Nitheesh NH

The US

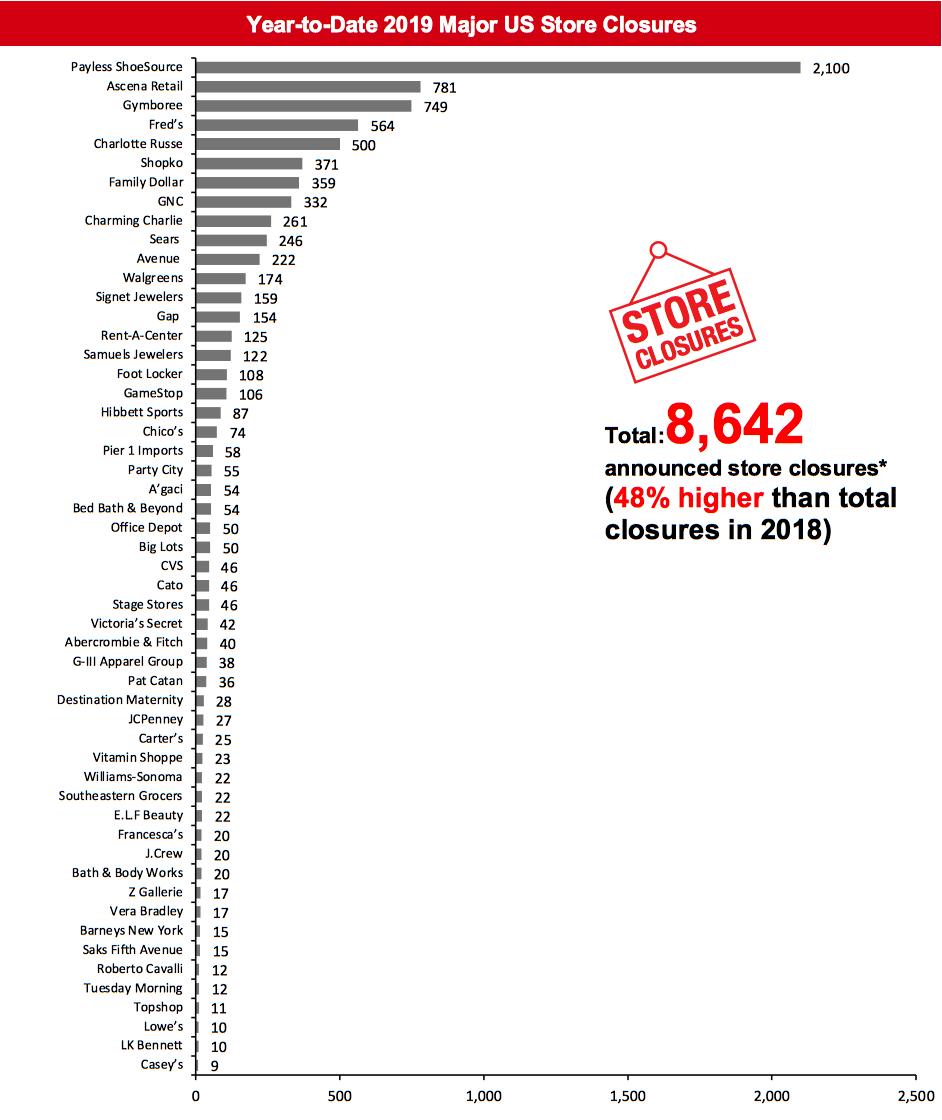

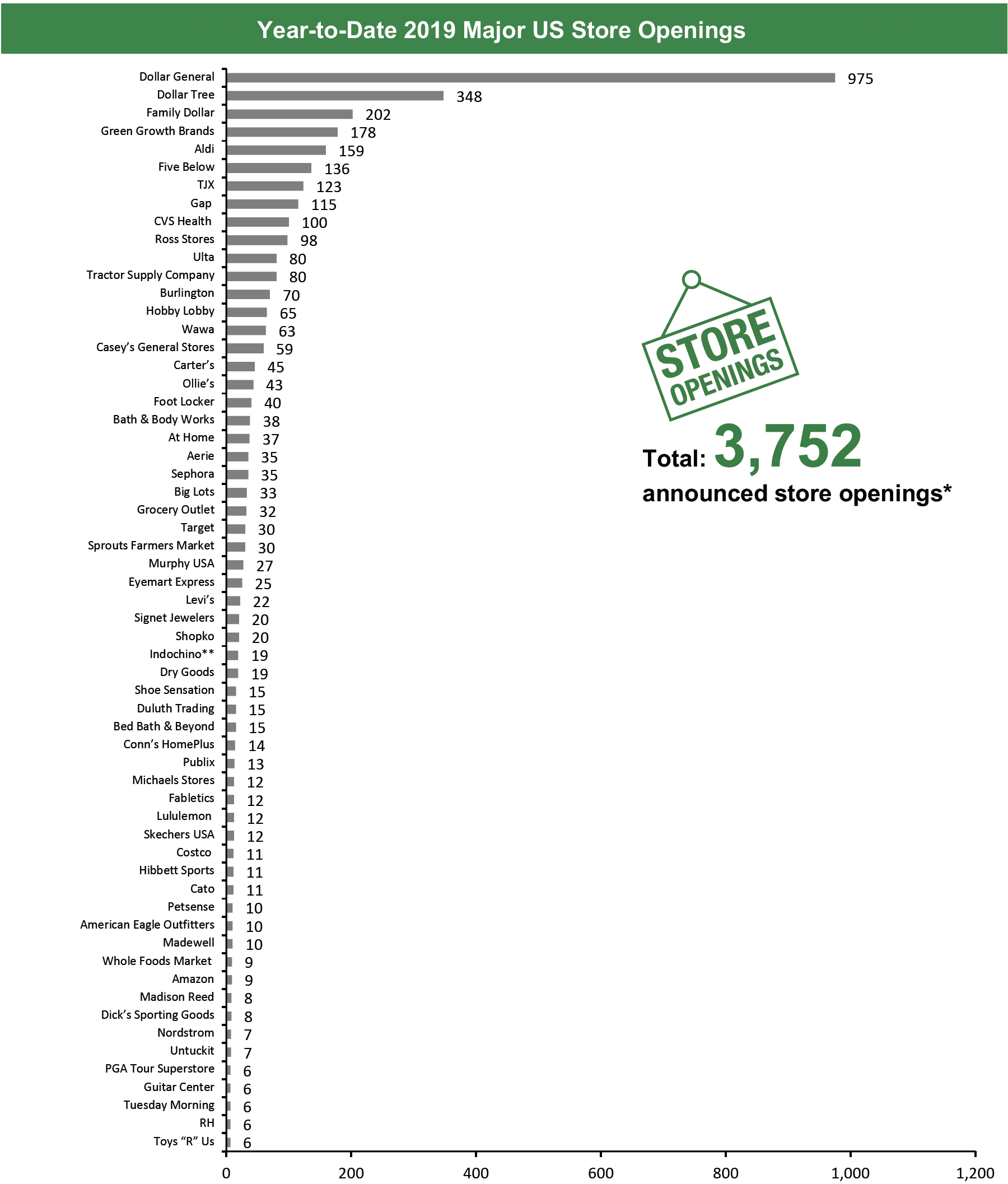

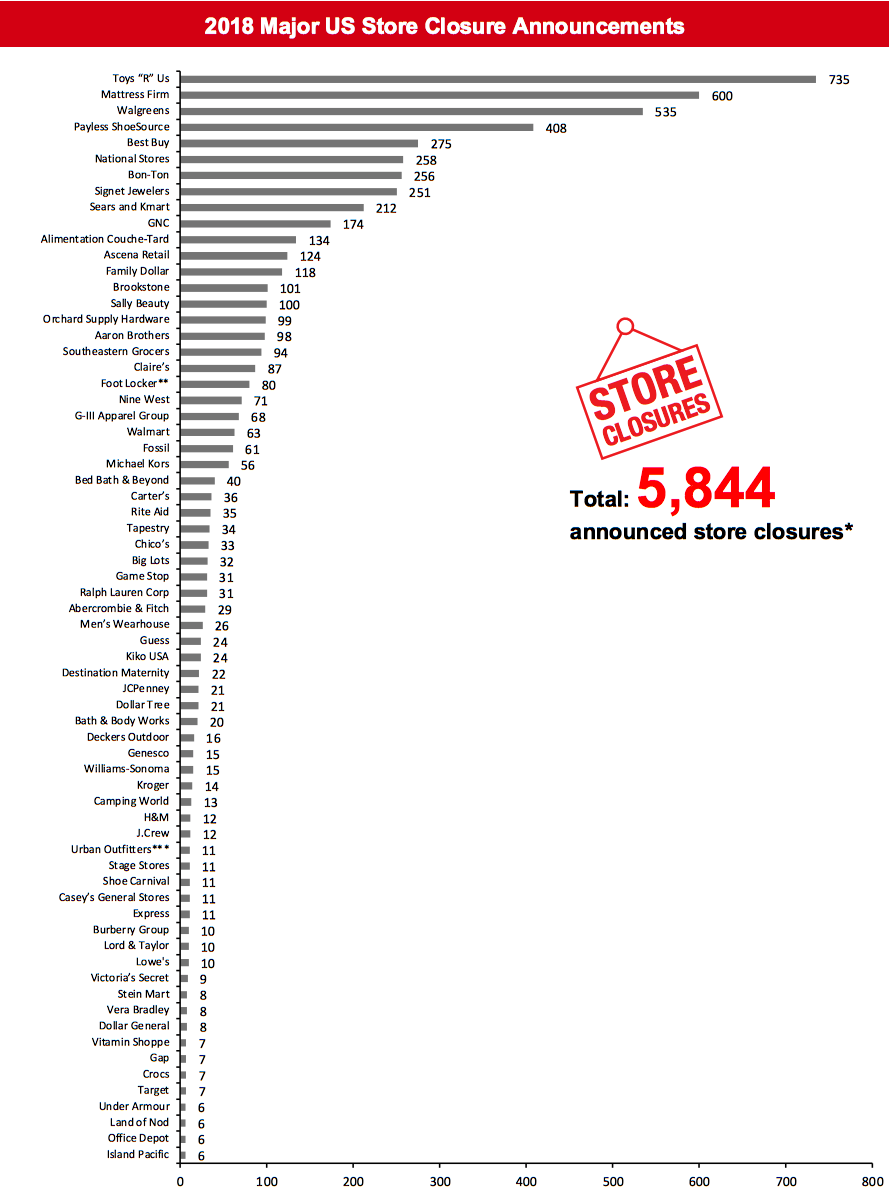

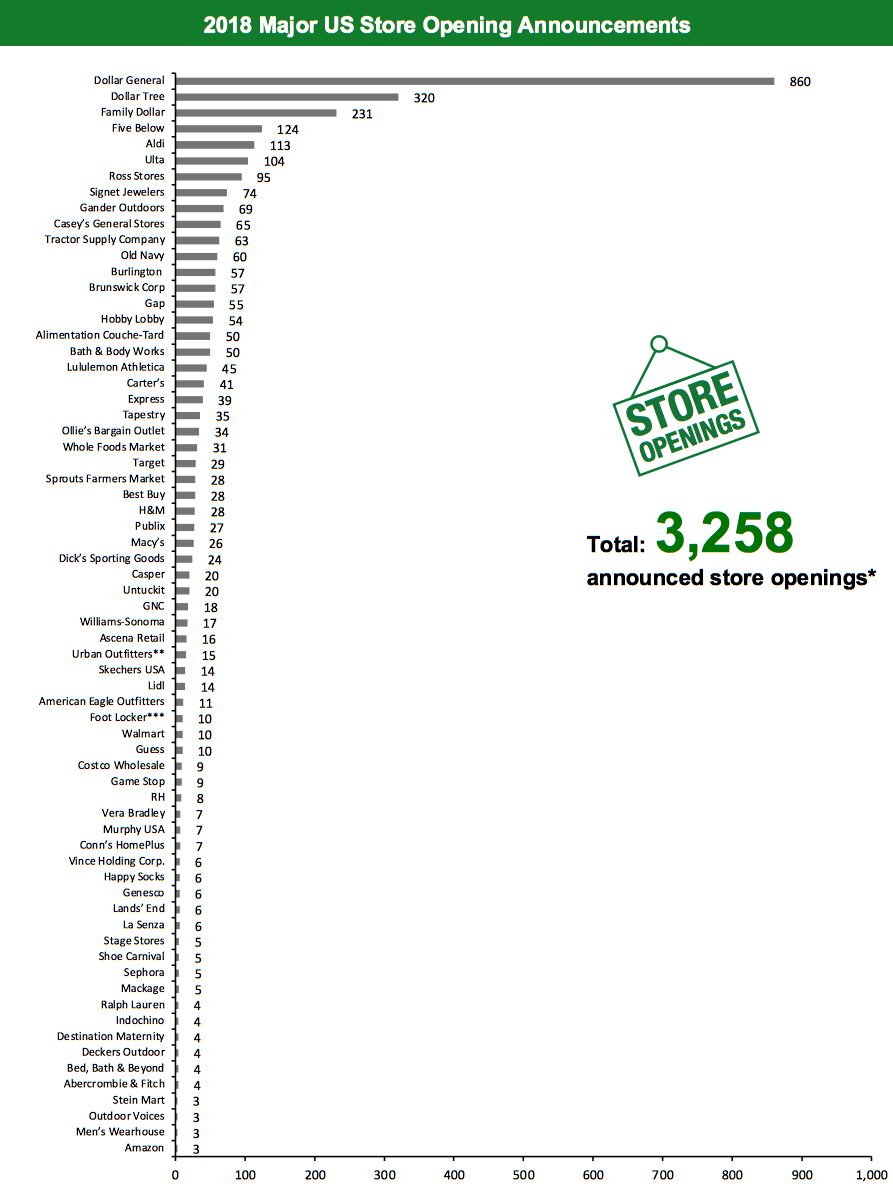

2019 Major US Store Closures and OpeningsYear to date in 2019, US retailers have announced they will close 8,642 stores and open 3,752. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.

The addition of data for Publix and TJX has increased our year-to-date store-openings total.

What Is Happening This Week in the US

Allbirds To Expand its Brick-and-Mortar Presence Eco-friendly footwear retailer Allbirds plans to expand its retail footprint by opening 20 stores in 2020. The new stores will open in multiple locations including new markets such as Atlanta, Dallas and Denver. The retailer currently operates thirteen stores—seven in the US, three in China and one each in Berlin, London and New Zealand. Coresight Research insight: Allbirds is a direct-to-consumer brand that is executing an online-to-offline strategy to better connect with new and existing consumers by providing a physical presence where they can engage with the brand. We have seen digitally native brands benefit from a halo effect whereby online sales grow in the surrounding area of a new store. Eyemart Express To Expand its Retail Footprint Eyewear retailer Eyemart Express plans to expand its store network and venture into new markets by opening 25 stores by the end of this year. The stores will open in four US states—Florida, Maryland, Pennsylvania and Wyoming. The retailer currently operates 206 stores across 38 states in the US. Indochino Opens 50th Location Custom apparel retailer Indochino opened its 50th location in Georgetown, Washington, DC. It plans to open two more stores this year—one in Cleveland on October 18 and another in New Orleans on November 8. The retailer had previously announced plans to open 20 new stores in North America, as a part of its 2019 store expansion plan. Ross Stores Opens 42 New Stores; Completes 2019 Store Expansion Plans Department store chain Ross Stores has opened 30 Ross Dress for Less and 12 dd’s Discount stores across 19 states in September and October this year. According to the retailer, it has completed its store expansion plan for fiscal 2019 with the addition of 98 new stores in the US. Coresight Research insight: Apparel retailers dominate our store-closures list for 2019. Off-price remains one of the few apparel segments to be seeing significant net openings. Schnucks To Shutter Three Stores in St. Louis Supermarket chain Schnucks has announced plans to close three underperforming stores in the St. Louis metropolitan area: one each in St. Peters and O’Fallon in Missouri and one in Edwardsville, Illinois. In May 2019, the chain shuttered two St. Louis-area stores, one in Festus and another in St. Ann. It also closed a store in East Alton, Illinois, in August 2019. The Vitamin Shoppe Opens its New Innovation-Concept Store Nutritional supplements retailer The Vitamin Shoppe has announced the opening of a new innovation store in Edgewater, New Jersey. The new store features on-demand digital product guides and mobile point-of-sale checkout. The store also includes a dedicated area to take the “Only Me” personalized health assessment, a complimentary body-composition analysis station and a supplement sampling machine. The retailer plans to open five new innovation-concept stores through January 2020. Transform Holdco May Close More Sears and Kmart Stores The Wall Street Journal reported that Transform Holdco (TransformCo), Sears Holdings’ new parent company, will close nearly 100 more Sears and Kmart stores by the end of this year. In separate announcements earlier this year, TransformCo announced that 93 Sears and 53 Kmart stores will close in 2019, and listed out the stores slated for closure.Non-Store-Closure News

Five Below To Pilot Gaming Centers Discount chain Five Below will partner with Nerd Street Gamers, an esports infrastructure company. Nerd Street Gamers has completed a $12 million Series A financing round led by Five Below to build esports facilities (Localhost) that house tournaments, training camps and leagues. Under this partnership, the two companies will build 3,000-square-foot Localhost gaming centers connected to select Five Below stores, starting with a multi-store pilot in 2020. Depending on the results of the pilot, this concept could expand to more than 70 locations over the coming years. JCPenney Appoints Laurie Wilson as SVP Planning, Allocation and Pricing Department store chain JCPenney has appointed Laurie Wilson as SVP, Planning and Allocation and Pricing, effective October 28, 2019. She succeeds John Welling who stepped down in August this year. Wilson has more than 25 years of experience in the field of planning and allocation, merchandise, finance, pricing, operations and strategy. She joins JCPenney from LW Associates where she served as President and CEO. [caption id="attachment_98159" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for Bed Bath & Beyond, GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners.*Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98210" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimate of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Estimate of store openings for H&M is based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Costco, Dollar Tree, Five Below and Family Dollar. Estimate of store openings for Bed Bath & Beyond, Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Estimate of store openings for H&M is based on net new stores in the US. Store total for Amazon includes Amazon Go, Amazon Books and Amazon 4-Star stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. TJX includes TJ Maxx, Marshalls, HomeGoods, Sierra and HomeSense.*Total includes a small number of retailers that each announced fewer than six store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the Greater Toronto Area.

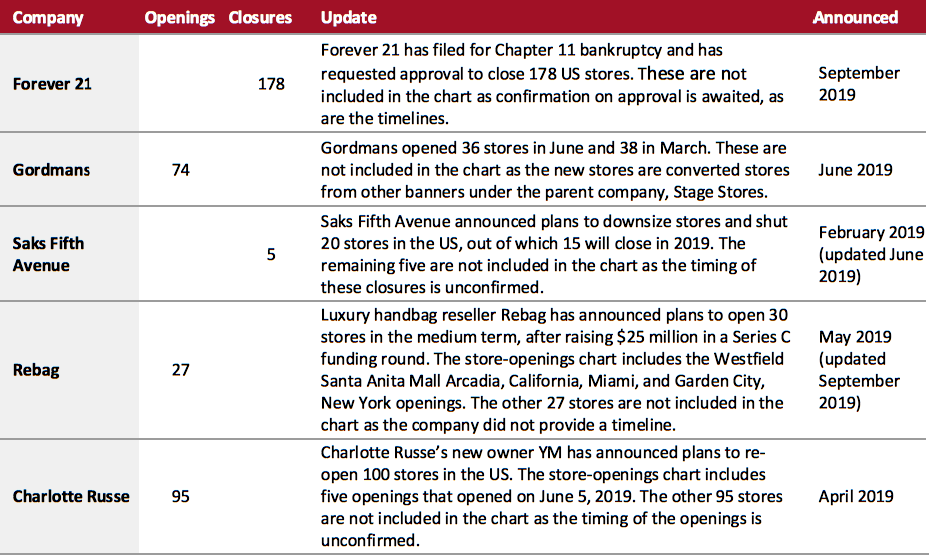

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_98161" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98162" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98162" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98163" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

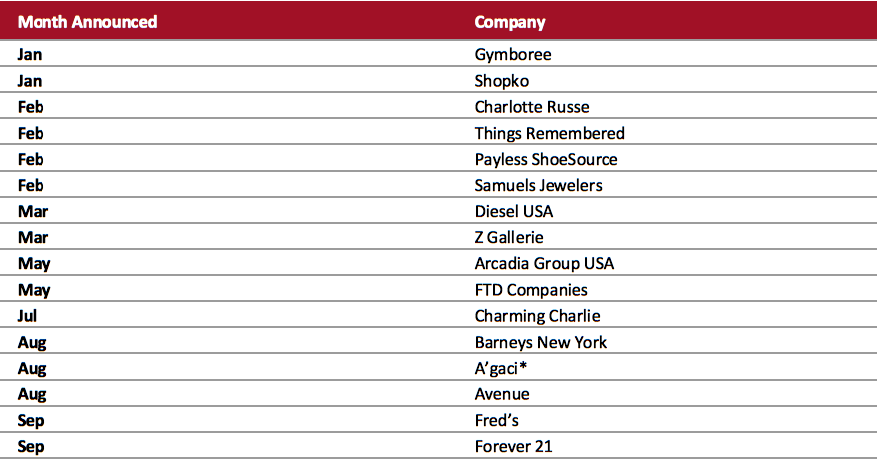

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_98164" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research[/caption]

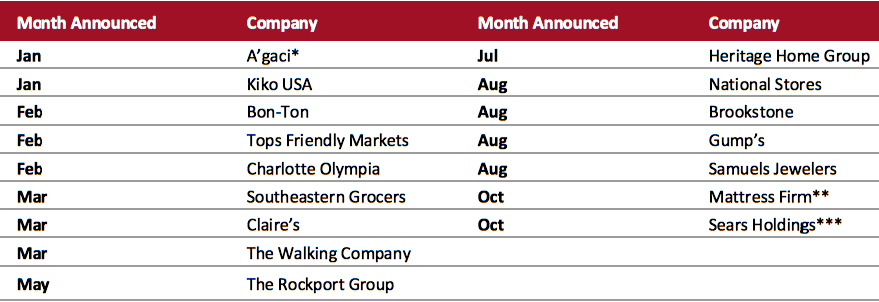

2018 Major US Retail Bankruptcies

[caption id="attachment_98165" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research[/caption]

2018 Major US Retail Bankruptcies

[caption id="attachment_98165" align="aligncenter" width="700"] *A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

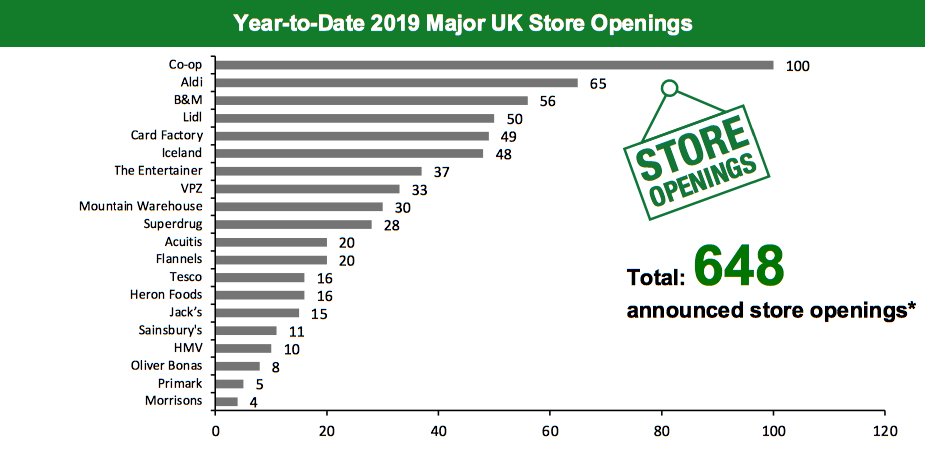

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 488 store closures and 648 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

HMV Opens Experiential Store in Birmingham Entertainment retailer HMV opened an experiential store called HMV Vault on October 11, 2019, in Birmingham. The 25,000-square-foot store is Europe’s largest music and entertainment space and offers a wide range of CDs and Blu-ray and DVD titles. HMV’s new owner Doug Putman also plans further store openings over the next year. LK Bennett To Close its Wimbledon Store Upmarket fashion retailer LK Bennett’s first ever brick-and-mortar store, which opened in Wimbledon in 1990, will close on October 29 this year. The retailer stated that the decision to close this store was owing to the landlord hiking the rent by 45%, according to Drapers. LK Bennett fell into administration in March 2019 and closed five UK stores. It was subsequently bought out of administration by its Chinese franchise partner Byland UK in April 2019. Byland UK had acquired 21 LK Bennett stores in the UK but decided to close the remaining 15 stores.Non-Store-Closure News

Laura Ashley Joint COO Resigns Laura Ashley has announced that Sean Anglim has resigned as Finance Director and Joint COO, after more than 20 years with the company. He will remain with Laura Ashley until the end of this year. Anglim joined the company in 1996 and was appointed as Joint COO in 2011. He was subsequently appointed as Finance Director and Joint COO in 2012. Jessops Plans To Call in Administrators Camera chain Jessops is reportedly planning to call in administrators as it seeks to secure a company voluntary agreement with its landlords and lenders. The retail chain’s owner Peter Jones had bought it out of administration in 2013 following its collapse, but failed to make it profitable, and losses have increased in recent years. [caption id="attachment_98166" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_98167" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

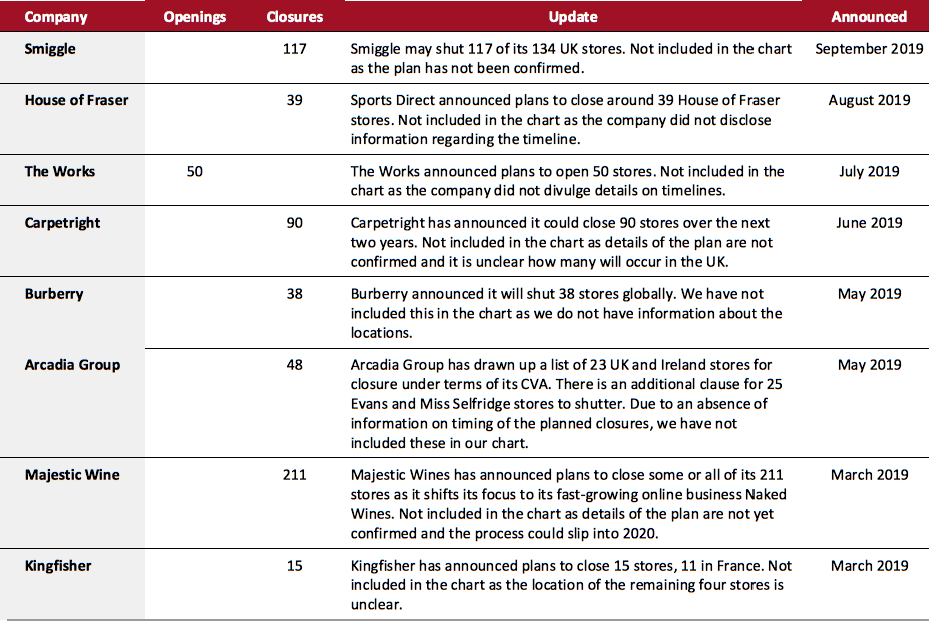

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_98168" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_98169" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

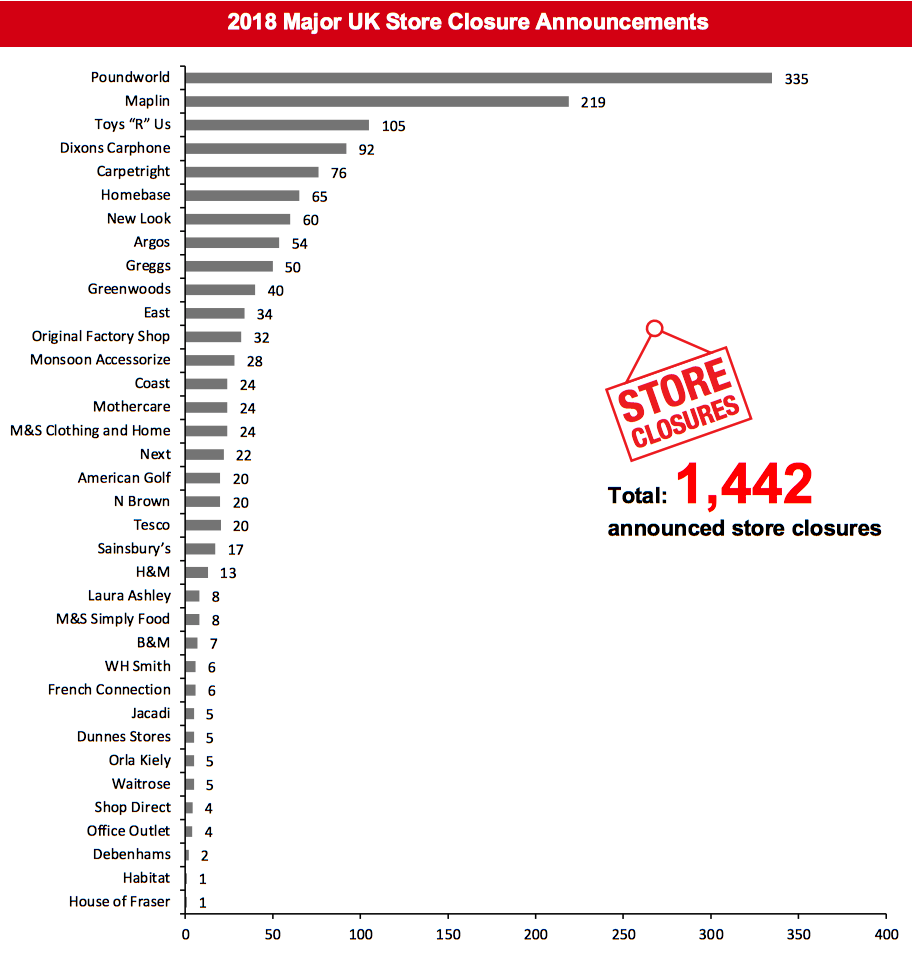

[caption id="attachment_98169" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_98170" align="aligncenter" width="700"]

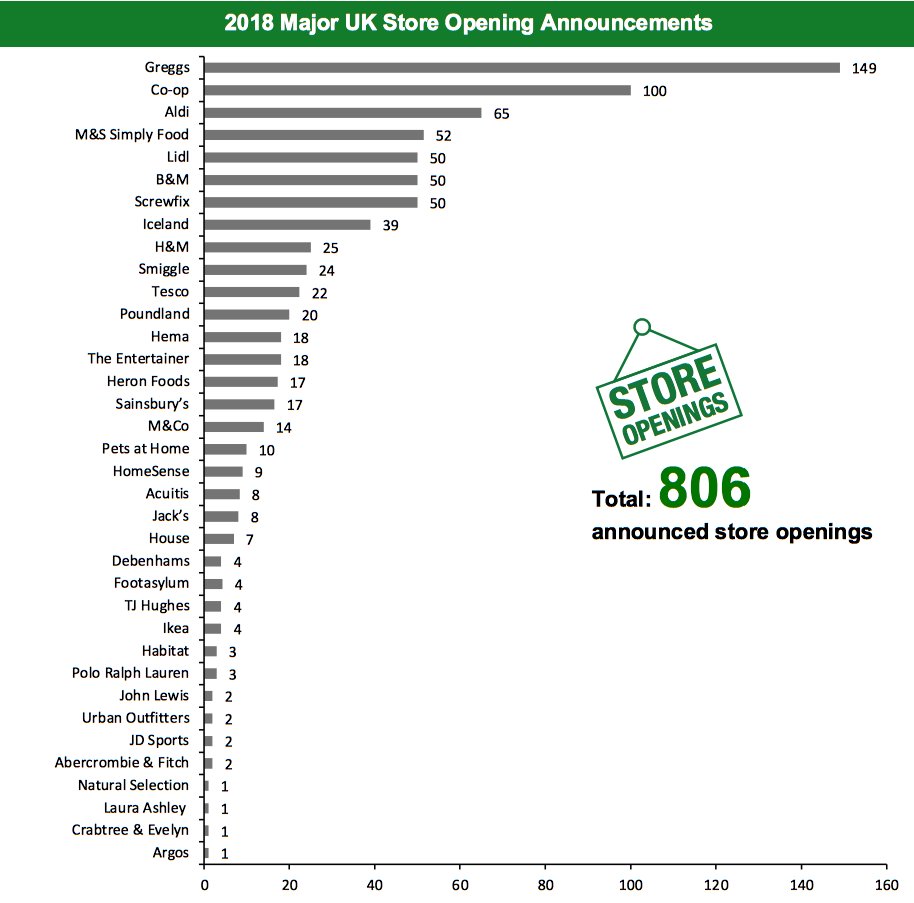

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.