DIpil Das

The US

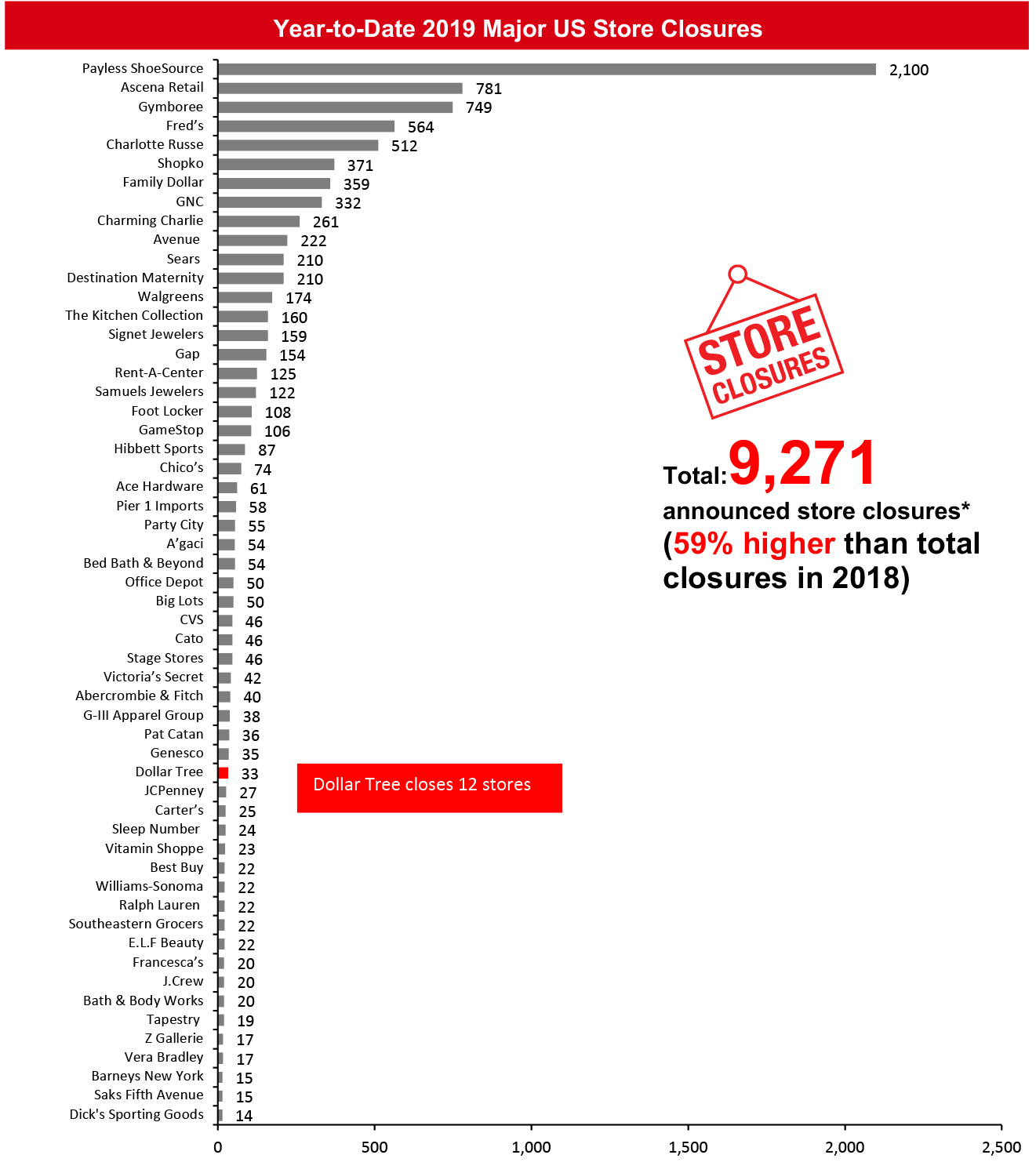

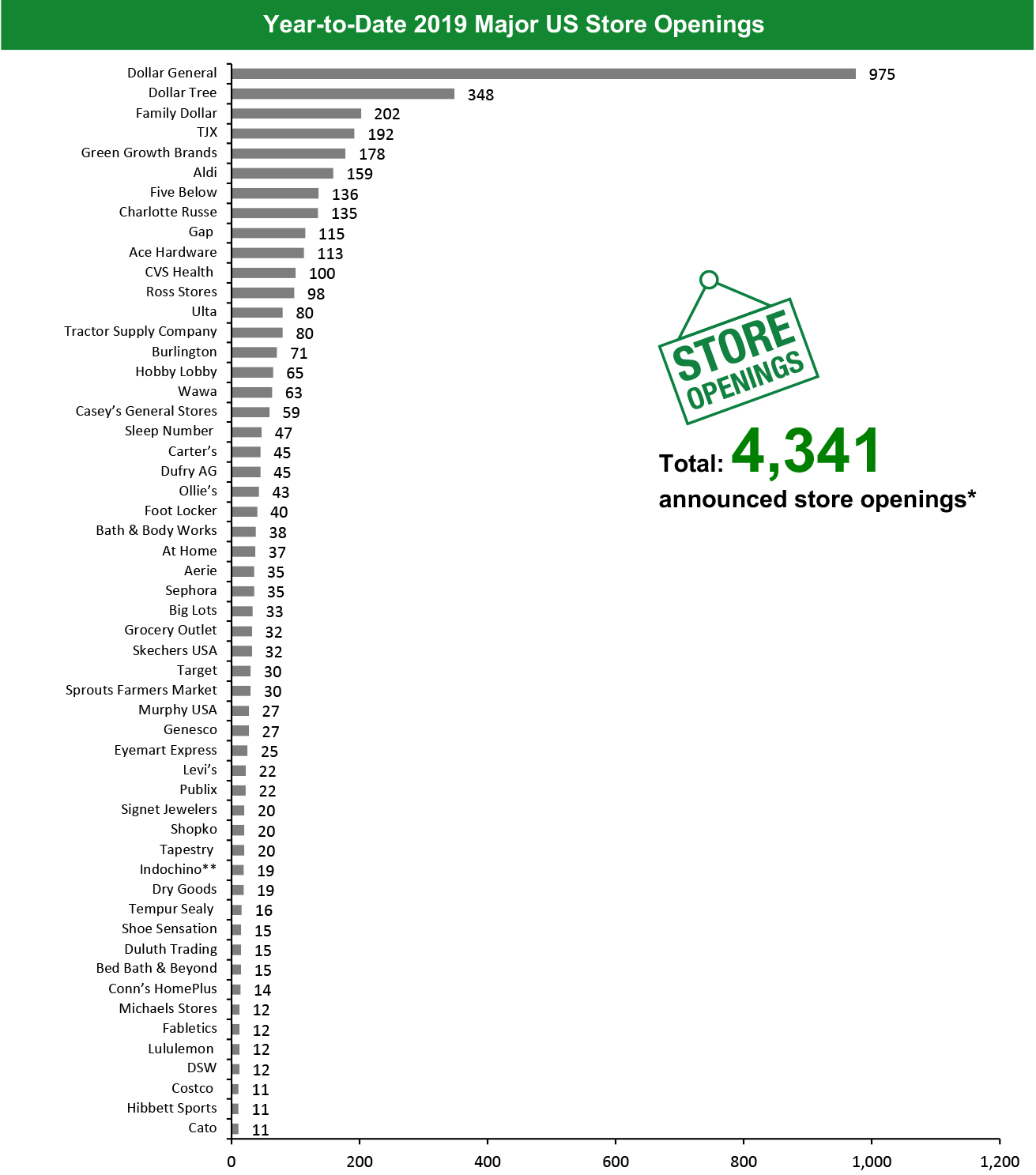

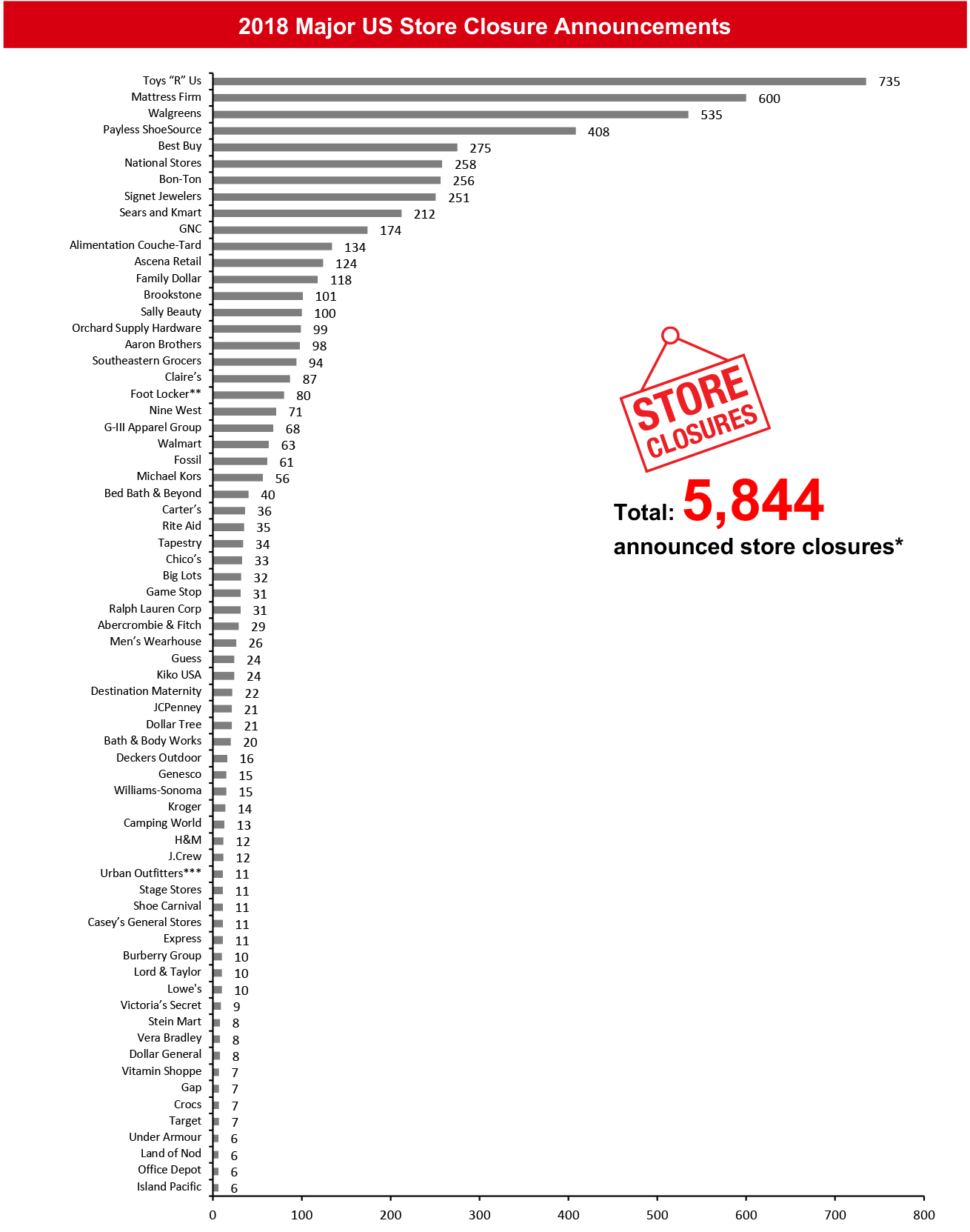

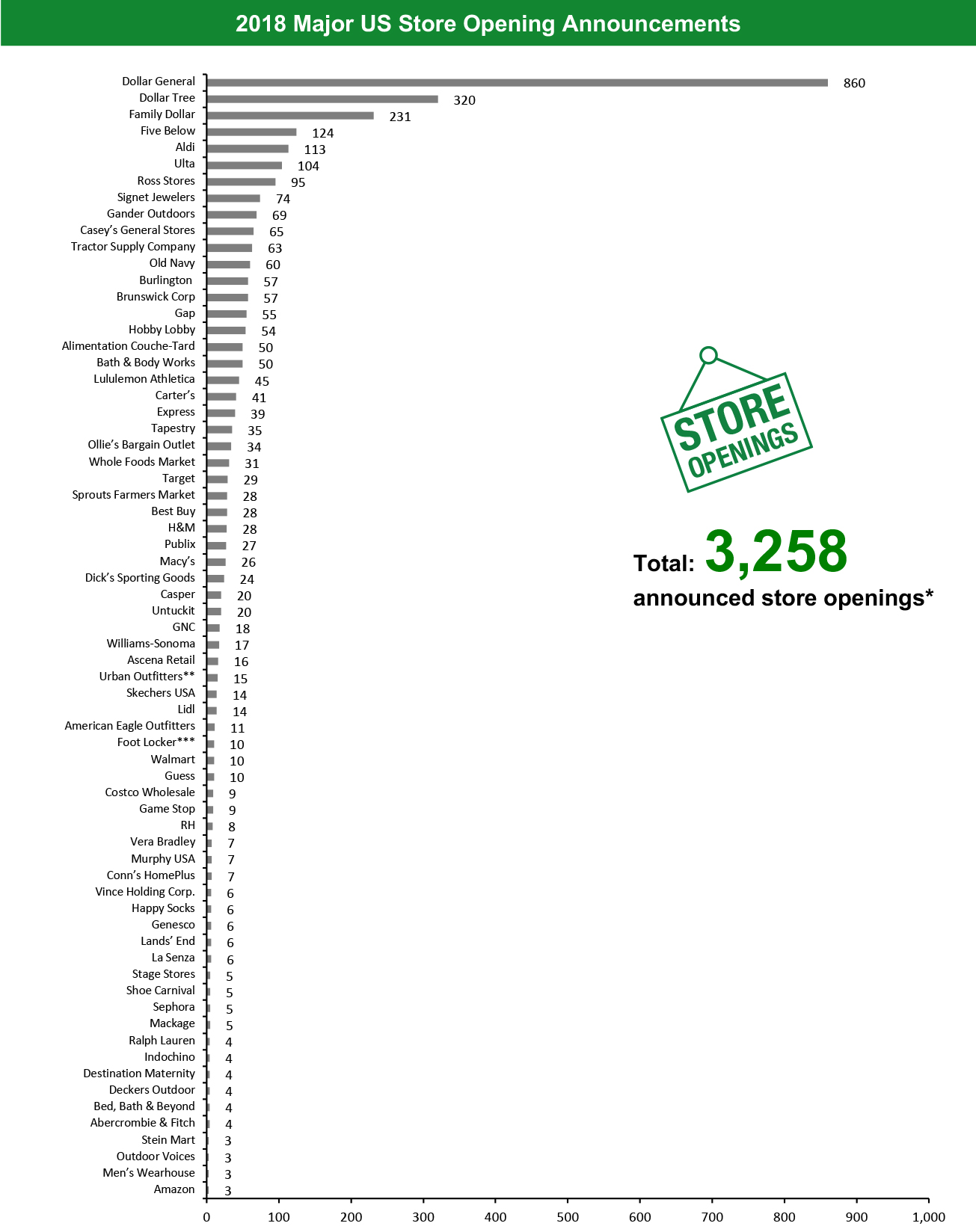

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 9,271 planned store closures and 4,341 openings. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year. This week, we added openings and closures for Ace Hardware Corp and Genesco to our charts, which has impacted the overall totals.What Is Happening This Week in the US

Charlotte Russe Expands Store Fleet Clothing retailer Charlotte Russe has opened 135 stores since its acquisition by North American fashion company YM Inc in April 2019, according to Retail Dive. YM Inc. announced plans in June to open 100 Charlotte Russe locations, including five that opened in the same month. According to a company spokesperson, the store expansion will continue next year, with an additional round of store openings set to kick-off in February 2020. Before its acquisition, Charlotte Russe filed for bankruptcy in February 2019 and subsequently shuttered 512 stores in the US. Coresight Research insight: Fast fashion and value pricing are a winning equation for Gen Z and young millennials, and Charlotte Russe targets this young fashionista demographic, alongside H&M and Zara. Through YM Inc, the brand can enjoy a relaunch on a small scale and with less onerous lease obligations. H&M Opens in Detroit H&M has opened a store in downtown Detroit, Michigan. Located at 1505 Woodward Avenue, it offers an entire collection of apparel for men, women and children. The 25,000-square-foot store offers casual, work and dress apparel as well as accessories. Nicole Crafts To Close A. C. Moore Stores Nicole Crafts, parent company of art and craft retailer A. C. Moore, has decided to exit its retail operations and close A. C. Moore stores, as a part of its strategic plan. According to the company, plans for closing specific A. C. Moore locations will be shared on the company’s website in the coming weeks. The Michaels Companies will take over leases for up to 40 A. C. Moore locations and a lease on the East Coast distribution facility. These stores are expected to reopen under the Michaels banner in 2020. A. C. Moore currently operates over 145 stores. The planned closures have not been included in our closures chart as the company has not divulged details regarding timelines. Coresight Research insight: Crafters have migrated to the ease of online purchasing, driving the consolidation of the arts and crafts specialty retail category. A. C. Moore was once a premiere destination for crafters, but online competition and lower-priced alternatives have undermined the big-box specialty retail operating model. Quarterly Store Openings/Closures Settlement This section records previous store opening and closure developments that have been reported in the latest quarterly company filings this week. Burlington Stores Confirms Opening of 45 Stores and Closing of Two Off-price retailer Burlington Stores has opened 45 new stores, relocated eight and closed two during its third quarter of fiscal year 2019, ended November 2. The retailer expects to total 76 new store openings during this fiscal year, and four store openings, one relocation and three store closures are planned for the fourth quarter, ending February 2, 2020. Burlington Stores has opened 72 new stores, relocated 15 and closed six during the nine-month period ended November 2, 2019. Dick’s Sporting Goods Opens Seven Stores and Closes Nine Dick’s Sporting Goods reported that it opened six Dick’s Sporting Goods and one specialty concept store during its third quarter of fiscal year 2019, ended November 2. It also closed nine specialty concept stores during the same period. The retailer opened 10 and closed 13 stores over the nine months ended November 2, 2019. Dollar Tree Opens 165 New Stores Dollar Tree reported that it opened 165 new stores—114 Dollar Tree and 51 Family Dollar stores—during its third quarter of fiscal year 2019, ended November 2. It also closed 12 Dollar Tree and 30 Family Dollar stores during the third quarter. The retailer closed a total of 342 Family Dollar and 30 Dollar Tree stores during the nine months ended November 2, 2019. These openings and closures are a part of the chain’s previously announced plans to open 350 new Dollar Tree stores and 200 new Family Dollar stores, and close 390 Family Dollar stores during fiscal year 2019, ending February 2, 2020. Gap To Close 230 Specialty Stores by the End of 2020 Gap announced in its third quarter of fiscal year 2019 earnings call that it plans to close around 230 specialty stores by the end of 2020, with 130 store closures to be completed in 2019. The retailer opened three Gap, eight Banana Republic, 24 Athleta and 60 Old Navy stores in North America over the nine months ended November 2, 2019. During the same period, the retailer closed one Intermix, two Old Navy, 34 Gap and 10 Banana Republic stores in North America. These openings and closures are a part of Gap’s previously announced plans to open 140 and close 190 company-operated stores globally in fiscal year 2019, ending February 2, 2020. While the openings primarily focus on Old Navy and Athleta, the closures are mainly geared towards restructuring Gap’s specialty fleet. Macy’s Opens Four Bluemercury Stores Macy’s reported that it opened four Bluemercury stores during its third quarter of fiscal year 2019, ended November 2. As of that date, Bluemercury operates around 171 standalone stores in the US. Target Furthers Expansion of Small-Format Stores Target has reported that it opened seven small-format locations during the third quarter of fiscal year 2019, ended November 2. It also reported six more small-format store openings in November. These openings are part of the company’s plans to open a total of 30 small-format stores this year. Non-Store-Closure News LVMH To Acquire Tiffany for $16.2 Billion Luxury goods conglomerate LVMH has entered into an agreement to acquire luxury jeweler Tiffany & Co. for $135 per share in cash, in a transaction with an equity value of approximately €14.7 billion ($16.2 billion). The deal is expected to close in mid-2020 and is subject to customary closing conditions, including approval from Tiffany's shareholders and regulators. [caption id="attachment_100468" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, Burberry, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tailored Brands includes Men’s Warehouse, Men’s Wearhouse and Tux, Jos. A. Bank and K&G banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Ralph Lauren and Tapestry closures pertain to North America. *Total includes a small number of retailers that each announced fewer than 14 store openings and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100469" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M and TJX are based on net new stores in the US. Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Macy’s includes Bloomingdale’s and Bluemercury banners. Tailored Brands includes Men’s Warehouse. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Dufry AG, Ralph Lauren, Tapestry and Tempur Sealy openings refer to North America openings. *Total includes a small number of retailers that each announced fewer than 11 store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

Source: Company reports/Coresight Research [/caption]

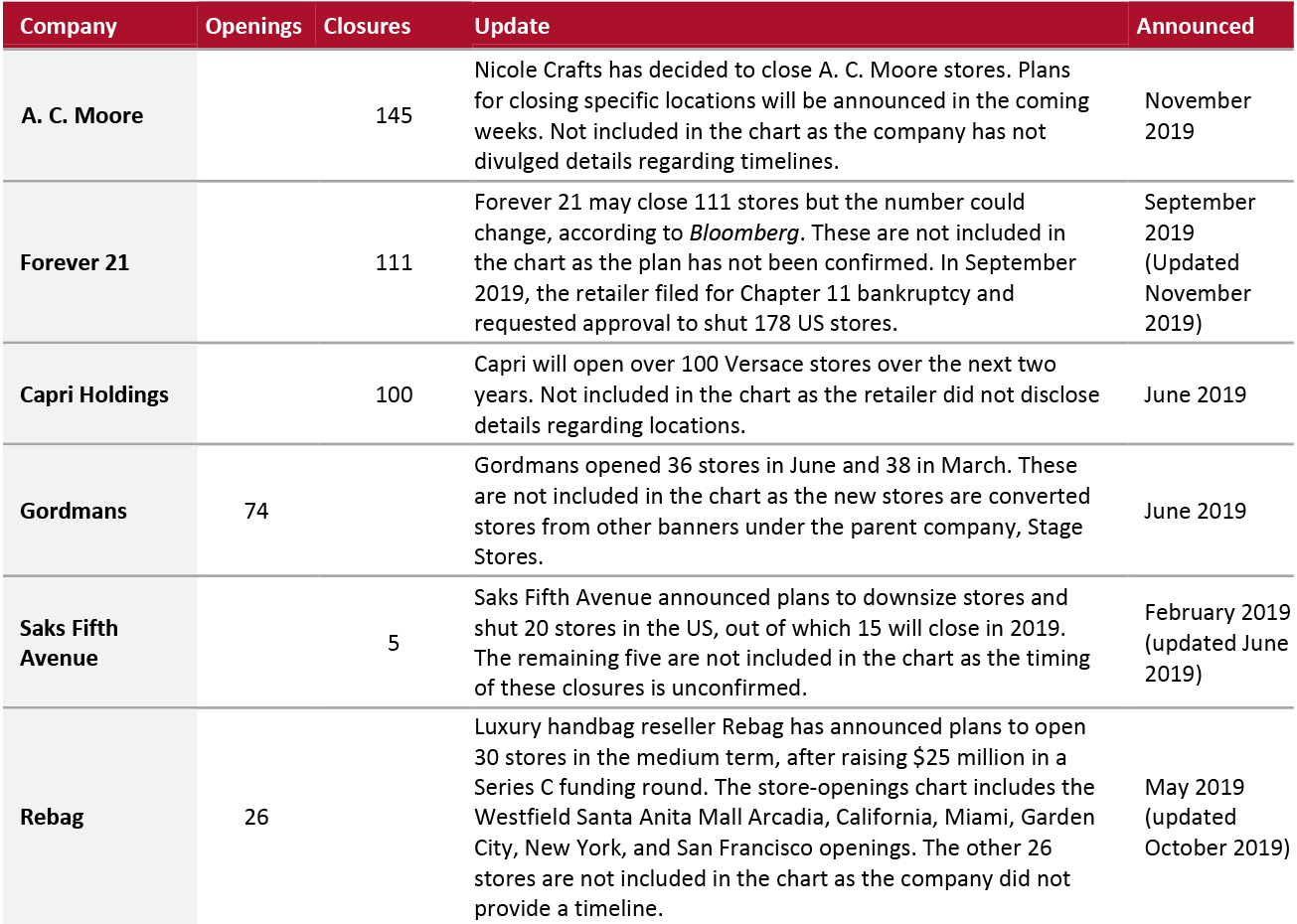

2019 Major US Uncharted Openings and Closures

The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location.

[caption id="attachment_100470" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_100471" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100472" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_100473" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

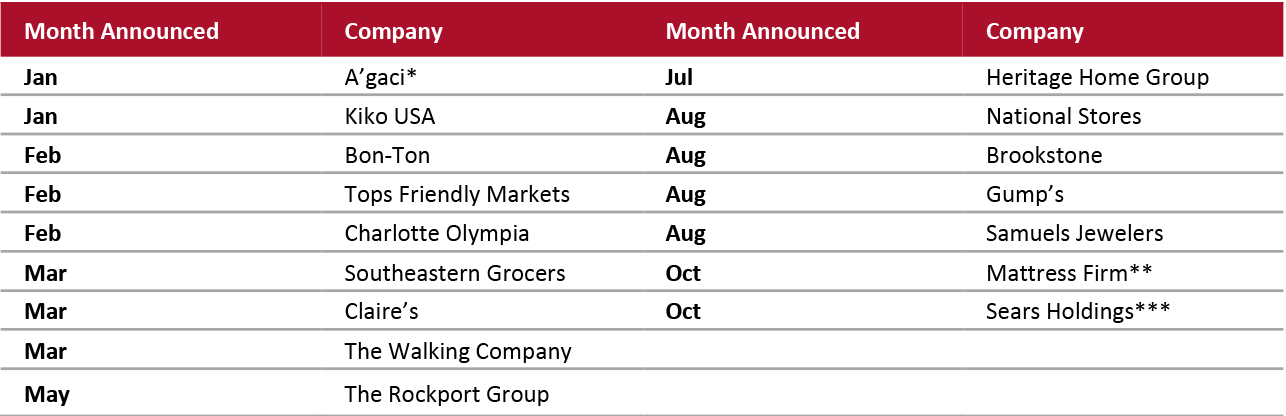

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research [/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_100475" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

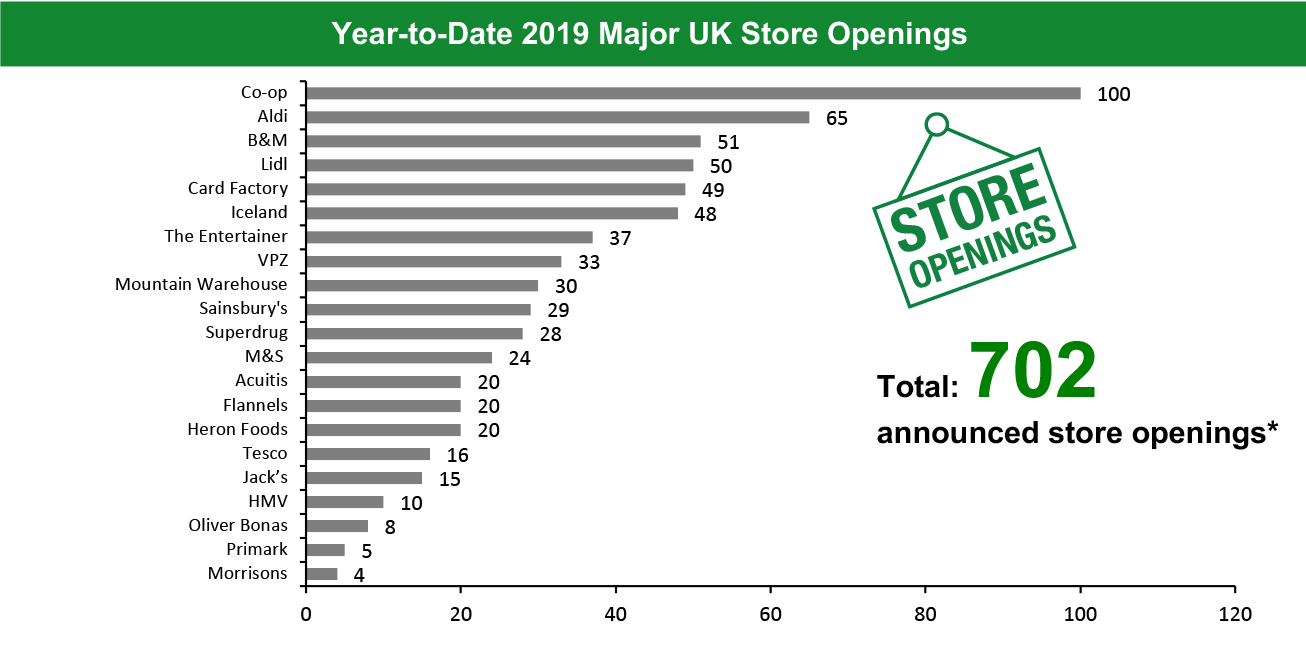

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 539 store closures and 702 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Abercrombie & Fitch Opens at Westfield London Lifestyle retailer Abercrombie & Fitch (A&F) has opened a new A&F store, including Abercrombie kids, at the Westfield London shopping center. The retailer has opened 13 new stores across its brands in the Europe, Middle East and Africa (EMEA) region this year, including the Westfield London store. A&F also announced that its Savile Row space—which is currently an Abercrombie kids store—will be repurposed as A&F’s EMEA Home Office. The Abercrombie kids store will be relocated to a nearby A&F Burlington Gardens store. In July 2019, the retailer opened a Hollister store at Westfield London shopping center. Arlo & Jacob To Open New Flagship Store Next Year Furniture retailer Arlo & Jacob has announced its plan to open a new flagship at Islington Square, London, in January 2020. The 4,700-square-foot store will be the retailer’s fifth location and will offer a collection of sofas, chairs and accessories. Three of the other stores are located in Bristol, Harrogate and London, and Arlo & Jacob opened its fourth store earlier this year in Marlow. Skopes Plans To Expand Retail Footprint Menswear retailer Skopes has announced plans to expand its retail footprint by opening 15 stores across the UK over the next two to three years, after the company managed to secure £6 million ($7.7 million) in funding from HSBC UK. The retailer currently operates three stores in the UK: Westfield in London and Junction 32 and Meadowhall in Sheffield. Weekday Opens at Shoreditch Swedish denim and fashion brand Weekday has opened a 5,000-square-foot store on Shoreditch High Street, London. The store features industrial materials and an in-store studio with screen-printing stations. The retailer plans to open two more stores this year, which will bring its total UK store count to five.Non-Store-Closure News

ASOS Appoints First-Ever Chief Growth Officer ASOS has appointed Robert Birge as its very first Chief Growth Officer, effective December 3, 2019. Birge will report to Chief Executive Nick Beighton and will be responsible for driving profitable growth as well as integrating ASOS’s marketing efforts with strategic planning, analytics and customer experience. He has worked with various firms including US online pharmacy Blink Health, travel app Lola, travel site Kayak and media agency IMG. [caption id="attachment_100476" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Burberry, Homebase, Laura Ashley, M&S, New Look and Office. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_100477" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. Abercrombie & Fitch includes Abercrombie & Fitch and Hollister banners. Urban Outfitters includes Anthropologie banner. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

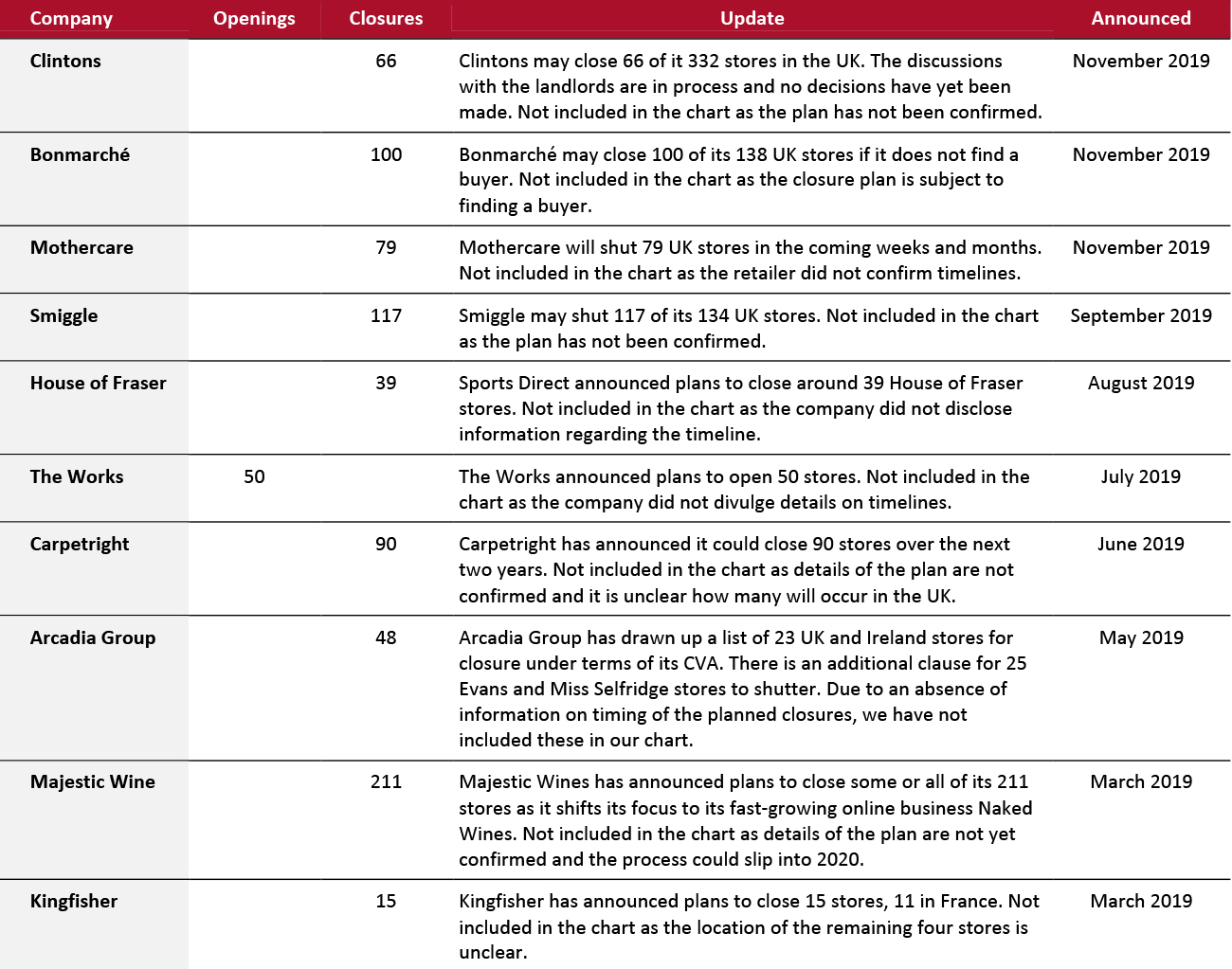

Source: Company reports/Coresight Research [/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_100478" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_100479" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

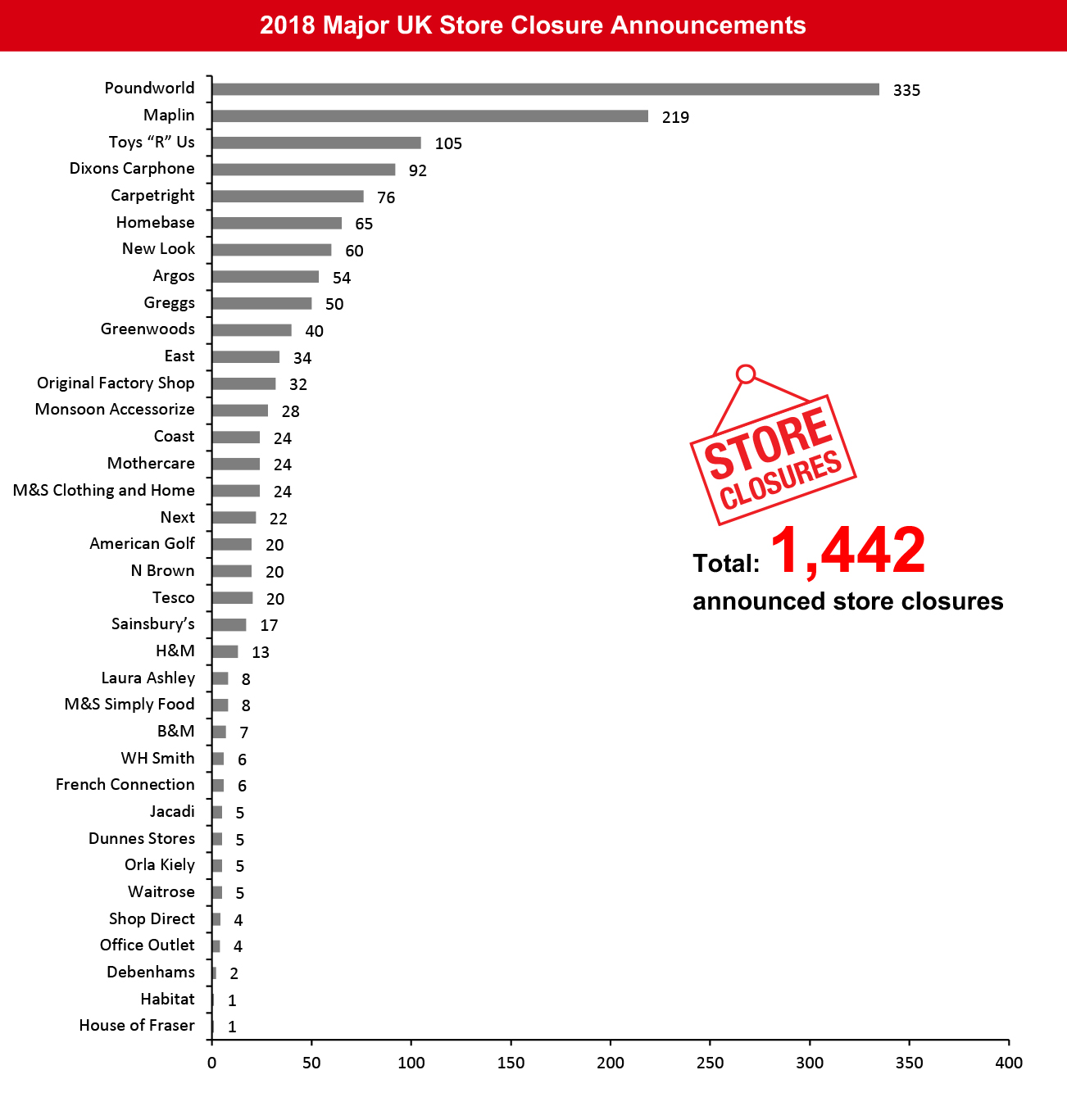

[caption id="attachment_100479" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_100480" align="aligncenter" width="700"]

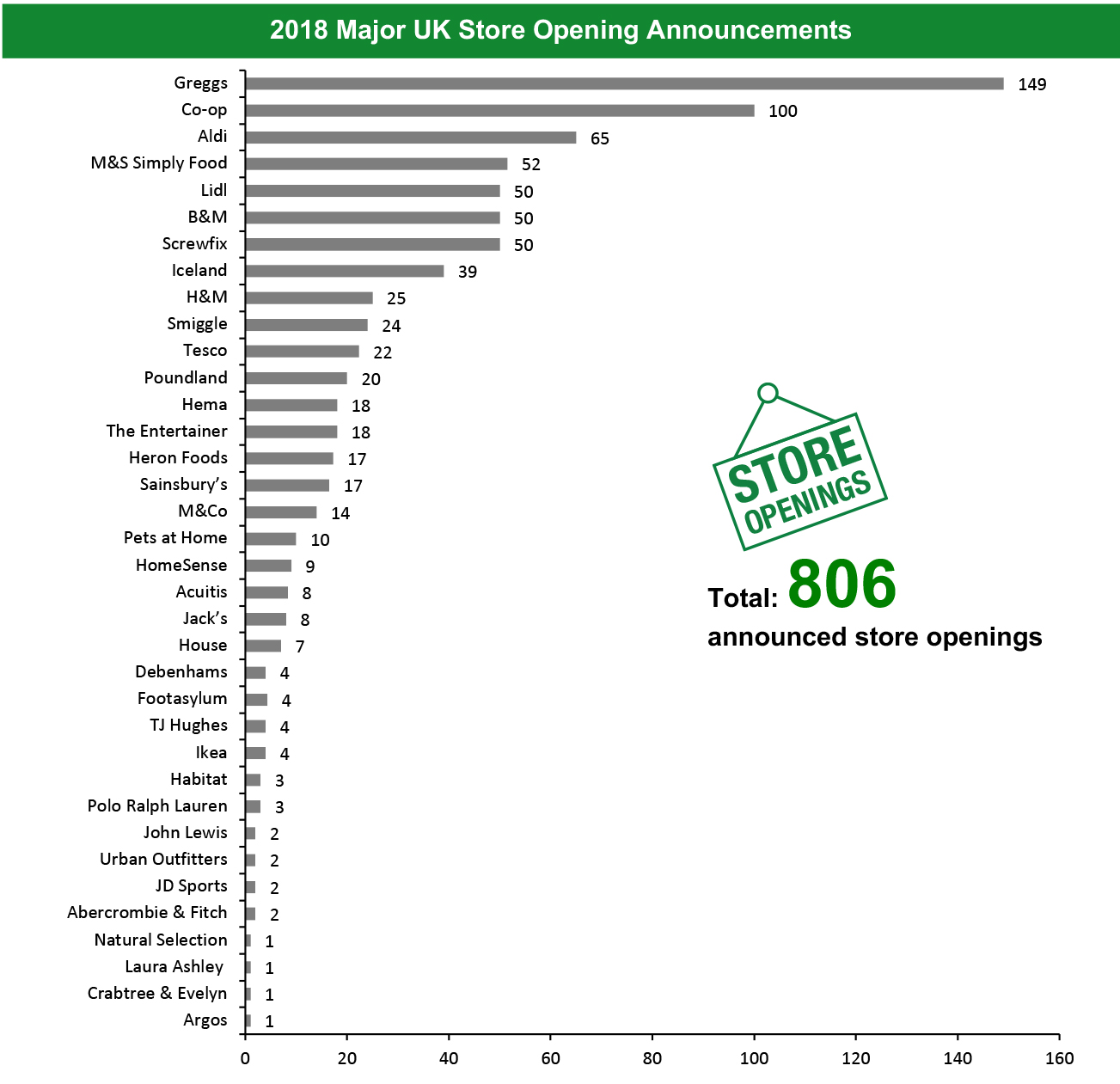

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.