Nitheesh NH

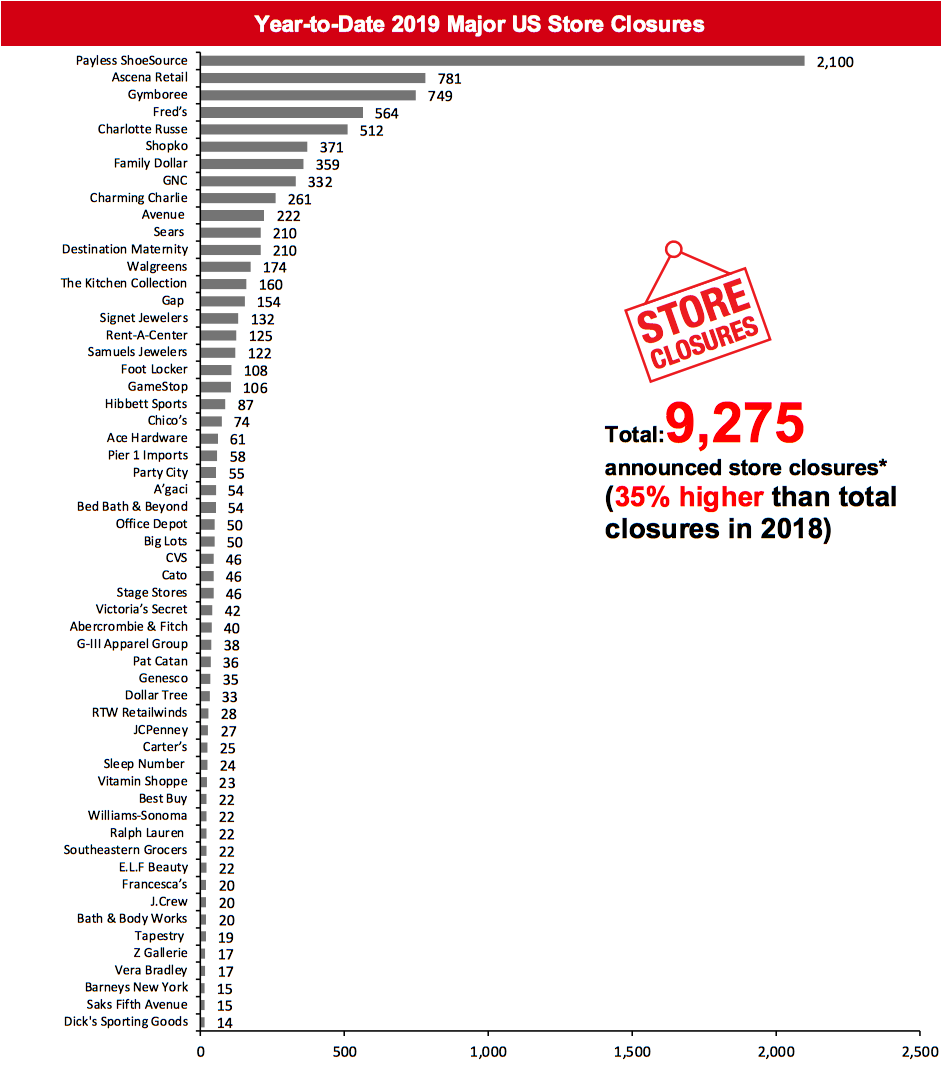

The US

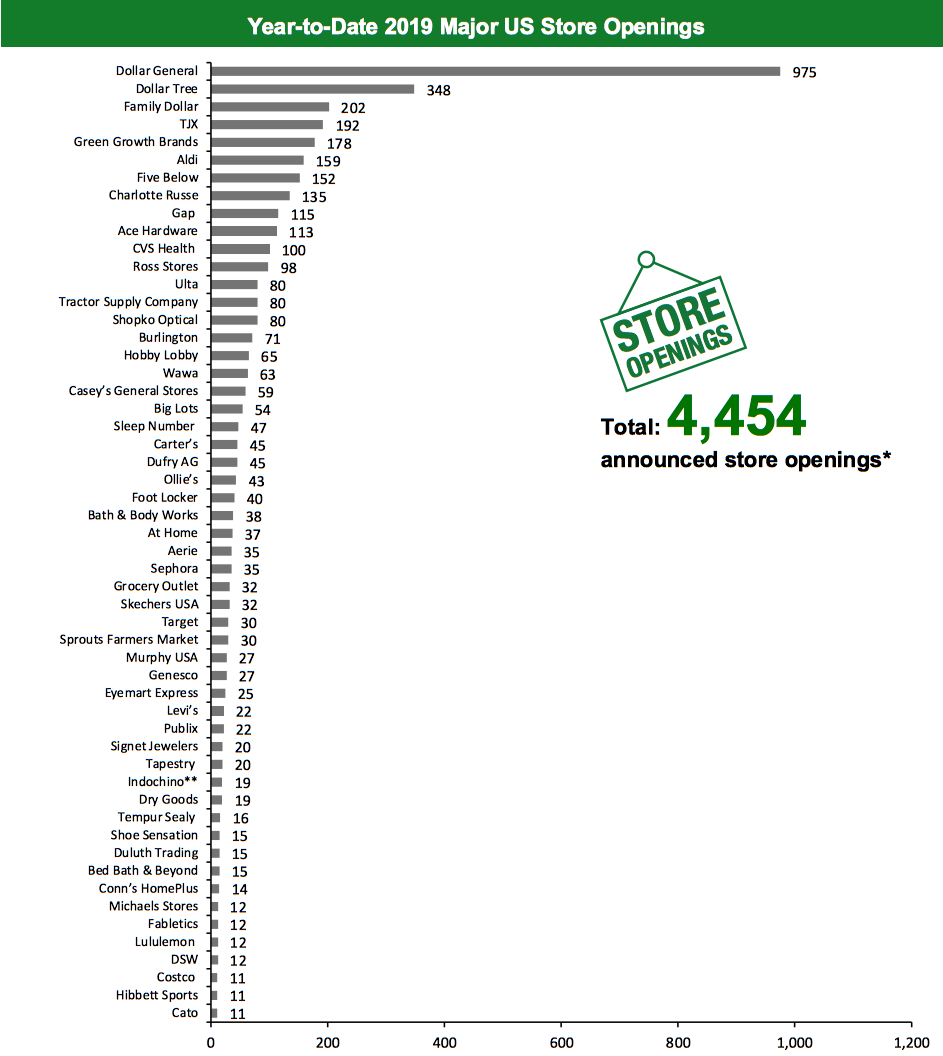

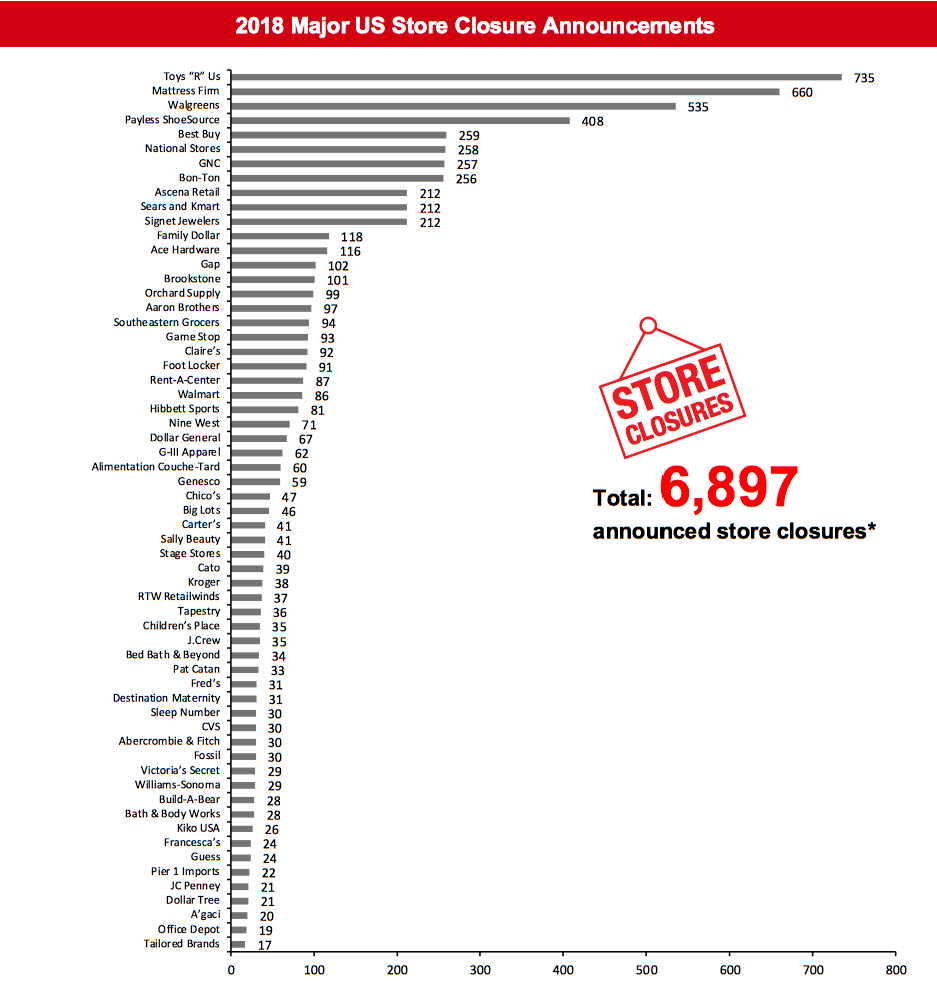

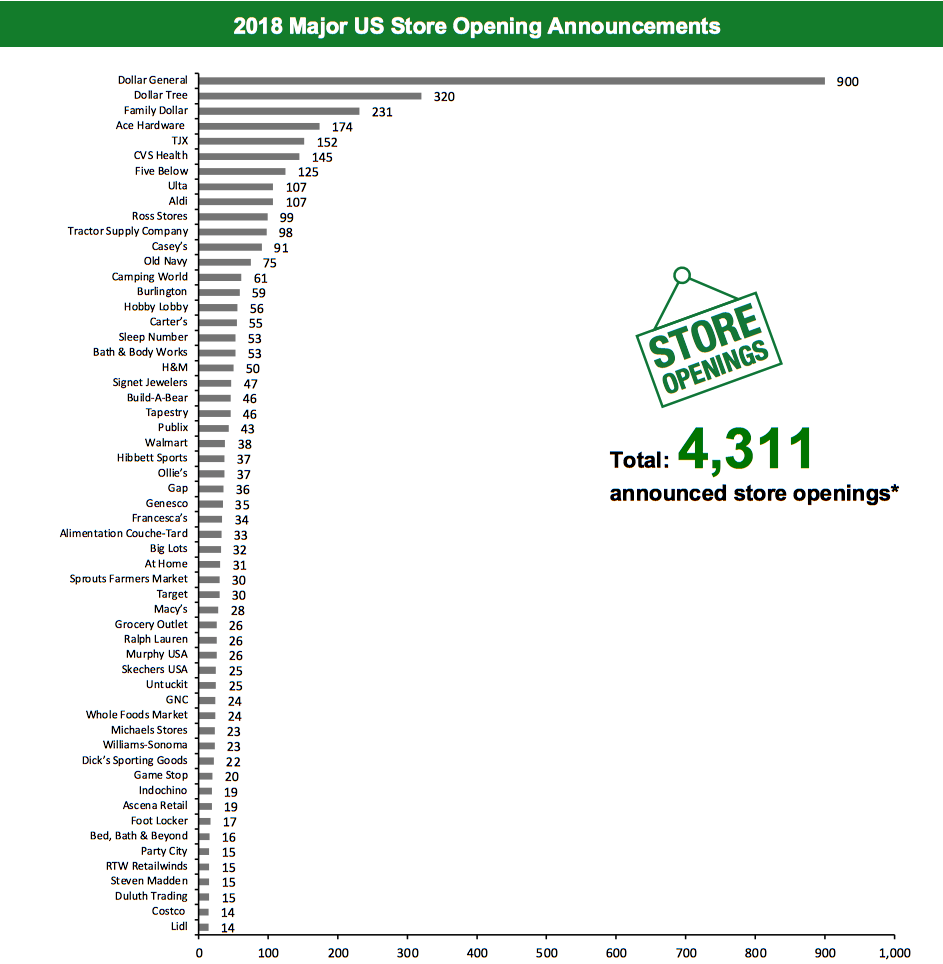

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 9,275 planned store closures and 4,454 openings. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 6,897 closures and 4,311 openings for the full year 2018. Our data represents closures and openings by calendar year. We revised our estimated closure count for Signet Jewelers this week and this has changed our US store closure count from last week. We have also reconciled the US opening and closure charts for 2018 to account for the larger base of companies we cover this year.What Is Happening This Week in the US

Jared Opens New Concept Store Signet Jewelers-owned jewelry brand Jared has opened a new format store at the Francis Scott Key Mall in Maryland. The new Jared store was developed as a collaboration with digital native diamond and bridal jewelry retailer James Allen, also a Signet Jewelers banner. The store is designed to enable a modern omni-channel shopping experience and it also offers a hands-on product experience. In April, Signet Jewelers announced plans to open 20 to 25 stores during its current fiscal year ending February 2, 2020. Coresight Research insight: Signet is in a multi-year store rationalization strategy focused on reducing mall-based exposure and exiting regional brands, with plans for an estimated 150 store closures in the current fiscal year. At the same time, Signet’s transformational strategy is focused on a customer-first omnichannel platform across all consumer touchpoints and the Jared x James Allen concept store is one such effort, bringing online and offline together with interactive digital displays and jewelry consultants for assistance.Non-Store-Closure News

BJ’s Wholesale Club Names New CEO Warehouse club chain BJ’s Wholesale Club has named Lee Delaney CEO effective February 2, 2020. Delaney joined the company in 2016 and currently serves as President of BJ’s Wholesale Club. He will succeed current CEO Christopher Baldwin, who will step down to become Executive Chairman. [caption id="attachment_101681" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on the proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101682" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Wearhouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes the New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area

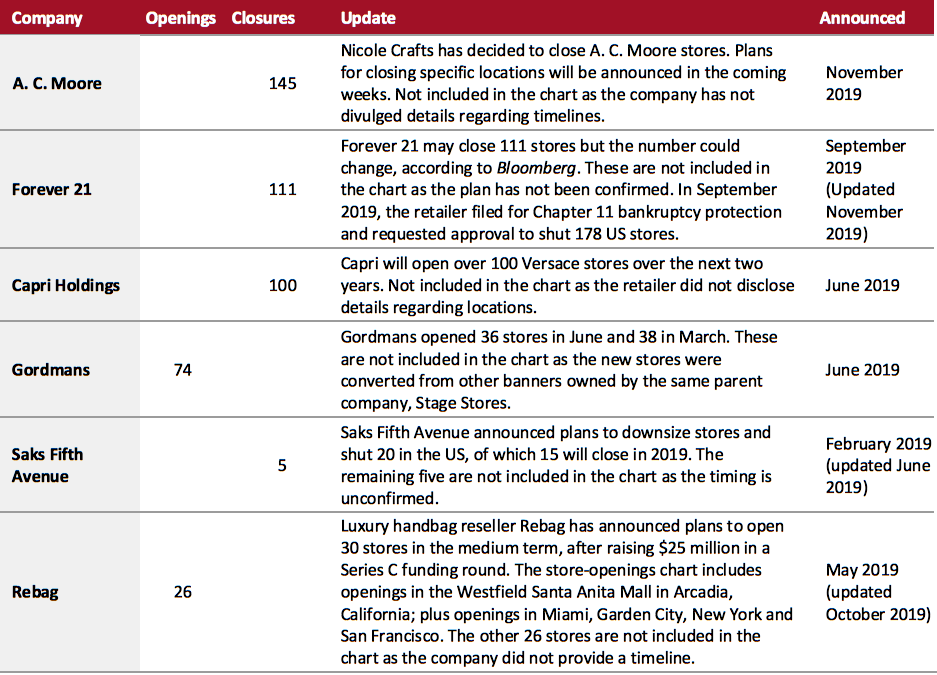

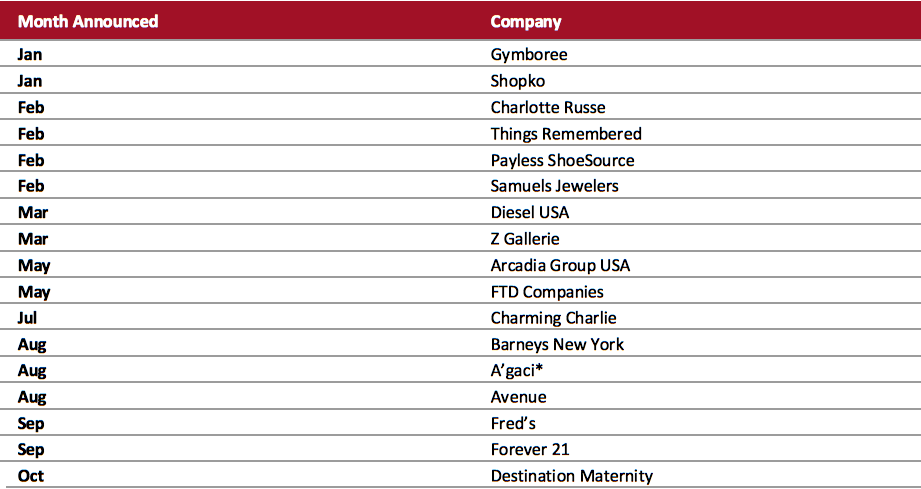

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_101683" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101684" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101684" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced fewer than 17 store closures and are not included in the chart. We estimate this information for retailers including Payless Shoesource, Signet Jewelers and Walgreens, among others. Estimates for Alimentation Couche-Tard, Foot Locker, Game Stop, Genesco, Ralph Lauren, Deckers Outdoor, J. Crew, Under Armour and Burberry are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Destination Maternity, Dollar Tree, Family Dollar, Gap, GNC, Party City, Ralph Lauren, Signet Jewelers and Tapestry closures pertain to North America closures. Fossil closures pertain to closures in the Americas (Canada, Latin America and the US). Abercrombie & Fitch includes the A&F and Hollister banners. Ascena Retail includes Ann Taylor, Dressbarn, LOFT, Maurices, Lane Bryant, Catherines and Justice banners. Dick’s Sporting Goods includes Dick’s Sporting Goods and Golf Galaxy banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Genesco includes Journeys Group, Schuh and Johnson & Murphy banners. Ralph Lauren includes Ralph Lauren and Club Monaco banners. RTW Retailwinds includes New York & Company and Fashion to Figure banners. Sears includes Sears and Kmart banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux and K&G banners. Tapestry includes Kate Spade, Coach and Stuart Weitzman banners. Tractor Supply Company includes Tractor Supply and Petsense banners. Urban Outfitters includes Urban Outfitters, Free People and Anthropologie banners. American Eagle Outfitters, G-III Apparel Group, Sally beauty and Under Armour refer to net closures.

*Total includes a small number of retailers that each announced fewer than 17 store closures and are not included in the chart. We estimate this information for retailers including Payless Shoesource, Signet Jewelers and Walgreens, among others. Estimates for Alimentation Couche-Tard, Foot Locker, Game Stop, Genesco, Ralph Lauren, Deckers Outdoor, J. Crew, Under Armour and Burberry are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Destination Maternity, Dollar Tree, Family Dollar, Gap, GNC, Party City, Ralph Lauren, Signet Jewelers and Tapestry closures pertain to North America closures. Fossil closures pertain to closures in the Americas (Canada, Latin America and the US). Abercrombie & Fitch includes the A&F and Hollister banners. Ascena Retail includes Ann Taylor, Dressbarn, LOFT, Maurices, Lane Bryant, Catherines and Justice banners. Dick’s Sporting Goods includes Dick’s Sporting Goods and Golf Galaxy banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Genesco includes Journeys Group, Schuh and Johnson & Murphy banners. Ralph Lauren includes Ralph Lauren and Club Monaco banners. RTW Retailwinds includes New York & Company and Fashion to Figure banners. Sears includes Sears and Kmart banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Tailored Brands includes Men’s Wearhouse, Men’s Wearhouse and Tux and K&G banners. Tapestry includes Kate Spade, Coach and Stuart Weitzman banners. Tractor Supply Company includes Tractor Supply and Petsense banners. Urban Outfitters includes Urban Outfitters, Free People and Anthropologie banners. American Eagle Outfitters, G-III Apparel Group, Sally beauty and Under Armour refer to net closures.Source: Company reports/Coresight Research[/caption] [caption id="attachment_101686" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart. We estimate this information for retailers including Aldi, Five Below and Dollar Tree among others. Estimates for Alimentation Couche-Tard, Foot Locker, Game Stop, Genesco, Ralph Lauren, Deckers Outdoor and Steven Madden are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Destination Maternity, Dollar Tree, Family Dollar, Gap, GNC, Michaels Stores, Old Navy, Party City, Ralph Lauren, Signet Jewelers and Tapestry openings pertain to North America openings. Fossil and Michael Kors openings pertain to Americas (Canada, Latin America and the US) openings. Abercrombie & Fitch includes A&F and Hollister banners. American Eagle Outfitters refers to Aerie openings. Ascena Retail includes Ann Taylor, LOFT, Maurices, Lane Bryant, Catherines and Justice banners. Dick’s Sporting Goods includes Dick’s Sporting Goods and Golf Galaxy banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Genesco includes Journeys Group, Schuh and Johnson & Murphy banners. Ralph Lauren includes Ralph Lauren and Club Monaco banners. Ross Stores includes Ross and dd’s DISCOUNTS banners. RTW Reatilwinds includes New York & Company and Fashion to Figure banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Tapestry includes Kate Spade, Coach and Stuart Weitzman banners. Tractor Supply Company includes Tractor Supply and Petsense banners. Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners. American Eagle Outfitters, Michael Kors and TJX refer to net new openings.

*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart. We estimate this information for retailers including Aldi, Five Below and Dollar Tree among others. Estimates for Alimentation Couche-Tard, Foot Locker, Game Stop, Genesco, Ralph Lauren, Deckers Outdoor and Steven Madden are based on the existing proportion of stores in the US. Build-A-Bear, Chico’s, Destination Maternity, Dollar Tree, Family Dollar, Gap, GNC, Michaels Stores, Old Navy, Party City, Ralph Lauren, Signet Jewelers and Tapestry openings pertain to North America openings. Fossil and Michael Kors openings pertain to Americas (Canada, Latin America and the US) openings. Abercrombie & Fitch includes A&F and Hollister banners. American Eagle Outfitters refers to Aerie openings. Ascena Retail includes Ann Taylor, LOFT, Maurices, Lane Bryant, Catherines and Justice banners. Dick’s Sporting Goods includes Dick’s Sporting Goods and Golf Galaxy banners. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. Gap includes Gap, Banana Republic, Athleta and Intermix banners. Genesco includes Journeys Group, Schuh and Johnson & Murphy banners. Ralph Lauren includes Ralph Lauren and Club Monaco banners. Ross Stores includes Ross and dd’s DISCOUNTS banners. RTW Reatilwinds includes New York & Company and Fashion to Figure banners. Signet Jewelers includes Kay, Zales, Peoples, Jared and regional banners. Stage Stores includes Bealls, Goody’s, Palais Royal, Peebles and Stage banners. Tapestry includes Kate Spade, Coach and Stuart Weitzman banners. Tractor Supply Company includes Tractor Supply and Petsense banners. Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners. American Eagle Outfitters, Michael Kors and TJX refer to net new openings.Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_101687" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

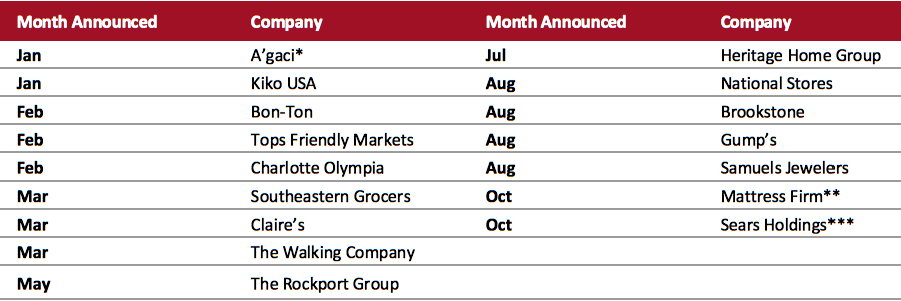

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_101688" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

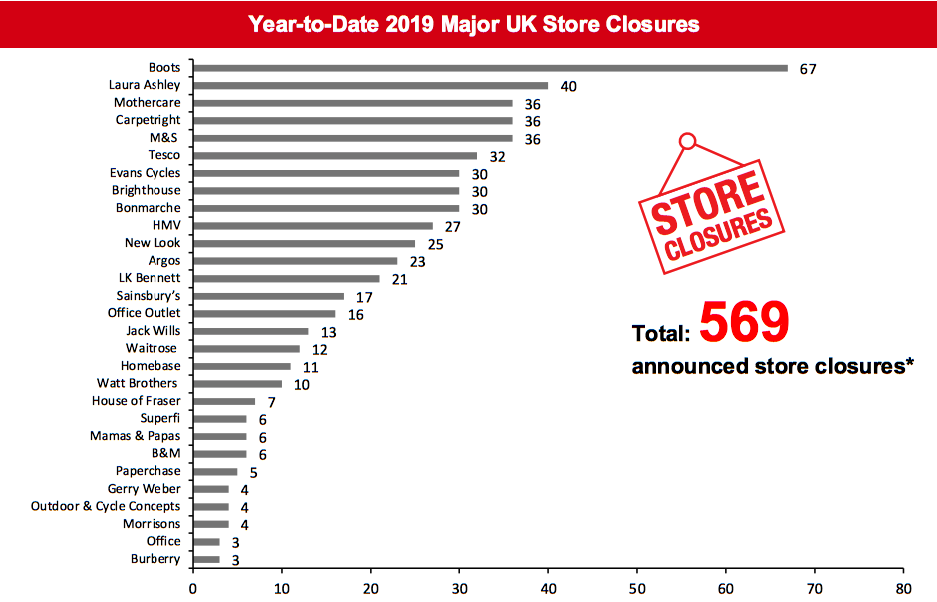

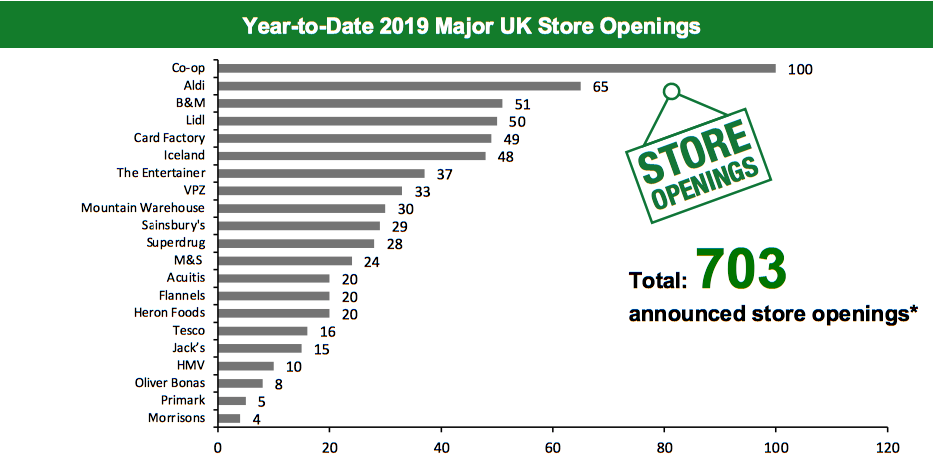

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 569 store closures and 703 store openings. Our data represents closures and openings by calendar year. We have reconciled the UK opening and closure charts for 2018 to account for the larger base of companies that we cover this year.What Is Happening This Week in the UK

Flannels Opens Store in Belfast Luxury fashion chain Flannels, a subsidiary of Frasers Group (formerly known as Sports Direct), opened its largest-ever store at the Victoria Square shopping center in Belfast. The 30,000-square-foot store showcases brands such as Balenciaga, Gucci and Saint Laurent, among others. The store also features its first-ever Flannels Café & Bar. In March 2019, the chain announced plans to open 60 new stores over the next three years. Flannels currently operates 46 stores across the UK.Non-Store-Closure News

Bonmarché CEO Resigns Clothing retailer Bonmarché CEO Helen Connolly has stepped down after joining the company in August 2016. Prior to joining Bonmarché, she worked for Dorothy Perkins and Next. Bonmarché collapsed into administration in October this year, with around 2,900 jobs and 318 stores facing uncertainty. [caption id="attachment_101689" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101690" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes the Anthropologie banner.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart

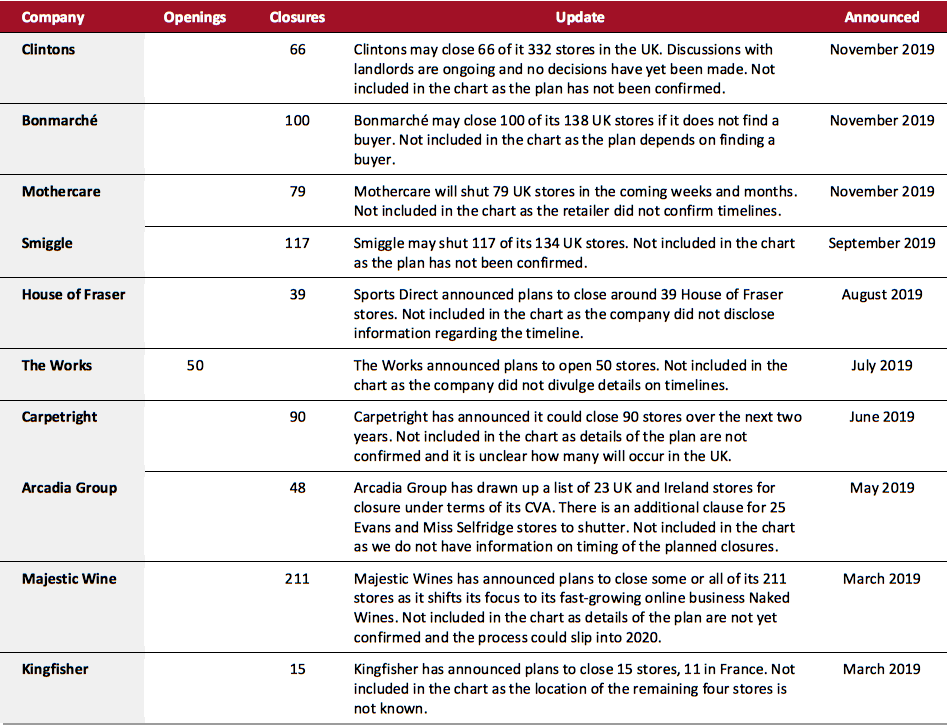

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_101691" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101692" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

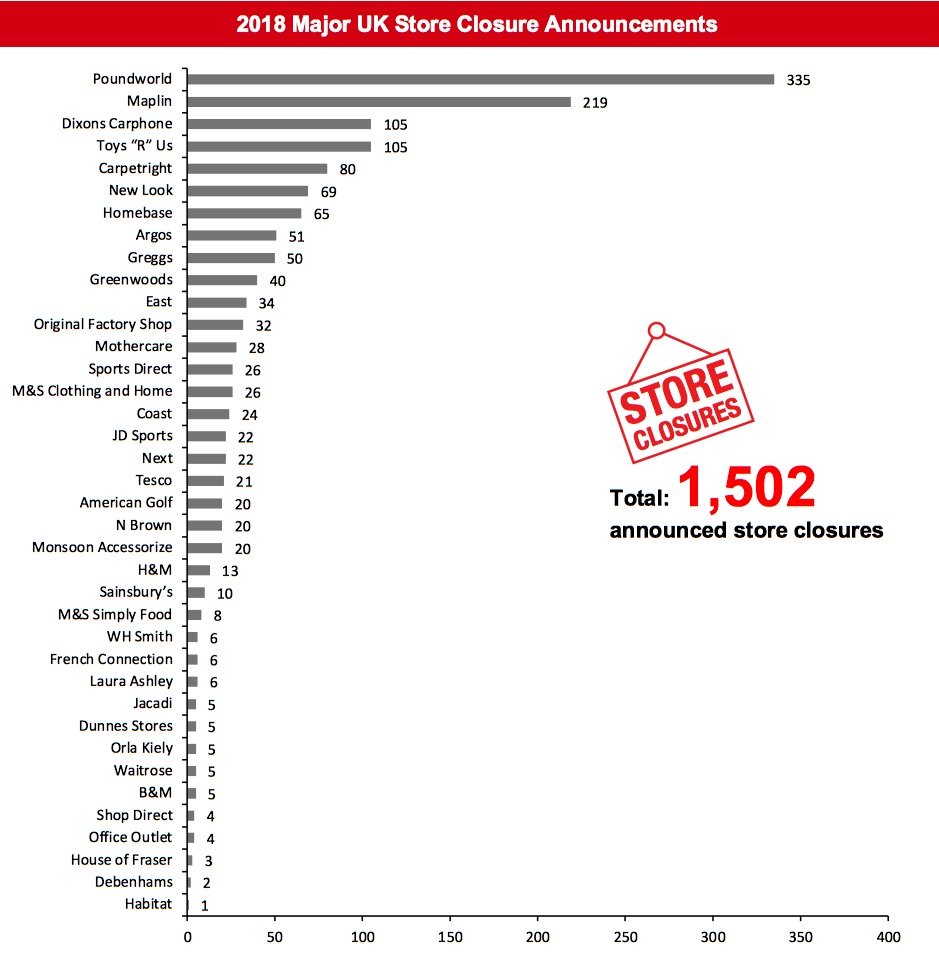

[caption id="attachment_101692" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco. JD Sports closures refer to the UK and Republic of Ireland closures.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco. JD Sports closures refer to the UK and Republic of Ireland closures.Source: Company reports/Coresight Research[/caption] [caption id="attachment_101693" align="aligncenter" width="700"]

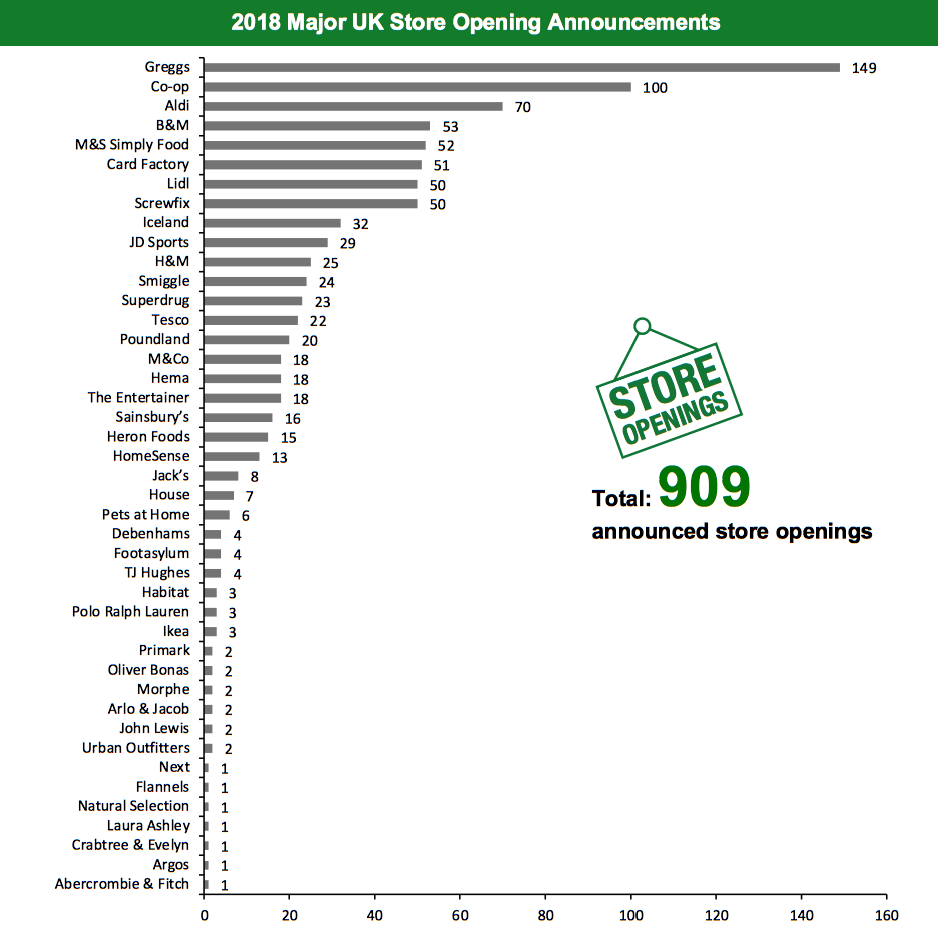

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle. Card Factory, HomeSense and Pets at Home refer to net new openings. JD Sports openings refer to the UK and Republic of Ireland.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle. Card Factory, HomeSense and Pets at Home refer to net new openings. JD Sports openings refer to the UK and Republic of Ireland.Source: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.