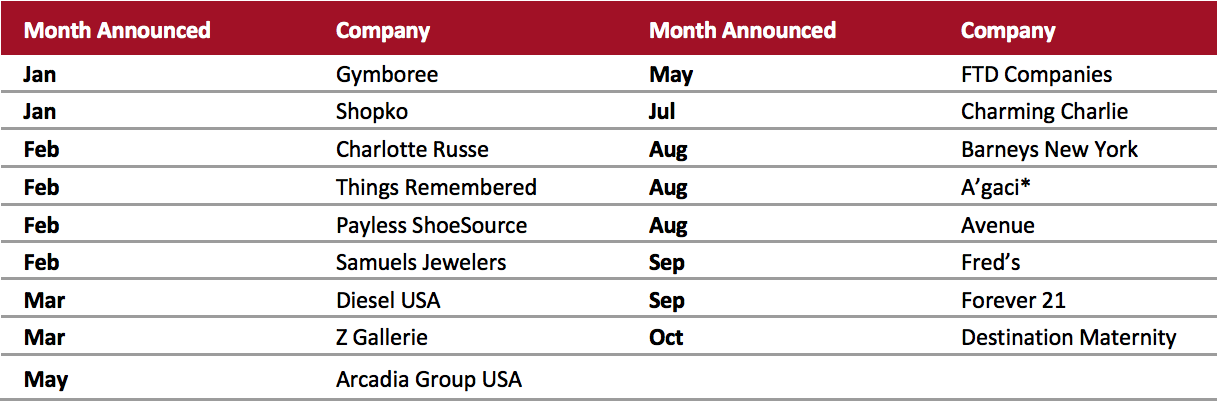

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_101828" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018.Source: Company reports/Coresight Research[/caption]

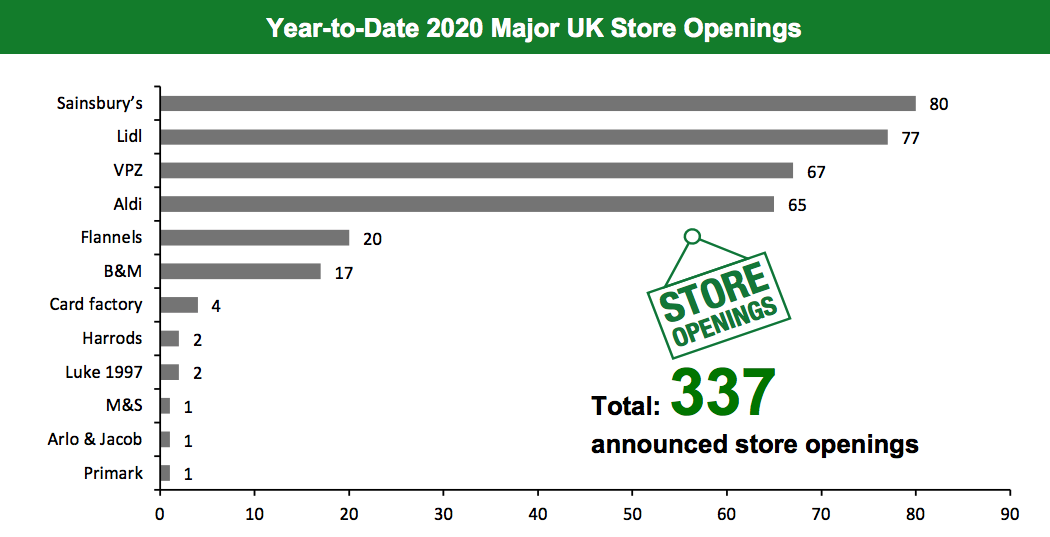

The UK

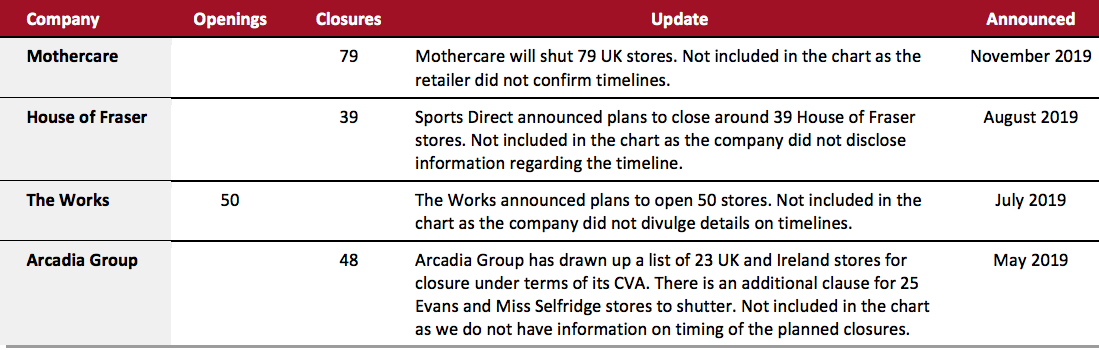

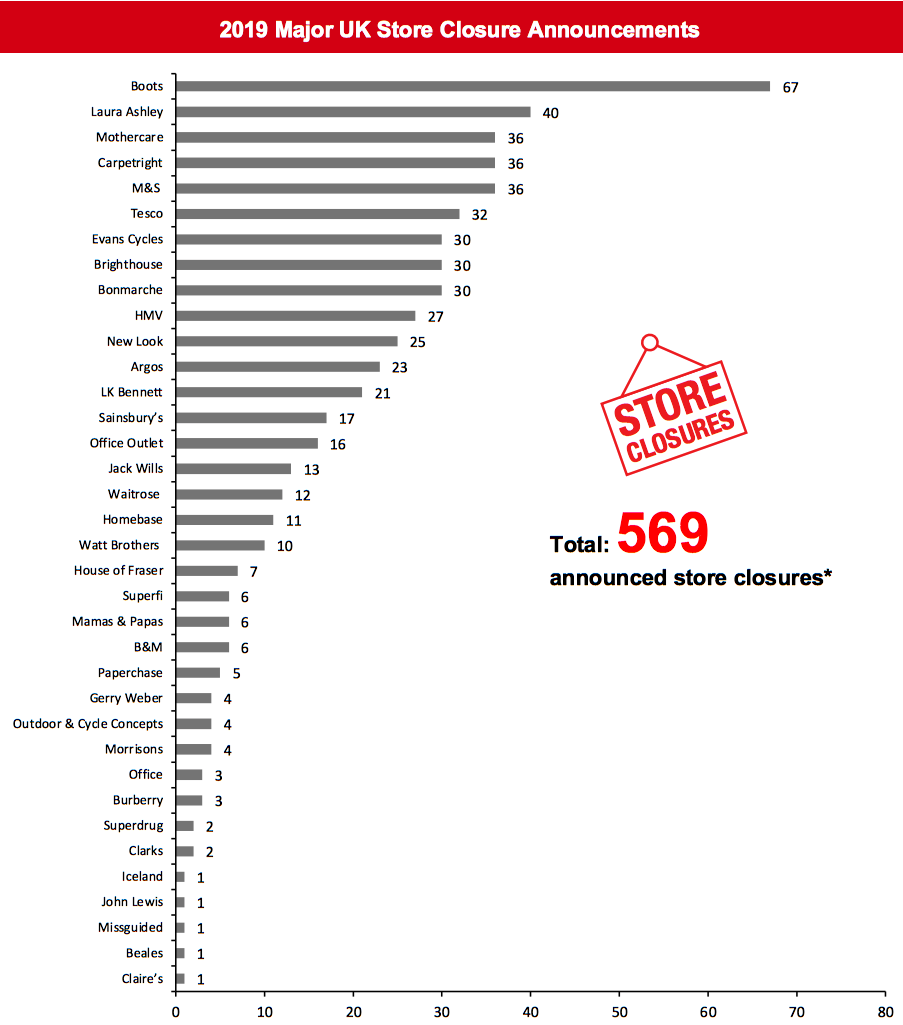

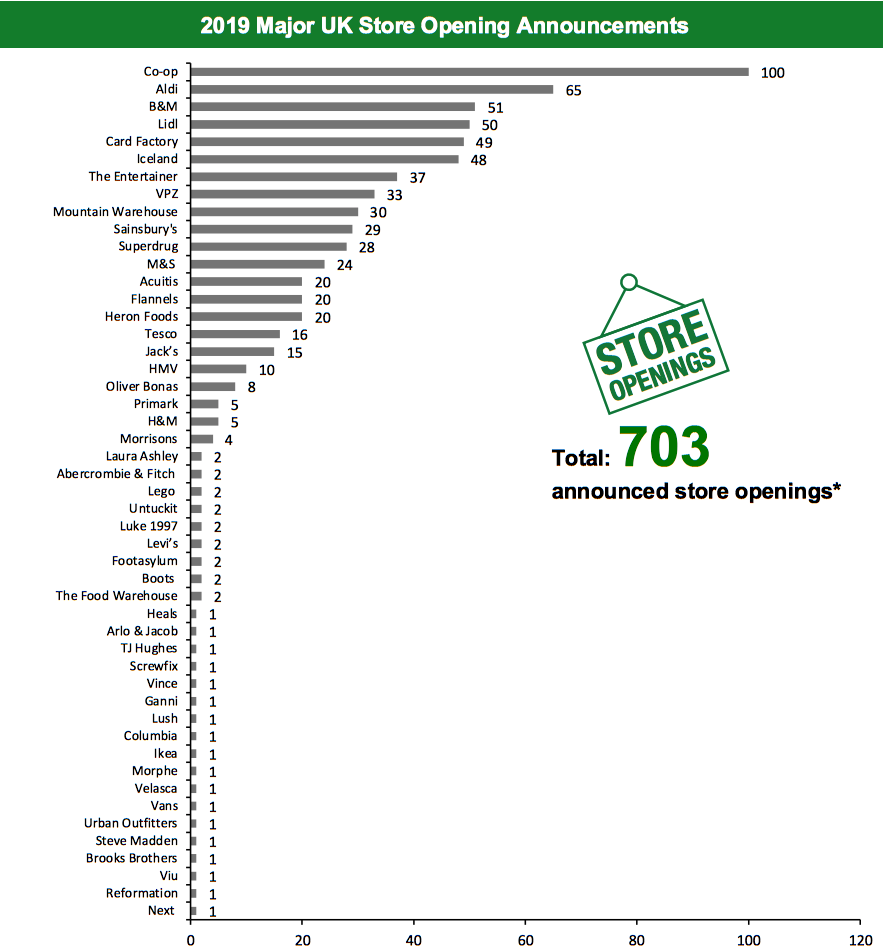

2019 Summary In the UK, we recorded a total of 569 closures by major retailers in 2019. We also recorded a total of 703 openings by major retailers in the UK in 2019. 2020 Major UK Store Closures and Openings For 2020, major retailers in the UK have announced 255 store closures and 337 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Joy Set To Collapse into Administration Clothing and accessories retailer Joy has announced its intention to appoint administrators two years after it was bought out of insolvency in a pre-pack deal by its founders. The retailer currently employs around 182 staff and operates 10 stores in the UK, the majority of which are in London. KRE Corporate Recovery handled Joy’s previous administration in 2017, which saw 78 job losses. [caption id="attachment_101829" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s.Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101830" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Boots, Debenhams, M&S and Sainsbury’s.Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101830" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Aldi, B&M, Lidl, M&S and Sainsbury’s. Card Factory is based on the proportion of net existing stores in the UK.Source: Company reports/Coresight Research[/caption] 2020 Major UK Uncharted Openings and Closures [caption id="attachment_101831" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101832" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101832" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101833" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner. H&M includes H&M and Weekday brands.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.