DIpil Das

The US

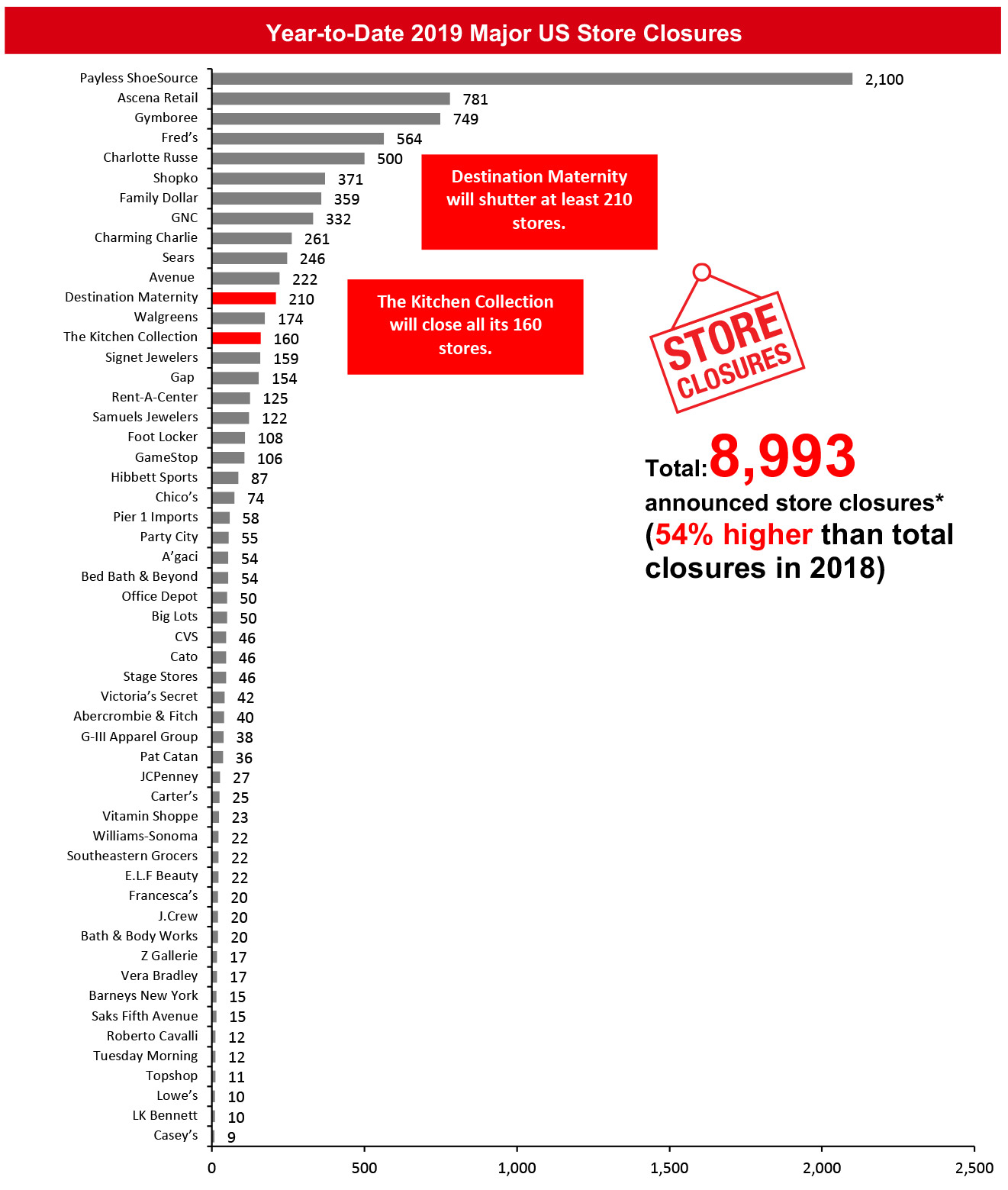

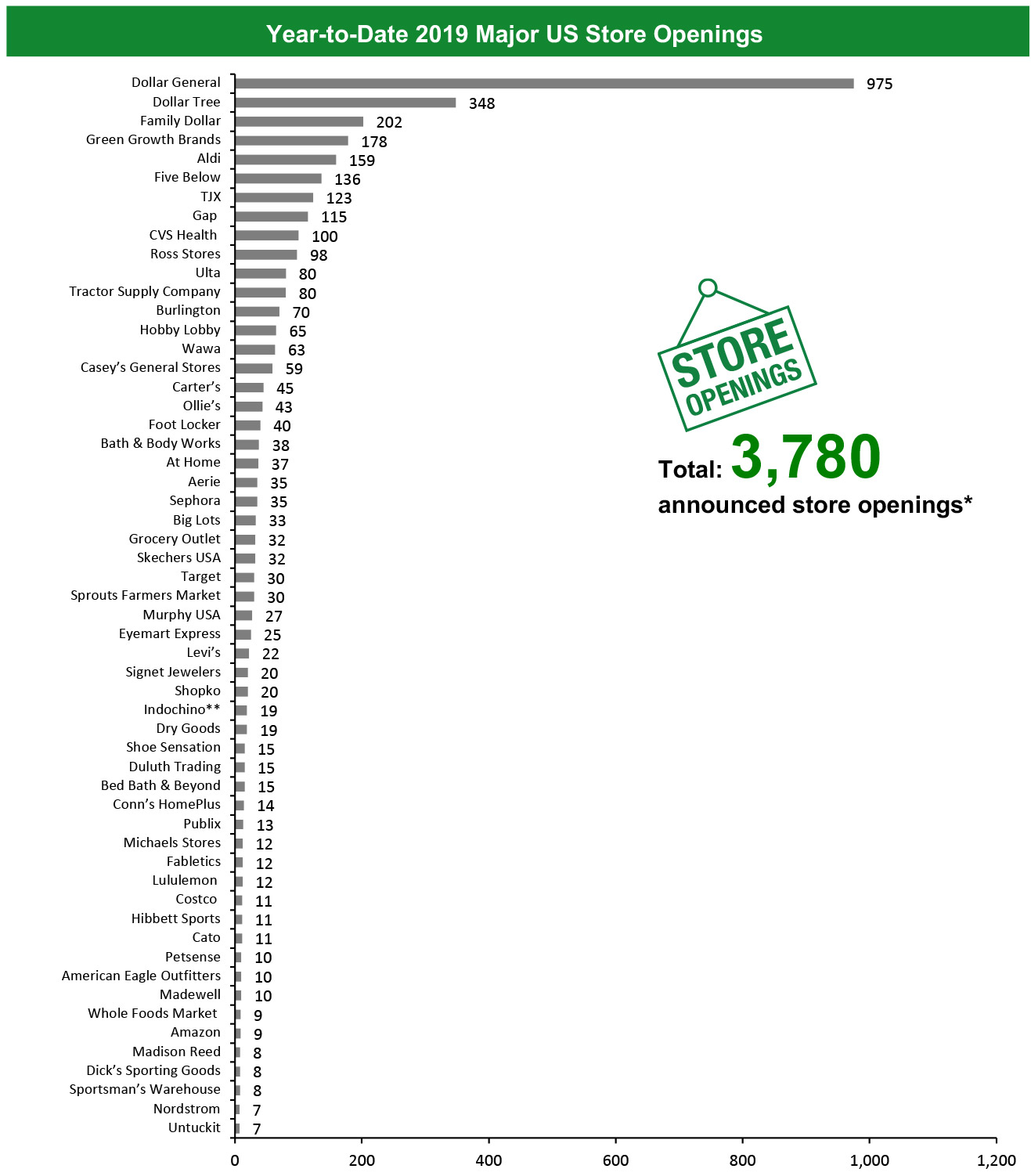

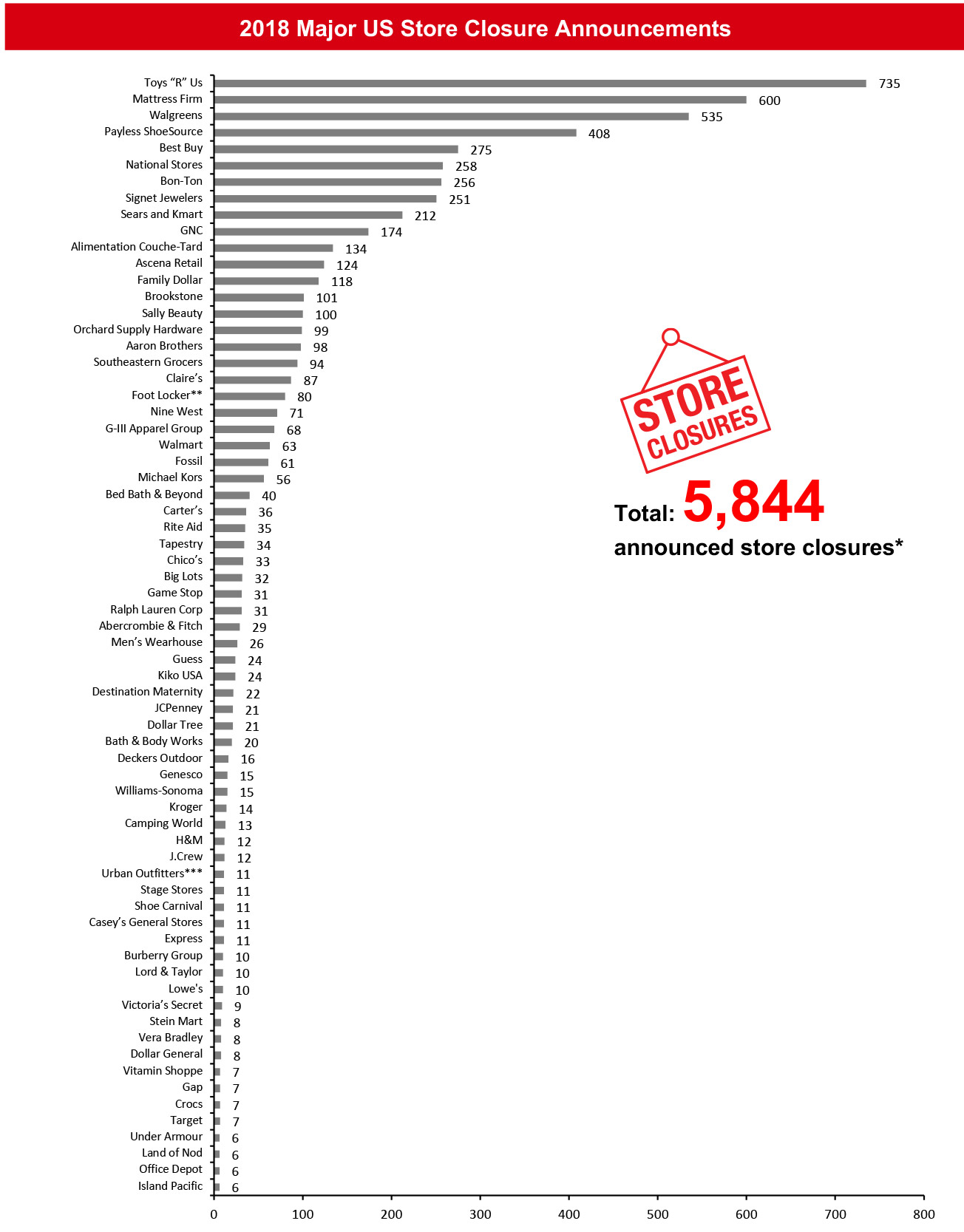

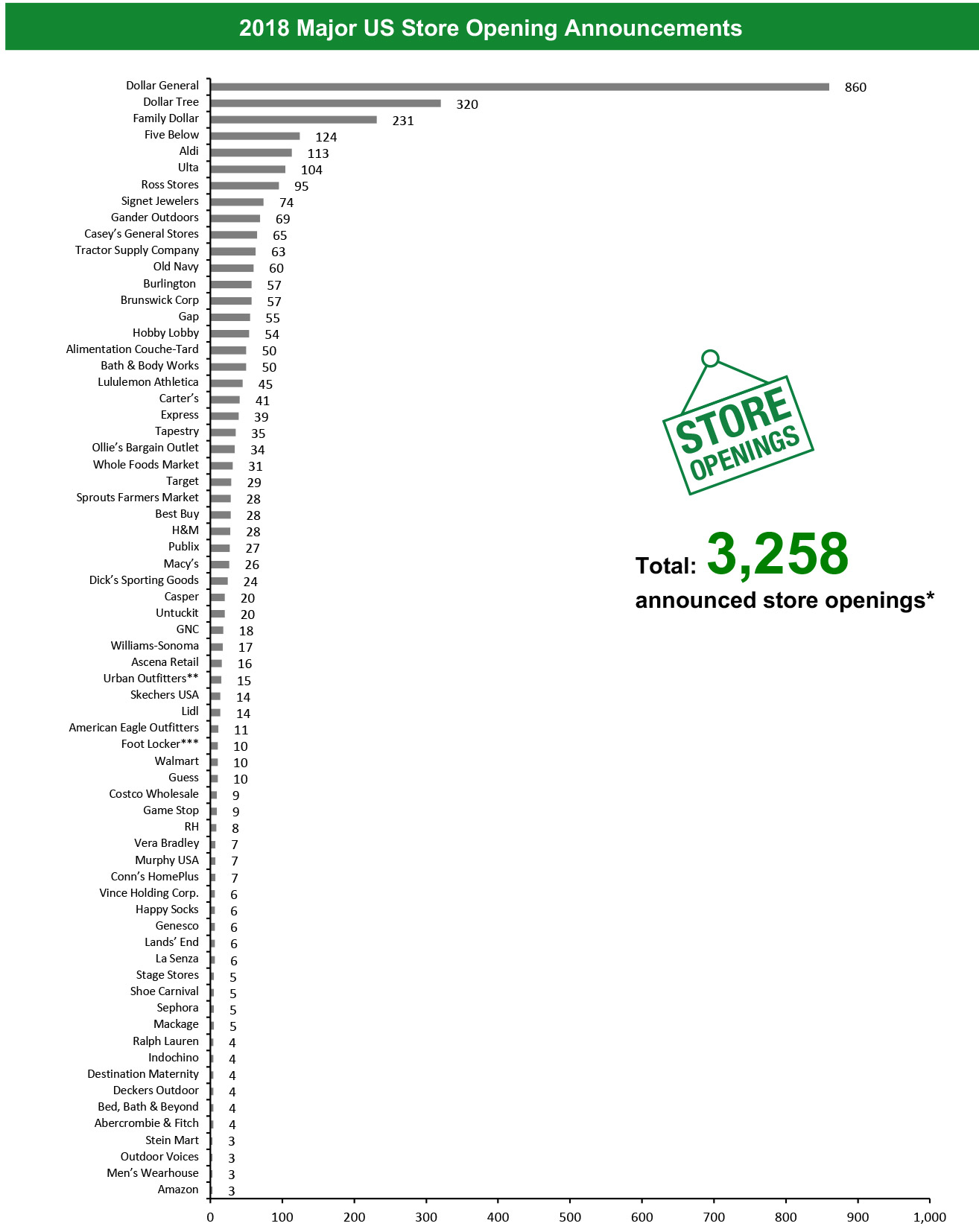

2019 Major US Store Closures and OpeningsYear to date in 2019, US retailers have announced they will close 8,993 stores and open 3,780. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.

What Is Happening This Week in the US

B8ta Launches New Store Concept

“Retail as a service” platform B8ta is expanding its retail business beyond electronics and technology devices with a fashion and lifestyle concept store called Forum. Its first Forum location will be on Melrose Avenue in Los Angeles, slated to open November 15. The new store concept will feature women’s athleisure brand ALALA as its first anchor partner, as well as a rotating selection of products from more than 25 brands across fashion and lifestyle categories. Additional Forum locations will be announced next year.

Destination Maternity Files for Chapter 11 Bankruptcy

Maternity wear retailer Destination Maternity has filed for bankruptcy after struggling against mounting debt and intense competition. The distressed retailer plans to close at least 183 stores by November 1, according to a court filing, after having already closed 27 stores earlier this year. The company operated 446 stores in the US, Canada and Puerto Rico as of August 3, 2019.

Coresight Research insight: As the stigma of wearing slightly used closed clothing diminishes and the rental and the resale markets grow double digits, Destination Maternity’s product line lends itself well to both categories, especially as maternity clothes tend to be expensive and are worn only for a relatively short time. Rental and resale have impacted primary demand and notably niche specialty retailersKitchen Collection to Shut All Its 160 Stores

Hamilton Beach Brands Holding has announced that it will shutter its specialty kitchenware subsidiary The Kitchen Collection’s entire store fleet of 160 stores by the end of the year. Clearance sales at these stores is ongoing and will continue through the holiday selling season.

Lidl To Debut Stores in Long Island

Discount supermarket chain Lidl plans to open four more stores in 2020 on Long Island, New York. The stores will be in East Meadow, Oakdale, Patchogue and Lake Grove. In April, the chain announced plans to open its first four stores in Long Island, in early 2020, bringing the total number of announced openings on Long Island to eight — two in Nassau County and six in Suffolk County.

Coresight Research insight: These stores are conversions from the Best Market banner, acquired in November 2018. In May, Lidl announced it would open 25 new stores by spring 2020, including conversions. This would take the still-nascent chain close to 100 US stores. Our running store count showed Lidl was up to from 62 stores at the start of 2019 to 74 stores by October 16.

Nordstrom Opens Women’s Flagship Store in New York

Luxury department store chain Nordstrom opened its first women’s flagship store in New York on October 24. Having previously opened a 47,000-square foot men’s store in April 2018, the new 320,000 square foot women’s store represents a significant move. The store, located across the street from the men’ store, has seven levels and will feature a number of exclusive offerings.

Coresight Research insight: Consumers who shop multiple formats spend more. The women’s flagship is part of a cohesive strategy to penetrate the New York metropolitan market, Nordstrom’s largest online market, where it also operates two Nordstrom Racks and recently opened two Nordstrom Locals.

Rebag Furthers Retail Expansion

Luxury handbag reseller Rebag has announced the opening of its ninth brick-and-mortar store. The new store, located in San Francisco’s Union Square, is its fourth in California. The 1,450-square foot store, like the retailer’s other stores, features the popular Rebag Bar and Hermès Birkin Wall. This store is the fourth of the 30 announced openings after Rebag raised $25 million in a Series C funding round in February this year, led by private equity company Novator, with participation from FJ Labs and General Catalyst. Rebag opened its eighth physical store last month, in Garden City, New York.

Coresight Research insight: Rebag’s physical expansion plans attest to the growing acceptance of recycled apparel and accessories, a trend which keeps more discretionary spend in consumers’ wallets as they clean out their closets of lightly worn clothing and accessories to find a new home. We see this trend impacting consumer purchasing decisions: We expect to see consumer look for items with better resale value at the high end, anticipating future consignment. At the same time, shoppers gain access designer and luxury labels they otherwise may not have been able to buy. Traditional handbag brands may see sales slow as shoppers opt for bags bearing greater resale value or simply buying from Rebag.

Skechers Opens 12 Stores and Closes One

Performance and lifestyle footwear retailer Skechers USA reported it opened 12 stores across eight states in the US and closed one in Seattle during its third quarter, ended September 30, 2019. To date in the fourth quarter, the retailer opened three company-owned stores in the US and plans to open five more stores before the end of the year.

Sportsman’s Warehouse Opens Eight Stores

Outdoor sporting goods retailer Sportsman’s Warehouse opened eight stores on October 19, as a part of its recent acquisition of Field & Stream stores from Dick’s Sporting Goods. The newly opened stores are converted Field & Stream stores which now operate under the Sportsman’s Warehouse banner. The newly opened locations include two stores in New York, three in Pennsylvania, two in North Carolina and one in Michigan.

Non-Store-Closure News

NIKE CEO Steps Down

Nike has announced CEO Mark Parker will step down from his role effective January 13. Parker will be replaced by John Donahoe, currently CEO of cloud-computing services provider ServiceNow. Donahoe had previously served as CEO at eBay, from 2008 to 2015.

Under Armour CEO To Step Down

Under Armour announced CEO Kevin Plank will step down and be succeeded by President and COO Patrik Frisk, who will also join Under Armour’s board of directors. Plank has served as Chairman and CEO since he founded the company in 1996. He will now take on a new role as Executive Chairman and Brand Chief, leading Under Armour’s board with a focus on “product elevation, amplifying the brand story and stewarding the company's strong team culture.”

United Colors of Benetton To Open Pop-Up Store

Apparel retailer United Colors of Benetton (Benetton) will open a pop-up store in the Santa Monica Place shopping center in southern California. The pop-up store will be the retailer’s first physical store in the US since 2014, when it began shutting all of its 60 US stores. The store will open on October 25, 2019 and close on November 24, 2019. It will offer exclusive collections from the 2019 Milan Fall Fashion show. While shoppers can try on clothing, they’ll have to order online (in-store) for later delivery.

[caption id="attachment_98511" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_98512" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimates of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon are based on the proportion of existing stores in the US. Estimates of store openings for H&M are based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense. *Total includes a small number of retailers that each announced fewer than seven store openings and are not included in the chart.

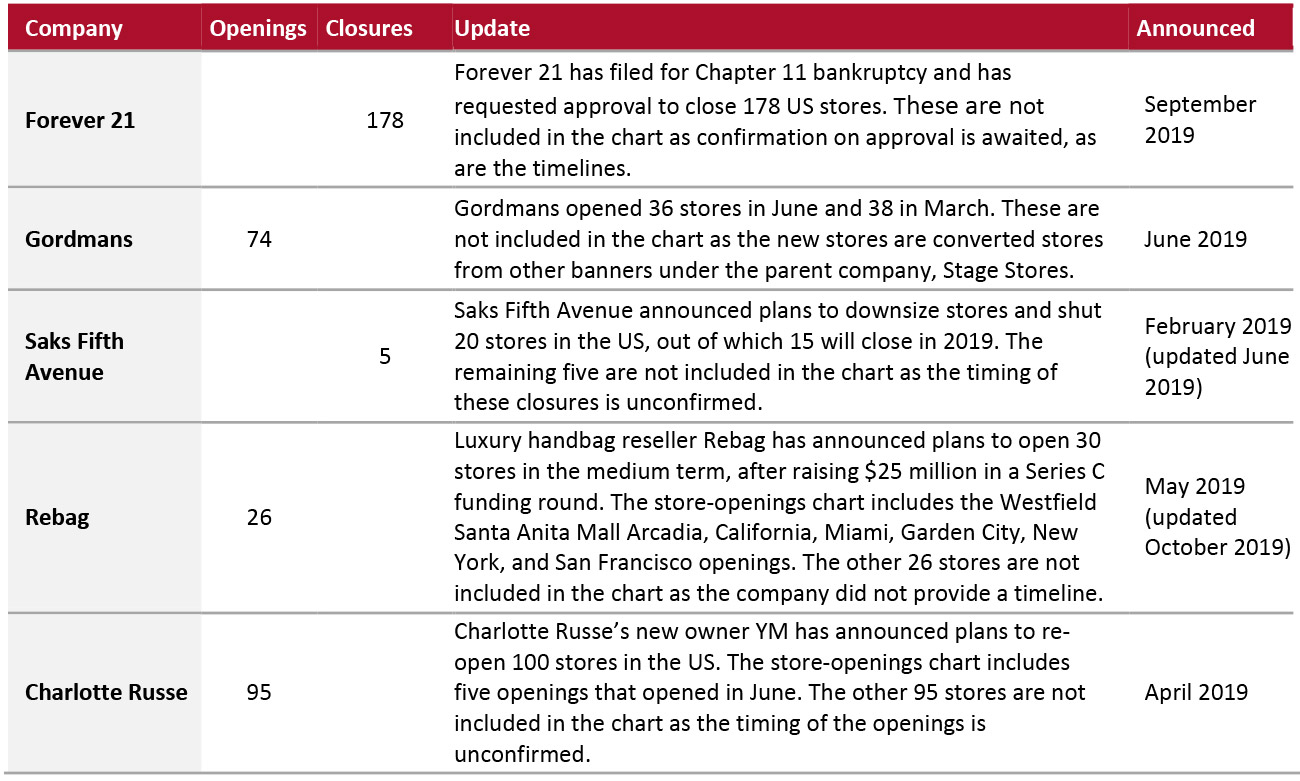

**Indochino openings refer to North America total openings, excluding one opening announced for the greater Toronto area. Source: Company reports/Coresight Research [/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_98513" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98514" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98514" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. ***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_98515" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners. ***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

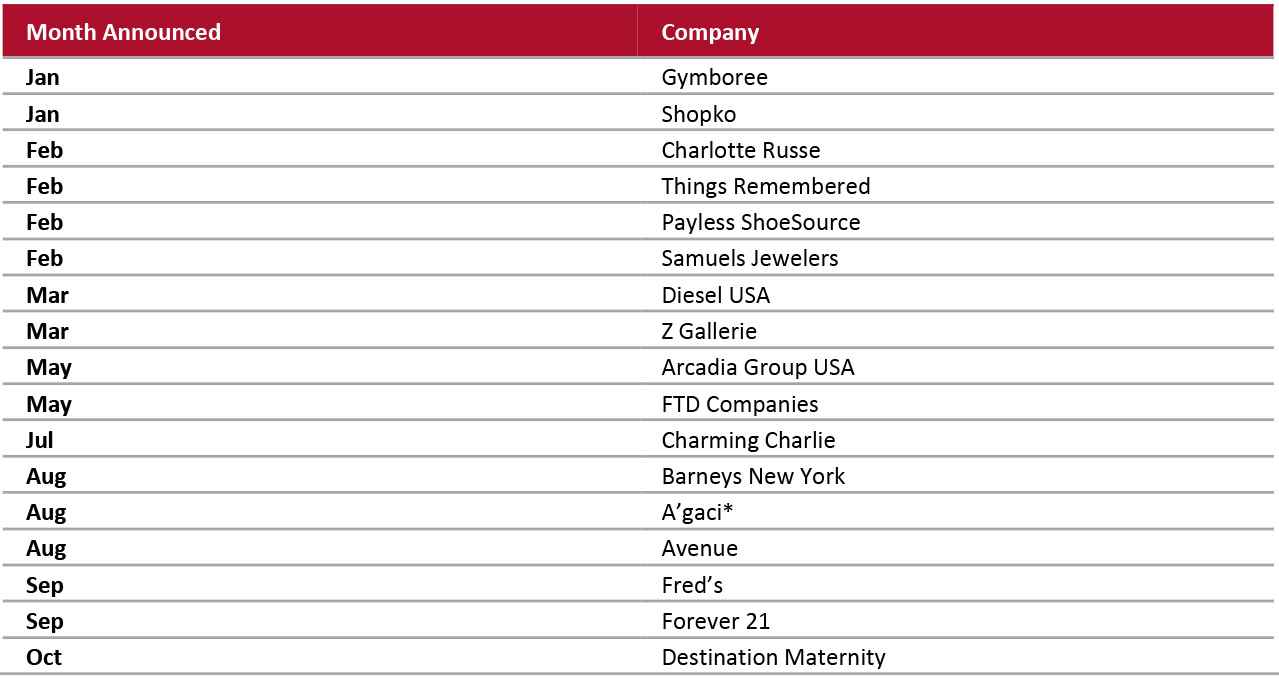

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_98516" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

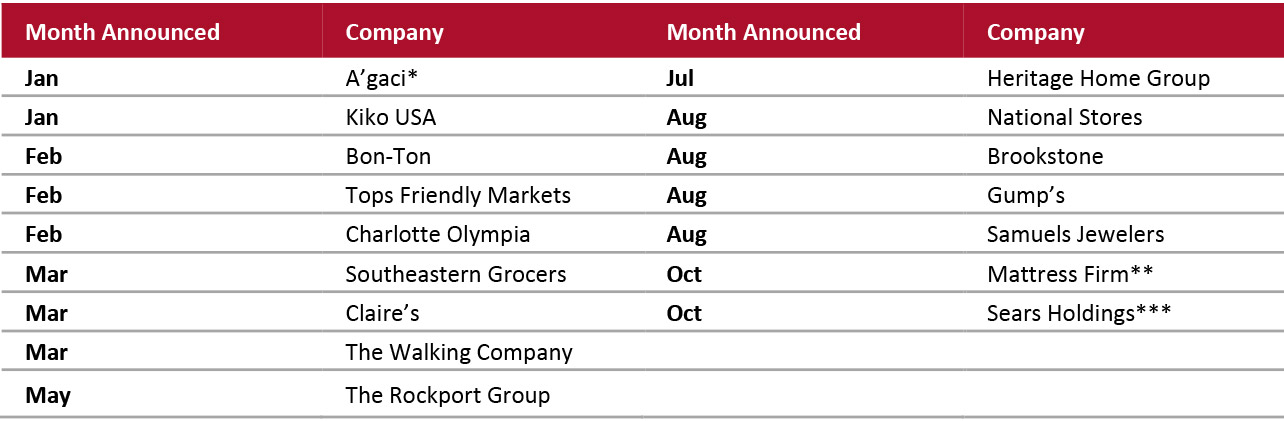

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research [/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_98517" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

2019 Major UK Store Closures and Openings

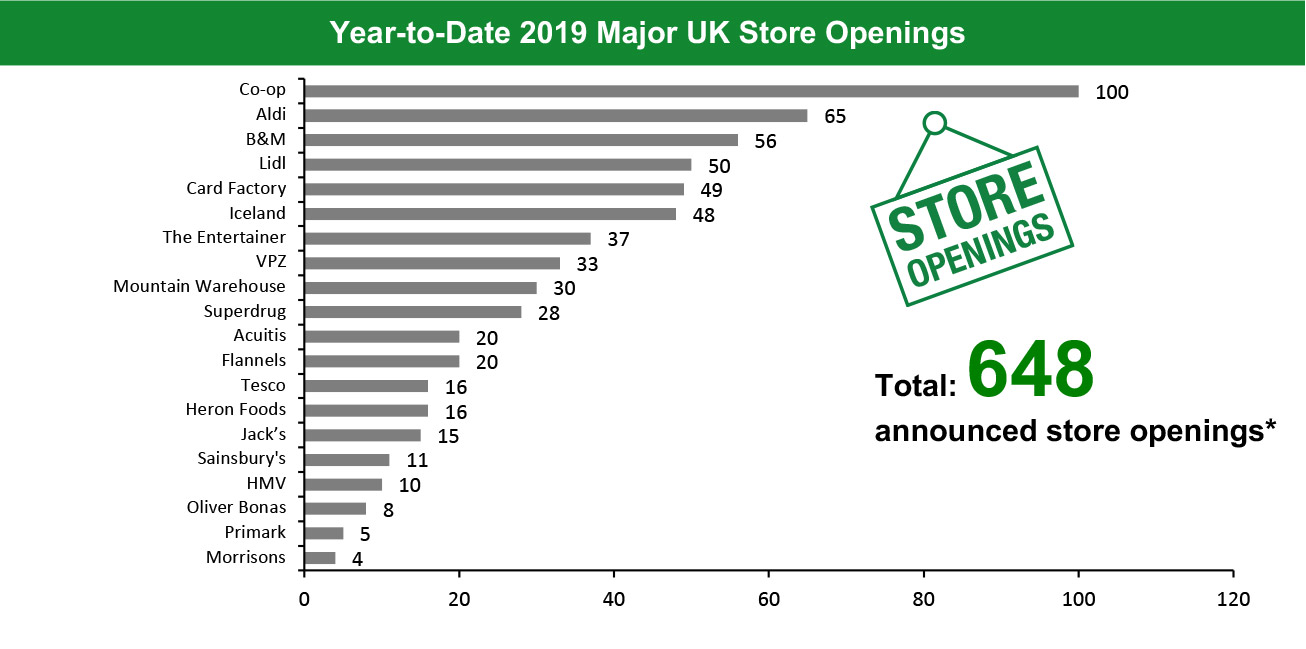

Year to date in the UK, major retailers have announced 498 store closures and 648 store openings. Our data represents closures and openings by calendar year.

What Is Happening This Week in the UK

Marks & Spencer To Open New Store in Nottingham

Marks & Spencer plans to open a 60,000-square foot store in Giltbrook Shopping Park, Nottingham, in 2020. The new store is a part of the retailer’s store transformation plan, which includes opening a limited number of clothing and home stores.

Watt Brothers Falls into Administration

Scottish department store chain Watt Brothers has entered into administration and 10 of the retailer’s 11 stores closed on October 18. The chain’s Glasgow flagship store remains open while running a stock clearance sale. Watt Brothers has closed stores across Scotland in Ayr, Clarkston, Clydebank, Falkirk, Hamilton, Irvine, Lanark, Livingston, Port Glasgow and Robroyston.

Non-Store-Closure News

Bonmarché Enters Administration

Clothing retailer Bonmarché has fallen into administration, with almost 2,900 jobs and 318 stores facing uncertainty. This is the second time the retailer has fallen into administration in seven years. Tony Wright, Alastair Massey and Phil Pierce, of specialist advisory firm FRP, were appointed as joint administrators for Bonmarché. FRP said the retailer would continue to operate with no immediate job losses or store closures. The retailer’s 318 stores will remain open during the search for a buyer.

Humphrey Singer Departs Marks & Spencer

Marks & Spencer has announced that Group CFO Humphrey Singer will step down on December 31, after a year with the company. Singer, who joined M&S in July last year, has been working with Chief Executive Steve Rowe and the M&S board to ensure a smooth transition and the succession process is underway. Prior to M&S, Singer was Group Finance Director at Dixons Carphone.

[caption id="attachment_98518" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_98519" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on the proportion of net existing stores in the UK. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

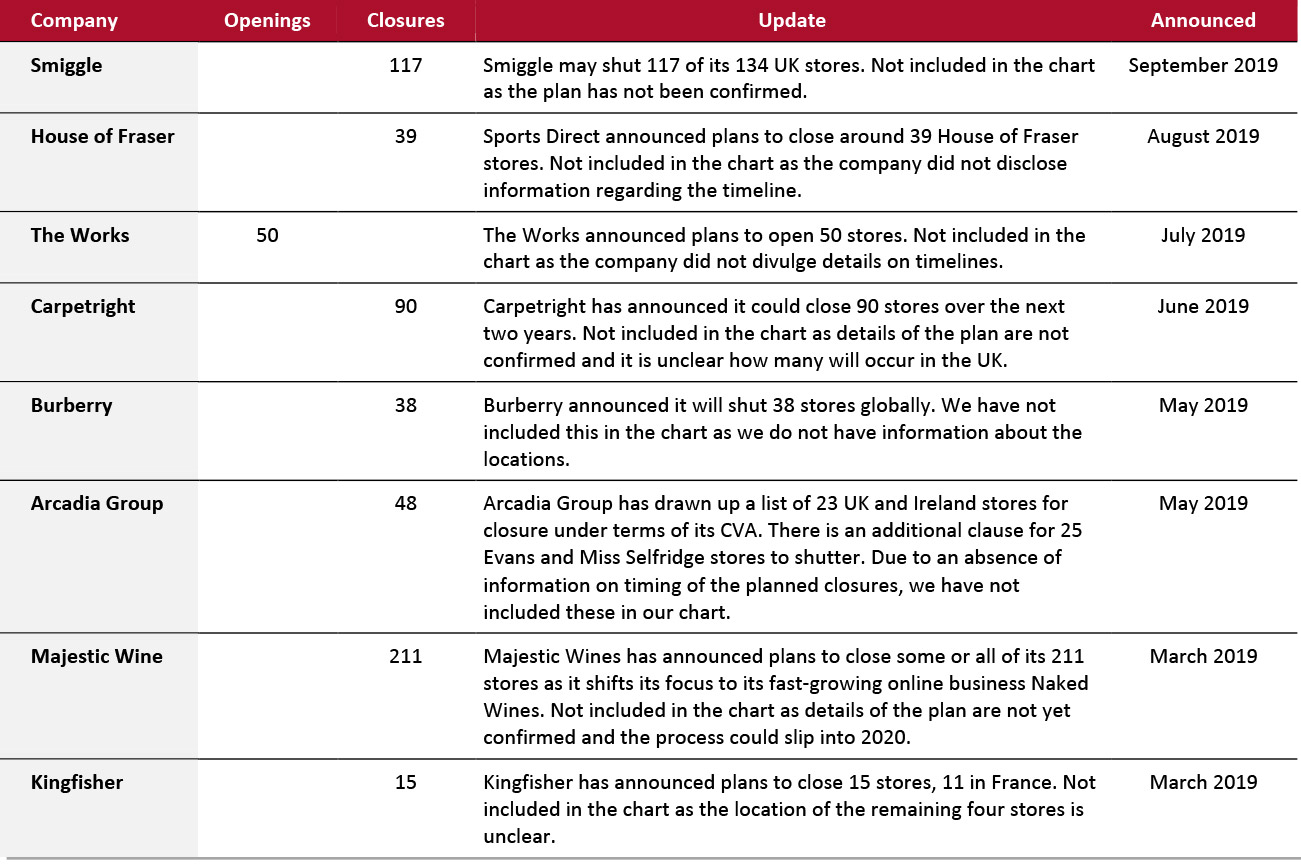

Source: Company reports/Coresight Research [/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_98520" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98521" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

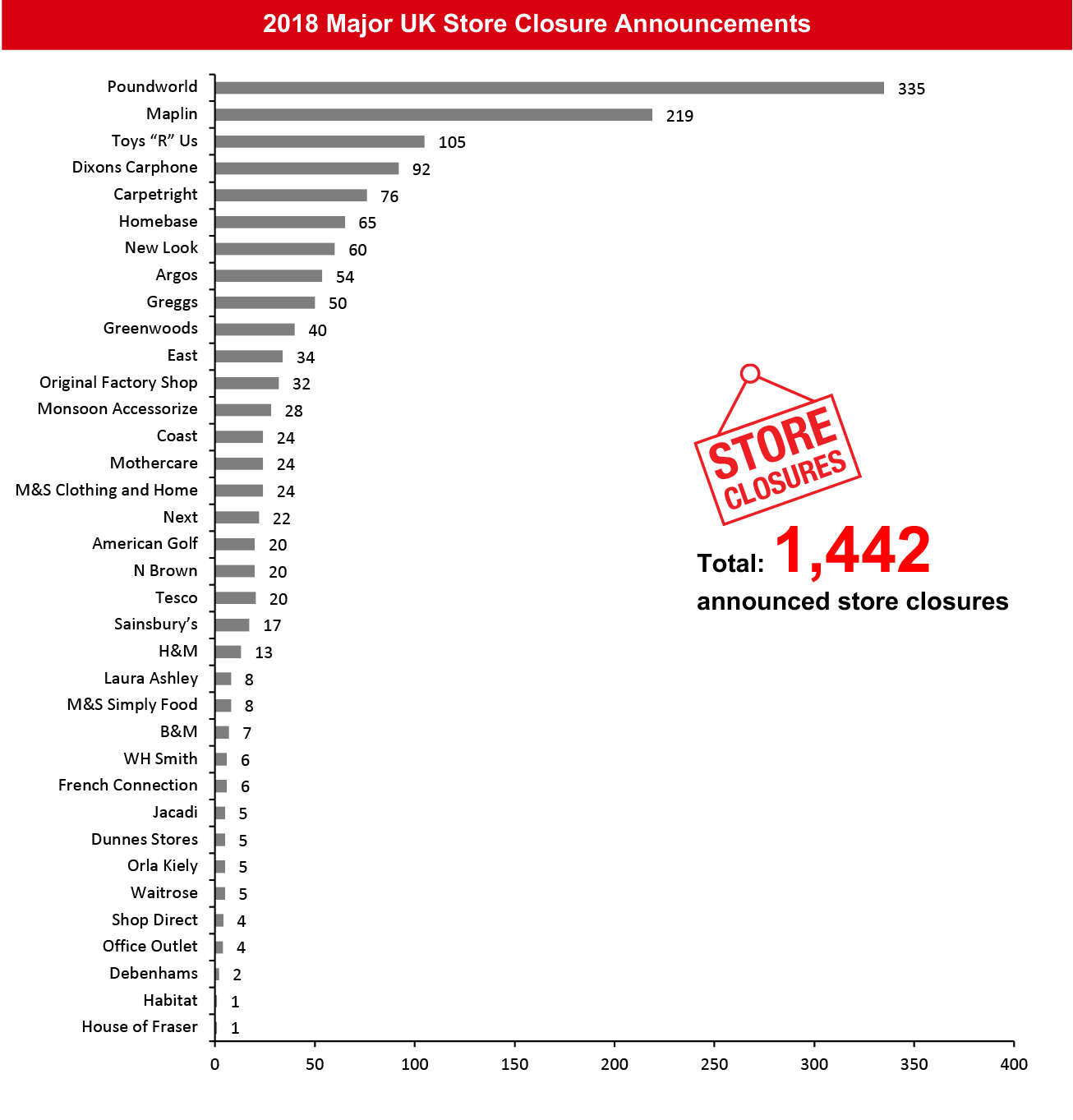

[caption id="attachment_98521" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_98522" align="aligncenter" width="700"]

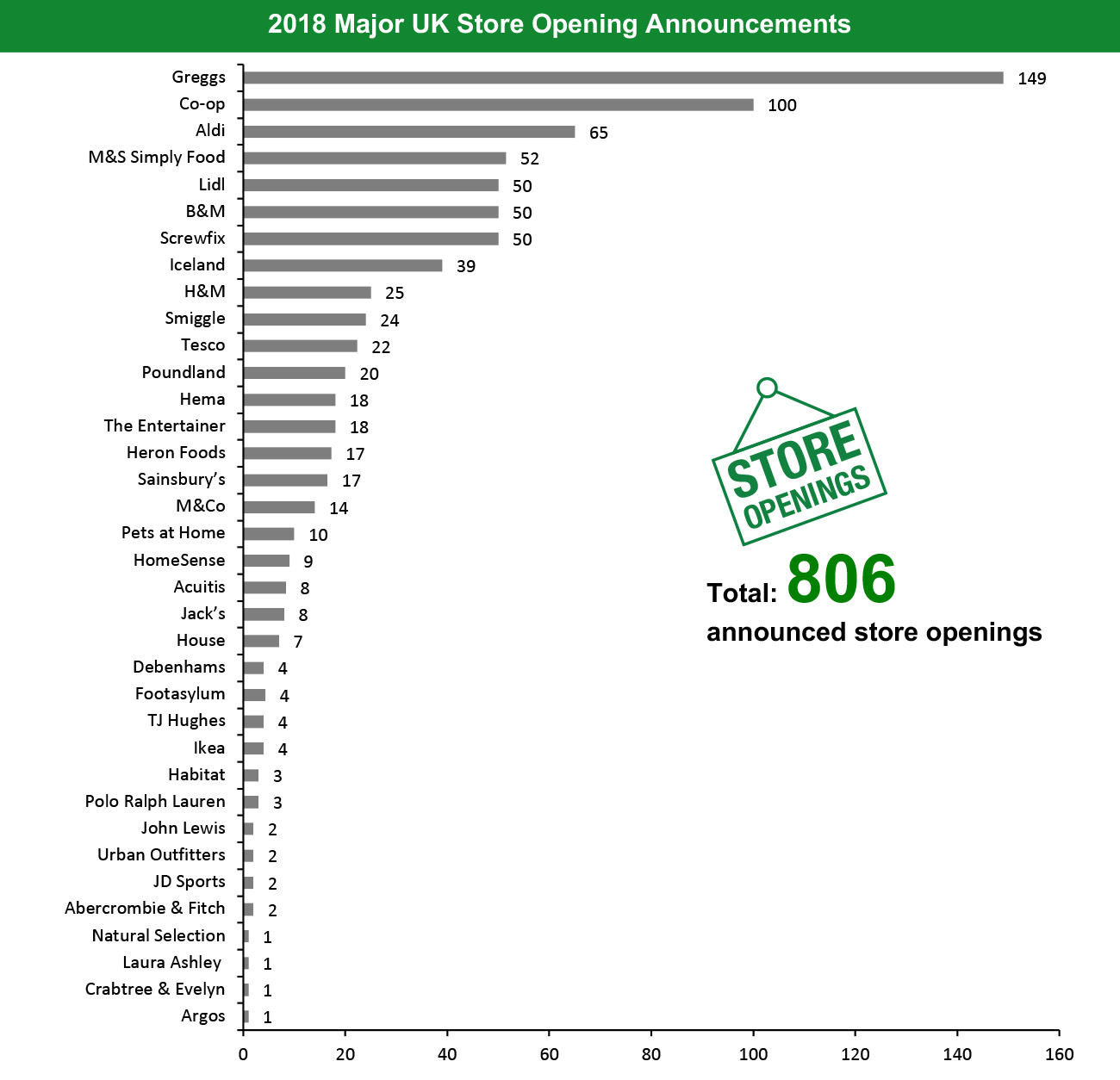

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption]

Notes

Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.