DIpil Das

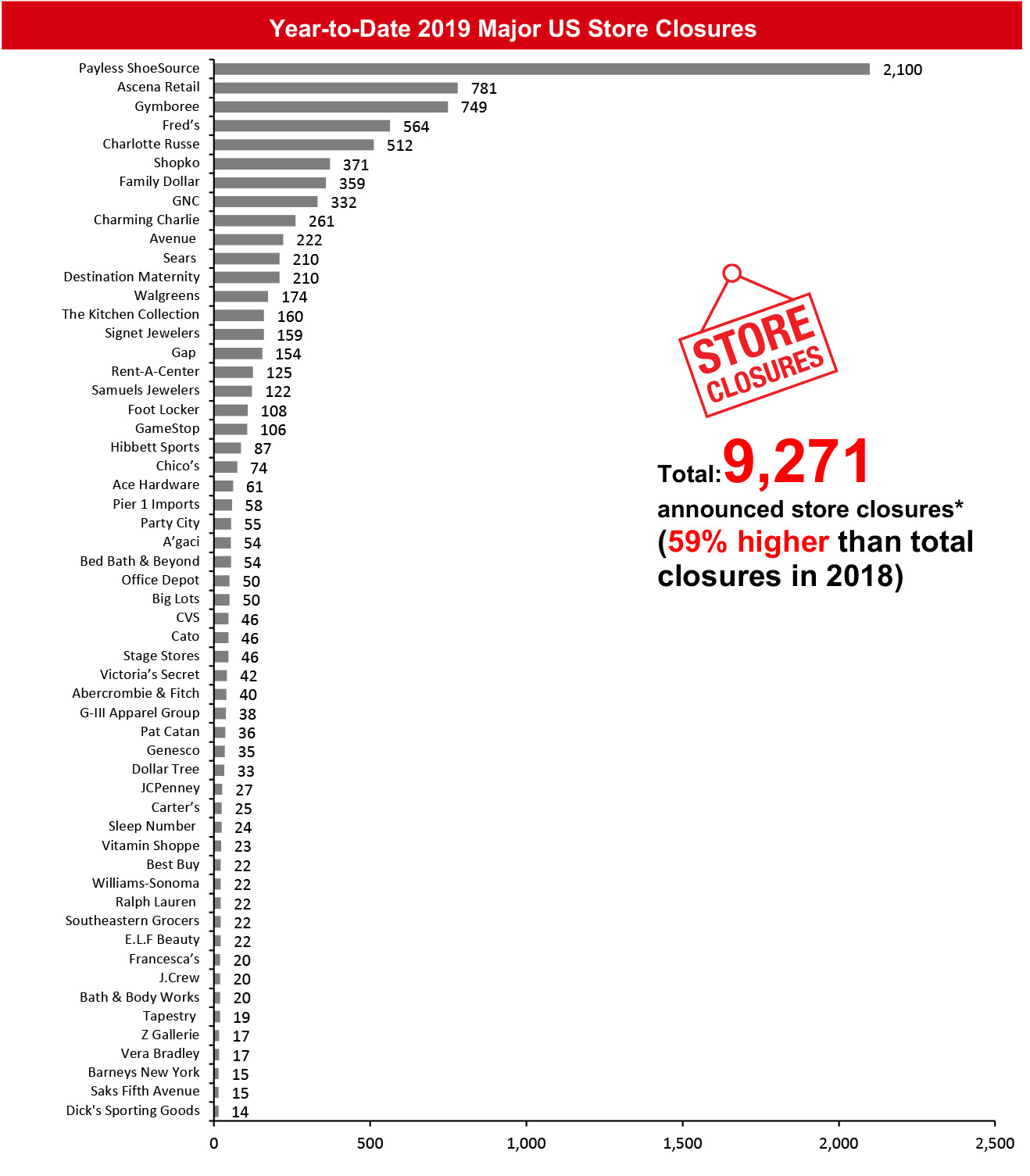

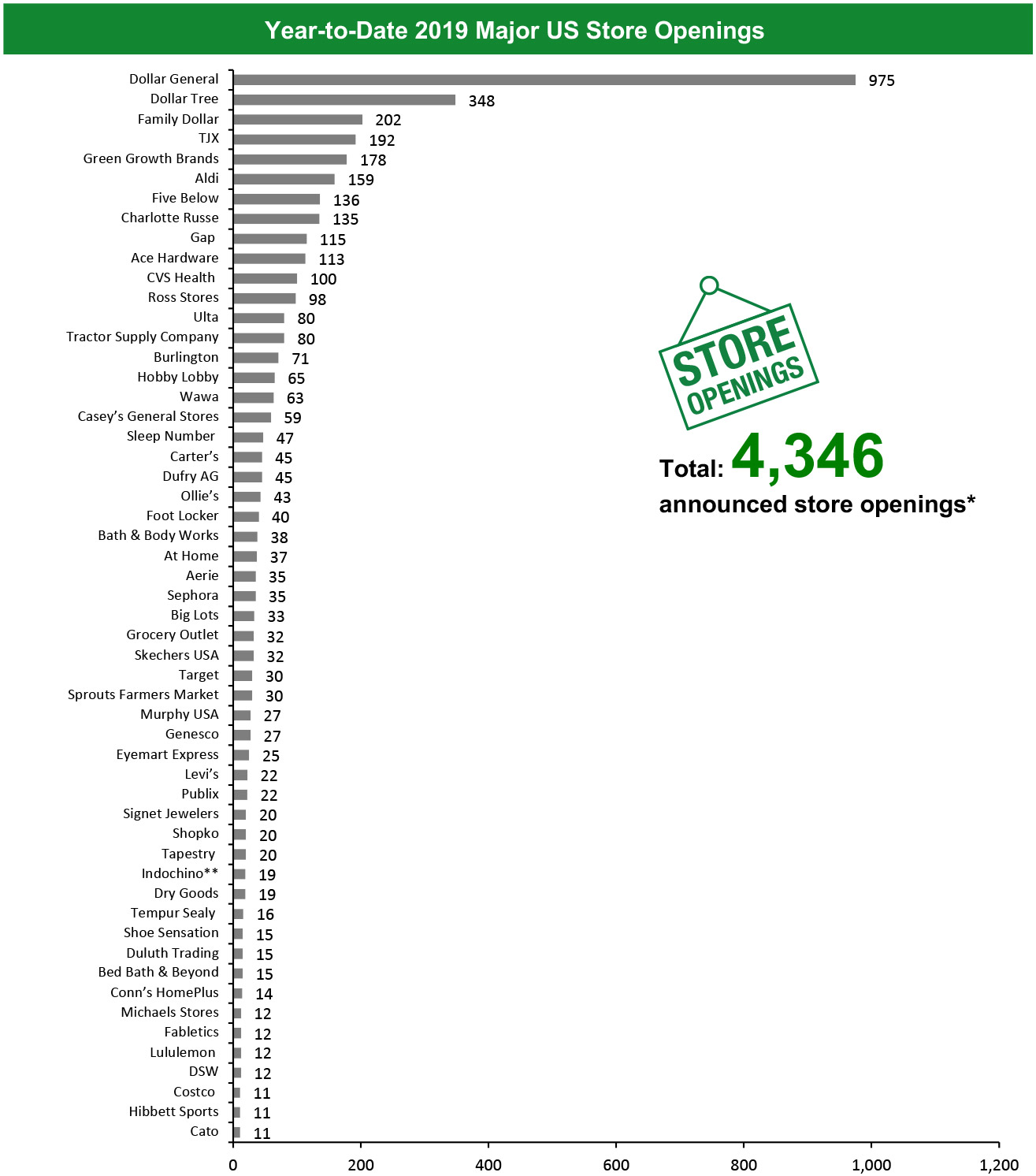

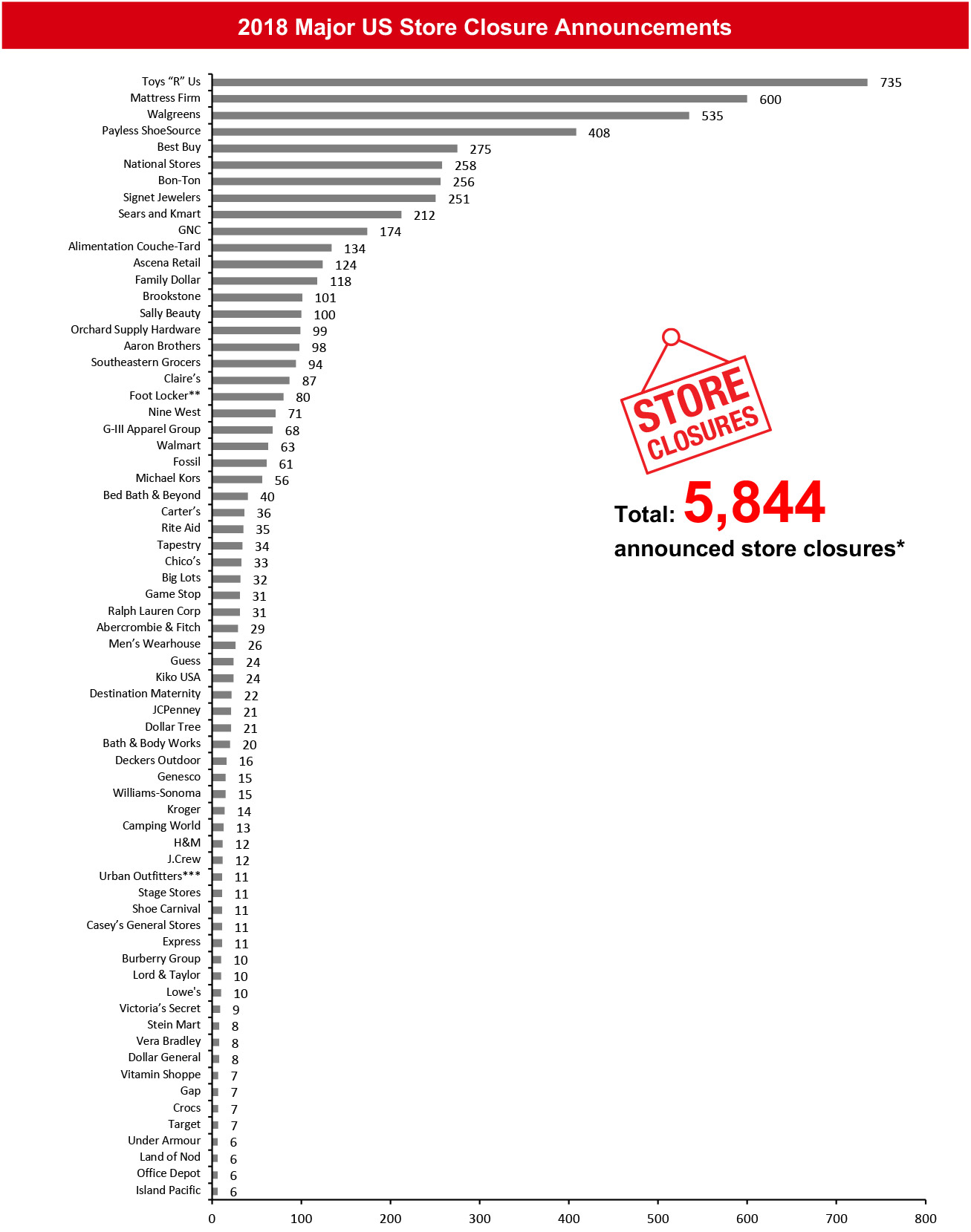

The US

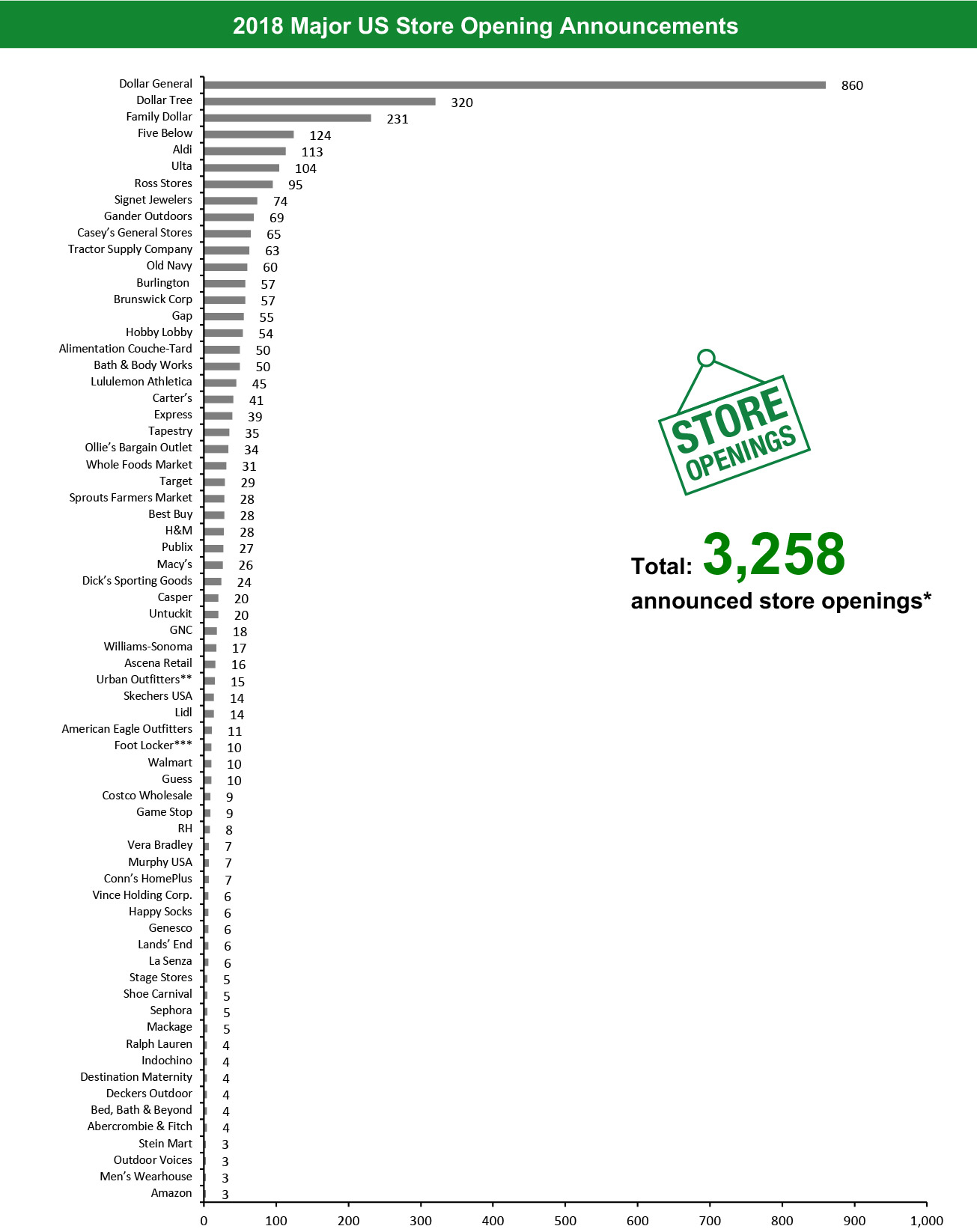

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 9,271 planned store closures and 4,346 openings. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year. This week, we added openings and closures for Ace Hardware Corp and Genesco to our charts, which has impacted the overall totals.What Is Happening This Week in the US

Citi Trends Pivots Away from Apparel; Plans To Open 25 to 30 Stores Annually Clothing retailer Citi Trends is stepping up plans to shift its merchandising strategy away from apparel and towards accessories and home goods. As part of this, the retailer plans to open 25 to 30 stores and remodel 50 existing stores on an annual basis. The company currently operates 566 stores in 33 states and has already approved 14 locations for store openings in 2020. Citi Trends expects to remodel 20 stores in January, followed by 30 more in the second quarter of 2020. Coresight Research insight: Year to date, the apparel sector has accounted for 62% of total store closure announcements, according to the Coresight Research Retail Store Databank, as apparel retailers and brands rationalize their store fleets. On the other hand, the home goods category is experiencing increased consumer interest in tandem with a healthy housing market and favorable demographics. Destination Maternity Announces Stalking Horse Bid from Marquee Brands; May Close Stores Brand owner Marquee Brands has made a bid worth $50 million for Destination Maternity, which has filed a motion to approve selection of the stalking horse bidder in advance of its Chapter 11 auction (scheduled for December 9). As per the terms of the bid, Destination Maternity would close all of its remaining 236 stores in addition to the 210 stores that have already been earmarked for closure. The deadline for submission of qualified bids was December 5, and Destination Maternity plans to seek court approval for the winning bid on December 12, 2019. Coresight Research insight: Today’s shoppers are increasingly becoming less attracted to transactional products and more to access and experiences—representing the uberization of consumer needs. The niche maternity apparel market is therefore highly vulnerable to disruptor retailers (rental, subscription and consignment). Everlane Set To Open a New Store in Boston in Spring 2020 Direct-to-consumer clothing retailer Everlane has revealed plans to open a new store in Boston in spring next year. The new 2,300-square-foot store will be the retailer’s first brick-and-mortar presence in Boston and will feature the Everlane’s signature minimalist design. The company currently operates two physical outlets in New York and three in California. Forever 21 Set To Shut Over a Dozen Stores in California Fashion retailer Forever 21 has confirmed plans to shut more than a dozen stores in California in January 2020 as per the company’s filings with the state. The stores that have been earmarked for closure include five Bay Area stores that will shutter by January 5 next year. Forever 21 filed for bankruptcy in September 2019. Lidl To Open Multiple Stores Discount supermarket chain Lidl has announced that it will open its first two Long Island stores and a store in Raleigh, North Carolina, on December 11. The two Long Island stores—to be located in Bergenfield, New Jersey, and Fayetteville, North Carolina—are the first of eight new stores planned for the area between now and summer 2020. Lidl opened its first store in Charlotte, North Carolina, on December 4 and will open the new stores on December 18. Toys “R” Us Returns to Brick-and-Mortar Retail Toys “R” Us opened a new store in Westfield Garden State Plaza in Paramus, New Jersey, last week and has announced plans to open a store at The Galleria in Houston on December 7. These store openings mark a return to brick-and-mortar retail for the brand, which filed for bankruptcy in 2018 and shuttered all of its stores. Tru Kids Brands, the current parent company of Toys “R” Us, forged an alliance with Target and relaunched the Toy “R” Us website in October 2019.Non-Store-Closure News

JCPenney Appoints New Chief Digital Officer Department-store chain JCPenney has hired Karl Walsh as its new Chief Digital Officer to “lead strategic advancements of the company’s digital platforms and bring the customer experience to life.” Walsh previously served in the same role at jewelry company Pandora and has also worked with Boston Consulting Group and McKinsey & Company. [caption id="attachment_100838" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100839" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. *Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

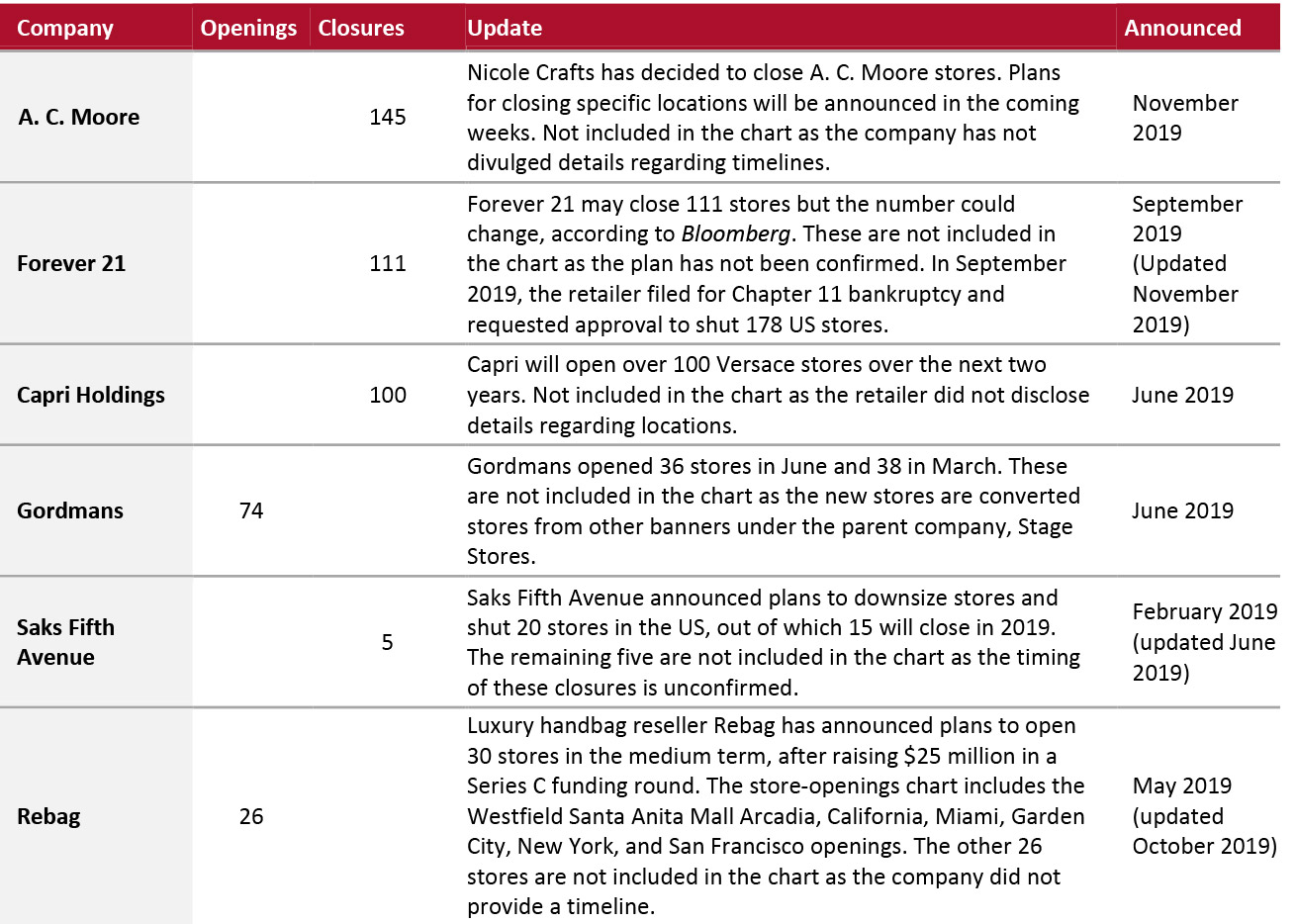

Source: Company reports/Coresight Research [/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_100840" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_100841" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_100841" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100842" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

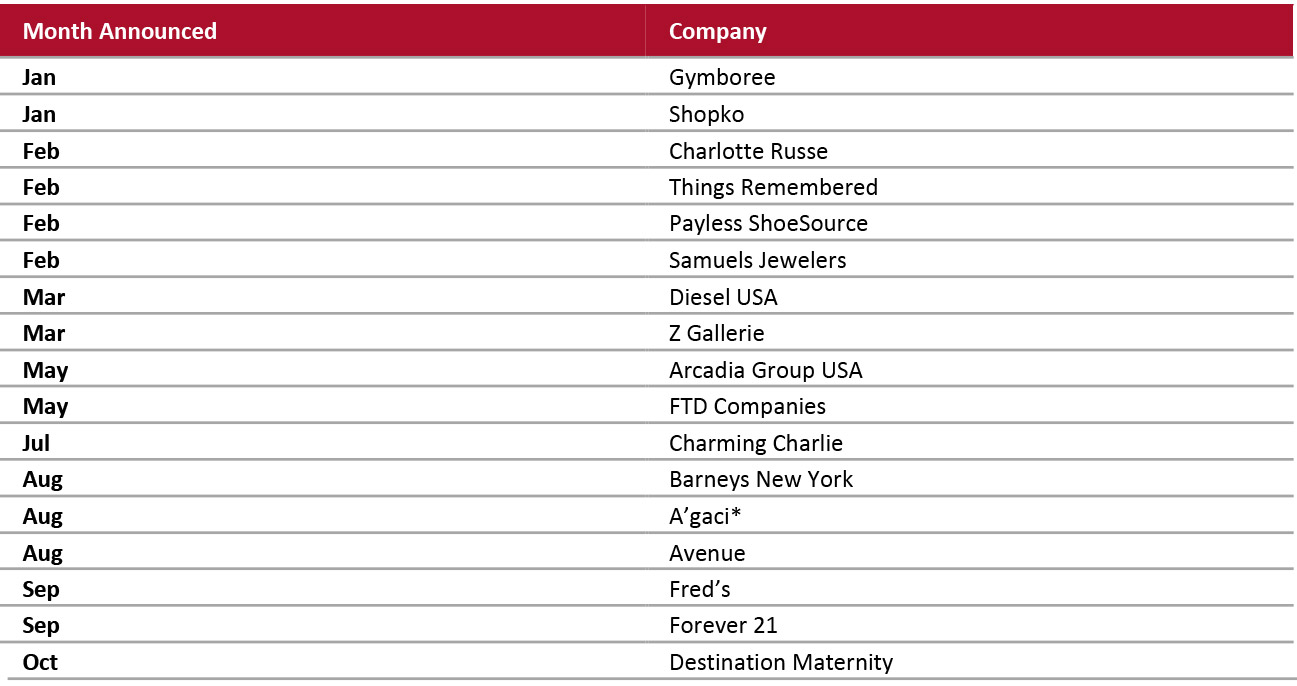

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_100843" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research [/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_100844" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

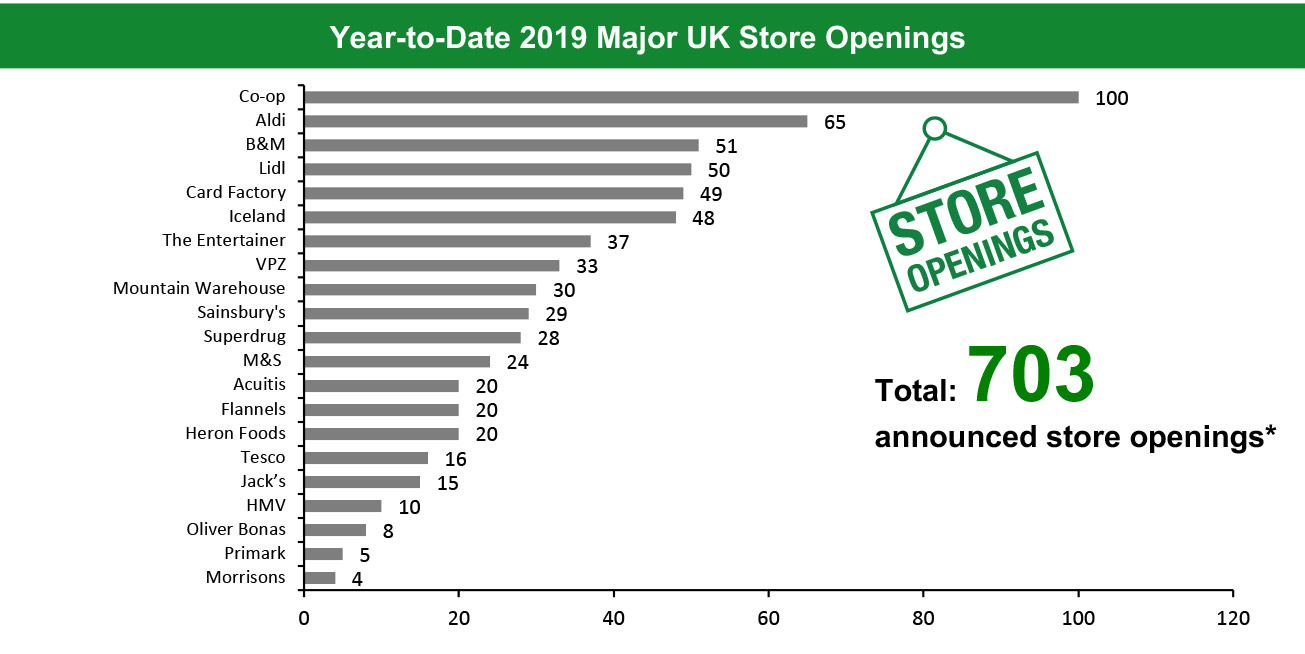

2019 Major UK Store Closures and Openings

Year to date in the UK, major retailers have announced 569 store closures and 703 store openings. Our data represents closures and openings by calendar year.

What Is Happening This Week in the UK

Bonmarché Set To Close 30 Stores

Womenswear retailer Bonmarché, which fell into administration in October 2019, looks set to close around 30 of its total 285 stores by December 11. However, the company is set to be rescued by value fashion retailer and former sister chain Peacocks, which has been confirmed as the preferred bidder by FRP Advisory. The administrators are looking to finalize the deal before December 25, which would see Bonmarché reunite with Peacocks.

Heals Opens Outlet in Chiswick

Home and design retailer Heals has opened a new store on Chiswick High Road. The new 2,080-square-foot store offers a range of cancelled, returned and overstocked items at significantly discounted prices, including up to 70% off across furniture, lighting and accessories.

Non-Store-Closure News

Seren and An Indian Summer Unveil Pop Up Stores

Ahead of Christmas, London-based fashion retailer Seren and lifestyle brand An Indian Summer have opened luxury fashion pop-ups in Chelsea. Seren’s pop-up at 279 Fulham Road is its first in the UK and will remain open until December 14. An Indian Summer’s pop-up at 340 King’s Road is the brand’s second of the year and will stay open until Christmas.

[caption id="attachment_100857" align="aligncenter" width="700"]*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100846" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

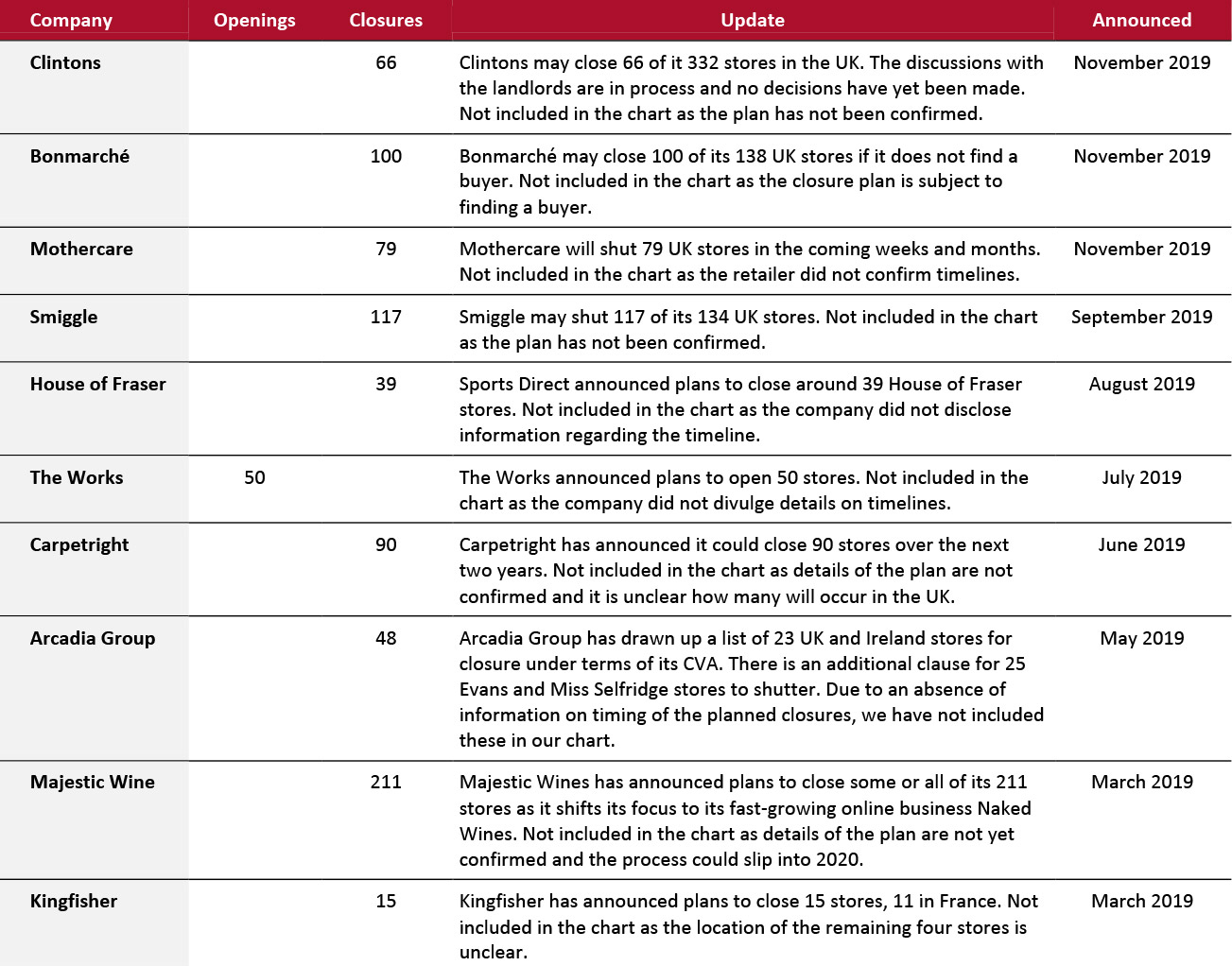

Source: Company reports/Coresight Research [/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_100847" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_100848" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

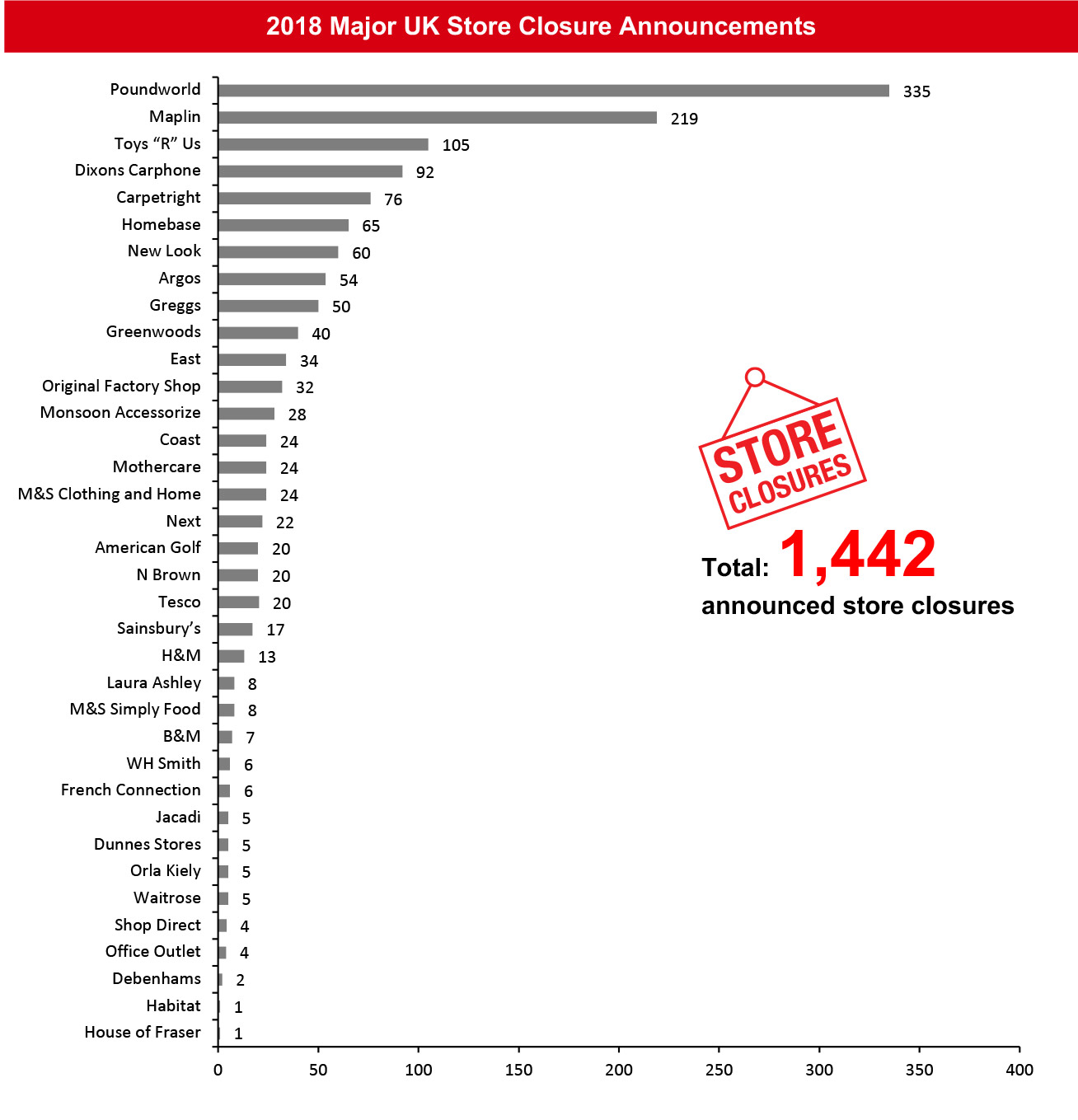

[caption id="attachment_100848" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_100849" align="aligncenter" width="700"]

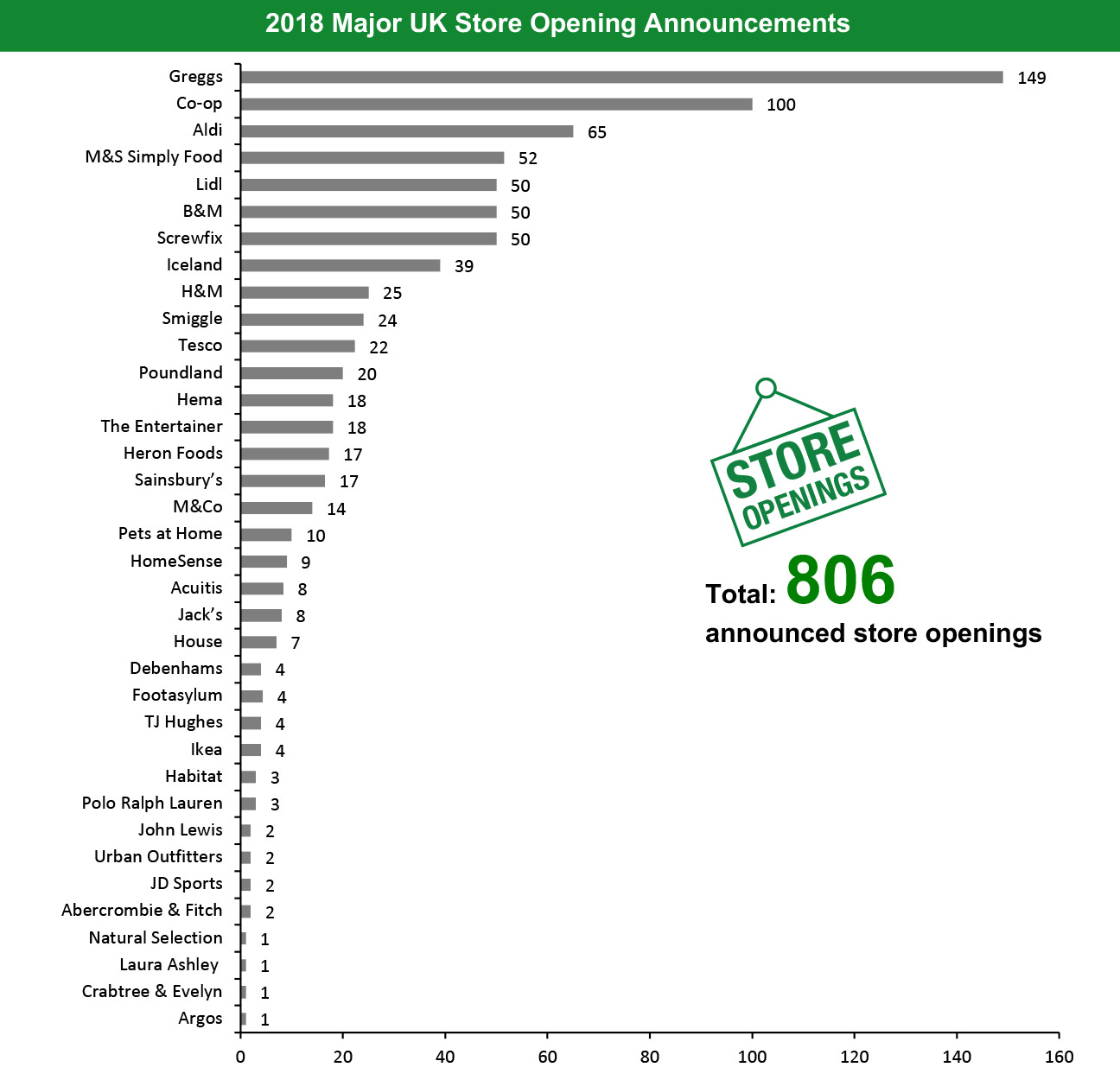

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.