Nitheesh NH

The US

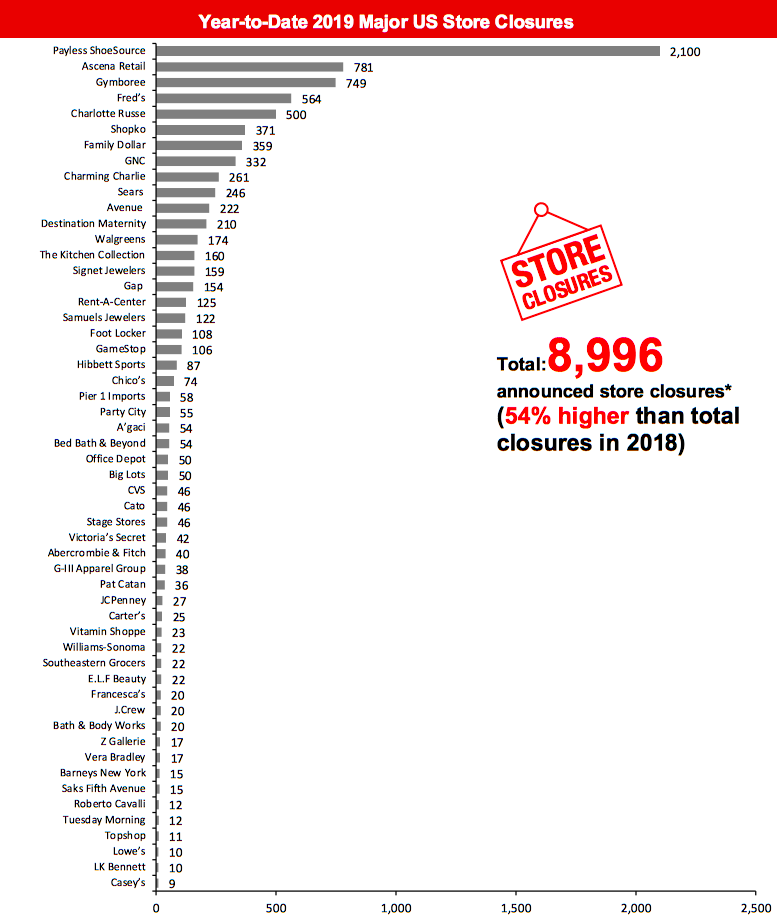

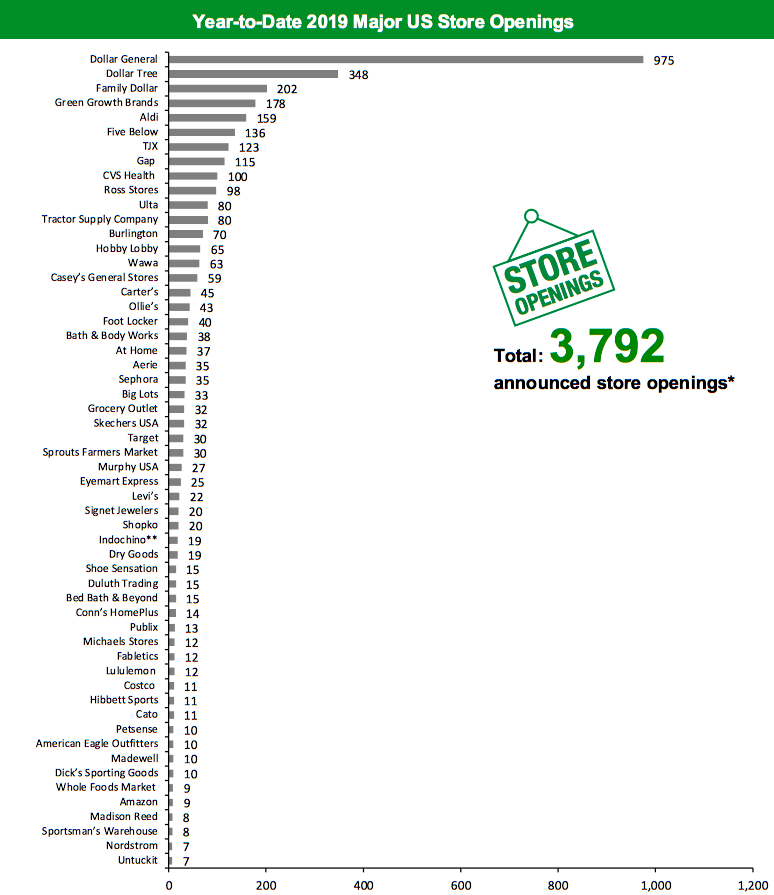

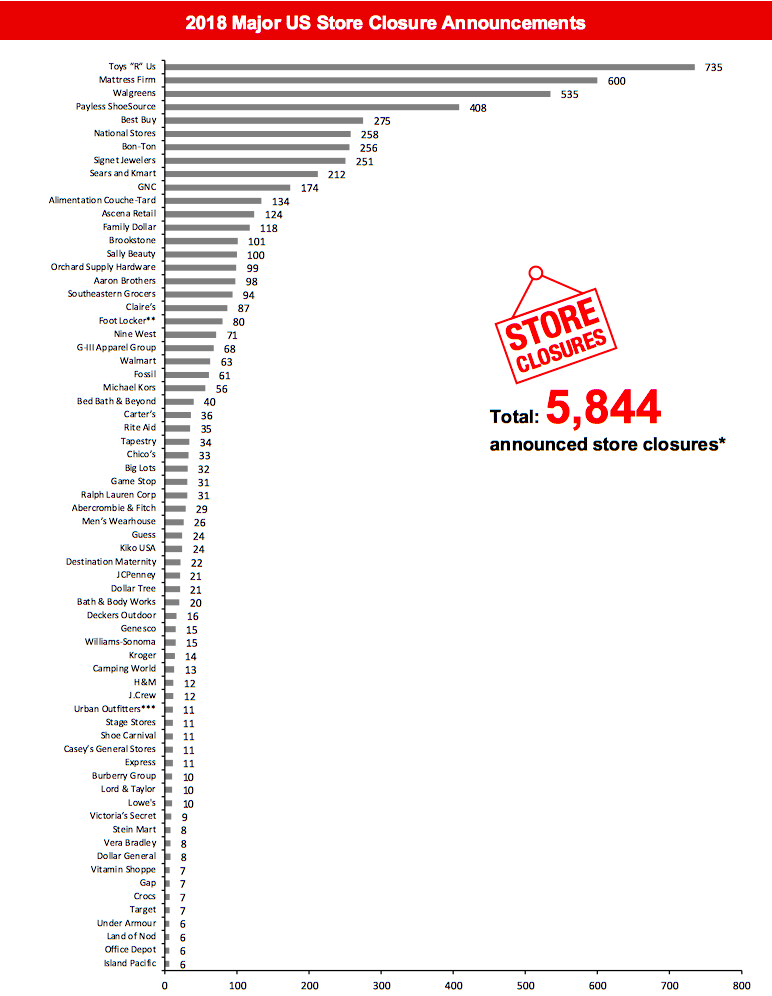

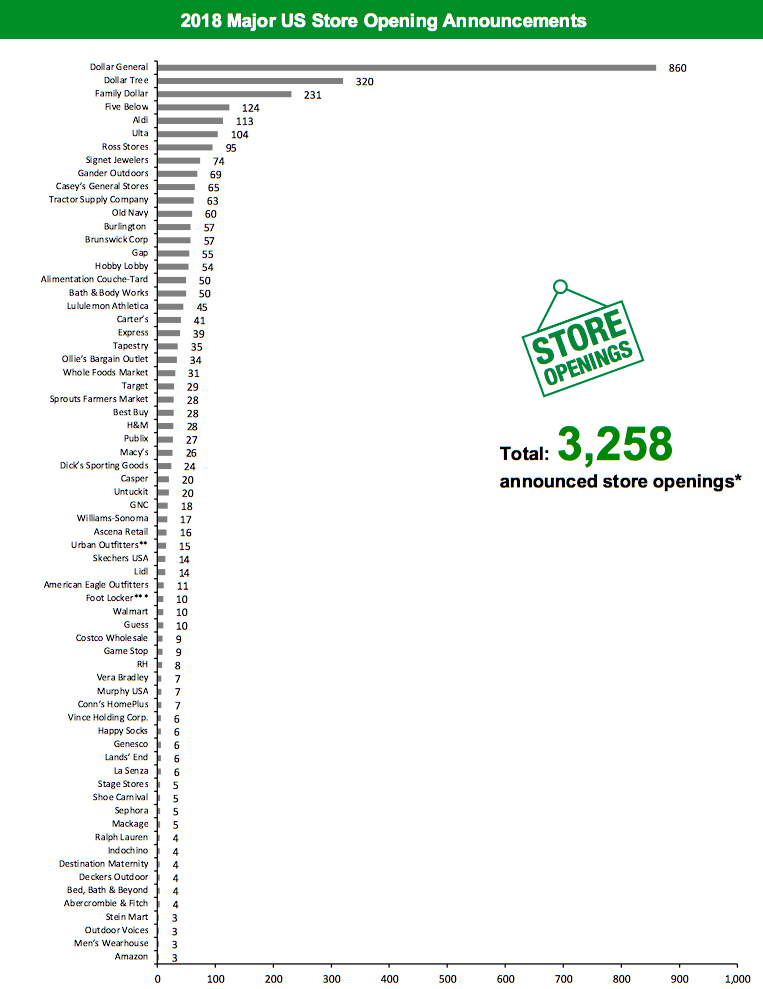

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced 8,996 planned store closures and 3,792 openings. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Dick’s Sporting Goods To Open Two New Stores in November Sporting goods retailer Dick’s Sporting Goods will expand its footprint by opening two new stores—a Dick’s Sporting Goods store in Manchester and a Golf Galaxy store in Florida—in November this year. The company had previously announced plans to open five Dick’s Sporting Goods stores and two Golf Galaxy stores in October 2019. Following the new openings, the retailer will operate 733 Dick’s Sporting Goods stores and 95 Golf Galaxy stores. Primark To Open a Store in Philadelphia Primark, a subsidiary of Associated British Foods, announced that it will open a 34,200-square-foot store in Fashion District, Philadelphia. The new store will open during the retailer’s next fiscal year ending September 2021. Associated British Foods previously reported plans to open two Primark stores, one in New Jersey in 2019 and another in Florida in 2020. Tractor Supply Company Confirms Opening of 25 Stores and Closure of Three Retail chain Tractor Supply Company reported that it has opened 25 new Tractor Supply stores and one new Petsense store in its third quarter of fiscal year 2019 that ended on September 28, 2019. The openings are part of the company’s previously announced plans to open 80 Tractor Supply stores and 10 Petsense stores in 2019. It also closed one Tractor Supply store and two Petsense stores during the quarter. As of October 24, 2019, the retailer has opened 50 Tractor Supply stores and three Petsense stores this year and closed one Tractor Supply and two Petsense stores. Coresight Research insight: Tractor Supply is a one-stop shop for people living a rural lifestyle. The company aloperates approximately 175 Petsense stores, and the US pet market is expected to reach $75.38 billion this year from $72.56 billion in 2018, according to the American Pet Products Association.Non-Store-Closure News

Amazon Offers Free Grocery Delivery Service Amazon is offering a free grocery delivery service for US Prime members and integrating all grocery orders into a single portal. The company stated that the portal will provide one- to two-hour delivery for orders from AmazonFresh and Whole Foods Market for products including meat, seafood, produce and everyday essentials. Previously, Prime members had access to AmazonFresh for $14.99 per month as an add-on to their Prime membership. The new perk enables existing Prime members who have been paying for Amazon Fresh to continue receiving the services for free. Coresight Research insight: Coresight Research’s 2019 US online grocery survey found Amazon remains the most-shopped retailer for groceries online. But it also found AmazonFresh was one of the company’s least-used services for grocery purchases, behind the regular Amazon.com site, Prime Now and Prime Pantry. Our research suggests Amazon grocery shoppers tend to be occasional or small-basket online shoppers. This latest push into grocery should help the company capture more regular, big-basket grocery shopping missions. Walgreens Plans To Offer Weight-Loss Services Pharmacy store chain Walgreens announced a collaboration with Jenny Craig to offer health and weight-loss management services called “Jenny Craig at Walgreens.” Under this partnership, 100 Jenny Craig locations will open inside Walgreens stores in January 2020. The in-store weight-loss service will debut in 20 states including Dallas, Houston and Philadelphia and will offer Jenny Craig’s weight-loss program, private one-on-one consultation, a customized menu plan and meal delivery. [caption id="attachment_98834" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98835" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense.*Total includes a small number of retailers that each announced fewer than seven store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area.

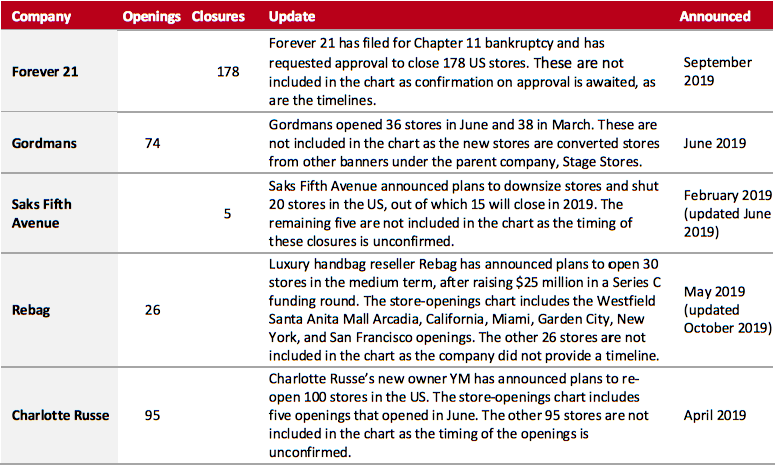

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_98836" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98837" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98837" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98838" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

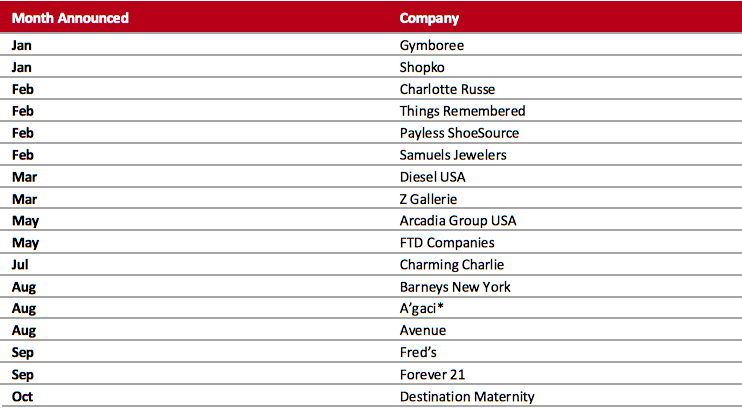

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_98839" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

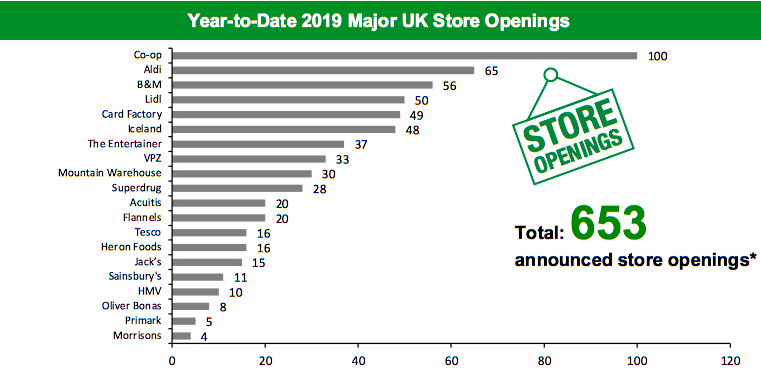

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_98840" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

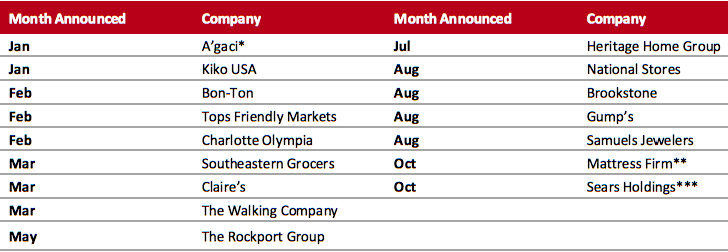

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 498 store closures and 653 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Forever 21 To Close Three Stores Next Year Fast-fashion retailer Forever 21 has confirmed that it will close three stores in the UK next year. The stores slated for closure are located in Birmingham, Liverpool and London. The retailer has already filed for Chapter 11 bankruptcy protection in the US in September 2019. It currently operates around 800 stores across 57 countries. Luke 1997 To Expand Retail Footprint Menswear retailer Luke 1997 plans to open four new stores by the end of 2020, to reach its target of operating 20 stores by its 20th anniversary in 2021. The company will open one store each in Cheshire and Sheffield’s Meadowhall shopping center in November this year. It will open the other two stores next year, one in Bicester Shopping Park in April and one in West Midlands Designer Center store in September. Untuckit Furthers Expansion Plans Apparel retailer Untuckit plans to open two new stores in the UK on November 6 this year. The 1,600-square-foot stores will open in Covent Garden and Westfield London. The stores will offer a wide range of Untuckit shirts, t-shirts, sports jackets and trousers. Walgreens Boots Alliance Closes 18 Boots Stores; Opens Flagship Stores Pharmacy retailer Walgreens Boots Alliance announced that it closed 18 of the planned 200 stores in June and August 2019. The company said it is on track to close the remaining stores by the end of its fiscal year ending August 2020. In June this year, the retailer announced plans to close 200 Boots stores in the UK within 18 months, as a part of its store optimization plan. Walgreens Boots Alliance also reported it opened a flagship store in Meadowhall, Sheffield, in October 2019. Coresight Research insight: Although Boots has a substantial estate, much of it looks to be suffering from underinvestment. Therefore, although flagship stores are welcome, the company must be prepared to invest in its broader estate, not least to retain its status as a destination for discretionary beauty purchases.Non-Store-Closure News

Gant CEO To Rejoin Adidas Clothing retailer Gant’s CEO Brian Grevy is reportedly stepping down after four years with the company to rejoin Adidas as a new executive board member, according to Drapers. Grevy joined Gant in 2016 as Chief Marketing Officer and was appointed as CEO in June 2018. Grevy will rejoin Adidas where he previously served for 12 years but will remain in his current position at Gant until a new successor is announced. [caption id="attachment_98841" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98842" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

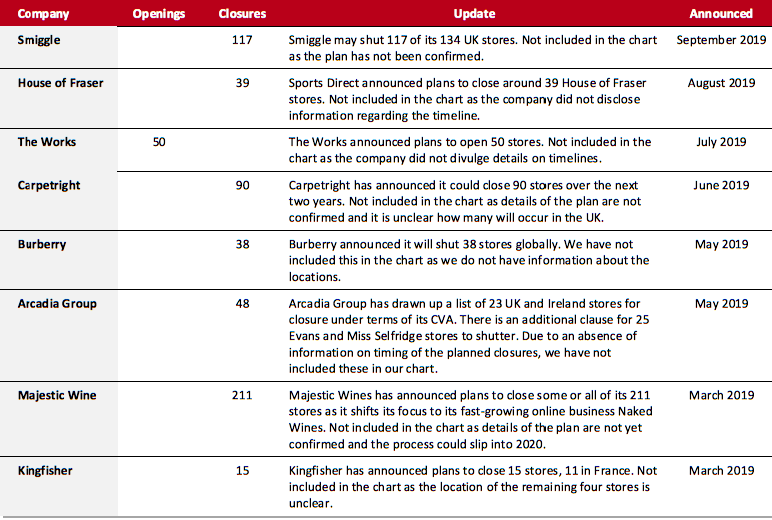

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_98843" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98844" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

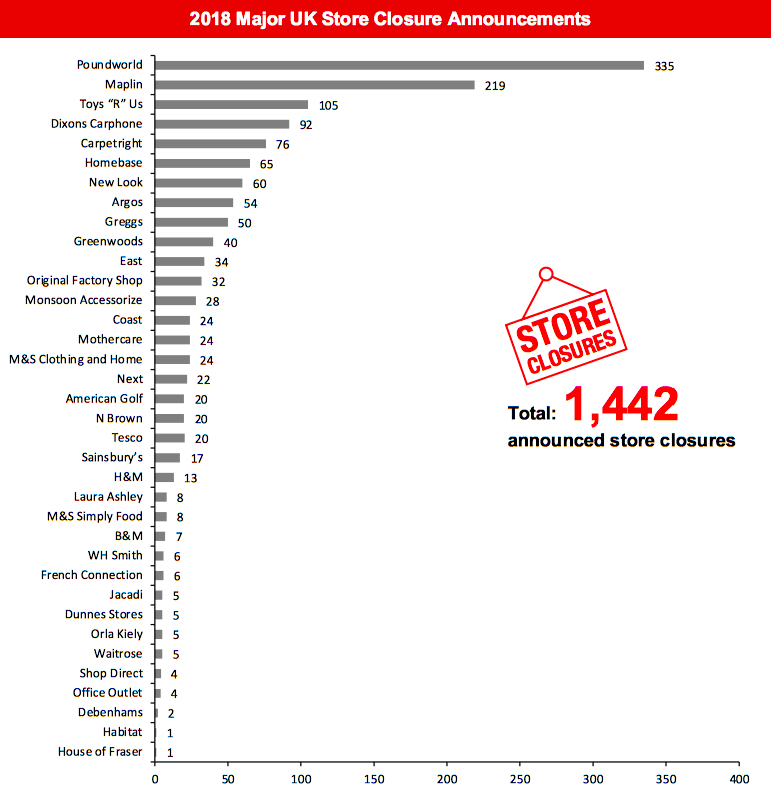

[caption id="attachment_98844" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_98845" align="aligncenter" width="700"]

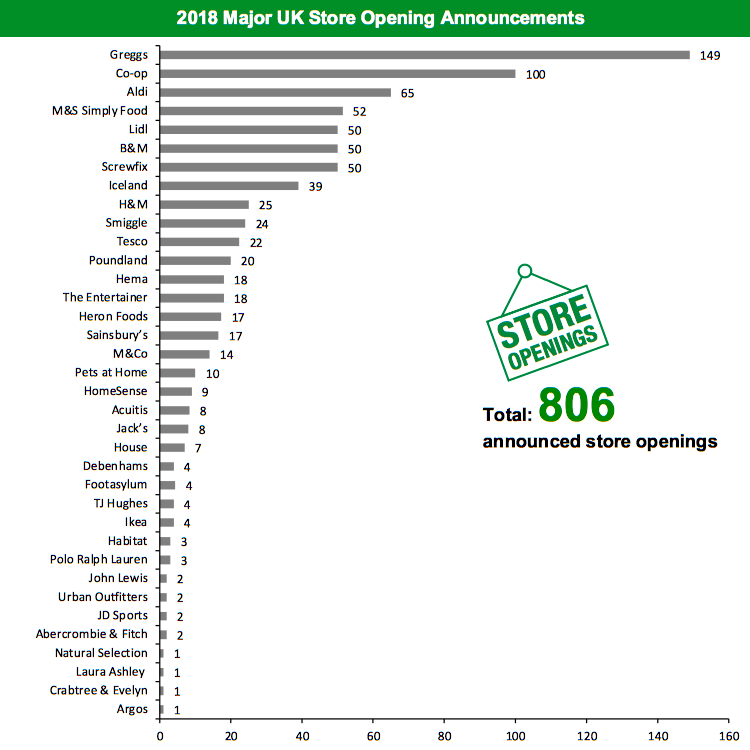

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.