Nitheesh NH

The US

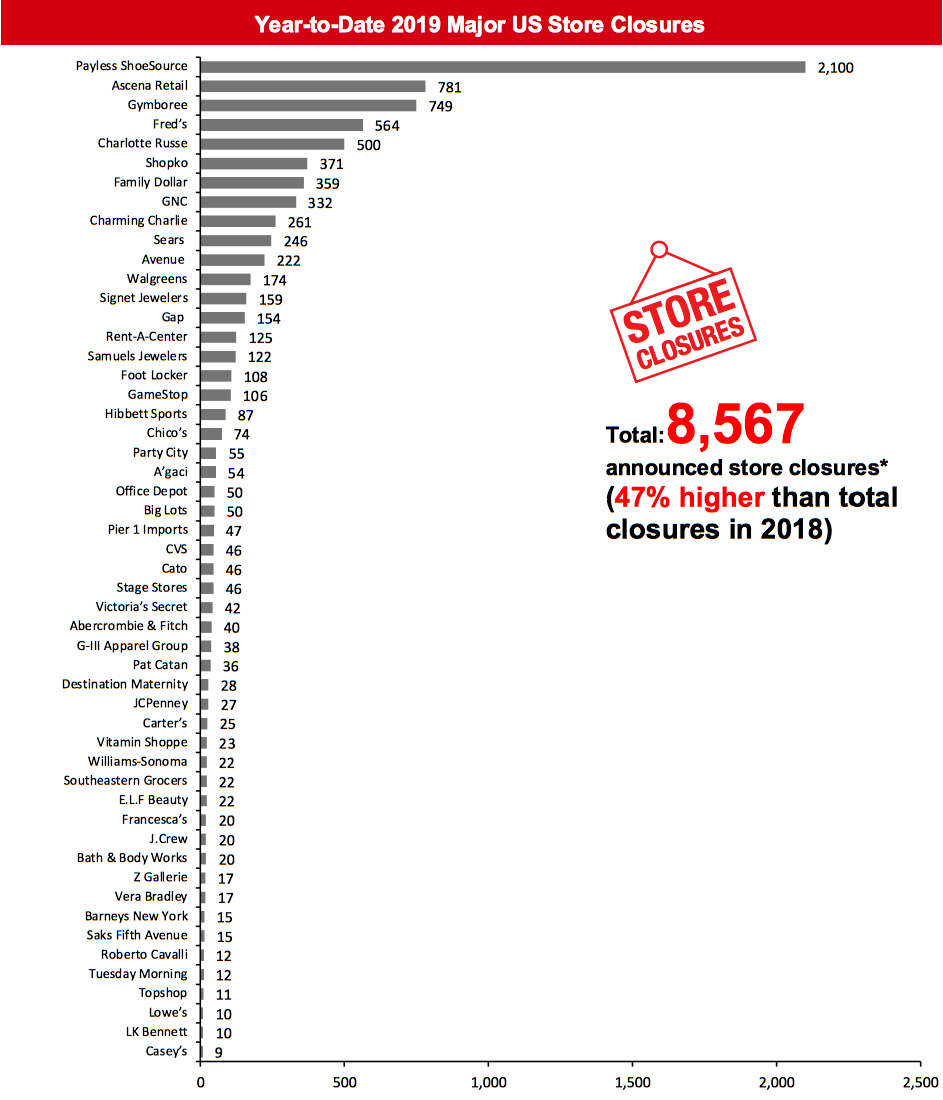

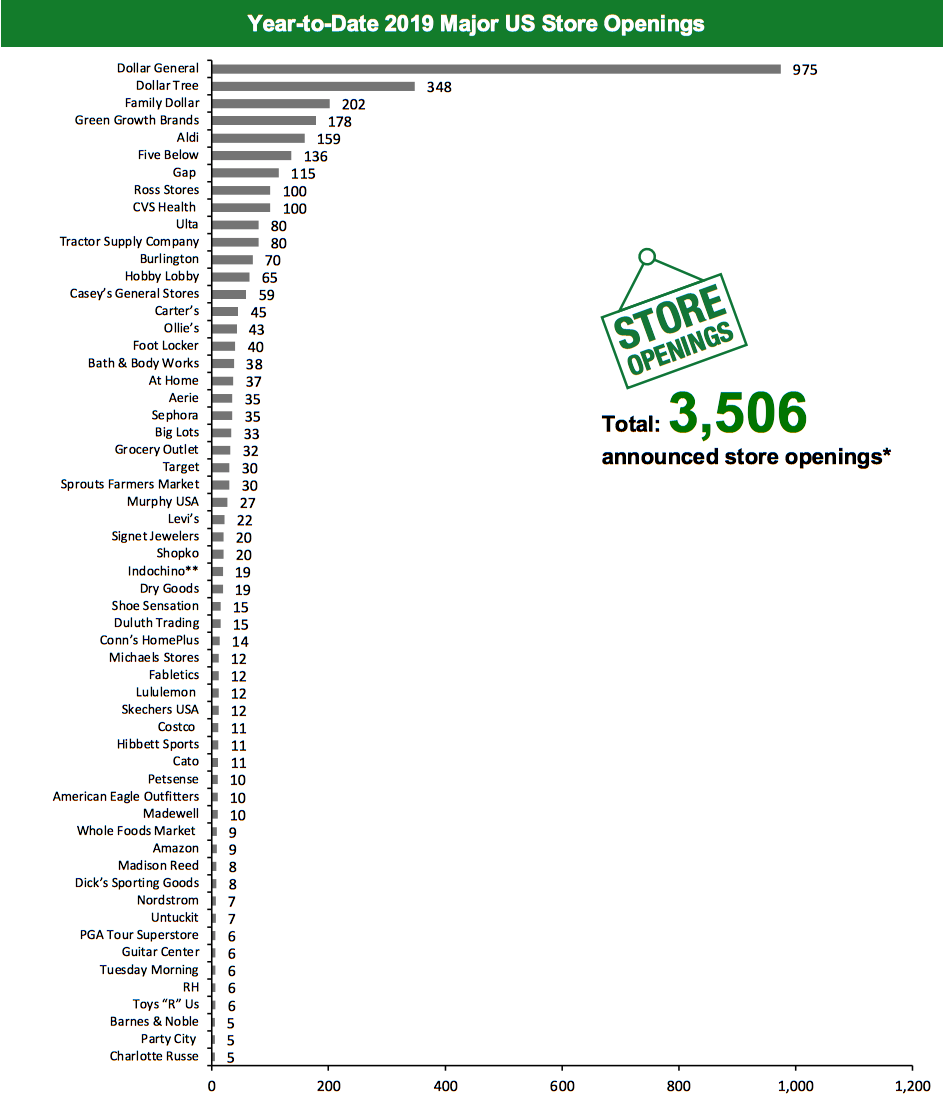

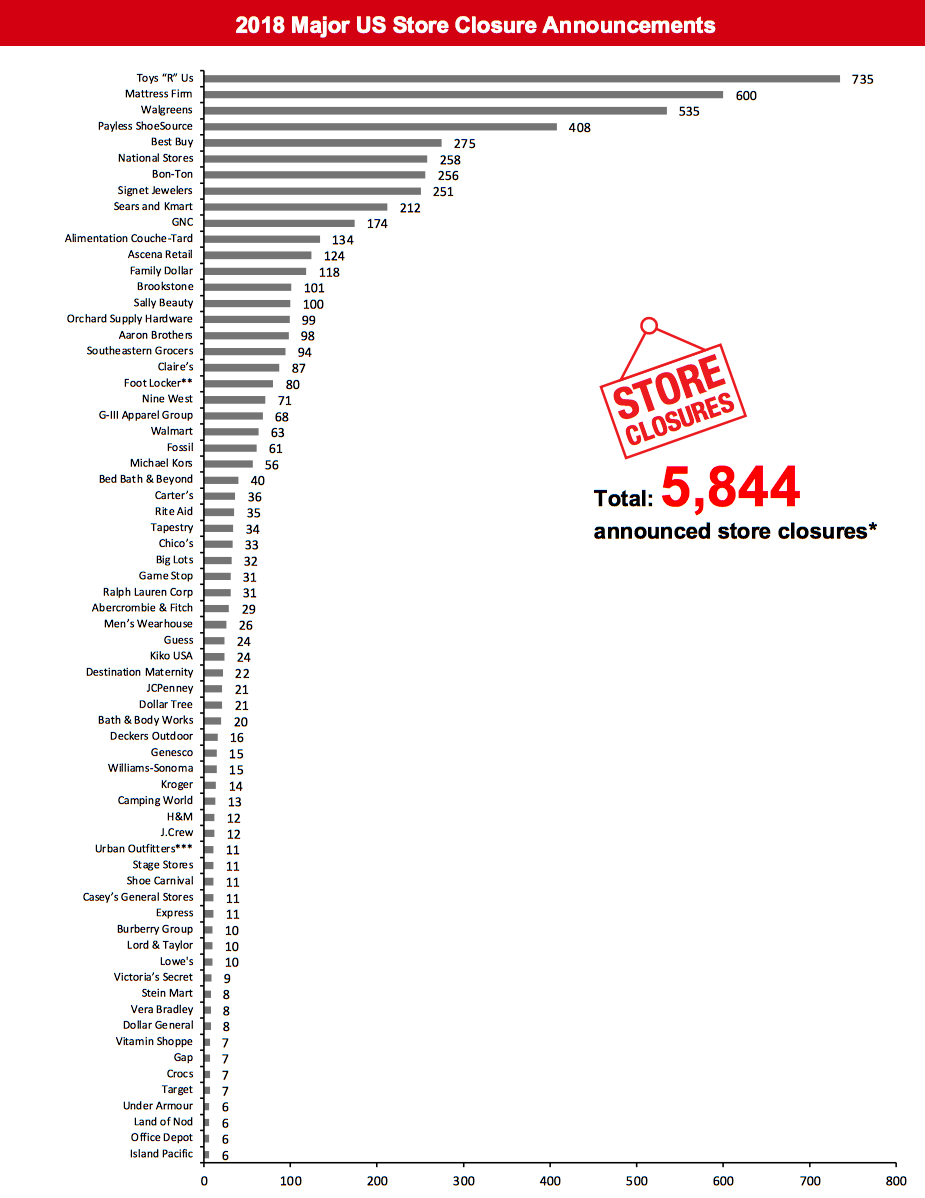

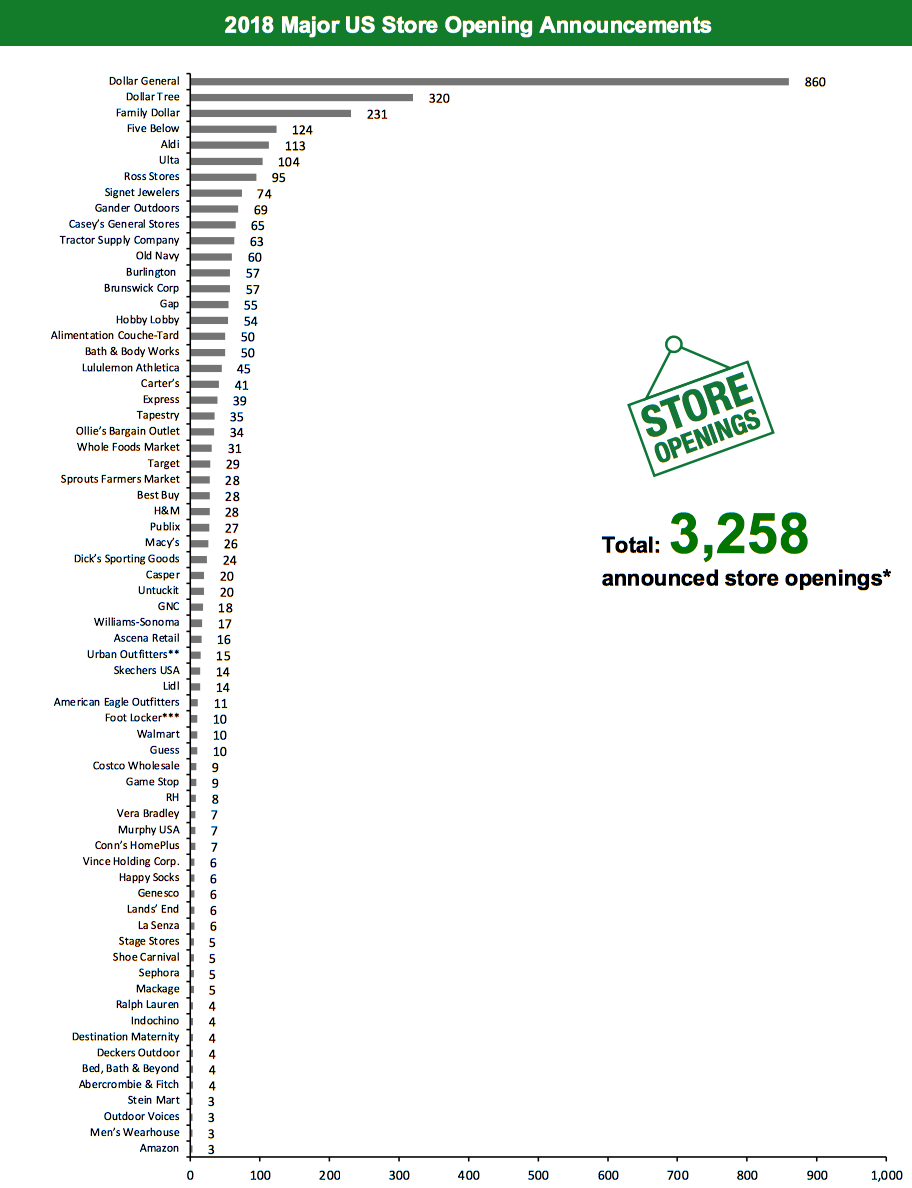

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 8,567 stores and open 3,506. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

At Home Furthers Retail Expansion Home décor and furnishings retailer At Home has opened two stores this month—one in Crestwood, Illinois, and another in Clearwater, Florida. The company expects to open two more stores in Lincoln, Nebraska, and Schaumburg, Illinois, by the end of September. Following these openings, the retailer will operate 209 stores across 39 states. Eloquii To Expand its Brick-and-Mortar Network Walmart-owned plus-size clothing retailer Eloquii has announced that it will open a store in Lenox Square, Atlanta, in November. The new store will represent the seventh physical location for Eloquii. The retailer opened a store in SoHo, New York, in May 2019 and expects to open a store at the King of Prussia mall, Pennsylvania, in late fall this year. Coresight Research insight: Inclusive sizing is a significant opportunity for apparel retailers and brands. By continuing to open stores in selected markets, Eloquii is building community among its fashion-forward shoppers as well as attracting potential shoppers to the brand. Parent company Walmart has access to this fashion-forward plus-size shopper and can increase the fashion quotient at its own stores and thus potentially expand its share in this growing market. Madison Reed To Expand to Hundreds of Locations Haircare and hair color products retailer Madison Reed plans to franchise its Madison Reed Color Bars via a joint venture with Franworth, a franchise consulting firm. In line with this plan, the retailer expects that 600 stores will be operational within the next four years, including 100 company-owned stores and 500 franchises, according to a company spokesperson. Coresight Research insight: Madison Reed continues to gain support with today’s clean-minded consumer. The hair color products are available in 27 shades that are formulated without parabens, ammonia or resorcinol. The company won best hair coloring product for its “Light Works Balayage Highlighting Kit” at the 2019 Cosmetic Executive Women awards. Although the brand has seen success as an at-home personalized coloring service, a franchised operating model will further expand its clientele to customers that prefer a salon environment.Non-Store-Closure News

Macy’s To Pilot Free Same-Day Delivery Department store retailer Macy’s will pilot free, same-day delivery in 30 markets across the US. This service will be available for online orders of $75 or more, starting October 1, 2019. No membership fee is required to avail the free, same-day delivery service, and the pilot will last for an unspecified, limited amount of time. Although the retailer has been providing same-day delivery for online orders of $75 or more since 2014 in some selected markets, the service included an $8 delivery fee. Walgreens To Pilot Drone Delivery Pharmacy store chain Walgreens will partner with Wing Aviation, a subsidiary of Alphabet, to pilot the “store to door” delivery of health, food, beverage and convenience items through drones. The on-demand drone-delivery service pilot will commence in Virginia from October, and Walgreens will thereby become the first retailer to offer this service in the US. [caption id="attachment_97110" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.*Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_97111" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.*Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the Greater Toronto Area.

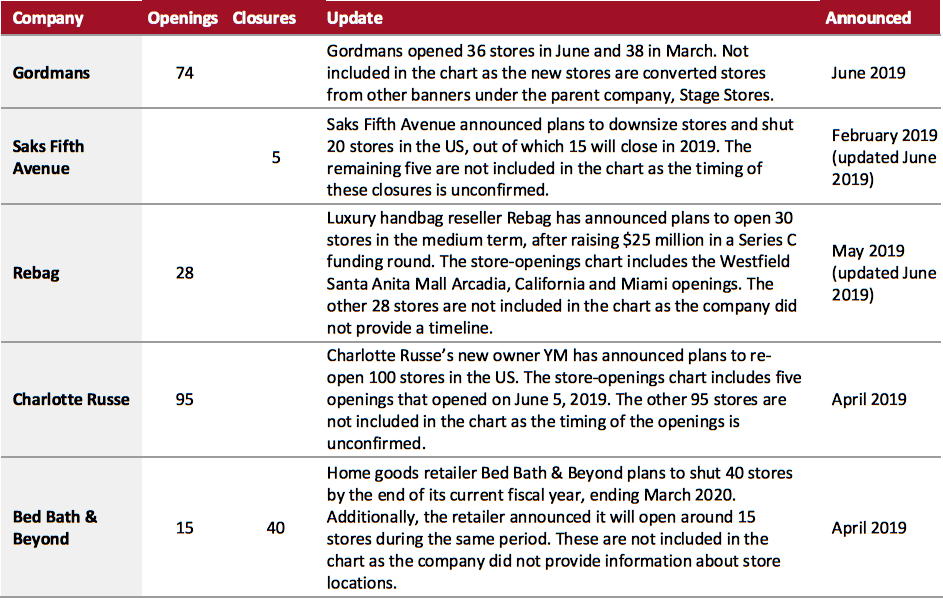

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_97112" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97113" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97113" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_97114" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_97115" align="aligncenter" width="700"]

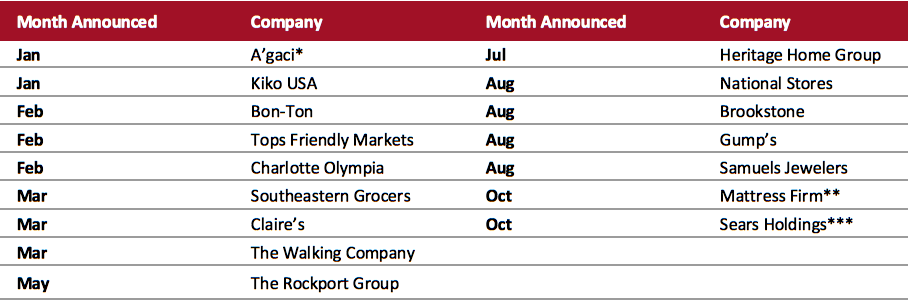

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_97116" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

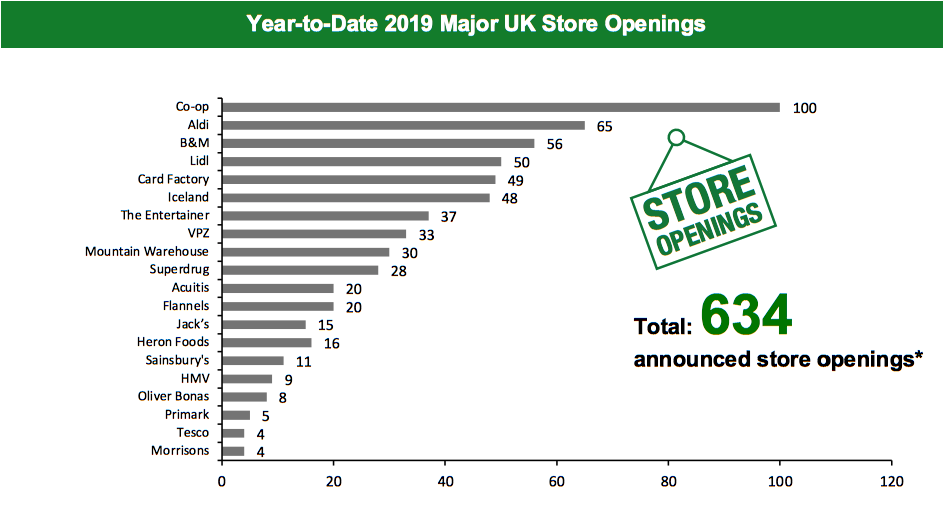

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 443 store closures and 634 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

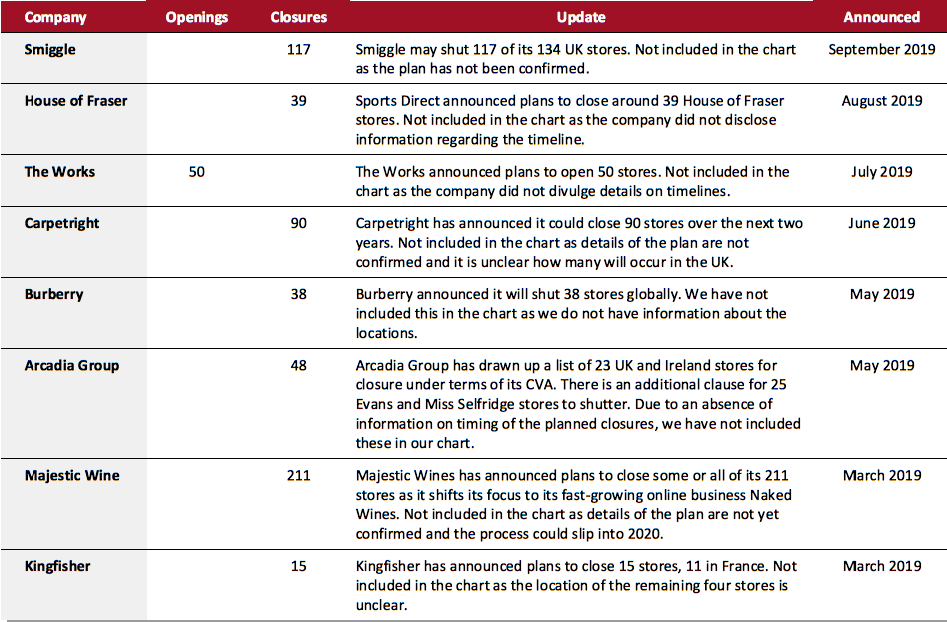

Debenhams To Close 50 Stores Department store chain Debenhams plans to shutter 50 stores within the next three years as a part of its store optimization plan. Following its recent win in a legal challenge against its restructuring process, the retailer will continue with its company voluntary agreement (CVA), which it had planned in April 2019. Debenhams will close 22 stores after Christmas this year, and it expects to close the remaining stores within the next three years. Coresight Research insight: This development represents progress toward Debenhams’ target of 50 closures, which was first announced in October 2018. Sainsbury’s To Overhaul its Store Estate Supermarket chain Sainsbury’s has announced plans to open 10 new supermarkets, 80 Argos stores in Sainsbury’s supermarkets and 110 convenience stores. The retailer also plans to close 10–15 Sainsbury’s supermarkets, 60–70 standalone Argos stores and 30–40 convenience stores. These openings and closures are a part of the company’s five-year turnaround plan. The retailer is shutting down Argos standalone stores and opening new Argos stores within Sainsbury’s supermarkets as a part of its store estate review plan. Coresight Research insight: These developments represent more cost cuts from Sainsbury’s, which, at the top line, has recently been the weakest of the major public grocers. Meanwhile, the consolidation of Argos stores within Sainsbury’s stores has been on the cards from the day the acquisition by Sainsbury’s was announced in 2016. Smiggle May Reduce its UK Store Estate Premier Investments, parent company of Australian stationery products retailer Smiggle, plans to step up pressure on landlords for a significant reduction in rents, failing which it may shut 117 of its 134 Smiggle UK stores. Coresight Research insight: Serving niche demand—children’s stationery—Smiggle’s aggressive store-opening program always looked over-ambitious (it is one of the top-ranking retailers in our 2018 store-openings chart, below). Sports Direct To Shutter Five More Jack Wills Stores Sporting goods retailer Sports Direct has announced plans to shut five more Jack Wills stores. The stores are located in Bluewater, Newcastle, Oxford, Winchester and London Gatwick airport. Last month, the retailer closed eight Jack Wills stores as it was unable to negotiate lower rents with landlords.Non-Store-Closure News

Gordon Mowat To Depart M&S Clothing and Home Supply Chain and Logistics Director Gordon Mowat will resign from Marks & Spencer (M&S) after serving two years in the role. He joined M&S in August 2017 and was responsible for consolidating the supply chain activities of all M&S’s non-grocery outfits. Mowat will be succeeded on an interim basis by Stephen Fitzgerald, who was CEO Steve Rowe’s former executive assistant. [caption id="attachment_97117" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_97118" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_97119" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_97120" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

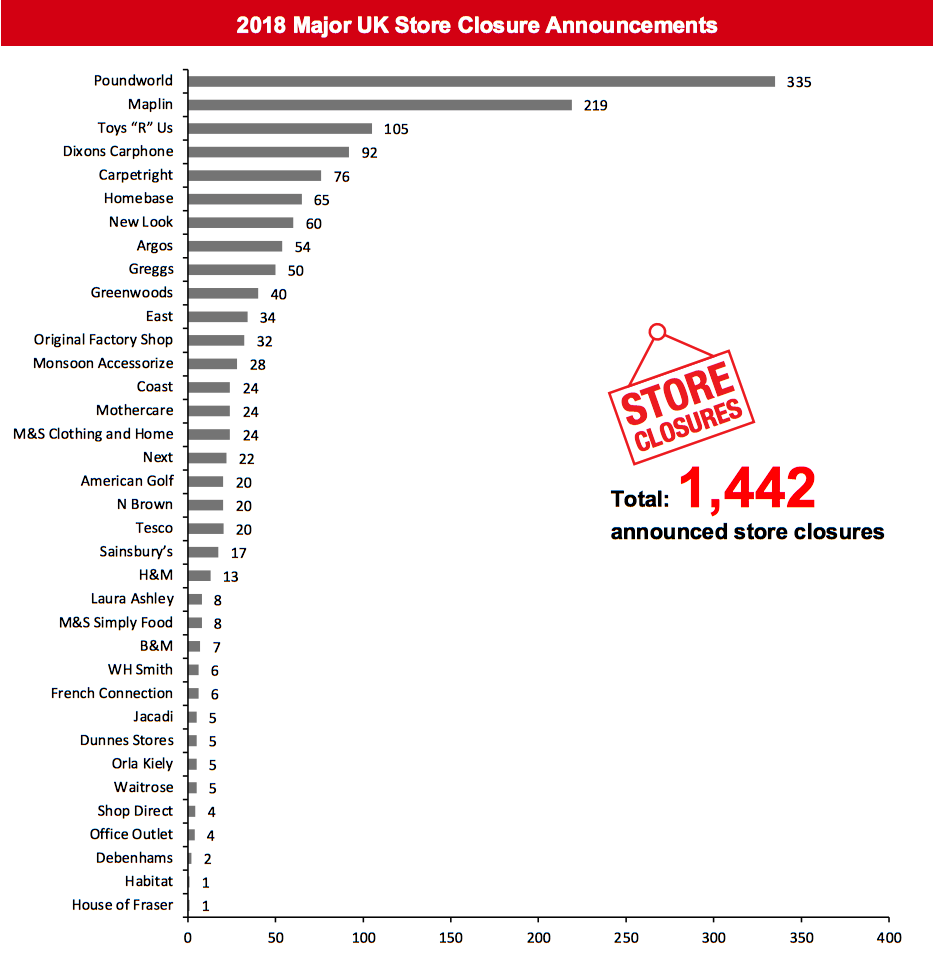

[caption id="attachment_97120" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and Tesco

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption] [caption id="attachment_97121" align="aligncenter" width="700"]

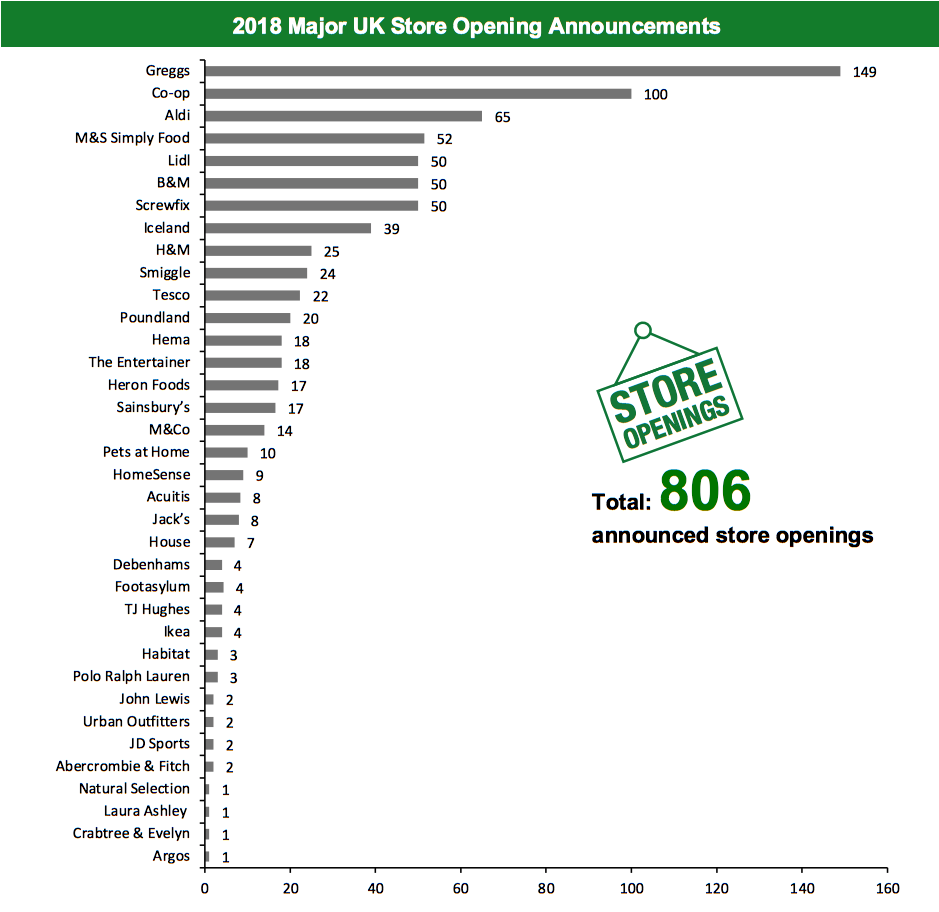

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.