Nitheesh NH

The US

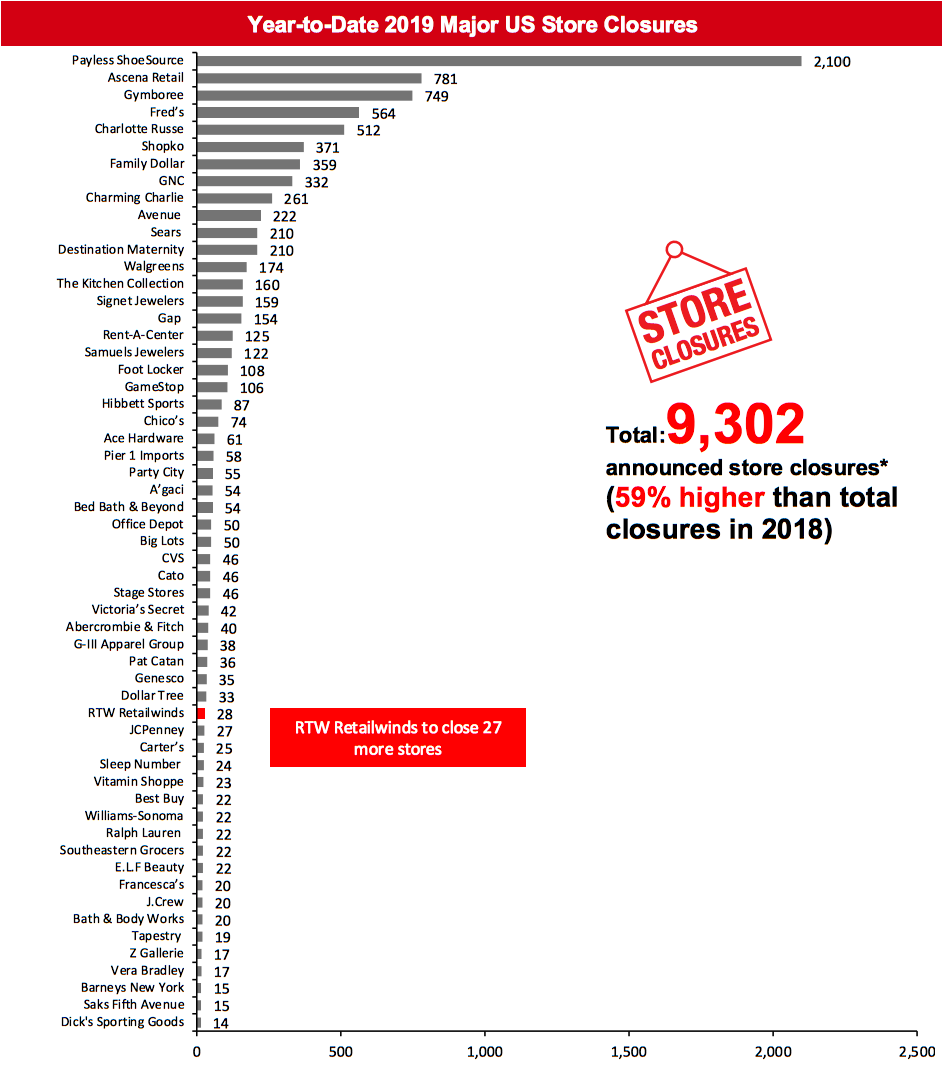

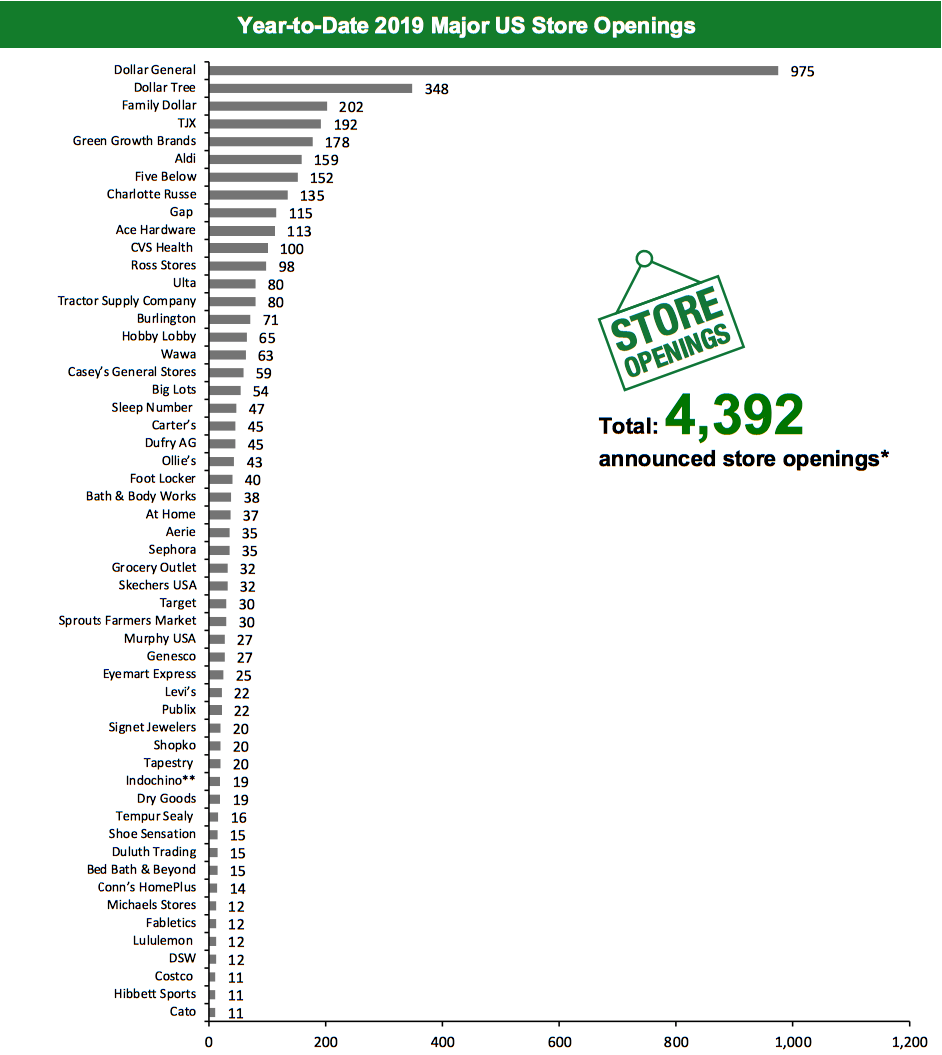

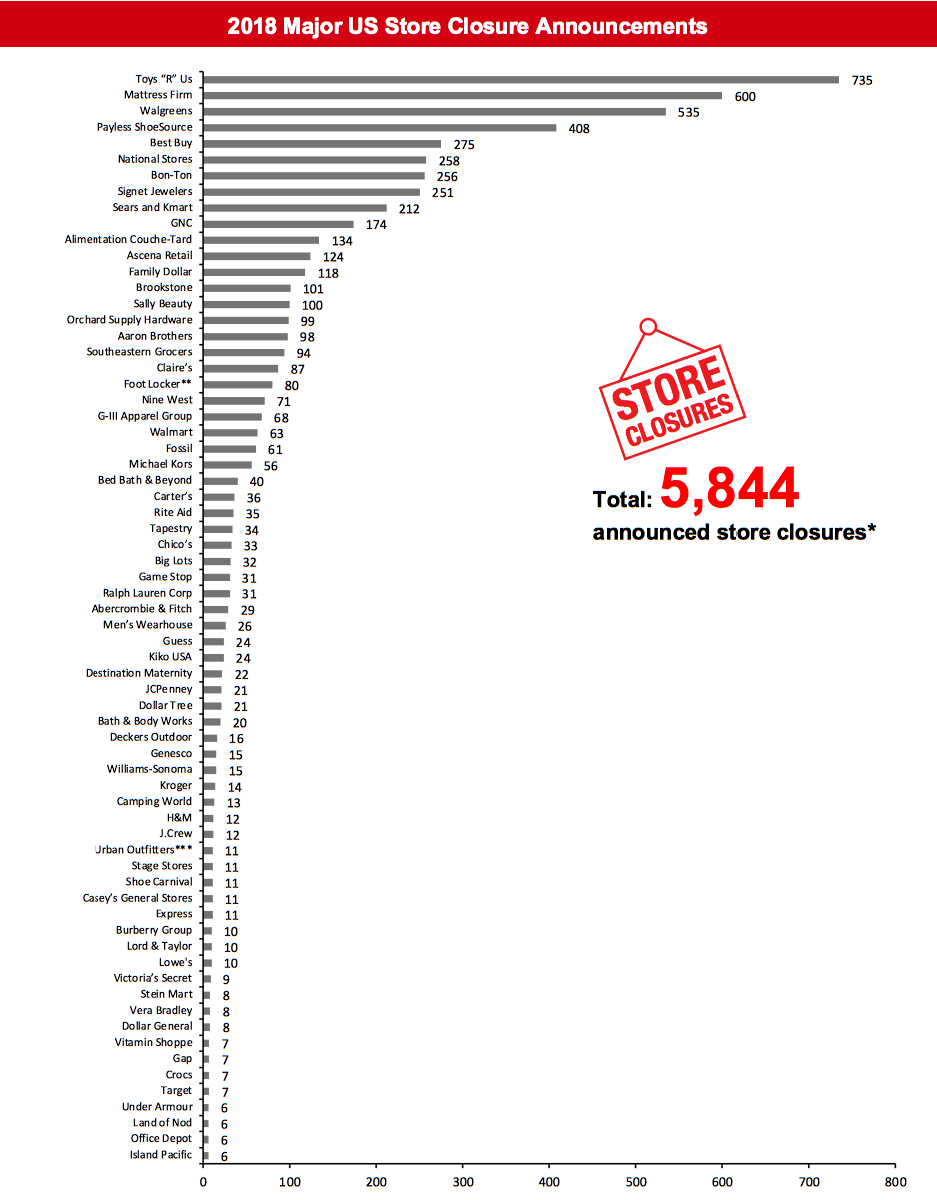

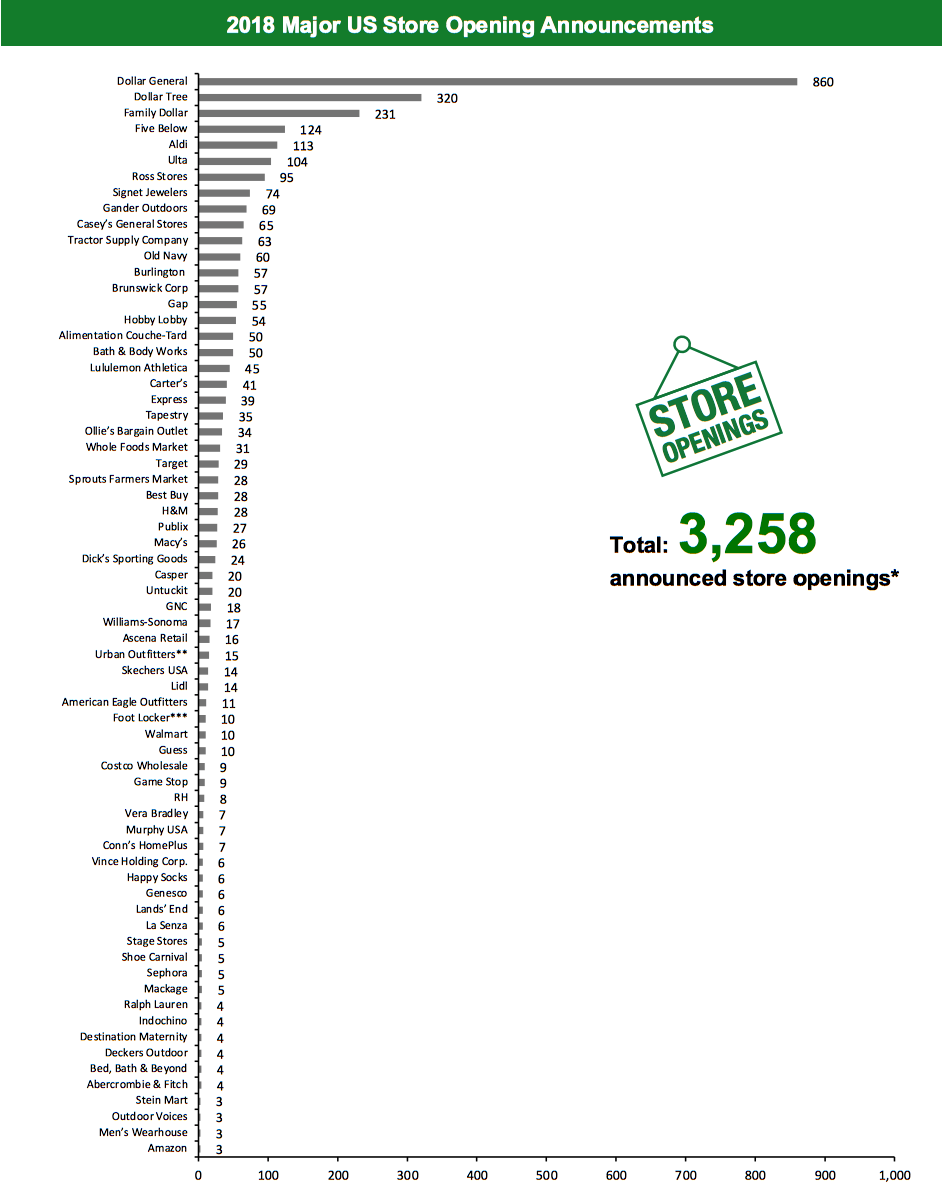

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 9,302 planned store closures and 4,392 openings. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Boot Barn To Double Store Count California-based workwear and lifestyle retailer Boot Barn has announced plans to double its store count to 500 locations, according to CNBC. The company intends to expand its retail footprint to Northeastern US and will soon debut in Pennsylvania. As of September 28, 2019, the retailer operates 248 stores across 33 states in the US. RTW Retailwinds To Shutter 27 Stores Apparel retailer RTW Retailwinds, formerly known as New York & Company, has revealed plans to close 27 stores—19 New York & Company stores, four Fashion to Figure stores and four outlet stores—in its fourth quarter ending February 2, 2020. The company also plans to open one New York & Company store during the fourth quarter. For fiscal year 2019 ending February 2, 2020, the retailer expects to have opened a total of seven New York & Company stores and two Fashion to Figure stores, as well as closing 31 stores—22 New York & Company stores, four Fashion to Figure stores and five outlet stores. Coresight Research insight: RTW Retailwinds is preparing for omnichannel growth via its celebrity brand focus. The retailer recently launched digitally native brand Happy X Nature, which is Kate Hudson’s first ready-to-wear line. Store closures form part of the company’s strategy, as approximately 70% of leases are coming up for renewal in the next two years and about 38% of sales are made online.Quarterly Store Openings/Closures Settlement

This section records previous store opening and closure developments that have been reported in the latest quarterly company filings this week. Ascena Retail Closes 85 Stores Clothing retailer Ascena Retail has reported that it closed 85 stores—including 72 Dressbarn stores—in its first quarter of fiscal year 2020, ended November 2, 2019. The retailer has also announced that it is on track to close the remaining 544 Dressbarn stores by December 31, 2019. As of November 2, 2019, the retailer operated 3,363 stores, including 544 Dressbarn stores. Big Lots Opens 21 Stores and Closes 14 Big Lots has reported that it opened 21 stores and closed 14 in its third quarter of fiscal year 2019 ended November 2. According to its previously announced plans, the retailer intends to close up to 45 stores and open 50 new stores in its current fiscal year, ending February 2, 2020. Casey’s Opens 21 Stores and Closes Three Convenience-store chain Casey’s has reported that it opened 21 stores and closed three in its second quarter of fiscal year 2020 ended October 31, 2019. Casey’s opened a total of 36 stores and closed nine during the first half of the year. These openings are a part of the company’s previously announced plans to open 60 new stores in its current fiscal year, ending April 30, 2020. Dollar General on Track To Open 975 Stores in 2019; Plans To Open 1,000 New Stores in Fiscal Year 2020 Discount retailer Dollar General has reported that it opened 280 stores in its third quarter of fiscal year 2019, ended November 1. During the first three quarters of the year, the retailer has opened a total of 769 stores, remodeled 928 and relocated 75 stores. Dollar General had previously announced plans to open 975 new stores, remodel 1,000 and relocate 100 stores in 2019. The company also revealed that it intends to open 1,000 new stores, remodel 1,500 and relocate 80 stores in fiscal year 2020, ending February 2, 2021. Five Below Opens 67 New Stores; Completes 2019 Store Expansion Plan Discount-store chain Five Below has reported that it opened 61 new stores in its third quarter of fiscal year 2019, ended November 2. To date in the fourth quarter, the company opened 6 more stores and completed plans to open 150 new stores in fiscal year 2019. As of November 2, Five Below operates 894 stores across 36 states in the US. Ollie’s Bargain Outlet Opens 13 New Stores Discount-store chain Ollie’s Bargain Outlet has reported that it opened 13 new stores in its third quarter of fiscal year 2019, ended November 2—including in Massachusetts and Oklahoma, which are two new states for the company. Ollie’s has opened a total of 42 stores over the nine months of this fiscal year, and these openings are a part of the retailer’s previously announced plans to open between 42 and 44 new stores in . Ulta Beauty Confirms Opening of 31 Stores Ulta Beauty has reported that it opened 31 new stores, remodeled three and relocated two stores in its third quarter of fiscal year 2019, ended November 2. In total, the retailer opened 73 new stores, remodeled 12 and relocated six during the first three quarters of the fiscal year. The openings are a part of Ulta’s previously announced plans to open 80 new stores this year.Non-Store-Closure News

Lululemon COO Departs Athletic-wear retailer Lululemon Athletica has announced that Stuart Haselden, Chief Operating Officer (COO) and Executive Vice President (EVP), Head of International, will leave the company, effective January 10, 2020. Haselden, who joined Lululemon in 2015 as Chief Financial Officer, is leaving the retailer to join travel and lifestyle brand Away as its CEO, effective January 13, 2020. Lululemon said it has begun an external search for the position of EVP, International. [caption id="attachment_101108" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. RTW Retailwinds includes New York & Company and Fashion to Figure banners.*Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101109" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes New York & Company and Fashion to Figure banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. RTW Retailwinds includes New York & Company and Fashion to Figure banners. *Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

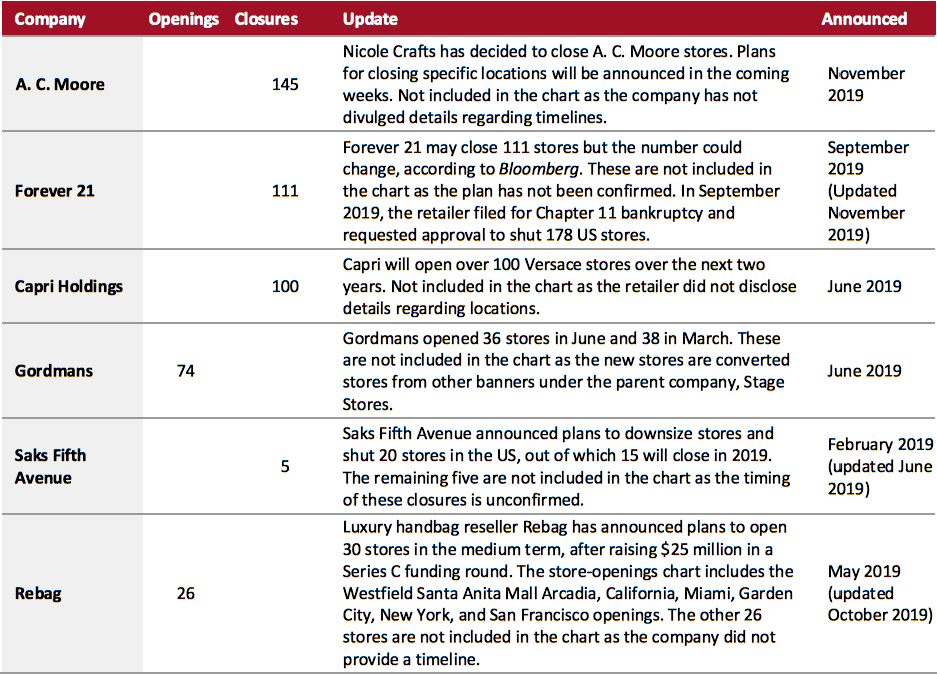

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_101110" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101111" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101111" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101112" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

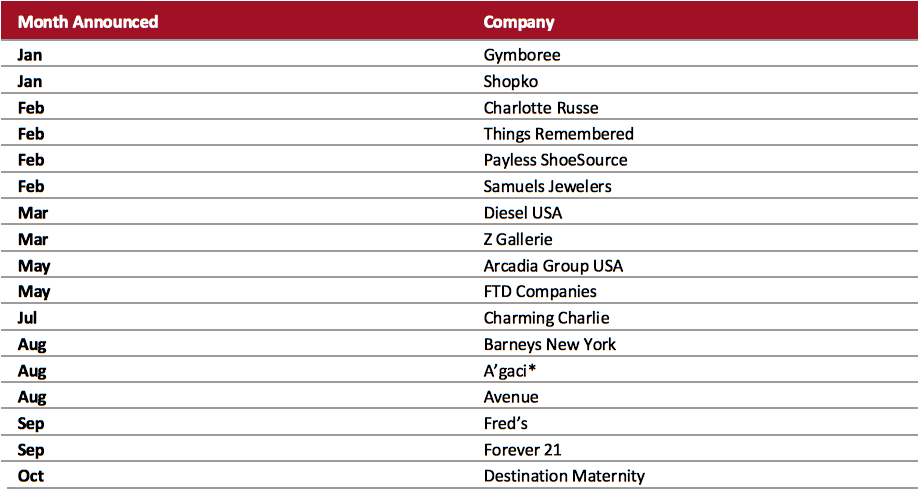

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_101113" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

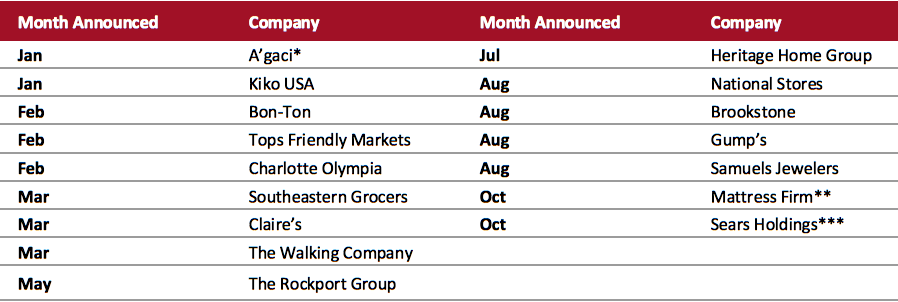

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_101114" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

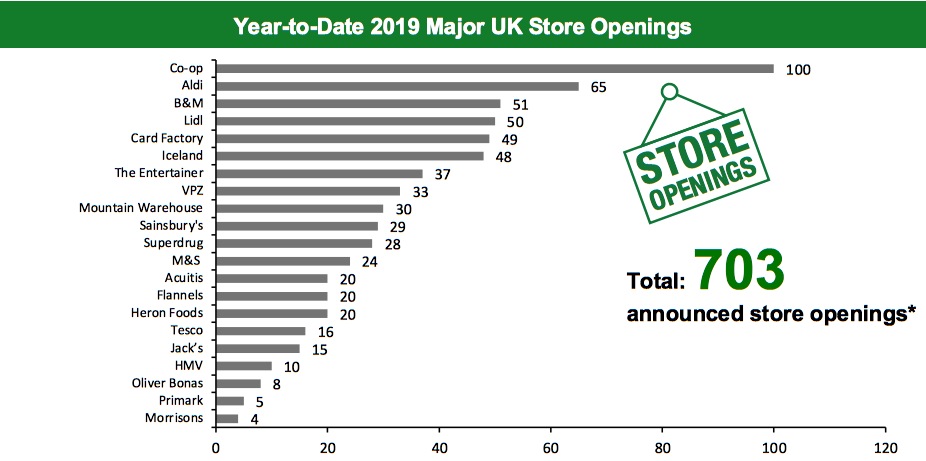

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 569 store closures and 703 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Co-op To Open 30 Stores Before Christmas Consumer co-operative group Co-op has announced that it intends to open 30 stores across UK before Christmas this year. The locations of the new stores include Bristol, Cambridge, Edinburgh, Forest Hill and Sheffield. These openings are part of the retailer’s previously announced plans to open 100 new stores in 2019 as part of a £200 million ($253.3 million) store investment programme. The programme also entails significant makeovers for around 200 stores. Quiz Warns of Store Closures Clothing retailer Quiz has warned that there may be more store closures on the anvil. According to Emma-Lou Montgomery, Associate Director of Fidelity Personal Investing, the retailer may close half of its stores. The news surfaced following declining sales across the Quiz’s stores and concessions. As of September 30, 2019, the retailer operates 73 stores and 171 concessions in the UK. We have not included the closures in the chart as the plan has not been confirmed.Non-Store-Closure News

Ted Baker Bosses Resign Luxury clothing retailer Ted Baker has announced that its CEO Lindsay Page, who was appointed in April 2019, has resigned. The retailer’s Chairman David Bernstein has also decided to step down from his role. Page will be replaced by Ted Baker’s current Chief Financial Officer Rachel Osbourne on an interim basis. Non-executive Director of the Board Sharon Baylay has become the acting Chair of the Board. Topshop and Topman CEO Resigns Paul Price, CEO of fashion retailer Topshop and Topman, has resigned from his role to relocate back to the US, according to Retail Gazette. He will depart the company at the end of the year, a spokesperson from Topshop and Topman parent company Arcadia confirmed. Price joined the company in September 2017 and had previously worked with Banana Republic, Burberry and Williams-Sonoma. [caption id="attachment_101115" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_101116" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

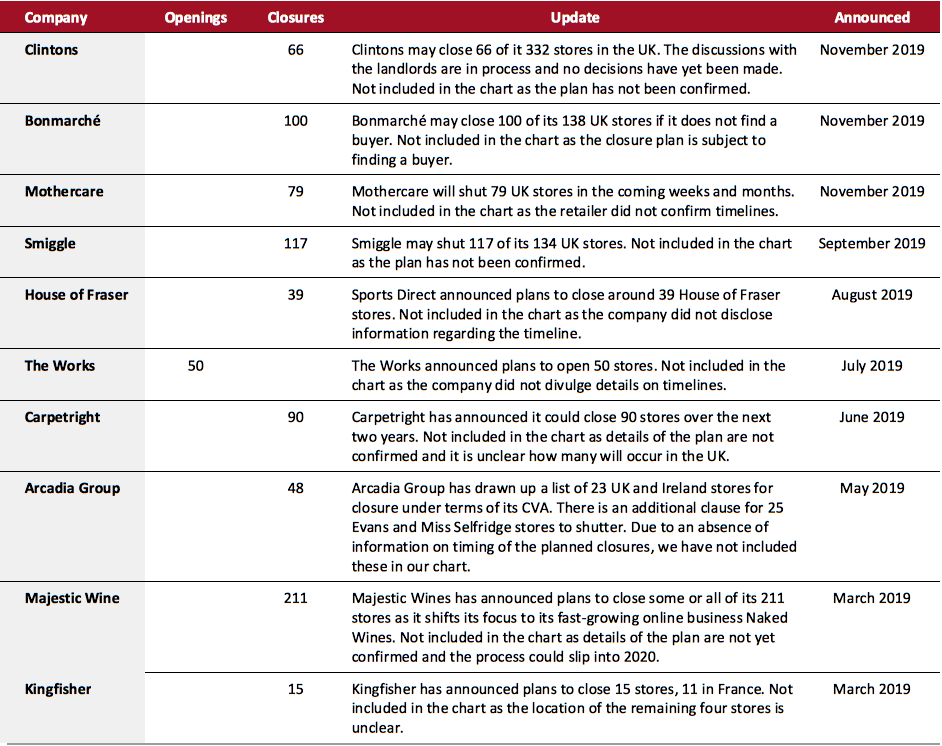

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_101117" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_101118" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

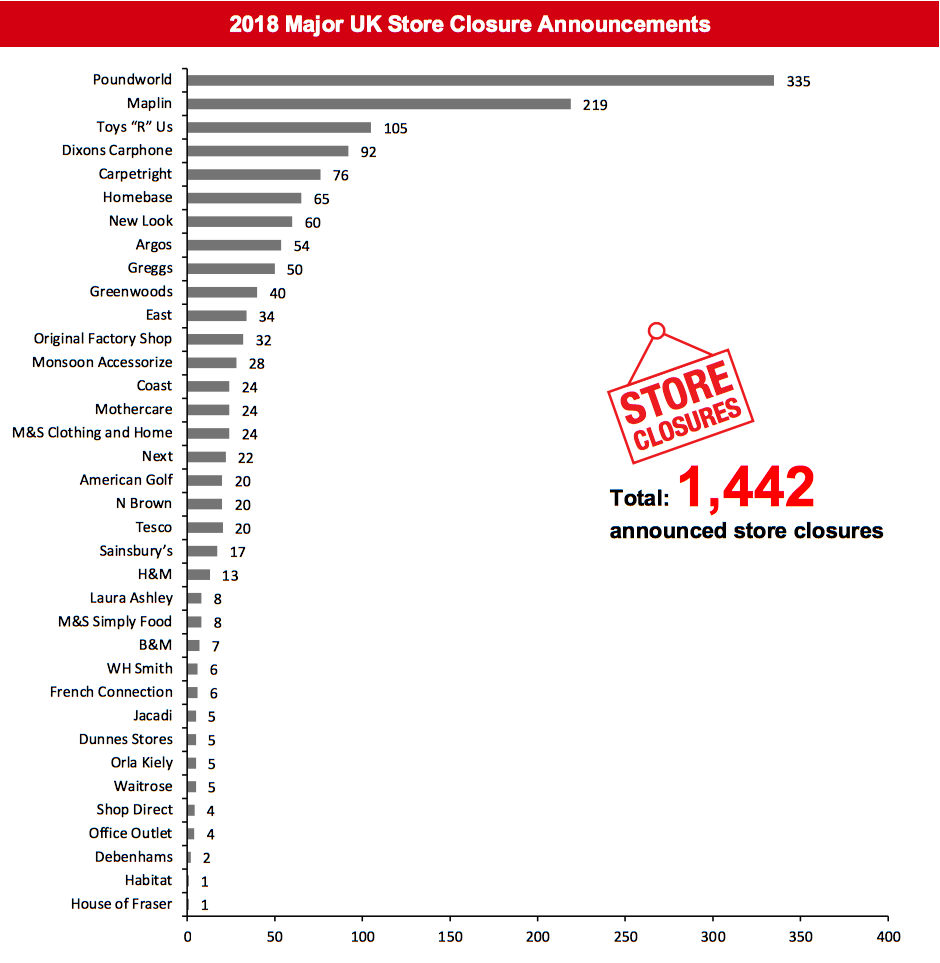

[caption id="attachment_101118" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_101119" align="aligncenter" width="700"]

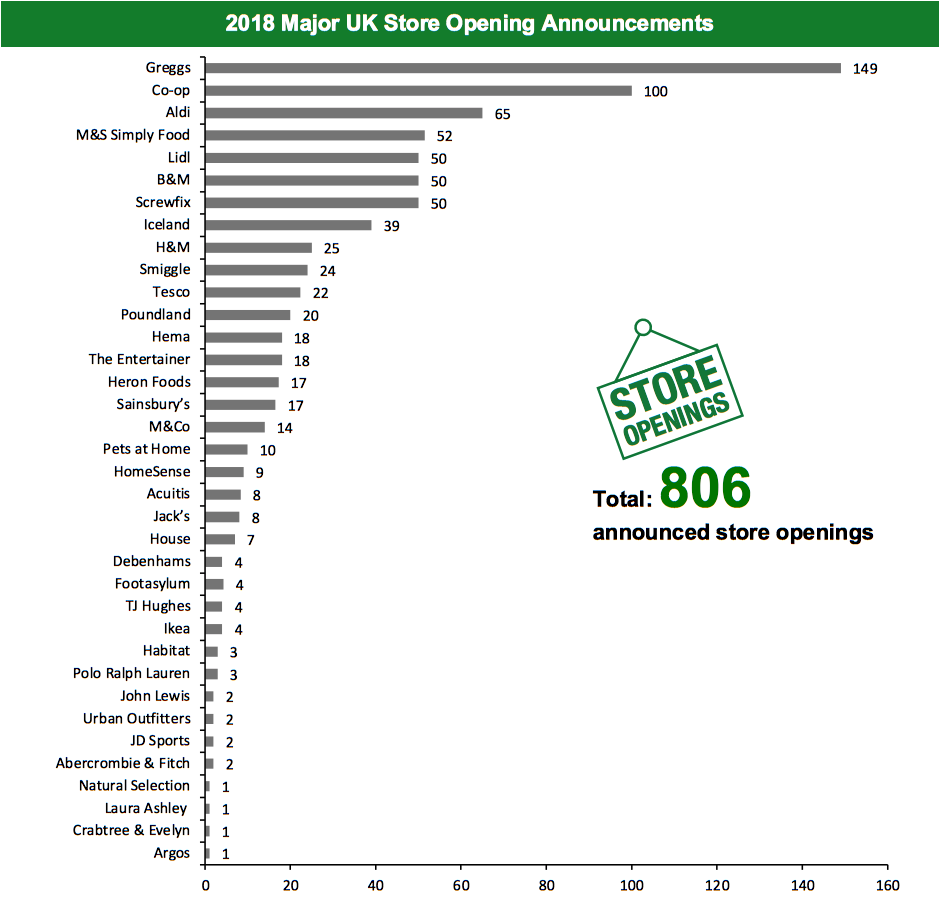

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.