Nitheesh NH

The US

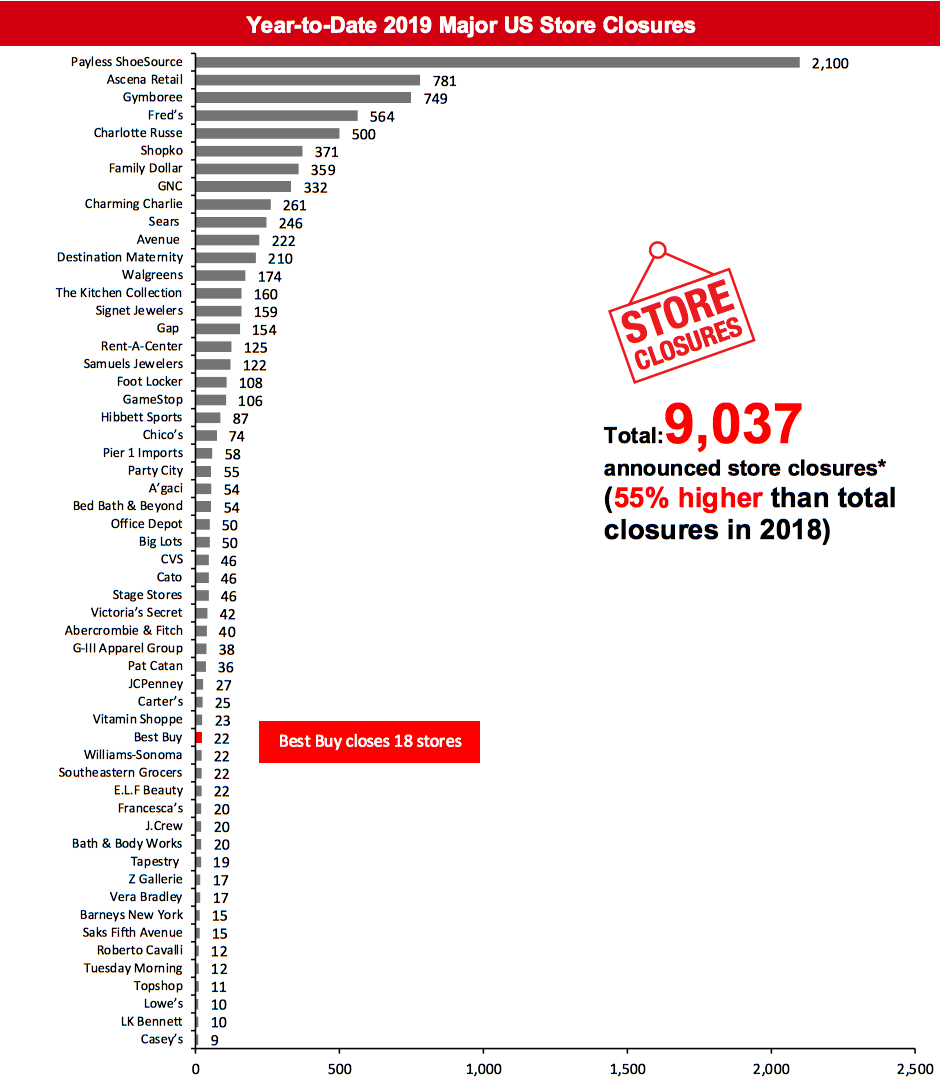

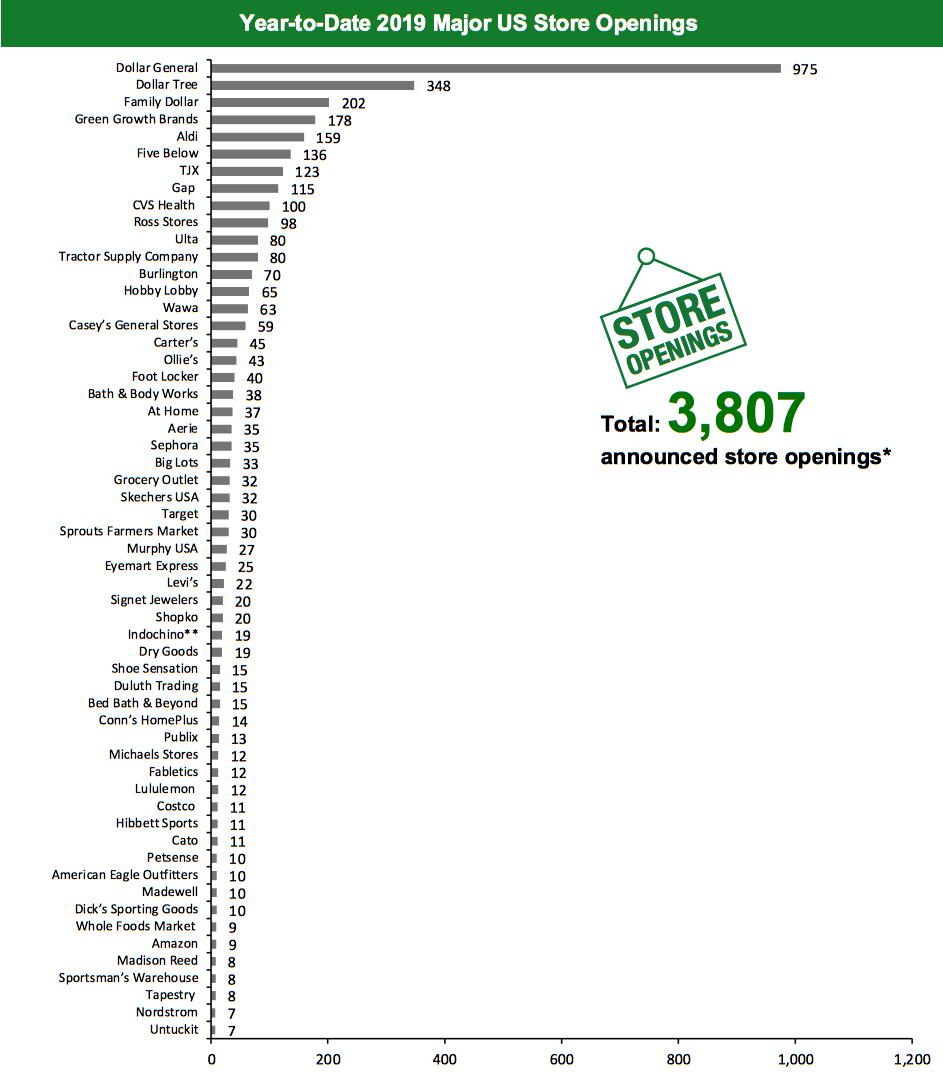

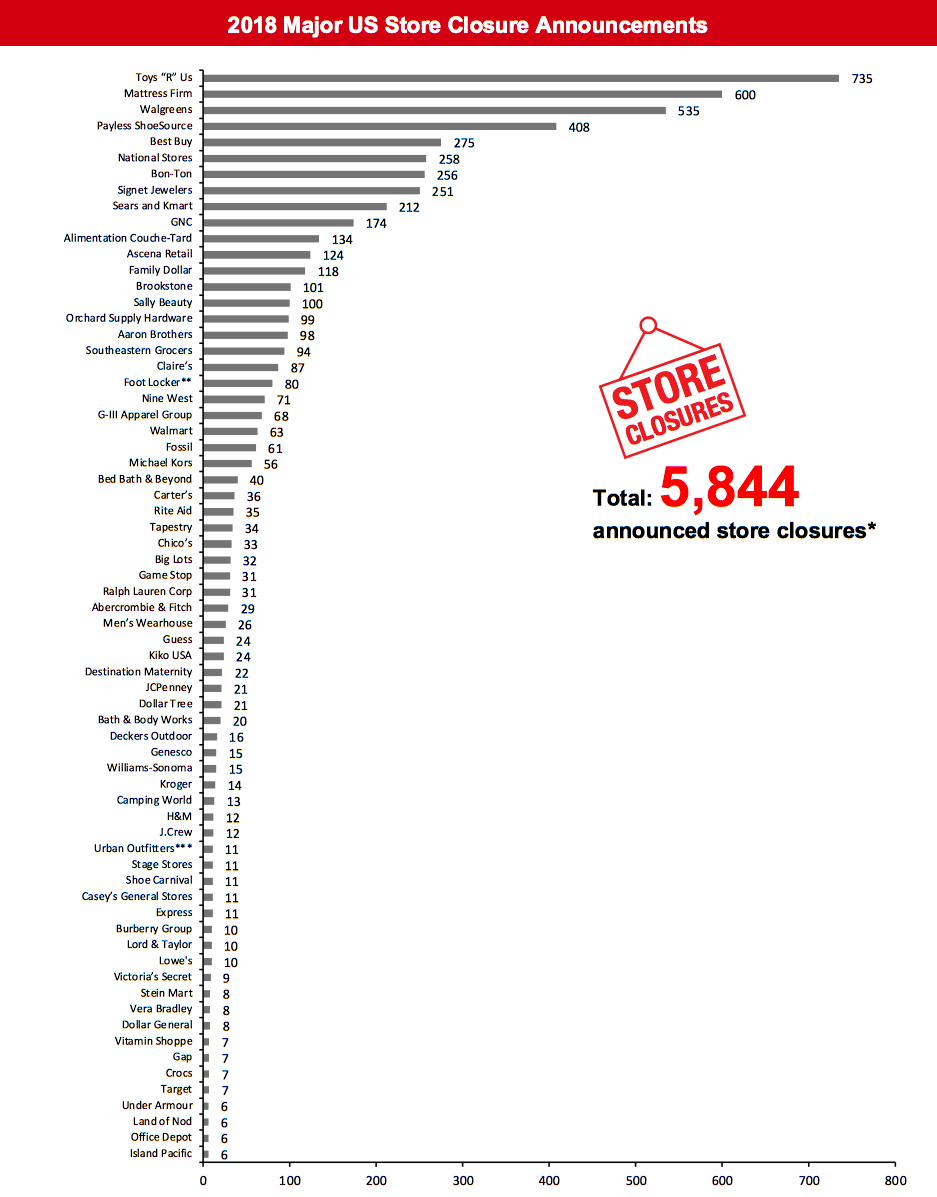

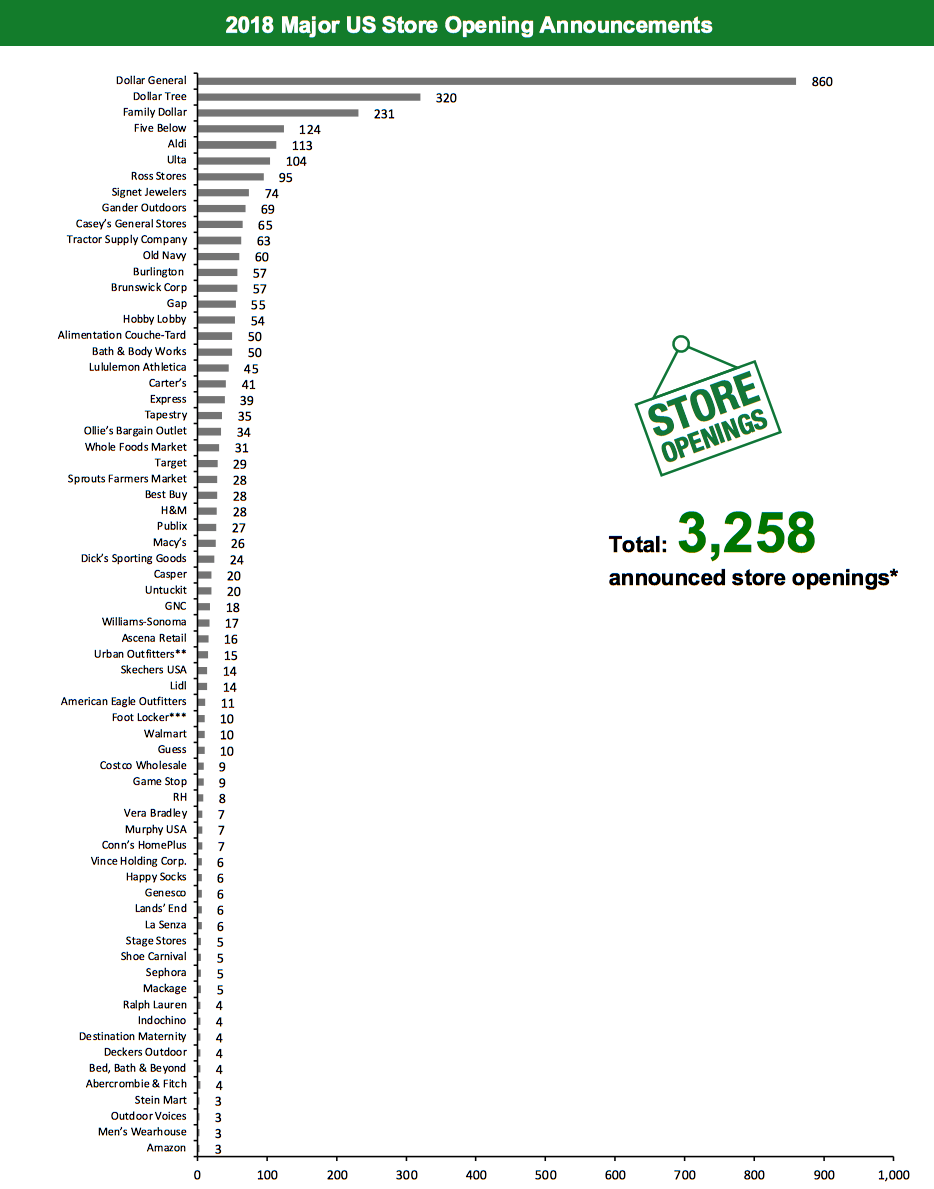

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 9,037 planned store closures and 3,807 openings. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Best Buy Closes 18 Stores Consumer electronics retailer Best Buy closed 18 stores in recent weeks, according to StarTribune. A Best Buy spokesperson declined to provide an official count of store closures but confirmed the list of 18 prepared by StarTribune. During the first two quarters of the fiscal year 2020 ended August 3, 2019, the retailer closed two Best Buy stores and opened three outlet centers. Coresight Research insight: Best Buy’s store closures are the result of the company re-evaluating its store portfolio as leases come up for renewal, rather than from planned reductions. The 18 stores set to close represent about 10% of the 170 leases that come up for renewal annually and less than 2% of the company’s 1,800-store fleet as of the end of fiscal year 2018. At its investor meeting in September 2019, Best Buy stressed the importance of physical stores as hubs for pickup, shipping and for deploying its broad service offerings. CVS To Shutter 75 Stores in 2020 Pharmacy retailer CVS has announced plans to shutter 75 stores in 2020, most of which will face natural lease expirations. The retailer will close 22 stores in the first quarter of fiscal year 2020 ending March 31. The announced closures will be in addition to the 46 underperforming CVS stores that were closed during the second quarter of the company’s current fiscal year, ended June 30, 2019. Dressbarn Announces Final Wind-Down; Will Launch New Website in 2020 Ascena Retail Group, parent company of Dressbarn, announced it will shutter the remaining 544 Dressbarn stores by the end of 2019. Store-closing sales at all locations will commence on November 1, and the stores are expected to close by December 26. In addition, Ascena Retail announced it has sold the intellectual property assets of Dressbarn and will begin transitioning its e-commerce business to a subsidiary of Retail Ecommerce Ventures. Dressbarn will relaunch its website in January 2020. Coresight Research insight: Brands have staying power and sometimes a second (and third…) life. The Dressbarn brand is following a strategy similar to that of Eloquii, the plus-size retailer that closed its doors about two years after its 2011 launch, as parent company The Limited chose to focus on its core business. Eloquii re-emerged online in 2014, captured Walmart’s interest in 2018 and then re-entered physical retail. It currently operates seven shops in the US. Forever 21 May Close About 60 Fewer Stores than Previously Planned Fast-fashion retailer Forever 21 plans to keep open 60 stores that were previously set to close as part of the retailer’s bankruptcy restructuring, according to a Bloomberg report citing unnamed sources. The news surfaced following rent concessions from the company’s landlords. Forever 21 filed for Chapter 11 bankruptcy in September this year and requested approval to shutter 178 US stores. According to the Bloomberg report, the retailer may close only 111 US stores, but this number could change. Kroger Confirms Opening of Three Stores Supermarket chain Kroger reported that it has opened three smaller-footprint stores in the last two months, in Atlanta, Cincinnati and Phoenix. Apart from fresh fruits, vegetables and groceries, the store offers grab-and-go and ready-to-heat meals for lunch and dinner. Tapestry Opens Eight Stores While Closing 19 Luxury retailer Tapestry reported that it opened three Kate Spade, three Stuart Weitzman and two Coach stores in its third and fourth quarters of the fiscal year 2019 ended June 29. The retailer also closed eight Kate Spade, one Stuart Weitzman and 10 Coach stores during the same period. Von Maur Furthers Retail Expansion Department store chain Von Maur opened a new 130,000-square-foot store on November 2 at Orland Square Mall, Orland Park, Illinois - the retailer’s seventh location in the state. Von Maur also plans to open its fourth Michigan store at The Village of Rochester Hills shopping mall in the fall of 2020 and a store in Wisconsin in the fall of 2021. Last month, Von Maur opened its third Michigan location at Woodland Mall, Grand Rapids.Non-Store-Closure News

Authentic Brands Group Purchases Barneys New York; Liquidation Sales To Begin Soon Authentic Brands Group has purchased the intellectual property of luxury department-store chain Barneys New York for more than $270 million. Barneys’ store-liquidation sales will begin soon at five flagship locations — Beverly Hills in California, Copley Place in Boston, Chelsea and Madison Avenue in Manhattan and Union Square in San Francisco. Barneys’ warehouse locations at Central Valley (New York) and San Francisco Premium Outlets (California) will also host store-closing sales. JCPenney Unveils New Store Format Department store chain JCPenney has opened a revamped location named “Penney’s” at North East Mall, near Dallas, Texas. The store features a new area called “All-You,” which offers fashion jewelry and accessories, as well as an in-store Sephora shop, Salon and Spa by InStyle and Penney’s first-ever barber shop, The Barbery. Penney’s also features a “Movement Studio,” offering instructor-led fitness and yoga classes. Other features include a children’s destination area, Pearl Cup Bistro café and technology-equipped fitting rooms. Pier 1 Imports Appoints Robert Riesbeck as CEO Home décor and furniture retailer Pier 1 Imports has appointed Robert Riesbeck as CEO and Director of the company. Riesbeck joined the retailer in July 2019 as CFO and will continue to serve in the position, according to a company press release. He succeeds Cheryl Bachelder, who has been serving as the interim CEO since December 2018 and will remain on Pier 1’s board. Riesbeck brings more than 25 years of experience in the field of retail and consumer goods. [caption id="attachment_99159" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Tapestry closures refer to North America total closures.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. Tapestry closures refer to North America total closures.*Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_99160" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Tapestry openings refer to North America total openings.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. Tapestry includes Coach, Kate Spade and Stuart Weitzman. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. Tapestry openings refer to North America total openings.*Total includes a small number of retailers that each announced fewer than seven store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

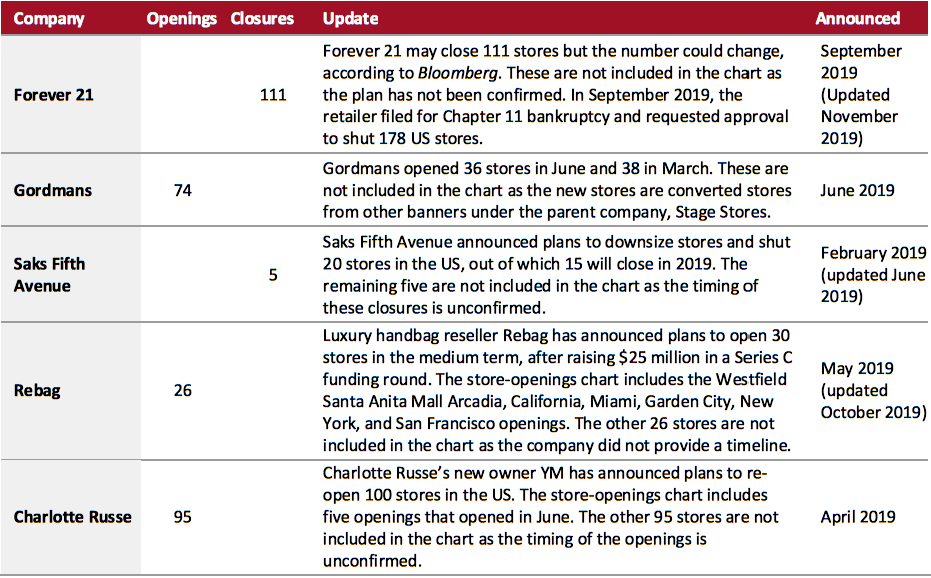

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_99161" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_99162" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_99162" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_99163" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

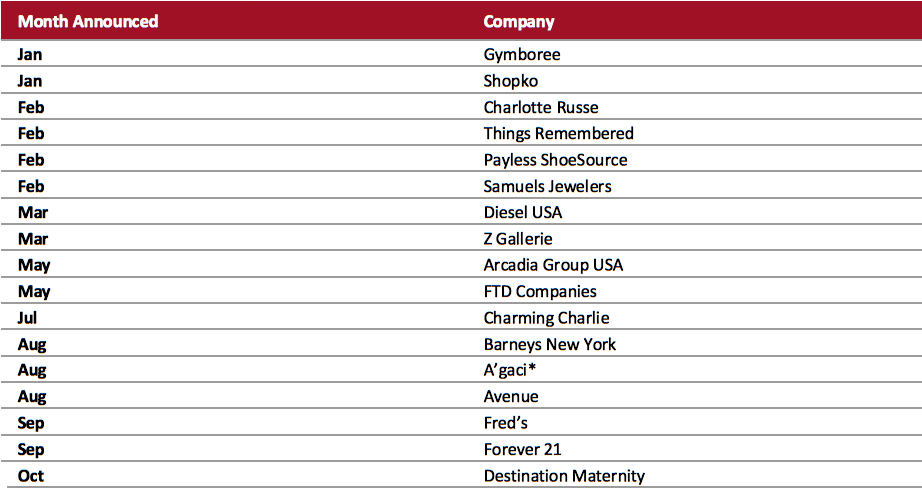

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_99164" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_99165" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

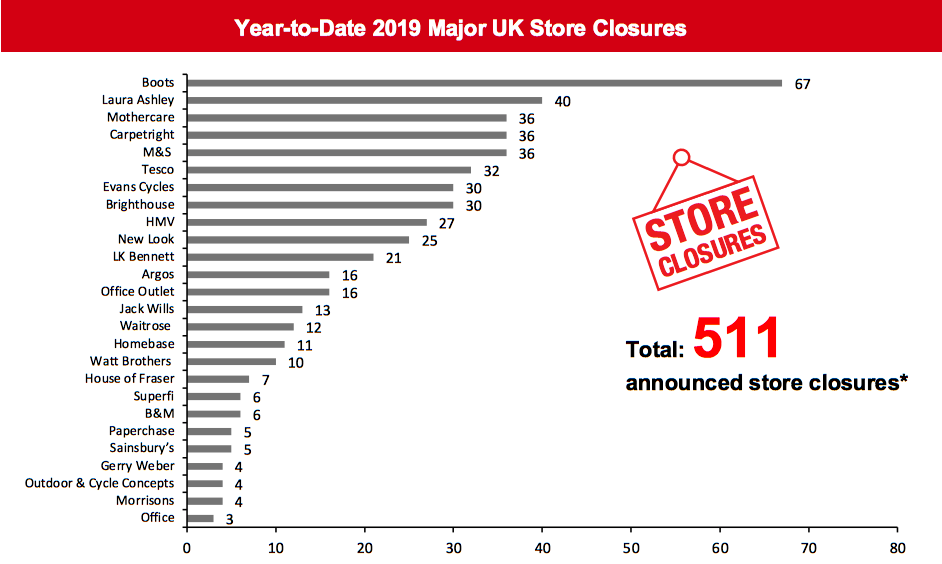

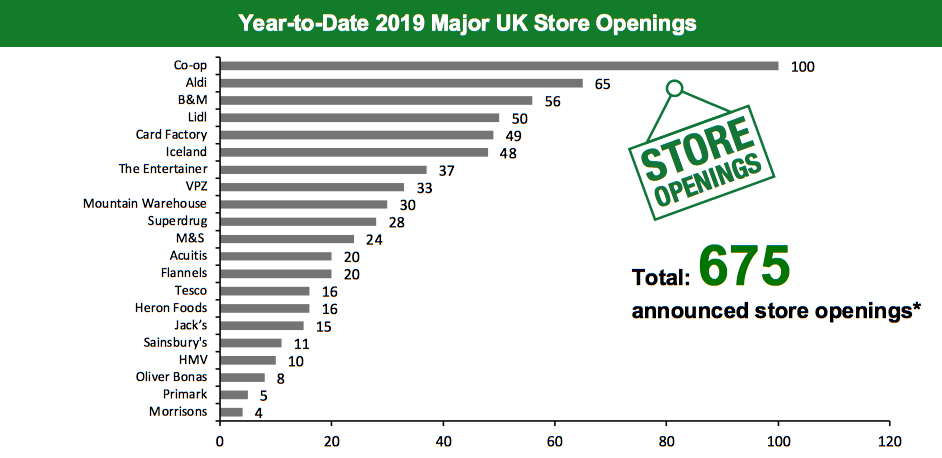

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 511 store closures and 675 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Bonmarché May Close 100 Stores Clothing retailer Bonmarché has earmarked 100 UK stores for closure if it does not find a buyer, according to Drapers. Closing-down sales have begun in stores located in Berwick-upon-Tweed in Northumberland, Market Harborough in Leicestershire and Kirkcaldy in Scotland, among others. Last month, the retailer appointed Alastair Massey, Phil Pierce and Tony Wright, of specialist advisory firm FRP, as joint administrators. The retailer currently operates 318 stores in the UK. Clarks To Close Stores Over Five Years Shoe retailer Clarks has announced this week that it will close some of its stores over the next five years. These closures were announced in the context of the company’s losses, which more than doubled to £82.9 million ($107 million) in the fiscal year ending February 2, 2019. Clarks closed 18 stores over the course of those 12 months and started a five-year plan to achieve profitability by 2023. The plan is to focus growth in Asia, boost the company’s digital strategy and reduce its commercial network in the European Union, the UK and the US. Clarks currently operates 553 stores in the UK and Ireland. Harrods To Open Standalone Beauty Store Upmarket department-store retailer Harrods plans to launch a new 23,000-square-foot standalone beauty fascia called “H Beauty” at Intu Lakeside, Essex, in April 2020. The store will offer premium beauty brands such as Chanel, Dior and Huda Beauty among others. Harrods intends to open another H Beauty store in Milton Keynes, with the exact location to be revealed in the future. Marks & Spencer Opens Seven Stores and Closes 20 Marks & Spencer reported that it closed 17 full-line stores, two outlets and one Simply Food store in its first half, ended September 30, 2019. Mothercare Appoints Administrators; To Close 79 Stores Specialist retailer Mothercare has appointed PricewaterhouseCoopers (PwC) as administrators for its UK business, less than 18 months after it launched a company voluntary agreement (CVA). Mothercare stated that its UK business is not capable of returning to profitability. Joint administrator and PwC partner Zelf Hussain stated that Mothercare’s stores would close in the coming weeks and months. Mothercare shuttered 36 stores in 2019; it currently operates 79 stores in the UK.Non-Store-Closure News

Links of London Administrators Deloitte Hires GCW as Property Advisors Deloitte, administrators of jewelry retailer Links of London, has hired GCW as property advisors. GCW will be responsible for overseeing the retailer’s portfolio of 28 standalone stores and four Folli Folllie stores in the UK and Ireland. Last month, Links of London collapsed into administration, with almost 300 jobs facing uncertainty. The retailer currently operates 28 stores and seven concessions across the UK and Ireland. [caption id="attachment_99166" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, M&S, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, M&S, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_99167" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland, Heron Foods and M&S. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

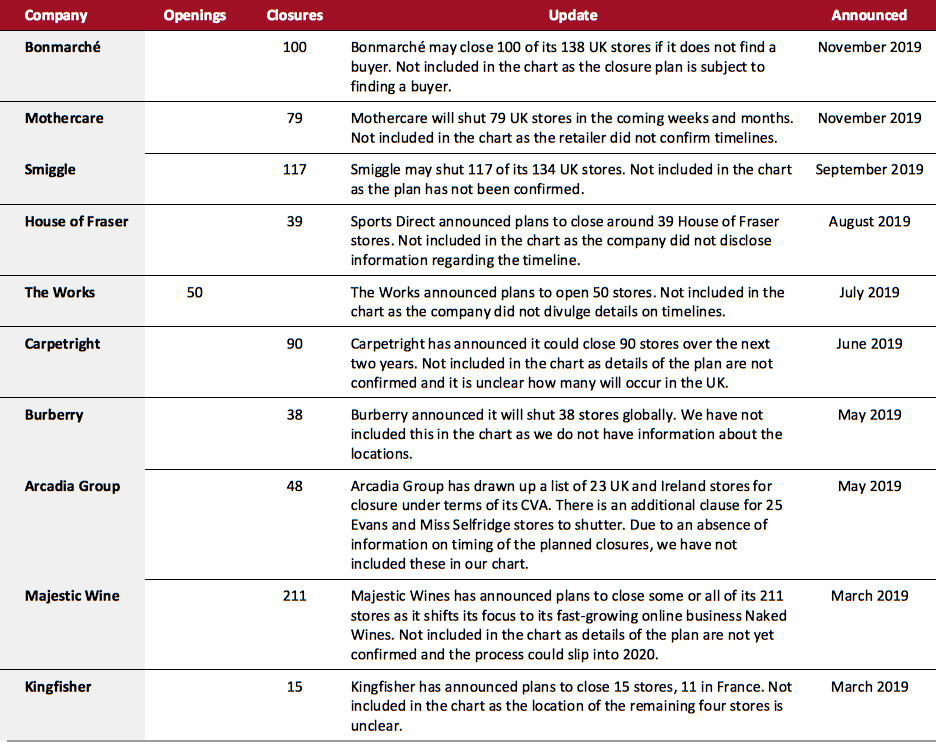

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_99168" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_99169" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

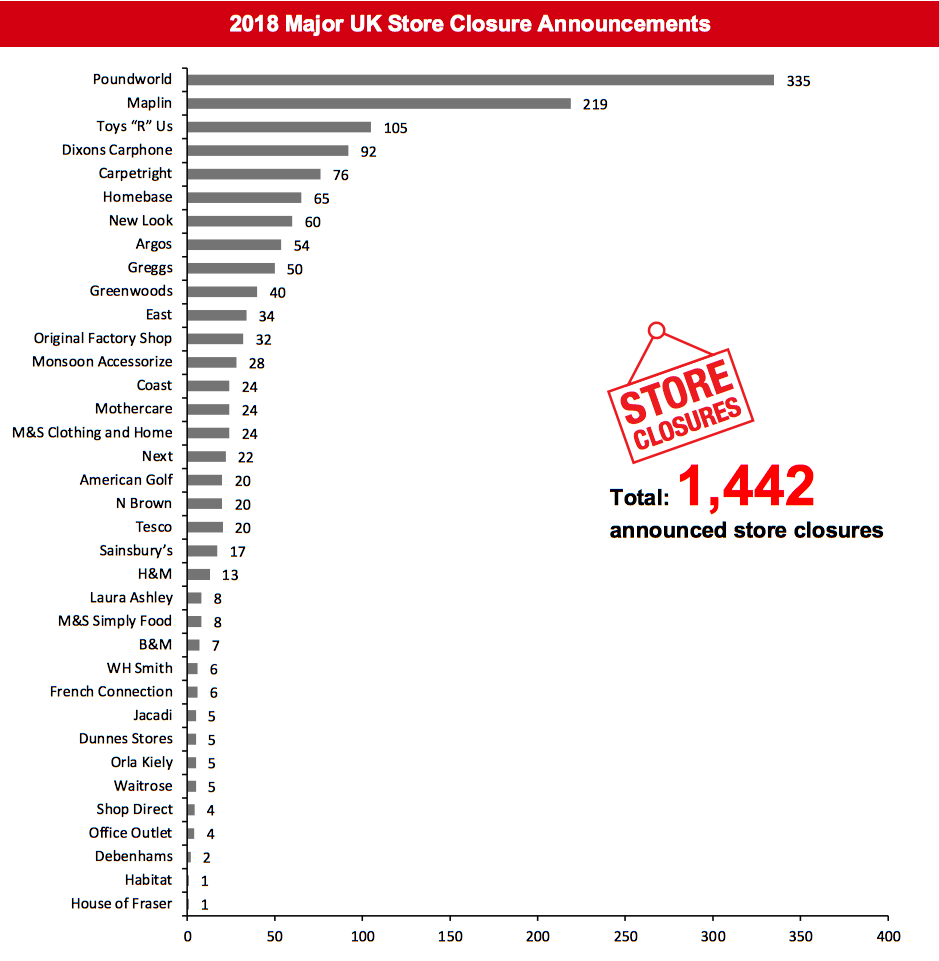

[caption id="attachment_99169" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_99170" align="aligncenter" width="700"]

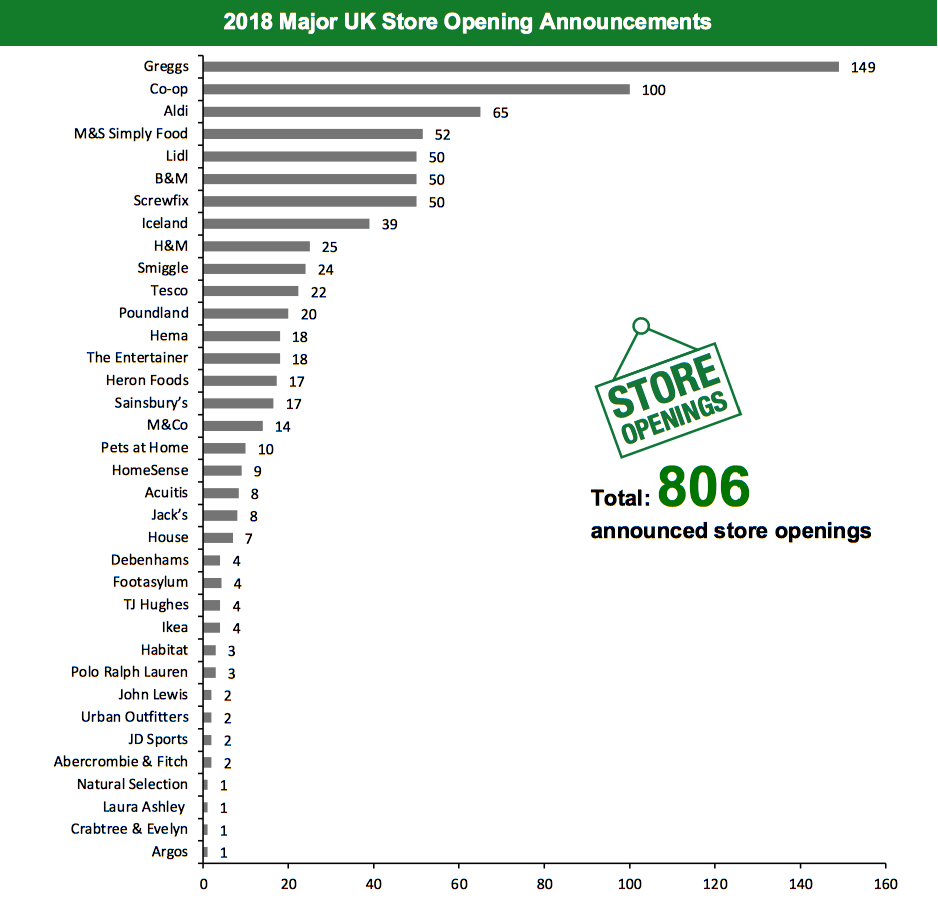

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.