Nitheesh NH

The US

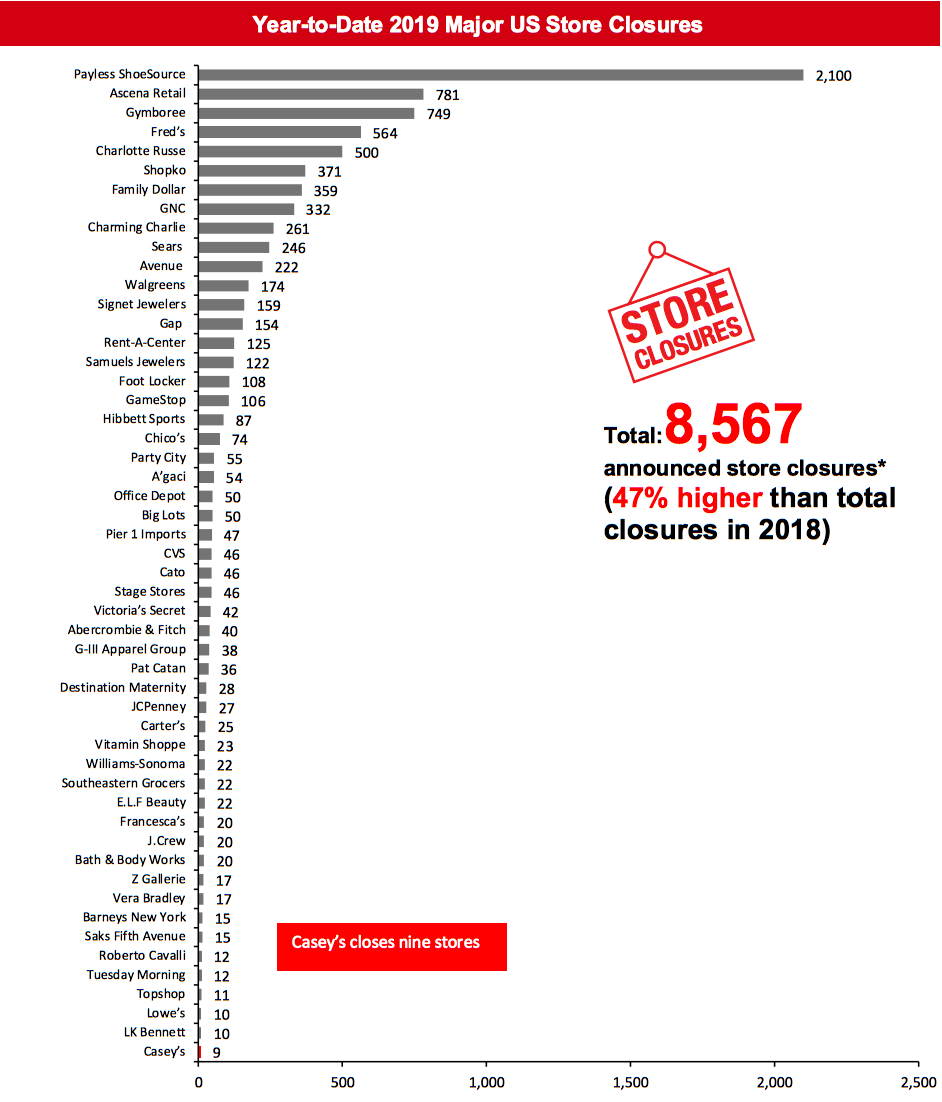

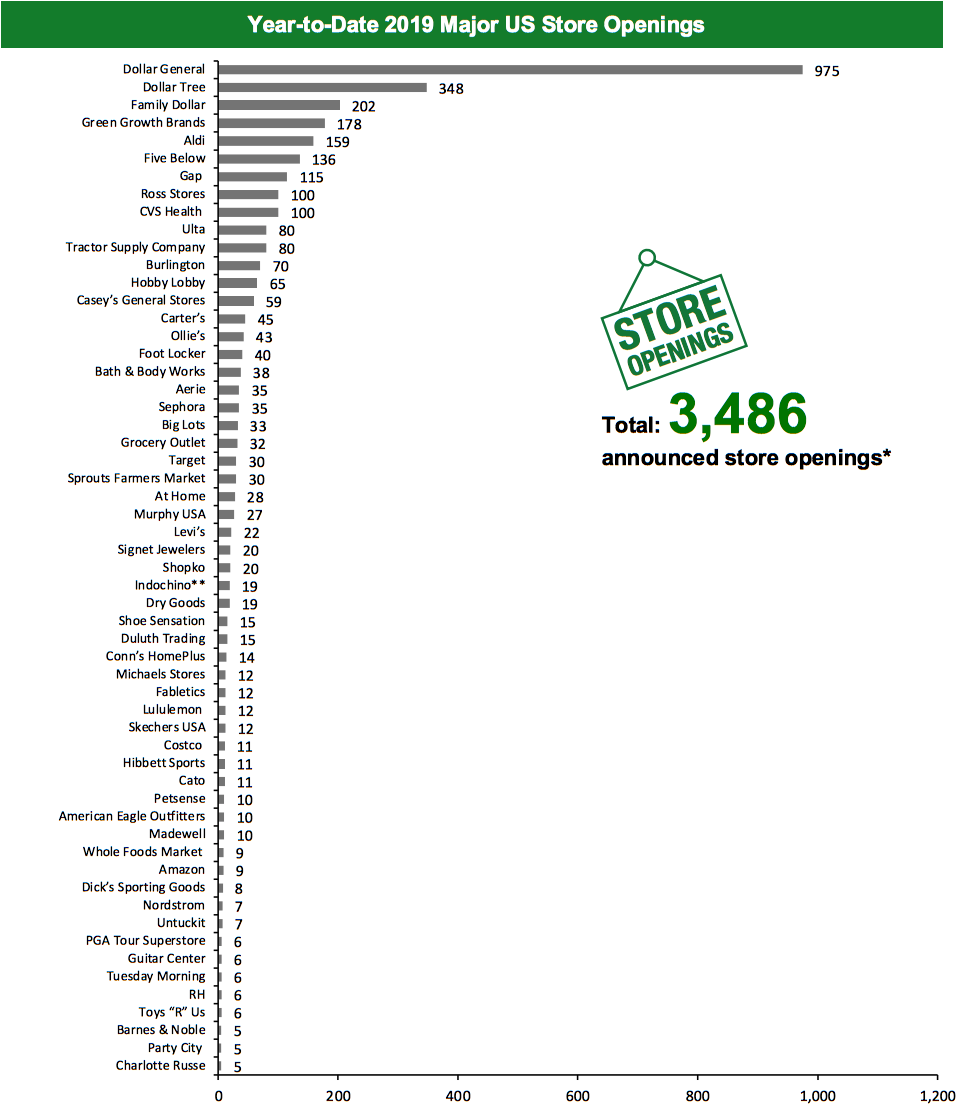

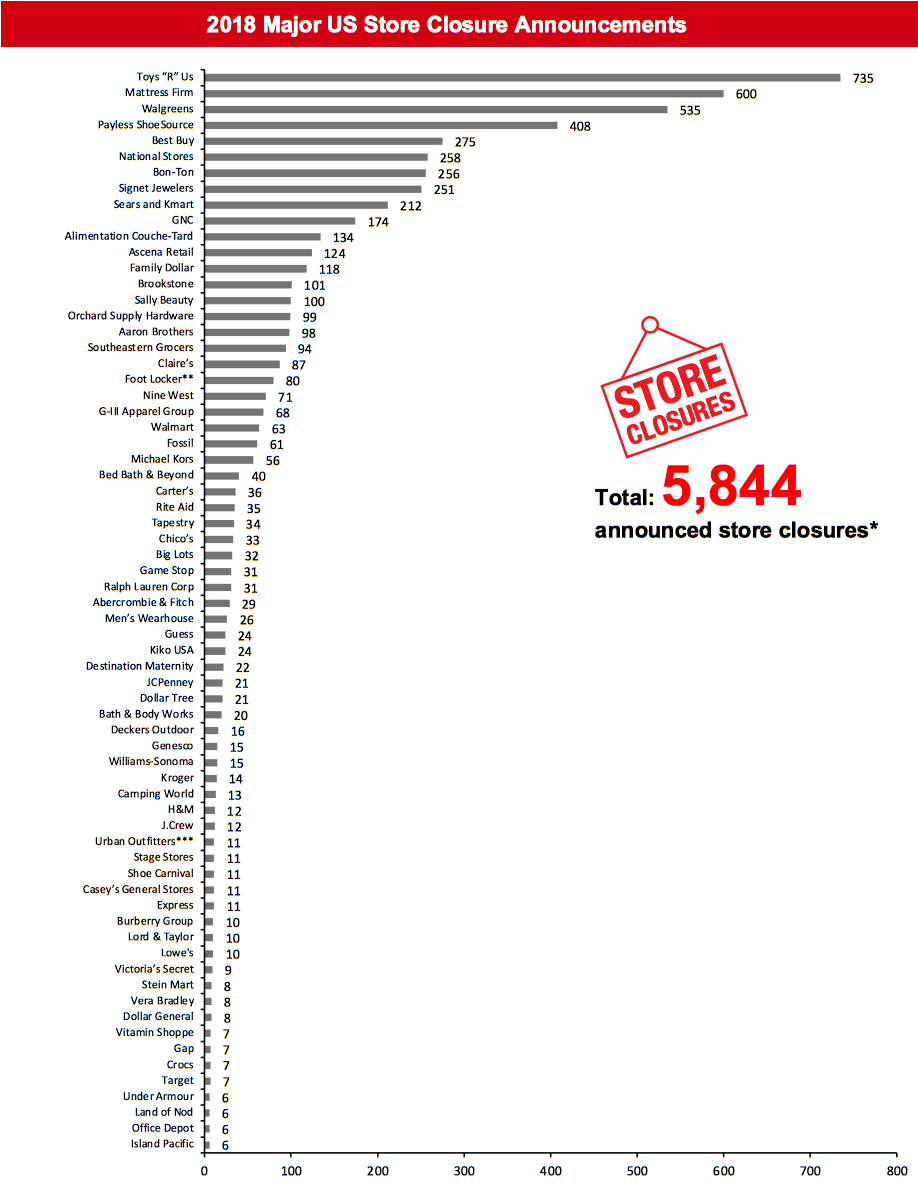

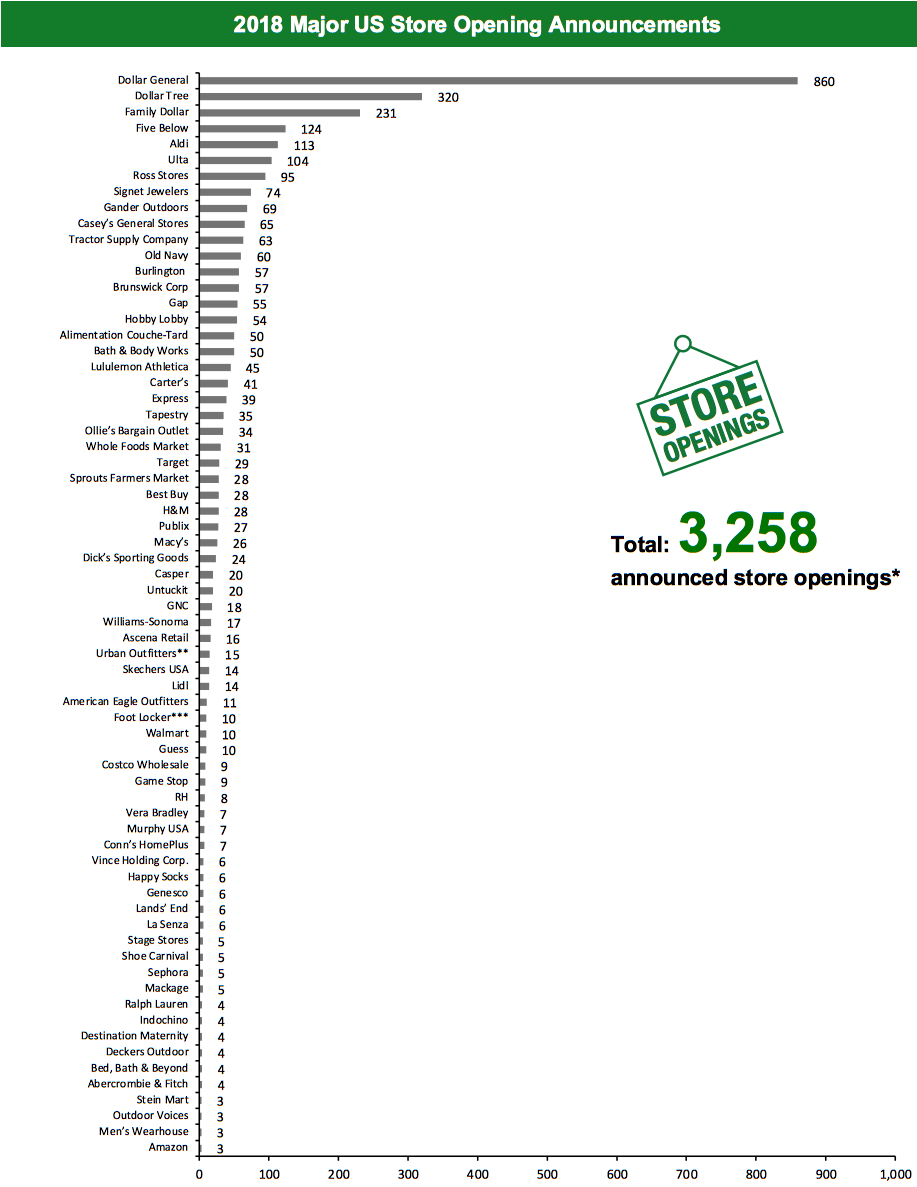

2019 Major US Store Closures and Openings Year to date in 2019, US retailers have announced they will close 8,567 stores and open 3,486. Coresight Research estimates US store closures could reach 12,000 by the end of 2019. By week 15 of 2019, year-to-date announced closures had already exceeded the total for all of 2018. We recorded 5,844 closures and 3,258 openings for the full year 2018. Our data represents closures and openings by calendar year.What Is Happening This Week in the US

Casey’s to Open 60 Stores Convenience store chain Casey’s plans to open 60 stores and acquire approximately 25 stores in its current fiscal year, ending April 30, 2020. The retailer reported it opened 15 new stores and closed six in its first quarter, ended July 31, 2019. Old Navy to Double its Store Fleet Clothing and accessories retailer Old Navy, owned by Gap, plans to open 800 new stores following its separation from Gap next year. As a part of its growth strategy, Old Navy intends to open approximately 75 stores per year, focusing on off-mall locations. In February 2019, Gap announced plans to create two independent publicly traded companies, with one being Old Navy and the other being the new Gap Inc. including the Gap brand, Athleta, Banana Republic, Hill City, Intermix and Janie & Jack banners. Coresight Research insight: Old Navy, Gap’s lower-priced brand, continues to see growth as consumers are seeking value for the family. The company will locate its new stores closer to consumers in off-mall locations and in smaller markets, as customers want stores closer to where they live. Old Navy has so far opened 35 stores in new, smaller markets with positive results. Stage Stores to Make Substantial Transition to Off-Price Business Model Department store chain Stage Stores intends to shut 40 stores in fiscal year 2020 in line with its plan to make a significant transition to an off-price business model. The company will convert all of its remaining department stores to the off-price Gordmans banner in February 2020. Stage Stores currently operates 158 off-price Gordmans stores and 625 stores under Bealls, Goody’s, Palais Royal, Peebles and Stage specialty department store banners. By the third quarter of fiscal year 2020, the company intends to operate around 700 stores, most of which will be off-price Gordmans stores. Coresight Research insight: Department stores are moving toward off-price models as full-price department store channels continue to feel pressured.Non-Store-Closure News

Madewell Files for IPO Chinos Holdings announced on September 13 that it has filed for an initial public offering (IPO) of its common stock. Prior to the completion of the offering, Chinos Holdings will be renamed as Madewell Group. As a part of the IPO, Madewell will be splitting from its parent company, J.Crew. Coresight Research insight: The company’s decision to spin off Madewell from parent company J.Crew may be viewed as strategic, as Chinos Holdings is positioned in the growing Gen Z and millennial market, with a strong denim market presence geared toward women and most recently in menswear. Walmart Expands Grocery Delivery Membership Program Walmart plans to expand its grocery delivery subscription program, “Delivery Unlimited,” to almost 1,400 stores in fall 2019. Customers can purchase groceries online and have them delivered to their homes at a cost of $98 per year or $12.95 per month. Walmart piloted this program in June 2019 in Houston, Miami, Salt Lake City and Tampa. The retailer will expand this service to all 200 metro areas where it currently provides the grocery delivery service. Coresight Research insight: Walmart is continuing to raise the service offerings of its grocery business to enhance the convenience it offers to customers, including moving from in-store pickup to delivery, and the company plans to begin testing in-home delivery this fall. Walmart commented that the average basket size for in-store pickup is twice the average basket size overall, and the company’s target is to offer the service in 3,100 stores by the end of 2019. [caption id="attachment_96790" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this for some retailers, including Abercrombie & Fitch, Athleta, Ascena Retail, Chico’s, Gap, Hibbett Sports, Old Navy, Signet Jewelers, Tuesday Morning and Walgreens. Our closure estimates for GameStop, Gap, GNC, GIII and Foot Locker are based on proportion of existing stores in the US. Ascena Retail includes Dressbarn. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.*Total includes a small number of retailers that each announced fewer than nine store openings and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_96791" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Aldi, Five Below, Family Dollar, Dollar Tree and Costco. Our estimate of store openings for Foot Locker, Gap, Levi’s and Lululemon is based on proportion of existing stores in the US. Store total for Amazon includes Amazon Go (5), Amazon Books (2) and Amazon 4-Star (2) stores. Foot Locker includes Foot Locker, Lady Foot Locker, Kids Foot Locker, Champ Sports, Footaction and SIX:02 banners. Gap includes Gap, Old Navy, Banana Republic, Athleta and Intermix banners. Sears includes Sears and Kmart banners.*Total includes a small number of retailers that each announced fewer than five store openings and are not included in the chart.

**Indochino openings refer to North America total openings, excluding one opening announced for the Greater Toronto Area.

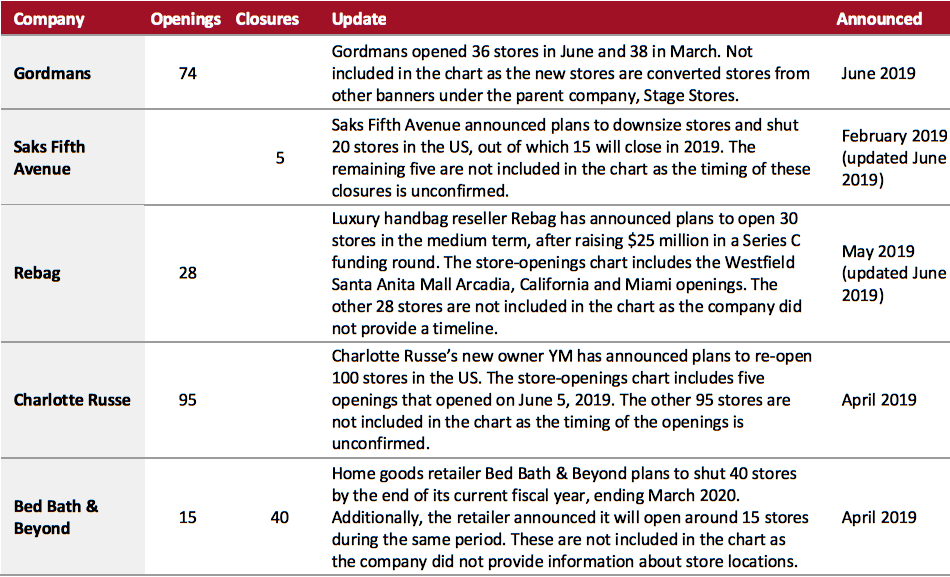

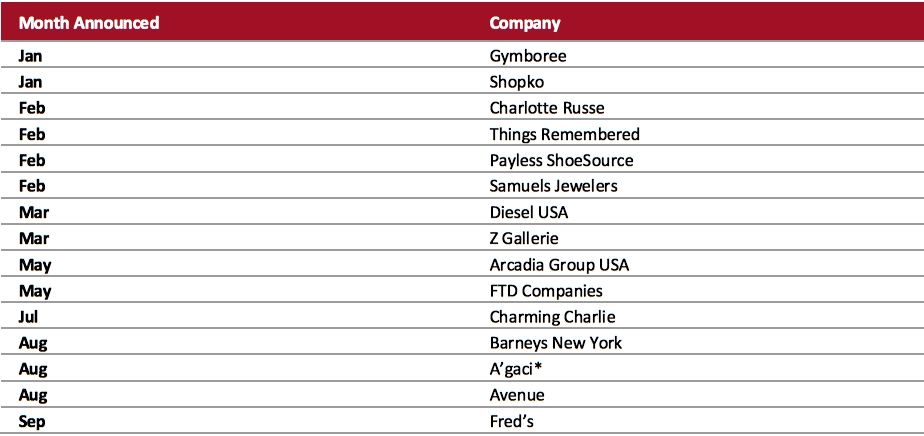

Source: Company reports/Coresight Research[/caption] 2019 Major US Uncharted Openings and Closures The table below shows announced openings and closures not included in our totals, as the companies did not provide detail on timing or location. [caption id="attachment_96792" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96793" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96793" align="aligncenter" width="700"] *Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.

*Total includes a small number of retailers that each announced between one and five store closures and are not included in the chart above.**Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

***Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_96794" align="aligncenter" width="700"]

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.

*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart above.**Urban Outfitters includes the Urban Outfitters, Free People and Anthropologie banners.

***Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports, Foot Action and SIX:O2 banners.

Source: Company reports/Coresight Research[/caption] 2019 Major US Retail Bankruptcies [caption id="attachment_96795" align="aligncenter" width="700"]

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018

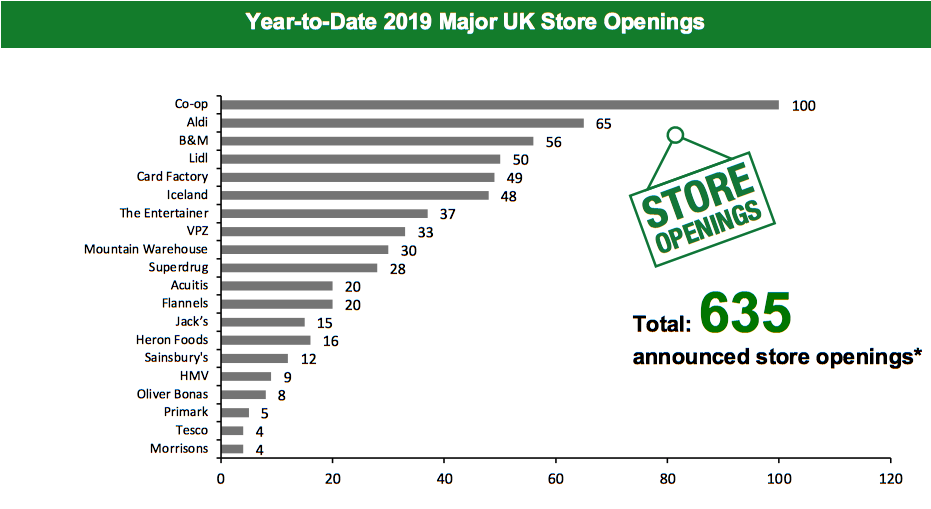

*A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018Source: Company reports/Coresight Research[/caption] 2018 Major US Retail Bankruptcies [caption id="attachment_96796" align="aligncenter" width="700"]

*A’gaci emerged from bankruptcy in August 2018

*A’gaci emerged from bankruptcy in August 2018**Mattress Firm emerged from Bankruptcy in November 2018

***Sears Holdings emerged from bankruptcy in January 2019

Source: Company reports/Coresight Research[/caption]

The UK

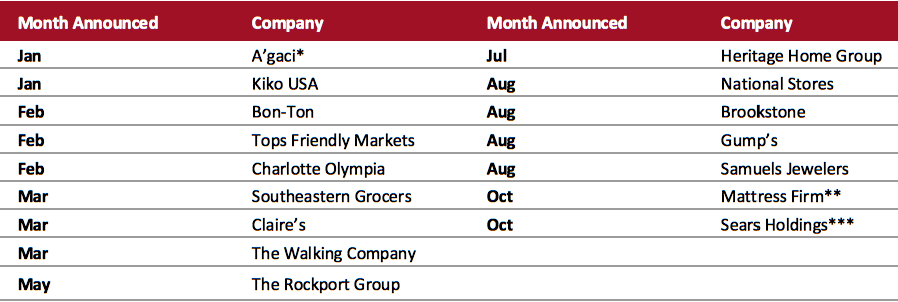

2019 Major UK Store Closures and Openings Year to date in the UK, major retailers have announced 431 store closures and 635 store openings. Our data represents closures and openings by calendar year.What Is Happening This Week in the UK

Aldi Plans to Open More Local Stores in London Discount supermarket chain Aldi plans to more than double its London store count by opening more Aldi Local stores. The retailer intends to increase its store count in M25 from 45 to 100 and reach a target of 1,200 stores by the end of 2025. In October 2018, Aldi announced it would open 130 stores in two years, creating over 5,000 new jobs in the UK. Levi’s to Debut in Northern Ireland Apparel retailer Levi’s will open a store in The Boulevard outlet center, Northern Ireland, in October this year. This will be the retailer’s debut Northern Irish standalone store. Reformation Opens a Store in London Los Angeles-based clothing and accessories retailer Reformation has opened a store in Notting Hill, London. Following the success of its pop-up store in London, the retailer opened its first European permanent store. Within the store, customers can digitally search for items and access real-time stock information through touch screens.Non-Store-Closure News

Amazon and Morrisons Expand Partnership Amazon and Morrisons have expanded their partnership to provide a one-hour grocery delivery service in more cities across UK. The service is currently offered to Prime Now customers in Birmingham, Leeds, Manchester and parts of London, whereby Morrisons’ products ordered online are picked and delivered by Amazon. This same-day delivery service will be expanded to cities including Glasgow, Newcastle, Portsmouth and Sheffield in 2019, and more cities across UK over the coming years. [caption id="attachment_96797" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including B&M, Homebase, Laura Ashley, New Look and Office.*Total includes a small number of retailers that each announced one or two store closures and are not included in the chart.

Source: Company reports/Coresight Research[/caption] [caption id="attachment_96798" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. We estimate this information for some retailers, including Iceland and Heron Foods. Our estimate of store openings for Card Factory is based on proportion of net existing stores in the UK.*Total includes a small number of retailers that each announced one or two store openings and are not included in the chart.

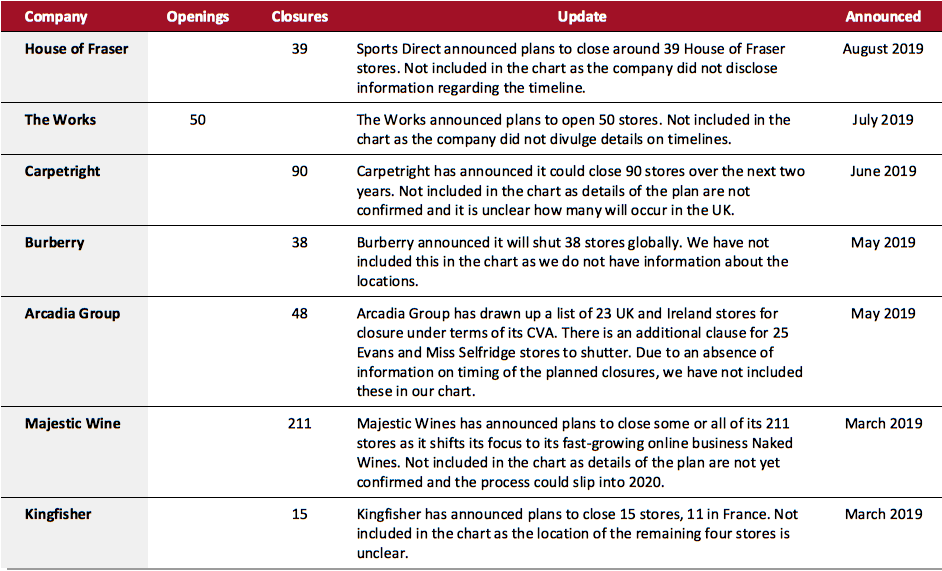

Source: Company reports/Coresight Research[/caption] 2019 Major UK Uncharted Openings and Closures [caption id="attachment_96799" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_96800" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

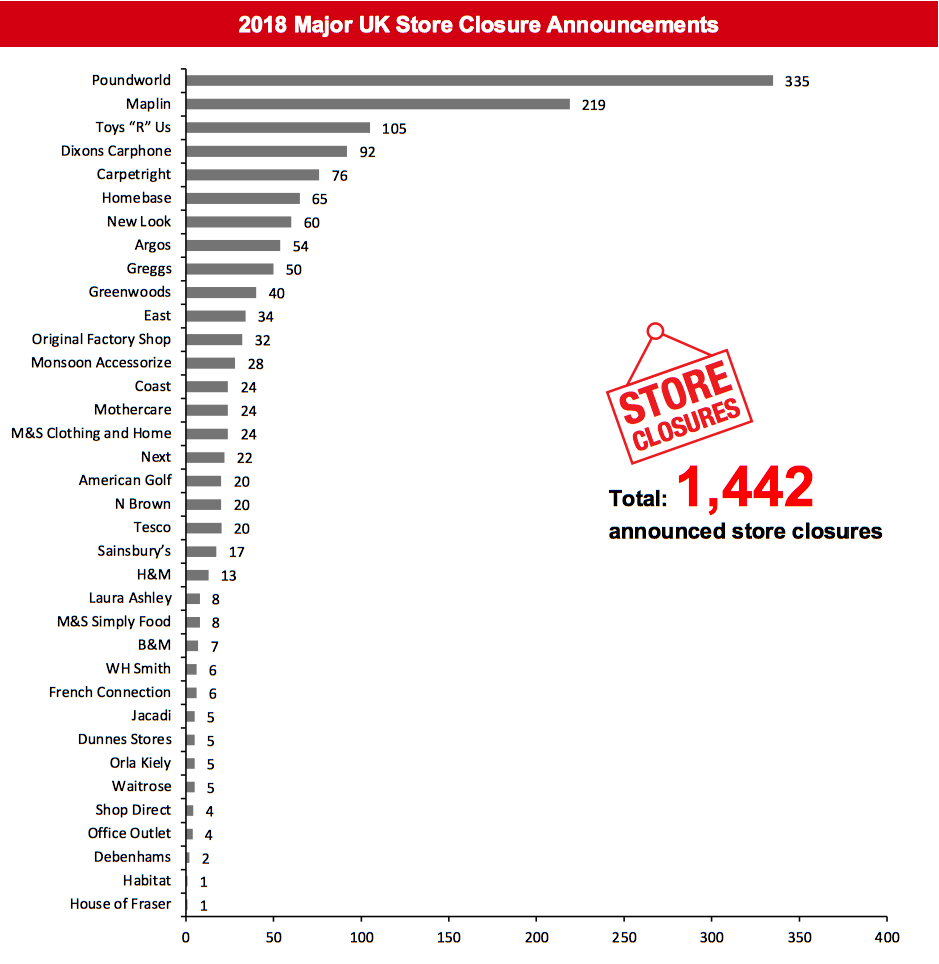

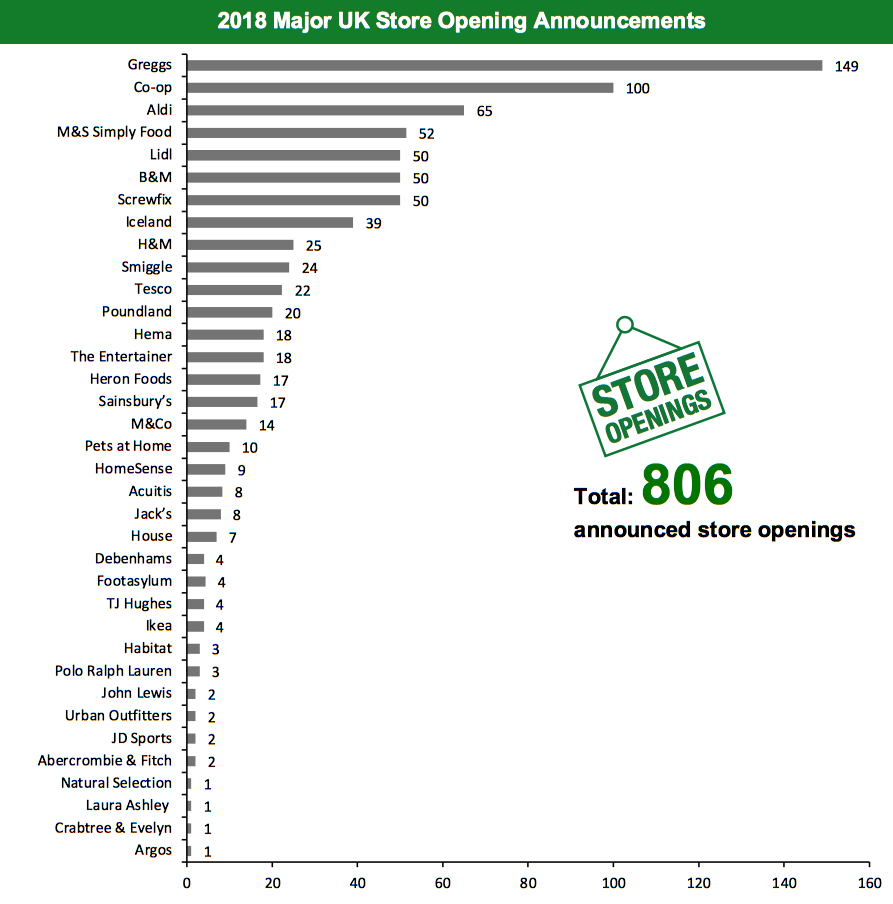

[caption id="attachment_96800" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption]

[caption id="attachment_96801" align="aligncenter" width="700"]

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including Argos, B&M, Homebase, M&S, Monsoon Accessorize, Sainsbury’s and TescoSource: Company reports/Coresight Research[/caption]

[caption id="attachment_96801" align="aligncenter" width="700"] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and Smiggle

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur, and we estimate this information for some retailers, including B&M, Footasylum, Greggs, Habitat, Hema, Heron Foods, House, Iceland, Lidl, M&Co, M&S, Pets at Home, Sainsbury’s and SmiggleSource: Company reports/Coresight Research[/caption] Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross.