DIpil Das

The US

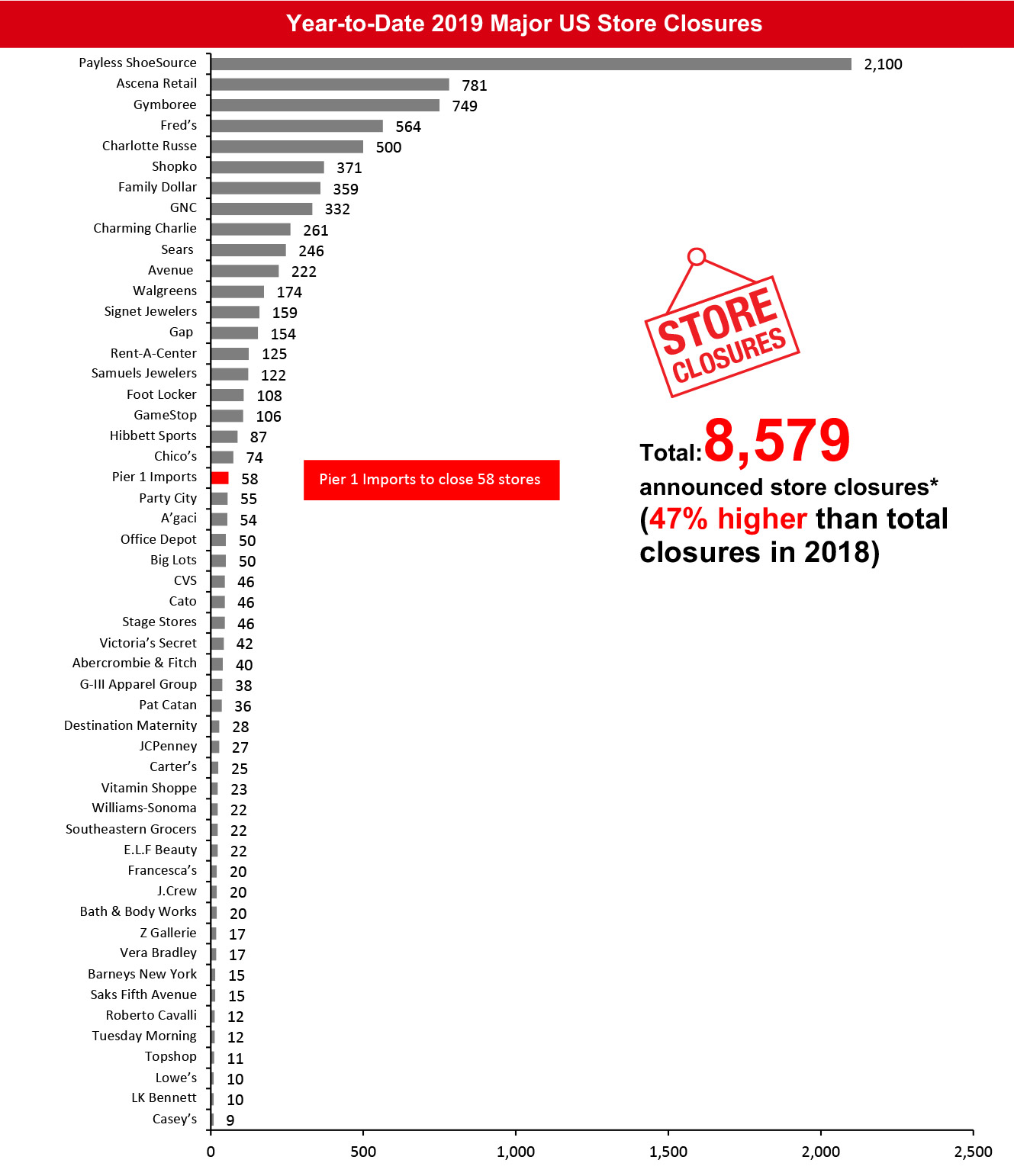

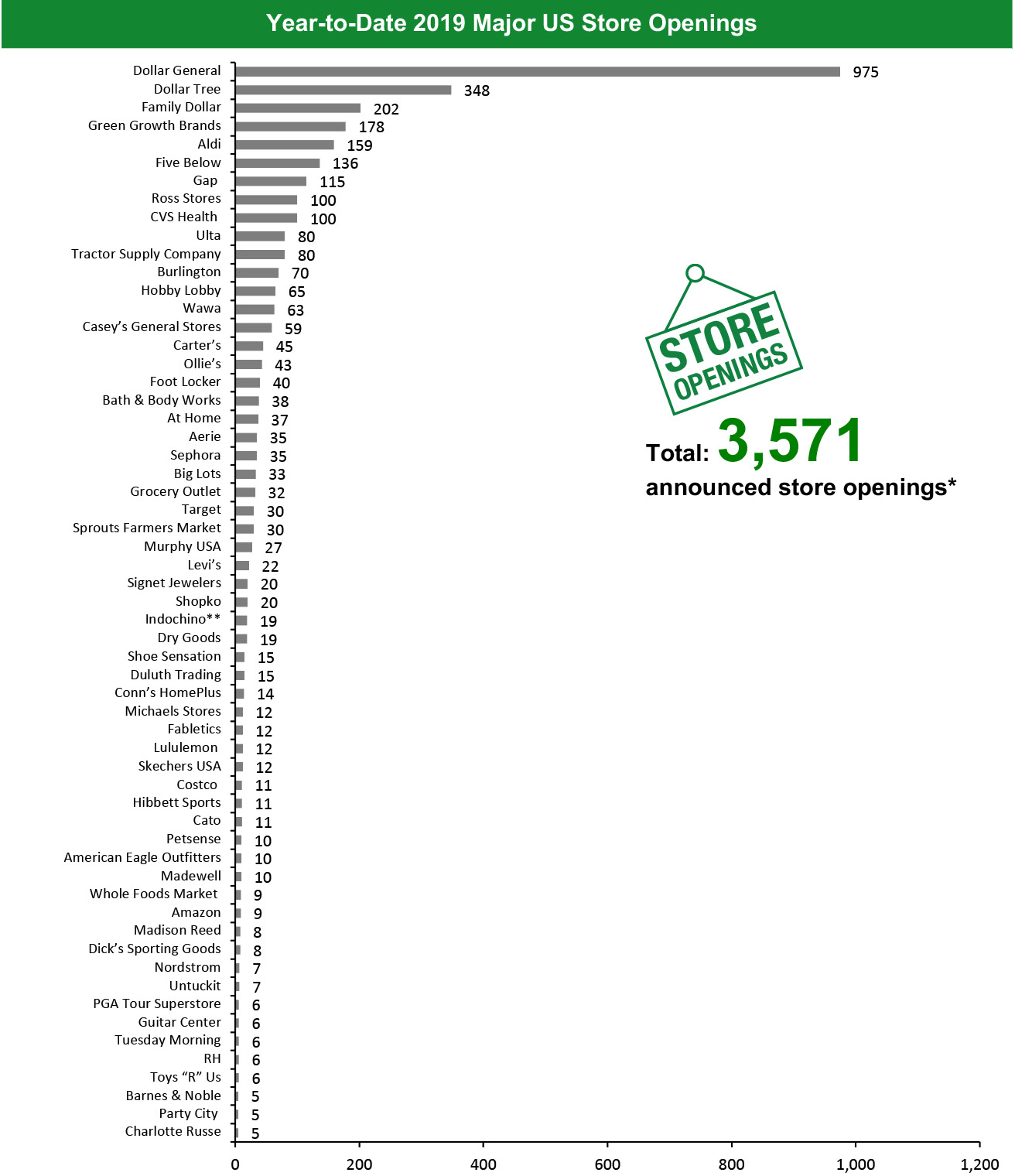

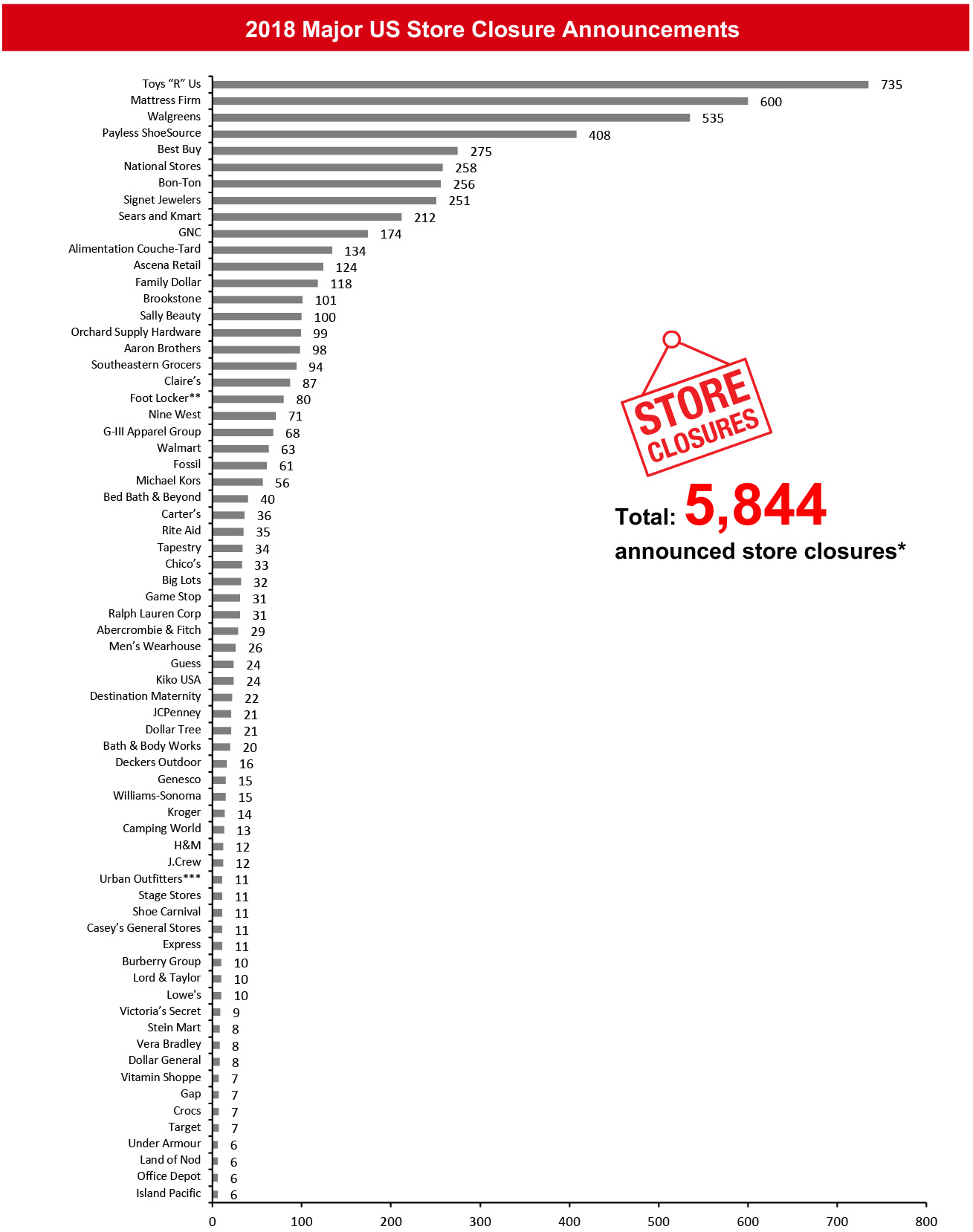

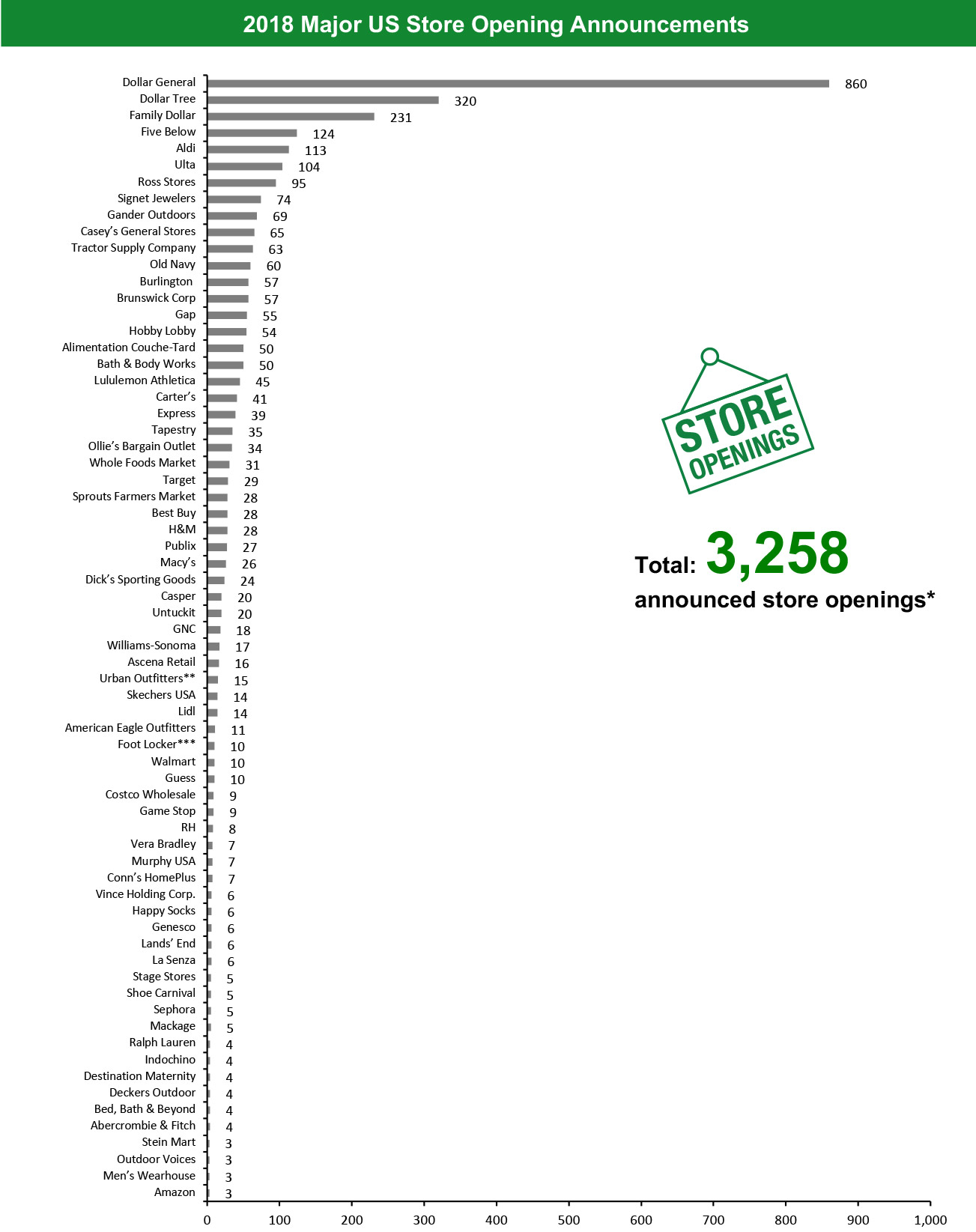

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 8,579 stores and open 3,571. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

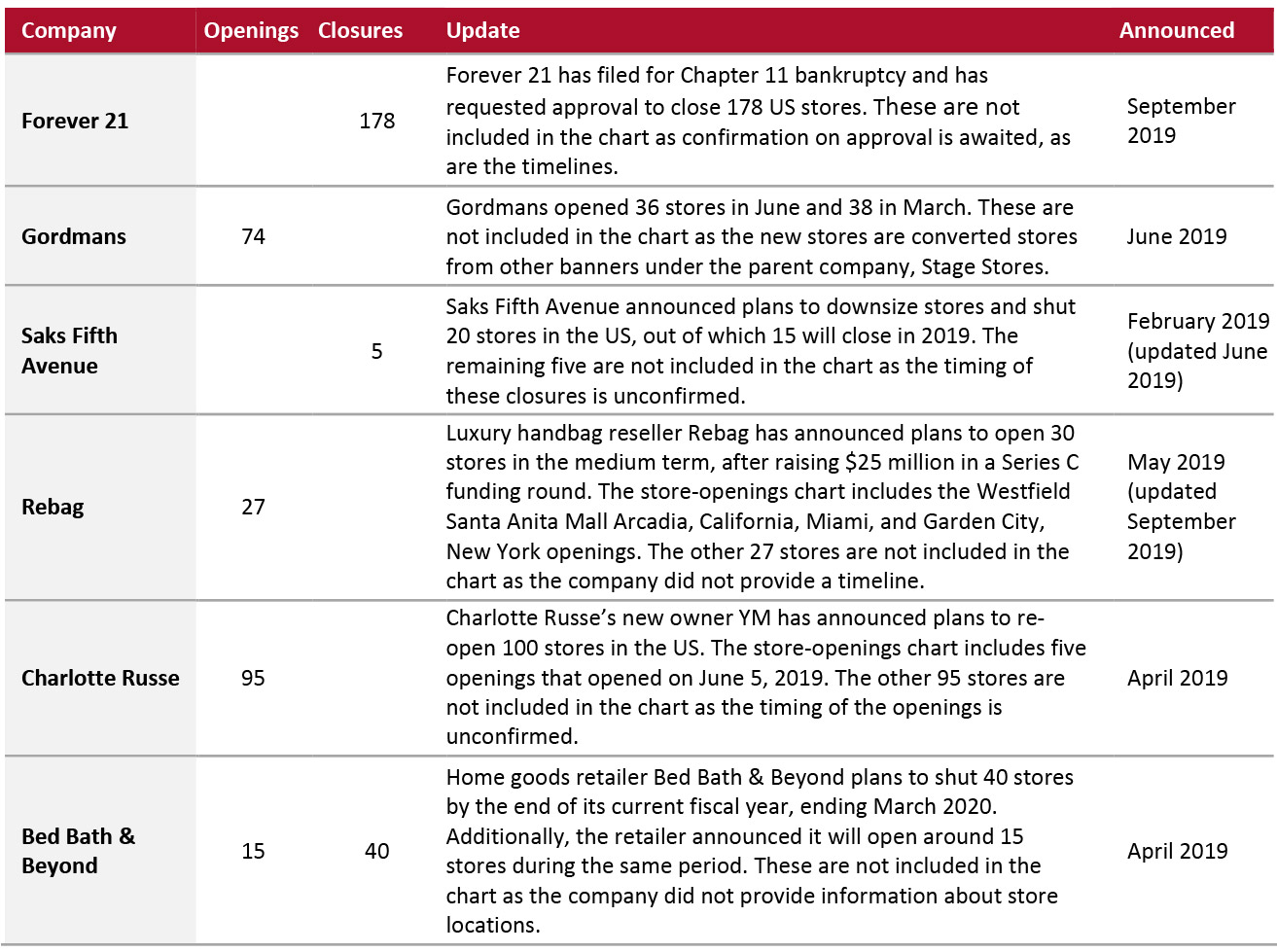

Forever 21 Files for Chapter 11 Bankruptcy; Plans To Close 178 US Stores Fast-fashion retailer Forever 21 has filed for Chapter 11 bankruptcy in the United States Bankruptcy Court and has requested approval to close up to 178 US stores. The retailer plans to implement a global restructuring strategy that will enable it to reorganize its business and reposition its brand. In line with this plan, the retailer intends to exit most of its international locations in Asia and Europe, but will continue operations in Latin America and Mexico. The planned closures are not included in our closures chart as we await confirmation on approval and timelines. Coresight Research insight: Long-standing value chains are facing increasing pressure to stay on-trend while maintaining value as competition from online and offline retailers increases. IKEA To Debut New Concept Store in Summer 2020 Swedish furniture retailer IKEA will open a new concept store in Queens, New York, in summer 2020. The store will be less than half the size of the company’s largest US stores and will feature a new layout with family-friendly and “rest-interactive spaces” to accommodate shoppers with children. Thousands of products will be on offer, but larger furniture products will be available for delivery only. Coresight Research insight: The smaller-format store will be easier for consumers to navigate, while the family-friendly layout and interactive spaces will appeal to families with children. Kroger Opens New Urban-Format Store with Food Hall Supermarket chain Kroger opened a new 52,000 sq ft urban-format store in Cincinnati on September 25. Apart from fresh fruit, vegetables and groceries, the store offers grab-and-go and ready-to-heat meals for lunch and dinner, and also features Kroger’s first-ever food hall, called On the Rhine Eatery. The food hall hosts Kitchen 1883 Café and Bar, DOPE! Asian Street Fare, Django Western Taco, Eli’s BBQ and Queen City Whip. Coresight Research insight: Kroger’s new food hall and urban store, located in Cincinnati’s busy central district, will combine ready-to eat meals with a variety of local restaurants, which will help to attract downtown workers and residents by providing a convenient one-stop shop for meeting after work, quick bites and food to go. Lululemon To Close Seven Ivivva Kids Stores Athletic wear retailer Lululemon will close its remaining standalone Ivivva kids stores, including four in the US and three in Canada, by mid-2020. The retailer plans to wind down the Ivivva business as a part of its long-term growth strategy. In April this year, Lululemon announced plans to double its men’s and online sales and quadruple its international business by 2023. The company had closed 48 of its 55 Ivivva stores in fiscal year 2017, ended January 28, 2018. Coresight Research insight: The closure of Lululemon’s remaining few children’s stores solidifies the company’s focus on its core businesses: men’s, women’s, international and digital. Macy’s To Close its Seattle Store Department store retailer Macy’s will close its landmark store in Third Avenue and Pine Street, Seattle, in February 2020. According to a company spokesperson, Macy’s has decided to sell the downtown Seattle building. Clearance sales will commence in January 2020, and the store will shut by the end of February. Coresight Research insight: This store closure is a result of store optimization, which is characteristic of the entire department store sector. Pier 1 Imports To Close At Least 70 Stores Home décor and furniture retailer Pier 1 Imports has decided to close at least 70 stores in fiscal year 2020, ending March 2, 2020, but suggested that this number could rise. According to a company spokesperson, the retailer could close 15% of its store portfolio if it is unable to achieve performance goals and sales targets. Our charted figures are calendarized estimates for 2019. Coresight Research insight: Pier 1 has struggled due to intense competition of value pricing in the home goods sector, particularly online. Rebag Furthers Brick-and-Mortar Expansion Luxury handbag reseller Rebag has opened its eighth store in Garden City, New York. It features the same hallmarks as the company’s previous stores, including the Rebag Bar and Hermès Birkin Wall. This is the third of 30 announced openings after Rebag raised $25 million in its series C funding round in February this year, led by private equity company Novator, with participation from FJ Labs and General Catalyst. Coresight Research insight: The resale market, particularly with luxury sneakers and goods such as handbags, is trending up in line with consumer demand. Wawa To Expand in Northern Virginia Convenience store chain Wawa plans to expand in Northern Virginia by opening 40 new stores over the next 15 years. The first of these is set to open in April 2020. In April 2019, Wawa announced plans to open 63 stores and remodel 59 stores by the end of 2019. Coresight Research insight: The Wawa convenience store chain is known for its high-quality, inexpensive food and clean stores, and the company has a solid customer following.Non-Store-Closure News

Foot Locker Announces Strategic Investment in NTWRK Sportswear and footwear retailer Foot Locker has announced a $3 million strategic investment in NTWRK, a youth culture e-commerce and content platform. The companies will bring together the world’s best brands using NTWRK’s story-telling format to release exclusive products, accessing popular figures in youth culture. Coresight Research insight: Foot Locker’s investment in NTWRK will enable the company to release products that are interesting to young consumers and are timely. [caption id="attachment_97569" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Pier 1 Imports, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Lululemon includes Lululemon and Ivivva banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_97570" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners. *Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the Greater Toronto Area.

Source: Company reports/Coresight Research [/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_97571" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97572" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97572" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above. **Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners. ***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_97573" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above. **Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research [/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_97574" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

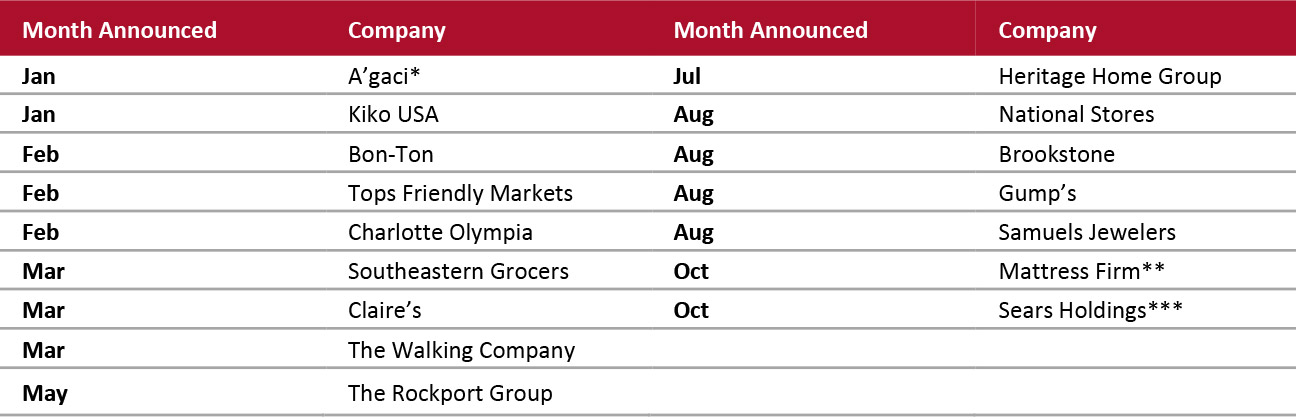

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018 Source: Company reports/Coresight Research [/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_97575" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018 **Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research [/caption]

The UK

2019 Major UK Store Closures and Openings

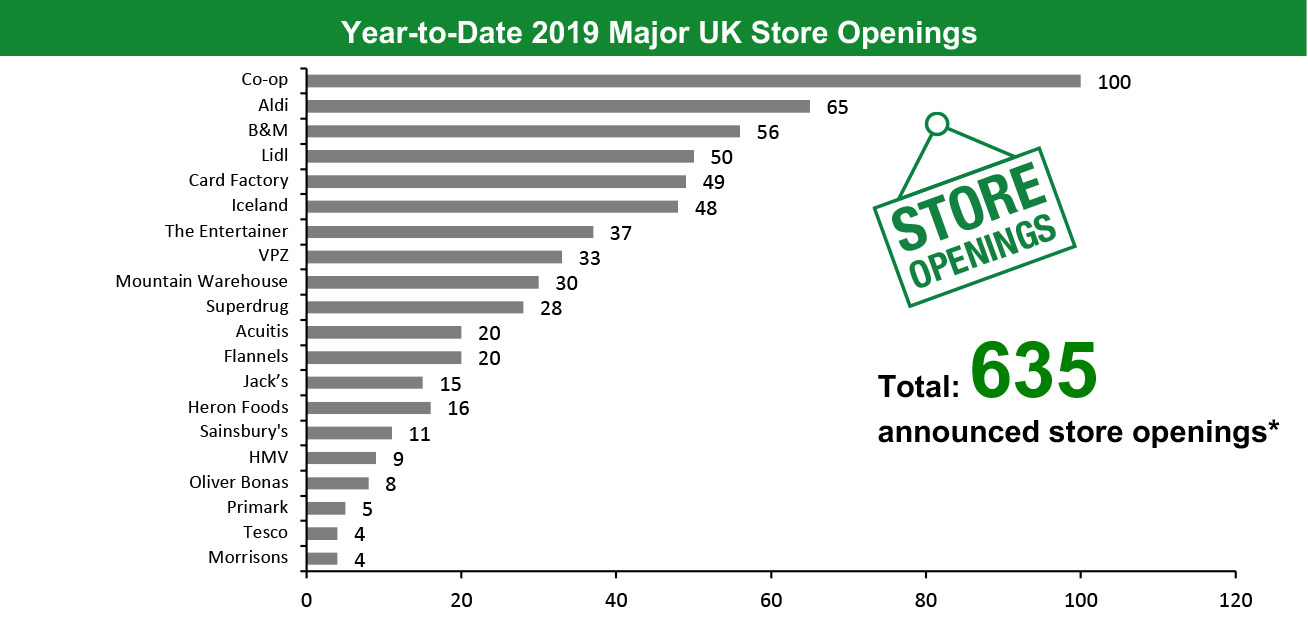

Year to date in the UK, major retailers have announced 443 store closures and 635 store openings. Our data represents closures and openings by calendar year.

What Is Happening This Week in the UK

Vince Opens Store in London

New York-based luxury apparel retailer Vince has opened its first European store in London. The store, located in South Kensington, offers a wide variety of women’s and men’s apparel, handbags, footwear and home goods from the Fall 2019 collection.

Non-Store-Closure News

Debenhams CFO Departs; Appoints Mike Hazell as CFO

Department store chain Debenhams has announced the departure of CFO Rachel Osborne after one year in the role. She is stepping down from her current role to join Ted Baker as CFO. Osborne will be succeeded by Mike Hazell, who is currently serving as the finance director. Along with his role as CFO, he will also join Debenhams’ board.

[caption id="attachment_97576" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office. *Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research [/caption] [caption id="attachment_97577" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK. *Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

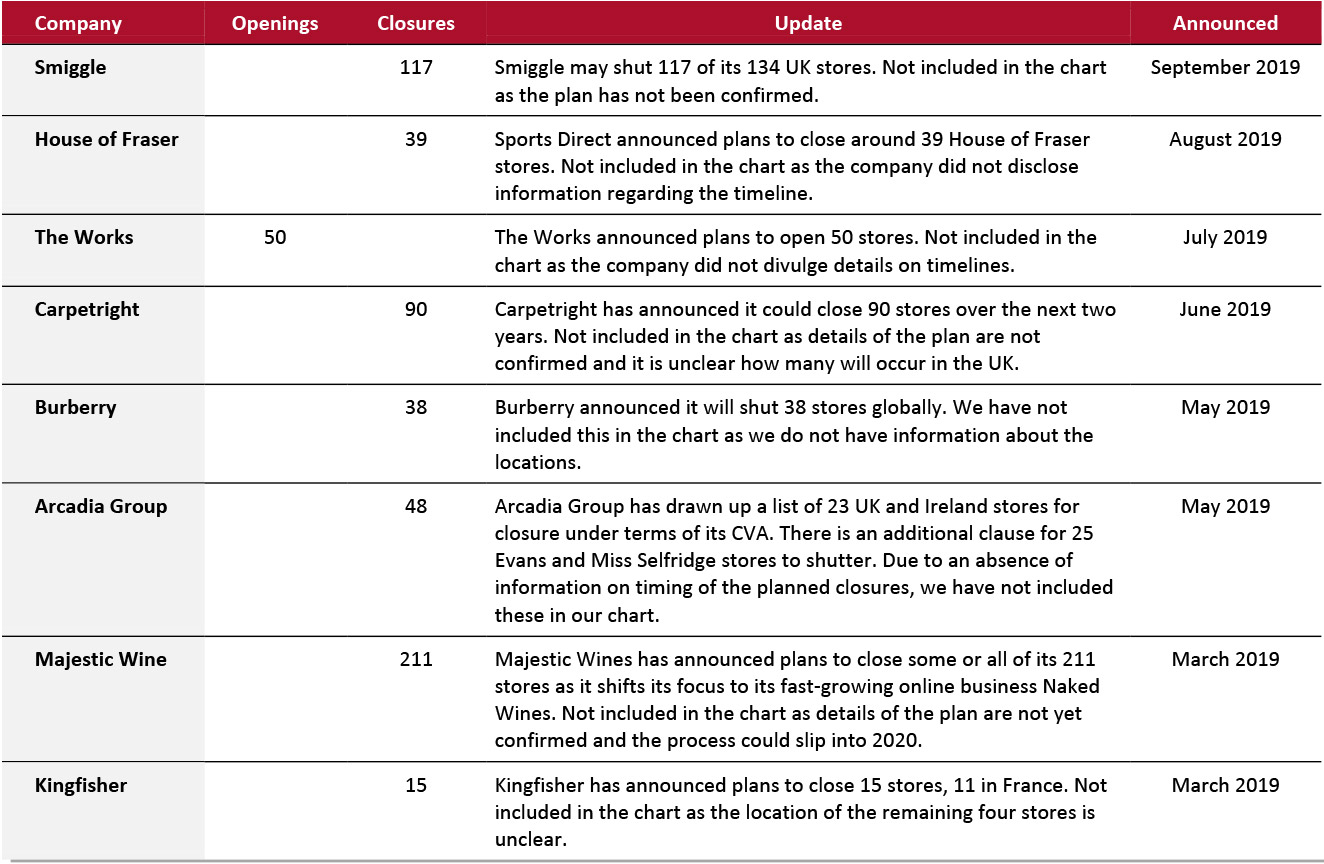

Source: Company reports/Coresight Research [/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_97578" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97579" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

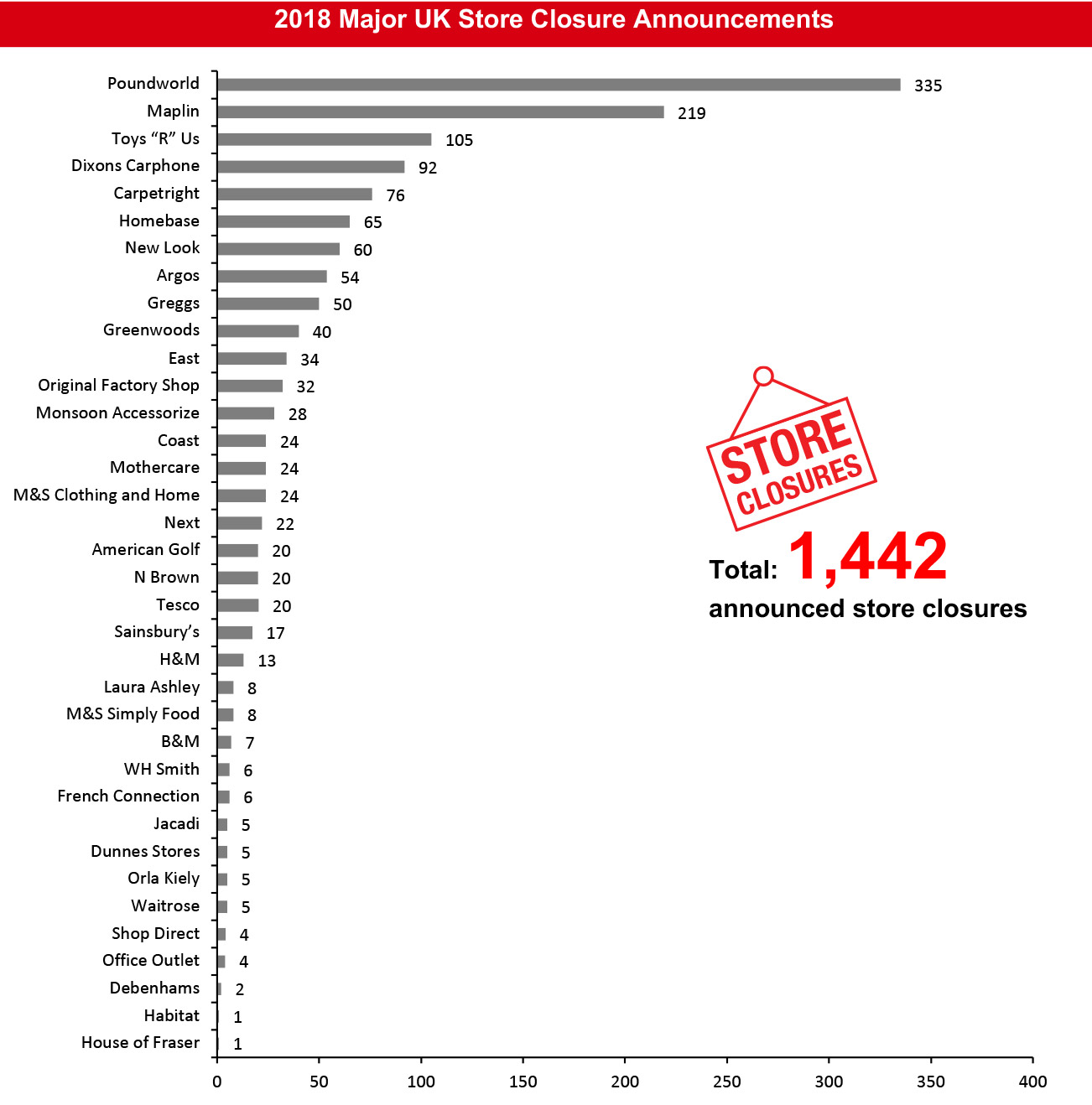

[caption id="attachment_97579" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco Source: Company reports/Coresight Research [/caption] [caption id="attachment_97580" align="aligncenter" width="700"]

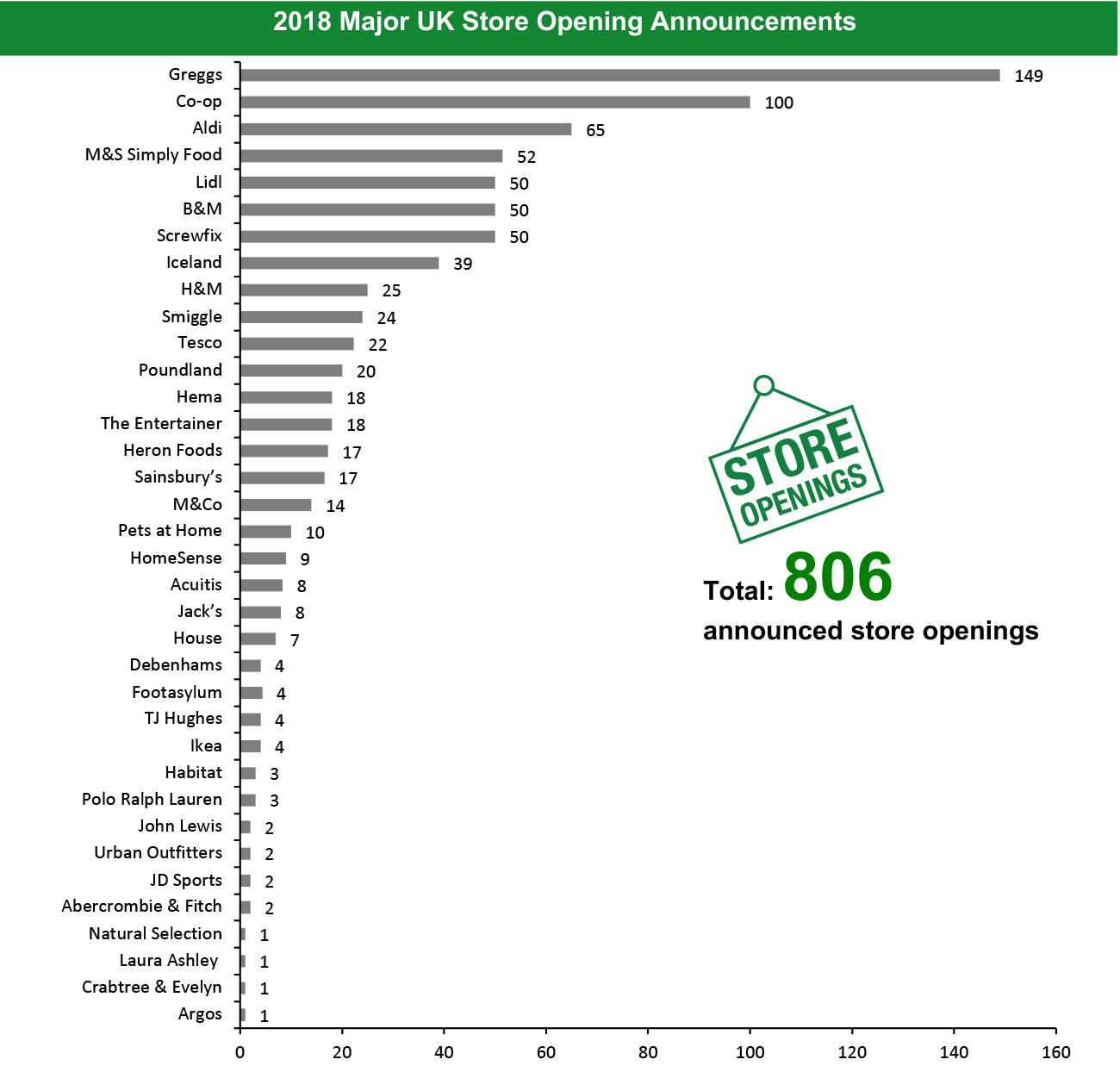

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle Source: Company reports/Coresight Research [/caption]

Notes

Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.